8 January 2025 : Seatrium Ltd (STM SP), Xiaomi Corp. (1810 HK), KKR & Co Inc. (KKR US)

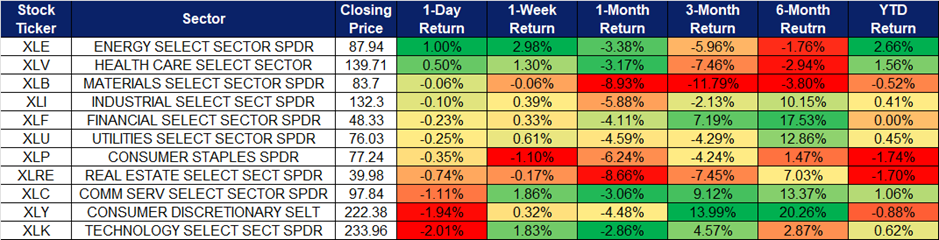

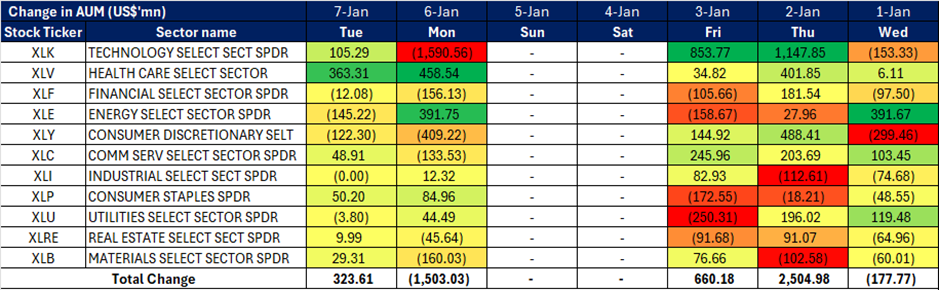

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Seatrium Ltd (STM SP): Strong project pipelines

- RE-ITERATE BUY Entry – 2.14 Target– 2.30 Stop Loss – 2.06

- Seatrium Ltd offers engineering solutions for the offshore, marine, and energy industries. The Company provides rigs and floaters, repairs and upgrades, offshore platforms, and specialized shipbuilding. Seatrium serves customers worldwide.

- New contract with BP. Seatrium Ltd. recently announced the signing of an engineering, procurement, construction, and onshore commissioning (EPC) contract with BP Exploration and Production Inc. (bp) for the Kaskida Floating Production Unit (FPU) project in the U.S. Gulf of Mexico. The Kaskida project is a greenfield development located approximately 250 miles southwest of New Orleans in the Keathley Canyon area. In its first development phase, the FPU is designed to produce up to 80,000 barrels of crude oil per day from six wells. This contract is expected to provide a significant boost to Seatrium’s long-term revenue and profitability, enhancing its position in the offshore energy sector.

- Collaboration with Cochin Shipyard (CSL). Seatrium Ltd.’s U.S. subsidiary, Seatrium Letourneau USA Inc. (SLET), has signed a Memorandum of Understanding (MOU) with Cochin Shipyard Ltd. (CSL) to jointly develop and supply key equipment for jack-up rigs tailored to the Indian market. In a media statement, Seatrium highlighted that the partnership aims to tap into the growing demand for Mobile Offshore Drilling Units (MODUs) in the region. The collaboration will combine CSL’s shipbuilding expertise with SLET’s technical knowledge and design capabilities to create MODUs that address India’s offshore energy needs. For Seatrium, this partnership marks a significant step in advancing its presence in India’s offshore sector and contributing to the country’s energy ambitions.

- Positive outlook with strong order book. As of the end of September 2024, Seatrium’s net order book stood at $24.4 billion, comprising 30 projects with scheduled deliveries through 2031. Gross orders amounted to nearly $38 billion, set to be delivered over the remainder of the decade. The company’s project pipeline remains robust, with continued interest from customers seeking partnerships. Seatrium anticipates a strong uptick in business activity and remains committed to reducing its debt while securing fresh capital to support ongoing and future projects.

- 1H24 results review. Revenue rose by 39.1% YoY to S$4.01bn in 1H24, compared to S$2.89bn in 1H23. Net profit was S$34.7mn in 1H24, compared to a net loss of S$240.5mn in 1H23. Basic EPS per share was 1.05 S cents in 1H24, compared to net loss per share of 9.40 S cents in 1H23.

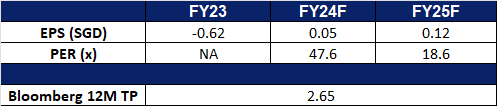

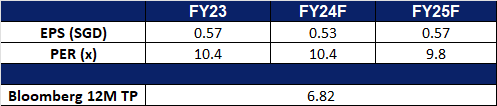

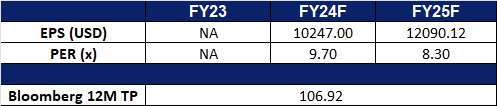

- Market Consensus.

(Source: Bloomberg)

Sembcorp Industries (SCI SP): Ahead of schedule

- RE-ITERATE BUY Entry – 5.45 Target– 5.85 Stop Loss – 5.25

- Sembcorp Industries Ltd provides utilities and integrated services for industrial sites such as power, gas, steam, water, wastewater treatment and other on-site services. Sembcorp Industries serves industrial parks, business, commercial, and residential spaces.

- Ahead of schedule. Sembcorp industries recently mentioned that its first greenfield renewables project in the Middle East will begin commercial operations more than four months ahead of schedule. This comes as its wholly owned subsidiary, Sembcorp Utilities, completed the acceptance tests to achieve the commercial operation of the power project in Oman. Manah II Solar Independent Power Project is Sembcorp’s first greenfield renewables development in the Middle East. The project is also backed by a 20-year power purchase agreement with Nama Power and Water Procurement Company. The development is expected to be accretive to the group’s earnings per share.

- Solar energy storage project in India. Sembcorp Industries’ wholly owned renewables subsidiary, Sembcorp Green Infra, was awarded a build-own-operate project by India’s public sector company, Solar Energy Corporation of India. Comprising a 150 megawatt (MW) solar photovoltaic project and a 300 MW-hour battery energy storage system (Bess), this represents Sembcorp’s first solar and Bess hybrid project in India. Sembcorp also mentioned that the agreement comes as part of a bid for two-gigawatt (GW) interstate transmission system-connected solar power projects with 4 GW-hour of Bess. The project is scheduled to be commercially operational within two years from the date the agreement is signed, and it will be funded through a mixture of internal funds and debt. It is expected to bring Sembcorp’s gross renewables capacity in India to almost 6 GW.

- 1H24 results review. Revenue fell by 12.3% YoY to S$3.21bn in 1H24, compared to S$3.66bn in 1H23. Net profit rose by 1.1% to S$550mn in 1H24, compared to S$544mn in 1H23. Basic EPS per share rose to 30.30 S cents in 1H24, compared to 29.71 S cents in 1H23.

- Market Consensus.

(Source: Bloomberg)

Xiaomi Corp. (1810 HK): Aggressive Expansion

- BUY Entry – 32.0 Target – 36.0 Stop Loss – 30.0

- Xiaomi Corp. is a China-based investment holding company principally engaged in the research, development and sales of smartphones, Internet of things (IoTs) and lifestyle products, the provision of Internet services, and investment business. The Company mainly conducts its businesses through four segments. The Smartphone segment is engaged in the sales of smartphones. The IoT and Lifestyle product segment is engaged in the sales of other in-house products, including smart televisions (TVs), laptops, artificial intelligence (AI) speakers and smart routers; ecosystem products, including IoT and other smart hardware products, as well as certain lifestyle products. The Internet service segment is engaged in the provision of advertising services and Internet value-added services. The Others segment is engaged in the provision of repair services for its hardware products. The Company distributes its products in domestic market and to overseas markets.

- Increasing Presence. Xiaomi has unveiled plans to open at least two more stores in Singapore by the end of 2025, bringing its total store count in the country to 10. This expansion is part of the company’s broader strategy to strengthen its presence and enhance direct customer engagement across Southeast Asia. Currently, Xiaomi operates seven stores in Singapore through distributor partnerships and has seen a steady increase in consumer interest. Beyond Singapore, Xiaomi remains focused on enhancing the customer experience globally, with a particular emphasis on Southeast Asia. The company recently expanded its regional footprint by launching new stores in Thailand and Malaysia. Additionally, Xiaomi Korea, the company’s South Korean branch, announced plans to open an official online store on January 15. To mark the occasion, Xiaomi will host a press conference in South Korea on the same day, where it will showcase its latest products, including smartphones, wearable devices, robot vacuums, and portable chargers.

- Partnership to improve EV charging. Xiaomi Auto has forged strategic partnerships with Li Auto, Nio, and XPeng to bolster its electric vehicle (EV) charging infrastructure. Through these collaborations, users will gain access to over 6,000 Li Auto charging stations via the Xiaomi Charging Map, with select stations offering direct charging through the Xiaomi Auto app. Additionally, the integration will extend to more than 14,000 Nio charging points and over 9,000 XPeng charging points. This initiative is poised to enhance convenience for EV owners, potentially driving increased adoption of Xiaomi’s EVs and those from its partner companies.

- Progress in EV business. Xiaomi has announced plans to launch its first sport utility vehicle (SUV), the YU7, in June or July of this year, marking a significant milestone in its entry into China’s fiercely competitive automotive market. The YU7 will share a design aesthetic with the SU7 sedan—Xiaomi’s inaugural electric vehicle—and will be powered by batteries supplied by a subsidiary of Chinese manufacturer CATL. According to sources, the YU7 will measure approximately 5 meters in length, 2 meters in width, and 1.6 meters in height, offering a more spacious yet lower-profile alternative to Tesla’s current Model Y SUV. This strategic design aims to position the YU7 as an attractive option for consumers seeking a balance between style and functionality in the electric vehicle (EV) market. In its broader EV ambitions, Xiaomi is targeting 300,000 vehicle deliveries by 2025, after having already delivered more than 135,000 units in 2024. The company is currently constructing the second phase of its Beijing plant, which, combined with the first phase, will provide an annual production capacity of 300,000 units. Additionally, Xiaomi EV has expanded its retail footprint, opening 200 stores across 58 cities, underscoring its commitment to scaling its automotive business.

- 3Q24 earnings. Revenue increased by 30.5% to RMB92.5bn in 3Q24, compared with RMB70.9bn in 3Q23. Net profit rose by 9.7% to RMB5.34bn in 3Q24, compared to RMB4.87mn in 3Q23. Basic EPS rose to RMB0.22 in 3Q24, compared with RMB0.20 in 3Q23.

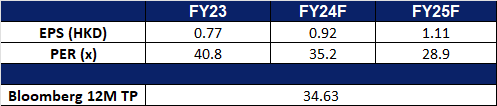

- Market consensus.

(Source: Bloomberg)

CGN Mining Co Ltd (1164 HK): Supply chain issues

- RE-ITERATE BUY Entry – 1.75 Target 2.05 Stop Loss – 1.60

- CGN Mining Co Ltd is a company mainly engaged in the trading of natural uranium. The Company operates its business through three segments. The Natural Uranium Trading segment is engaged in the trading of natural uranium. The Property Investment segment is engaged in leasing business. The Other Investments segment is engaged in investment activities.

- Restricted uranium supply. Cameco recently announced a production halt at its Inkai joint venture with Kazatomprom in Kazakhstan due to delays in submitting required documentation to the Ministry of Energy. The Inkai JV had anticipated receiving an extension to file its updated Uranium Deposit Development project documentation by the end of 2024. However, the extension has not been granted, prompting Kazatomprom to suspend operations to avoid potential breaches of Kazakhstan’s regulations. As Kazakhstan is the world’s largest uranium producer, the suspension raises concerns about potential supply chain disruptions in the uranium market. This has driven uranium prices higher, with prices rising by $1.60 per pound, or 2.19%, since the start of 2025.

Uranium futures prices

(Source: Bloomberg)

- China’s increasing stake in uranium. Russia’s nuclear giant Rosatom has announced the sale of significant stakes in its uranium mining operations in Kazakhstan to Chinese companies, signaling a shift in influence in Central Asia. Uranium One Group, a subsidiary of Rosatom, has sold 49.99% of its shares in Kazakhstan to Astana Mining Company, owned by China’s State Nuclear Uranium Resources Development (SNPTC). Additionally, Uranium One is expected to sell a 30% stake in Khorasan-U and Kyzylkum LLP to China Uranium Development Company, a subsidiary of China General Nuclear Power Corporation (CGN). This transition highlights China’s growing presence in former Soviet republics and a gradual decline in Moscow’s influence in the region. The move follows Beijing’s recent stimulus packages that include substantial investments in infrastructure, particularly nuclear power plants, which are driving higher demand for uranium—the key fuel for nuclear energy. China’s ambitious nuclear energy expansion, with 22 of the 58 nuclear reactors currently under construction globally, positions the country at the forefront of a global nuclear renaissance. This aggressive push is enhancing the long-term investment outlook for uranium, attracting stronger interest in the market.

- Big Tech venture into nuclear power. Over the past few months, Microsoft reignited interest in nuclear energy stocks by signing a power purchase agreement with Constellation Energy (CEG), the largest clean energy supplier in the U.S. According to the agreement, Constellation will restart the Three Mile Island Nuclear Station in Pennsylvania to support Microsoft’s growing artificial intelligence (AI) needs. Google, a subsidiary of Alphabet, has also partnered with private firm Kairos Power to construct a series of SMRs with a total capacity of 500 megawatts. Amazon also announced plans to collaborate with Energy Northwest, Dominion Energy, and private firm X-energy to build several SMRs. These nuclear resources will support Amazon’s future AI services. These partnerships are bound to drive more interest towards the uranium market.

- 3Q24 operation update In 3Q24, the Group’s natural uranium deposits produced 692.6 tU of uranium, achieving 97.2% of the quarterly production target of 712.8 tU. Of this total, 228.9 tU were produced by Semizbay-U LLP, a 49%-owned joint venture in Kazakhstan, while 463.7 tU were produced by Mining Company Ortalyk LLP, a 49%-owned associate in Kazakhstan. For the first half of the year, the planned uranium extraction was 712.8 tU, with actual extraction reaching 692.6 tU, reflecting a completion rate of 97.2%. Specifically, the Semizbay Mine produced 95.0 tU, and the Irkol Mine contributed 133.9 tU to the overall output.

- 1H24 earnings. Revenue grew by 38.8% to HK$4.07bn. Gross loss was HK$56.4mn compared to HK$186.7mn profit in 1H23. Net profit attributable to the shareholders of the company declined by 37.0% to HK$113.1mn.

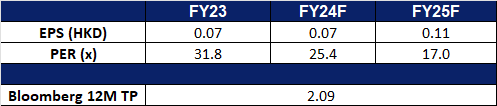

- Market consensus.

(Source: Bloomberg)

KKR & Co Inc. (KKR US): Positive M&A outlook

- RE-ITERATE BUY STOP Entry – 148 Target – 168 Stop Loss – 138

- KKR & Co. Inc. operates as an investment firm. The Company manages investments such as private equity, energy, infrastructure, real estate, credit strategies, and hedge funds. KKR & Co serves clients worldwide.

- Global M&A activities are expected to continue in 2025. The anticipated decrease in federal funds rates, coupled with modest US economic growth, will likely increase corporate refinancing needs. Moreover, with high valuations in the US stock market, more companies will seek to go public. The primary market is gradually recovering after two consecutive years of secondary market gains and positive sentiment, especially in areas like AI applications and other emerging technologies. Under a potential Trump presidency, global trade friction is likely to intensify, prompting more multinational corporations to mitigate potential losses from geopolitical risks through M&A or asset divestitures.

- Asset management scale and fee income have shown impressive growth. As of Q3 of fiscal year 2024, the company’s asset management scale increased by 26.6% YoY to $624.396bn. The fundraising amount in the first three quarters of 2024 was $118.308bn, compared to $380.89bn in the same period of 2023. Company management has revealed that 60% of its private equity holdings have an unrealized return on investment exceeding 50%, and the overall unrealized profit has increased by 40% YoY. Management fee-related income grew by 79.5% YoY and 34.5% QoQ to $1bn in the third quarter.

- 3Q24 results. The company’s revenue increased by 44.5% to US$4.79bn in 3Q24, compared to US$3.32bn in 3Q23. The company’s net profit fell to US$654.6mn in 3Q24, compared to US$1,472.9mn in 3Q23. The company’s basic earnings per share fell to US$0.74 in 3Q24, compared to basic earnings per share of US$1.71 in 3Q23.

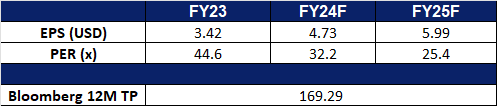

- Market consensus.

(Source: Bloomberg)

Banco Marco SA (BMA US): A glimmer of hope

- RE-ITERATE BUY STOP Entry – 100 Target – 120 Stop Loss – 90

- Banco Macro SA attracts deposits and offers retail and commercial banking services. The Bank offers Visa and Amex credit cards, consumer loans, insurance, and other financial services. Bansud operates in Argentina and in the Bahamas through its subsidiary Sun Bank & Trust.

- A glimmer of hope for the Argentine economy. Argentina’s GDP grew by 3.9% quarter-on-quarter in the third quarter of 2024, marking the first positive quarterly growth since entering a recession at the end of 2023. The main drivers were increased consumption, a rebound in capital investment, and growth in agricultural and mining product exports. The annual inflation rate dropped to a new low of 166% since December 2023. President Milei’s shock therapy approach, including significant cuts in government spending and deregulation, is showing initial results.

- GDP growth is expected to reach 5% in 2025. The World Bank forecasts Argentina’s economy to grow by 5% in 2025, compared to a decline of 3.5% in 2024. In its new economic plan, the Argentine government will implement a 90% reduction in taxes and return tax autonomy to the provinces. On the other hand, Argentina plans to promote monetary competition by allowing the use of different currencies for transactions. One of the major goals for 2025 is to eliminate exchange rate controls.

- Plays a significant role in the Argentine banking industry. This bank is the second largest state-owned private bank in Argentina and the sixth largest bank (by deposits and loans). As of the third quarter of 2024, the bank’s total assets amounted to US$147.4bn.

- 3Q24 results. The company’s revenue declined by 22.7% to ARS$873.0bn in 3Q24, compared to ARS$1,128.7bn in 3Q23. The company’s net profit saw an increase to ARS$92.0bn in 3Q24, compared to ARS$23.9bn in 3Q23. The company reported an adjusted earnings per share of 143.9ARS in 3Q24, compared to a adjusted earnings per share of 37.39ARS in 3Q23.

- Market consensus.

(Source: Bloomberg)

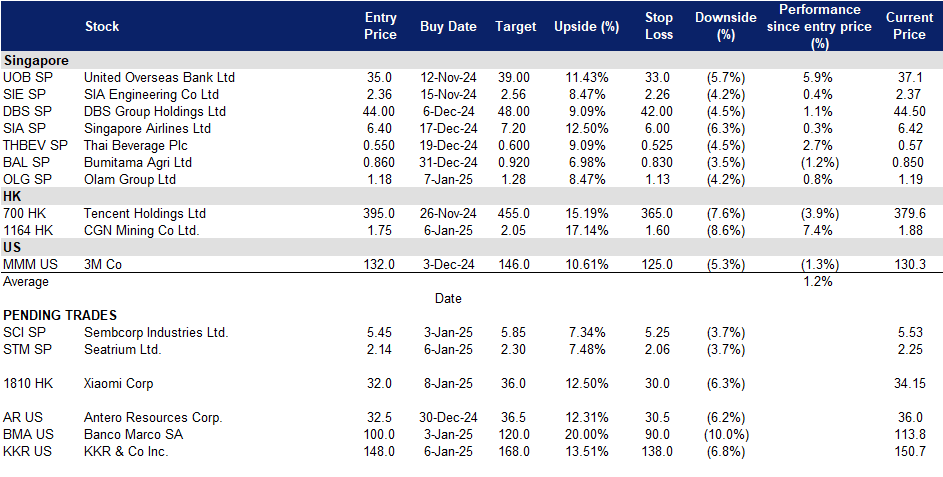

Trading Dashboard Update: Take profit on IONQ Inc (IONQ US) at US$50. Add Olam Group Ltd (OLG SP) at S$1.18 and CGN Mining Co Ltd (1164 HK) at HK$1.75. Stop loss on Lenovo Group Ltd (992 HK) at HK$9.7 and Sinopharm Group Co Ltd. (1099 HK) at HK$20.4.