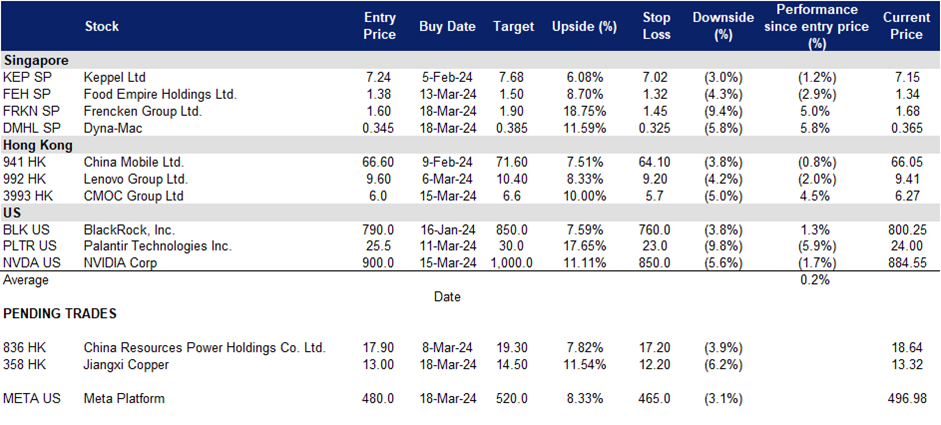

20 March 2024: Dyna-Mac Holdings Ltd (DMHL SP), CMOC Group Ltd (3993 HK), NVIDIA Corp (NVDA US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

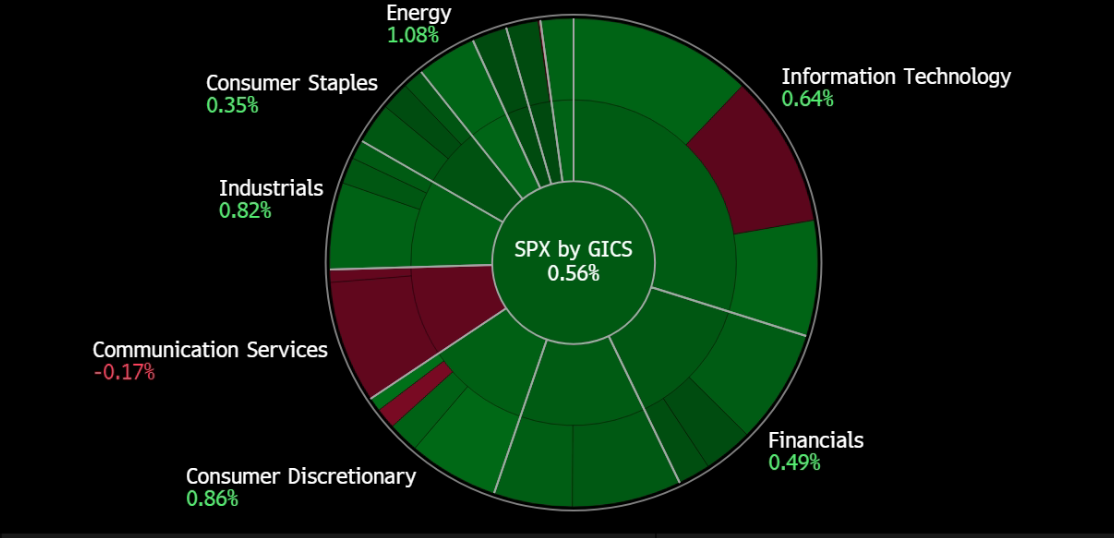

United States

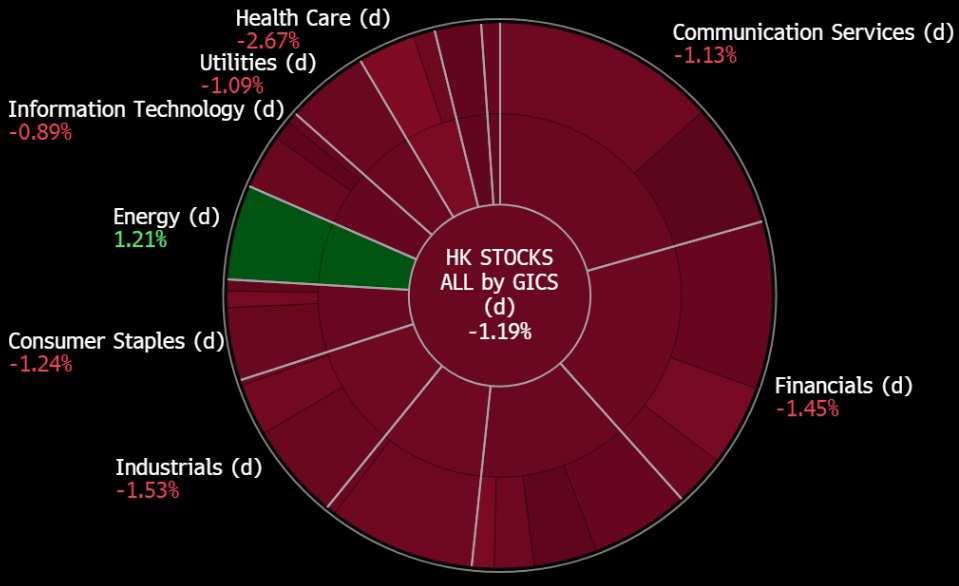

Hong Kong

Dyna-Mac Holdings Ltd (DMHL SP): Oil prices on the rise

- RE-ITERATE Entry – 0.345 Target– 0.385 Stop Loss – 0.325

- Dyna-Mac Holdings Ltd. offers engineering, procurement and construction services to the offshore oil and natural gas, marine construction and other industries. The Company builds topside modules for floating production storage and offloading, semi-submersibles, manifolds, buoys, process piping, and tanks for petrochemical and pharmaceutical plants.

- Oil price rebounding. On 15 March, oil prices reached over US$85 a barrel for the first time since November, due to increased demand from US refiners completing planned maintenance. Brent crude futures decreased to US$85.33 a barrel, while US WTI crude dropped to US$81.09. Tightening supplies for motor fuels have driven concerns about potential price hikes. However, worries persist that the US Federal Reserve may be unable to cut interest rates due to inflation exceeding the central bank’s target. Despite recent fluctuations, oil demand is projected to increase, especially with disruptions in shipping caused by Houthi attacks. US energy firms have added a significant number of oil and gas rigs, indicating potential future output growth. Ukrainian strikes on Russian oil refineries have further supported prices. Additionally, unexpected declines in US crude oil stockpiles and gasoline inventories have contributed to price stability. While lower interest rates could stimulate economic growth and oil demand, signs of slowing economic activity in the US are not expected to prompt immediate rate cuts by the Federal Reserve.

- IEA forecasts in demand. The International Energy Agency (IEA) forecasts oil demand growth of 1.3mn barrels per day (bpd) for this year, a decrease of 1mn bpd from 2023 but up by 110,000 bpd from the previous month’s estimate due to Houthi attacks in the Red Sea delaying supplies. The IEA’s growth forecast is notably lower than OPEC’s, which is more optimistic about the economy by nearly 1mn bpd. Despite short-term shipping disruptions boosting demand, the post-pandemic slowdown and uncertain economic outlook will dampen oil demand, especially with improving vehicle efficiencies and expanding electric vehicle fleets. Oil demand growth will be primarily driven by non-OECD countries, with China’s dominance in demand growth expected to slow. If OPEC+ maintains voluntary cuts through 2024, the IEA anticipates the market to be in a slight deficit rather than a surplus. Supply growth from non-OPEC+ countries is expected to surpass oil demand expansion significantly.

- Order book and future plans. Dyna Mac had an order book totalling S$438.2mn as of December 2023, deliveries are scheduled into FY2025. To accommodate larger orders, Dyna-Mac is expanding its yard space to mitigate capacity constraints. Additionally, the company aims to diversify its revenue streams through mergers, acquisitions, and strategic partnerships with industry leaders.Top of Form

- FY23 results review. FY23 revenue increased by 32.1% to S$385.2mn, compared to S$291.5mn in FY22. This was due to higher progressive recognition from projects carried out in the year. Net profit rose 118% YoY to S$28.5mn from the previous S$13.1mn. EPS amounted to 2.75 cents for FY23 vs 1.27 cents in FY22. A final dividend of 0.83 Singapore cents per share was declared for FY23.

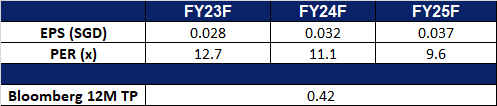

- Market Consensus

(Source: Bloomberg)

Frencken Group Ltd. (FRKN SP): Following the semiconductor recovery

Frencken Group Ltd. (FRKN SP): Following the semiconductor recovery

- RE-ITERATE Entry – 1.60 Target– 1.90 Stop Loss – 1.45

- Frencken Group Limited (“Frencken”) is a Global Integrated Technology Solutions Company that is listed on the Main Board of the Singapore Exchange. They provide comprehensive Original Design, Original Equipment and Diversified Integrated Manufacturing solutions for world-class multinational companies in the analytical & life sciences, automotive, healthcare, industrial and semiconductor industries.

- Strong AI chip demand signal from the world’s largest semiconductor producer. Taiwan Semiconductor Manufacturing’s strong demand for high-end chips used in artificial intelligence (AI) has propelled the semiconductor index up, contributing to broader market gains. The positive outlook for AI demand in 2024 has driven optimism, with experts foreseeing substantial revenue growth for semiconductor companies, indicating the early stages of a technological revolution. Nvidia, a key player in AI computing, also experienced share gains, reaching a fresh record peak. We anticipate that this positive momentum will translate into revenue generated by Frencken’s semiconductor segment, which accounted for about 40% of its Q3 revenue.

- Continued demand for AI Chips. Applied Materials, Frencken’s main customer, announced an earnings beat for FY23 and expects continued outperformance as customers ramp up next-generation chip technologies critical to AI and the Internet of Things. Their key customer, Taiwan Semiconductor Manufacturing Co., also highlighted that revenue rose 9.4% in 2024’s first two months, riding a wave of global AI development. These strong demands for AI chips would translate to more revenue growth for Frencken.

- Anticipated decline in interest rates. Fed Chair Jerome Powell recently mentioned that inflation is “not far” from where it needs to be for the central bank to start cutting interest rates, but did not provide a specific timeline. The market expects a rate cut to occur in June’s FOMC meeting, with a market’s implied probability of 25bps in June at 56.7%. The expected rate decline throughout the year could contribute to increased valuations in the semiconductor sector.

- FY23 results review. FY23 revenue declined by 5.5% to $742.9mn, compared to $786.1mn in FY22. Net profit plunged 38.1% YoY to $32.0mn due to challenging business conditions for the technology sector, compared to $51.6mn in FY22. Gross profit margin contracted to 13.2% in FY23 from 15.1% in FY22, attributing it to lower revenue, inflationary cost pressures as well as increased depreciation expenses.

- Market Consensus

(Source: Bloomberg)

CMOC Group Ltd (3993 HK): Copper and gold hitting highs

- RE-ITERATE BUY Entry – 6.0 Target – 6.6 Stop Loss – 5.7

- CMOC Group Ltd, formerly China Molybdenum Co Ltd, is a China-based company mainly engaged in the mining, smelting, processing and trading of molybdenum, tungsten, copper and other metals. The Company operates through six segments. The Molybdenum and Tungsten Related Products segment is engaged in the mining of molybdenum and tungsten ore. The Copper and Gold Related Products segment is engaged in the mining of copper and gold. The Niobium and Phosphate Related Products segment is mainly engaged in the production of niobium and phosphate fertilizers. The Copper and Cobalt Related Products segment is engaged in the production of copper and cobalt. The Metals Trading segment is principally engaged in the sales of metals. The Other segment is mainly engaged in mining support business.

- Copper price rally. Copper prices jumped to near 11-month highs due to potential supply tightness. News of Chinese smelters discussing production cuts, along with ongoing disruptions in major copper producers Peru and Chile, fuelled the rally. China’s top copper smelters, facing a shortage of raw materials due to global mine disruptions, agreed for the first time in a while to jointly cut production at some loss-making plants. Each smelter will determine the extent of the cuts, but the move comes after a significant drop in copper concentrate fees, a key material for copper production. This shortage is despite China’s rapidly expanding smelter capacity in anticipation of rising copper demand for green energy. However, concerns linger about the long-term outlook. The spike in copper prices will benefit CMOC’s revenue.

China Shanghai copper spot price (RMB/tonne)

(Source: Bloomberg)

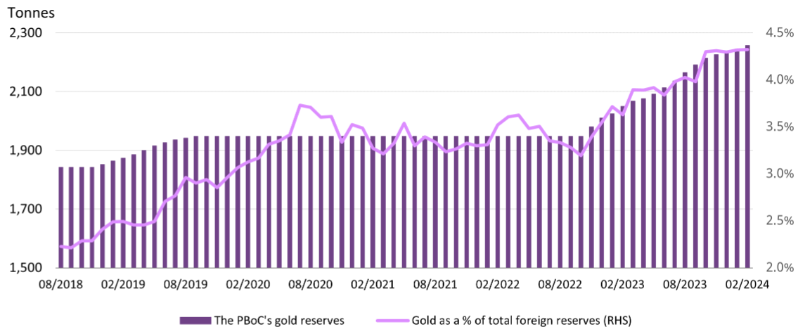

- China increasing its gold reserves. China recently extended its continuous gold purchase record after the central bank bought another 12 tonnes of precious metal in February. This brings China’s gold reserves now a total of 2,257 tonnes, according to the World Gold Council. These purchases increase the country’s already sizable holdings as part of a strategy to reduce its reliance on the US dollar. Gold now makes up 4.33% of China’s foreign exchange reserves in US dollars, the highest level ever recorded. The central bank’s gold buying spree, combined with weak performances of Chinese assets such as equities and properties, has sparked retail investors’ interest in gold. It also contributed to a surge in local gold investment demand during 2023 and could continue to support the sector’s growth.

PBOC Gold Reserves

(Source: PBoC, World Gold Council)

- Interest rate cuts in sight. The Federal Reserve is likely to hold interest rates steady until at least June due to higher-than-expected inflation. Recent inflation readings indicate the Fed’s previous interest rate hikes have yet to control inflation as much as they hoped. Economists now predict the Fed will raise its inflation forecasts and may only cut rates twice this year, instead of the previously expected three cuts. While a rate cut in June’s FOMC meeting is still on the table, some believe the Fed might wait until July. With interest rate cuts in sight, the price of gold may see more positives.

Gold Price and Dollar Index Trend

(Source: Bloomberg)

- FY23 earnings. Total operating revenue rose 7.68% YoY to RMB186.269bn. Net profit attributable to shareholders increased 35.98% YoY to RMB8.25bn in FY23, mainly attributable to investment income from the disposal of Australian operations. Basic earnings per share was RMB0.38 in FY23, compared to RMB0.28 in FY22.

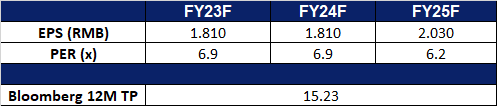

- Market consensus.

(Source: Bloomberg)

Jiangxi Copper Company Limited (358 HK): Copper breakout

- RE-ITERATE BUY Entry – 13.0 Target – 14.5 Stop Loss – 12.2

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The Company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

- Copper price rally. Copper prices jumped to near 11-month highs due to potential supply tightness. News of Chinese smelters discussing production cuts, along with ongoing disruptions in major copper producers Peru and Chile, fuelled the rally. China’s top copper smelters, facing a shortage of raw materials due to global mine disruptions, agreed for the first time in a while to jointly cut production at some loss-making plants. Each smelter will determine the extent of the cuts, but the move comes after a significant drop in copper concentrate fees, a key material for copper production. This shortage is despite China’s rapidly expanding smelter capacity in anticipation of rising copper demand for green energy. However, concerns linger about the long-term outlook. The spike in copper prices will benefit CMOC’s revenue.

China Shanghai copper spot price (RMB/tonne)

(Source: Bloomberg)

- 3Q23 earnings. Revenue rose 16.9% YoY to RMB132.0bn in 3Q23. Net profit attributed to company shareholders rose 25.5 % to RMB1.6bn in 3Q23. Basic earnings per share was RMB0.46 in 3Q23.

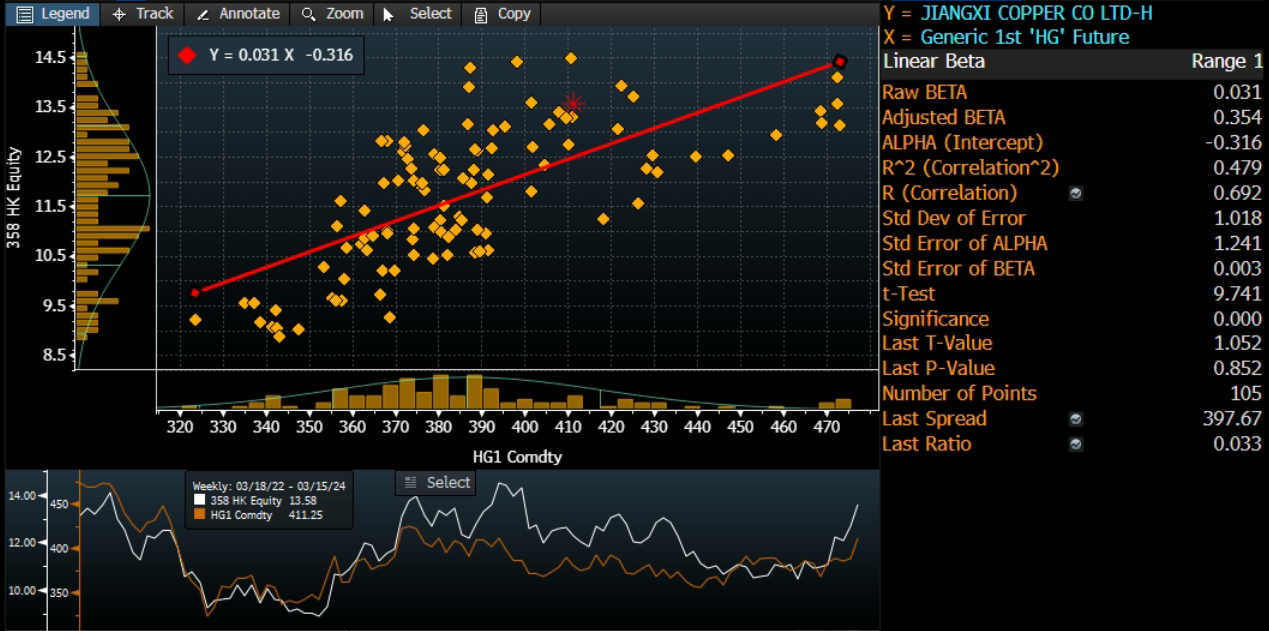

- Market consensus.

Share price and copper price (US$/lb) correlation

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

NVIDIA Corp (NVDA US): Highly anticipated GTC event

- RE-ITERATE BUY Entry – 900 Target – 1,000 Stop Loss – 850

- NVIDIA Corporation designs, develops, and markets three dimensional (3D) graphics processors and related software. The Company offers products that provides interactive 3D graphics to the mainstream personal computer market.

- GTC 2024. NVIDIA’s annual GTC conference kicks off next week (17 March), with the highlight expected to be the unveiling of its new Blackwell architecture chips, codenamed B100, designed to advance AI capabilities. While updates on data centers, workstations, or consumer products are less likely, investors can expect software updates on NVIDIA’s AI platforms and news on its collaboration with Microsoft’s Azure cloud. Over 900 sessions on various AI applications and talks from industry leaders will fill the five-day event, alongside product demos and exhibitions showcasing the latest in generative AI. The upcoming GTC conference is expected to shed light on NVIDIA’s future plans, potentially boosting the stock.

Nvidia stock price performance during the GTC period

Date | Returns |

20 – 23 March 2023 | 5.0% |

19 – 22 September 2022 | -6.1% |

21 – 24 March 2022 | 5.3% |

12 – 16 April 2021 | 4.6% |

5 – 9 October 2020 | 0.9% |

- 4Q24 earnings review. Revenue rose by 265.3% YoY to US$22.1bn, beating estimates by US$1.55bn. EPS was US$5.16, beating estimates by US$0.52. In FY25 revenue is expected to be US$24bn vs consensus of US$22.03bn, plus or minus 2%.

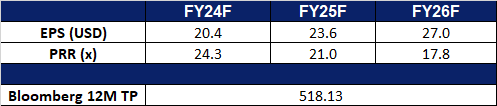

- Market consensus.

(Source: Bloomberg)

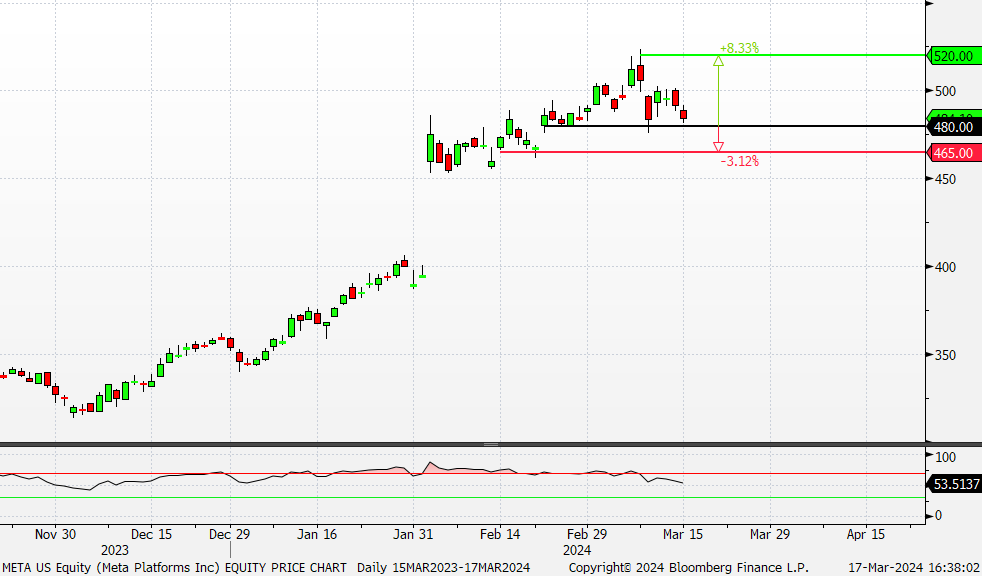

Meta Platform (META US): One man’s loss is another man’s gain

- RE-ITERATE BUY Entry – 480 Target – 520 Stop Loss –465

- Meta Platforms, Inc. operates as a social technology company. The Company builds applications and technologies that help people connect, find communities, and grow businesses. Meta Platform is also involved in advertisements, augmented, and virtual reality.

- TikTok ban. The House of Representatives passed a bill last Wednesday to urge ByteDance to divest TikTok from the company or ban the applications on the US app stores. The US has been hostile towards TikTok for the last few years, and it finally determinedly takes actions before the election day in November. It is expected that companies which put online advertisements on TikTok will reduce commercials or drop out from the application. Peers such as Meta platform, Google, or X (previous known as Twitter) could benefit from the bill, as they are the alternatives in the US market.

- Digital advertisements growth. According to Insider Intelligence, global digital AD spending is expected to grow 13.2% this year. In the backdrop of China’s sluggish domestic consumption, domestic e-commerce companies are actively exploring foreign markets, so they are increasing their advertising efforts on foreign social media. Meta is one of the major beneficiaries.

- LLaMA is one of the key contenders in the AI wave. At present, there are few mature large language models in the market. The training of the model requires a large amount of data support, and Meta has significant advantages in terms of individual and enterprise users, so LLaMA has the potential to compete with ChatGPT and increase market share.

- 4Q23 earnings review. Revenue grew by 24.7% YoY to US$40.11bn, beating estimates by US$940mn. GAAP EPS was US$5.33, beating estimates by US$0.39. 1Q24 total revenue is expected to be in the range of US$34.5bn-US$37.0bn vs US$33.87bn consensus. Meta’s board of directors declared a cash dividend of US$0.50 per share of our outstanding common stock.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Frencken (FRKN SP) at S$1.60 and Dyna-Mac (DMHL SP) at S$0.345. Cut loss on SIA Engineering (SIE SP) at S$2.26 and Geo Energy (GERL SP) at S$0.33.