10 January 2025 : Centurion Corp Ltd (CENT SP), Lenovo Group Ltd. (992 HK), GE Healthcare Technologies Inc (GEHC US)

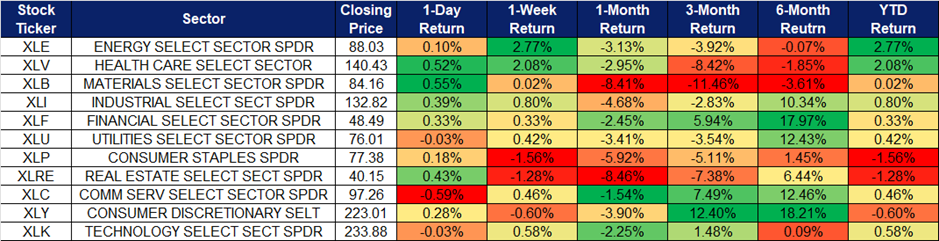

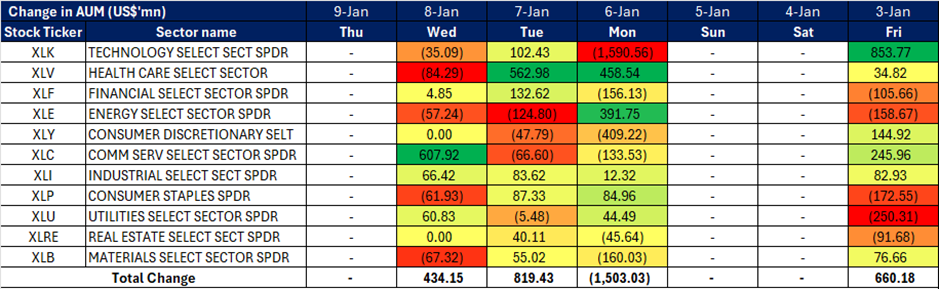

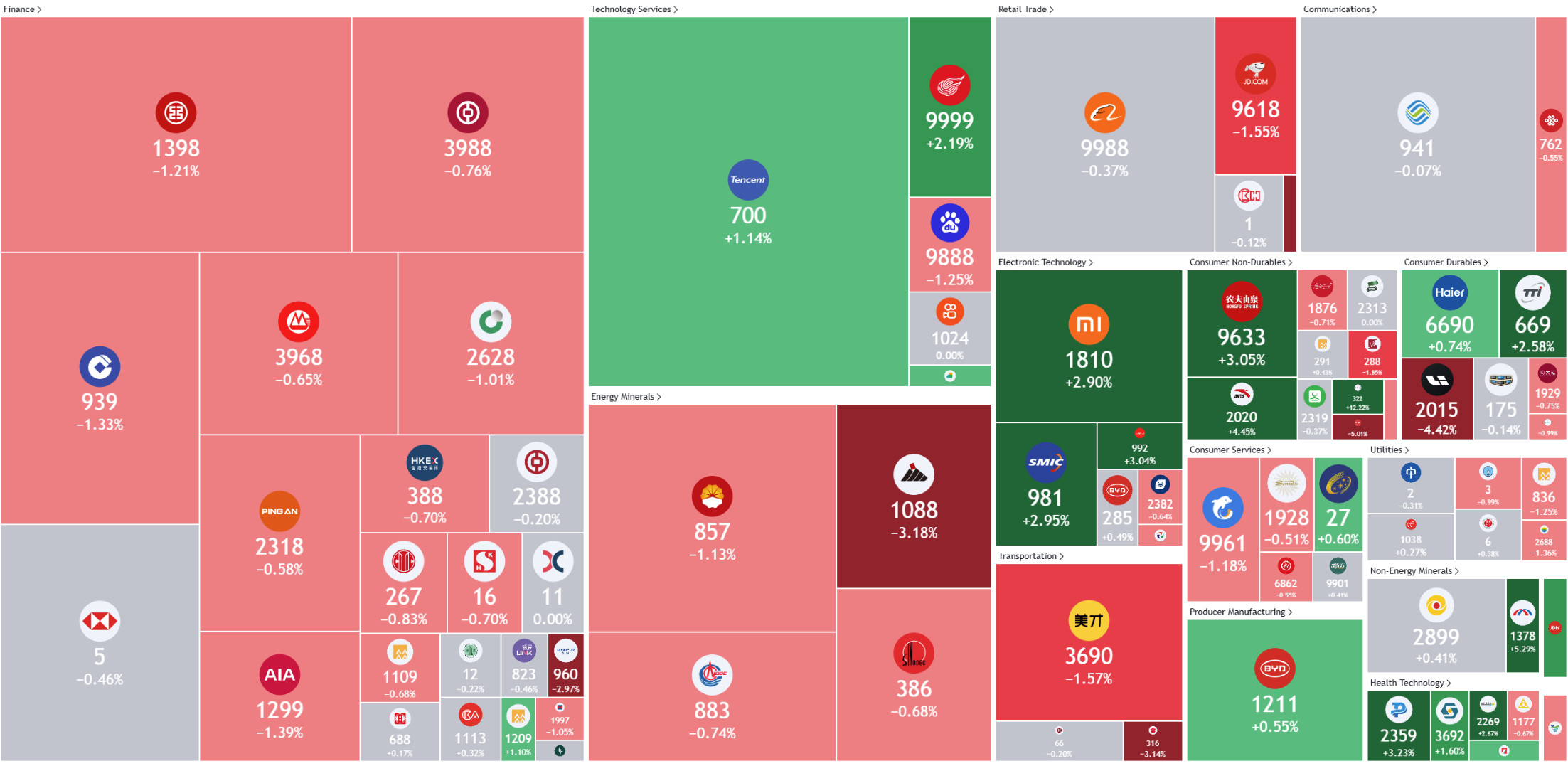

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

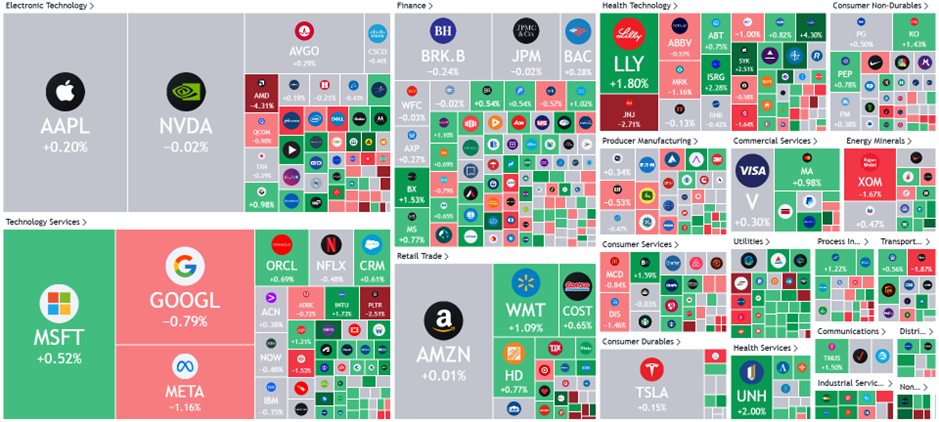

United States

Hong Kong

Centurion Corp Ltd (CENT SP): Potential REIT listing

- BUY Entry – 0.98 Target– 1.06 Stop Loss – 0.94

- Centurion Corporation Limited provides purpose-built workers and student accommodation services. Centurion owns, develops, and manages quality and purpose-built workers accommodation assets. Centurion serves customers worldwide.

- Exploratory REIT listing. Centurion Corporation is considering establishing a real estate investment trust (REIT) comprising its workers’ and student accommodation assets. If approved by the Singapore Exchange (SGX) and Monetary Authority of Singapore, the REIT will be listed on SGX’s mainboard. Centurion is working with DBS Bank and UBS to evaluate terms and timing. A potential dividend-in-specie of REIT units to shareholders is also under review. However, there’s no certainty the listing will proceed, as past plans in 2015 were deferred due to SGX’s chain listing rule considerations.

- Inorganic growth through geographical expansion. Centurion entered China’s Purpose-Built Student Accommodation (PBSA) market with two master-leased properties in Kowloon, Hong Kong. These properties will be refurbished to cater to students, which commenced operations in September 2024. Furthermore, a third master lease for a larger Purpose-Built Workers Accommodation (PBWA) in the New Territories was secured, commenced operations in December 2024. To further solidify its presence, Centurion also established two joint ventures with Xiamen’s CityHome Apartments for two master-leased Build-to-Rent (BTR) projects, offering a combined 1,500 beds. These strategic acquisitions are anticipated to significantly enhance Centurion’s revenue potential.

- 3Q24 results review. Revenue rose by 22% YoY to S$62.1mn in 1H24, from S$51.0mn in 3Q23, due to strong occupancy rates and healthy rental revisions across its portfolio of PBWAs and PBSAs.

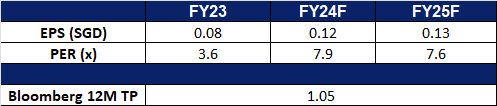

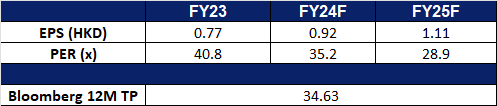

- Market Consensus.

(Source: Bloomberg)

Seatrium Ltd (STM SP): Strong project pipelines

- RE-ITERATE BUY Entry – 2.14 Target– 2.30 Stop Loss – 2.06

- Seatrium Ltd offers engineering solutions for the offshore, marine, and energy industries. The Company provides rigs and floaters, repairs and upgrades, offshore platforms, and specialized shipbuilding. Seatrium serves customers worldwide.

- New contract with BP. Seatrium Ltd. recently announced the signing of an engineering, procurement, construction, and onshore commissioning (EPC) contract with BP Exploration and Production Inc. (bp) for the Kaskida Floating Production Unit (FPU) project in the U.S. Gulf of Mexico. The Kaskida project is a greenfield development located approximately 250 miles southwest of New Orleans in the Keathley Canyon area. In its first development phase, the FPU is designed to produce up to 80,000 barrels of crude oil per day from six wells. This contract is expected to provide a significant boost to Seatrium’s long-term revenue and profitability, enhancing its position in the offshore energy sector.

- Collaboration with Cochin Shipyard (CSL). Seatrium Ltd.’s U.S. subsidiary, Seatrium Letourneau USA Inc. (SLET), has signed a Memorandum of Understanding (MOU) with Cochin Shipyard Ltd. (CSL) to jointly develop and supply key equipment for jack-up rigs tailored to the Indian market. In a media statement, Seatrium highlighted that the partnership aims to tap into the growing demand for Mobile Offshore Drilling Units (MODUs) in the region. The collaboration will combine CSL’s shipbuilding expertise with SLET’s technical knowledge and design capabilities to create MODUs that address India’s offshore energy needs. For Seatrium, this partnership marks a significant step in advancing its presence in India’s offshore sector and contributing to the country’s energy ambitions.

- Positive outlook with strong order book. As of the end of September 2024, Seatrium’s net order book stood at $24.4 billion, comprising 30 projects with scheduled deliveries through 2031. Gross orders amounted to nearly $38 billion, set to be delivered over the remainder of the decade. The company’s project pipeline remains robust, with continued interest from customers seeking partnerships. Seatrium anticipates a strong uptick in business activity and remains committed to reducing its debt while securing fresh capital to support ongoing and future projects.

- 1H24 results review. Revenue rose by 39.1% YoY to S$4.01bn in 1H24, compared to S$2.89bn in 1H23. Net profit was S$34.7mn in 1H24, compared to a net loss of S$240.5mn in 1H23. Basic EPS per share was 1.05 S cents in 1H24, compared to net loss per share of 9.40 S cents in 1H23.

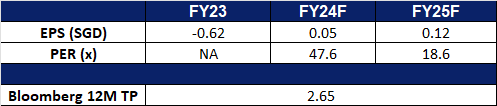

- Market Consensus.

(Source: Bloomberg)

Lenovo Group Ltd. (992 HK): Exciting CES releases

- BUY Entry – 9.70 Target – 10.90 Stop Loss – 9.10

- Lenovo Group Ltd is an investment holding company primarily engaged in development, manufacture and marketing of technology products and services. The Company operates its business through three segments. The Intelligent Devices Group segment is engaged in the manufacture and sale of personal computer (PC), tablet, smartphone and other smart devices. The Infrastructure Solutions Group segment is engaged in the provision of artificial intelligence (AI) products, services and partnerships, the development of comprehensive full-stack infrastructure solutions portfolio as well as the provision of storage solutions. The Solutions and Services Group segment is engaged in the provision of information technology (IT) solutions and services across PC, infrastructure, and smart verticals, including attached services, managed services and As a Service (AaS) offering. The Company conducts its business in the domestic and overseas markets.

- Exciting CES releases. At CES 2025, Lenovo unveiled an impressive lineup of consumer, gaming, and commercial products, showcasing its vision for the future of AI-driven technology, modern design, and advanced performance. The launch included new ThinkPad and IdeaPad laptops, Legion gaming devices, and tablets, all aimed at enhancing user experiences across diverse sectors. Among the highlights were two groundbreaking innovations set to redefine personal computing and gaming. Lenovo introduced the ThinkBook Plus Gen 6 Rollable AI PC, the industry’s first commercially available notebook with a rollable OLED display. This revolutionary device expands its screen by up to 50%, extending from a 14-inch base size, providing professionals on the go with a larger, more versatile workspace. Also making its debut was the Legion Go S, a handheld gaming console powered by SteamOS, offering gamers a portable, high-performance solution for immersive gameplay. These cutting-edge products underscore Lenovo’s commitment to pushing technological boundaries and addressing the evolving needs of users across various segments.

- More presence in Saudi Arabia. Lenovo recently finalized a USD 2 billion deal with Alat Enate, a unit of Saudi Arabia’s Public Investment Fund, as part of a strategic cooperation agreement announced in May 2024. As part of the partnership, Lenovo will establish a regional headquarters for the Middle East and Africa in Riyadh and build a sustainable manufacturing facility in Saudi Arabia to serve both regional and global markets. The new plant, set to begin production in 2026, is expected to deliver several million PCs and servers annually. This facility will play a pivotal role in Lenovo’s global manufacturing network, which currently spans over 30 markets, including Argentina, Brazil, China, Germany, Hungary, India, Japan, Mexico, and the United States. Lenovo emphasized that its Middle East business is poised for accelerated growth this year, further enhancing its global influence and diversified manufacturing footprint while driving its business transformation initiatives. The company plans to introduce its world-class supply chain, technology, and manufacturing expertise to Saudi Arabia, contributing to the creation of thousands of jobs and supporting the country’s long-term economic goals.

- Partnership to with Volcano Engine. At the recent 2024 Lenovo Tianxi Ecosystem Partner Conference in Beijing, Lenovo officially announced its partnership with Volcano Engine. Leveraging the “super brain” of the Doubao large language model, Lenovo’s AI desktop assistant, Ruyi, will evolve from a traditional system tool into a comprehensive intelligent conversational assistant. This transformation aims to significantly enhance user interaction with PC systems, offering a more advanced and intuitive experience. These upgrades are expected to drive increased consumer interest and boost demand for Lenovo’s AI-powered PCs.

- 1H25 earnings. Revenue increased by 21.9% to US$33.3bn in 1H25, compared with US$27.3bn in 1H24. Net profit rose by 34.8% to US$636.8mn in 1H25, compared to US$472.5 in 1H24. Basic EPS rose to 4.91 US cents in 1H25, compared with 3.57 US cents in 1H24.

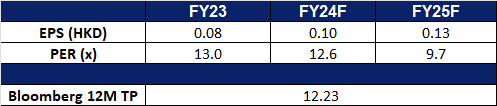

- Market consensus.

(Source: Bloomberg)

Xiaomi Corp. (1810 HK): Aggressive Expansion

- RE-ITERATE BUY Entry – 32.0 Target – 36.0 Stop Loss – 30.0

- Xiaomi Corp. is a China-based investment holding company principally engaged in the research, development and sales of smartphones, Internet of things (IoTs) and lifestyle products, the provision of Internet services, and investment business. The Company mainly conducts its businesses through four segments. The Smartphone segment is engaged in the sales of smartphones. The IoT and Lifestyle product segment is engaged in the sales of other in-house products, including smart televisions (TVs), laptops, artificial intelligence (AI) speakers and smart routers; ecosystem products, including IoT and other smart hardware products, as well as certain lifestyle products. The Internet service segment is engaged in the provision of advertising services and Internet value-added services. The Others segment is engaged in the provision of repair services for its hardware products. The Company distributes its products in domestic market and to overseas markets.

- Increasing Presence. Xiaomi has unveiled plans to open at least two more stores in Singapore by the end of 2025, bringing its total store count in the country to 10. This expansion is part of the company’s broader strategy to strengthen its presence and enhance direct customer engagement across Southeast Asia. Currently, Xiaomi operates seven stores in Singapore through distributor partnerships and has seen a steady increase in consumer interest. Beyond Singapore, Xiaomi remains focused on enhancing the customer experience globally, with a particular emphasis on Southeast Asia. The company recently expanded its regional footprint by launching new stores in Thailand and Malaysia. Additionally, Xiaomi Korea, the company’s South Korean branch, announced plans to open an official online store on January 15. To mark the occasion, Xiaomi will host a press conference in South Korea on the same day, where it will showcase its latest products, including smartphones, wearable devices, robot vacuums, and portable chargers.

- Partnership to improve EV charging. Xiaomi Auto has forged strategic partnerships with Li Auto, Nio, and XPeng to bolster its electric vehicle (EV) charging infrastructure. Through these collaborations, users will gain access to over 6,000 Li Auto charging stations via the Xiaomi Charging Map, with select stations offering direct charging through the Xiaomi Auto app. Additionally, the integration will extend to more than 14,000 Nio charging points and over 9,000 XPeng charging points. This initiative is poised to enhance convenience for EV owners, potentially driving increased adoption of Xiaomi’s EVs and those from its partner companies.

- Progress in EV business. Xiaomi has announced plans to launch its first sport utility vehicle (SUV), the YU7, in June or July of this year, marking a significant milestone in its entry into China’s fiercely competitive automotive market. The YU7 will share a design aesthetic with the SU7 sedan—Xiaomi’s inaugural electric vehicle—and will be powered by batteries supplied by a subsidiary of Chinese manufacturer CATL. According to sources, the YU7 will measure approximately 5 meters in length, 2 meters in width, and 1.6 meters in height, offering a more spacious yet lower-profile alternative to Tesla’s current Model Y SUV. This strategic design aims to position the YU7 as an attractive option for consumers seeking a balance between style and functionality in the electric vehicle (EV) market. In its broader EV ambitions, Xiaomi is targeting 300,000 vehicle deliveries by 2025, after having already delivered more than 135,000 units in 2024. The company is currently constructing the second phase of its Beijing plant, which, combined with the first phase, will provide an annual production capacity of 300,000 units. Additionally, Xiaomi EV has expanded its retail footprint, opening 200 stores across 58 cities, underscoring its commitment to scaling its automotive business.

- 3Q24 earnings. Revenue increased by 30.5% to RMB92.5bn in 3Q24, compared with RMB70.9bn in 3Q23. Net profit rose by 9.7% to RMB5.34bn in 3Q24, compared to RMB4.87mn in 3Q23. Basic EPS rose to RMB0.22 in 3Q24, compared with RMB0.20 in 3Q23.

- Market consensus.

(Source: Bloomberg)

GE Healthcare Technologies Inc (GEHC US): Positive health technology outlook

- BUY Entry – 86 Target – 100 Stop Loss – 79

- GE HealthCare Technologies Inc. provides medical technology, pharmaceutical diagnostics, and digital solutions. The Company offers imaging, ultrasound, maternal, ventilator, and patient monitoring equipment, as well as performance management, cybersecurity, technical training, site planning, integrated asset optimization, and clinical network solutions.

- Robotics rising in popularity. Major technological firms are targeting the robotics sector amid growing demand for smart facilities and automated manufacturing capabilities. The robotics sector is gaining traction as major technology firms like Nvidia and Samsung unveiled their robotics strategies alongside the display of robots from other firms were showcased at CES 2025. In healthcare, companies such as GE HealthCare are leveraging robotics and AI to revolutionize the industry with products such as the Allia IGS 7 and Vscan Air SL. Future healthcare innovations are expected to enhance surgical precision, support patient care, and streamline laboratory tasks. As robotics continue to advance, increased autonomy will allow healthcare workers to focus more on direct patient care, reducing risks and improving overall efficiency.

- Newfound reliance on AI. GE Healthcare is utilizing AI to address critical challenges in healthcare, such as data overload and operational inefficiencies. At the recent RSNA 2024, GE HealthCare announced the FDA submission of CleaRecon DL, an AI-powered tool to enhance cone-beam computed tomography (CBCT) imaging by reducing streaks and improving clarity. Designed for Allia IGS Systems, the technology supports better clinical outcomes and greater CBCT adoption in minimally invasive procedures. The company also introduced OnWatch Predict, a predictive monitoring system for interventional equipment to forecast failures and reduce downtime. These innovations aim to advance imaging accuracy and operational efficiency in healthcare settings, which aim to improve efficiency, enhance diagnostic accuracy, and expand access to quality healthcare by streamlining workflows, automating tasks, and enabling more informed decision-making.

- Advancements in remote patient monitoring. The emergence of 5G and beyond technologies, with their high-speed data transmission, low latency, and robust connectivity, is revolutionizing remote patient monitoring. This enables early diagnosis and personalized care, particularly for aging populations as well as those with underlying health conditions. GE HealthCare leverages this technology with virtual care-at-home solutions, integrating patient monitors, wireless devices, and IT workflows under its Clinical Information Logistics system. This empowers caregivers with real-time clinical intelligence, leading to improved patient outcomes and efficient monitoring outside of hospital settings. As the global population ages and these technologies become more accessible, this segment holds significant potential for driving future growth in GE Healthcare’s sales.

- 3Q24 results. The company’s revenue increased by 1% to US$4.86bn in 3Q24, compared to US$4.82bn in 3Q23. The company’s net income rose 25% YoY to US$470mn in 3Q24. The company’s diluted earnings per share rose to US$1.02 in 3Q24, compared to US$0.83 in 3Q23. The company’s adjusted earnings per share rose to US$1.14 in 3Q24, compared to US$0.99 in 3Q23.

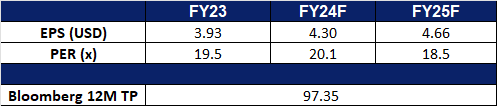

- Market consensus.

(Source: Bloomberg)

KKR & Co Inc. (KKR US): Positive M&A outlook

- RE-ITERATE BUY STOP Entry – 148 Target – 168 Stop Loss – 138

- KKR & Co. Inc. operates as an investment firm. The Company manages investments such as private equity, energy, infrastructure, real estate, credit strategies, and hedge funds. KKR & Co serves clients worldwide.

- Global M&A activities are expected to continue in 2025. The anticipated decrease in federal funds rates, coupled with modest US economic growth, will likely increase corporate refinancing needs. Moreover, with high valuations in the US stock market, more companies will seek to go public. The primary market is gradually recovering after two consecutive years of secondary market gains and positive sentiment, especially in areas like AI applications and other emerging technologies. Under a potential Trump presidency, global trade friction is likely to intensify, prompting more multinational corporations to mitigate potential losses from geopolitical risks through M&A or asset divestitures.

- Asset management scale and fee income have shown impressive growth. As of Q3 of fiscal year 2024, the company’s asset management scale increased by 26.6% YoY to $624.396bn. The fundraising amount in the first three quarters of 2024 was $118.308bn, compared to $380.89bn in the same period of 2023. Company management has revealed that 60% of its private equity holdings have an unrealized return on investment exceeding 50%, and the overall unrealized profit has increased by 40% YoY. Management fee-related income grew by 79.5% YoY and 34.5% QoQ to $1bn in the third quarter.

- 3Q24 results. The company’s revenue increased by 44.5% to US$4.79bn in 3Q24, compared to US$3.32bn in 3Q23. The company’s net profit fell to US$654.6mn in 3Q24, compared to US$1,472.9mn in 3Q23. The company’s basic earnings per share fell to US$0.74 in 3Q24, compared to basic earnings per share of US$1.71 in 3Q23.

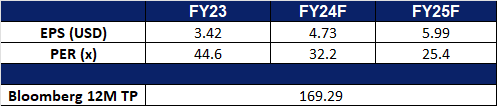

- Market consensus.

(Source: Bloomberg)

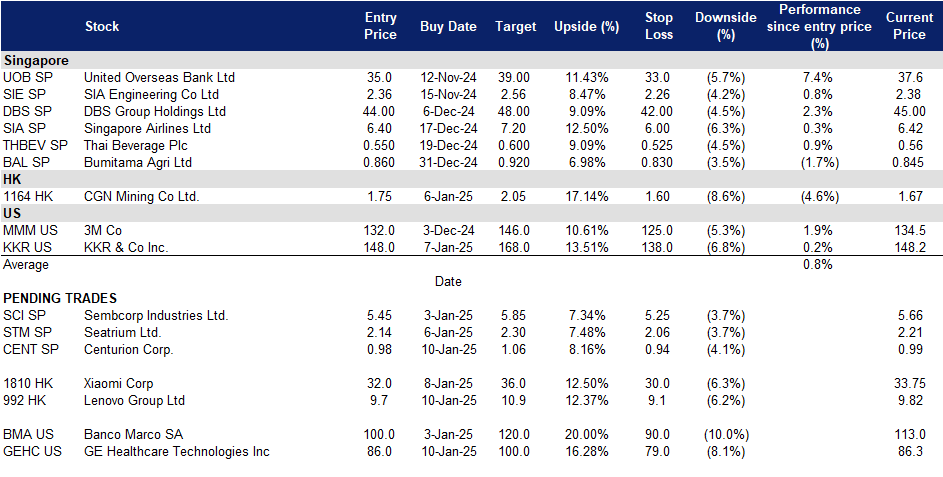

Trading Dashboard Update: Add KKR & Co Inc (KKR US) at US$148. Stop loss on Olam Group Ltd (OLG SP) at S$1.13 and Tencent Holdings Ltd (700 HK) at HK$365.