6 September 2023: AEM Holdings Ltd (AEM SP), Baidu, Inc. (9888 HK), Netflix Inc (NFLX US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

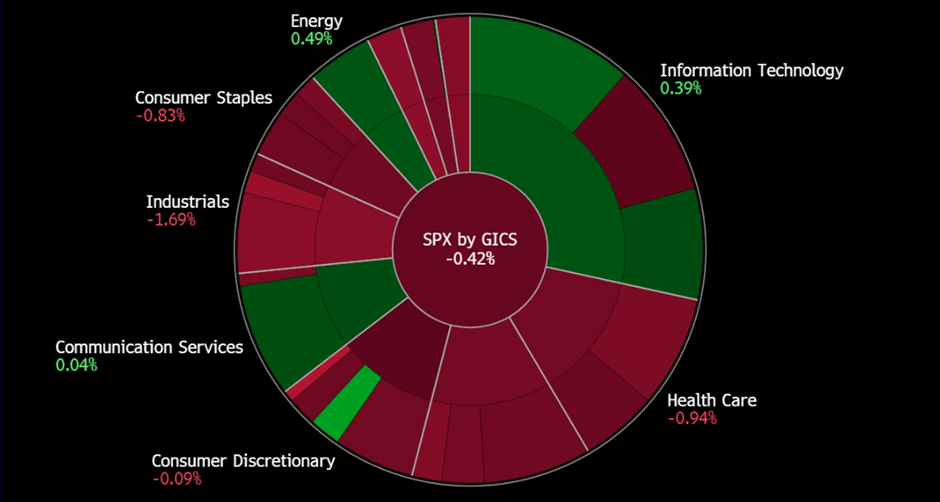

United States

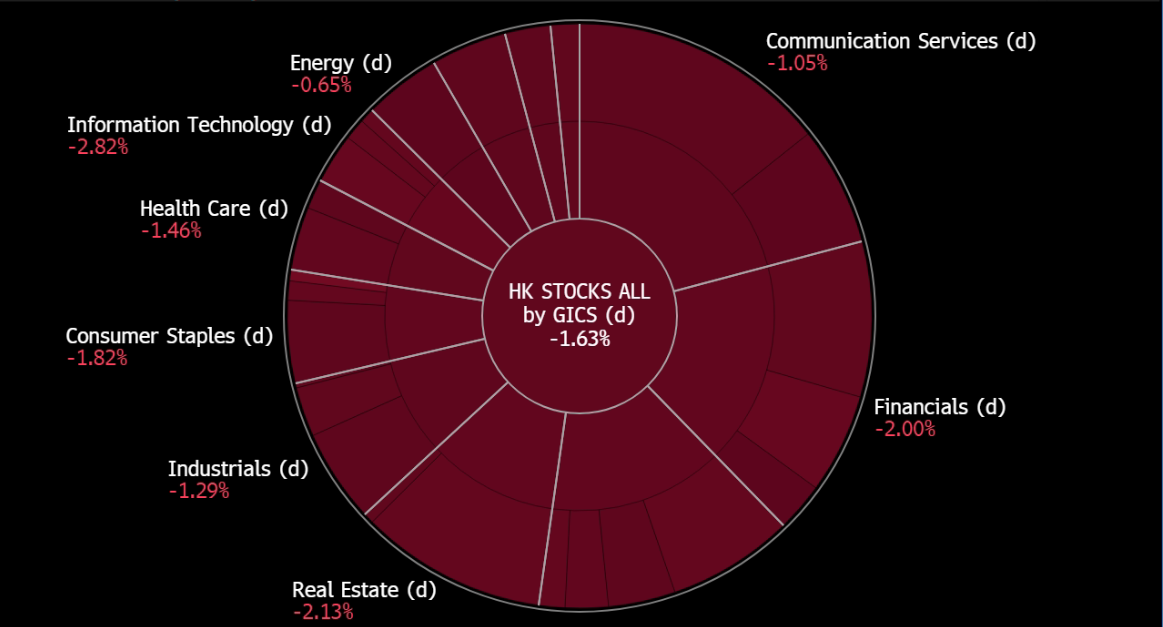

Hong Kong

AEM Holdings Ltd (AEM SP): Positive signs of recovery

- RE-ITERATE BUY Entry 3.50 – Target – 4.00 Stop Loss – 3.25

- AEM Holdings Limited is a Singapore-based company, which offers application specific-intelligent system test and handling solutions for semiconductor and electronics companies serving computing, fifth generation (5G) and artificial intelligence (AI) markets. Its segments include Equipment systems solutions (ESS), System Level Test & Inspection (SLT-i), Micro-Electro-Mechanical Systems (MEMS), Test and Measurement Solutions (TMS) and Others.

- An early sign of recovery. Early on, Intel released better-than-expected 2Q23 earnings. Revenue beat estimates by US$760mn though it dropped by 15.7% YoY to US$12.9bn. Non-GAAP EPS was US$0.13, beating estimates by US$0.16. Intel turned profitable after two prior consecutive loss-making quarters. The company guided 3Q23 adjusted EPS to be US$0.2, topping estimates of US$0.13. Its Client Computing segment delivered 17.5% QoQ growth and arrived at US$6.78bn due mainly to strong demand for Chromebooks and high-end notebooks. Data center & AI segment grew by 26.0% QoQ to US$4.00bn. The company’s foundry unit revenue surged 96.6% QoQ to US$232M. The turnaround in 2Q23 showed an early sign that the PC cycle was bottoming out. Last week, Dell also released its 2Q23 results, exceeding market expectations. Dell sees PC demand slowing rate is declining and is optimistic that the market will resume low single-digit growth in 2024.

- 1H23 earnings review. Revenue fell by 49% YoY to S$275.2mn. Gross profit fell by 50% YoY to S$83.1mn. GPM dropped by 2.3ppts to 30.2%. PATMI fell by 76% YoY to S$19.7mn. NPM dropped by 8.2 ppts to 7.2%. Full-year guidance for revenue was revised to the range between S$460mn and S$490mn. A US$20mn legal settlement will be recognised in 3Q23.

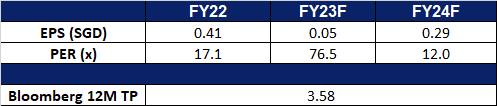

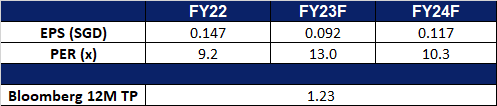

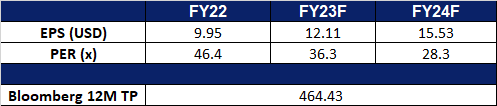

- Market consensus.

DBS Group Holdings Ltd (DBS SP): SGD strengthens again

- RE-ITERATE BUY Entry 33.10 – Target – 34.50 Stop Loss –32.35

- DBS Group Holdings Limited and its subsidiaries provide a variety of financial services. The Company offers services including mortgage financing, lease and hire purchase financing, nominee and trustee, funds management, corporate advisory and brokerage . DBS Group also acts as the primary dealer in Singapore government securities.

- Jumping into the metaverse. DBS Bank is developing a metaverse game called DBS BetterWorld to raise awareness of sustainability issues, particularly global food waste. The game will be available later this year on The Sandbox platform and will allow players to interact with characters, take part in activities, and earn in-game rewards. DBS is partnering with sustainable companies to create the game and is using the metaverse to engage with its younger customers and promote its brand values.

- Largest foreign bank in Taiwan. DBS Bank recently acquired Citigroup’s consumer banking business in Taiwan, becoming the largest foreign bank by assets in the market. The deal effectively doubled DBS’ consumer banking customers in Taiwan and its credit card accounts climbed nearly fivefold. DBS paid a lower premium for the purchase than originally expected, and said the deal would accelerate its consumer business growth in Taiwan by at least 10 years. The acquisition is part of DBS’ strategy to build meaningful scale in its core Asian markets.

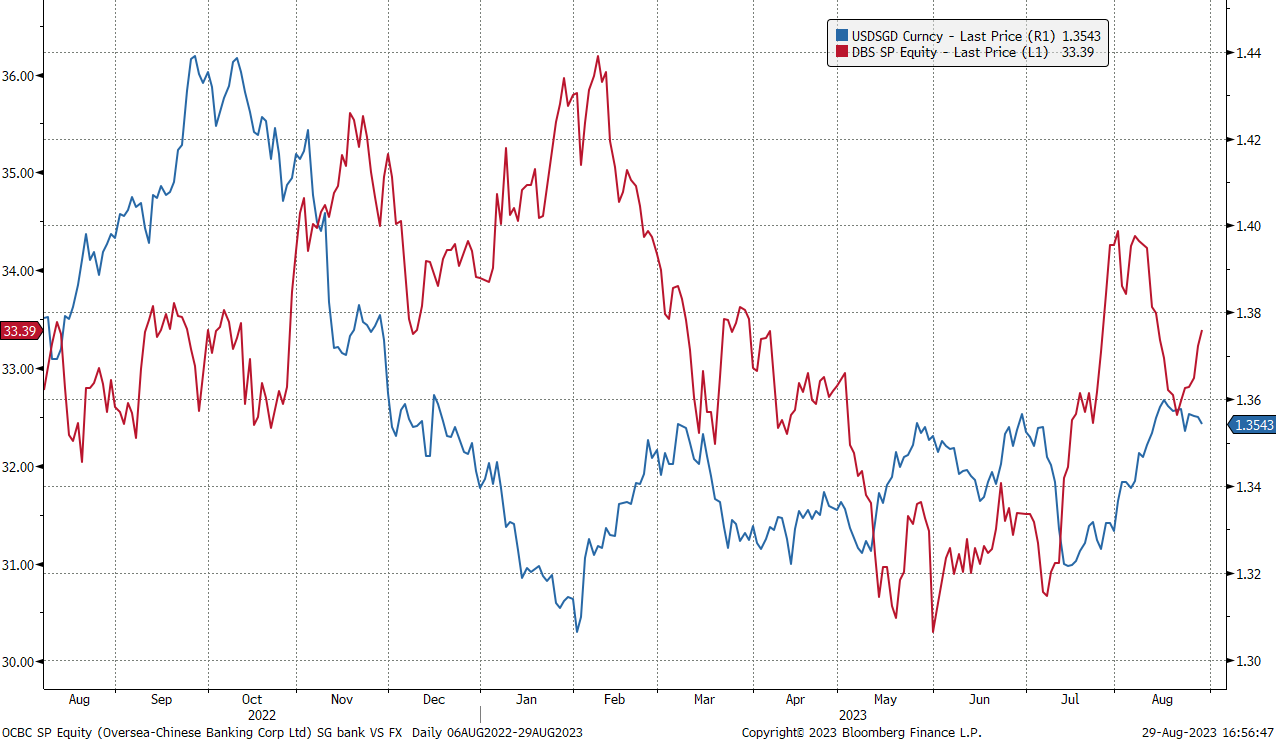

Share price and USD/SGD correlation

(Source: Bloomberg)

(Source: Bloomberg)

- 2Q23 results review. Profit rose 48% YoY to S$2.69bn from S$1.82bn in 2Q22, beating forecast. This jump in profit was due to higher interest rates and strong inflow of wealth into Singapore.

- Market consensus.

(Source: Bloomberg)

Baidu, Inc. (9888 HK): Autobots, roll out!

- RE-ITERATE BUY Entry – 138 Target – 148 Stop Loss – 133

- Baidu Inc is a Chinese language Internet search provider. The Company offers a Chinese language search platform on its Baidu.com Website that enables users to find information online, including Webpages, news, images, documents and multimedia files, through links provided on its Website. The Company operates through two segments, Baidu Core segment and iQIYI segment. Baidu Core mainly provides search-based, feed-based, and other online marketing services, as well as products and services from the Company’s new artificial intelligence (AI) initiatives. Within Baidu Core, the Company’s product and services offerings are categorized as Mobile Ecosystem, Baidu AI Cloud and Intelligent Driving & Other Growth Initiatives. iQIYI is an online entertainment service provider that offers original, professionally produced and partner-generated content on its platform.

- Ernie Bot. Chinese authorities granted their approval for the tech giant Baidu to introduce its artificial intelligence Ernie Bot to the general public, commencing on 31st August 2023. Baidu achieved the distinction of being the first company to secure such approval, overcoming previous regulatory obstacles. Additionally, Baidu is gearing up to unveil a collection of new AI-native applications. This puts Baidu at the same competitive edge with other large language model competitors such as Google’s Bard, and OpenAI’s Chat-GPT.

- AI to drive more growth. With the successful approval of Baidu’s Ernie bot by the Chinese authorities,Baidu would be able to make use of AI to complement its online business. The use of AI allows Baidu to better match advertising to Baidu’s search queries, which in turn helped boost the company’s quarter’s online marketing sales growth.

- Driverless Taxis. Baidu’s self-driving taxi initiative has achieved a significant milestone by becoming the inaugural provider of autonomous transportation to and from airports in China. The introduction of Baidu’s Apollo Go service at Wuhan Tianhe International Airport signifies a groundbreaking achievement as it marks the first instance in China where an autonomous ride-hailing service seamlessly connects urban areas with an airport. Furthermore, this accomplishment also represents the pioneering integration of Chinese autonomous vehicles on both urban roads and highways.

- 1H23 earnings. Revenue rose by 15% YoY to RMB34.1bn, compared to RMB29.6bn in 1H22. Net profit rose 43% YoY to RMB5.2bn, compared to RMB3.6bn in 1H22. Basic EPS rose by 42% YoY to RMB14.17, compared to RMB9.97 in 1H22.

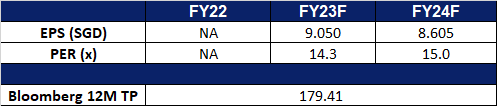

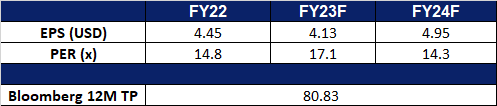

- Market Consensus.

(Source: Bloomberg)

Hong Kong Exchanges & Clearings. (388 HK): Expect to follow the mainland to lower stamp duties

- RE-ITERATE BUY Entry – 300 Target – 330 Stop Loss – 285

- Hong Kong Exchanges and Clearing Limited is principally engaged in the operation of stock exchanges. The Company operates through five business segments. The Cash segment includes various equity products traded on the Cash Market platforms, the Shanghai Stock Exchange and the Shenzhen Stock Exchange. The Equity and Financial Derivatives segment includes derivatives products traded on Hong Kong Futures Exchange Limited (HKFE) and the Stock Exchange of Hong Kong Limited (SEHK) and other related activities. The Commodities segment includes the operations of the London Metal Exchange (LME). The Clearing segment includes the operations of various clearing houses, such as Hong Kong Securities Clearing Company Limited, the SEHK Options Clearing House Limited, HKFE Clearing Corporation Limited, over the counter (OTC) Clearing Hong Kong Limited and LME Clear Limited. The Platform and Infrastructure segment provides users with access to the platform and infrastructure of the Company.

- Expectations towards lowering stamp duty. China recently announced that the country will be halving its stamp duties on securities transactions. This lowers the margin requirement for buying stocks, which as a result boosts investor confidence. Investors expect Hong Kong to follow suit in the footsteps of China, to reduce the stamp duty within the Hong Kong Stock Exchange to provide a boost and increase transaction volumes.

- Taskforce to boost stock market liquidity. Hong Kong recently announced that it is setting up a task force to improve the liquidity of its stock market, which will help to boost its performance and strengthen its competitiveness as an international financial center. The task force would thoroughly examine the factors influencing market liquidity and provide recommendations to the chief executive office. This would allow Hong Kong with a broader scope of alternatives to boost its stock market liquidity.

- Lower loan prime rate. China recently cut its one-year loan prime rate by another 10bps to 3.45%, from 3.55% previously. The lower loan prime rate would make it more attractive for investors to buy stocks, as they can earn a higher return on their investment. This can lead to increased demand and hence volume for stocks.

- 1H23 earnings. Revenue rose by 13.4% YoY to HK$10.8bn in 1H23, compared to HK$8.9bn in 1H22. Net profit rose 31.9% YoY to HK$6.3bn, compared to HK$4.8bn in 1H22. Basic EPS rose by 30.6% YoY to HK$4.99 in 1H23, compared to HK$3.82 in 1H22.

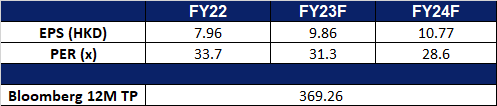

- Market Consensus.

Monthly Market Highlights – July

(Source: Bloomberg)

Netflix Inc (NFLX US): A hot show strikes again

- RE-ITERATE BUY Entry – 438.0 Target – 475.0 Stop Loss – 419.5

- Netflix, Inc. operates as a subscription streaming service and production company. The Company offers a wide variety of TV shows, movies, anime, and documentaries on internet-connected devices. Netflix serves customers worldwide.

- Live-action. Netflix’s new Japanese pirate series “One Piece,” which is a live-action adaptation of a popular manga franchise, has garnered positive reviews and social media buzz. The show focuses on pirates in search of a legendary treasure and has been well-received by fan communities. It achieved a 95% audience approval rating on RottenTomatoes, although critics rated it slightly lower at 80%. Adapting anime into live-action has historically been challenging, with many previous attempts falling short of fan expectations. However, Netflix took seven years to adapt “One Piece,” working closely with the creator and experienced directors who are fans of Japanese comics to ensure a faithful adaptation. This effort seems to have paid off with a strong initial response from viewers. The successful adaptation of “One Piece” opens the door for Netflix to explore more adaptations of beloved series.

- Gaming expansion. Netflix has been gradually introducing gaming to its platform, aiming to provide a diverse range of games for its subscribers. While it has been offering mobile games since November 2021, it has taken a cautious approach to understand the gaming market better. This strategy, focused on mobile games initially, is seen as a clever move to avoid the pitfalls experienced by other media brands entering the gaming industry. Netflix intends to leverage its intellectual property to create unique gaming experiences, aiming to make gaming more accessible to a wider audience. The success of this approach will become clear in the future as Netflix continues to evolve its gaming offerings.

- Docu-series popularity. Netflix has taken a unique approach to sports programming by creating a deep catalogue of docu-series about various sports and athletes, rather than investing in live sports broadcasting rights, which can be costly and challenging. This strategy allows Netflix to tap into the sports-loving audience while avoiding the logistical challenges of live broadcasting. These sports docu-series are typically more cost-effective to produce and have a longer shelf life compared to live sports events. The success of series like “Formula 1: Drive to Survive” has demonstrated the appeal of this approach. Through this innovative and creative approach, Netflix has distinguished itself in the streaming industry, establishing a strong presence in the sports docu-series category.

- 2Q23 earnings review. Revenue rose 2.8% year-over-year to US$8.19bn, missing estimates by US$100mn. GAAP EPS of $3.29 beat expectations by $0.44. It reported an increase of 5.9mn subscribers after its crackdown on password sharing.

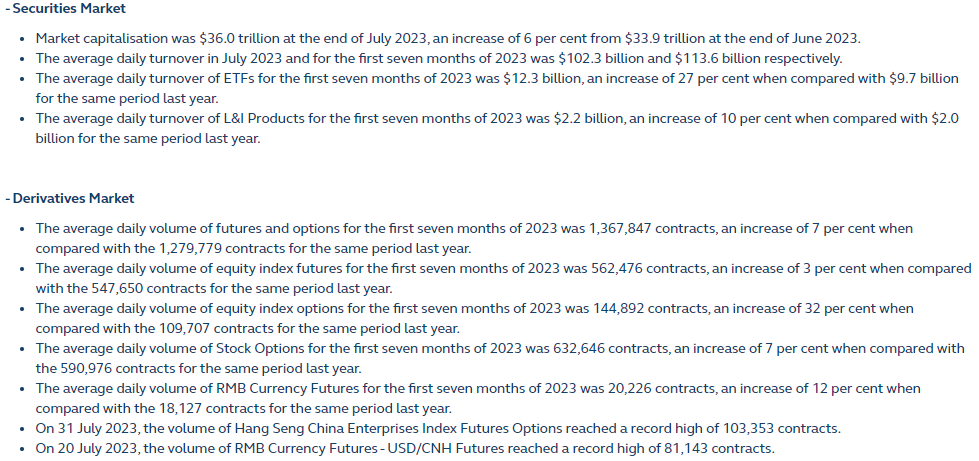

- Market consensus.

(Source: Bloomberg)

Hasbro Inc (HAS US): Passing GO

Hasbro Inc (HAS US): Passing GO

- RE-ITERATE BUY Entry – 70 Target – 80 Stop Loss – 65

- Hasbro, Inc. designs, manufactures, and markets toys, games, interactive software, puzzles, and infant products. The Company’s products include a variety of games, including traditional board, card, hand-held electronic, trading card, role-playing, and DVD games, as well as electronic learning aids and puzzles.

- Monopoly GO! success. The digital version of Monopoly GO!, launched in mid-April 2023, has generated $200mn in revenue and is the highest-grossing iOS app in the United States. It is expected to contribute to Hasbro’s profits and is ranked in the top five free mobile game charts in more than 100 countries based on downloads. The game is similar to the board game Monopoly but with some twists. It is a social game that can be played with players globally and is designed to be played anywhere and anytime, without having to commit a lot of time. Players can purchase dice, in-game currency, and stickers needed to complete challenges. These purchases will continue to contribute to its revenue as more players join the game and make in-app purchases.

- Realign focus on it’s priority brands. Hasbro has sold its eOne production studio to Lionsgate for $500mn. The deal is expected to close by the end of 2023. Hasbro will use the proceeds to pay down debt and focus on its toy and game businesses. The company will continue to licence its intellectual property to studios for film and TV projects, but will no longer be involved in production. It is also heavily investing in digital gaming, with successful releases such as Magic: The Gathering Arena and Baldur’s Gate 3. Hasbro believes that this will be a major growth driver for the future.

- 2Q23 earnings review. Revenue fell 9.7% year-over-year to US$1.21bn, beating estimates by US$90mn. Non-GAAP EPS of $0.49 miss expectations by $0.08.

- Market consensus.

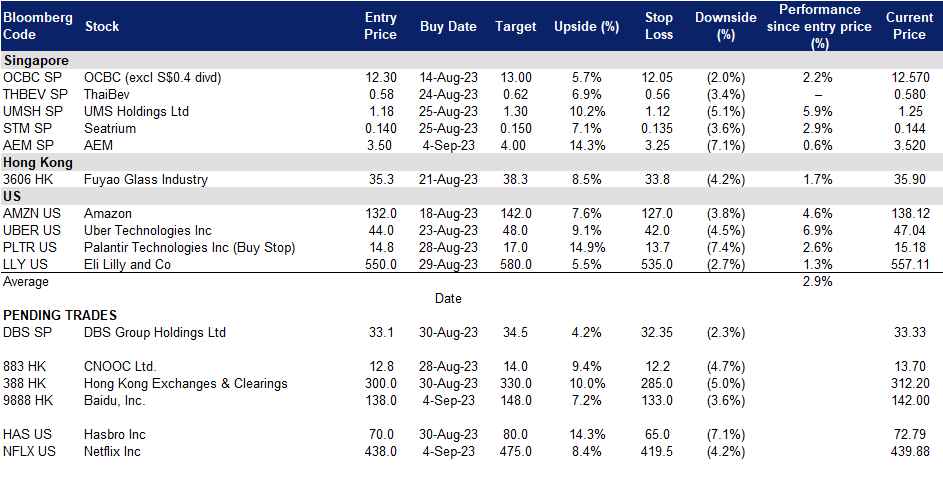

Trading Dashboard Update: Add AEM (AEM SP) at S$3.50. Cut loss on East Buy Holdings (1797 HK) at HK$38.0 and Yangzijiang Shipbuilding (YZJSGD SP) at S$1.62.

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)