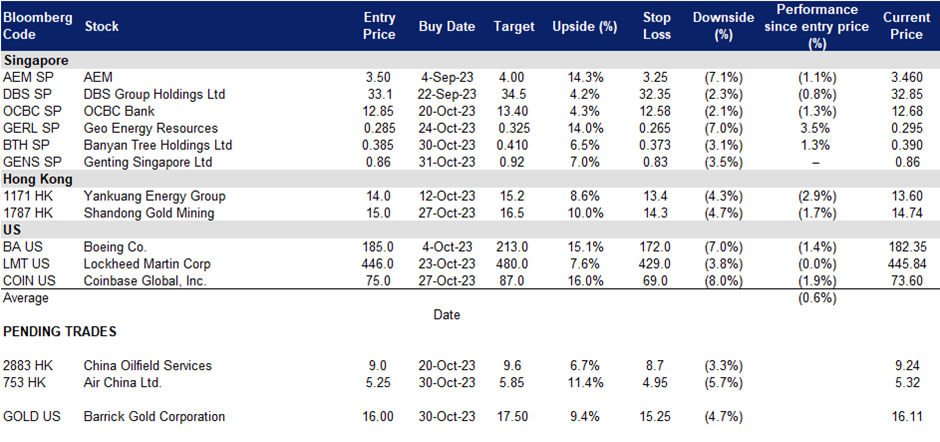

1 November 2023: Banyan Tree Holdings Ltd. (BTH SP), Air China Ltd. (753 HK), Barrick Gold Corporation (GOLD US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

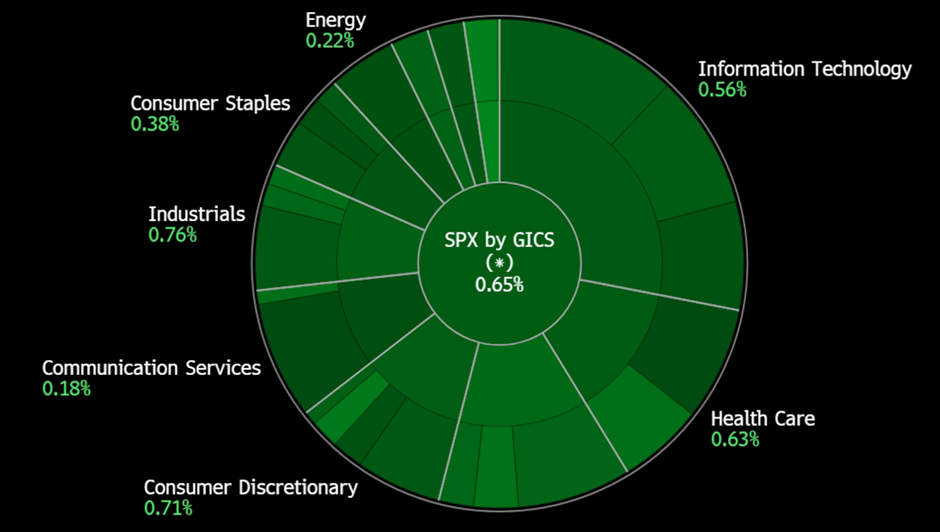

United States

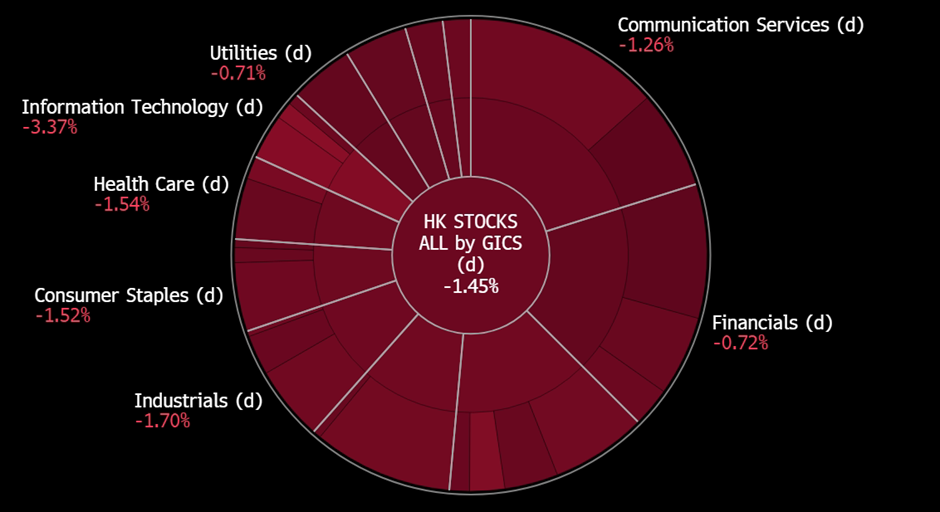

Hong Kong

Banyan Tree Holdings Ltd. (BTH SP): Growing expansion plans

- BUY Entry 0.385 – Target – 0.410 Stop Loss – 0.373

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Entering Philippines. Banyan Tree is set to open its first-ever residential project in the Philippines, called Banyan Tree Residences Manila Bay in 2026. This project will offer 188 residences across three glass-enclosed towers overlooking Manila Bay, blending modern living with Philippine design traditions, including a focus on weaving in both architecture and interior design. Residents will enjoy a range of amenities, such as a 24-hour concierge, restaurants, a rooftop garden, infinity pools, a fitness center, and the first Banyan Tree Spa and Gallery in the Philippines. Additionally, owners can access the Banyan Tree Sanctuary Club, offering exclusive benefits and access to the brand’s global network of resorts and properties. Banyan Tree has further expansion plans in the Philippines, including a hotel, two golf courses, island developments, and resorts, with a focus on the thriving Southeast Asian real estate market.

- Debut Garrya in Java. The Banyan Tree Group has launched a new resort called Garrya Bianti Yogyakarta on Indonesia’s Java island, continuing the global expansion of its minimalist Garrya brand. The resort draws design inspiration from Javanese culture and the iconic Yogyakarta temple. It offers 24 villas, including a two-bedroom villa with a private plunge pool and wellness facilities, along with a spa offering Asian-rooted wellness therapies. Culinary options feature traditional Javanese dishes made from local ingredients, and guests can explore local arts and crafts. Banyan Tree Group plans to open four Garrya resorts in Vietnam and two in China by 2025.

- Visa-free travel. Thailand temporarily waives tourist visa requirements for visitors from China and Kazakhstan from 25 September 2023 to 29 February 2024, in an effort to attract more tourists and spur spending during the year-end high season to stimulate the economy, which is slowing due to weak exports. The business sector has welcomed the government’s new policy, and airlines are preparing to increase flights and add more capacity to accommodate the expected increase in tourists. The tourism industry is optimistic that the visa-free scheme will be a success and boost tourism spending in Thailand. This would also benefit businesses such as Banyan Tree, which has multiple properties in the country. The visa-free scheme would make it easier and more convenient for Chinese tourists to visit Thailand, which could lead to an increase in bookings at Banyan Tree’s properties.

- 1H23 results review. Revenue for 1H23 increased 21% to S$143.7mn, from S$118.6mn a year ago. It achieved a 68% increase in core operating profit to S$18.7mn in 1H23 from S$11.1mn in 1H22. RevPAR rose 64% in 1H23 (on a same-store basis) vs 1H22.

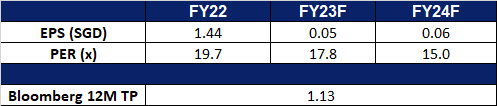

- Market Consensus.

(Source: Bloomberg)

Genting Singapore Ltd (GENS SP): Bottoming out

- RE-ITERATE BUY Entry 0.86 – Target – 0.92 Stop Loss – 0.83

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

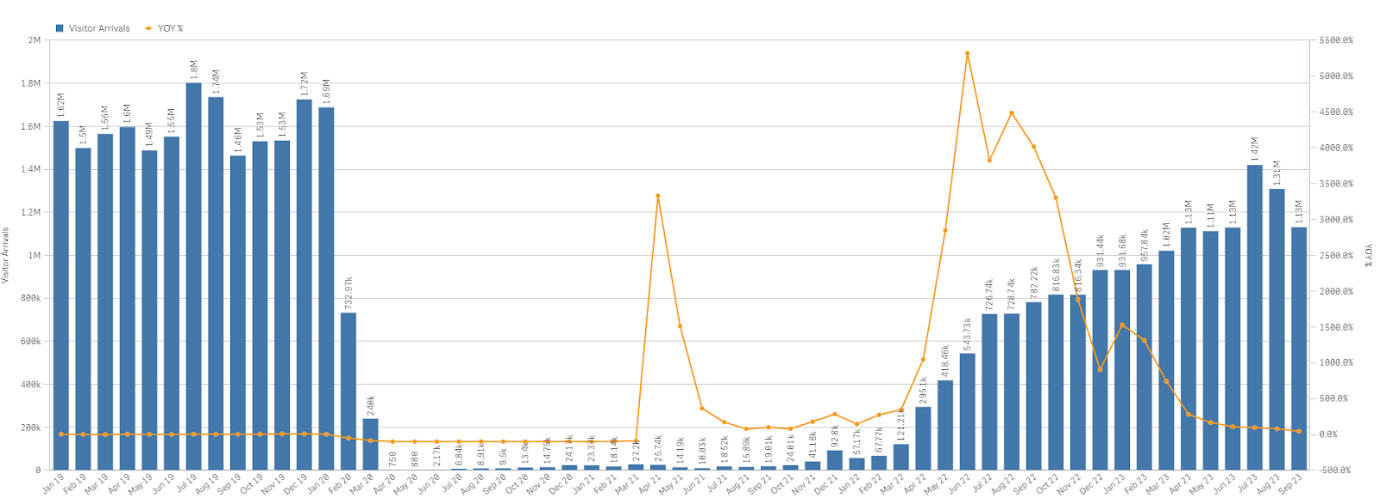

- Tourism expected to increase. Despite a slight decline from the peak of 1.42mn visitors in July, an increase in visitor numbers to Singapore is anticipated for the remainder of the year. Singapore is positioning itself as a global entertainment hub, attracting tourists with high-profile events like the F1 Grand Prix and upcoming concerts by Coldplay and Taylor Swift, which are expected to significantly boost the tourism sector and benefit airlines, airport services, and entertainment companies. Genting Singapore’s Resorts World Sentosa (RWS) could experience a boost in visitors. This increased footfall can translate into higher revenue for RWS, which could, in turn, lead to higher profits. Furthermore, the anticipation of more Chinese tourists visiting Singapore in 4Q23 aligns with Genting Singapore’s potential for revenue growth in FY24.

- Singapore Tourism Board partnership with Trip.com. Trip.com and the Singapore Tourism Board have extended their partnership for three more years. They will work together to promote inbound travel to Singapore, enhance the visitor experience, and highlight Singapore’s offerings for meetings, incentives, conferences, and exhibitions (MICE). The collaboration includes launching marketing campaigns in several countries and developing new products and custom itineraries. The partnership aims to capitalise on the increasing number of Chinese tourists visiting Singapore and strengthen the country’s position as a preferred travel destination.

Singapore monthly visitor arrivals trend (2019-2023)

(Source: Singapore Tourism Analytics Network)

- Correlation between tourists and revenue. Genting Singapore reported a significant increase in net profit and revenue for 1H23. The company attributed this improved performance to an increase in foreign visitor arrivals to Singapore, despite challenges such as limited air capacity from certain regional countries and higher airfares affecting leisure travel. Resorts World Sentosa (RWS) saw a 37% growth in adjusted earnings in 2Q23, mainly due to a rebound in the non-gaming business, a strong VIP win rate, and a recovery in regional gaming activities. Gross gaming revenue also rose 3% on a hold-normalised basis, reaching $547.9mn. We anticipate continued growth in Genting’s revenue from the increase in visitor arrivals in 2H23 alongside its strong VIP gaming segment and keys added to its newly refurbished Ora Hotel.

- Project timeline. Genting Singapore previously mentioned that it aims to begin construction in FY24 after government approvals on the new Waterfront building, the Equarius Hotel extension and the Health and Wellness Centre.

- 1H23 earnings. The company revenue rose to S$1,080.4mn, +63% YoY compared to 1H22. The company’s net profit for the period was S$276.7mn, more than 3 times the net profit in 1H22 of S$84.4mn. Basic earnings per share were S$2.29 cents compared to the previous S$0.70 cents in 1H22. It also paid out an interim dividend of S$1.5cents on 22 September 2023.

- Market Consensus.

(Source: Bloomberg)

Air China Ltd. (753 HK): Flights to increase go forward

- BUY Entry – 5.25 Target – 5.85 Stop Loss – 4.95

- Air China Limited is a China-based company principally engaged in the provision of air passenger transportation, freight transportation, postal transportation and maintenance services in Mainland China, Hong Kong, Macau and foreign regions. The Company is also engaged in domestic and international business aviation businesses, plane business, aircraft maintenance, airlines business agents, ground and air express services related to main businesses, duty free on boards, retail business on boards and aviation accident insurance sales agents business.

- Returning to Profit. Air China returned to profitability during the initial nine months of the year, driven by a substantial increase in business and leisure travel after Beijing eased stringent COVID-19 restrictions. With the increase in deployment of transportation capacity by the company, and driven by the increase in both passenger load factor and price, the loss decreased significantly with growth in profit.

- More flights between China and the US. The US Department of Transportation announced that flights between China and the US will increase to 70 a week starting on 9 November, from the current 48 a week. The average flights between the two counties averaged 340 a week in the pre-COVID period. Recently, China and the US top officials started visiting each other, signalling some improvements in China-US relations.

- Rising seasonal travel demand. With the peak travel season coming up in November, travel demand is bound to pick up as consumers make their plans to travel for the end of the year, to escape the winter cold, or to experience the winter season. This winter holiday is also the first winter holiday since China’s reopening in Jan earlier this year, and hence is likely to see a rise in travel volume over the period. Chinese airlines have also seen a rise in scheduled flights for winter-spring, scheduling 96,651 domestic cargo and passenger flights each week for the upcoming winter-spring season, an increase of 33.95% from the same period in 2019-2020, according to the Civil Aviation Administration of China (CAAC). 516 new domestic routes will also be opened from Oct 29 to March 30 next year,, providing 7,202 flights each week, according to the CAAC. In terms of international flights, 150 domestic and foreign airlines plan to arrange 16,680 flights per week, reaching 68 foreign countries.

- 3Q23 earnings. Revenue rose to RMB45.86bn, up 152.89% YoY. Net profit was RMB 4.07bn, returning to profit for the first time for the year. Basic earnings per share was RMB0.28.

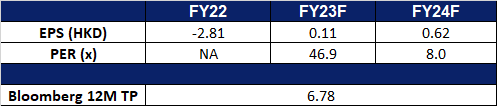

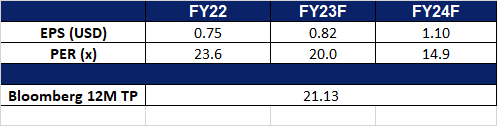

- Market Consensus.

(Source: Bloomberg)

Shandong Gold Mining (1787 HK): Shinning gold

- RE-ITERATE BUY Entry – 15.0 Target – 16.5 Stop Loss – 14.3

- Shandong Gold Mining Co., Ltd. is a China-based company principally engaged in the mining, processing and sales of gold. The Company operates two segments. The Gold Mining segment is engaged in the mining of gold ore. The Gold Refining segment is engaged in the production and sales of gold. The Company is also engaged in the distribution of other metals extracted during the gold ore smelting process, such as silver, copper, iron, lead and zinc. The Company conducts its businesses in domestic and overseas markets.

- Rising global geopolitical tension. The ongoing Israle-Hamas conflict is likely to escalate regional tensions. This week, China’s 6 warships were stationed in the Middle East, and the authority proclaimed that these warships were on routine escort missions instead of being involved in the conflict. The US previously deployed two aircraft carriers to the eastern Mediterranean. Meanwhile, China and Russia strengthen their relationships to work on the Middle East solution. Rising global geopolitical tensions lead to the pursuit of safe haven assets such as gold.

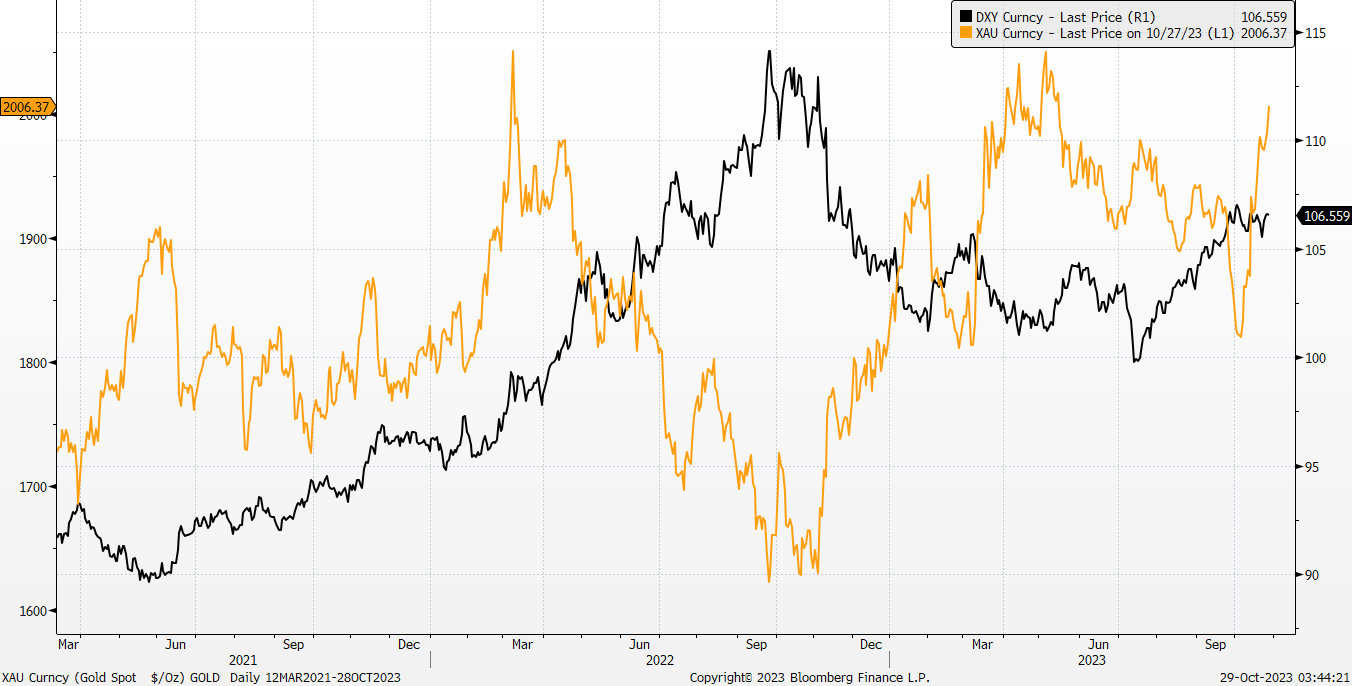

- Defying strong USD. Generally, gold and USD perform an inverse correlation. However, recent movements of the two assets broke the general rule, as US Dollar index stayed firmly at around 106 but gold rebounded by nearly 10% over the past two weeks. Meanwhile, the 10-year US Treasuries yield climbed to a high of 5% since 2007. Right now the yields remain elevated. The abnormal gold’s performance under such as a backdrop is attributable to fear sentiment towards the unrest in the Mediterranean region.

- Positive profit alert. The company announced that it expected 9M23 net profit attributable to shareholders to be in the range between RMB1.2bn and RMB1.4bn, up 73.17% to 102.03% YoY. The adjusted 9M23 net profit attributable to shareholders is estimated to be in the range between RMB1.135bn and RMB1.335bn, up 50.01% to 76.45% YoY.

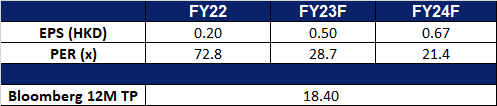

- Market Consensus.

(Source: Bloomberg)

Barrick Gold Corporation (GOLD US): Safety net

- BUY Entry – 16.00 Target – 17.50 Stop Loss –15.25

- Barrick Gold Corporation engages in the exploration, mine development, production, and sale of gold and copper properties. It has ownership interests in producing gold mines that are located in Argentina, Canada, Côte d’Ivoire, the Democratic Republic of Congo, the Dominican Republic, Mali, Tanzania, and the United States.

- Escalating tensions. The ongoing conflicts in Russia-Ukraine and Israel-Hamas have introduced significant economic uncertainty in global markets. The recent escalation in the Gaza conflict, marked by intensified ground operations and violent clashes, has added to the turmoil. Israeli forces increased airstrikes, targeting tunnels and underground infrastructure, while cutting off internet and communications in Gaza, raising concerns about potential mass atrocities and disrupting humanitarian efforts. Israel’s bombardment has led to widespread displacement and critical shortages in Gaza. Worldwide demonstrations, including arrests in New York, have called for a ceasefire, and violence has escalated in the occupied West Bank. The United Nations has warned of unprecedented suffering in Gaza and urged an immediate humanitarian truce. Consequently, the ongoing conflicts have contributed to macroeconomic instability, prompting individuals to seek safer assets like Gold.

- September US CPI above expectations. In September, consumer prices in the United States increased by 0.4%, which was higher than expected. This brought the YoY inflation rate to 3.7%, exceeding forecasts. Excluding volatile food and energy prices, the core Consumer Price Index (CPI) increased by 0.3% for the month and 4.1% over the past 12 months, in line with expectations. Rising shelter costs, accounting for about a third of the CPI’s weight, played a significant role in this inflation increase, surging by 0.6% for the month and 7.2% YoY. Energy costs rose by 1.5%, with higher gasoline and fuel oil prices, and food costs increased by 0.2%. Services prices, which are important for long-term inflation trends, also saw gains. Real average hourly earnings fell by 0.2% for the month, causing worker wages to decline in real terms. With concerns about inflation and the uncertain macroeconomic environment, the Federal Reserve remains steadfast in its higher for longer decision regarding US interest rates.

- September US PPI data above expectations. In September, the producer price index (PPI) in the United States exceeded expectations by rising 0.5% against the predicted 0.3% rise. When excluding food and energy, the core PPI increased by 0.3%, in line with expectations. The inflation pressures mainly came from final demand goods, surging 0.9% for the month, while services increased by 0.3%. Gasoline and food prices were significant contributors to the rise in goods prices. This suggests that inflation remains a concern, and has implicated interest rates and policy decisions from the Federal Reserve.

- Better outlook for gold price in 2023. Gold prices are influenced by various factors, with significant impact coming from the direction of the US dollar and global geopolitical risks. Gold tends to find support from limited inflation and low unemployment, serving as a hedge against inflation and a safe haven during uncertain economic times. The market anticipates rates staying higher for longer. The US dollar’s ascent, driven by rebounding gasoline prices and expectations of more Fed interest rate hikes, is contributing to the situation. PGold prices are also affected by persistent inflation and geopolitical tensions, with concerns in both areas influencing the market. Added caution has emerged from the ongoing war between Israel and Hamas. As a result, gold prices are likely to remain volatile, with their direction contingent upon inflation, interest rates, and geopolitical developments. Gold continues to be viewed as a reliable safe haven.

Gold Price and Dollar Index Trend

(Source: Bloomberg)

(Source: Bloomberg)

- 2Q23 earnings review. Revenue dropped by 1.0% YoY to US$2.83bn, missing estimates by US$100mn. Non-GAAP EPS was US$0.19, beating estimates by US$0.01. Gold production in Q2 was up 6% at just over 1mn ounces while copper production increased by 22% to 107mn pounds.

- Market consensus.

(Source: Bloomberg)

Coinbase Global Inc (COIN US): Bull run kickstarted

- RE-ITERATE BUY Entry – 75 Target – 87 Stop Loss – 69

- Coinbase Global, Inc. provides financial solutions. The Company offers platform to buy and sell cryptocurrencies. Coinbase Global serves clients worldwide.

- Spot Bitcoin ETF. The prospect of the first US spot Bitcoin ETF gaining approval from the SEC has caused a surge in Bitcoin prices. This rally is fuelled by market expectations that the SEC will shift its long-standing policy of rejecting spot ETFs, given applications from industry giants like BlackRock and Franklin Templeton. If approved, this would cement Bitcoin’s status as a recognised asset class, offering a more secure and cost-effective method for people to invest in cryptocurrency. The SEC is expected to deliver its initial verdict on ETF filings early next year. Additionally, Coinbase Singapore has secured a Major Payment Institution licence from the Monetary Authority of Singapore, enabling the exchange to broaden its digital payment token services to both individuals and institutions within the nation.

- Bitcoin hit new high. Bitcoin recently hit a new high of US$35,000, since May 2022. After consolidating at around US$26,000, Bitcoin price surged due to investors’ optimism on the approval of the ETF. Bitcoin is halved every 4 years, and the next halving date is April 25 2024. Bitcoin halving leads to a slowdown in mining output. In other words, the supply of Bitcoin after the halving date will be less. Based on the previous two halvings, Bitcoin experienced bull cycles for 18 months (Previous two halving dates: July 9 2016 and May 11 2020). Historically, Bitcoin’s upward momentum started 6 months before the halving date. Therefore, the Bitcoin upcycle could have started currently.

Bitcoin Halving

(Source: Bloomberg)

- Priced in one more rate hike expectation. The current sell-off in growth/risky assets is attributable to prolonged high rate expectations. Given a robust labour market in the US and sticky inflation, the Fed is expected to hike another 25bps by the end of 2023. Meanwhile, the US 10-year government yield reanched near 4.9%, a high since 2007. However, the plunge in oil prices and the soft consumer spending mitigated the inflation pressure. Peak rate expectations remain, and risky assets are expected to rebound in the near term.

- 2Q23 results. Revenue rose to US$707.9mn, down 12.4% YoY, beating expectations by US$70.1mn. GAAP EPS beat estimates by US$0.36 at -US$0.42.

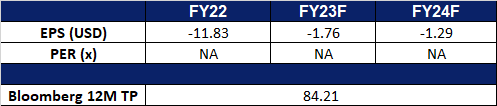

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Sunny Optical Technology Group (2382 HK) at HK$69. Add Banyan Tree Holdings Ltd. (BTH SP) at S$0.385 and Genting Singapore Ltd (GENS SP) at S$0.86. Stop loss on CNOOC Ltd (883 HK) at HK$12.8.