16 October 2024: Genting Singapore Ltd (GENS SP), Lenovo Group Ltd (992 HK), Deckers Outdoor Corp (DECK US)

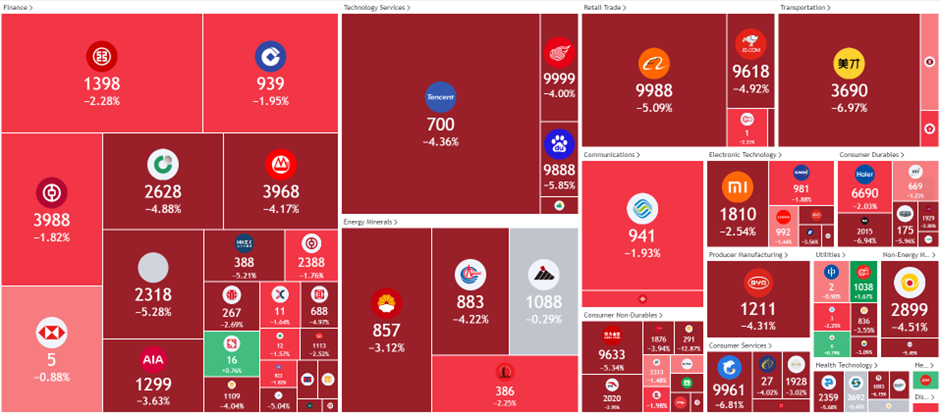

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

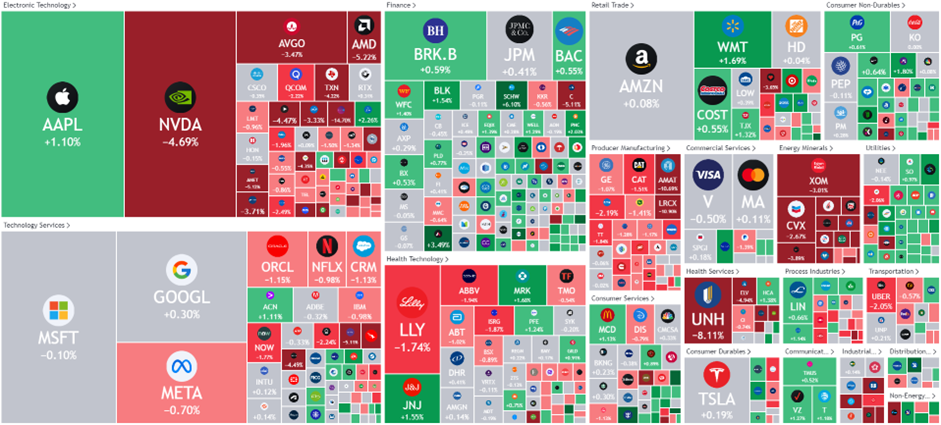

United States

Hong Kong

Genting Singapore Ltd (GENS SP): Seasonal tailwinds

- RE-ITERATE BUY Entry – 0.860 Target– 0.940 Stop Loss – 0.820

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

- Expectations towards year-end travel season. With upcoming school holidays, as well as employees looking to clear their leaves before the year ends, we expect the year-end travel season to provide a boost to travel demand. Consumers who avoid the cold weather are also likely to travel to warmer countries, and vice versa. Travel demand has also remained strong ahead of the upcoming travel seasonality. Recently, Trip.com reported strong flight bookings globally as people flock to Singapore to watch the F1 Singapore GP in September, and also saw China’s travel booking during Golden Week reaching an all-time high. Many airlines such as Korean Air, Peach Aviation, AirAsia have also increased their flight routes moderately ahead of winter demand. The expectation of higher travel demand is likely to affect Genting Singapore positively.

- November is a good month seasonally. November has been a seasonally good month for Genting Singapore’s share price, with an average increase in share price by 8.78% in November over the past 10 years. Strong travel bookings and the announcement of more flight routes also add to positive sentiments as investors start to expect higher travel demand towards the end of the year. We expect these positive sentiments to positively benefit Genting Sing share price in November.

Genting Singapore Share Price Seasonality Performance

(Source: Bloomberg)

- More Catalysts ahead. Resorts World Sentosa plans to host more lifestyle events, such as Harry Potter: Visions of Magic, in late 2024 and is on track with new projects like Minion Land and Singapore Oceanarium, set to open in early 2025. Additionally, Resorts World Sentosa (RWS) has received the government’s provisional permission for a new Waterfront development which is expected to start construction in late 2024, and a new luxury hotel will launch in early 2025. Furthermore, back in May, RWS also signed an MoU with Sentosa Development Corporation and other partners to enhance RWS’s appeal as part of broader. government efforts to boost tourism, which saw receipts exceed S$27.2bn in 2023. This MoU is likely to continue benefitting Genting Singapore.

- 1H24 results review. Revenue increased by 25.5% YoY to S$1.36bn in 1H24, compared to S$1.08b in 1H23. Net profit rose by 29.0% to S$356.9mn in 1H24, compared to S$276.7mn in 1H23. Basic EPS rose to 2.96 Scents in 1H24, compared to 2.29 Scents in 1H23.

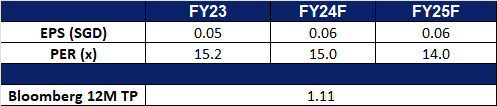

- Market Consensus.

(Source: Bloomberg)

Wilmar International Ltd (WIL SP): Increased curbs on palm oil supplies

- RE-ITERATE BUY Entry – 3.32 Target– 3.60 Stop Loss – 3.18

- Wilmar International Limited operates as a food processing company. The Company offers oil palm cultivation, edible oil refining, crushing, and gains processing services, as well as provides sugar, flour, and rice. Wilmar International serves customers worldwide.

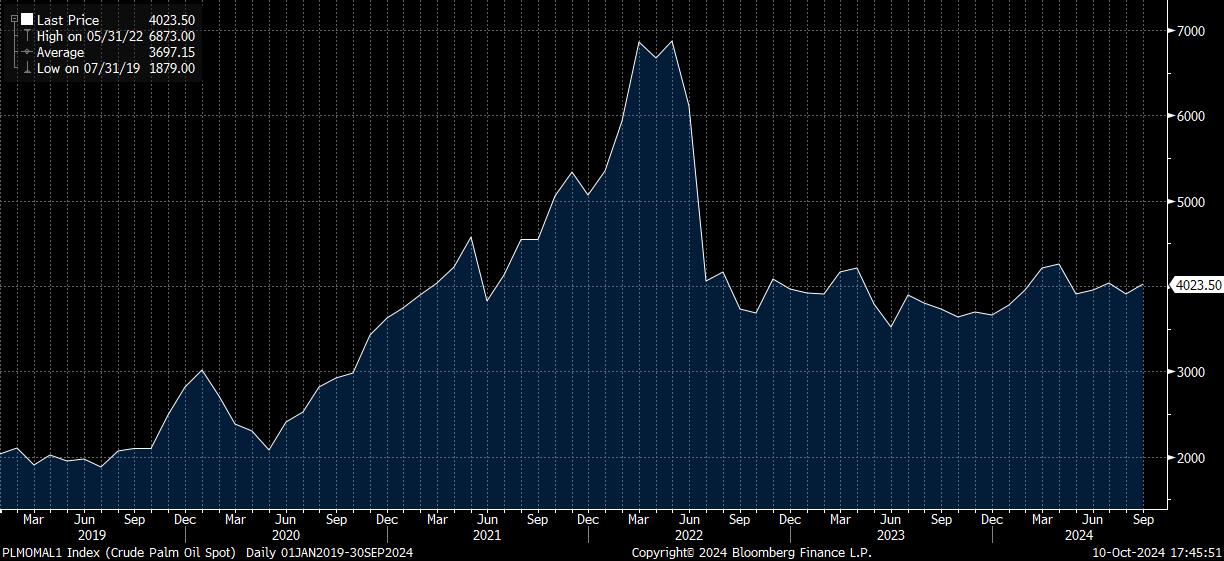

- Expected rise in palm oil prices. Indonesia’s plan to increase its biodiesel mandate from 35% to 40% palm oil-based fuel could significantly tighten global palm oil supplies. This shift could raise Indonesia’s biodiesel consumption to 16 million kilolitres, using an additional 1.5 to 1.7 million metric tons of palm oil. As a result, export volumes may decrease, causing global supply shortages and higher prices for consumers. The move comes as palm oil production in Indonesia and Malaysia has been affected by labour shortages, rising fertilizer costs, and weather conditions. Global palm oil production is expected to increase by 2.3 million metric tons in 2024/25, but the rise in demand for biodiesel could offset this growth, driving prices higher. Palm oil prices are forecasted to rise further, with projections suggesting a price of around 4,000 ringgit per metric ton in 2025. This anticipated price increase benefits palm oil producers such as Wilmar International.

Crude Palm Oil Price

(Source: Bloomberg)

- Stake reduction in joint venture. Adani Enterprises and Wilmar International are set to sell a 13% stake in their joint venture, Adani Wilmar, valued at around US$736 million, to meet Indian regulations requiring at least 25% of shares to be held by non-founders within three years of listing. Adani Wilmar, established in 1999, is a key consumer goods company in India, offering products like edible oils, wheat flour, rice, and sugar. Currently, the two companies collectively hold 88% of the venture, and this sale will reduce their combined stake to 75% by February when the three-year grace period ends. Advisors will soon start engaging with potential investors in the US, Southeast Asia, and India.

- 1H24 results review. Total revenue for 1H24 decreased by 4.9% YoY to US$30,934.6mn from US$32,538.0mn, primarily due to the decline in commodity prices, partially offset by higher sales volume. Core net profit was US$606.3mn in 1H24, an increase of 5.0% YoY and net profit rose by 5.2% YoY to US$579.6mn, driven by better performances in the Feed & Industrial Products and Food Products segments but partially offset by lower contributions from the Group’s joint ventures & associates as well as sugar milling operations. EPS rose in 1H24 to 9.3 UScents from 8.8 UScents in 1H23.

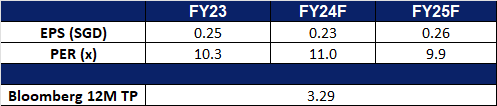

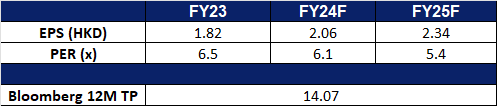

- Market Consensus.

(Source: Bloomberg)

Lenovo Group Ltd (992 HK): PC shipment recovery on track

- BUY Entry – 10.7 Target 12.1 Stop Loss – 10.0

- Lenovo Group Limited is an investment holding company principally engaged in personal computers and related businesses. The Company’s main products include Think-branded commercial personal computers and Idea-branded consumer personal computers, as well as servers, workstations and a family of mobile Internet devices, including tablets and smart phones. The Company operates its business through four geographical segments, including China, Asia Pacific (AP), Europe, the Middle East and Africa (EMEA) and Americas (AG). The Company also provides cloud service and other related services. The Company distributes its products in domestic market and to overseas markets.

- Global PC recovery to continue through 1H25. Worldwide PC shipments reached 62.9 million units in the third quarter of 2024, reflecting a 1.3% decline compared to the same period in 2023, according to preliminary data from Gartner, Inc. This marks the first decline after three consecutive quarters of year-over-year growth in the PC market. Despite this dip, the market remains on a recovery trajectory. Global demand for PCs is expected to accelerate toward the end of 2024, with stronger growth anticipated in 2025 as the PC refresh cycle peaks. Lenovo maintained its position as the global market leader, holding a 26.3% share in Q3 2024 and posting a 2.5% year-over-year increase in shipments. The company’s strong financial performance in the first quarter of 2025, supported by rising global AI investments, reinforces optimism for a steady recovery in the computing industry. This resurgence is fueled by growing demand for servers, which are essential for AI development, helping to revitalize the hardware sector following the post-pandemic slowdown. As the industry approaches the four-year anniversary of the COVID-19 pandemic, the PC commercial refresh cycle is expected to gain momentum. With inventory levels stabilizing, average selling prices are projected to rise, driven by more advanced configurations and a reduction in discounting.

- Ramping up global AI spending. Major technology companies, including Microsoft, Alphabet, Meta, and Amazon, are projected to invest over $1tn in AI over the coming years, according to sources. In their recent earnings reports, these companies informed investors that they anticipate increased spending on AI infrastructure, particularly data centres, to secure their long-term positions in the AI sector and meet the growing computational demands. By investing in AI infrastructure now, these tech giants aim to ensure they have the necessary computing technology as AI continues to evolve. Lenovo’s AI PCs is likely to benefit from these AI investments.

- Expanding AI product portfolio. Lenovo continues to expand its AI product portfolio following the launch of its AI-enabled PCs earlier this year. The company recently introduced the Lenovo ThinkSmart Core Gen 2, one of the first AI-optimized devices specifically designed to power video conferencing room systems. Additionally, Lenovo announced that its Indian manufacturing facility has begun producing AI-powered servers. This news was further bolstered by the company’s plans to establish a new research and development lab in Bengaluru, its fourth globally. Looking ahead, Lenovo aims to integrate AI capabilities into all of its PCs by 2027. These advancements position the company to capitalize on the growing adoption of AI across industries as more businesses embrace AI-driven solutions in their operations.

- 1Q25 earnings. The company’s revenue rose by 19.7% YoY to US$15.4bn in 1Q25, compared to US$12.9bn in 1Q24. The company’s net profit rose by 38.3% YoY to US$253mn in 1Q25, compared to US$183mn in 1Q24. Basic earnings per share rose to US1.99 cents in 1Q25, compared to US1.48 cents in 1Q24.

- Market consensus.

(Source: Bloomberg)

China State Construction International Holdings Ltd (3311 HK): More fiscal stimulus

- RE-ITERATE BUY Entry – 12.4 Target 14.0 Stop Loss – 11.6

- China State Construction International Holdings Limited is an investment holding company principally engaged in construction contracts business. The Company is also engaged in infrastructure project investments, facade contracting business and infrastructure operation. The Company operates its business through four segments: Hong Kong, Mainland China, Macau and Overseas. Through its subsidiaries, the Company is also engaged in building construction, civil and foundation engineering works.

- Monetary policy tool to support capital market. China’s central bank announced the establishment of the Securities, Funds, and Insurance Companies Swap Facility (SFISF), with an initial scale of 500 billion yuan, aimed at promoting the healthy and stable development of the capital market. This marks China’s first monetary policy tool designed to support the capital market. The SFISF will allow eligible securities, funds, and insurance companies to use their assets, such as bonds, stock ETFs, and holdings in CSI 300 Index constituents, as collateral to obtain highly liquid assets like treasury bonds and central bank bills, according to a statement by the People’s Bank of China. The facility’s scale could be expanded based on market conditions. For China State Construction International Holdings (CSCIH), this provides access to highly liquid assets, strengthening its liquidity position and enhancing its ability to manage cash flow and finance operations. Additionally, the SFISF is expected to mitigate herd behavior and other pro-cyclical actions in the capital market, fostering a more stable and predictable environment for CSCIH to operate in.

- Fiscal stimulus. The Ministry of Finance reiterated that the central government has room to increase fiscal deficit. The key policies shown are expected to ease property and construction companies’ liquidity issues.

- Allocate 400 billion yuan (US$56.57 billion) from the local government debt balance limit to expand local financial resources.

- Tap funding from an unused bond quota of 2.3 trillion yuan (US$325.3 billion) for local governments.

- Introduce a one-time, large-scale debt ceiling increase for local governments to swap their hidden debts.

- Allow local governments to use special bonds to purchase idle land from troubled developers.

- Use special bonds to purchase existing commercial homes. Earmark more for offering government-subsidised homes, and less on building new homes.

- Optimise tax policies and study the abolition of value-added tax on ordinary residential buildings.

- Double quota for college student subsidies and increase the per-person amount.

- Allocate 400 billion yuan (US$56.57 billion) from the local government debt balance limit to expand local financial resources.

- 1H24 earnings. Revenue grew by 12.1% to HK$61.8bn in 1H24, compared to HK$55.1bn in 1H23. Net profit attributable to the shareholders of the company rose by 12.7% to HK$5.47bn in 1H24, compared to HK$4.85bn in 1H23. Basic EPS rose to 108.48 HK cents in 1H24, compared to 96.25 HK cents in 1H23.

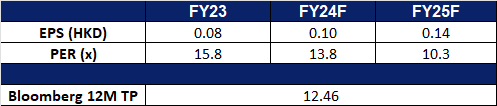

- Market consensus.

(Source: Bloomberg)

Deckers Outdoor Corp (DECK US): Upcoming shopping spree

- RE-ITERATE BUY Entry – 156 Target – 176 Stop Loss – 146

- Deckers Outdoor Corporation designs and markets footwear and accessories. The Company offers footwear for men, women and children. Deckers sells its products including, accessories such as handbags, headwear, and outerwear. Deckers Outdoor serves customers in the United States.

- HOKA’s Growth Momentum. With the rise of professional outdoor sports in China, HOKA’s road running, trail running, and hiking shoes have gained significant traction in the market. The brand’s rapid expansion in China is driven by double-digit growth in the country’s trail running shoe segment. Deckers is capitalizing on this demand by increasing its store count and planning to open a flagship store in China. Over the past four years, HOKA has maintained an impressive annual revenue growth rate exceeding 50%, reaching US$1.41bn in FY24, with projections to hit US$2bn in FY25.

- UGG’s Resurgence. UGG snow boots have experienced a revival in the past two years, driven by the Y2K fashion trend, which draws inspiration from the late 1990s and early 2000s. This trend has contributed to a rapid rise in UGG’s sales, as the boots have become a popular choice once again among fashion-conscious consumers.

- Optimism for 4Q24. Deckers is well-positioned to benefit from the year-end shopping season in both China and Western markets. Key events such as China’s Double 11 Shopping Festival and Black Friday in Europe and the US provide strong opportunities for retail brands to boost their sales and meet annual targets. Historically, consumer discretionary stocks, especially those in the retail sector, perform well in November and December, and Deckers is likely to see a positive impact from better-than-expected holiday sales performance and strong Christmas season guidance in Western markets.

- 1Q25 earnings review. Revenue increased 22.1% YoY, exceeding expectations by US$18.82mn. GAAP earnings per share were US$4.52, beating expectations by US$1.01. The company guided for FY25 net sales to grow approximately 10% to US$4.7bn, with an earnings per share range of US$29.75 to US$30.65, higher than the previous range of US$29.5 to US$30.0.

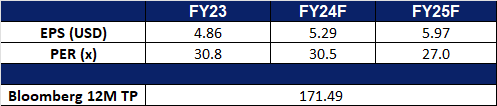

- Market consensus.

(Source: Bloomberg)

On Holding AG (ONON US): Embracing shopping season

On Holding AG (ONON US): Embracing shopping season

- RE-ITERATE BUY Entry – 50 Target – 56 Stop Loss – 47

- On Holding AG operates as a holding company. The Company, through its subsidiaries, provides footwear and sports apparel products includes ultralight and stretchable fabrics and accessories. On Holding serves customers worldwide.

- Increase in consumer spending. The outlook for consumer spending is positive as lower interest rates are expected to boost confidence. Federal Reserve Chair Jerome Powell recently indicated that the Fed will likely continue with gradual, quarter-percentage-point rate cuts, following a larger half-point cut in September. Powell emphasized a cautious approach, balancing inflation control with maintaining low unemployment, with two more rate cuts anticipated by year-end, dependent on key economic data. The fourth quarter in the US is traditionally a time when consumer spending increases due to the winter holidays. In 2023, Americans heightened their spending at retailers during the holiday season, according to the Commerce Department retail sales rose by 0.6% in December, following a 0.3% increase in November which indicated continued consumer confidence and a willingness to spend freely. A record-breaking 200.4 million consumers shopped over the five-day holiday weekend from Thanksgiving through Cyber Monday, surpassing the 2022 record of 196.7 million, according to the National Retail Federation (NRF) and Prosper Insights & Analytics. Looking ahead to the upcoming winter season, we expect continued strength in consumer spending, particularly during key holiday periods such as Thanksgiving, Black Friday, Cyber Monday, Christmas, and Boxing Day. This is anticipated to boost sales for many brands across both physical stores and online channels, including brands like On Holdings.

- Expansion opportunities. On Holding continues to expand its distribution capabilities in North America and is advancing its warehouse automation project in the U.S. The brand is also focused on diversifying into new apparel categories and growing in various geographical regions, which will drive future sales. In line with its multi-channel strategy, On recently opened new retail stores in Paris and Hong Kong, supporting its global expansion.

- Innovative product line. The company unveiled its innovative LightSpray™ technology with the release of the Cloudboom Strike LS marathon shoe. This groundbreaking method uses a robotic arm to spray material onto a mold, creating a seamless, lace-free upper. The high-end shoe is lightweight and aerodynamic, catering to marathon runners. This production technique, which reduces reliance on traditional manufacturing processes, can be scaled more easily with the introduction of additional robots.

- 2Q24 earnings review. The company delivered revenue of CHF567.7mn, a 27.8% YoY increase, gross profit margin of 59.9% and an adjusted EBITDA margin of 16%. The company reaffirmed its full-year guidance, expecting at least 30% net sales growth (constant currency), a gross profit margin around 60%, and an adjusted EBITDA margin between 16% to 16.5%.

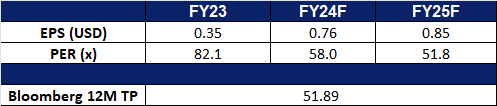

- Market consensus.

(Source: Bloomberg)

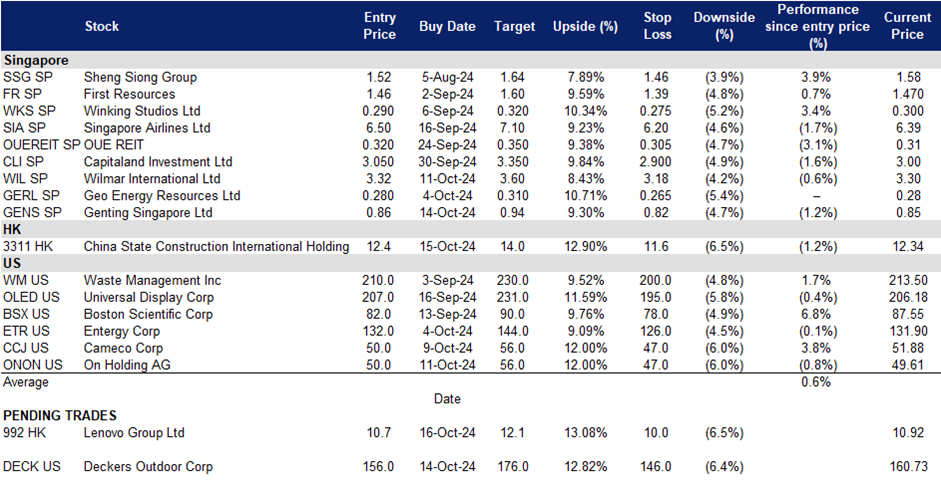

Trading Dashboard Update: Take profit on Dell Technologies Inc (DELL US) at US$130. Add Genting Singapore Ltd (GENS SP) at S$0.86, Geo Energy Resources Ltd (GERL SP) at S$0.280, and China State Construction International Holding Ltd (3311 HK) at HK$12.40. Stop loss on General Mills Inc (GIS US) at US$70.5 and Anta Sports Products Ltd (2020 HK) at HK$88.