07 August 2024: Sheng Siong Group Ltd (SSG SP), Tencent Holdings Ltd. (700 HK), American Electric Power Company Inc (AEP US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

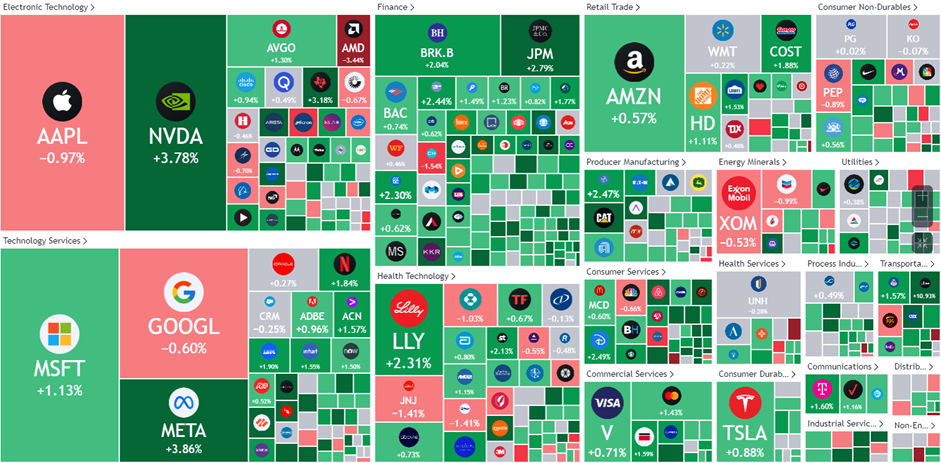

United States

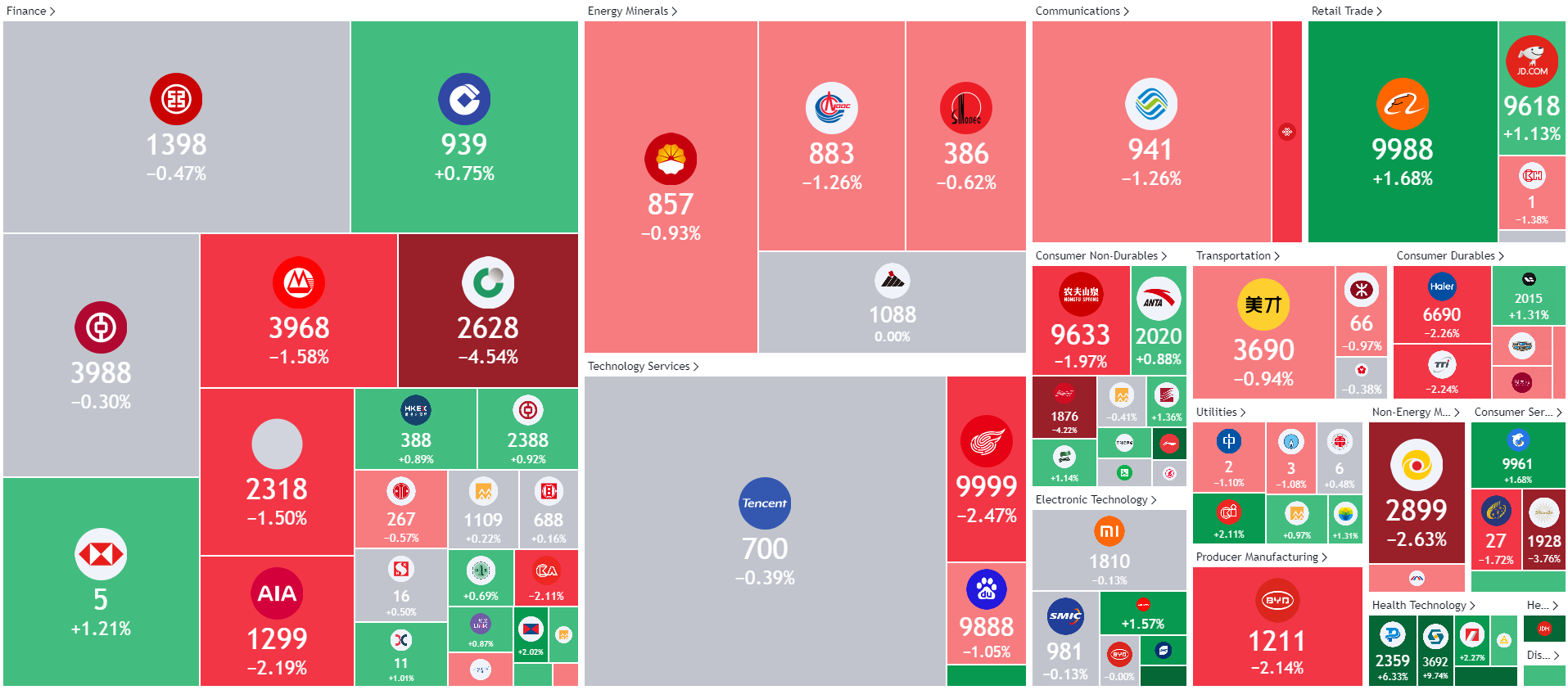

Hong Kong

Sheng Siong Group Ltd (SSG SP): Value driven

- RE-ITERATE BUY Entry – 1.52 Target– 1.64 Stop Loss – 1.46

- Sheng Siong Group Ltd is a retailer in Singapore. The Company operates a groceries chain across Singapore. Sheng Siong’s stores provide fresh and chilled produce, seafood, meat and vegetables, processed, packaged and preserved food products as well as general merchandise such as toiletries and essential household items.

- Delivered strong 1H results. Sheng Siong reported a 7% increase in net profit to S$69.9mn for 1H24, up from S$65.4mn the previous year. Revenue grew by 3.4% to S$714.2mn, driven by a longer sales period before Chinese New Year. Profit margins rose slightly to 30.1% due to an improved sales mix and efforts to manage rising staff costs. Earnings per share increased by 6.9% to 4.65 cents. Operating cash flow rose to S$93mn, and the company’s cash position improved to S$349.6mn. An interim dividend of 3.2 Scents per share was declared. Its CEO highlighted the company’s resilience amidst external disruptions and commitment to offering quality products at affordable prices. Sheng Siong plans to continue diversifying its supply chain and improving operational efficiency to address challenges from rising labor and energy costs, and opened new stores, including one in China, bringing its total there to six.

- Value shopping trends and new stores. With Singapore’s core inflation rate holding steady at 3.1% in May for the third consecutive month, consumers are increasingly gravitating towards value grocery shopping, boosting demand for budget-friendly supermarkets and house brand products. The Assurance Package and government efforts to mitigate the GST hike for lower to middle-income groups are expected to bolster consumer spending. Sheng Siong aims to diversify supply sources and enhance operational efficiency to manage rising labor and energy costs, ensuring more affordable quality products for consumers. The group opened two new stores and expanded one in the first half of 2024, with further openings planned, including a new store in China, which will contribute to increased revenue.

- 1H24 results review. Total revenue rose by 3.4% YoY to S$714.2mn in 1H24, compared to S$690.5mn in 1H23. Net profit rose by 6.8% to S$70.0mn in 1H24, compared to S$65.5mn in 1H23. EPS was 4.65 Scents in 1H24, compared to 4.35 Scents in 1H23.

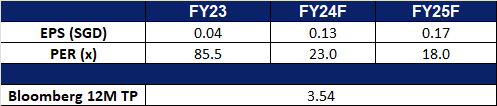

- Market Consensus.

(Source: Bloomberg)

SATS Ltd (SATS SP): Service improvement amidst air travel recovery

- BUY Entry – 2.90 Target– 3.20 Stop Loss – 2.75

- SATS Ltd. provides gateway services and food solutions. The Company specializes in airfreight, ramp and baggage handling; passenger services; aviation security services; aircraft cleaning; and cruise centre management. It also provides airline catering; institutional catering; aviation laundry; and food distribution and logistics. SATS has presence across Asia and the Middle East.

- Partnership to expand food solutions business. SATS is partnering with Mitsui & Co to expand its food and retail solutions businesses. They created a subsidiary, Food Solutions Sapphire Holdings, for joint investments. Mitsui will invest S$36.4mn for a 15% stake in this subsidiary, which includes four of SATS’ food solutions entities. The collaboration aims to enhance the food value chain by leveraging Mitsui’s global network and SATS’ expertise. They plan to grow the food solutions business in key Asian markets, focusing on product development, kitchen production, and logistics. The partnership is already showing results, especially in Japan, with plans to supply frozen meals to Muji Japan by early 2025. This collaboration is expected to drive long-term growth for SATS.

- Self-driving buses on trial. Changi Airport will trial a self-driving bus for transporting workers in its restricted area starting in the third quarter of 2024. The agreement on 17 July, involving Changi Airport Group (CAG), Singapore Airlines Engineering Company (SIAEC), and Sats Airport Services, aims to boost manpower productivity through automation. The two-year proof of concept will be in two phases: a nine-month controlled environment test followed by a live operational test. A safety driver will be on board throughout both phases. This trial is part of broader efforts, including previous trials of autonomous baggage vehicles, to improve operational efficiency and reduce congestion at Changi Airport. The project is co-funded by the Civil Aviation Authority of Singapore. Successful implementation could potentially benefit SATS, by reducing manpower for its airside operations.

- Air passenger traffic not slowing. According to the International Air Transport Association, in 2024, the airline industry has recovered from the COVID-19 crisis, with total traffic surpassing 2019 levels in February. Domestic travel returned to pre-COVID levels in spring 2023, while international routes have also recently recovered. Most regions are expected to exceed 2019 levels in 2024, with Asia Pacific leading growth at 17.2% YoY. Over the next 20 years, global passenger journeys are expected to increase by an average of 3.8% annually, resulting in over 4 billion additional journeys by 2043 compared to 2023. This yearly rise in global travel will contribute to SATS revenue growth in the coming years.

- Business restructuring. SATS recently announced the division of its airport ground handling services into separate units for Singapore and the Asia-Pacific region to stimulate company growth. The restructuring of its Gateway Services business resulted in the creation of two new units: the Singapore Hub and Gateway Services Asia-Pacific. The Singapore Hub will focus on enhancing aviation hub competitiveness in Singapore, while Gateway Services Asia-Pacific will aim to expand the group’s market share by managing operations in overseas airports.

- FY24 results review. Total revenue rose by 192.9% YoY to S$5.15bn in FY24, compared to S$1.76bn in FY23. Core PATMI rose by 331.3% to S$78.5mn in FY24, compared to S$18.2mn in FY23. Basic EPS was 3.8 Scents in FY24, compared to -2.2 Scents in FY23.

- Market Consensus.

(Source: Bloomberg)

Tencent Holdings Ltd. (700 HK): To benefit from policy support

- BUY Entry – 350 Target – 390 Stop Loss – 330

- Tencent Holdings Ltd is an investment holding company primarily engaged in the provision of value-added services (VAS), online advertising services, as well as FinTech and business services. The Company primarily operates through four segments. The VAS segment is mainly engaged in the provision of online games, video account live broadcast services, paid video membership services and other social network services. The Online Advertising segment is mainly engaged in media advertising, social and other advertising businesses. The FinTech and Business Services segment mainly provides commercial payment, FinTech and cloud services. The Others segment is principally engaged in the investment, production and distribution of films and television program for third parties, copyrights licensing, merchandise sales and various other activities.

- Policy Support for AI development. Since the beginning of the year, the Chinese government has implemented various policies to boost and regulate the development of the artificial intelligence (AI) sector. Recently, they announced new guidelines specifying seven key areas for developing the AI standard system in the country, including standards for key technologies, intelligent products and services, and industry applications. According to these guidelines, China aims to formulate over 50 national and industrial standards for AI by 2026 and develop a comprehensive standard system to ensure the sector’s high-quality development. Tencent is poised to benefit significantly from these AI-focused policies.

- Further approval of games. China has recently approved 15 more foreign-developed titles for the local market, bringing the total for this year to 75. Domestic tech giants Tencent Holdings and NetEase have secured licenses for several major games. Tencent has received approval to release Tom Clancy’s Rainbow Six, one of the most popular tactical shooter games, and the role-playing game Paper Mario: The Origami King for the Nintendo Switch platform in China. Since the government resumed the approval of new video game licenses in 2023, China’s gaming market has been recovering. Last year, the market grew by nearly 14%, reaching almost 303 billion yuan, with the number of gamers hitting a record 668 million. These additional game approvals and the ongoing recovery of China’s gaming market are likely to boost the companies’ sales.

- Investment into AI. Tencent recently announced its participation in a financing round exceeding $300mn for Chinese generative AI startup Moonshot, raising the latter’s valuation to $3.3bn. This move reflects Tencent’s strategy to support promising ventures in the competitive AI sector, similar to its competitor Alibaba. The investment in Moonshot is part of a broader trend of substantial capital inflow into Chinese AI firms, with major technology companies and venture capitalists investing heavily to establish a strong presence in the AI market. This push for AI dominance aims to fill a market gap similar to that of ChatGPT in the United States.

- 1Q24 results review. Revenue increased 6.3% YoY to RMB159.5bn in 1Q24, compared with RMB150.0bn in 1Q23. Net profit rose 62.1% to RMB41.9bn in 1Q24, compared to RMB25.8bn in 1Q23. Basic earnings per share was RMB4.479 in 1Q24, compared to RMB2.725 in 1Q23.

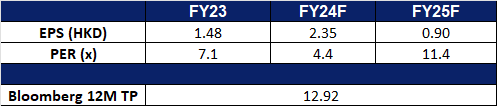

- Market consensus.

(Source: Bloomberg)

COSCO Shipping Holdings Co. Ltd. (1919 HK): Improving freight rates

- RE-ITERATE BUY Entry – 10.90 Target – 11.90 Stop Loss – 10.40

- COSCO SHIPPING Holdings Co. Ltd., formerly China COSCO Holdings Company Limited, is an investment holding company principally engaged in container shipping and related businesses. The Company is engaged in container shipping, dry bulk shipping, the management and operation of container terminals, container leasing and the provision of logistics services. The Company operates its business through two segments. The Container Shipping segment is engaged in the transportation of goods across the Pacific, Asia and Europe, and other international routes. The Terminal Operation and Investment segment is engaged in the operation and management of ports. The Company is also involved in the management and leasing of containers.

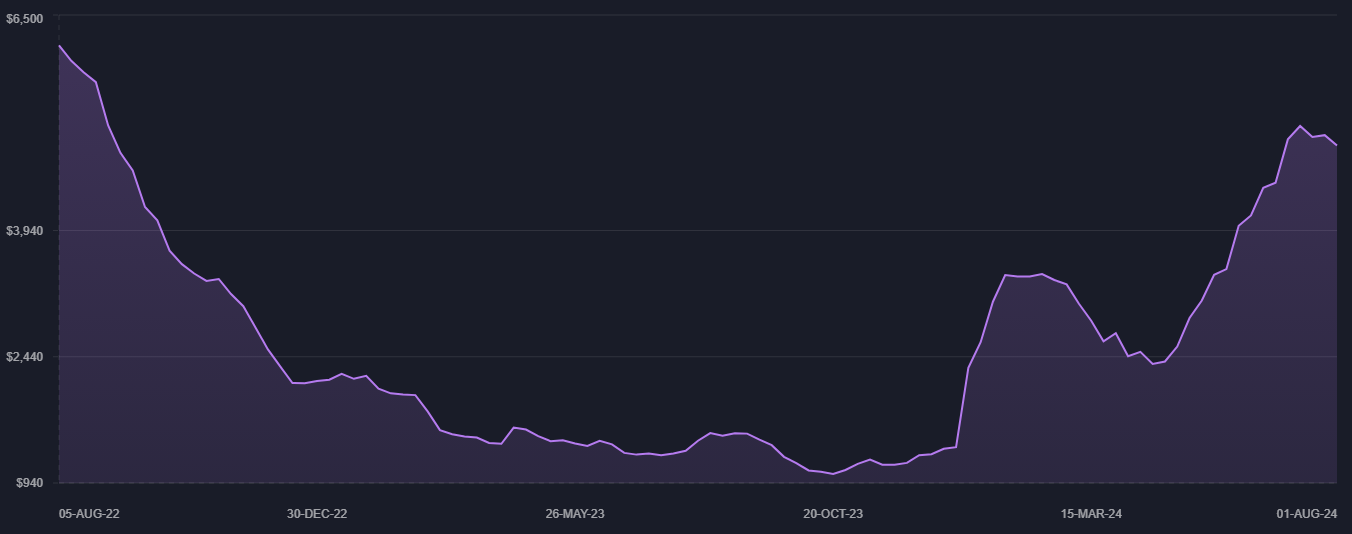

- Rallying freight rates. The Freightos Baltic Index has been rising steadily since April 2024, reaching its highest level recently since September 2022. This trend reflects the broader dynamics of the container shipping industry, characterized by robust demand and supply chain disruptions. The increased demand for sea freight is driven by changing consumer behaviours and a growing reliance on e-commerce platforms. Additionally, ocean carriers are rerouting away from the Red Sea and opting to navigate around Africa’s Cape of Good Hope due to ongoing vessel attacks and tensions in the Middle East, further straining the supply chain by extending shipping times. Furthermore, global port congestion has also resulted in shipping, further putting a strain on the shipping industry’s supply chain. This rebound in freight rates is expected to positively impact COSCO Shipping.

Freightos Baltic Index

(Source: Freightos)

- Green Development of shipping industry. Cosco Shipping has announced a green partnership with Fortescue to promote the sustainable development of the shipping industry. This initiative aims to transform the energy structure of the shipping sector, encourage eco-friendly growth, and contribute to a globally interconnected, low-carbon, sustainable shipping ecosystem. The companies will collaborate on developing technologies to reduce emissions and build a green fuel supply chain. This includes the potential use of Cosco Shipping vessels, or jointly-owned vessels, powered by green ammonia to transport iron ore and other mineral products, with the goal of reducing the carbon emissions of the China-Australia Iron Ore Green Shipping Corridor.

- More shipping services. Cosco Shipping recently announced an expansion of its service offerings on the rapidly growing trade route between China and Mexico. The company has launched the Mexico Express service, providing a more efficient shipping connection with Asia as trade with China surges. This service will deploy eight vessels with capacities ranging from 6,000 to 8,000 TEU, primarily calling at the ports of Busan, Dalian, Ningbo, Shanghai, Qingdao, Ensenada, Manzanillo, and Ensenada. The new routes are designed to meet the demand for maritime transport capacity and container space from enterprises in Northeast China targeting markets in Latin America.

- 1Q24 results review. Revenue increased 1.94% YoY to RMB48.3bn in 1Q24, compared with RMB47.4bn in 1Q23. Net profit fell 5.23% to RMB6.76bn in 1Q24, compared to RMB7.13bn in 1Q23. Basic earnings per share was RMB0.42 in 1Q24, compared to RMB0.44 in 1Q23.

- Market consensus.

(Source: Bloomberg)

American Electric Power Company Inc (AEP US): A recession-themed stock

- RE-ITERATE BUY Entry – 100 Target – 110 Stop Loss – 95

- American Electric Power Company, Inc. operates as a public utility holding company. The Company generates, transmits, distributes, and sells electricity to residential and commercial customers. AEP serves customers in the United States.

- Signs of an economic slowdown in the United States, and defensive sectors have benefited. Based on the U.S. macro data of the past two months, inflation continues to decline, but at the same time the labour market cools, consumer spending and confidence decline, and the manufacturing industry begins to shrink; therefore, concerns about a soft path for the U.S. economy are rising, major growth sectors have experienced sharp corrections, and funds rotate to more defensive sectors.

- Optimistic outlook for electric power. According to the International Energy Agency’s (IEA) mid-year report, U.S. electricity demand will rebound sharply in 2024, growing 3% compared with the same period last year. The stronger growth rate is partly due to a 1.6% drop in demand compared with 2023 due to mild weather. As the economic outlook improves and demand for air conditioning increases amid severe heat waves and a surge in data centre expansions, so does electricity consumption. Demand is expected to grow by 1.9% by 2025.

- 2Q24 earnings review. Revenue rose by 4.5% YoY to US$4.6bn, miss estimates by US$110mn. Non-GAAP earnings per shares was US$1.25 beating expectations by US$0.02. The company reiterated its FY24 Non-GAAP operating profit guidance of US$5.53 to US$5.73, compared with a consensus of US$5.61 per share and long-term growth of 6% to 7%. American Electric Power has signed a letter of intent to connect an additional 15 gigawatts of data centres over the next 10 years, or 42% of the company’s current peak power load.

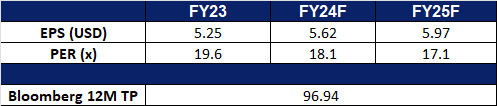

- Market consensus.

(Source: Bloomberg)

Home Depot Inc (HD US): Rate cuts incoming

Home Depot Inc (HD US): Rate cuts incoming

- RE-ITERATE BUY Entry – 356 Target – 390 Stop Loss – 339

- The Home Depot, Inc. is a home improvement retailer. The Company offers wide range of building materials, home improvement, lawn, and garden products, as well as provides DYI ideas, installation, repair, and other services. Home Depot serves customers worldwide.

- The US housing market is expected to recover. The market expects the Federal Reserve to start a rate-cutting cycle in the third quarter. The housing market has been under pressure for the past two years due to the high-interest-rate environment. In the ongoing US bull market, its positive wealth effect has benefited the US public. Therefore, when mortgage rates decline, it is expected that some funds will flow into the real estate industry. Correspondingly, the home improvement industry will also benefit from the future recovery of the real estate market.

- Sector rotation. Looking back at the first half of the US stock market, funds were concentrated on artificial intelligence themes, leading to high valuations for popular stocks and lacklustre performance for other value stocks. In a rate-cut cycle, traditional sector stocks are likely to see valuation repair and have significant upside potential.

- 1Q25 earnings review. Revenue fell by 2.4% YoY to US$36.4bn, missing estimates by US$25mn. GAAP EPS was US$3.63, beating estimates by US$0.04. FY24 sales are expected to increase 1% (including Week 53), while comparable sales for Week 52 are expected to decline 1%. The company plans to open 12 new stores.

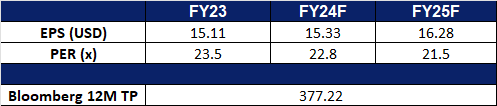

- Market consensus.

(Source: Bloomberg)

(Source: Bloomberg)

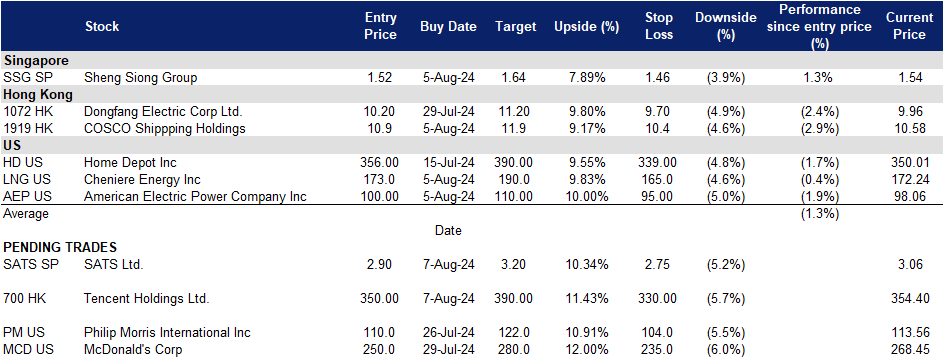

Trading Dashboard Update: Add SATS Ltd (SATS SP) at S$3.14, Sheng Siong Group (SSG SP) at S$1.64, Cheniere Energy Inc. (LNG US) at US$173, and American Electric Power at US$100. Cut loss on Banyan Tree Holdings (BTH SP) at S$0.37, Valuetronics Holdings Ltd (VALUE SP) at S$0.63, Singapore Technologies Engineering Ltd (STE SP) at S$4.22, AAC Technologies Holdings Inc (2018 HK) at HK$25.5, Prada S.P.A. (1913 HK) at HK$55, Wilmar International Ltd (WIL SP) at S$3.07, TSH Resources Bhd (TSHRES SP) at S$0.325, SATS Ltd (SATS SP) at S$3.01, Best Buy (BBY US) at US$80 and Toll Brothers Inc (TOL US) at US$130.