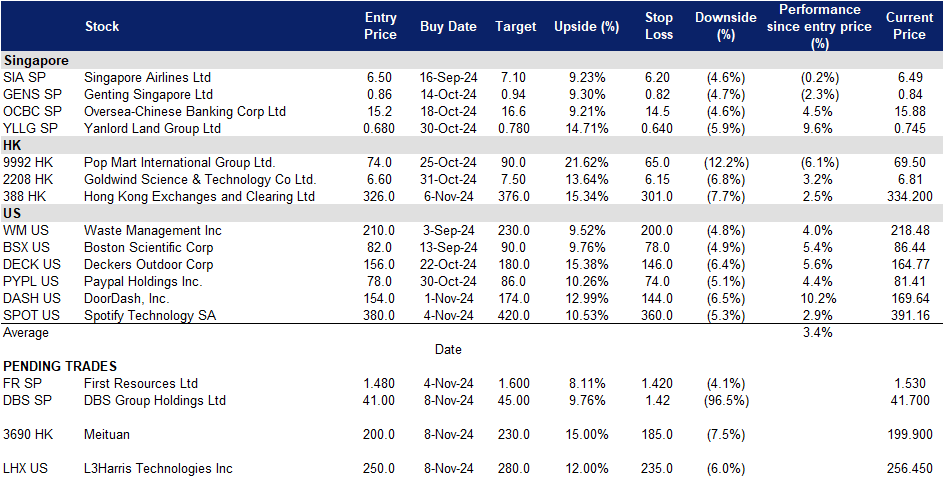

8 November 2024: DBS Group Holdings Ltd (DBS SP), Hong Kong Exchanges and Clearing Ltd. (388 HK), L3Harris Technologies Inc (LHX US)

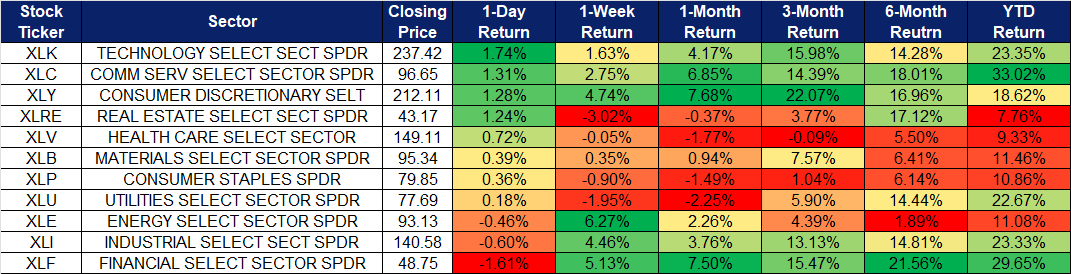

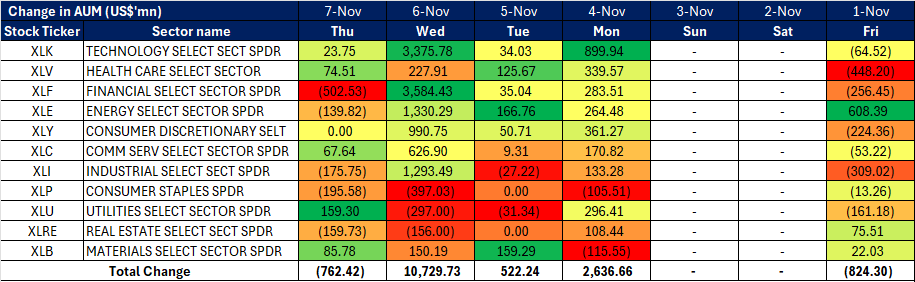

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

DBS Group Holdings Ltd (DBS SP): Singapore’s Trump-themed trade

- BUY Entry – 41.0 Target– 45.0 Stop Loss – 39.0

- DBS Group Holdings Limited and its subsidiaries provide a variety of financial services. The Company offers services including mortgage financing, lease and hire purchase financing, nominee and trustee, funds management, corporate advisory and brokerage. DBS Group also acts as the primary dealer in Singapore government securities.

- Record high quarterly profit. DBS reported a record quarterly net profit of S$3.03bn for 3Q24, driven by strong wealth management fees and trading income. The bank announced a S$3bn share buyback program, which will lead to an increase in its earnings per share and return on equity. Despite concerns about buying back shares at record highs, its CEO emphasized that the timing would be prudent and based on the bank’s fundamentals. DBS expects pre-tax profits for 2025 to remain around 2024 levels but sees potential upside if tighter monetary policies are maintained under Donald Trump’s administration. The incoming 15% global minimum corporate tax in Singapore is expected to impact net profit, while its non-interest income is projected to grow in high-single digits next year. Additionally, it announced a quarterly dividend of S$0.54 per share. We anticipate continued momentum in the current quarter from its wealth management and trading business segments to drive further growth in earnings and support the share buyback program.

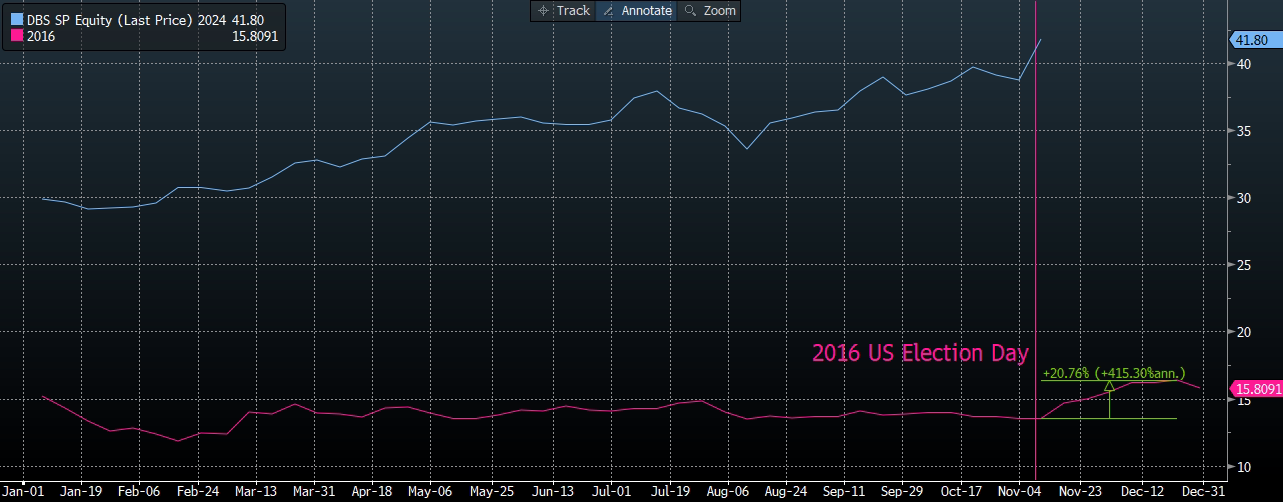

DBS price comparison (current vs Trump victory 2016)

(Source: Bloomberg)

- Benefitting from Trump’s victory. DBS anticipates potential benefits from President-elect Donald Trump’s return to office, as his inflationary policies, such as imposing tariffs and lowering tax rates, could lead to tighter monetary policy. This would help DBS by boosting its net interest margins (NIMs) and supporting the repricing of its fixed asset portfolio.

- 3Q24 results review. Total income for 3Q24 rose 11% to S$5.75bn and net profit rose 15% YoY to surpass S$3bn for the first time. DBS announced a new S$3bn share buyback programme and declared Q3 dividend at S$0.54 per share to be paid out on or about 25 November.

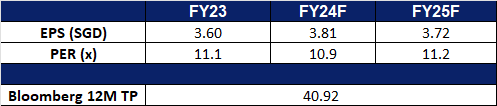

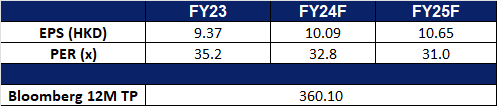

- Market Consensus.

(Source: Bloomberg)

First Resources (FR SP): Palm oil prices at a two-year high

- RE-ITERATE BUY Entry – 1.48 Target– 1.60 Stop Loss – 1.42

- First Resources Limited produces crude palm oil. The Company is an upstream operator with primary business activities in the cultivation and harvesting of oil palms, and the processing of fresh fruit bunches into crude palm oil for local and export sales.

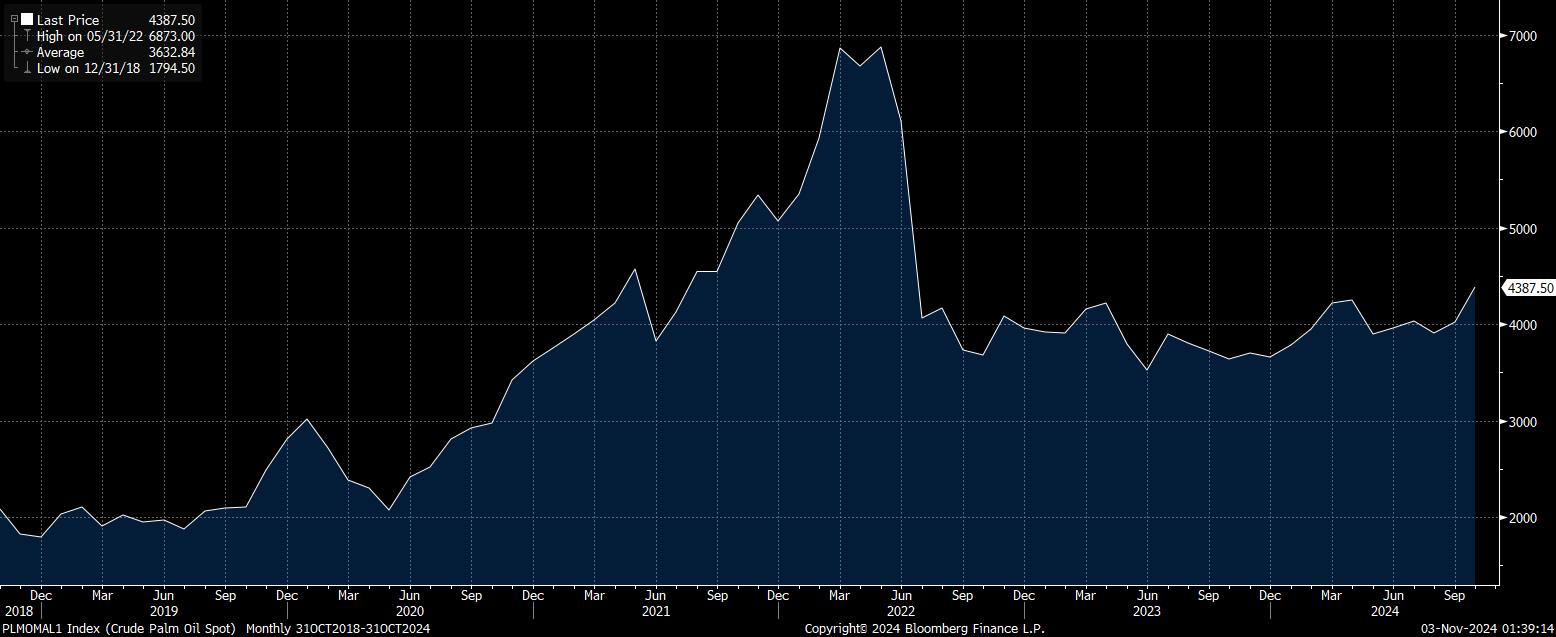

- Palm oil prices surged to a two-year high. Palm oil prices have surged for three consecutive days, reaching a two-year high due to strong demand and tightening supply. October exports from Malaysia, the world’s second-largest palm oil producer, rose 11%, driven by increased shipments to India, China, and the EU. Higher crude oil prices also boosted palm oil’s demand as a biofuel feedstock. Additional demand is expected from Indonesia’s plan to raise palm oil use in biofuel next year. Supply challenges, partly due to aging palm trees, have driven palm oil prices up over 30% this year. Experts anticipate the rally may continue into the first quarter of 2025, supported by seasonal consumption, limited supply, and biodiesel demand. This price increase benefits palm oil producers such as First Resources.

Crude Palm Oil Price

(Source: Bloomberg)

- Thailand bans exports of palm oil. Thailand’s Department of Internal Trade has imposed a temporary ban on raw palm oil exports due to reduced production from drought and plant diseases, intending to stabilize local prices and maintain sufficient stock. The ban, expected to last until December, aims to shield consumers and farmers from price spikes. With crude palm oil stocks over 200,000 tonnes, industry associations have agreed to halt exports and keep prices stable until January 2025. Retailers and wholesalers have also pledged to maintain reasonable bottled palm oil prices, with potential penalties for violators, including fines or prison time. This ban will result in reduced palm oil supplies, which will continue to bolster prices.

- 1H24 results review. Total revenue for 1H24 increased by 1.9% YoY to US$457.2mn from US$448.8mn, primarily due to the higher production volumes as compared to the same period last year, partially offset by a reduction in purchases of palm oil products from third parties for processing and sale. Net profit was US$103.9mn in 1H24, an increase of 45.4% YoY and profit from operations rose by 48.9% YoY to US$143.5mn, driven by higher production volumes and improved processing margins. Basic EPS rose in 1H24 to 6.67 UScents from 4.56 UScents in 1H23.

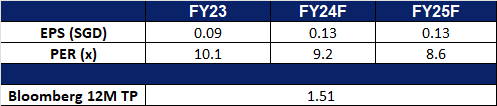

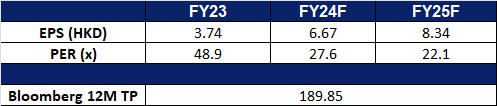

- Market Consensus.

(Source: Bloomberg)

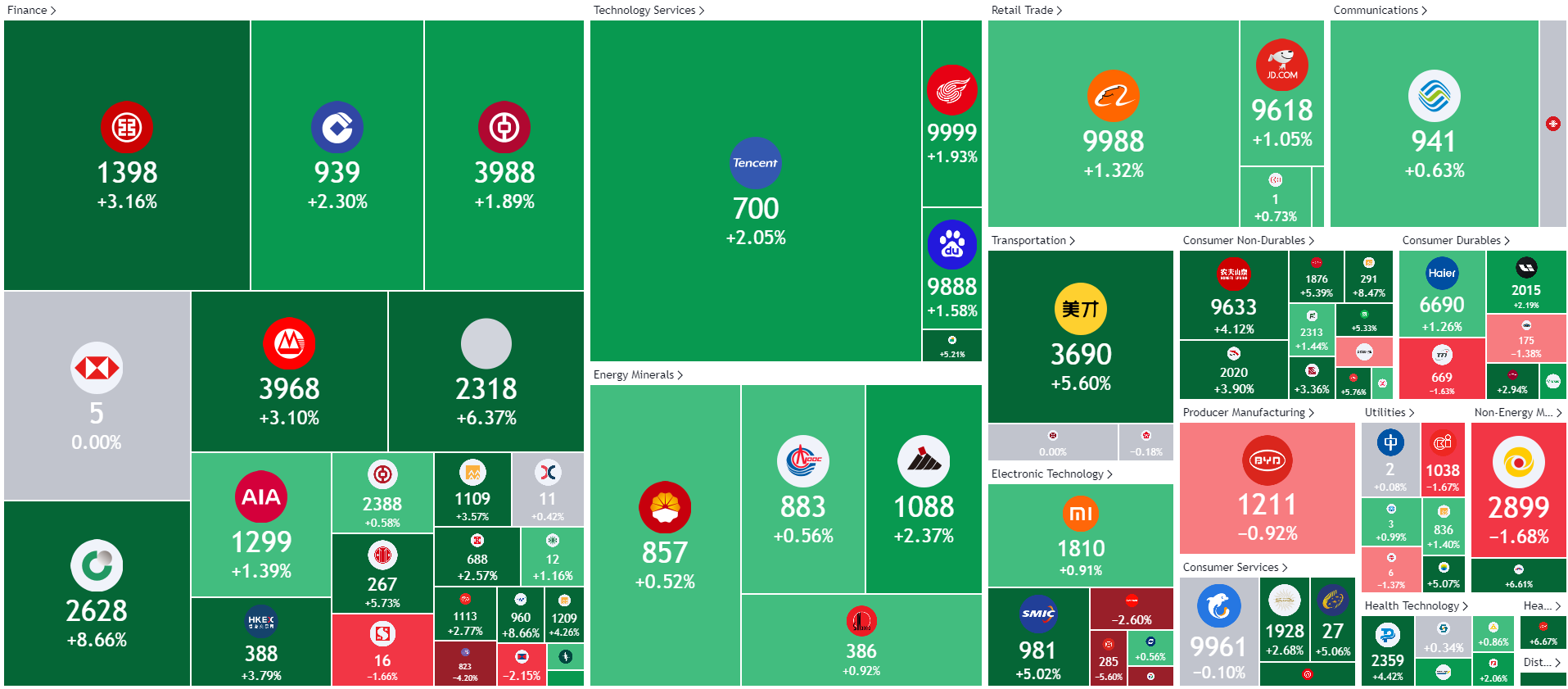

Hong Kong Exchanges and Clearing Ltd. (388 HK): China has the trump cards

- RE-ITERATE BUY Entry – 326 Target 376 Stop Loss – 301

- Hong Kong Exchanges and Clearing Limited is principally engaged in the operation of stock exchanges. The Company operates through five business segments. The Cash segment includes various equity products traded on the Cash Market platforms, the Shanghai Stock Exchange and the Shenzhen Stock Exchange. The Equity and Financial Derivatives segment includes derivatives products traded on Hong Kong Futures Exchange Limited (HKFE) and the Stock Exchange of Hong Kong Limited (SEHK) and other related activities. The Commodities segment includes the operations of the London Metal Exchange (LME). The Clearing segment includes the operations of various clearing houses, such as Hong Kong Securities Clearing Company Limited, the SEHK Options Clearing House Limited, HKFE Clearing Corporation Limited, over the counter (OTC) Clearing Hong Kong Limited and LME Clear Limited. The Platform and Infrastructure segment provides users with access to the platform and infrastructure of the Company.

- Expectations of upcoming China policies. From 4th November through 8th November, the Standing Committee of the National People’s Congress (NPC), China’s top legislative body, will convene in Beijing to address a broad agenda of issues. A substantial fiscal stimulus package—strongly advocated by prominent economists and highly anticipated by investors—will likely be a key topic. Investors expect that Beijing may unveil details of fiscal support on Friday, 8th November. Recently, Finance Minister Lan Foan also indicated that China plans to “significantly increase” government debt to support consumers and the struggling property sector. Additionally, reports suggest that China is considering authorizing over RMB10tn (US$1.4tn) in new debt issuance next week. This move would aim to address hidden local debt, finance the repurchase of idle land, and reduce the large inventory of unsold properties. Decisions on these measures are anticipated by the close of this week’s meeting. Reports indicating that the NPC is set to meet market expectations suggest that liquidity and volatility on the Hong Kong Stock Exchange (HKEX) may see a notable increase following the policy announcements on November 8.

- Smart money embraces China again. Trump won the 2024 US election and his economic/foreign affairs/immigration policies are well-known. The US allies have prepared for a more isolated US and now could U-turn some policies against China. Smart money will pick the side with comprehensive supply chains which provide stable and constant goods and services. Therefore, China market is a sweet spot to counter the upcoming global trade tensions.

- Expanding presence. HKEX recently announced plans to open an office in Riyadh in 2025, enhancing its presence in the Middle East. This office will serve as a strategic hub, strengthening HKEX’s connectivity with the Gulf region and fostering opportunities for both customers and issuers. Located in Saudi Arabia’s financial center, the Riyadh office will allow HKEX to engage directly with investors and companies in one of the world’s most dynamic economies, supporting their access to Hong Kong’s financial product ecosystem. This expansion is expected to boost trading volume and liquidity on HKEX over the long term.

- 3Q24 earnings. The company’s revenue rose to HK$5.37bn in 3Q24, +5.7% YoY, compared to HK$5.08bn in 3Q23. The company’s profit attributable to shareholders rose by 6.5% YoY to HK$3.15bn in 3Q24, compared to HK$2.95bn in 3Q23. Basic earnings per share rose to HK$2.49 in 3Q24, compared to HK$2.33 in 3Q23.

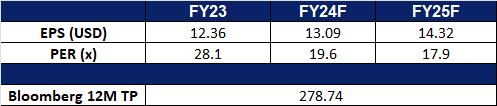

- Market consensus.

(Source: Bloomberg)

Meituan (3690 HK): Seasonally positive sentiment

- BUY Stop Entry – 200 Target 230 Stop Loss – 185

- Meituan, formerly Meituan Dianping, is a China-based e-commerce platform providing life services. The Company connects consumers and businesses to provide services satisfying people’s daily eating needs. The Company owns an instant food ordering and delivery brand, Meituan, as well as provides services through its mobile application, Meituan. The Company is also engaged in the operation of a bike-sharing brand, Mobike.

- Shopping peak season. The once-in-a-year “Double Eleven” shopping festival will come next week. Seasonally, consumer companies especially those e-commerce platforms will promote sales throughout this month, and the weekly sales data starting from November 11th spurs investor sentiments. We believe consumption in China is recovering as trading volumes of the housing market improved recently. Next week, China will release its October retail sales data and loan growth.

- Immune to trade tensions. Trump takes back the Oval Office, igniting concerns about global trade tensions. However, Meituan’s operations and businesses are 100% domestic. The goods and services provided on the platform are immune to tariffs and less impacted by import restrictions.

- 1H24 earnings. Total revenue rose by 22.9% YoY to RMB155.5 bn in 1H24, compared to RMB126.6bn in 1H23. Net profit rose by 107.8% YoY to RMB16.7bn in 1H24, compared to RMB8.05bn in 1H23. Basic earnings per share was RMB2.70 in 1H24, compared to RMB1.30 in 1H23.

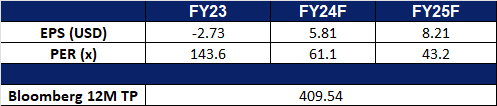

- Market consensus.

(Source: Bloomberg)

L3Harris Technologies Inc (LHX US): Defending the nation

- BUY Entry – 250 Target – 280 Stop Loss – 235

- L3Harris Technologies, Inc. is an aerospace and defense technology innovator. The Company designs, develops, and manufactures radio communications products and systems, including single channel ground and airborne radio systems. L3Harris Technologies provides advanced defense and commercial technologies across air, land, sea, space, and cyber domains.

- Sale of subsidiary. On November 4, L3Harris signed an agreement with BWX Technologies for the sale of its Aerojet Ordnance Tennessee, Inc. (A.O.T.) business for approximately US$100 million, with the transaction expected to close by year-end. This divestiture will streamline L3Harris’ operations, enabling greater focus and capital allocation toward its core business segments to drive revenue growth.

- Increased demand for defence products. Global demand for rocket motors has risen as militaries anticipate future conflicts requiring larger inventories of precision firepower. Acquired by L3Harris 15 months ago, Aerojet Rocketdyne is one of only two major solid-fuel rocket motor suppliers to the Pentagon and since its acquisition it has spurred substantial improvements in the rocket motor unit’s facilities and processes, addressing years of underinvestment and delayed deliveries. As countries such as the US seek to build a tactical missile inventory to deter potential threats, L3Harris’ business is well-positioned to capitalize on this growing demand.

- Strategic partnership with Palantir. L3Harris and Palantir have partnered to advance defence technology by combining Palantir’s Artificial Intelligence Platform (AIP) with L3Harris’ sensor and software systems. This collaboration supports US Army initiatives, including TITAN and the Unified Network Strategy, and facilitates L3Harris’ internal digital transformation. In a recent test, Palantir’s Sensor Inference Platform (SIP) integrated with L3Harris’ WESCAM MX-20 system, boosting target identification and situational awareness while reducing operator workload. This partnership enhances L3Harris’ capabilities with AI-driven solutions, strengthening its competitive position in defence and opening potential growth opportunities in the commercial sector.

- 3Q24 results. Revenue increased 7.7% YoY to US$5.3bn surpassing expectations by US$20mn. Non-GAAP earnings of US$3.34 per share, beat estimates by US$0.08.

- Market consensus.

(Source: Bloomberg)

Spotify Technology SA (SPOT US): A leader maintains its competitive edge

- RE-ITERATE BUY Entry – 380 Target – 420 Stop Loss – 360

- Spotify Technology S.A. and its subsidiaries provide audio streaming subscription services worldwide. It operates through two business segments: paid subscriptions and ad-supported.

- Leading music streaming platform. As of the second quarter of 2024, Spotify maintained its position as the top music streaming platform, with a record 625mn monthly active users (MAUs). This includes an all-time high of 393mn ad-supported users and 246mn paying subscribers. With an estimated global music streaming user base of 713mn, Spotify holds a leading 31.7% market share. Average revenue per user (ARPU) was €4.62 in Q2, close to its historical peak of €4.63.

- Podcast growth driven by audience shifts. The expansion of Spotify’s podcast audience reflects a shift in media consumption, as public trust in traditional media declines. A Washington Post commentary highlighted distrust in mainstream media, with a notable drop of 200,000 subscribers. In contrast, alternative media like podcasts are gaining traction—Donald Trump’s recent appearance on Joe Rogan’s show garnered 26mn views and listens within 24 hours, underscoring the popularity of podcasts. Spotify’s podcast offerings have grown to 250,000 videos by Q2 2024, from 100,000 at the end of 2023, with over 170mn users engaging with its video podcasts.

- Leveraging artificial intelligence. Spotify has integrated artificial intelligence to enhance user experience, providing personalized music, podcasts, and playlists. In 2023, the company introduced AI-driven voice translation for podcasts, boosting engagement and user retention. This advanced AI model strengthens Spotify’s competitive edge and enhances user loyalty.

- 2Q24 results. Revenue increased 20.2% YoY to €$3.81bn. Basic earnings were €137mn compared to a loss of €155mn in the same period last year. The company expects third-quarter revenue of €400mn and a total of 639mn monthly active users.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on China Hongqiao Group Ltd (1378 HK) at HK$14.1. Add Hong Kong Exchanges and Clearing Ltd (388 HK) at HK$326. Stop loss on Lenovo Group Ltd (992 HK) at HK$10.0, Tianjin Pharmaceutical Da Ren Tang Group (TIAN SP) at S$2.3 and Xinyi Solar Holdings Ltd (968 HK) at HK$3.55.