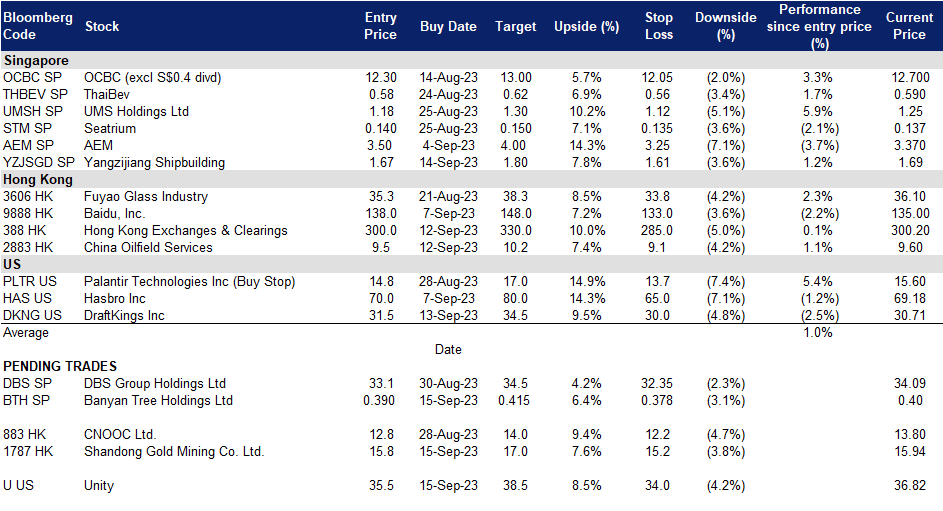

15 September 2023: Banyan Tree Holdings Ltd. (BTH SP), Shandong Gold Mining Co. Ltd. (1787 HK), Unity Software Inc (U US)

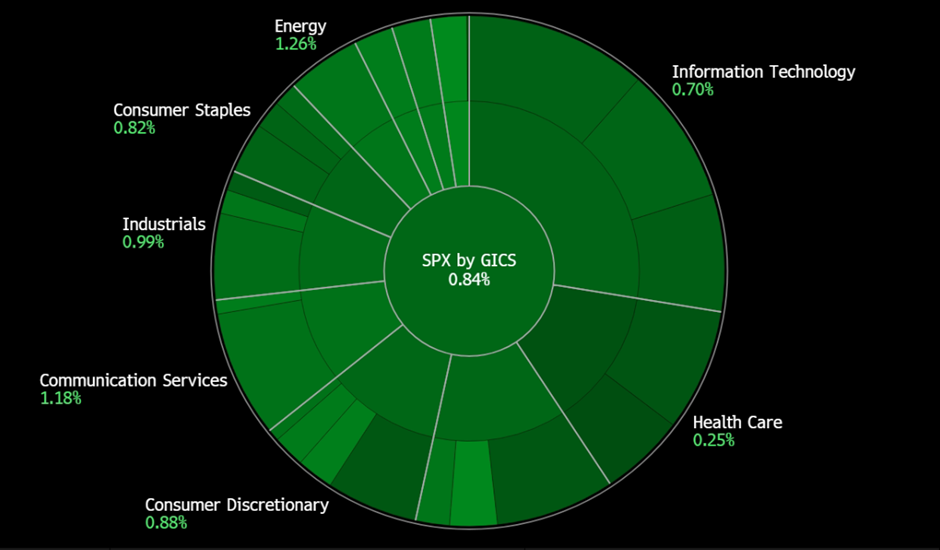

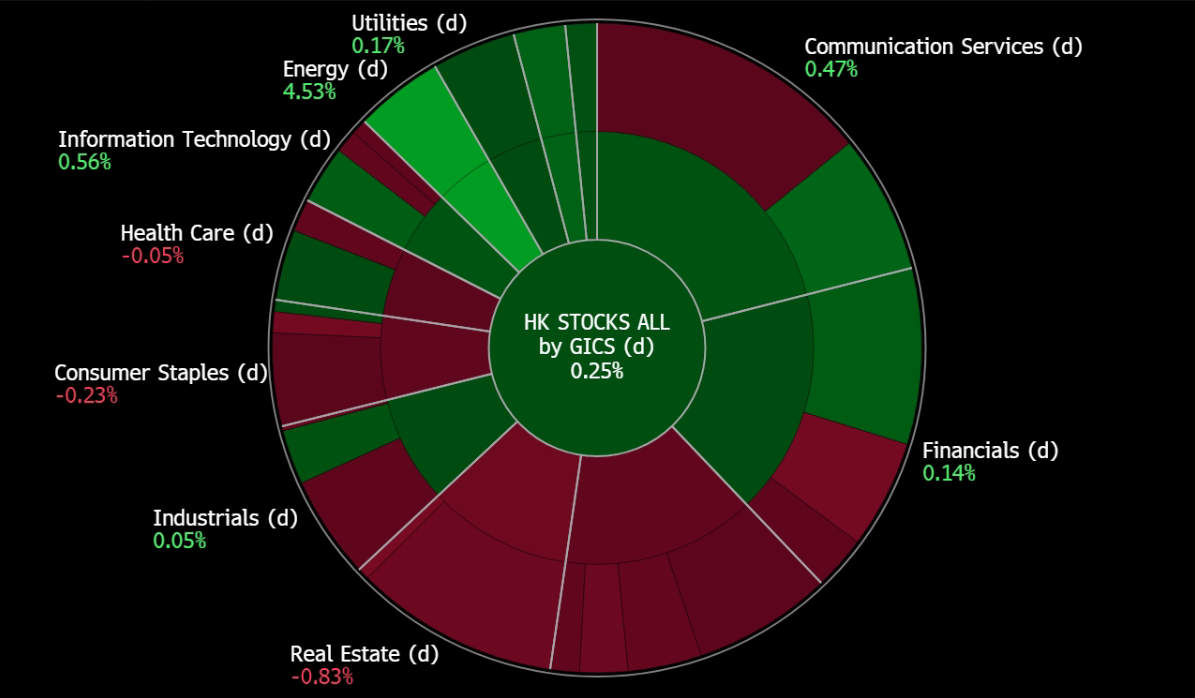

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Banyan Tree Holdings Ltd. (BTH SP): Fear not, tourism is here to stay

- BUY Entry 0.390 – Target – 0.415 Stop Loss – 0.378

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Visa-free travel. Thailand will temporarily waive tourist visa requirements for visitors from China and Kazakhstan from 25 September 2023 to 29 February 2024, in an effort to attract more tourists and spur spending during the year-end high season to stimulate the economy, which is slowing due to weak exports. The business sector has welcomed the government’s new policy, and airlines are preparing to increase flights and add more capacity to accommodate the expected increase in tourists. The tourism industry is optimistic that the visa-free scheme will be a success and boost tourism spending in Thailand. This would also benefit businesses such as Banyan Tree, which has multiple properties in the country. The visa-free scheme would make it easier and more convenient for Chinese tourists to visit Thailand, which could lead to an increase in bookings at Banyan Tree’s properties.

- Banyan Tree Dubai. Banyan Tree Group, Ennismore, and Dubai Holding have partnered to open a new Banyan Tree hotel in Dubai, replacing the existing Caesars Palace Dubai on Bluewaters Island. The new hotel will be co-operated by Banyan Tree Group and Ennismore and is scheduled to open in November 2023. It will have 179 rooms, including 30 suites and a brand-new four-bedroom villa, a Banyan Tree spa, a mini rainforest, five F&B outlets, and 96 private residences. This is the first of many hotel and brand development projects that Accor and Dubai Holding plan to collaborate on, to further develop and grow the hospitality sector in Dubai.

- Confidence in recovery. Ho Kwon Ping, founder of Banyan Tree Holdings, expects the tourism sector to benefit from the return of Chinese tourists, although the mass market is taking longer to recover. He is not worried about the lack of Chinese tourists, as Banyan Tree does not cater to mass market travellers. He is also confident that the Chinese real estate market will not collapse, as the banking system is strong. Additionally, he mentioned that Banyan Tree’s exposure to the Chinese real estate bubble is not large due to the sale of a few hotels in China before the bubble.

- 1H23 results review. Revenue for 1H23 increased 21% to S$143.7mn, from S$118.6mn a year ago. It achieved a 68% increase in core operating profit to S$18.7mn in 1H23 from S$11.1mn in 1H22. RevPAR rose 64% in 1H23 (on a same-store basis) vs 1H22.

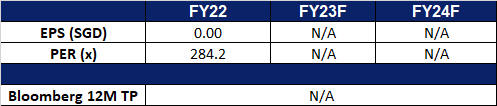

- Market consensus.

(Source: Bloomberg)

ThaiBev (THBEV SP): Expecting a tourism boost in Thailand during China’s upcoming golden week

- RE-ITERATE BUY Entry 0.58 – Target – 0.62 Stop Loss – 0.56

- Thai Beverage Public Company Limited is Thailand’s largest and leading beverage producer and distributor. Its operation is considered among the leading distillers and brewers and in Southeast Asia. ThaiBev’s leading products include a variety of well-established spirits brands, including its famous brew Chang Beer. In the non-alcoholic beverage category, key products include water, tonic soda, energy drink, ready-to-drink coffee and green tea.

- Visa-free travel. Thailand will temporarily waive tourist visa requirements for visitors from China and Kazakhstan from 25 September 2023 to 29 February 2024, in an effort to attract more tourists and spur spending during the year-end high season to stimulate the economy, which is slowing due to weak exports. The business sector has welcomed the government’s new policy, and airlines are preparing to increase flights and add more capacity to accommodate the expected increase in tourists. The tourism industry is optimistic that the visa-free scheme will be a success and boost tourism spending in Thailand.

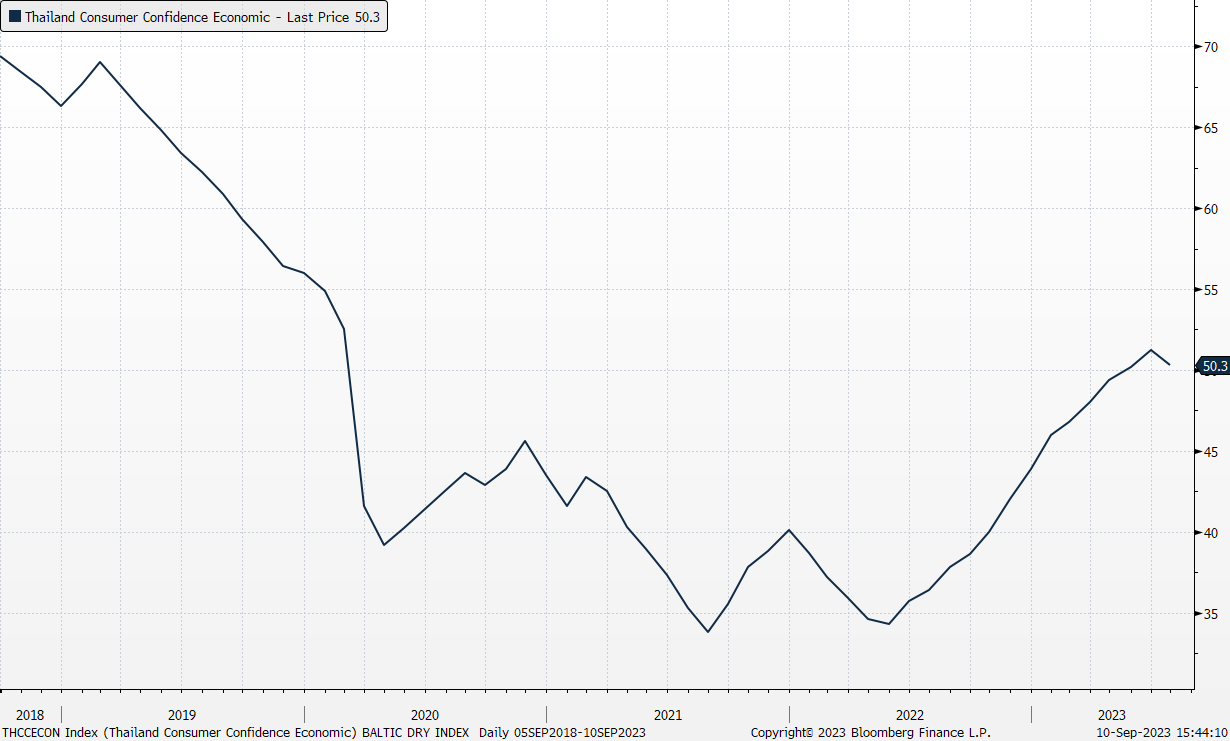

- Consumer confidence remains strong. According to the latest consumer confidence survey, the index recovered to the highest level since the COVID outbreak, reaching 51.2 in June before declining slightly to 50.3 in July. This promising recovery was driven by the growth in tourism and the demand for industrial and agricultural goods.

Thailand Consumer Confidence Economic Index

(Source: Bloomberg)

- Tourism to drive alcohol consumption. Thailand’s economy is expected to have grown by 3.1% in 2Q23, up from 2.7% in 1Q23. The growth was driven by increased foreign tourist arrivals, which have been recovering since the country reopened its borders in late 2022. However, exports, a key driver of growth, have contracted since October 2022, indicating weak global demand. Despite the challenges, the Thai economy is still expected to grow by an average of 3.7% in 2023, in line with the Bank of Thailand’s estimate. With alcohol being readily available in Thailand and as more foreign tourists visit Thailand, it is anticipated that the amount of alcohol consumed will increase alongside tourism arrivals. Thailand is expected to see another peak in tourism during the upcoming golden week in China (China’s National Day holiday) as the Chinese still favour Thailand as an overseas travelling destination.

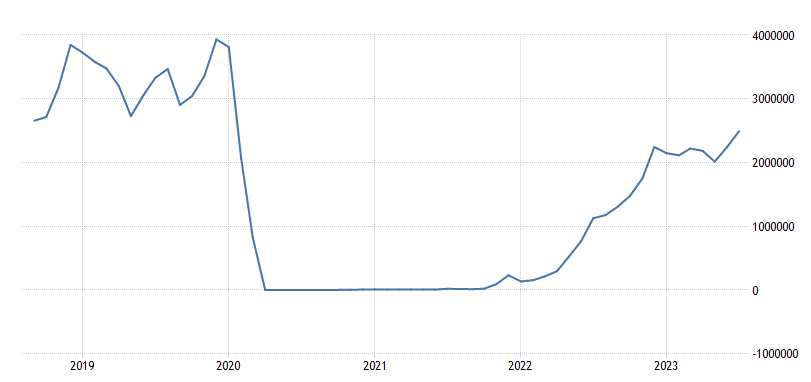

Thailand Tourists Arrivals

(Source: Trading Economics)

- 3Q23 earnings review. Revenue grew mildly by 3.8% YoY to 215.9bn THB. EBITDA was down 3.4% YoY to 37.8bn THB. Its largest revenue contributor, the spirits business revenue was 93.7bn THB a 3.3% rise YoY.

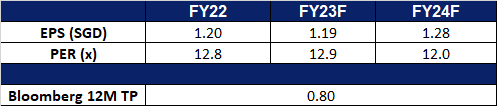

- Market consensus.

(Source: Bloomberg)

Shandong Gold Mining Co. Ltd. (1787 HK): Go for Gold

- BUY Entry – 15.8 Target – 17.0 Stop Loss – 15.2

- Shandong Gold Mining Co., Ltd. is a China-based company principally engaged in the mining, processing and sales of gold. The Company operates two segments. The Gold Mining segment is engaged in the mining of gold ore. The Gold Refining segment is engaged in the production and sales of gold. The Company is also engaged in the distribution of other metals extracted during the gold ore smelting process, such as silver, copper, iron, lead and zinc. The Company conducts its businesses in domestic and overseas markets.

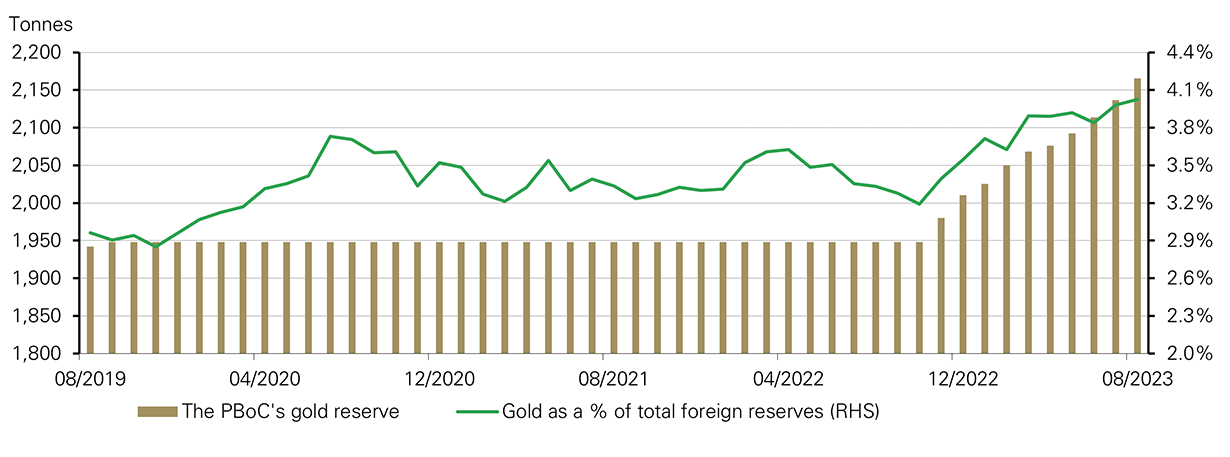

- China increasing its gold reserves. China has been buying gold for 10 consecutive months, increasing its already sizable holdings as part of a strategy to reduce its reliance on the US dollar. China’s central bank increased its gold holdings by 930,000 troy ounces, or around 29 tonnes in August, according to the bank’s statement recently. Gold now makes up 4.03% of China’s foreign exchange reserves in US dollars, the highest level ever recorded.

PBOC Gold Reserves

(Source: PBoC, World Gold Council)

- New discovery of Gold resources. Shandong Gold Group Co. announced that the estimated total gold reserves at the Xiling gold mine in Shandong province have increased to about 592.2 metric tons, up more than 200 tons from previous estimates. The gold reserves have a potential value of more than 200bn yuan (US$27.7 bn), making Xiling the largest single gold reserve mine in China. Accordingly to the company. the Xiling gold mine is also expected to maintain production for about 40 years, if its annual processing capacity is 3.3mn tons.

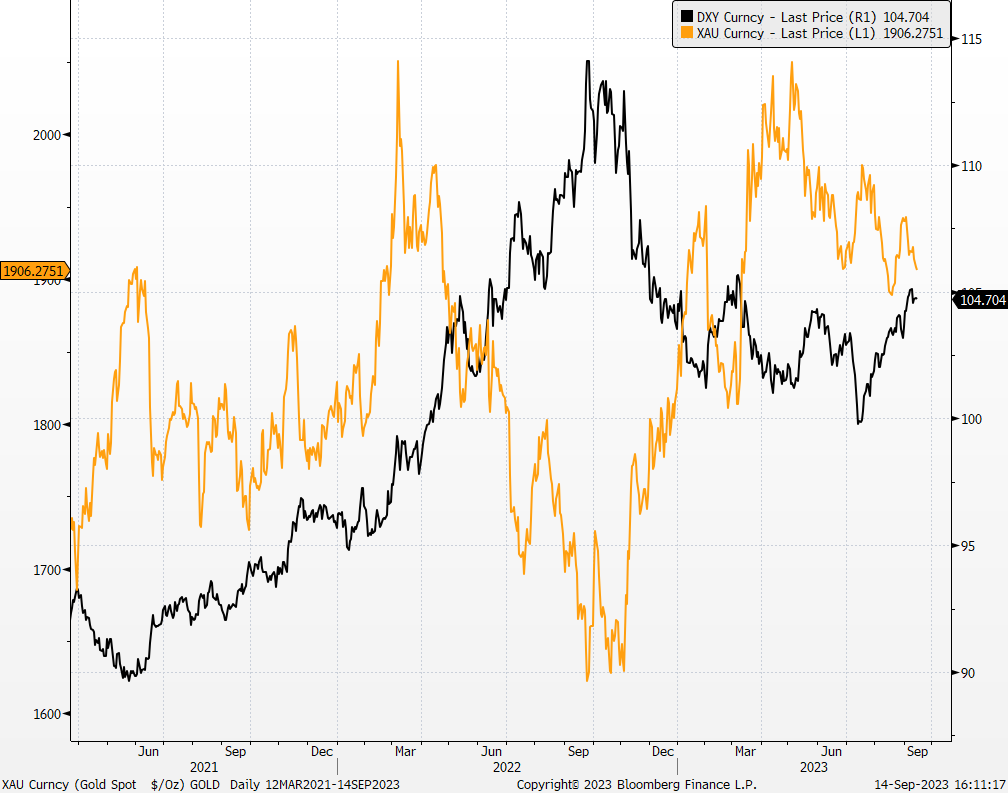

- Interest Rates expectations near its peak. Investors expects the Federal Reserve to leave Fed Fund Rate unchanged in September, and is only expected to start its rate cuts in 2Q2024 or later, with the current Fed Fund Rate atn 5.25% to 5.50%.With interest rates reaching its peak, the price of gold may see some positives, given that inflation continues to show signs of slowing down.

Gold Price and Dollar Index Trend

(Source: Bloomberg)

- 1H23 results. Revenue fell slightly to RMB27.4bn, down 8.1% YoY, compared to RMB29.8bn in 1H22. Net profit rose to RMB979.8mn in 1H23, up 69.8% YoY, compared to RMB577.1mn in 1H22. Basic EPS was RMB0.14 cents in 1H23, compared to RMB0.09 in 1H22.

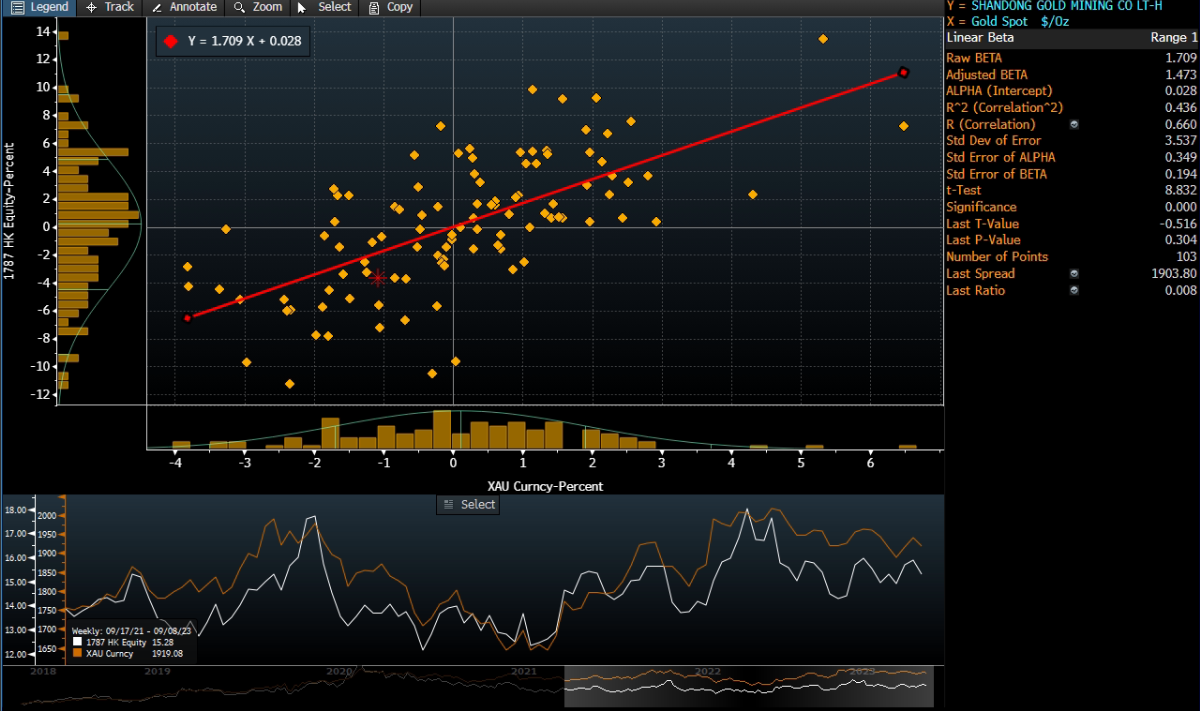

Shandong Gold vs Gold Price

(Source: Bloomberg)

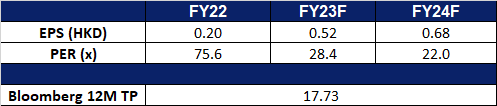

- Market Consensus.

(Source: Bloomberg)

China Oilfield Services (2883 HK): Capturing Oil Demand

- RE-ITERATE BUY Entry – 9.50 Target – 10.20 Stop Loss – 9.10

- China Oilfield Services Limited is a comprehensive oilfield service provider. The Company mainly operates through four business segments. The Drilling Services segment is mainly engaged in the provision of oilfield drilling services. The Oil Field Technical Services segment is mainly engaged in the provision of oilfield technical services, including the logging, drilling fluids and directional drilling services. The Geophysical and Engineering Exploration Services segment is mainly engaged in the provision of seismic prospecting and engineering exploration services. The Marine Support Services segment is engaged in the transportation of supplies, including the delivery of crude oil, as well as refined oil and gas products. The Company mainly operates its businesses in domestic and overseas markets.

- New Drilling Rig Service Contracts. China Oilfield Services recently announced that its wholly owned subsidiary, COSL Drilling Europe, has entered into multiple drilling rig service agreements with two multinational oil firms in Norway, each with a set term and an option to extend for up to five years. The total value of the contracts with fixed terms is around 4.7 billion RMB.

- Demand for oil to outgrow supply. World oil demand is surging to record levels, with growth being driven by a number of factors, including a rebound in air travel, increased oil use in power generation, and strong demand from China’s petrochemical industry. Demand is expected to rise by 2.2 mb/d in 2023, reaching 102.2 mb/d. China is expected to account for more than 70% of this growth. Additionally, major oil-producing countries, including Saudi Arabia, also recently announced that they would be extending the voluntary oil cuts to year-end, putting more constraints on oil supply, and driving up oil prices in the near term. Saudi Arabia will be extending its voluntary oil cut of 1mn barrels per day to the end of 2023, and Moscos will be extending its voluntary oil cut of 300,000 barrels per day to end of 2023, with both countries to still review the cuts monthly. Consequently, the cost of oil is anticipated to increase within the market.

- 1H23 earnings. Revenue rose by 24.1% YoY to RMB18.9bn, compared to RMB15.2bn in 1H22. Net profit rose 31.0% YoY to RMB1.46bn, compared to RMB1.11bn in 1H22. Basic EPS rose by 21.1% YoY to RMB28.06, compared to RMB23.17 in 1H22.

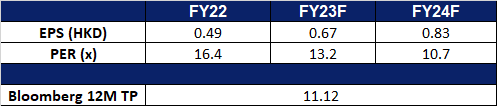

- Market Consensus.

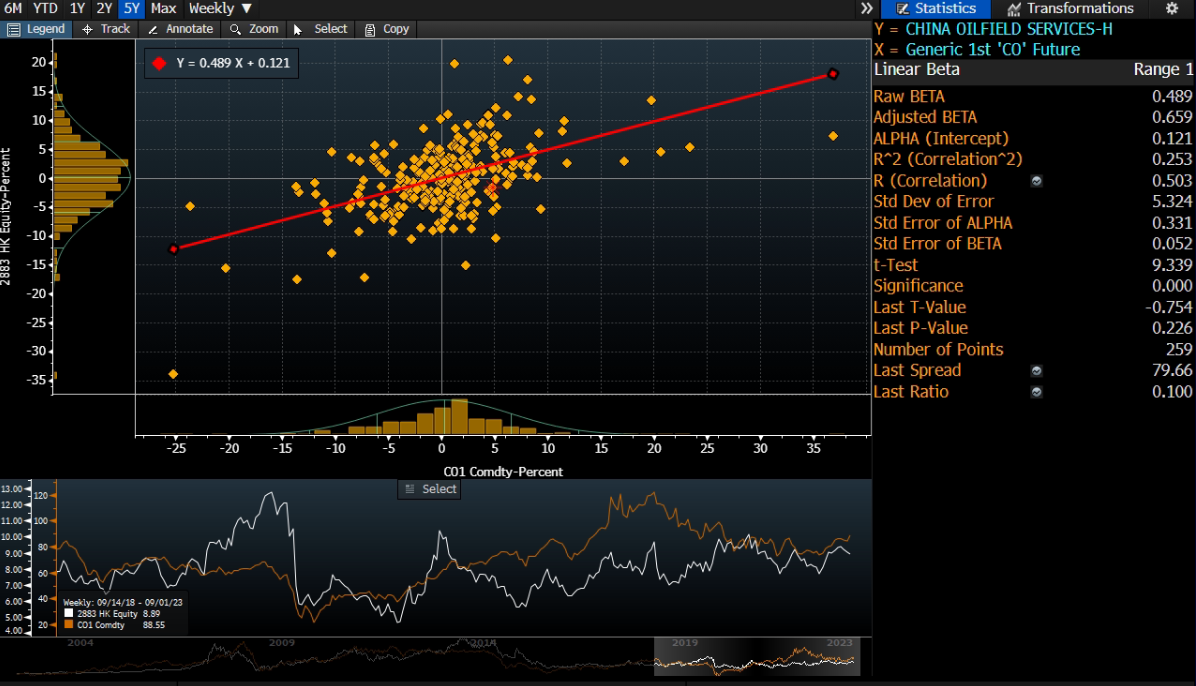

Share price and Brent crude oil price correlation

(Source: Bloomberg)

(Source: Bloomberg)

Unity Software Inc (U US): Buy the dip

- BUY Entry – 35.5 Target – 38.5 Stop Loss – 34.0

- Unity Software Inc. provides software solutions. The Company offers graphic tools to create, run, and monetize real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. Unity Software serves customers worldwide.

- Introduction of Runtime Fee. On 13 September, Unity announced that it would introduce a new “Unity Runtime Fee” at the start of 2024 that will charge developers for every game install. The fee will be charged to developers who have crossed specific revenue and install thresholds, and will vary depending on the licence and region. Unity is also making some updates to its licensing plan, such as allowing developers to use a Unity Personal license even if they are making revenue from their game. The company has stated that the fee will not impact the majority of its customers, but some developers have expressed concern that it will disproportionately impact indie developers and smaller studios. This initial install-based fee would allow creators to keep the ongoing financial gains from player engagement, as opposed to a revenue share model, which would require them to give up a portion of their revenue. Although the share price of Unity fell after the announcement of the new fee, we believe that this fee will be beneficial for the company in the long run. The fee may encourage users to become paying subscribers, while most of the current user base is likely to remain with Unity, as developers are unlikely to switch to alternative game engines, especially larger corporations with significant in-game users. Therefore, we believe that this is a good opportunity to buy the dip in Unity’s stock price.

- 2Q23 earnings review. Revenue rose 79.6% year-over-year to US$533.48mn, beating estimates by US$16.13mn. GAAP EPS of -$0.51 beat expectations by $0.11.

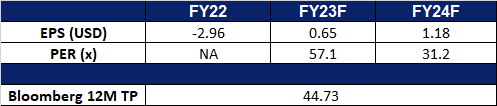

- Market consensus.

(Source: Bloomberg)

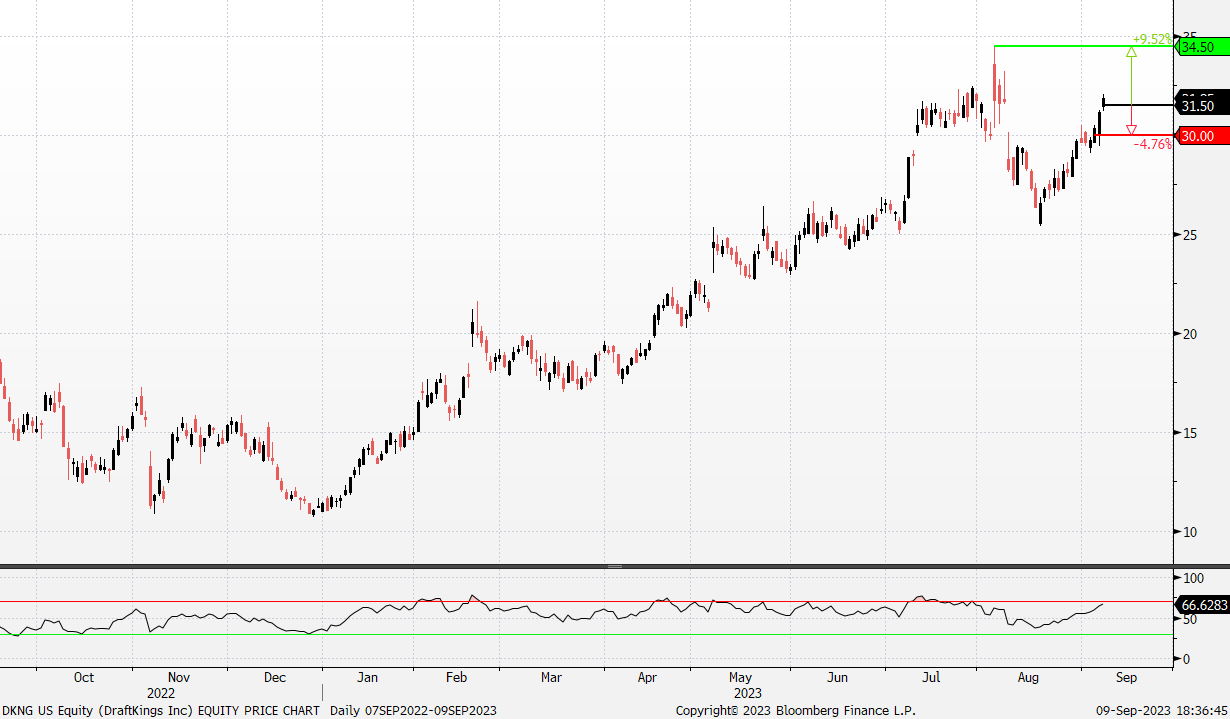

DraftKings Inc (DKNG US): Super Bowl Season

DraftKings Inc (DKNG US): Super Bowl Season

- RE-ITERATE BUY Entry – 31.5 Target – 34.5 Stop Loss – 30.0

- DraftKings Inc. operates as a daily fantasy sports contest and sports betting company. The Company allows users to enter daily and weekly fantasy sports-related contests and win money based on individual player performances in American sports. DraftKings serves customers in the United States.

- NFL season. The NFL season, which commenced last Thursday and will culminate in the Super Bowl in Las Vegas on 11 February 2024, holds a prominent position in the sports betting industry. A survey conducted by the American Gaming Association anticipates a substantial surge in adults participating in NFL betting this year, projecting 73.5 million participants compared to 27 million in 2022. Currently, FanDuel and DraftKings dominate the sports betting market share, while competitors such as BetMGM, Caesars Entertainment, and Bet365 vie for their share. The entry of ESPN Bet, facilitated by a partnership with Penn Entertainment, introduces an element of uncertainty to the landscape. DraftKings stands to benefit from the increase in anticipated participants and promotional activities in the sector.

- Possible game changer. Disney’s ESPN Bet is gearing up to play a significant role in the upcoming NFL season, in partnership with Penn Entertainment. Although ESPN Bet will only launch in the middle of the season, it will benefit from ESPN’s extensive football coverage across various platforms. Recent survey data from Jefferies highlights a growing interest in online sports betting, with 44% of respondents having placed bets in the past year, up from 37% in January. Moreover, 89% of respondents are likely to continue betting with their current accounts, compared to 83% in January. Notably, more bettors are considering maintaining multiple sportsbook accounts, with 33% planning to stick with just one account (down from 40%), 39% intending to have two accounts (up from 37%), and those looking to keep three accounts increasing to 20% from 15% in the previous survey. However, it’s worth noting that previous ESPN marketing partnerships with companies like Caesars Entertainment and DraftKings had mixed success, and media partnerships with Bally’s, Fox Bet, and PointsBet-NBC didn’t live up to the initial hype. Therefore, ESPN Bet’s impact on DraftKings’ revenue during this Super Bowl season remains uncertain.

- Promotions to entice users. DraftKings presents an enticing “Bet $5, Get $200” welcome bonus for newcomers. To qualify, simply click the provided link, place a $5 bet on any market, and enjoy a cash payout if their bet wins. Win or lose, DraftKings sweetens the deal with eight $25 bonus bets, each requiring just a 1x playthrough. Beyond this, DraftKings boasts an array of promotions, including free-to-play pools, enhanced parlays, a referral program, and a rewards initiative. The platform is accessible in multiple states and offers user-friendly web and mobile interfaces for betting. Nonetheless, it falls short in customer support, is limited to email, and could enhance withdrawal processing times. Overall, DraftKings distinguishes itself with a generous welcome bonus and a user-friendly interface, making it an excellent choice for sports betting enthusiasts.

- 2Q23 earnings review. Revenue rose 87.8% year-over-year to US$875mn, beating estimates by US$112.16mn. Non-GAAP EPS of $0.14 beat expectations by $0.28. DraftKings’ Q2 revenue increase was driven by the acquisition of new customers and higher bets on lucrative products. The number of monthly unique players grew by 44% to 2.1mn. The company raised its FY23 revenue guidance to a range of $3.46bn to $3.54bn.

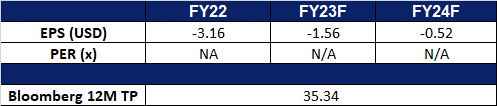

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Yangzijiang Shipbuilding (YZJSGD SP) at S$1.67 and DraftKings Inc (DKNG US) at US$31.5. Cut loss on Samsonite International S.A. (1910 HK) at HK$24.3 and Netflix Inc (NFLX US) at US$419.5.