Trading Ideas 10 February 2025 : Wee Hur Holdings Ltd (WHUR SP), BYD Co. Ltd. (1211 HK), Costco Wholesale Corp (COST US)

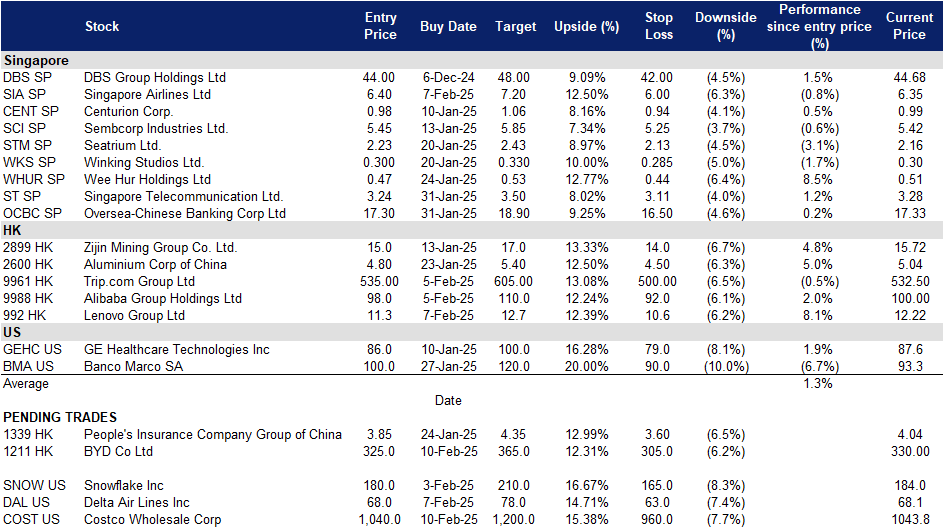

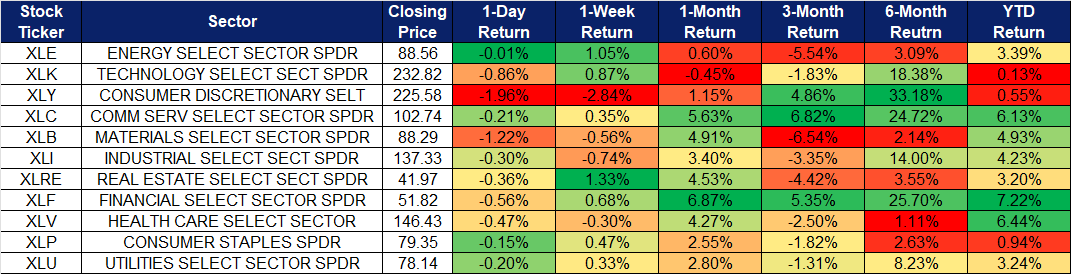

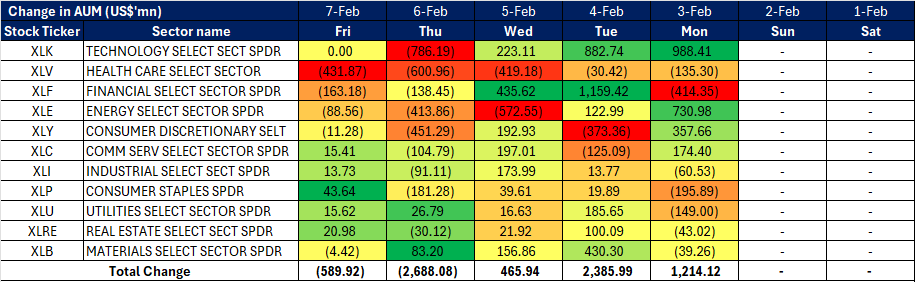

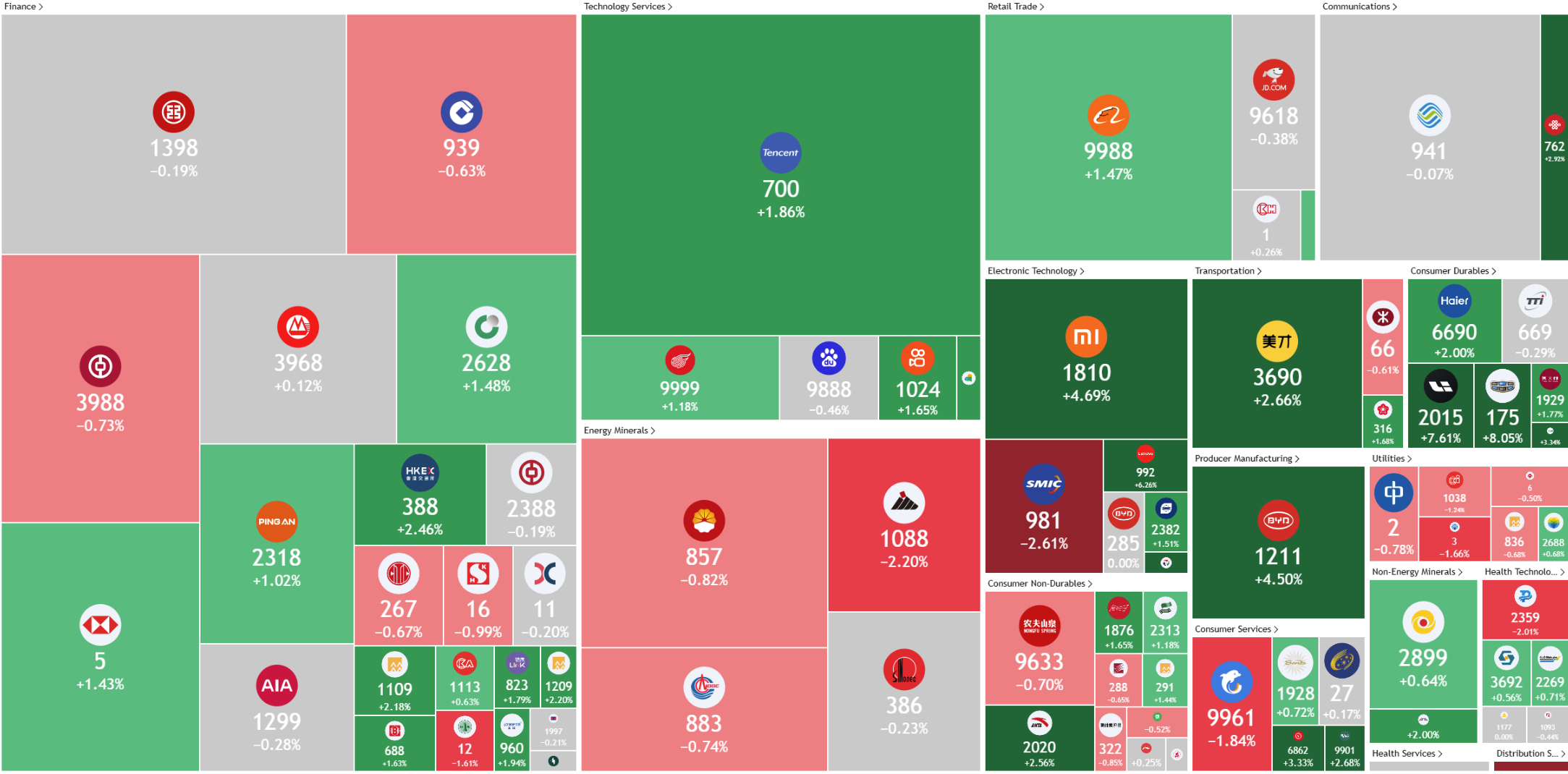

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

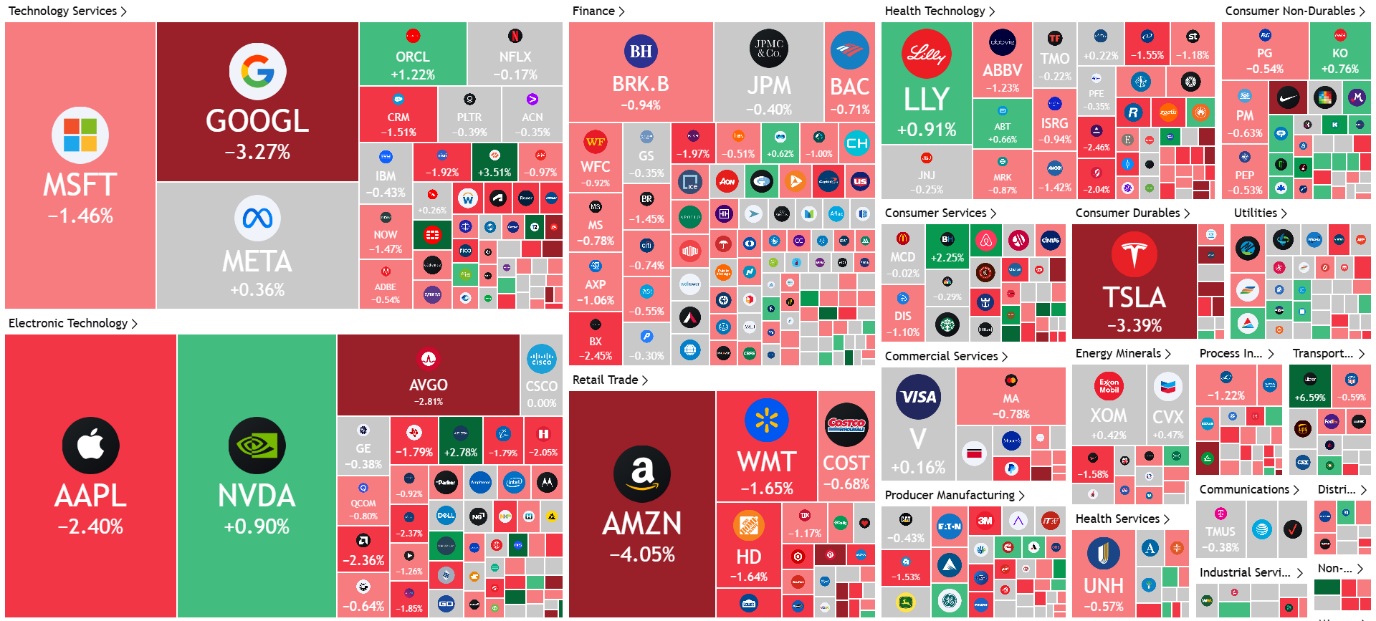

United States

Hong Kong

Wee Hur Holdings Ltd (WHUR SP): Strategic repositioning

- RE-ITERATE BUY Entry – 0.47 Target– 0.53 Stop Loss – 0.44

- Wee Hur Holdings Ltd provides building construction services and acts as the management or main contractor in construction projects for both private and public sectors. The Company’s clients from the private sector include property owners and developers, and those from the public sector comprise government bodies and statutory boards.

- Increased construction demand in Singapore. Wee Hur Holdings showcased robust performance in the first half of 2024, underpinned by its strong dormitory segment and increased contributions from investments in associates and joint ventures. A key strength lies in its Tuas View Dormitory, which saw higher revenue as rising construction demand in Singapore drove the need for worker accommodation. As a BCA-registered A1-grade contractor, Wee Hur is well-positioned to tender for public projects of unlimited value, spanning residential, commercial, industrial, and conservation projects, further solidifying its expertise in the construction sector. The recent sale of its Australian PBSA portfolio has provided the company with additional capital flexibility, enabling it to focus on core segments like construction and dormitories. With Singapore’s construction demand projected to reach S$47bn to S$53bn in 2025, fuelled by major projects such as Changi Airport Terminal 5 and public housing developments, Wee Hur is poised to capitalize on these opportunities. Its diversified capabilities, including expertise in new constructions, refurbishments, and heritage restoration, further enhance its versatility and competitive edge in the market. These strengths position Wee Hur to thrive amid Singapore’s growing infrastructure and construction needs.

- Capitalising on sale of assets. Wee Hur Holdings sold its Australian student accommodation assets for A$1.6bn to Greystar, generating S$320mn in cash and retaining a 13% stake worth A$200mn in the new venture. The portfolio, comprising over 5,500 beds, has benefited from high occupancy rates and rising rental income. Wee Hur intends to allocate the proceeds toward expanding its construction and engineering business and exploring alternative investment opportunities. The sale also enabled the company to clear associated debt, strengthening its financial position. Additionally, Wee Hur continues to advance other key projects, including the development of new worker dormitories and student accommodations. Looking ahead, investors are optimistic about the potential for special dividends once the company receives the net proceeds from the transaction, further enhancing shareholder value.

- 1H24 results review. Total revenue for 1H24 increased by 10% YoY to S$109.12mn from S$99.21mn driven by higher contributions from Tuas View Dormitory, the Group’s first Purpose-Built Dormitory in Singapore, which operated at nearly full occupancy throughout 1H24. Gross profit for 1H24 surged to S$44.73mn, an increase of 144% YoY from S$18.30mn in 1H23. Profit from continuing operations for 1H24 was S$75.07mn, an increase of 488% from S$12.77mn the year before, this was mainly attributable to improved performance at Tuas View Dormitory and higher profits from investments in associates and joint ventures.

- Market Consensus.

(Source: Bloomberg)

Singapore Airlines Ltd (SIA SP): Poised for growth

- RE-ITERATE BUY Entry – 6.4 Target– 7.2 Stop Loss – 6.0

- Singapore Airlines Limited provides air transportation, engineering, pilot training, air charter, and tour wholesaling services. The Company’s airline operation covers Asia, Europe, the Americas, South West Pacific, and Africa.

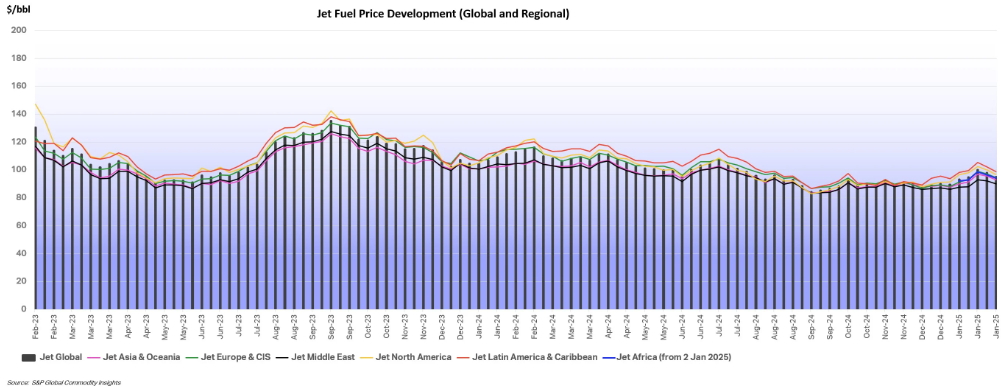

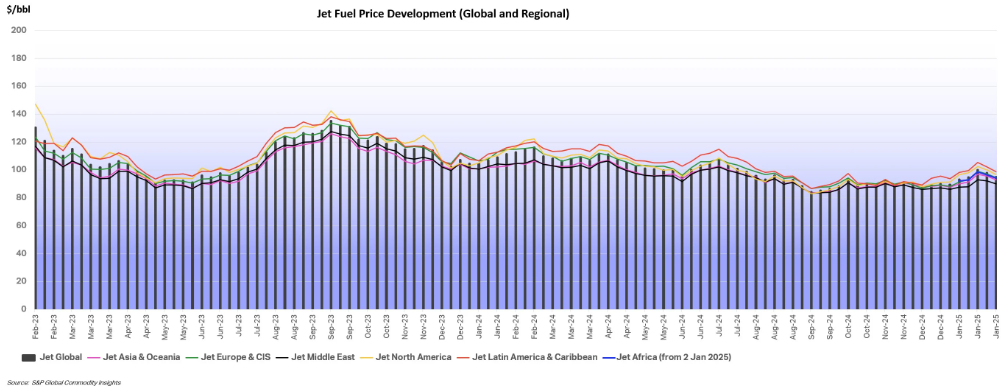

- Jet fuel price to remain low. The jet fuel market is expected to maintain relatively low prices in early 2025, continuing the trend from late 2024. The International Air Transport Association (IATA) projects an average jet fuel cost of US$87/bbl, or US$2.0714/gal, with total fuel expenditures expected to drop to US$248 billion nearly 5% lower than in 2024. While refinery disruptions could temporarily impact prices, overall stability is expected. Additionally, fuel costs are projected to comprise 26.4% of total airline expenses, down from 28.4% in 2024, contributing to improved profitability for airlines. As of the week ending 31 January 2025, the global average jet fuel price fell 3.0% compared to the week before to US$94.93/bbl.

Jet Fuel Price Trend

(Source: IATA)

- SIA to Benefit from Changi Airport’s Growth in 2025. Changi Airport is on track for continued growth in 2025 after handling 67.7 million passengers in 2024, reaching 99.1% of pre-pandemic levels. With a projected 3%-5% increase in passenger traffic this year, the airport is set to capture a larger share of regional aviation growth, supported by strong demand, new routes, and airline expansions. Ongoing S$3 billion infrastructure upgrades will further enhance its position as a leading global hub. Singapore Airlines (SIA) is well-positioned to benefit from Changi’s expansion, particularly through transit traffic growth, which is expected to offset softer visitor arrivals. As competition among regional hubs intensifies, SIA’s strategic expansion, premium offerings, and focus on transit passengers will help strengthen its market position. The airline’s efficient hub operations, strong brand, and expanding long-haul network will reinforce its leadership in the Asia-Pacific aviation market.

- Scoot Expands European Network with New Vienna Route. Scoot, the low-cost subsidiary of Singapore Airlines Group, will launch direct flights between Singapore and Vienna starting June 3rd, operating three times weekly on Boeing 787-8 Dreamliners. Vienna will become Scoot’s second European destination after Athens, further expanding its footprint in the region. To optimize network efficiency, Scoot will suspend services to Berlin, which were previously operated via Athens. The new Vienna route reflects the airline’s strategy to adjust capacity based on demand, while maintaining connectivity between Singapore and key European cities.

- 1H24 results review. Revenue rose S$335 million, a 3.7% YoY increase to S$9,497 million, with passenger flown revenue up S$118 million and cargo flown revenue higher by S$42 million. Increased competition and higher passenger capacity in key markets exerted pressure on yields, which fell 5.6%. On the cargo front, yield was 13.4% lower amid the continued recovery in bellyhold capacity. The demand for air travel remained healthy in the first six months, with SIA and Scoot carrying 19.2 million passengers, a 10.8% YoY increase. However, passenger traffic growth of 7.9% trailed the SIA Group’s passenger capacity expansion of 11.0%, resulting in a 2.4 percentage point decline in Group passenger load factor (PLF) to 86.4%. SIA and Scoot achieved PLFs of 85.7% and 88.6% respectively. The Group posted a net profit of S$742 million, a 48.5% YoY decline, primarily due to the weaker operating performance.

- Market Consensus.

(Source: Bloomberg)

BYD Co. Ltd. (1211 HK): Upcoming smart-car strategy

- BUY Entry – 325 Target – 365 Stop Loss – 305

- BYD Company Limited is a China-based company principally engaged in the manufacture and sales of transportation equipment. The Company is also engaged in the manufacture and sales of electronic parts and components and electronic devices for daily use. The Company’s products include rechargeable batteries and photovoltaic products, mobile phone parts and assembly, and automobiles and related products. The Company mainly conducts its businesses in China, the United States and Europe.

- BYD to Unveil Smart-Car Strategy. BYD is set to reveal its vehicle intelligence strategy on February 10, 2025, with market expectations that the company will integrate autonomous-driving technology into its more affordable models. The event invitation, which emphasizes “making advanced autonomous-driving technology affordable for everyone,” suggests that BYD aims to democratize self-driving capabilities in China’s increasingly competitive autonomous vehicle market. The company is expected to expand the number of models equipped with autonomous-driving features, reinforcing its position in the sector.

- Strong January Sales Despite Holiday Impact. BYD sold 300,538 electric vehicles in January, marking a 47.5% YoY increase. Exports surged to 66,336 units, up 83.3% YoY, setting a new monthly record. The company also produced 327,864 vehicles, up 49.1% YoY, and installed 15.511 GWh of battery capacity into EVs. While MoM sales declined, the drop was attributed to the Chinese New Year holiday (January 27–February 4), which limited domestic sales activity in the final week of January. BYD also ranked as the top automobile brand in China’s passenger car market by sales revenue in 2024, highlighting its continued dominance, a trend expected to persist in 2025.

- BYD Expands Southeast Asia Presence via Grab Partnership. BYD has partnered with Grab to provide up to 50,000 BYD electric vehicles to Grab’s driver-partners across Southeast Asia, increasing the availability of green vehicles for ride-hailing users. High upfront costs remain a key barrier to EV adoption in the region, and this partnership aims to accelerate transportation electrification by offering Grab’s fleet and driver-partners access to BYD EVs at competitive rates with extended battery warranties. The collaboration will also integrate IoT connectivity between BYD’s vehicles and Grab’s platform, enhancing operational efficiency. This move strengthens BYD’s brand presence in Southeast Asia, a fast-growing EV market with significant long-term potential.

- 3Q24 earnings. Operating revenue increased by 24.0% to RMB201.1bn in 3Q24, compared with RMB162.2bn in 3Q23. Net profit rose by 11.5% to RMB11.6bn in 3Q24, compared to RMB10.4bn in 3Q23. Basic EPS rose to RMB4.00 in 3Q24, compared with RMB3.58 in 3Q23.

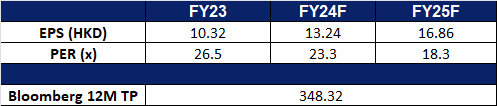

- Market consensus.

(Source: Bloomberg)

Lenovo Group Ltd. (992 HK): Happy Lunar New Year Shopping

- RE-ITERATE BUY Entry – 11.3 Target – 12.7 Stop Loss – 10.6

- Lenovo Group Ltd is an investment holding company primarily engaged in development, manufacture and marketing of technology products and services. The Company operates its business through three segments. The Intelligent Devices Group segment is engaged in the manufacture and sale of personal computer (PC), tablet, smartphone and other smart devices. The Infrastructure Solutions Group segment is engaged in the provision of artificial intelligence (AI) products, services and partnerships, the development of comprehensive full-stack infrastructure solutions portfolio as well as the provision of storage solutions. The Solutions and Services Group segment is engaged in the provision of information technology (IT) solutions and services across PC, infrastructure, and smart verticals, including attached services, managed services and As a Service (AaS) offering. The Company conducts its business in the domestic and overseas markets.

- China’s Retail Subsidies Fuel Lunar New Year Shopping Surge. China’s expanded trade-in subsidy program is driving a surge in consumer electronics sales ahead of the Lunar New Year. Earlier this year, the government extended its national trade-in initiative to include smartphones, tablets, and smartwatches. The Ministry of Commerce (MOC) reported receiving subsidy applications for 10.79mn electronic devices over just four days starting January 20. Retail data from Suning.com, one of China’s largest home-appliance chains, shows smartphone sales in Shanghai have jumped over 90% YoY since January 20, while tablet sales surged more than 200%. This surge in consumer spending is likely to have benefited Lenovo, particularly in its PC and smart device segments.

- Lenovo to Launch World’s First ‘Rollable’ Laptop in March. Lenovo announced plans to launch the world’s first laptop with an expanding rollable display in March, pricing it at $3,499. The ThinkBook Plus Gen 6 Rollable features a 14-inch display that extends into a nearly 17-inch portrait-oriented screen, offering enhanced flexibility for professionals. The laptop integrates Microsoft’s Copilot+ AI technology and other AI-driven tools, catering to business travelers seeking a larger, yet compact, display with advanced productivity features. Measuring 19.9mm in thickness and weighing just 1.7kg, the device strikes a balance between portability and functionality.

- Lenovo Acquires Infinidat, Expands Enterprise Storage Business. Lenovo has announced the acquisition of Israeli enterprise storage company Infinidat, marking its first investment in Israel. As part of the deal, Lenovo will establish a development center in the country, reinforcing its market presence in the region. The acquisition strengthens Lenovo’s enterprise storage portfolio, particularly in the entry and mid-range segments, while enhancing its ability to drive innovation in computing and storage convergence. Strategically, this move bolsters Lenovo’s global enterprise business, expands its footprint in Israel, and enhances its ability to deliver next-generation storage solutions to customers worldwide.

- 1H25 earnings. Revenue increased by 21.9% to US$33.3bn in 1H25, compared with US$27.3bn in 1H24. Net profit rose by 34.8% to US$636.8mn in 1H25, compared to US$472.5 in 1H24. Basic EPS rose to 4.91 US cents in 1H25, compared with 3.57 US cents in 1H24.

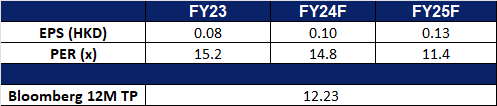

- Market consensus.

(Source: Bloomberg)

Costco Wholesale Corp (COST US): Beneficiary of tariffs

- BUY Entry – 1,040 Target – 1,200 Stop Loss – 960

- Costco Wholesale Corporation is a membership warehouse club The Company sells all kinds of food, automotive supplies, toys, hardware, sporting goods, jewelry, electronics, apparel, health, and beauty aids, as well as other goods. Costco Wholesale serves customers worldwide.

- Tariff policies drive potential inflationary pressure. In 2024, the US trade deficit reached US$918.4bn, increasing by 17% YoY. The US-China trade deficit accounted for US$295.4bn of this total. The Trump administration has begun using tariff policies to pressure major US trading partners. While tariffs on Canada and Mexico have been temporarily paused, the administration has maintained a 10% tariff increase on Chinese goods. The market expects the next round of tariffs to target high-value-added products from Taiwan, South Korea, and Japan. As a result, inflationary pressure in the US is expected to rise, leading to increased capital inflows into inflation-related sectors.

- Defensive and growth attributes. Unlike traditional large supermarkets that rely on low-margin, high-volume sales, Costco maintains ultra-low wholesale prices, with its primary source of profit coming from membership fees. Membership growth and fee increases serve as long-term growth drivers. As of December 2024, the number of paid household members reached 77.4 million, an 8% YoY increase, with a total of 138.8 million cardholders. The global membership renewal rate stood at 90.4%. Additionally, since 1 September 2024, Costco has raised membership fees in the US and Canada, increasing the standard membership fee from US$60 to US$65 and the executive membership fee from US$120 to US$130. In South Korea, membership fees will increase by 7.5% to 15.2% in May 2025. Currently, the company operates 897 warehouses across 13 countries and plans to open 29 new warehouses in 2025, with 12 located outside the US

- 1Q25 results. Costco Wholesale Corp’s revenue increased by 7.5% YoY to US$62.15bn in 1Q25, above estimates by US$150mn. It delivered non-GAAP EPS of US$3.82, above estimates by US$0.03. The company reported strong sales performance for January 2025, with net sales reaching US$19.51bn, marking a 9.2% increase from US$17.87bn in the previous year. The company’s 22-week net sales grew 8.2% to US$113.55bn. It declared a of $1.16/share quarterly dividend, in line with previous, payable on 21 February for shareholders of record 7 February.

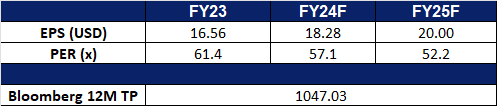

- Market consensus

(Source: Bloomberg)

Delta Air Lines Inc (DAL US): Poised for record breaking growth

- RE-ITERATE BUY Entry – 68 Target – 78 Stop Loss – 63

- Delta Air Lines, Inc. provides scheduled air transportation for passengers, freight, and mail over a network of routes. The Company offers flight status information, bookings, baggage handling, and other related services. Delta Air Lines serves customers worldwide.

- Jet fuel price to remain low. The US jet fuel market is expected to maintain relatively low prices in early 2025, continuing the trend from late 2024. The International Air Transport Association (IATA) projects an average jet fuel cost of US$87/bbl, or US$2.0714/gal, with total fuel expenditures expected to drop to US$248 billion nearly 5% lower than in 2024. While refinery disruptions could temporarily impact prices, overall stability is expected. Additionally, fuel costs are projected to comprise 26.4% of total airline expenses, down from 28.4% in 2024, contributing to improved profitability margins for airlines like Delta. As of the week ending 31 January 2025, the global average jet fuel price fell 3.0% compared to the week before to US$94.93/bbl.

Jet Fuel Price Trend

(Source: IATA)

- Expected rise in travel demand. Air travel demand is projected to increase significantly in 2025, with passenger numbers surpassing five billion for the first time, a 6.7% rise from 2024. IATA estimates global departures will reach 40 million, supporting industry revenue growth of 4.4% to over US$1tn. Increased connectivity will drive economic benefits across multiple sectors, such as hospitality and retail, while airline employment is expected to grow to 3.3 million. Despite cost pressures, Delta is well-positioned to capitalize on rising demand through strategic network expansion and operational efficiency.

- Best year yet. Delta Air Lines is on track for its strongest financial year yet, fuelled by robust travel demand, strategic expansion, and a continued focus on premium services. The airline expects over US$4bn in free cash flow and annual earnings surpassing US$7.35 per share. A key driver of this success is its longstanding partnership with American Express, which generated nearly US$2bn in 4Q24 alone. This collaboration, alongside Delta’s growing SkyMiles loyalty program and premium travel offerings, is expected to enhance customer retention and increase revenue. Delta’s fleet strategy will further strengthen its market position. In 2025, the airline plans to retire around 30 older aircraft while adding over 40 new planes, including 12-13 widebody Airbus A330s and A350s, supporting strong transatlantic demand. Half of its expected capacity growth will come from better utilization of its existing mainline and regional fleet, with 80% of incremental capacity focused on high-margin core hubs. By increasing efficiency, reducing maintenance costs, and expanding premium seating, Delta is positioning itself for long-term profitability and market leadership. Looking ahead, the airline plans to expand international routes, optimize its domestic network, and enhance customer experience to sustain its competitive advantage.

- 4Q24 results. Delta Air Line Inc’s revenue increased by 9.4% YoY to US$15.56bn in 4Q24, above estimates by US$1.08bn. It delivered non-GAAP EPS of US$1.85, above estimates by US$0.11. For FY25, the company earnings to grow by greater than 10% to US$7.35 per share in 2025 and over US$4bn in free cash flow in 2024. For 1Q25, Delta expects revenue to rise 7% to 9%, ahead of the roughly 5% growth analysts had forecast and earnings per share of between US$0.70 and US$1.0, slightly ahead of Wall Street forecast of between US$0.65 and US$0.97.

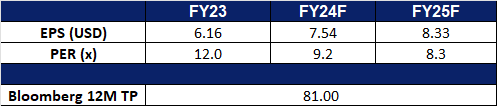

- Market consensus

Trading Dashboard Update: Add Lenovo Group Ltd (992 HK) at HK$11.30.