15 November 2024: SIA Engineering Co Ltd (SIE SP), Tencent Holdings Ltd. (700 HK), Old Dominion Freight Line Inc (ODFL US)

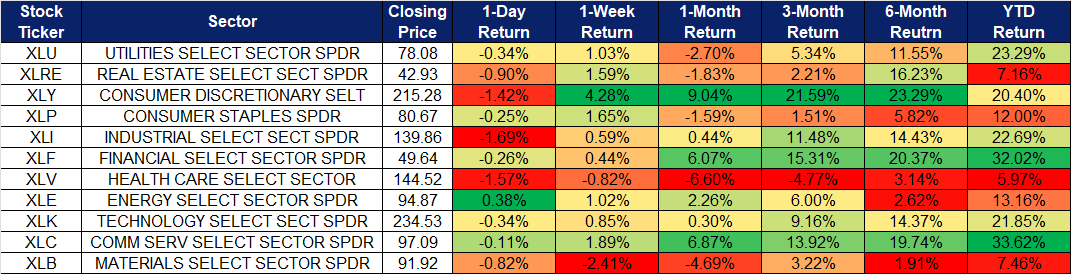

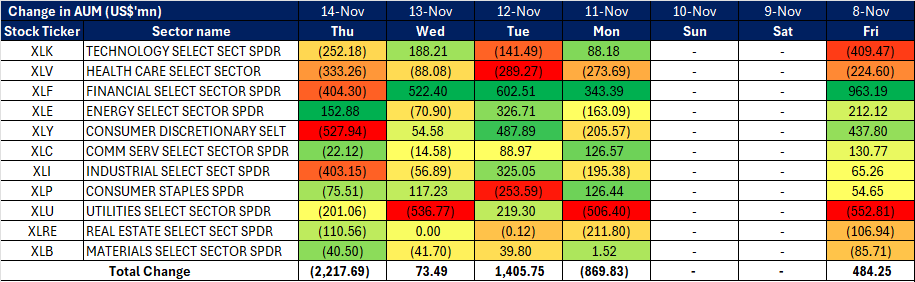

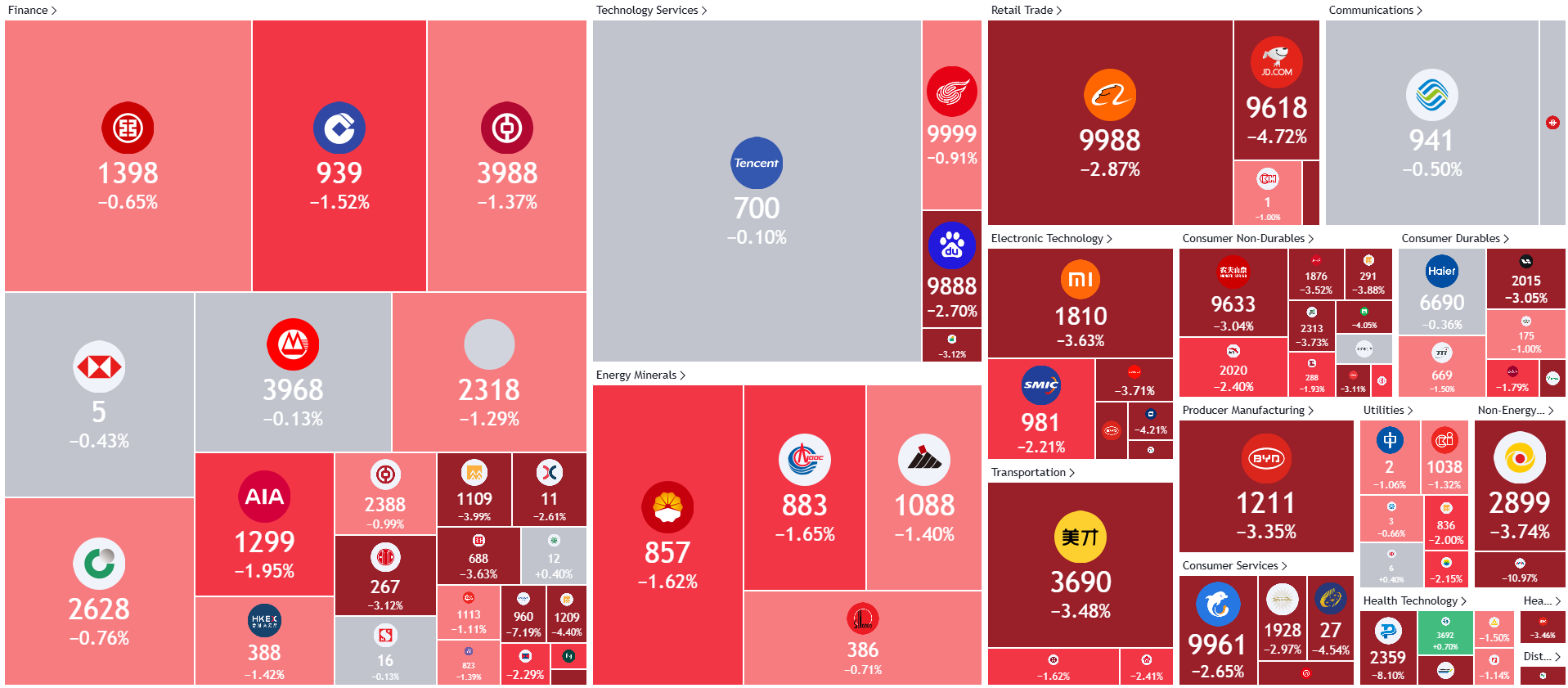

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

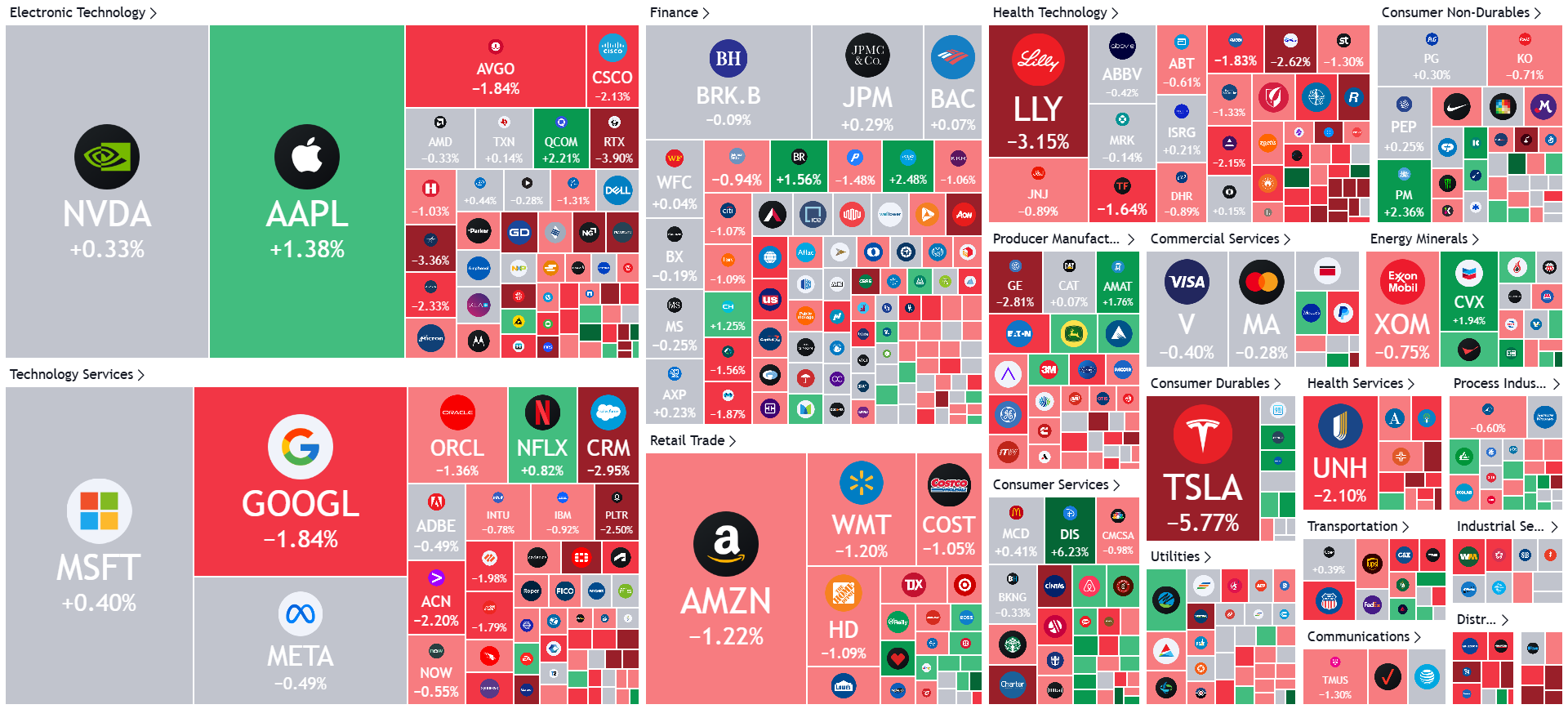

United States

Hong Kong

SIA Engineering Co Ltd (SIE SP): Maintain strength amidst flight recovery

- BUY Entry – 2.36 Target– 2.56 Stop Loss – 2.26

- SIA Engineering Co Ltd provides airframe and component overhaul services, line maintenance and technical ground handling services. The Company also manufactures aircraft cabin equipment, refurbishes aircraft galleys, repairs and overhauls hydromechanical aircraft equipment.

- Continued flight recovery. SIAEC saw total flights handled by the company’s line maintenance business reaching 95% of pre-COVID level as of September 2024. The increased flight activities contributed to an increased demand for aircraft maintenance, repair, and overhaul services. This recovery trend is expected to continue as more airlines ramp up flight schedules, alongside the arrival of the year-end peak travelling season, alongside more visa-free travel agreements between countries.

- Framework agreement with Xiamen Iport Group. SIAEC recently announced the signing of a non-binding Framework Agreement to explore a potential investment in Airport Aircraft Maintenance & Engineering (Fujian) (“Airport AME”), a subsidiary of IPORT Group that provides line maintenance and ground services at airports in Fujian, China. Under this Framework Agreement, both parties will work toward finalizing and signing definitive agreements, subject to regulatory requirements and necessary approvals. This partnership offers SIAEC opportunities for additional revenue sources over the long term.

- Subang base operational in 2H25. Base Maintenance Malaysia Sdn. Bhd. (BMM), a wholly owned subsidiary under SIAEC signed a lease agreement for Hangar facilities in Subang, Malaysia in December 2023. This adds 2 more hangar facilities with a combined capacity of six simultaneous aircraft checks with a lease term of 15 years to SIAEC’s portfolio. The hangars are expected to begin operations in the second half of 2025 and contribute to the group’s revenue growth.

- Interim dividend. The company declared an interim 1HFY25 dividend of 2 SG cents per share, no change from 1HFY24.

- 1H24 results review. SIA Engineering reported revenue of S$576.2mn for 1HFY24/25, up 12.1% YoY, compared to S$514.0mn in 1HFY23/24, as the company continues to benefit from the recovery of demand for aircraft MRO services. The company also reported a 1HFY24/25 operating profit of S$3.4mn, compared to an operating profit of S$0.1mn in 1HFY23/24. Group profit after tax came in at S$68.8mn in 1HFY24/25, up 16.0% YoY, compared to S$59.3mn in 1HFY23/24, largely attributed to a higher share of profits of JVs and Associated companies.

- We have fundamental coverage with a BUY recommendation and a TP of S$2.59. Please read the full report here.

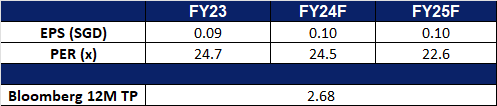

- Market Consensus.

(Source: Bloomberg)

United Overseas Bank Ltd (UOB SP): Continuation of Singapore’s Trump-themed trade

- RE-ITERATE BUY Entry – 35 Target– 39 Stop Loss – 33

- United Overseas Bank Limited provides a wide range of financial services including personal financial services, wealth management, private banking, commercial and corporate banking, transaction banking, investment banking, corporate finance, capital market activities, treasury services, futures broking, asset management, venture capital management and insurance.

- Record high price. In the third-quarter, UOB reported a 16% YoY increase in net profit, reaching S$1.61bn, beating the consensus forecast of S$1.51bn. The growth was attributed to record highs in net fee income and strong trading and investment income. Earnings per share rose to S$3.79, and total income increased by 11% to S$3.83bn. Core return on equity improved to 14.3%, excluding one-off acquisition expenses. Net interest income grew slightly by 1% to S$2.46bn, though the net interest margin decreased to 2.05%. Net fee income rose 7% to S$630mn, driven by wealth management and card fees. Trading and investment income surged 82% to S$709mn, contributing to a 70% increase in other non-interest income. Credit allowances increased by 29% to S$304mn, mainly due to integration issues with Citi’s Thai retail customers, which are expected to normalize soon. Asset quality remained stable with a non-performing loan ratio of 1.5%, and the cost-to-income ratio improved to 42.4%.

- Potential share buyback. UOB’s CFO noted that the company has excess capital of S$2 billion to S$2.5 billion and anticipates an uptick in loan growth for FY25. The bank is considering a potential share buyback to optimize capital management. For FY25, UOB expects high single-digit loan growth, double-digit fee growth, higher total income, a cost-to-income ratio between 41% and 42%, and credit costs within 25 to 30 basis points. This optimistic outlook is expected to drive further growth in its share price, bolstered by increased investor confidence.

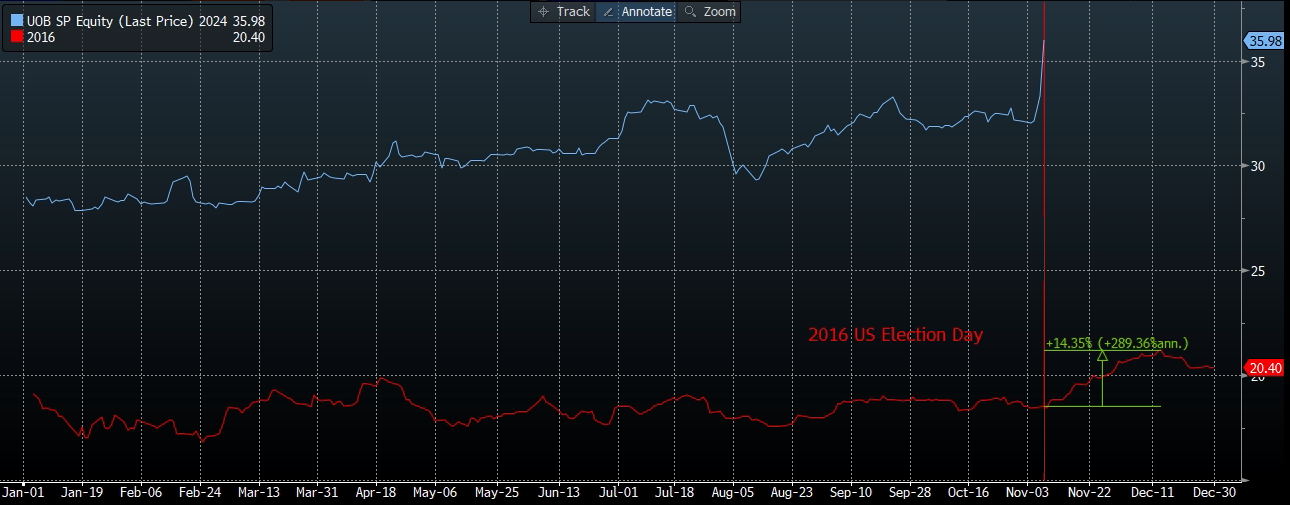

UOB price comparison (current vs Trump victory 2016)

(Source: Bloomberg)

- Benefitting from Trump’s victory. Singapore banks, such as UOB, are well-positioned to benefit from President-elect Donald Trump’s anticipated economic policies. His proposed measures, including tariff impositions and tax reductions, could lead to a larger fiscal deficit, potentially driving up inflation. In response, the Federal Reserve may adopt a tighter monetary stance, resulting in a higher interest rate environment. This scenario is advantageous for UOB, as elevated rates would enhance net interest margins (NIMs), allowing the bank to generate greater income from the difference between lending and deposit rates.

- 3Q24 results review. Total income for 3Q24 rose 11% to S$3.83bn and net profit rose 16% YoY to S$1.61bn from S$1.38bn the year before. Earnings per share was S$3.79 from S$3.23 in 3Q23.

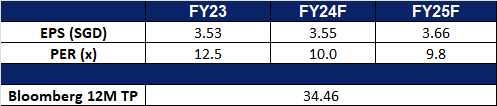

- Market Consensus.

(Source: Bloomberg)

Tencent Holdings Ltd. (700 HK): Video gaming boom

- BUY Entry – 395 Target – 455 Stop Loss – 365

- Tencent Holdings Ltd is an investment holding company primarily engaged in the provision of value-added services (VAS), online advertising services, as well as FinTech and business services. The Company primarily operates through four segments. The VAS segment is mainly engaged in the provision of online games, video account live broadcast services, paid video membership services and other social network services. The Online Advertising segment is mainly engaged in media advertising, social and other advertising businesses. The FinTech and Business Services segment mainly provides commercial payment, FinTech and cloud services. The Others segment is principally engaged in the investment, production and distribution of films and television program for third parties, copyrights licensing, merchandise sales and various other activities.

- Strong profits in 3Q24 buoyed by growth in the video gaming segment. Tencent Holdings, the operator of China’s largest social media platform and the world’s top gaming company by revenue, surpassed analyst expectations with a 47% profit increase in Q3 2024, driven by renewed momentum in its gaming segment. The company reported a profit of 53.2 billion yuan for the quarter, up from 36.2 billion yuan a year earlier, beating the consensus estimate of 45.3 billion yuan. This growth was fueled by strong performance in its gaming business, where established titles maintained consistent engagement globally, complemented by contributions from newer games with long-term potential. Additionally, Q3 marked Tencent’s first full-quarter revenue from Dungeon & Fighter (DnF) Mobile, which launched in May and quickly gained popularity in China. Tencent’s mobile titles continued to perform well, and its August release, Black Myth: Wukong, a global success inspired by the Chinese classic Journey to the West, also bolstered Tencent’s investment portfolio, as the company holds a stake in the game’s developer.

- Further approval of games. China’s gaming industry continues its recovery with the approval of 128 new game titles in October 2024, sustaining the steady approval pace seen throughout the year. This latest batch includes Tencent-backed releases like Supercell’s Squad Busters and the eagerly awaited Goddess of Victory: Nikke, maintaining strong market momentum following the successful launch of Black Myth: Wukong. Throughout 2024, China has consistently approved over 100 domestic titles monthly, with foreign game approvals occurring roughly every two months, signaling government support to rejuvenate the industry after regulatory restrictions in 2021. The regular flow of new approvals has significantly boosted market confidence, with industry projections estimating a compound annual growth rate (CAGR) of 7.63% from 2024 to 2029. The number of gamers in China reached a record high of over 674 million by the end of the first half of 2024. This consistent approval of new games, along with market recovery, is expected to drive continued growth in sales for companies across the sector.

- Continued focused on new growth opportunities in AI. In its latest earnings release, Tencent outlined plans to pursue new growth avenues by advancing the adoption of its proprietary Hunyuan large language model across various industries and enhancing its AI infrastructure for enterprise clients. The company emphasized that it is already realizing tangible benefits from integrating AI across its products and operations, including in areas like marketing services and cloud computing, and remains committed to investing in AI-driven technologies, tools, and solutions to support users and partners. Tencent is also exploring new overseas opportunities in cloud computing, aiming to leverage global demand for AI technology to counteract increasing competition in China, where both established players and startups are engaged in intense price competition. These initiatives could pave the way for additional growth in the coming years.

- 3Q24 results review. Revenue increased 8% YoY to RMB167.2bn in 3Q24, compared with RMB154.6bn in 3Q23. Net profit rose 47% to RMB54.0bn in 3Q24, compared to RMB36.8bn in 3Q23. Basic earnings per share was RMB5.762 in 3Q24, compared to RMB3.828 in 3Q23, representing a 51% YoY increase.

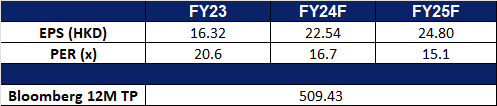

- Market consensus.

(Source: Bloomberg)

Pop Mart International Group Ltd. (9992 HK): Labubu Craze

- RE-ITERATE BUY Entry – 74.0 Target 90.0 Stop Loss – 65.0

- Pop Mart International Group Ltd is a China-based company mainly engaged in the provision of pop toy. intellectual property (IP) is at the core of its business. It has established an integrated platform covering the entire industry chain of pop toys, including artists development, IP operation, consumer access and pop toy culture promotion. The Company develops a broad array of pop toy products based on its IPs. Its Pop Mart brand products are primarily categorized into blind boxes, action figures, ball-jointed doll (BJDs) and accessories. The Company conducts its businesses within the China market and to overseas markets.

- In trendy series continue to rake in revenue. Pop Mart’s Labubu series recently went viral globally, thanks in part to a social media post by BLACKPINK’s Lisa. Combined with endorsements from several other celebrities, this surge in visibility has sparked overwhelming demand for Labubu toys, with products consistently selling out both in stores and online shortly after release. The Labubu series generated RMB 626.8 million in sales during the first half of 2024 and is on track to become Pop Mart’s top IP by revenue for the year. Other popular series, such as Molly and Skullpanda, have also performed exceptionally well, bringing in RMB 782.1 million and RMB 574.3 million in revenue, respectively, as of 1H24.

- Better than expected 3Q24 business updates. Pop Mart recently released its 3Q24 business update, projecting revenue to more than double YoY. The company expects overall revenue to grow by 120%-125% YoY. Revenue from operations in Mainland China increased by 55%-60% YoY, while revenue from Hong Kong, Macao, Taiwan, and overseas markets surged by 440%-445% YoY. This significant growth in overseas revenue highlights the success of Pop Mart’s expansion efforts and its strengthening market presence outside China. The company’s global growth strategy is clearly paying off, contributing substantially to its overall performance.

- Expanding presence locally and overseas. Pop Mart, the renowned high-end toy brand, has officially opened a store at Sun World Ba Na Hills in Da Nang, creating a highly artistic space. Situated in a prime location atop Ba Na Hills, the store features impressive interior architecture resembling a grand castle, inspired by the artistic and cultural charm of an old French village. This marks Pop Mart’s first store in a Southeast Asian theme park. Visitors can explore iconic characters like Molly, SkullPanda, Hirono, Dimoo, and The Monsters, making each visit a unique artistic experience. In addition, Pop Mart recently launched its first theme park in Beijing, transforming Chaoyang Park—the city’s largest park—into an immersive entertainment space filled with beloved characters like Molly, Labubu, and Dimoo. These expansions, coupled with the growing popularity of The Monsters and Molly series, are set to attract even more visitors and strengthen Pop Mart’s global presence.

- 1H24 earnings. The company’s revenue rose to RMB4.56bn in 1H24, +62.0% YoY, compared to RMB2.81bn in 1H23. The company’s net profit rose by 93.3% YoY to RMB964.1mn in 1H24, compared to RMB477.2mn in 1H23. Basic earnings per share rose to RMB69.49 in 1H24, compared to RMB35.46 in 1H23.

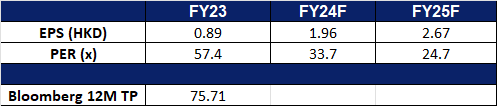

- Market consensus.

(Source: Bloomberg)

Old Dominion Freight Line Inc (ODFL US): Domestic logistics to benefit from Trump’s re-election

- BUY Entry – 222 Target – 248 Stop Loss – 209

- Old Dominion Freight Line, Inc. is an inter-regional and multi-regional motor carrier. The Company primarily transports less-than-truckload shipments of general commodities, such as consumer goods, textiles, and capital goods. Old Dominion Freight Line serves regional markets throughout the United States.

- Increased domestic trucking demand. President-elect Donald Trump’s proposed tariffs on imports, particularly from China, aim to encourage more domestic manufacturing and reduce reliance on foreign-made goods. In the short term, domestic manufacturers may frontload imports of commodities and components to avoid potential tariff hikes, likely causing temporary freight rates and domestic trucking rate increases due to demand spikes. Long term, once tariffs are enacted and US manufacturing scales up, demand for domestic logistics is expected to rise, benefiting carriers like Old Dominion Freight Line as they transport goods produced domestically across the US.

- Declining oil prices. Trump’s energy policies, focused on boosting US oil production and lowering gasoline costs, are anticipated to lead to a decline in oil prices. This drop would reduce operating costs for domestic trucking companies, benefiting their bottom lines. With the US as the world’s largest oil producer, increased production would further boost global oil supply, exerting downward pressure on prices. Additionally, Trump’s limited emphasis on climate change may delay a transition from diesel engines, potentially prolonging low fuel costs for companies like Old Dominion Freight Line, and supporting further improvements to its bottom lines.

- 3Q24 results. Revenue decreased by 3.3% YoY to US$1.47bn, missing expectations by US$20mn. GAAP earnings per share were US$1.43, beating expectations by US$0.01.

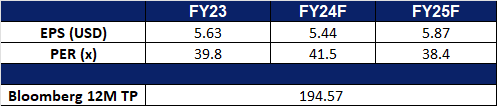

- Market consensus.

(Source: Bloomberg)

Palantir Technologies Inc (PLTR US): Growth in commercial revenue

- RE-ITERATE BUY Entry – 56 Target – 64 Stop Loss – 52

- Palantir Technologies Inc. develops software to analyze information. The Company offers solutions support many kinds of data including structured, unstructured, relational, temporal, and geospatial. Palantir Technologies serves customers worldwide.

- Artificial intelligence application prospects are clear. The U.S. Department of Defense stands as the company’s largest public customer, leveraging its platform to deliver AI training to the U.S. Navy and Army. Given the sensitive and confidential nature of this data, the business has a strong competitive moat, ensuring stable and predictable growth in receivables. Additionally, the company’s commercial customer base is expanding rapidly. Its business model connects the AI platform with enterprise data to perform business analysis and provide tailored solutions. As customers become integrated, recurring revenue steadily increases. Overall, the company is in the early stages of significant growth.

- The performance of the last two quarters complies with the Rule of 40. The Rule of 40 is an indicator used to measure the comprehensive benefits of a Software as a Service (SaaS) company. This rule states that a combination of revenue growth rate and profit margin (EBITDA Margin) should equal or exceed 40% to indicate strong financial health. Palantir Technologies has exceeded this threshold in the last two quarters, demonstrating its robust fundamentals.

- 3Q24 results. Revenue increased by 30% YoY to US$725.5 million, exceeding expectations by US$21.83 million. GAAP earnings per share were US$0.1, beating expectations by US$0.01. Expected FY2024 revenue to be between US$767 million and US$771 million, lower than market expectations of US$774.05 million; raised U.S. commercial revenue forecast to at least US$687 million, with growth of at least 50%; revised adjusted operating income Guidance was raised to US$1.054 billion to US$1.058 billion; adjusted cash flow guidance was raised to more than US$1 billion; and it continues to expect positive GAAP operating income and net income in each quarter this year.

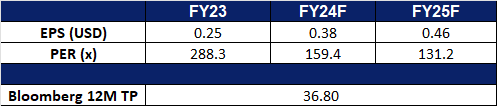

- Market consensus.

(Source: Bloomberg)

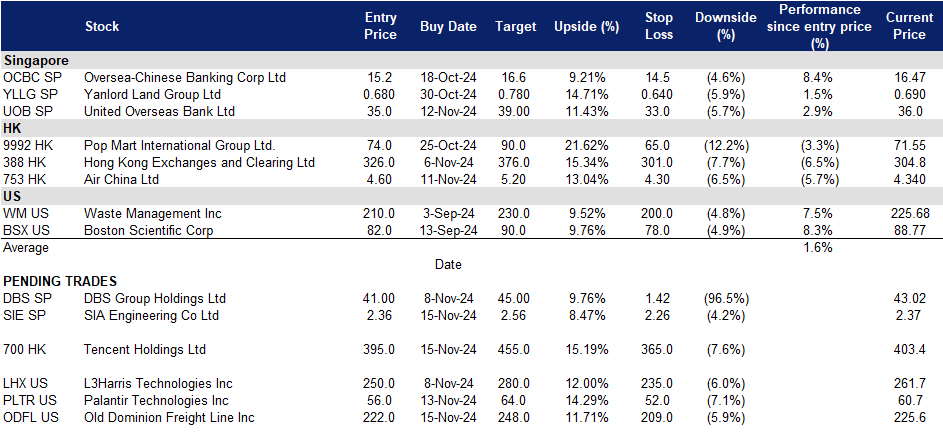

Trading Dashboard Update: Take Profit on Deckers Outdoor Corp (DECK US) at US$180 and Spotify Technology SA (SPOT US) at US$420. Add United Overseas Bank Ltd (UOB SP) at S$35. Cut loss on Goldwind Science & Technology Co. Ltd. (2208 HK) at HK$6.15 and Singapore Airlines Ltd (SIA SP) at S$6.20.