4 October 2024: Singapore Airlines Ltd (SIA SP), CGN Mining Co Ltd (1164 HK), Entergy Corp (ETR US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

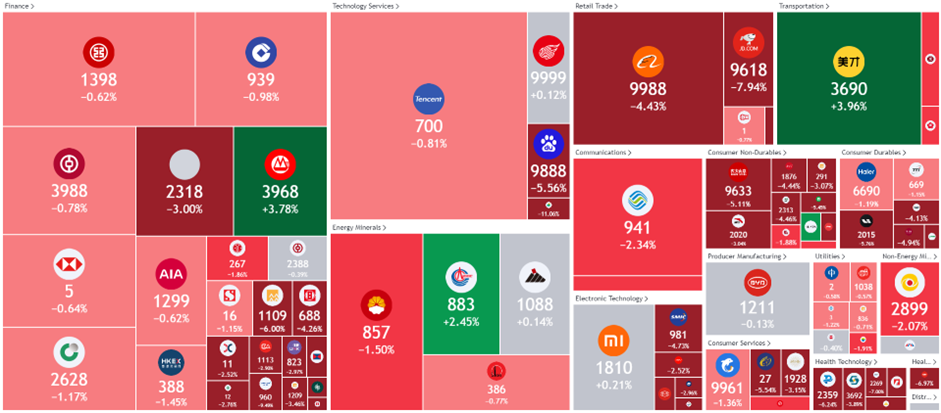

Hong Kong

Singapore Airlines Ltd (SIA SP): Improved margins

- RE-ITERATE BUY Entry – 6.5 Target– 7.1 Stop Loss – 6.2

- Singapore Airlines Limited provides air transportation, engineering, pilot training, air charter, and tour wholesaling services. The Company’s airline operation covers Asia, Europe, the Americas, South West Pacific, and Africa.

- Adjusting to market trends. Scoot, Singapore Airlines’ low-cost subsidiary, recently announced that it will be expanding its network to meet rising demand during the Northern Winter season. Beginning in November 2024, Scoot will add weekly flights to popular destinations like Chiang Mai, Hanoi, Perth, Melbourne, Seoul, and Tokyo. Flights to Southeast Asian destinations such as Davao, Balikpapan, and Makassar will also increase. Additionally, Scoot recently launched daily flights to Subang, Malaysia, and will begin service to Kertajati, Indonesia, and Malacca, Malaysia. Meanwhile, Singapore Airlines is responding to fierce competition by offering discounts of up to 60% on flights from Hong Kong to Asia-Pacific destinations. These limited-time deals are part of an aggressive strategy to capture market share and compete with rivals like Cathay Pacific. This demonstrates Singapore Airline’s commitment to staying ahead of market trends and making necessary adjustments to drive revenue growth.

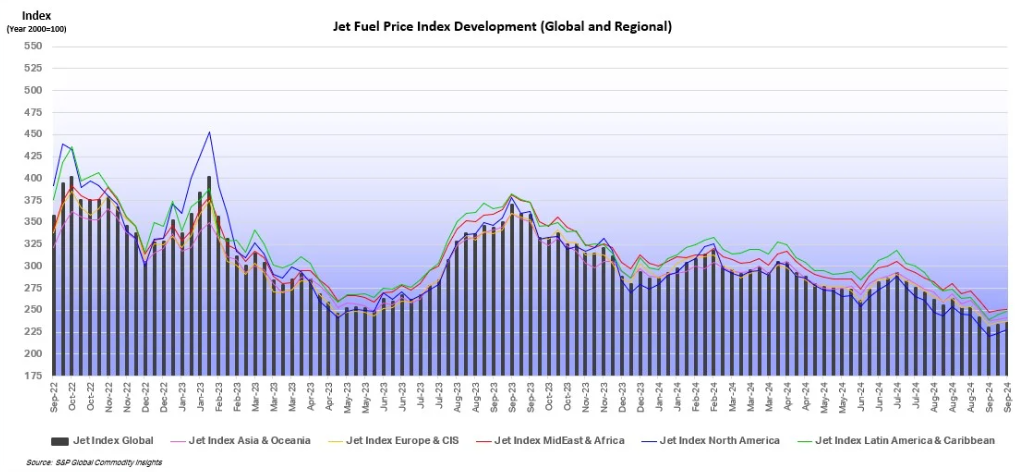

- Continued strong travel demand. According to the International Air Transport Association (IATA) in July 2024, global air passenger demand increased by 8%, reaching a record high, with capacity up 7.4% and a load factor of 86%. International travel grew by 10.1%, while domestic demand rose 4.8%, despite disruptions like the CrowdStrike IT outage. Asia-Pacific saw the highest demand growth at 19.1%, though some routes remain below pre-pandemic levels, while Europe and Latin America also posted strong gains. North America had the highest load factor at 89.4%. IATA highlighted the need to resolve supply chain issues to maintain accessibility and affordability in air travel. With declining jet fuel prices and sustained demand, Singapore Airlines will continue to benefit from improved margins.

Jet Fuel Price Trend

(Source: International Air Transport Association)

- Potential growth in the Indian travel market. It was announced that SBI Card, India’s largest pure-play credit card issuer, has partnered with Singapore Airlines to launch the KrisFlyer SBI Card, the airline’s first co-branded credit card in India. The collaboration combines SBI Card’s secure payment solutions with Singapore Airlines’ global network. This travel-focused card offers users exclusive benefits across the Singapore Airlines Group, including KrisFlyer miles that can be earned and redeemed for flights, upgrades, and other travel perks. India previously also approved Singapore Airlines’ foreign direct investment into the merged Air India-Vistara entity, clearing the final hurdle for the merger. SIA will hold a 25.1% stake in the new carrier with an initial investment of ₹20.6 billion, expected to increase to ₹50.2 billion after completion. Vistara flights will be operated by Air India starting in November 2024. The merger, delayed from its original March target, is expected to close by the end of 2024, giving SIA a significant foothold in India’s rapidly growing travel market.

- 1Q25 results review. Total revenue for Q1 increased by 5.3% YoY to S$4,718mn from S$4,479mn in 1Q24. Passenger flown revenue grew 4.1% to S$3.8bn, supported by a 13.8% increase in passengers carried and strong load factors. Net profit saw a 38.4% YoY decline to S$452mn, due to weaker operating performance, a reduction in net interest income, lower surplus on disposal of aircrafts and spare engines, and a lower share of profit from its associated companies.

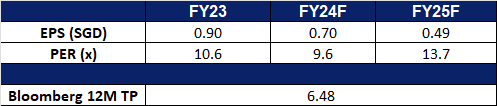

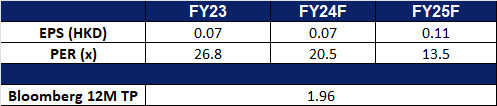

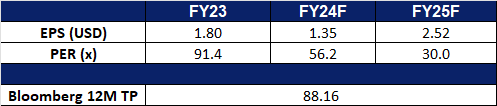

- Market Consensus.

(Source: Bloomberg)

Geo Energy Resources Ltd (GERL SP): Navigating challenges with strategic investments

- BUY Entry – 0.280 Target– 0.310 Stop Loss – 0.265

- Geo Energy Resources Limited is an integrated coal mining specialist. The Company owns and operates coal mines, offers mine contracting services to third party mine owners, and sells coal to both coal traders and coal export companies.

- Dividend policy holds firm despite market challenges. Geo Energy reported a 14% YoY decline in net profit to US$24.2mn for 1H24, primarily due to a reduction in coal prices. Despite this, the company maintained its commitment to shareholders by declaring an interim dividend of S$0.002 per share, representing a payout ratio of 11.4%. Production volumes totaled 2.8 Mt, mainly from the SDJ and TBR mines, while the TRA mine contributed 0.3 Mt. Stable coal sales of 3.2 Mt and a resilient cost model supported a healthy cash profit margin of 23%.

- Accelerated growth through infrastructure investment and diversification. Geo Energy recently signed a US$150mn EPC contract with CCCC First Harbor Consultants and Norinco International Cooperation to develop a 92 km hauling road and jetty in South Sumatera and Jambi Province, Indonesia. This infrastructure will boost PT Triaryani (TRA) mine’s transport capacity to 40-50 Mt per year, with 25 Mt allocated for TRA. The project’s deferred payment mechanism minimizes upfront cash outlay, allowing the infrastructure to generate revenue before payments begin. Upon completion in early 2026, not only will this development scale up production to 25 Mt annually but also it results in significant logistical cost savings, potentially generating US$400-500 mn in annual EBITDA. The project also diversifies Geo Energy’s revenue stream as an infrastructure provider.

- Coal prices to normalise. With demand and supply currently in balance, coal prices are expected to remain relatively steady for FY24. As a result, Geo Energy’s potential to boost its topline will rely more on increasing production volumes rather than benefiting from price fluctuations. The company has revised its full-year production forecast from the initial 10-11 Mt down to 8-9 Mt, having produced 2.8 Mt in 1H24. July’s production levels indicate that the company is on track to meet this new target.

- 1H24 results review. Revenue for 1H24 declined by 29% YoY to US$169.4mn, primarily due to lower ICI4 coal prices, averaging US$56.13 per tonne compared to US$70.46 in 1H23. Production was adversely affected by unfavorable weather conditions in the first half of the year. However, cash profit per tonne remained robust at US$11.94, reflecting its cost-efficient model where cash costs decrease in line with lower ICI4 prices. Geo Energy declared a second interim dividend of S$0.002 per share.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.68. Please read the full report here.

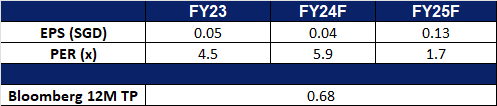

- Market Consensus.

(Source: Bloomberg)

CGN Mining Co Ltd (1164 HK): Growing nuclear power demand

- BUY Entry – 1.50 Target 1.70 Stop Loss – 1.40

- CGN Mining Co Ltd is a company mainly engaged in the trading of natural uranium. The Company operates its business through three segments. The Natural Uranium Trading segment is engaged in the trading of natural uranium. The Property Investment segment is engaged in leasing business. The Other Investments segment is engaged in investment activities.

- China Stimulus to boost demand for uranium. China’s recent announcement of stimulus packages has boosted bullish momentum in uranium markets, driven by increasing energy demand from the world’s third-largest power producer. Furthermore, China’s push to expand its nuclear energy capacity has improved the investment outlook, fueling stronger interest in uranium. With 22 of the 58 global nuclear reactors currently under construction in China, the country is at the forefront of a global nuclear renaissance.

- Potential restricted uranium supply. Russian President Putin said Moscow should consider limiting uranium, titanium, and nickel exports. Russia has approximately 44% of the world’s uranium enrichment capacity and provides 5.5% of the global supply. It owns about 8% of the global reserves. In May, the US passed the Prohibiting Russia Uranium Imports Act. Countries with nuclear energy, especially the Western ones have been sourcing reliable supplies. Russia’s potential uranium export restriction will lead to tight supplies, and prices will rebound accordingly. Current uranium prices has risen toward $82 per pound in October, the highest in over one month.

Uranium futures prices

(Source: Bloomberg)

- 1H24 operation update. In 1H24, the total equity source of the Group was 39,000tU and equity production was 624tU. The group was interested in 49% of the equity interest of Semizbay-U, which mainly owns and operates the Semizbay Mine and the Irkol Mine in Kazakhstan. The planned uranium extracted was 471tU with actual extraction of 477tU and the completion rate of planned production was 101% in the first half of the year; among which, actual uranium extracted from the Semizbay Mine and the Irkol Mine was 182tU and 295tU, respectively. The average production costs of the Semizbay Mine and the Irkol Mine were US$31.93/lbU3O8 and US$23.83/lbU3O8, respectively. The group was interested in 49% of the equity interest of Ortalyk, which mainly owns and operates the Central Mynkuduk Deposit and the Zhalpak Deposit in Kazakhstan. The planned uranium production was 905tU with actual production of 858tU and the completion rate of planned production was 95% in the first half of the year; among which, actual uranium extracted from the Central Mynkuduk Deposit and Zhalpak Deposit was 792tU and 66tU, respectively.

- 1H24 earnings. Revenue grew by 38.8% to HK$4.07bn. Gross loss was HK$56.4mn compared to HK$186.7mn profit in 1H23. Net profit attributable to the shareholders of the company declined by 37.0% to HK$113.1mn.

- Market consensus.

(Source: Bloomberg)

Hong Kong Exchanges and Clearing Ltd (388 HK): Fast and furious bull run

- BUY Entry – 362 Target 402 Stop Loss – 342

- Hong Kong Exchanges and Clearing Limited (HKEX) is principally engaged in the operation of stock exchanges. The Company operates through five business segments. The Cash segment includes various equity products traded on the Cash Market platforms, the Shanghai Stock Exchange and the Shenzhen Stock Exchange. The Equity and Financial Derivatives segment includes derivatives products traded on Hong Kong Futures Exchange Limited (HKFE) and the Stock Exchange of Hong Kong Limited (SEHK) and other related activities. The Commodities segment includes the operations of the London Metal Exchange (LME). The Clearing segment includes the operations of various clearing houses, such as Hong Kong Securities Clearing Company Limited, the SEHK Options Clearing House Limited, HKFE Clearing Corporation Limited, over the counter (OTC) Clearing Hong Kong Limited and LME Clear Limited. The Platform and Infrastructure segment provides users with access to the platform and infrastructure of the Company.

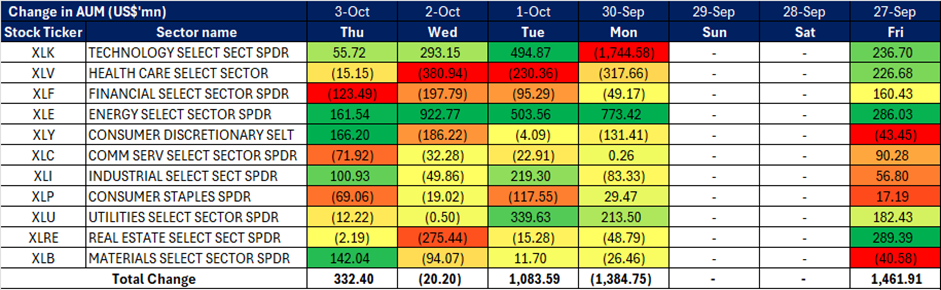

- Booster jabs for China’s economy and equity market. Before Golden Week (China’s national holiday), the central government announced a series of monetary and fiscal stimulus which exceeded market expectations. Lowering key rates and RRR, easing property purchase restrictions, and initiating equities pledges for government bonds were several main positive measures. Meanwhile, the authority also hinted more upcoming stimulus. China and Hong Kong equity markets reacted positively and swiftly. Hong Kong Stock Exchange recorded a new high of daily turnover on 27th Sep, amounting to more than HK$400bn. Fear of missing out is happening in both markets.

- Breakout of a key psychological level. The recent recovery of the Hang Seng Index, which is now trading at a 52-week high, above the 20,000 level is bound to improve investor sentiments, further driving fund flows in the Hong Kong stock market. HKEX is well-positioned to benefit from the increased liquidity and volume of the stock market.

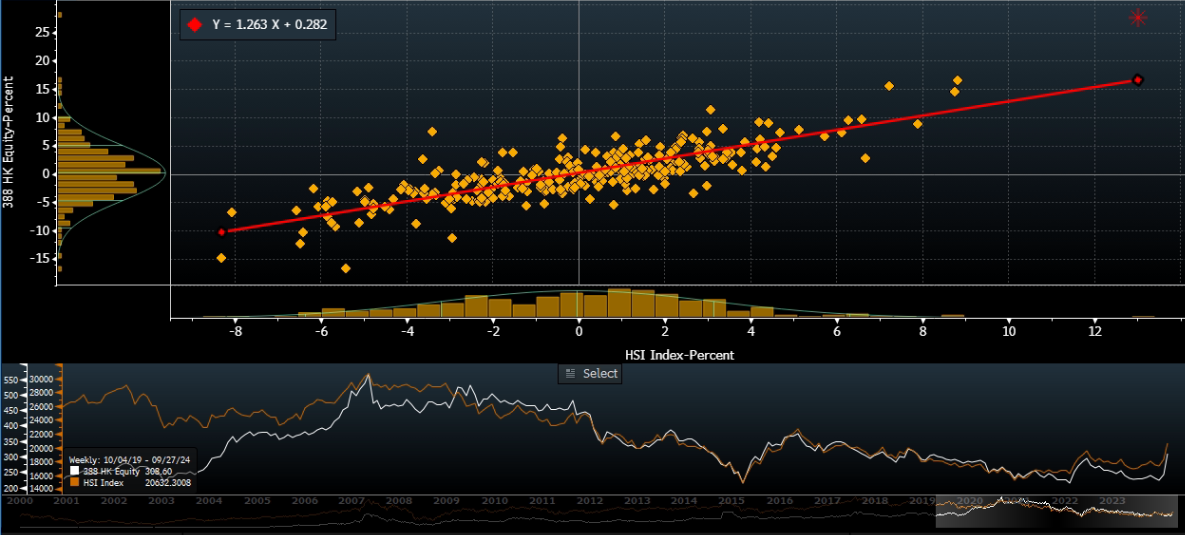

HKEX Stock Price and HSI Correlation

(Source: Bloomberg)

- To benefit from increasing IPO activities. Hong Kong’s IPO market is poised for growth, with positive signals suggesting more mega deals on the horizon. According to Chan, CEO of HKEX, the market expects increased IPO activity and sustained momentum. Medea’s recent IPO on the HKEX raised HK$31.01 billion, marking the city’s largest listing in over three years. So far this year, Hong Kong has raised approximately HK$51 billion through 45 IPOs and is expected to see continued robust activity through year-end. Alongside IPOs, the city’s secondary fundraising market is also gaining traction, with over US$20 billion raised through follow-on offerings to date. This surge in IPO and fundraising activity is set to significantly benefit HKEX.

- 1H24 earnings. Revenue rose marginally by 0.4% YoY to HK$10.6bn in 1H24, compared to HK$10.8bn in 1H23. Net profit fell by 3.0% YoY to HK$6.12bn in 1H24, from HK6.31bn in 1H23. Basic and diluted earnings per share was HK$4.84 in 1H24, compared to HK$4.99 in 1H23.

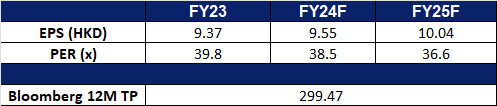

- Market consensus.

(Source: Bloomberg)

Entergy Corp (ETR US): Cleaning up the mess Helene made

- BUY Entry – 132 Target – 144 Stop Loss – 126

- Entergy Corporation is an integrated energy company that is primarily focused on electric power production and retail electric distribution operations. The Company delivers electricity to utility customers in Arkansas, Louisiana, Mississippi, and Texas. Entergy also owns and operates nuclear plants in the northern United States.

- Power restoration in progress. Hurricane Helene’s recent passage through the southeastern United States left a trail of destruction, causing widespread power outages and infrastructure damage. Entergy, a major utility company, has been at the forefront of restoration efforts, deploying over 1,000 workers to assist affected regions. In Florida, Entergy crews collaborated with Florida Power & Light to restore power to over 95% of customers within four days of the storm’s landfall. As the recovery efforts shifted to Georgia, which experienced its most destructive hurricane on record, Entergy teams continued to provide support to Georgia Power. Entergy has also been assisting other utilities, such as AEP Appalachian Power and Duke Energy Carolinas, in the Carolinas. These efforts are made possible through mutual aid agreements between utility companies, ensuring a coordinated response to major weather events. The devastating aftermath of Hurricane Helene is expected to increase retail sales volume for Entergy’s utility business as customers rebuild and replace damaged property.

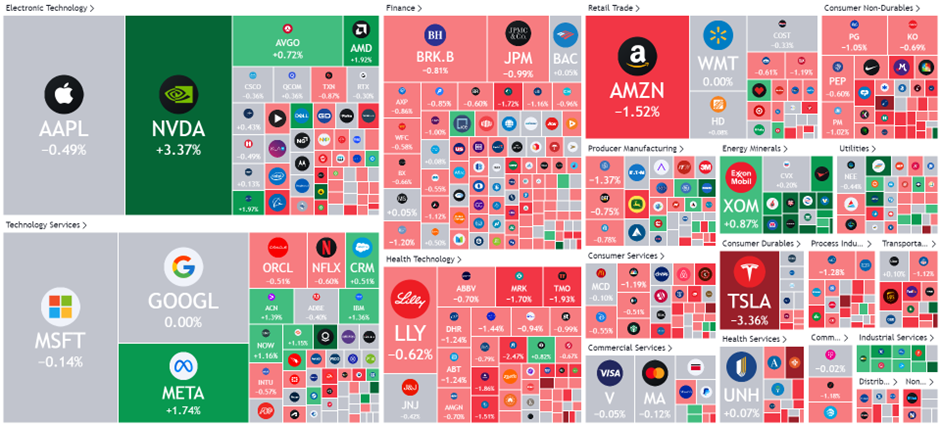

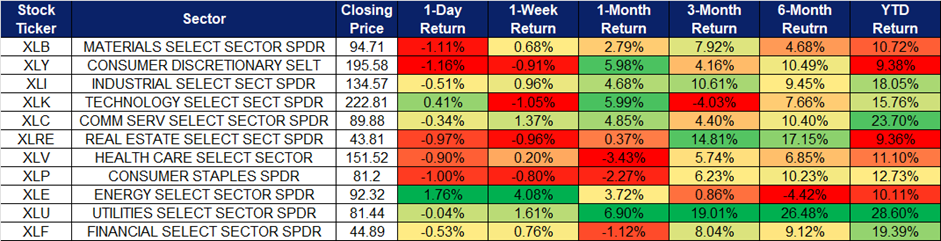

- Funds are rotated into cyclical and growth sectors. Entering the fourth quarter, institutions’ asset portfolios will be adjusted. The market still maintains expectations that the Federal Reserve will cut interest rates by 200 basis points in the next year. Loose monetary policies will continue to benefit platform stocks in obtaining capital inflows and reflect lower interest expenses.

- Expansion plans underway. Entergy Louisiana is partnering with local governments to strengthen electric infrastructure in southeast Louisiana, using several Building Resilient Infrastructure and Communities (BRIC) grants. Projects in Ascension, Lafourche, and Jefferson parishes will harden power lines, preventing outages and reducing restoration costs from storms. Entergy is also awaiting decisions on Grid Resilience and Innovative Partnerships (GRIP) grant applications for Baton Rouge and Reserve, which could further bolster grid resilience. In Arkansas, Entergy received US Department of Energy grants to enhance hydroelectric facilities, ensuring continued clean energy generation. Meanwhile, Entergy Mississippi is building a new natural gas power plant in Greenville, set to drive economic growth and provide reliable energy. This plant, designed to support hydrogen blending, is part of Entergy’s efforts to modernize its energy grid, replacing older power stations and reducing carbon emissions. These plans underway will further sustain Entergy’s robust growth and continue to unlock value for its stakeholders.

- 2Q24 earnings review. Non-GAAP earnings per share were US$1.92, beating expectations by US$0.16. The company affirmed its 2024 adjusted EPS guidance range of US$7.05 to US$7.35 vs US$7.21 consensus.

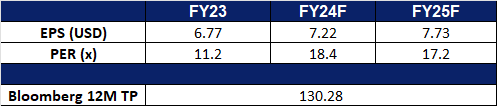

- Market consensus.

(Source: Bloomberg)

Uber Technologies Inc (UBER US): Rolling out Robotaxi

Uber Technologies Inc (UBER US): Rolling out Robotaxi

- RE-ITERATE BUY Entry – 75 Target – 83 Stop Loss – 71

- Uber Technologies Inc provides ride hailing services. The Company develops applications for road transportation, navigation, ride sharing, and payment processing solutions. Uber Technologies serves customers worldwide.

- Actively promote the robot taxi business. Uber Technologies, which has been making a lot of moves in the self-driving and robo-taxi space recently, recently announced a partnership with WeRide to bring the Chinese self-driving technology company’s vehicles to the sharing platform, starting with the United Arab Emirates. In addition, the company expanded its cooperation with Waymo to introduce robot taxis to Austin and Atlanta in the United States. The company is also working with Cruise, GM’s robo-taxi unit, which will offer self-driving cars on the platform starting next year.

- Funds are rotated into cyclical and growth sectors. Entering the fourth quarter, institutions’ asset portfolios will be adjusted. The market still maintains expectations that the Federal Reserve will cut interest rates by 200 basis points in the next year. Loose monetary policies will continue to benefit platform stocks in obtaining capital inflows.

- 2Q24 earnings review. Revenue increased by 15.9% YoY to US$10.7bn, exceeding expectations by US$120mn. GAAP earnings per share were US$0.47, beating expectations by US$0.16. The company’s third-quarter gross bookings guidance is US$40.25bn to US$41.75bnn (an annual increase of 18% to 23% at constant exchange rates).

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Cut loss on Centurion Corp Ltd (CENT SP) at S$0.745 and Tesla Inc (TSLA US) at US$242.