17 January 2025 : Seatrium Ltd (STM SP), Aluminium Corp of China (2600 HK), Broadcom Inc (AVGO US)

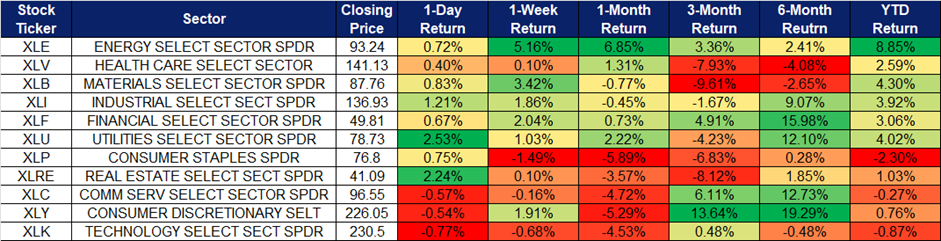

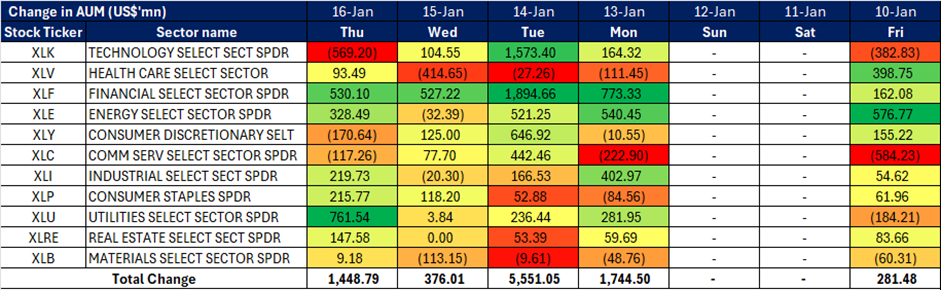

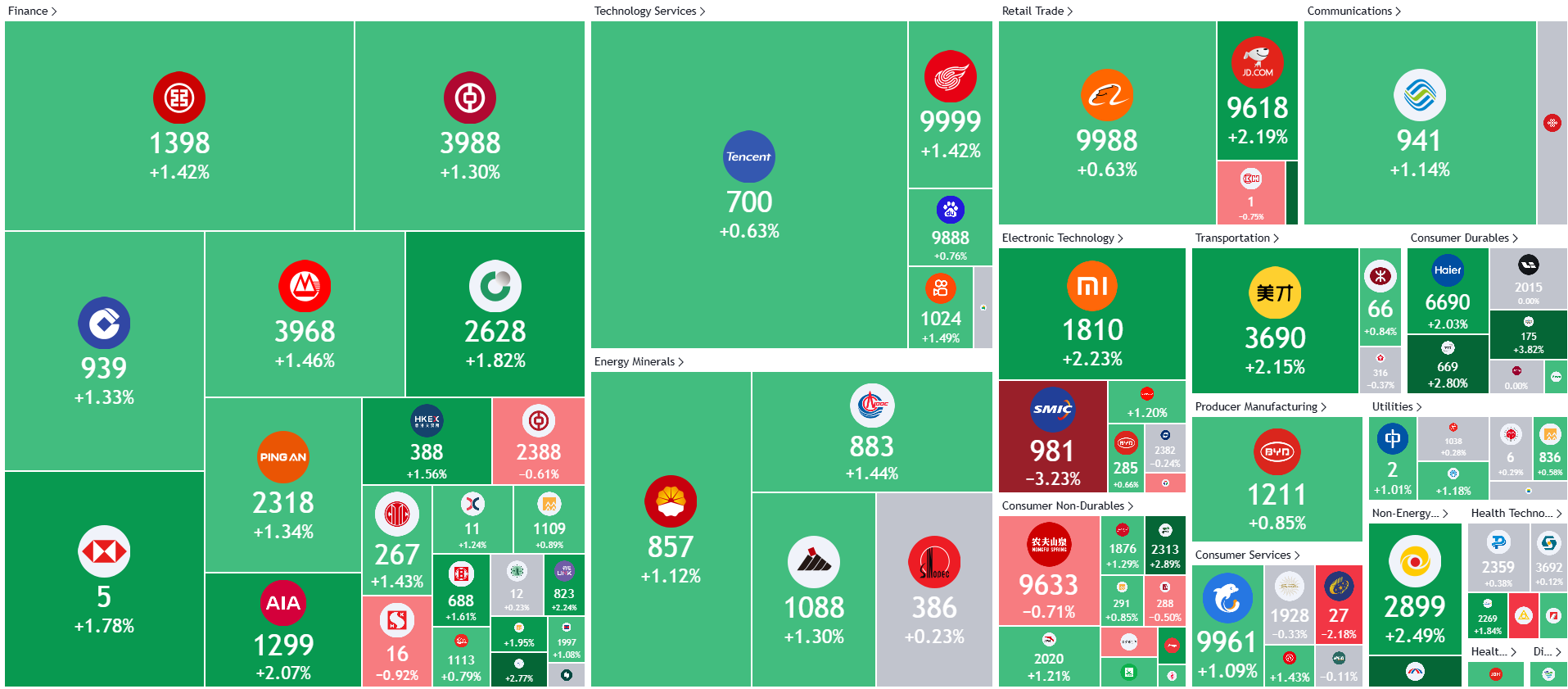

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

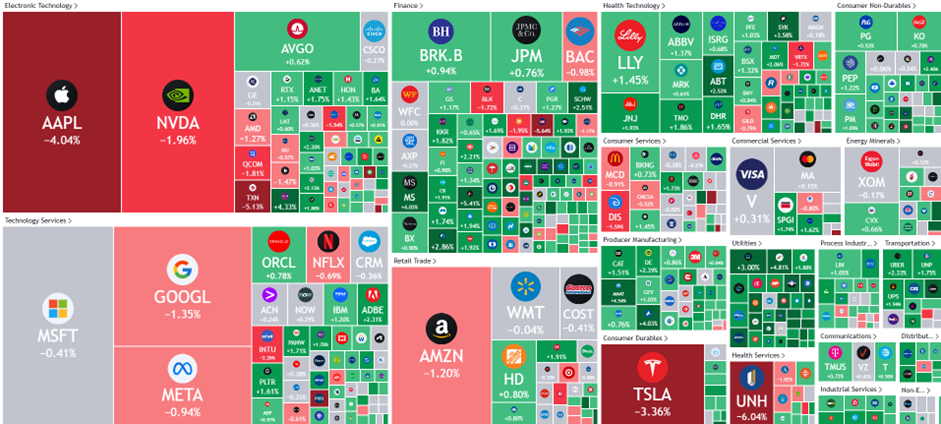

United States

Hong Kong

Seatrium Ltd (STM SP): Potential growth from cross-border cooperation

- BUY Entry – 2.23 Target– 2.43 Stop Loss – 2.13

- Seatrium Ltd offers engineering solutions for the offshore, marine, and energy industries. The Company provides rigs and floaters, repairs and upgrades, offshore platforms, and specialized shipbuilding. Seatrium serves customers worldwide.

- Johor-Singapore Special Economic Zone project to support energy transition. Singapore and Malaysia launched the Johor-Singapore Economic Zone (JS-SEZ), a collaborative initiative focused on green energy, advanced manufacturing, and climate change mitigation. This comprehensive framework encompasses 11 key sectors, including manufacturing, logistics, food security, tourism, energy, digital economy, green economy, financial services, business services, education, and healthcare. The initiative aims to deliver 100 projects and create 20,000 jobs over the next decade. A key component of the JS-SEZ is the acceleration of renewable energy trading between the two nations. This includes a 50 MW green electricity deal and plans to import 1 GW of hydropower from Malaysia. With bilateral trade reaching $132.6 billion in 2023, the JS-SEZ strengthens economic ties and positions the region as a global leader in sustainability and energy transition. By leveraging its expertise in offshore energy, shipbuilding, and marine technologies, Seatrium can position itself to play a significant role in the success of the JS-SEZ and contribute to the region’s sustainable development goals.

- New contract with BP. Seatrium Ltd. recently announced the signing of an engineering, procurement, construction, and onshore commissioning (EPC) contract with BP Exploration and Production Inc. (bp) for the Kaskida Floating Production Unit (FPU) project in the U.S. Gulf of Mexico. The Kaskida project is a greenfield development located approximately 250 miles southwest of New Orleans in the Keathley Canyon area. In its first development phase, the FPU is designed to produce up to 80,000 barrels of crude oil per day from six wells. This contract is expected to provide a significant boost to Seatrium’s long-term revenue and profitability, enhancing its position in the offshore energy sector.

- Positive outlook with strong order book. As of the end of September 2024, Seatrium’s net order book stood at $24.4 billion, comprising 30 projects with scheduled deliveries through 2031. Gross orders amounted to nearly $38 billion, set to be delivered over the remainder of the decade. The company’s project pipeline remains robust, with continued interest from customers seeking partnerships. Seatrium anticipates a strong uptick in business activity and remains committed to reducing its debt while securing fresh capital to support ongoing and future projects.

- 1H24 results review. Revenue rose by 39.1% YoY to S$4.01bn in 1H24, compared to S$2.89bn in 1H23. Net profit was S$34.7mn in 1H24, compared to a net loss of S$240.5mn in 1H23. Basic EPS per share was 1.05 S cents in 1H24, compared to net loss per share of 9.40 S cents in 1H23.

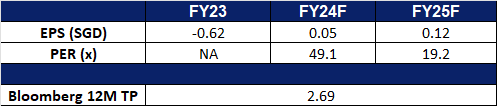

- Market Consensus.

(Source: Bloomberg)

ISOTeam Ltd (ISO SP): Expanding drone capabilities

- RE-ITERATE BUY Entry – 0.057 Target– 0.061 Stop Loss – 0.055

- ISOTeam Ltd. is a building maintenance and estate upgrading company experienced in implementing eco-driven solutions through R&R and A&A services to the public and private sector. The Company has extensive experience in upgrading, retrofitting and maintenance of buildings and facilities in Singapore, and reshapes and rejuvenates public housing landscape, amenities, and environment.

- Drone potential. ISOTeam signed a binding MOU with Acclivis Technologies and Nippon Paint (Singapore) to develop autonomous painting drones for building facades which marks a strategic step toward revolutionizing the built environment. By integrating AI-driven drone technology, ISOTeam can enhance its productivity and significantly reduce reliance on manpower, addressing labour shortages and high costs in Singapore. These drones promise substantial cost and time savings by eliminating scaffolding requirements, minimizing labour-intensive processes, and enhancing operational safety. Furthermore, the standardized operations of these drones improve quality control and allow for advanced inspection and tracking capabilities, ensuring consistent results. Public adoption of such technology could position ISOTeam as a leader in innovative and sustainable building maintenance solutions, broadening its market reach and enhancing its competitive edge. This initiative builds on the company’s existing efforts, such as its collaboration with H3 Dynamics for HDB facade projects, to further cement its expertise in AI and automation-driven solutions, creating new growth opportunities for the company.

- Growth through more projects. ISOTeam operates across four segments with nearly two-thirds of its contracts stemming from public-sector projects, including Housing Board upgrades. The company expressed optimism about sustained growth, supported by steady demand from government-driven projects like the Home Improvement and Neighbourhood Renewal Programmes. Singapore’s construction sector is expected to grow by 12% in 2024 according to Turner & Townsend and public-sector projects are expected to account for 60% of the S$27bn to S$32bn construction demand projected for the year. As of June 30, ISOTeam’s order book stood at S$175.8mn, providing visibility for the next two years.

- 2H24 results review. Revenue rose 19.3% from S$56.5mn in 2H23 to S$67.4mn in 2H24. Revenue increase was mainly due to higher revenue generated by the core business segments (R&R, A&A and C&P), partially offset by the decrease in revenue from the others business segment because of disposal of a subsidiary. The Group’s gross profit increased by S$5.8mn from S$6.1mn in 2H23 to S$11.9mn in 2H24 and increased by S$9.1mn from S$11.1mn in FY23 to S$20.2mn in FY24 mainly due to improved margins.

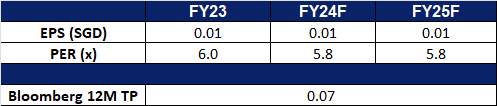

- Market Consensus.

(Source: Bloomberg)

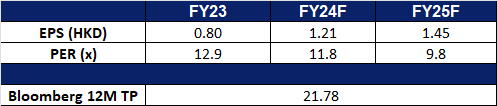

Aluminium Corp of China (2600 HK): Rebounding Aluminium Prices

- BUY Entry – 4.80 Target – 5.40 Stop Loss – 4.50

- Aluminum Corporation of China Ltd is a China-based company primarily engaged in the production and sale of primary aluminum and aluminum products. The Company conducts its business primarily through five segments. The Alumina segment is engaged in the mining and purchase of bauxite, the production and sale of alumina and alumina bauxite. The Primary Aluminum segment is engaged in the smelting of alumina, the production and sale of primary aluminum, carbon products, aluminum alloy and other aluminum products. The Energy segment is engaged in coal mining, electricity generation by thermal power, wind power and solar power, new energy related equipment manufacturing business. The Trading segment is engaged in the trading of alumina, primary aluminum, aluminum fabrication products, other non-ferrous metal products and coal products. The Corporate and Other Operating segment is engaged in the management of corporate, research and development activities and others.

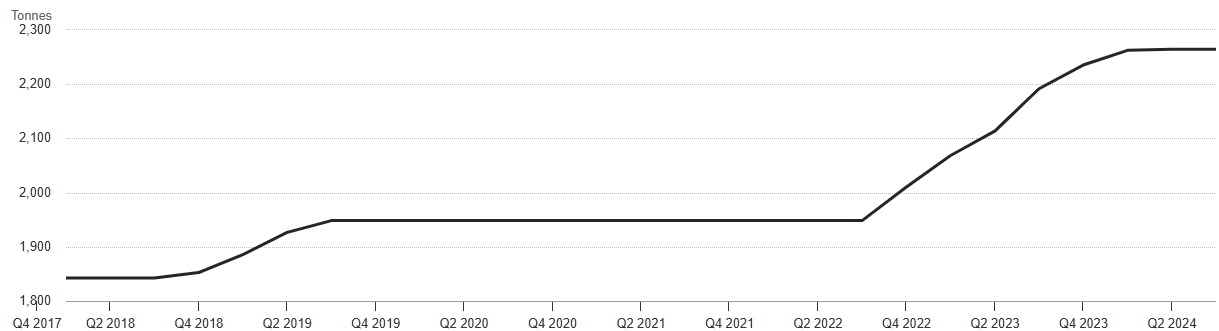

- Aluminium Price rebound. Aluminum futures climbed above $2,600 per tonne, recovering sharply from the near four-month low of $2,490 on January 6th. The rally aligns with broader gains in base metals as China signaled additional measures to boost consumption, improving the demand outlook for manufacturing inputs. In December, aggregate financing and new yuan loans in China exceeded expectations, reflecting the initial impact of aggressive monetary stimulus introduced by the People’s Bank of China (PBoC). These developments follow the government’s commitment to increased deficit spending and looser monetary policy aimed at stimulating economic activity. Additionally, aluminum futures outside China received support from Beijing’s decision to end tax rebates on aluminum semi-manufactured products, which has bolstered demand for aluminum in markets outside the world’s largest producer.

Aluminium Spot Price

(Source: Bloomberg)

- Potential new sanctions on Aluminium. The European Union is reportedly considering imposing additional import restrictions on Russian aluminum as part of its 16th sanctions package against Moscow in response to the invasion of Ukraine. These measures would coincide with the third anniversary of the war. According to reports, the restrictions would be implemented gradually, with the specific timeline and scope yet to be finalized. Russia, the largest aluminum producer outside of China, accounts for approximately 5% of global aluminum production. If enacted, these sanctions could potentially disrupt the global aluminum supply chain, adding pressure to already tight markets. This may, in turn, contribute to higher aluminum prices, reflecting the anticipated reduction in supply.

- Embracing AI. Aluminum Corporation of China recently announced a strategic collaboration with peers in the nonferrous metals industry to advance the digital development and application of large AI models. This initiative is expected to gain support from the China Nonferrous Metals Industry Association, key government departments, and other relevant partners. As a leading enterprise in the nonferrous metals sector, Chalco has established an independently controlled AI computing center and developed Kun’an, the industry’s first general-purpose large language model. Kun’an leverages AI to enhance operational workflows across the industry, spanning exploration, mining, processing, and recycling. It also bolsters security in critical areas such as mineral resources, production processes, networks, data, and algorithms. Looking ahead, Chalco aims to further solidify the technological foundation of large AI models, accelerate advancements in cognitive intelligence operating systems and key industrial AI technologies, and foster deeper integration of capital, talent, technology, data, and computing power. This synergy is expected to drive coordinated innovation, empower the industry’s transformation towards high-quality development, and expedite the emergence of new, high-value productive forces.

- 3Q24 earnings. Revenue rose 16.04% YoY to RMB63.1bn in 3Q24, compared with RMB54.3bn in 3Q23. Net profit rose 3.34% to RMB2.0bn in 3Q24, compared to RMB1.94bn in 3Q23. Basic earnings per share was RMB0.116 in 3Q24, compared to RMB0.111 in 3Q23.

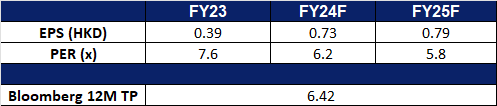

- Market consensus.

(Source: Bloomberg)

Zijin Mining Group Co. Ltd. (2899 HK): Moving to Lithium

- RE-ITERATE BUY Entry – 15.0 Target – 17.0 Stop Loss – 14.0

- Zijin Mining Group Company Limited is a China-based company in mineral business. The Company operates nine segments. The Gold Bullion segment mainly produces gold ingots for the production links of other divisions. The Processed, Refined and Trading Gold segment is engaged in the processing of purchased gold ingots and trading gold ingots. The Gold concentrate section processes gold bearing ores and generates gold concentrates. The Electrolytic Copper segment is produced by electrolytic copper and electrowinning copper. The Refined Copper segment is engaged in the processing of self-produced copper and purchased copper. The Copper concentrates segment processes copper ore and produce copper concentrate. The Other Concentrate segment is responsible for producing zinc concentrate, tungsten concentrate and lead concentrate. The Zinc Bullion segment produces zinc ingots. Others segment is mainly engaged in the sales of sulfuric acid, copper strip, silver and iron.

- Potential foray into lithium. China’s Zijin Mining Group Co. is stepping up its foray into lithium with the potential purchase of a Chinese producer of the battery material. The company is currently in talks to buy shares in Zangge Mining Co. Ltd. that could lead to a takeover. Zangge is based in China’s minerals-rich western region of Qinghai and has a market value of 46.6 billion yuan on the Shenzhen Stock Exchange. It primarily produces potash — used in fertilizer — but gets about a third of its revenue from lithium extracted from salt lakes in Qinghai. The company’s recent lithium push was driven by the prospect of a decades-long demand boom for the material used in EV batteries.

- China increasing its gold reserves. China’s central bank expanded its gold reserves for a second month in December, signaling renewed appetite after temporarily pausing purchases last year as prices soared. Bullion held by the People’s Bank of China rose to 73.29 million fine troy ounces in December, from 72.96 million in the previous month, according to sources. The central bank resumed adding to its gold reserves in November after a 6-month pause.The purchase shows the PBOC is still keen to diversify its reserves even with gold at historically expensive levels.

PBOC Gold Reserves

(Source: PBoC, World Gold Council)

- Economic uncertainties to support gold prices. The World Gold Council highlighted in its 2025 gold outlook that if the economy performs according to market-consensus expectations gold prices should rise at a more modest rate than this year. Gold has potential for upside if central-bank demand proves stronger-than-expected or if a rapid financial deterioration drives safe-haven demand—though a reversal of the interest rate cutting cycle would bring challenges. Concerns about mounting European sovereign debt—coupled with continued geopolitical instability in the Middle East, Eastern Europe and elsewhere, also continues to add to the support for gold prices. The market currently is pricing in around 100 basis points of U.S. interest-rate cuts for 2025, with a similar figure expected for European central banks. This is also likely to positively affect gold prices, as will expectations for the U.S. dollar to remain flat or slightly weaken as conditions normalize.

Gold Price and Dollar Index Trend

(Source: Bloomberg)

- 3Q24 earnings. Operating income rose 7.11% YoY to RMB80.0bn in 3Q24, compared with RMB74.7bn in 3Q23. Net profit rose 54.8% to RMB11.2bn in 3Q24, compared to RMB7.24bn in 3Q23. Basic earnings per share was RMB0.349 in 3Q24, compared to RMB0.223 in 3Q23.

- Market consensus.

(Source: Bloomberg)

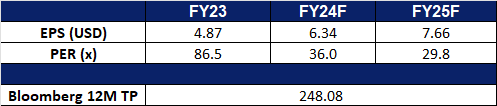

Broadcom Inc (AVGO US): Orderbooks secured

- BUY Entry – 224 Target – 250 Stop Loss – 211

- Broadcom Inc. designs, develops, and supplies semiconductor and infrastructure software solutions. The Company offers storage adapters, controllers, networking processors, motion control encoders, and optical sensors, as well as infrastructure and security software to modernize, optimize, and secure the complex hybrid environments. Broadcom serves customers worldwide.

- Gaining AI market share. Broadcom is solidifying its role as a key AI hardware partner for hyperscale’s diversifying away from Nvidia. Its CEO revealed plans from three hyperscale customers to deploy one million XPU clusters each by 2027, with two more in advanced development. SK Hynix, a dominant HBM supplier, is scaling DRAM production by 70% in 2025 to meet surging demand from Broadcom and Nvidia, focusing on advanced HBM3E technology. Broadcom’s AI-driven semiconductor revenue reached US$30.1bn in 2024, reflecting a 220% YoY growth in AI revenue and highlighting its expanding influence in AI chip innovation.

- Continued innovation. Broadcom launched the Brocade G710, a 24-port 64G Fibre Channel SAN switch designed for small to mid-sized businesses. It offers low latency (460 ns), energy efficiency (65W), and scalability from 8 to 24 ports. Key features include cyber-resilient architecture, autonomous self-healing capabilities, and six nines (99.9999%) reliability. The G710 ensures robust data security with network isolation and root-of-trust validation. Backed by a lifetime warranty, it provides 24/7 support, firmware updates, and security patches, delivering a cost-effective solution for high-performance, secure, and reliable data canters.

- Data center growth prospects. According to JLL, global data center demand is expected to soar in 2025, with 10GW of capacity projected to break ground and 7GW expected to be completed. Market growth, driven by AI and advancements in semiconductors, is forecasted at a 15%–20% CAGR through 2027. AI workloads are driving higher power densities, with chips reaching up to 250kW per rack, though traditional workloads will remain significant, comprising over 50% of demand by 2030. The Biden administration has prioritized data center development, enabling the leasing of Department of Defense and Energy sites for gigawatt-scale AI projects. Developers are required to integrate sufficient clean energy resources to meet these facilities’ power demands. Additionally, a hyperscaler is planning 20 edge data centers across the US to reduce latency and improve redundancy. Globally, Spain will see two gigawatt-scale campuses developed through public-private partnerships, while Aligned Data Centers has raised US$12bn to fund its expansion. Macquarie Asset Management will invest US$5bn in Applied Digital, supporting its AI and HPC-focused facilities. Broadcom is well-positioned to benefit from this growth, offering solutions that optimize server speed, uptime, and storage connectivity, reducing the cost and complexity of hyperscale deployments. These developments will likely bolster its infrastructure software revenue as data center expansion accelerates globally.

- 4Q24 results. Broadcom’s revenue increased by 51% YoY to US$14.054bn in 4Q24, compared to US$9.295bn in 4Q24, driven by the successful integration of VMware and AI revenue growth. It delivered GAAP net income of US$4.324bn and non-GAAP net income of US$6.965bn for the fourth quarter. GAAP diluted EPS was US$0.90 and non-GAAP diluted EPS was US$1.42. The company also announced an increase in its quarterly common stock dividend by 11% YoY to US$0.59 per share. Looking ahead, Broadcom expects 1Q25 revenue of approximately US$14.6bn, an increase of 22% from the prior year period and an adjusted EBITDA guidance of approximately 66% of projected revenue.

- Market consensus

(Source: Bloomberg)

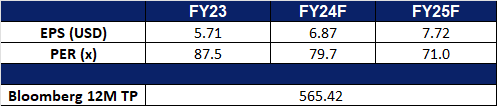

Intuitive Surgical Inc (ISRG US): Increased reliance on robotic healthcare systems

- RE-ITERATE BUY Entry – 544 Target – 600 Stop Loss – 516

- Intuitive Surgical, Inc. design, manufactures, and markets surgical systems. The Company offers endoscopes, endoscopic retractors and disectors, scissors, scalpels, forceps, needle holders, electrocautery, ultrasonic cutters, and accessories during surgical procedures. Intuitive Surgical operates worldwide.

- Global leader in robotic surgery systems. The company’s core product, the da Vinci Surgical System, is widely utilized in fields such as urology, gynecology, and general surgery, with a global installed base of over 8,200 systems. The company employs a “razor-and-blade” business model, generating stable recurring revenue not only through the sale of robotic systems but also from consumables, surgical services, and maintenance fees.

- Broad market growth prospects. The current total addressable market (TAM) for soft tissue surgeries stands at 6 million, with the company holding approximately 30% market share. The company estimates the global TAM to be 20 million, presenting significant room for market share expansion. Sales of the da Vinci system continue to grow rapidly, with 379 systems sold in the first three quarters of FY2024, representing a 22% year-on-year increase. The company expects its full-year 2024 revenue growth to reach 14.8%, surpassing the robotic surgery industry average of 14.5% and marking the highest growth rate among its peers.

- 3Q24 results. Intuitive Surgical’s revenue increased by 17% to US$2.04bn in 3Q24, compared to US$1.74bn in 3Q23. The Company grew its da Vinci surgical system installed base to 9,539 systems as of 30 September 2024, an increase of 15% compared with 8,285 as of the end of 3Q23 and worldwide da Vinci procedures grew approximately 18% YoY. The company’s non-GAAP net income attributable to Intuitive was US$669mn, or US$1.84 per diluted share, compared with US$524mn, or US$1.46 per diluted share, in 3Q23.

- Market consensus.

(Source: Bloomberg)

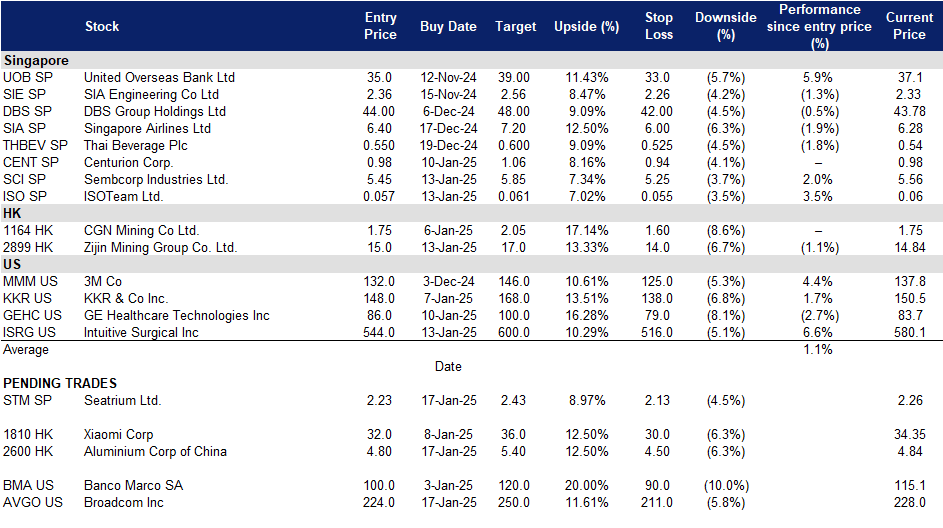

Trading Dashboard Update: Cut loss on Lenovo Group Ltd (992 HK) at HK$9.1.