9 October 2024: Yanlord Land Group Ltd (YLLG SP), Anta Sports Products Ltd (2020 HK), Cameco Corp (CCJ US)

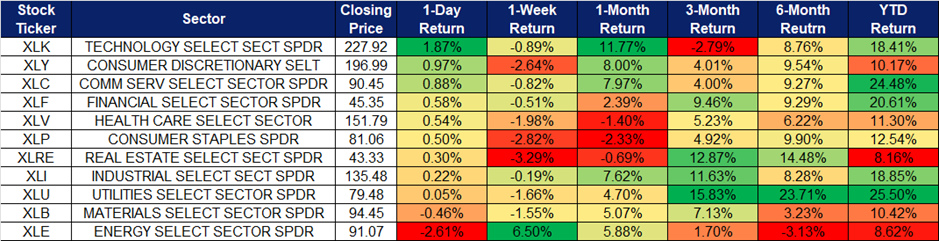

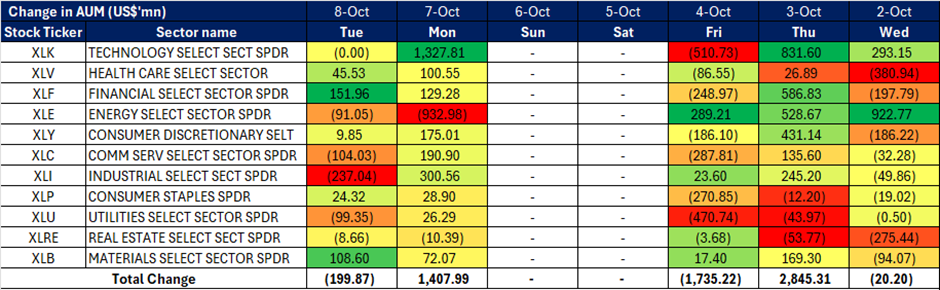

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

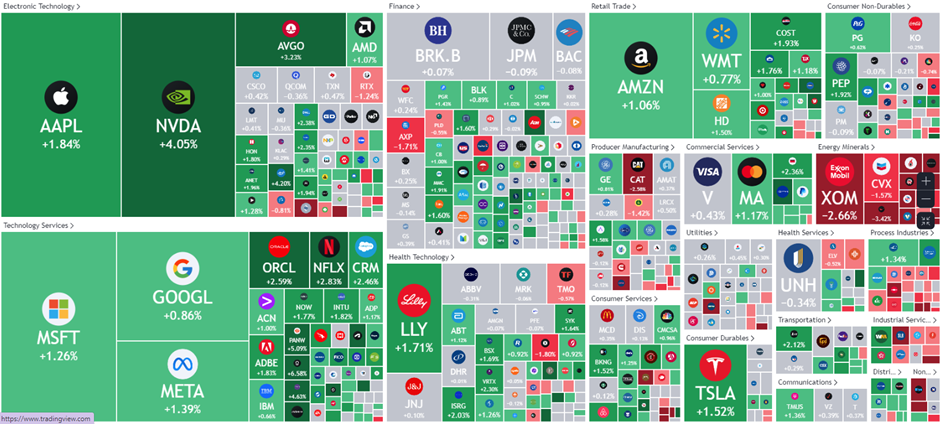

United States

Hong Kong

Yanlord Land Group Ltd (YLLG SP): China’s stimulus to boost value

- RE-ITERATE BUY Entry – 0.75 Target– 0.83 Stop Loss – 0.71

- Yanlord Land Group Ltd is a real estate development company. The Company develops high-end residential property projects in the Peoples Republic of China.

- Chinese companies favoured. Beijing’s massive stimulus package has triggered a significant surge in the share prices of Chinese companies listed in Singapore. Such stocks like Yanlord Land have soared, benefiting from China’s measures to address its economic slowdown. These measures include monetary easing, infrastructure spending, real estate support, tax cuts, and consumption-boosting subsidies. The Singapore Exchange-listed companies with China exposure, such as real estate investment trusts, banks, and developers, have seen sharp gains. The rally in Chinese stocks is driven by optimism about the stimulus, but investors should remain cautious in watching its long-term effectiveness. While there is some fear funds might shift to Hong Kong and China markets, “China fever” rally can continue in the near term.

- Strengthening of Yuan. China’s yuan recently reached a 16-month high against the US dollar after Beijing introduced new stimulus measures, including a 50-basis point cut to banks’ reserve requirement ratios and eased mortgage repayments for households. The yuan strengthened 0.65% to 7.017 per dollar. Bullish sentiment on the yuan further increased as global investors reallocated funds to China, with long positions reaching their highest since January 2023, following initiatives like interest rate cuts and a US$114bn fund to boost share prices. Analysts anticipate the USD/RMB exchange rate to decline in the coming months. This appreciation of the yuan is expected to enhance Yanlord’s property valuations and revenue, as it develops properties in China, thereby improving its overall financial performance, especially since its results are reported in RMB.

- Revival of the property market. Beijing rolled out new stimulus measures aimed at boosting the sector and the economy. The Politburo pledged to meet the 2024 economic growth target of 5% and to halt declines in the housing market, while the central bank unveiled its largest stimulus since the pandemic. Major cities, including Guangzhou, Shanghai, and Shenzhen, have eased restrictions on home purchases, with Guangzhou lifting all curbs and others lowering the minimum downpayment for first-time buyers to 15%. These changes spurred strong sales, with developers like Shui On Land and Longfor Group selling out new projects within hours. The central bank also announced plans to lower mortgage rates for existing home loans before 31 October, with expectations that further government liquidity injections will help stabilize the market by the second half of 2025. These measures will benefit Yanlord, as increased property demand would drive growth in real estate development.

- 1H24 results review. Total revenue for 1H24 increased by 34.8% YoY to RMB19.953bn from RMB14.805bn in 1H23. Income from property development, property investment and hotel operations, and property management for 1H24 increased by 42.4%, 1.9% and 0.4% to RMB17.488bn, RMB894mn and RMB591mn, respectively, while income from other segment decreased by 7.2% to RMB980mn, compared to 1H23. The Group reported a loss for the period of RMB421mn and a loss attributable to the owners of the Company of RMB486mn in 1H24, mainly due to write-down of completed properties for sale and properties under development for sale and net impairment losses on financial assets.

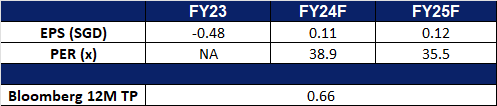

- Market Consensus.

(Source: Bloomberg)

Geo Energy Resources Ltd (GERL SP): Navigating challenges with strategic investments

- RE-ITERATE BUY Entry – 0.280 Target– 0.310 Stop Loss – 0.265

- Geo Energy Resources Limited is an integrated coal mining specialist. The Company owns and operates coal mines, offers mine contracting services to third party mine owners, and sells coal to both coal traders and coal export companies.

- Dividend policy holds firm despite market challenges. Geo Energy reported a 14% YoY decline in net profit to US$24.2mn for 1H24, primarily due to a reduction in coal prices. Despite this, the company maintained its commitment to shareholders by declaring an interim dividend of S$0.002 per share, representing a payout ratio of 11.4%. Production volumes totaled 2.8 Mt, mainly from the SDJ and TBR mines, while the TRA mine contributed 0.3 Mt. Stable coal sales of 3.2 Mt and a resilient cost model supported a healthy cash profit margin of 23%.

- Accelerated growth through infrastructure investment and diversification. Geo Energy recently signed a US$150mn EPC contract with CCCC First Harbor Consultants and Norinco International Cooperation to develop a 92 km hauling road and jetty in South Sumatera and Jambi Province, Indonesia. This infrastructure will boost PT Triaryani (TRA) mine’s transport capacity to 40-50 Mt per year, with 25 Mt allocated for TRA. The project’s deferred payment mechanism minimizes upfront cash outlay, allowing the infrastructure to generate revenue before payments begin. Upon completion in early 2026, not only will this development scale up production to 25 Mt annually but also it results in significant logistical cost savings, potentially generating US$400-500 mn in annual EBITDA. The project also diversifies Geo Energy’s revenue stream as an infrastructure provider.

- Coal prices to normalise. With demand and supply currently in balance, coal prices are expected to remain relatively steady for FY24. As a result, Geo Energy’s potential to boost its topline will rely more on increasing production volumes rather than benefiting from price fluctuations. The company has revised its full-year production forecast from the initial 10-11 Mt down to 8-9 Mt, having produced 2.8 Mt in 1H24. July’s production levels indicate that the company is on track to meet this new target.

- 1H24 results review. Revenue for 1H24 declined by 29% YoY to US$169.4mn, primarily due to lower ICI4 coal prices, averaging US$56.13 per tonne compared to US$70.46 in 1H23. Production was adversely affected by unfavorable weather conditions in the first half of the year. However, cash profit per tonne remained robust at US$11.94, reflecting its cost-efficient model where cash costs decrease in line with lower ICI4 prices. Geo Energy declared a second interim dividend of S$0.002 per share.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.68. Please read the full report here.

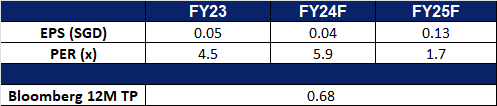

- Market Consensus.

(Source: Bloomberg)

Anta Sports Products Ltd (2020 HK): Consumption to revive

- BUY Entry – 94 Target 106 Stop Loss – 88

- ANTA Sports Products Ltd is a company principally engaged in the production and sale of sporting goods. The Company’s main businesses are brand marketing, production, design, procurement, supply chain management, wholesale and retail of branded sporting goods, including footwear, apparel and accessories. The Company explores the potential of the sporting goods market through diversified brands, including ANTA, FILA, DESCENTE and KOLON SPORT. The Company’s products are sold to domestic and international markets.

- China Stimulus aimed at stimulating consumption. China recently announced plans to issue special sovereign bonds worth approximately 2.0tn yuan ($284.43bn) this year as part of a new fiscal stimulus package, with 1.0tn yuan specifically aimed at boosting consumption. According to sources, the Ministry of Finance will use the proceeds from these bonds, which are floated for specific purposes, to increase subsidies for the trade-in and renewal of consumer goods. According to Reuters, the funds will be used to provide a monthly allowance of about 800 yuan ($114) per child to families with two or more children, excluding the first child. This increases the income of middle and low-income group and improves the consumption structure in China. China also plans to raise another 1.0tn yuan through a separate sovereign debt issuance to assist local governments in addressing their debt challenges. These policies are expected to drive higher consumption across the country, benefitting Anta Sports Products.

- Lower rates to drive growth. China has unveiled a series of rate cuts aimed at stimulating economic growth, with a focus on boosting both consumption and investment. As part of these measures, the People’s Bank of China lowered interest rates on existing mortgages by 0.5 percentage points and reduced banks’ reserve requirements to encourage more lending. The stimulus package also includes easing borrowing restrictions for stock market investments and lowering the minimum down payment for second homes from 25% to 15%. These steps are expected to enhance business confidence and drive consumer spending, benefiting companies like Meituan. Additionally, the National Development and Reform Commission (NDRC) reaffirmed plans to introduce a private-sector promotion law, designed to create a favourable environment for private-sector growth, further boosting consumption levels.

- New product showcases to benefit from upcoming NBA season. Anta has made a bold move in its global expansion by launching the ‘Kai 1 Speed’ basketball shoes in collaboration with Kyrie Irving’s father. The exclusive release is now available in over 60 Foot Locker stores across North America and Europe, marking a significant step in the company’s international growth strategy. This follows the global debut of the Kai 1 series in Dallas in March, with subsequent rollouts in key cities such as New York, San Francisco, Dubai, Singapore, Manila, and major locations in China, including Beijing, Shanghai, and Guangzhou. With the NBA season set to begin in late October 2024, these new releases are poised to capture consumer attention.

- 1H24 earnings. Revenue grew by 13.8% to RMB33.7bn in 1H24, compared to RMB29.6bn in 1H23. Net profit attributable to the shareholders of the company rose by 17.0% to RMB6.16bn in 1H24, compared to RMB5.26bn in 1H23. Basic EPS rose to RMB2.75 in 1H24, compared to RMB1.74 in 1H23.

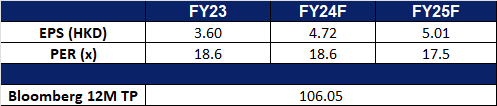

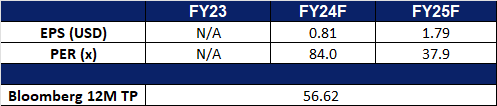

- Market consensus.

(Source: Bloomberg)

CGN Mining Co Ltd (1164 HK): Growing nuclear power demand

- RE-ITERATE BUY Entry – 1.50 Target 1.70 Stop Loss – 1.40

- CGN Mining Co Ltd is a company mainly engaged in the trading of natural uranium. The Company operates its business through three segments. The Natural Uranium Trading segment is engaged in the trading of natural uranium. The Property Investment segment is engaged in leasing business. The Other Investments segment is engaged in investment activities.

- China Stimulus to boost demand for uranium. China’s recent announcement of stimulus packages has boosted bullish momentum in uranium markets, driven by increasing energy demand from the world’s third-largest power producer. Furthermore, China’s push to expand its nuclear energy capacity has improved the investment outlook, fueling stronger interest in uranium. With 22 of the 58 global nuclear reactors currently under construction in China, the country is at the forefront of a global nuclear renaissance.

- Potential restricted uranium supply. Russian President Putin said Moscow should consider limiting uranium, titanium, and nickel exports. Russia has approximately 44% of the world’s uranium enrichment capacity and provides 5.5% of the global supply. It owns about 8% of the global reserves. In May, the US passed the Prohibiting Russia Uranium Imports Act. Countries with nuclear energy, especially the Western ones have been sourcing reliable supplies. Russia’s potential uranium export restriction will lead to tight supplies, and prices will rebound accordingly. Current uranium prices has risen toward $82 per pound in October, the highest in over one month.

Uranium futures prices

(Source: Bloomberg)

- 1H24 operation update. In 1H24, the total equity source of the Group was 39,000tU and equity production was 624tU. The group was interested in 49% of the equity interest of Semizbay-U, which mainly owns and operates the Semizbay Mine and the Irkol Mine in Kazakhstan. The planned uranium extracted was 471tU with actual extraction of 477tU and the completion rate of planned production was 101% in the first half of the year; among which, actual uranium extracted from the Semizbay Mine and the Irkol Mine was 182tU and 295tU, respectively. The average production costs of the Semizbay Mine and the Irkol Mine were US$31.93/lbU3O8 and US$23.83/lbU3O8, respectively. The group was interested in 49% of the equity interest of Ortalyk, which mainly owns and operates the Central Mynkuduk Deposit and the Zhalpak Deposit in Kazakhstan. The planned uranium production was 905tU with actual production of 858tU and the completion rate of planned production was 95% in the first half of the year; among which, actual uranium extracted from the Central Mynkuduk Deposit and Zhalpak Deposit was 792tU and 66tU, respectively.

- 1H24 earnings. Revenue grew by 38.8% to HK$4.07bn. Gross loss was HK$56.4mn compared to HK$186.7mn profit in 1H23. Net profit attributable to the shareholders of the company declined by 37.0% to HK$113.1mn.

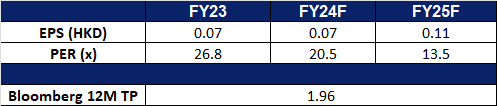

- Market consensus.

(Source: Bloomberg)

Cameco Corp (CCJ US): Potential growth of Uranium prices

- RE-ITERATE BUY Entry – 50 Target – 56 Stop Loss – 47

- Cameco Corporation explores, develops, mines, refines, converts, and fabricates uranium. The Company offers uranium for sale as fuel for generating electricity in nuclear power reactors. Cameco operates worldwide.

- Uranium supply blocked. Moscow considers restricting exports of uranium, titanium and nickel. Russia has about 44% of the world’s uranium enrichment capacity and accounts for 5.5% of global supply. In May this year, the United States passed the “Banning Uranium Imports from Russia Act.” Countries with nuclear power, especially in the West, are always looking for reliable supplies. Potential Russian uranium export restrictions will lead to tight supply and prices will rebound accordingly. The current uranium price rose to $82 per pound in October, the highest level in more than a month.

- Nuclear power demand to drive uranium growth. Looking ahead to the next decade, the market is expected to continue to grow. According to the baseline scenario in the World Nuclear Energy Association’s “2023 Nuclear Fuel Report”, uranium demand will increase by 28% between 2023 and 2030, and by 51% between 2031 and 2040. Licenses to extend the life of nuclear power plants and the economic attractiveness of continuing to operate older reactors are key factors for the uranium market in the medium term. However, according to the International Energy Agency’s 2023 World Energy Outlook Report, electricity demand is likely to increase by about 50% by 2040 compared with 2022. In a world that attaches great importance to carbon emission restrictions, there is considerable room for growth in nuclear power capacity.

- Stable uranium prices and more room for growth. The current price of uranium is $82 per pound, a new high in a month. It will exceed $105 per pound in late 2023 and early 2024. The US dollar interest rate cut cycle and the potential expansion of the supply gap will drive future price increases.

- 2Q24 earnings review. The company delivered revenue of C$598mn, a 24.1% YoY increase, non-GAAP earnings per share of C$0.14 and an adjusted EBITDA of C$337mn. For FY24, the company expects strong cash flow generation, with estimated consolidated revenue of between about C$2.85bn and C$3.0bn.

- Market consensus.

(Source: Bloomberg)

Entergy Corp (ETR US): Cleaning up the mess Helene made

Entergy Corp (ETR US): Cleaning up the mess Helene made

- RE-ITERATE BUY Entry – 132 Target – 144 Stop Loss – 126

- Entergy Corporation is an integrated energy company that is primarily focused on electric power production and retail electric distribution operations. The Company delivers electricity to utility customers in Arkansas, Louisiana, Mississippi, and Texas. Entergy also owns and operates nuclear plants in the northern United States.

- Power restoration in progress. Hurricane Helene’s recent passage through the southeastern United States left a trail of destruction, causing widespread power outages and infrastructure damage. Entergy, a major utility company, has been at the forefront of restoration efforts, deploying over 1,000 workers to assist affected regions. In Florida, Entergy crews collaborated with Florida Power & Light to restore power to over 95% of customers within four days of the storm’s landfall. As the recovery efforts shifted to Georgia, which experienced its most destructive hurricane on record, Entergy teams continued to provide support to Georgia Power. Entergy has also been assisting other utilities, such as AEP Appalachian Power and Duke Energy Carolinas, in the Carolinas. These efforts are made possible through mutual aid agreements between utility companies, ensuring a coordinated response to major weather events. The devastating aftermath of Hurricane Helene is expected to increase retail sales volume for Entergy’s utility business as customers rebuild and replace damaged property.

- Funds are rotated into cyclical and growth sectors. Entering the fourth quarter, institutions’ asset portfolios will be adjusted. The market still maintains expectations that the Federal Reserve will cut interest rates by 200 basis points in the next year. Loose monetary policies will continue to benefit platform stocks in obtaining capital inflows and reflect lower interest expenses.

- Expansion plans underway. Entergy Louisiana is partnering with local governments to strengthen electric infrastructure in southeast Louisiana, using several Building Resilient Infrastructure and Communities (BRIC) grants. Projects in Ascension, Lafourche, and Jefferson parishes will harden power lines, preventing outages and reducing restoration costs from storms. Entergy is also awaiting decisions on Grid Resilience and Innovative Partnerships (GRIP) grant applications for Baton Rouge and Reserve, which could further bolster grid resilience. In Arkansas, Entergy received US Department of Energy grants to enhance hydroelectric facilities, ensuring continued clean energy generation. Meanwhile, Entergy Mississippi is building a new natural gas power plant in Greenville, set to drive economic growth and provide reliable energy. This plant, designed to support hydrogen blending, is part of Entergy’s efforts to modernize its energy grid, replacing older power stations and reducing carbon emissions. These plans underway will further sustain Entergy’s robust growth and continue to unlock value for its stakeholders.

- 2Q24 earnings review. Non-GAAP earnings per share were US$1.92, beating expectations by US$0.16. The company affirmed its 2024 adjusted EPS guidance range of US$7.05 to US$7.35 vs US$7.21 consensus.

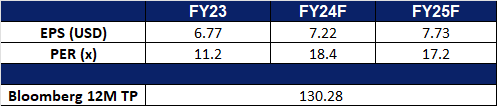

- Market consensus.

(Source: Bloomberg)

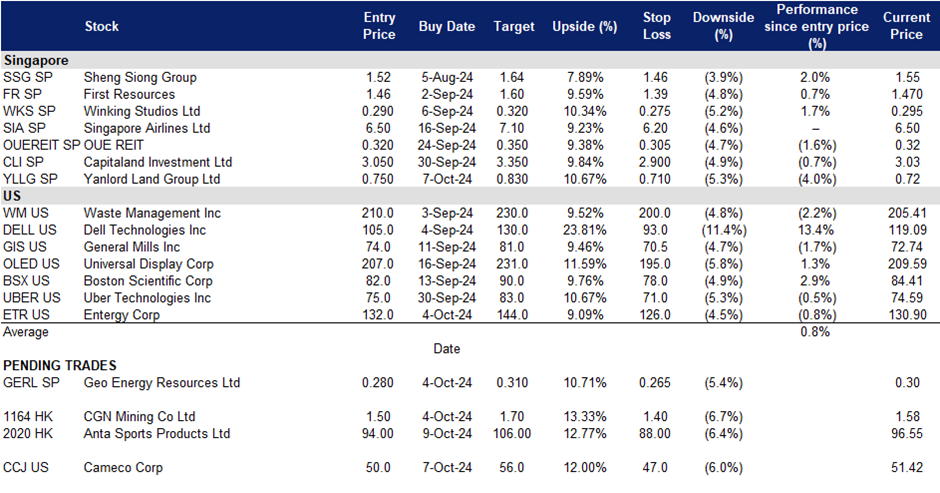

Trading Dashboard Update: Take profit on Food Empire Holdings Ltd (FEH SP) at S$1.06. Add CapitaLand Investment Ltd (CLI SP) at S$3.05 and Yanlord Land Group Ltd (YLLG SP) at S$0.750 and Anta Sports Products Ltd (2020 HK) at HK$100.0. Cut loss on United Hampshire US REIT (UHU SP) at S$0.47 and Hong Kong Exchanges and Clearing Ltd (388 HK) at HK$342 and Anta Sports Product Ltd (2020 HK) at HK$94.0.