3 July 2024: Banyan Tree Holdings Ltd (BTH SP), China Longyuan Power Group Corp Ltd. (916 HK), Zscaler Inc (ZS US)

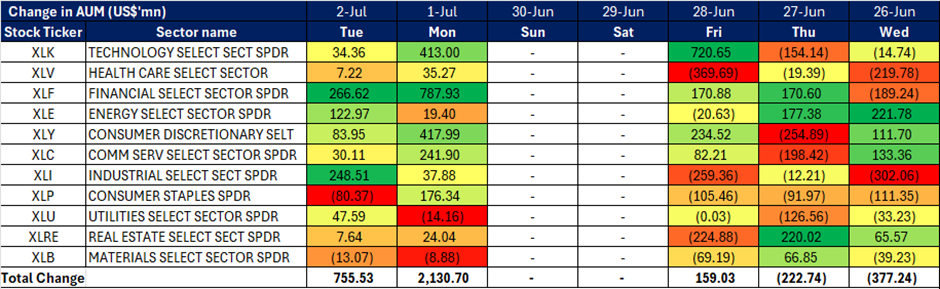

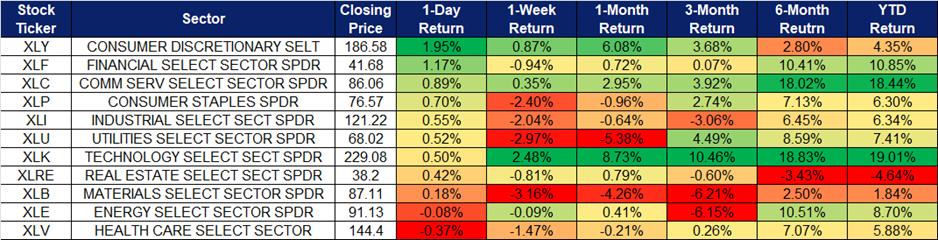

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Banyan Tree Holdings Ltd (BTH SP): Summer seasonality

- RE-ITERATE BUY Entry – 0.390 Target– 0.430 Stop Loss – 0.370

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Upcoming summer holidays. Tourism levels are expected to rise during the upcoming summer season. Many airlines have already increased the number of international flights to meet the heightened travel demand. Sporting events like UEFA Euro 2024 and the Paris 2024 Olympic Games have sparked significant interest in summer travel to Europe. Year-over-year growth in flight and hotel bookings has been substantial in these popular destinations. The Paris government anticipates 15 million visitors between late July and early September due to the Paris 2024 Olympic Games. According to digital booking site Hopper, airfares for flights from the U.S. to Paris during the weekend of the opening ceremony average about $877 per ticket, reflecting the increased interest in summer travel.

- Increasing market presence. Banyan Tree recently announced the upcoming opening of Banyan Tree Higashiyama Kyoto in the third quarter of 2024. The new property will feature 52 guestrooms, a signature Banyan Tree Spa, and two distinctive dining experiences. This addition enhances Banyan Tree Holdings’ portfolio, which includes over 80 hotels and resorts, more than 60 spas and galleries, and 14 branded residences in more than 20 countries. Additionally, the company was appointed to manage a new luxury island retreat in Bimini, Bahamas. These expansions underscore Banyan Tree’s capabilities as a global hospitality brand.

- 1Q24 results review. Revenue increased 38.8% to 1.90bn Baht in 1Q24, compared to 1.37bn Baht in 1Q23. FY24 net profit to 289.9mn Baht in 1Q24, compared to 65.3mn Baht in 1Q23. EPS rose to 1.65Baht in 1Q24, compared to 0.38Baht in 1Q23.

- Market Consensus.

(Source: Bloomberg)

Singapore Telecommunications Ltd (ST SP): Investing in AI and Data Centres for future prospects

- RE-ITERATE BUY Entry – 2.74 Target– 2.88 Stop Loss – 2.67

- Singapore Telecommunications Limited wireless telecommunication services. The Company offers diverse range of services including fixed, mobile, data, internet, TV, and digital solutions. Singapore Telecommunications serves customers worldwide.

- Partnership to research industrial AI solutions. Hitachi Digital, a subsidiary of Hitachi, is set to incorporate Singtel’s Paragon platform at its US facilities to speed up the deployment of 5G, edge computing, and AI. The initial deployment will occur at Hitachi Americas’ Santa Clara R&D Labs and later at a US factory for Industry 4.0. The collaboration aims to test Hitachi AI applications in various areas such as quality assurance, workplace safety, training, and maintenance on Paragon. This partnership will allow the smooth integration of Paragon with Hitachi’s industry cloud applications, enhancing connectivity and productivity. Hitachi Digital Services will provide Paragon-integrated solutions, targeting enterprise clients who require robust industrial AI and network capabilities, which will benefit both companies. Additionally, with AI bringing a new level of complexity, the partnership is expected to accelerate AI adoption for corporations. This collaboration with Hitachi will allow Singtel to expand its Paragon platform’s reach and demonstrate its capabilities, fostering growth and innovation for Singtel in the global market.

- Exploring multilingual large language models. Singtel, Deutsche Telekom, e&, SK Telecom, and SoftBank Corp., founding members of the Global Telco AI Alliance (GTAA), recently signed a Joint Venture (JV) agreement at TM Forum’s DTW24-Ignite. This JV aims to co-develop and launch multilingual Large Language Models (Telco LLM) tailored for telecommunications companies. The JV will receive equal investments from the parties to develop AI solutions enhancing customer interactions and operational efficiencies. These models, available in languages like Korean, English, German, Arabic, and Bahasa, will cater to a global customer base of approximately 1.3 billion across 50 countries. The launch is pending regulatory approvals.

- Launch of Singtel28. Singtel launched Singtel28 (ST28), a new growth plan aimed at enhancing customer experiences and delivering sustained value for shareholders following a successful strategic reset initiated in 2021. This reset focused on transforming the company amidst accelerated digitalisation driven by COVID-19. ST28 builds on this foundation by emphasising business performance improvement and smart capital management. It includes integrating Singtel Singapore and Optus to drive synergies, expanding into growth areas like ICT and data centers with NCS and Nxera, and scaling up Paragon for 5G and edge cloud computing. The plan also prioritises sustainability, divesting non-core assets, and enhancing shareholder returns through a revised dividend policy and capital recycling initiatives. Hence, signaling confidence in Singtel’s future growth and profitability.

- FY24 results review. FY24 net profit dropped 64% YoY to S$795mn due to exceptional loss of S$1.47bn, from impairment charges on goodwill and Optus Enterprise’s fixed network assets. However, excluding these charges, underlying net profit was up 10% YoY to S$2.26bn, showing an increase in regional associate contributions and higher interest income. Singtel also revised its dividend policy and declared a higher total ordinary dividend payout of 15.0Scents for FY24, a 52% YoY increase.

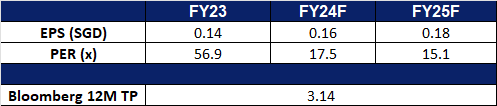

- Market Consensus.

(Source: Bloomberg)

China Longyuan Power Group Corp Ltd. (916 HK): Going green

- BUY Entry – 7.40 Target 8.00 Stop Loss – 7.10

- China Longyuan Power Group Corp Ltd is a China-based company mainly engaged in power sales business. The company operates three segments. Wind Power segment constructs, manages and operates wind power plants and produces electricity and sells it to grid companies. Coal Power segment constructs, manages and operates coal-fired power plants and produces electricity and sells it to power grid companies. All Others segment is mainly engaged in manufacturing and selling power generation equipment, providing consulting services, providing maintenance and training services to wind power enterprises and other renewable energy power generation and sales.

- Launch of wind-fishery integrated floating platform. The world’s first wind-fishery integrated floating platform, was put into operation in Fujian province last week, with China Longyuan Power Group Corp being the operator. The new wind-fishery integrated floating platform, pioneering a new marine economic development model that combines underwater fish farming and above-water power generation in the field of floating offshore wind power, will take better advantages of the marine resources. The electricity generated by the offshore wind turbine will also ensures the safe and stable operation of the aquaculture equipment, solving the common problems of “insufficient power supply and unstable power supply” in traditional marine ranching.

- Transition to green energy. China’s power storage capacity is poised for significant growth, driven by rapid advancements in renewable energy, innovative technologies, and ambitious government policies promoting sustainable development. For the first 5 months of 2024, China has consumed over 180bn kWh of green electricity, representing a three fold increase YoY, according to the China Electricity Council. China has become a leader in renewable energy adoption, particularly focusing on enhancing its energy storage capabilities. In the first quarter of 2024, the nation’s energy storage capacity expanded substantially, with installed new-type energy storage reaching 35.3 gigawatts by the end of March, a 2.1-fold increase YoY. The surging demand for energy storage solutions, essential for integrating intermittent renewable sources like wind and solar into the power grid, has spurred extensive investments in storage projects nationwide. This momentum is expected to continue, positioning China to dominate the global energy storage market in the coming years.

- Offloading of Jiangyin Sulong. China Longyuan Power Group recently announced plans to dispose of 27% of its holdings in Jiangyin Sulong Heat and Power Generating for 1.32bn yuan. While the transaction will decrease the Chinese power company’s installed capacity by 1,240.76 megawatts, the deal will also raise the company’s net profit by 297mn yuan.

- 1Q24 results review. Revenue increased 0.10% YoY to RMB9.88bn in 1Q24, compared with RMB9.87bn in 1Q23. Net income rose by 1.3% to RMB2.76bn in 1Q24, compared to RMB2.72bn in 1Q23. Earnings per share was RMB0.329 in 1Q24, compared to RMB0.325 in 1Q23.

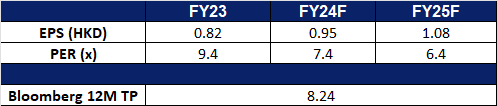

- Market consensus.

(Source: Bloomberg)

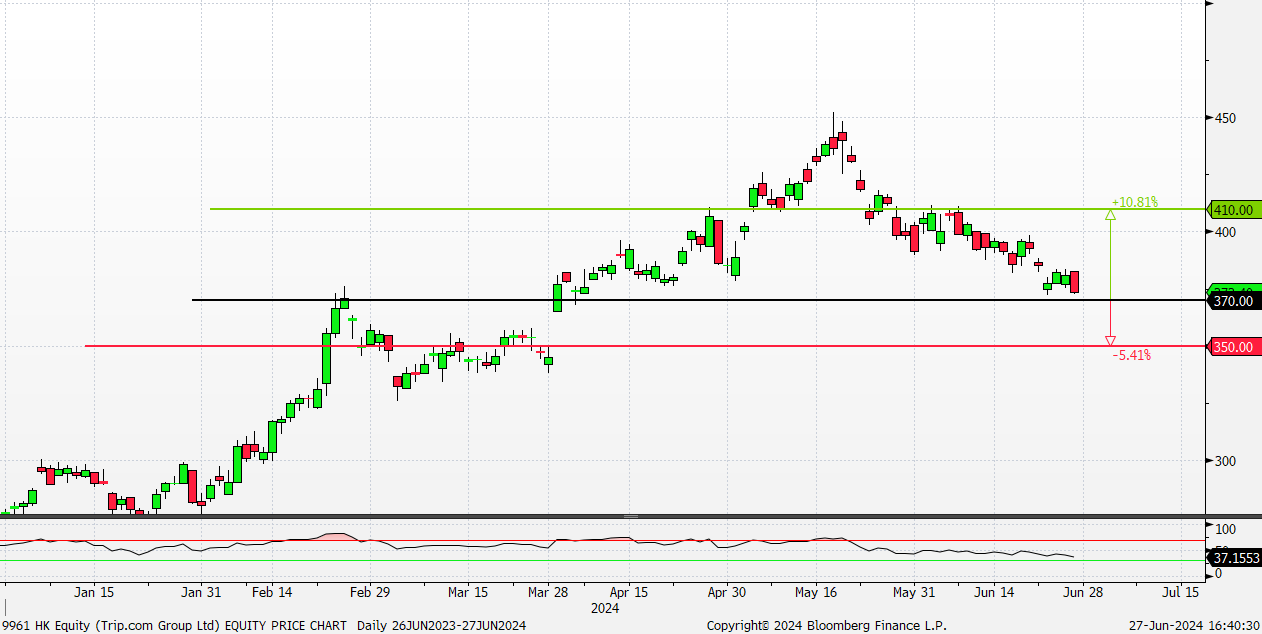

Trip.com Group Ltd. (9961 HK): Kickstarting the summer holidays

- RE-ITERATE BUY Entry – 370 Target 410 Stop Loss – 350

- Trip.com Group Ltd is a China-based company mainly engaged in the operation of one-stop travel platform. The Company’s platform integrates a comprehensive suite of travel products and services and differentiated travel content. Its platform aggregates its product and service offerings, reviews and other content shared by its users based on their real travel experiences, and original content from its ecosystem partners to enable leisure and business travelers to have access to travel experiences and make informed and cost-effective bookings. Users come to its platform for any type of trip, from in-destination activities, weekend getaways, and short-haul trips, to cross-border vacations and business trips.

- Incoming summer holidays. Tourism levels in China are expected to rise during the upcoming summer holidays. Many airlines, including Air China, plan to increase the number of international flights to meet passenger demand and support China’s global civil aviation market. Sporting events like UEFA Euro 2024 and the Paris 2024 Olympic Games have also sparked interest in summer travel to Europe. YoY growth in flight and hotel booking volumes has been significant in these popular destinations. According to Tongcheng Travel, flight bookings from major Chinese cities to Paris for July have increased by more than 70% YoY, while hotel bookings in Paris for the same period have surged by 150% YoY, highlighting the strong tourism trend for the summer season.

- Heightened interest from visa-free travel. China recently added Australia to its visa-free list, sparking increased interest among Australian tourists in visiting China. Just thirty minutes after the announcement on Monday, Trip.com, China’s largest online travel agency, saw a more than 80% surge in search volumes for China-related keywords from Australian tourists compared to the previous day. With new flights and increased frequencies between China and Australia since the start of the year, travel between the two countries has been on the rise. Trip.com is poised to benefit from the expected increase in travel volume due to the visa-free policy.

- Furthering expansion efforts into APAC. Trip.com Group recently signed a three-year Memorandum of Collaboration with the Malaysia Tourism Board during the ITB China trade show. This agreement aims to extend their existing partnership beyond China into the broader Asia Pacific region. The collaboration will focus on attracting more Chinese and international visitors to Malaysia, emphasizing marketing efforts and promoting key products such as hotels and attractions. This initiative is expected to positively impact Trip.com Group’s revenue.

- 1Q24 results review. Revenue increased 29% YoY to RMB11.9bn in 1Q24, compared with RMB9.2bn in 1Q23. Adjusted net income rose by 26% to RMB4.3bn in 1Q24, compared to RMB3.4bn in 1Q23. Diluted basic earnings per share was RMB6.38 in 1Q24, compared to RMB5.02 in 1Q23.

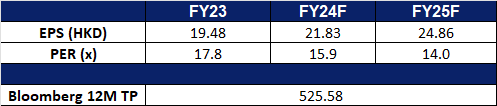

- Market consensus.

(Source: Bloomberg)

Zscaler Inc (ZS US): Demand for cybersecurity

- RE-ITERATE BUY Entry – 190 Target –210 Stop Loss – 180

- Zscaler, Inc. operates as a security software company. The Company offers cloud-based platform that provides web and mobile security, threat protection, cloud application visibility, and networking solutions. Zscaler serves clients worldwide.

- Partnership with Nvidia. Zscaler has announced a collaboration with NVIDIA to enhance enterprise security and user experience using AI-powered copilot technologies. This partnership will enable Zscaler to leverage NVIDIA AI technologies to process over 400 billion transactions daily from its Zero Trust Exchange platform. The collaboration introduces new AI capabilities, including NVIDIA NeMo Guardrails and the NVIDIA Morpheus framework, to defend against cyber threats and simplify IT and network operations. The Zscaler ZDX Copilot, in collaboration with NVIDIA NeMo Guardrails, offers insights into network, device, and application performance, simplifying IT support and operations on a larger scale. Additionally, Zscaler will utilize Nvidia’s Morpheus framework and Nvidia NIM inference microservices to deploy predictive and generative AI solutions, including the Zscaler ZDX Copilot with NVIDIA Morpheus and the Zscaler ZDX Copilot with Nvidia NIM, which can help to accelerate threat detection and the deployment of generative AI models.

- Relationship between AI and cybersecurity. In the first half of 2024, there was a notable increase in funding for cybersecurity startups, particularly those that utilize generative AI. This bounce-back comes after a decrease in early-stage funding deals in 2023. Venture capital investment in cybersecurity is once again on the rise, with a specific focus on AI-driven solutions for threat management and access control. Both attackers and defenders are increasingly using AI in cybersecurity, indicating a shift in the industry. As AI continues to advance, its impact on cybersecurity becomes significant for both attackers and defenders. AI allows cyber threats to conduct more successful large-scale phishing campaigns and use deepfakes for deception. In cyber defence, AI-driven security systems offer a proactive approach to threat detection by analysing patterns and predicting potential vulnerabilities. The rapid advancement of AI introduces new complexities to cybersecurity, requiring more investments in AI cyber defence to counteract modern cyber risks.

- 3Q24 earnings review. Revenue grew by 32.1% YoY to US$553.2mn, beating estimates by US$17.11mn. Non-GAAP EPS was US$0.88, beating estimates by US$0.23. 4Q24 revenue is expected to be between US$565mn to US$567mn vs consensus of US$564.98mn. Non-GAAP EPS is expected to be US$0.69 to US$0.70 vs consensus of US$0.67. FY24 revenue to be approximately US$2.140bn to US$2.142bn vs consensus of US$2.21B and Non-GAAP EPS to be between US$2.99 to US$3.01 vs consensus of US$2.76.

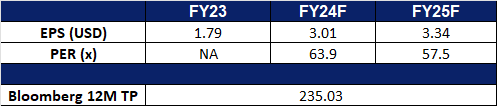

- Market consensus.

(Source: Bloomberg)

Airbnb Inc (ABNB US): Tailwinds from the Paris Olympic Games

- RE-ITERATE BUY Entry – 147 Target –165 Stop Loss – 141

- Airbnb, Inc. operates an online marketplace for travel information and booking services. The Company offers lodging, home-stay, and tourism services via websites and mobile applications. Airbnb serves clients worldwide.

- Benefit from the Paris Olympics and the European Cup. The quadrennial Olympic Games will be held in Paris from July to August, with an estimated 3 million visitors expected to arrive in the city. This will boost demand for accommodation and dining in Paris and surrounding cities. Airbnb bookings in Paris have surged by 400%, and bookings in other nearby cities such as Saint-Denis and Chartres have also skyrocketed. The company has previously reached an agreement with the International Olympic Committee to operate short-term rentals in Paris. However, Paris has a cap on the number of short-term rental nights per year at 120. In addition to the upcoming Olympics, the ongoing European Championship is also driving up Airbnb bookings in Europe.

- Summer tourist season. Airbnb’s revenue exhibits pronounced seasonal fluctuations, with peak booking volumes concentrated in July and August. The company’s stock price also demonstrates a similar seasonal pattern.

Share Price Seasonality Chart

(Source: Bloomberg)

- 1Q24 earnings review. Revenue grew by 18% YoY to US$2.14bn, beating estimates by US$80mn. GAAP EPS was US$0.41 beating estimates by US$0.18. 2Q24 revenue is expected to range between US$2.68bn to US$2.74bn vs consensus of US$2.74bn.

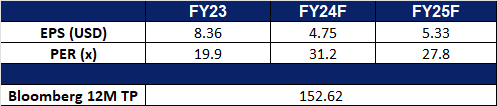

- Market consensus.

(Source: Bloomberg)

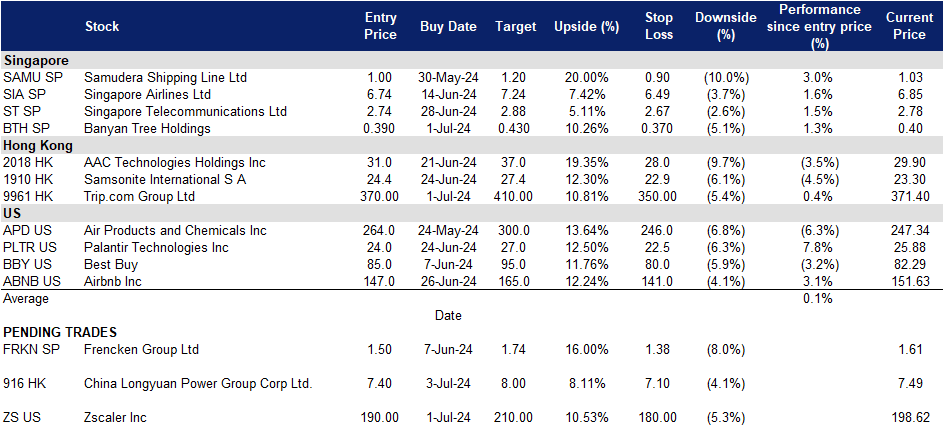

Trading Dashboard Update: Add Banyan Tree Holdings (BTH SP) at S$0.390 and Trip.com Group Ltd (9961 HK) at HK$370. Cut loss on Genting Singapore Ltd (GENS SP) at S$0.84.