11 October 2024: Wilmar International Ltd (WIL SP), China State Construction International Holdings Ltd (3311 HK), On Holding AG (ONON US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

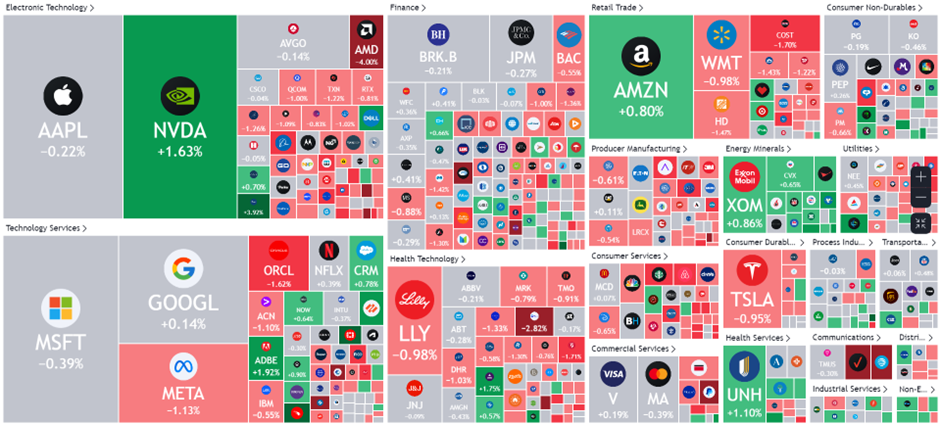

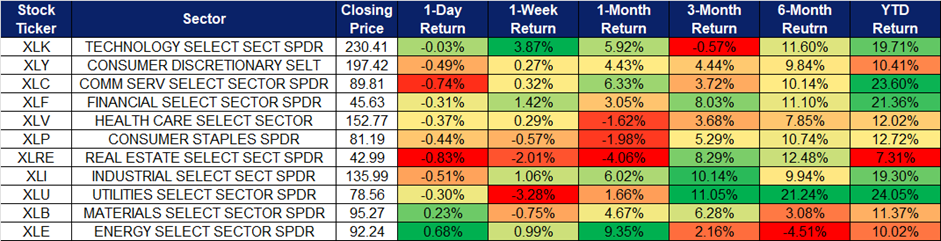

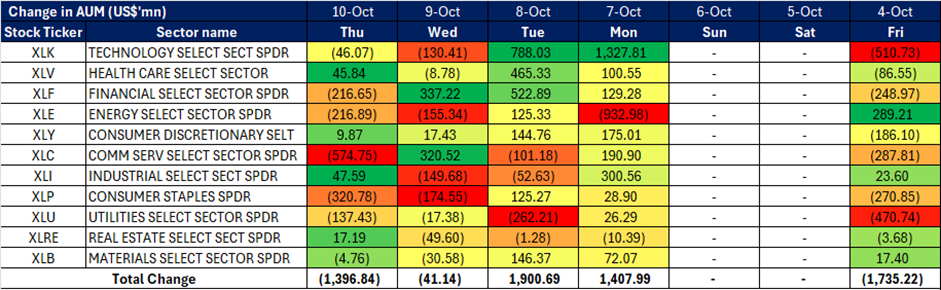

United States

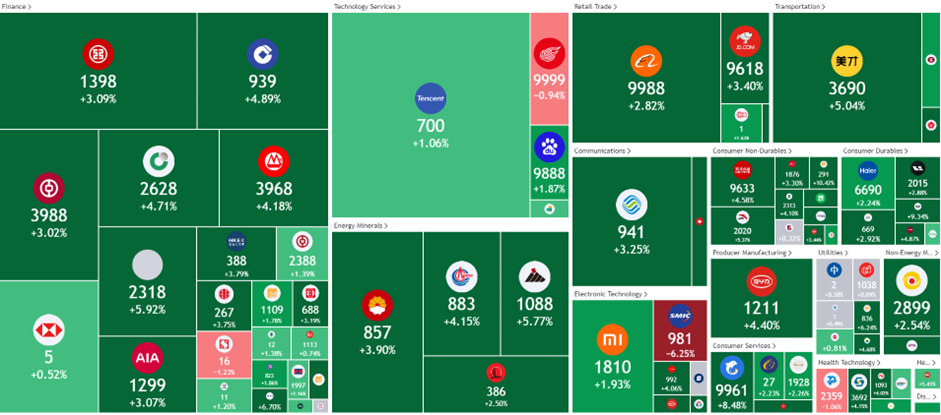

Hong Kong

Wilmar International Ltd (WIL SP): Increased curbs on palm oil supplies

- BUY Entry – 3.32 Target– 3.60 Stop Loss – 3.18

- Wilmar International Limited operates as a food processing company. The Company offers oil palm cultivation, edible oil refining, crushing, and gains processing services, as well as provides sugar, flour, and rice. Wilmar International serves customers worldwide.

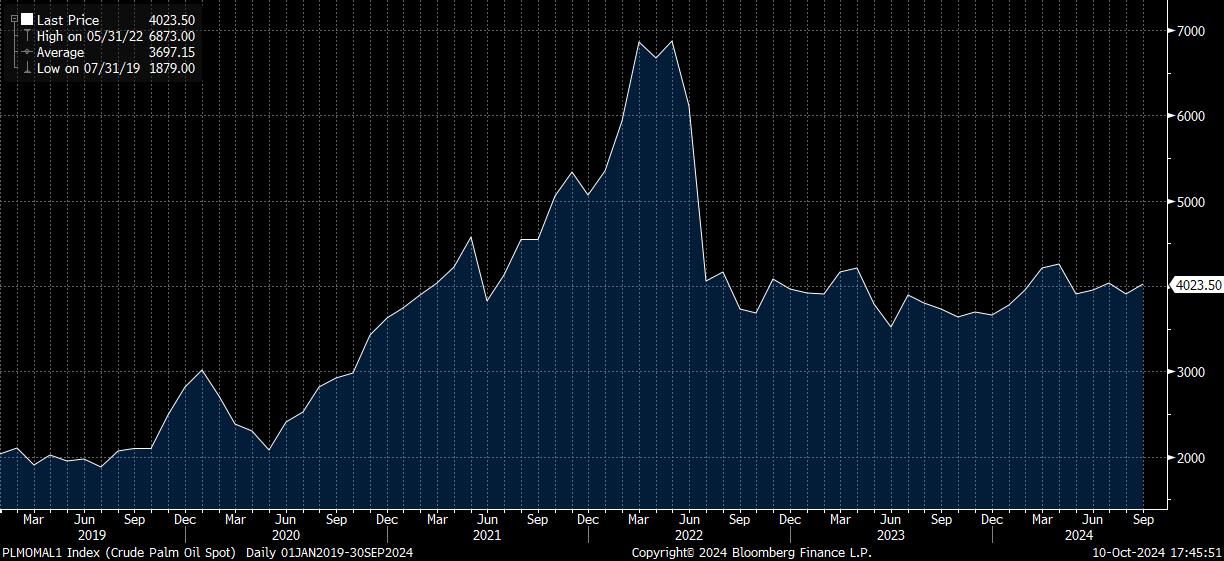

- Expected rise in palm oil prices. Indonesia’s plan to increase its biodiesel mandate from 35% to 40% palm oil-based fuel could significantly tighten global palm oil supplies. This shift could raise Indonesia’s biodiesel consumption to 16 million kilolitres, using an additional 1.5 to 1.7 million metric tons of palm oil. As a result, export volumes may decrease, causing global supply shortages and higher prices for consumers. The move comes as palm oil production in Indonesia and Malaysia has been affected by labour shortages, rising fertilizer costs, and weather conditions. Global palm oil production is expected to increase by 2.3 million metric tons in 2024/25, but the rise in demand for biodiesel could offset this growth, driving prices higher. Palm oil prices are forecasted to rise further, with projections suggesting a price of around 4,000 ringgit per metric ton in 2025. This anticipated price increase benefits palm oil producers such as Wilmar International.

Crude Palm Oil Price

(Source: Bloomberg)

- Stake reduction in joint venture. Adani Enterprises and Wilmar International are set to sell a 13% stake in their joint venture, Adani Wilmar, valued at around US$736 million, to meet Indian regulations requiring at least 25% of shares to be held by non-founders within three years of listing. Adani Wilmar, established in 1999, is a key consumer goods company in India, offering products like edible oils, wheat flour, rice, and sugar. Currently, the two companies collectively hold 88% of the venture, and this sale will reduce their combined stake to 75% by February when the three-year grace period ends. Advisors will soon start engaging with potential investors in the US, Southeast Asia, and India.

- 1H24 results review. Total revenue for 1H24 decreased by 4.9% YoY to US$30,934.6mn from US$32,538.0mn, primarily due to the decline in commodity prices, partially offset by higher sales volume. Core net profit was US$606.3mn in 1H24, an increase of 5.0% YoY and net profit rose by 5.2% YoY to US$579.6mn, driven by better performances in the Feed & Industrial Products and Food Products segments but partially offset by lower contributions from the Group’s joint ventures & associates as well as sugar milling operations. EPS rose in 1H24 to 9.3 UScents from 8.8 UScents in 1H23.

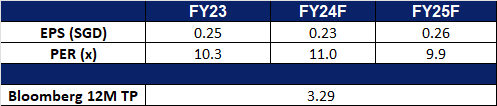

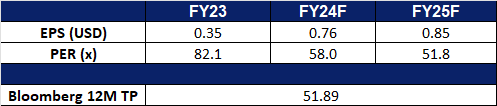

- Market Consensus.

(Source: Bloomberg)

Geo Energy Resources Ltd (GERL SP): Navigating challenges with strategic investments

- RE-ITERATE BUY Entry – 0.280 Target– 0.310 Stop Loss – 0.265

- Geo Energy Resources Limited is an integrated coal mining specialist. The Company owns and operates coal mines, offers mine contracting services to third party mine owners, and sells coal to both coal traders and coal export companies.

- Dividend policy holds firm despite market challenges. Geo Energy reported a 14% YoY decline in net profit to US$24.2mn for 1H24, primarily due to a reduction in coal prices. Despite this, the company maintained its commitment to shareholders by declaring an interim dividend of S$0.002 per share, representing a payout ratio of 11.4%. Production volumes totaled 2.8 Mt, mainly from the SDJ and TBR mines, while the TRA mine contributed 0.3 Mt. Stable coal sales of 3.2 Mt and a resilient cost model supported a healthy cash profit margin of 23%.

- Accelerated growth through infrastructure investment and diversification. Geo Energy recently signed a US$150mn EPC contract with CCCC First Harbor Consultants and Norinco International Cooperation to develop a 92 km hauling road and jetty in South Sumatera and Jambi Province, Indonesia. This infrastructure will boost PT Triaryani (TRA) mine’s transport capacity to 40-50 Mt per year, with 25 Mt allocated for TRA. The project’s deferred payment mechanism minimizes upfront cash outlay, allowing the infrastructure to generate revenue before payments begin. Upon completion in early 2026, not only will this development scale up production to 25 Mt annually but also it results in significant logistical cost savings, potentially generating US$400-500 mn in annual EBITDA. The project also diversifies Geo Energy’s revenue stream as an infrastructure provider.

- Coal prices to normalise. With demand and supply currently in balance, coal prices are expected to remain relatively steady for FY24. As a result, Geo Energy’s potential to boost its topline will rely more on increasing production volumes rather than benefiting from price fluctuations. The company has revised its full-year production forecast from the initial 10-11 Mt down to 8-9 Mt, having produced 2.8 Mt in 1H24. July’s production levels indicate that the company is on track to meet this new target.

- 1H24 results review. Revenue for 1H24 declined by 29% YoY to US$169.4mn, primarily due to lower ICI4 coal prices, averaging US$56.13 per tonne compared to US$70.46 in 1H23. Production was adversely affected by unfavorable weather conditions in the first half of the year. However, cash profit per tonne remained robust at US$11.94, reflecting its cost-efficient model where cash costs decrease in line with lower ICI4 prices. Geo Energy declared a second interim dividend of S$0.002 per share.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.68. Please read the full report here.

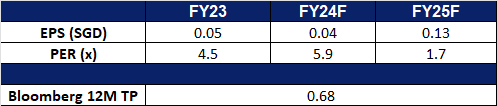

- Market Consensus.

(Source: Bloomberg)

The Hong Kong market is closed today in observance of a public holiday (Double Ninth Festival). Trading resumes on Monday, 14 October.

On Holding AG (ONON US): Embracing shopping season

- BUY Entry – 50 Target – 56 Stop Loss – 47

- On Holding AG operates as a holding company. The Company, through its subsidiaries, provides footwear and sports apparel products includes ultralight and stretchable fabrics and accessories. On Holding serves customers worldwide.

- Increase in consumer spending. The outlook for consumer spending is positive as lower interest rates are expected to boost confidence. Federal Reserve Chair Jerome Powell recently indicated that the Fed will likely continue with gradual, quarter-percentage-point rate cuts, following a larger half-point cut in September. Powell emphasized a cautious approach, balancing inflation control with maintaining low unemployment, with two more rate cuts anticipated by year-end, dependent on key economic data. The fourth quarter in the US is traditionally a time when consumer spending increases due to the winter holidays. In 2023, Americans heightened their spending at retailers during the holiday season, according to the Commerce Department retail sales rose by 0.6% in December, following a 0.3% increase in November which indicated continued consumer confidence and a willingness to spend freely. A record-breaking 200.4 million consumers shopped over the five-day holiday weekend from Thanksgiving through Cyber Monday, surpassing the 2022 record of 196.7 million, according to the National Retail Federation (NRF) and Prosper Insights & Analytics. Looking ahead to the upcoming winter season, we expect continued strength in consumer spending, particularly during key holiday periods such as Thanksgiving, Black Friday, Cyber Monday, Christmas, and Boxing Day. This is anticipated to boost sales for many brands across both physical stores and online channels, including brands like On Holdings.

- Expansion opportunities. On Holding continues to expand its distribution capabilities in North America and is advancing its warehouse automation project in the U.S. The brand is also focused on diversifying into new apparel categories and growing in various geographical regions, which will drive future sales. In line with its multi-channel strategy, On recently opened new retail stores in Paris and Hong Kong, supporting its global expansion.

- Innovative product line. The company unveiled its innovative LightSpray™ technology with the release of the Cloudboom Strike LS marathon shoe. This groundbreaking method uses a robotic arm to spray material onto a mold, creating a seamless, lace-free upper. The high-end shoe is lightweight and aerodynamic, catering to marathon runners. This production technique, which reduces reliance on traditional manufacturing processes, can be scaled more easily with the introduction of additional robots.

- 2Q24 earnings review. The company delivered revenue of CHF567.7mn, a 27.8% YoY increase, gross profit margin of 59.9% and an adjusted EBITDA margin of 16%. The company reaffirmed its full-year guidance, expecting at least 30% net sales growth (constant currency), a gross profit margin around 60%, and an adjusted EBITDA margin between 16% to 16.5%.

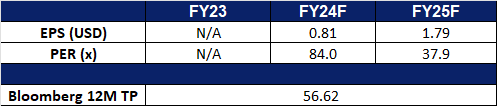

- Market consensus.

(Source: Bloomberg)

Cameco Corp (CCJ US): Potential growth of Uranium prices

Cameco Corp (CCJ US): Potential growth of Uranium prices

- RE-ITERATE BUY Entry – 50 Target – 56 Stop Loss – 47

- Cameco Corporation explores, develops, mines, refines, converts, and fabricates uranium. The Company offers uranium for sale as fuel for generating electricity in nuclear power reactors. Cameco operates worldwide.

- Uranium supply blocked. Moscow considers restricting exports of uranium, titanium and nickel. Russia has about 44% of the world’s uranium enrichment capacity and accounts for 5.5% of global supply. In May this year, the United States passed the “Banning Uranium Imports from Russia Act.” Countries with nuclear power, especially in the West, are always looking for reliable supplies. Potential Russian uranium export restrictions will lead to tight supply and prices will rebound accordingly. The current uranium price rose to $82 per pound in October, the highest level in more than a month.

- Nuclear power demand to drive uranium growth. Looking ahead to the next decade, the market is expected to continue to grow. According to the baseline scenario in the World Nuclear Energy Association’s “2023 Nuclear Fuel Report”, uranium demand will increase by 28% between 2023 and 2030, and by 51% between 2031 and 2040. Licenses to extend the life of nuclear power plants and the economic attractiveness of continuing to operate older reactors are key factors for the uranium market in the medium term. However, according to the International Energy Agency’s 2023 World Energy Outlook Report, electricity demand is likely to increase by about 50% by 2040 compared with 2022. In a world that attaches great importance to carbon emission restrictions, there is considerable room for growth in nuclear power capacity.

- Stable uranium prices and more room for growth. The current price of uranium is $82 per pound, a new high in a month. It will exceed $105 per pound in late 2023 and early 2024. The US dollar interest rate cut cycle and the potential expansion of the supply gap will drive future price increases.

- 2Q24 earnings review. The company delivered revenue of C$598mn, a 24.1% YoY increase, non-GAAP earnings per share of C$0.14 and an adjusted EBITDA of C$337mn. For FY24, the company expects strong cash flow generation, with estimated consolidated revenue of between about C$2.85bn and C$3.0bn.

- Market consensus.

(Source: Bloomberg)

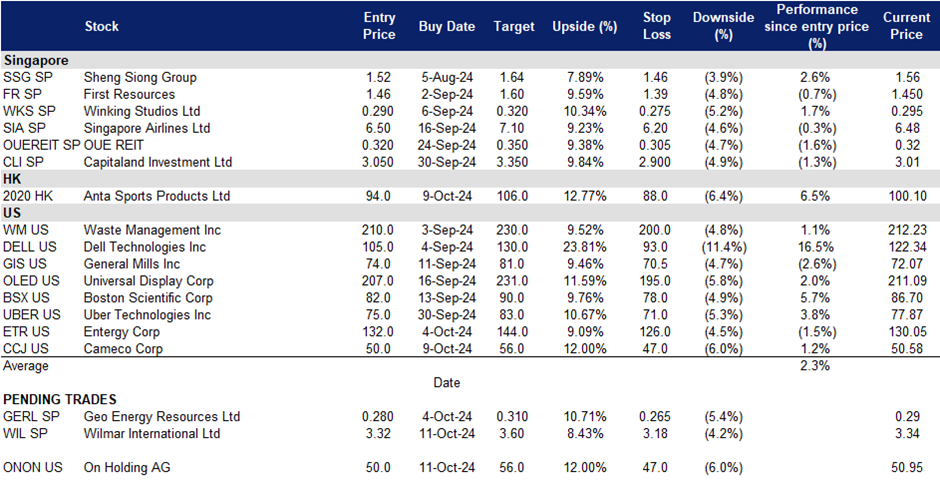

Trading Dashboard Update: Add Anta Sports Products Ltd (2020 HK) at HK$94.0 and Cameco Corp (CCJ US) at US$50.0. Cut loss on Yanlord Land Group Ltd (YLLG SP) at S$0.710.