24 January 2025 : Wee Hur Holdings Ltd (WHUR SP), People’s Insurance Company Group of China Ltd. (1339 HK), Ciena Corporation (CIEN US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

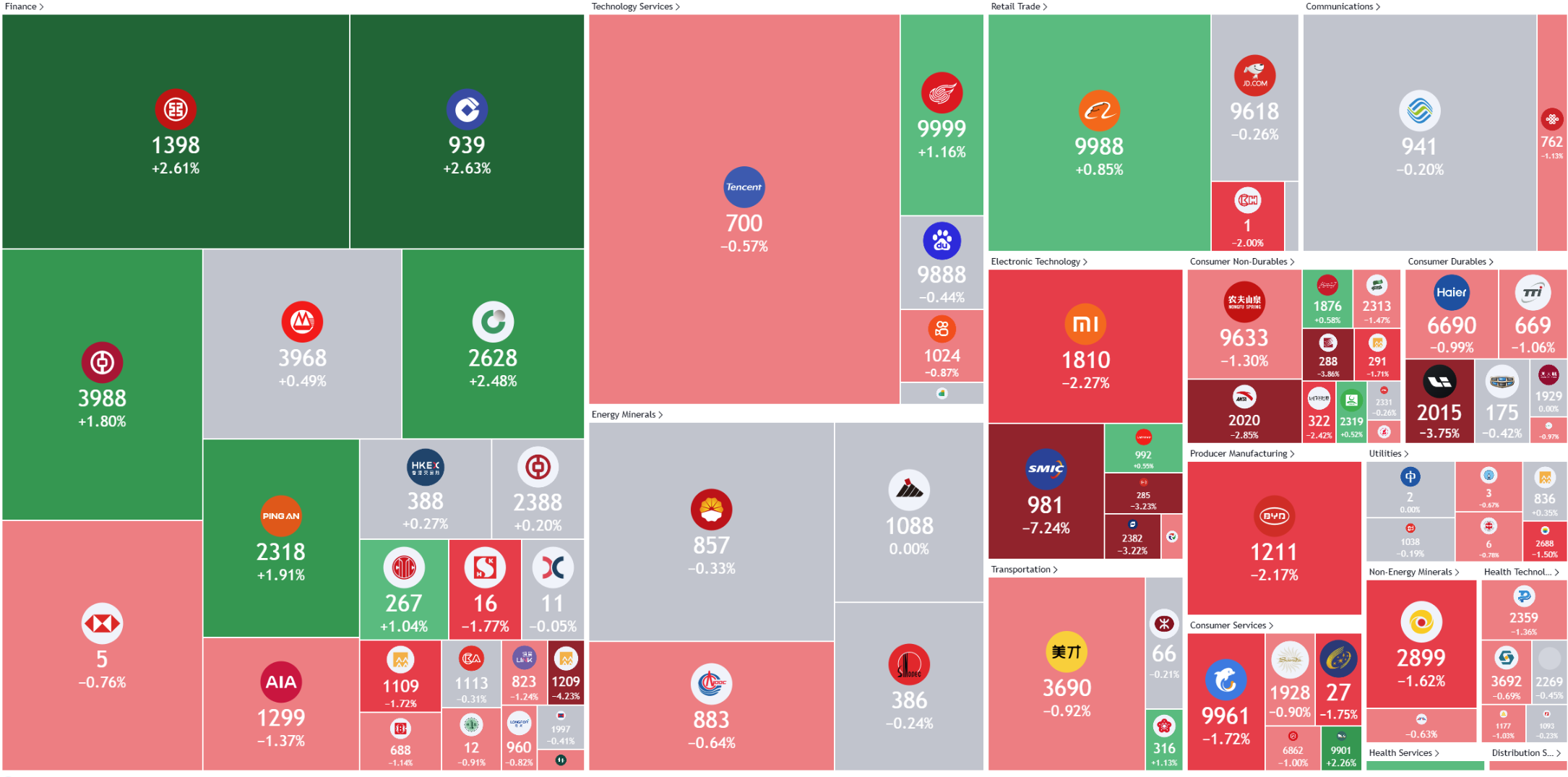

Hong Kong

Wee Hur Holdings Ltd (WHUR SP): Strategic repositioning

- BUY Entry – 0.47 Target– 0.53 Stop Loss – 0.44

- Wee Hur Holdings Ltd provides building construction services and acts as the management or main contractor in construction projects for both private and public sectors. The Company’s clients from the private sector include property owners and developers, and those from the public sector comprise government bodies and statutory boards.

- Increased construction demand in Singapore. Wee Hur Holdings showcased robust performance in the first half of 2024, underpinned by its strong dormitory segment and increased contributions from investments in associates and joint ventures. A key strength lies in its Tuas View Dormitory, which saw higher revenue as rising construction demand in Singapore drove the need for worker accommodation. As a BCA-registered A1-grade contractor, Wee Hur is well-positioned to tender for public projects of unlimited value, spanning residential, commercial, industrial, and conservation projects, further solidifying its expertise in the construction sector. The recent sale of its Australian PBSA portfolio has provided the company with additional capital flexibility, enabling it to focus on core segments like construction and dormitories. With Singapore’s construction demand projected to reach S$47bn to S$53bn in 2025, fuelled by major projects such as Changi Airport Terminal 5 and public housing developments, Wee Hur is poised to capitalize on these opportunities. Its diversified capabilities, including expertise in new constructions, refurbishments, and heritage restoration, further enhance its versatility and competitive edge in the market. These strengths position Wee Hur to thrive amid Singapore’s growing infrastructure and construction needs.

- Capitalising on sale of assets. Wee Hur Holdings sold its Australian student accommodation assets for A$1.6bn to Greystar, generating S$320mn in cash and retaining a 13% stake worth A$200mn in the new venture. The portfolio, comprising over 5,500 beds, has benefited from high occupancy rates and rising rental income. Wee Hur intends to allocate the proceeds toward expanding its construction and engineering business and exploring alternative investment opportunities. The sale also enabled the company to clear associated debt, strengthening its financial position. Additionally, Wee Hur continues to advance other key projects, including the development of new worker dormitories and student accommodations. Looking ahead, investors are optimistic about the potential for special dividends once the company receives the net proceeds from the transaction, further enhancing shareholder value.

- 1H24 results review. Total revenue for 1H24 increased by 10% YoY to S$109.12mn from S$99.21mn driven by higher contributions from Tuas View Dormitory, the Group’s first Purpose-Built Dormitory in Singapore, which operated at nearly full occupancy throughout 1H24. Gross profit for 1H24 surged to S$44.73mn, an increase of 144% YoY from S$18.30mn in 1H23. Profit from continuing operations for 1H24 was S$75.07mn, an increase of 488% from S$12.77mn the year before, this was mainly attributable to improved performance at Tuas View Dormitory and higher profits from investments in associates and joint ventures.

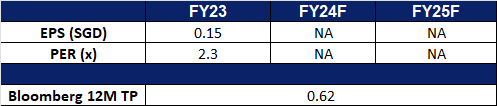

- Market Consensus.

(Source: Bloomberg)

Winking Studios Ltd (WKS SP): Continued momentum from M&A strategy

- RE-ITERATE BUY Entry – 0.300 Target– 0.330 Stop Loss – 0.285

- Winking Studios Limited operates as a game art outsourcing studio. The Company provides complete end-to-end art outsourcing and game development services across various platforms for the video games industry. Winking Studios serves customers worldwide.

- New acquisition. On 17 January, Winking Studios announced plans to acquire Shanghai Mineloader Digital Technology, a leading Asian game art outsourcing and development studio, for approximately RMB 146mn (S$27.2mn). Mineloader, with 466 employees and a strong focus on console platform games, generates 90% of its revenue from game art outsourcing. For the financial year ending 31 December 2023, Mineloader delivered EBITDA of approximately S$3.6mn. This deal aims to expand Winking Studios’ scale in Asia, access Western clients, and support global ambitions. Completion of the proposed acquisition is expected by 2Q25, with Mineloader’s leadership continuing under Winking Studios’ resources and expertise.

- M&A focused. Winking Studios’ largest peer Keywords Studios was previously listed on AIM in 2013, valued at £49mn. It was then acquired for £2.1bn, rewarding investors as the business grew 40-fold by providing services like music, art, and translation for video games. Winking Studios leverages key industry trends like art outsourcing and mobile gaming, attracting major clients like Ubisoft and EA. With a focus on high-quality, cost-effective services and a strong foundation with Acer as a major shareholder, Winking aims to replicate Keyword’s success. This includes organic growth, strategic acquisitions, and leveraging AI to enhance its offerings. As Winking Studios continues to execute its growth strategy and demonstrates increasing value, we anticipate its SGX share price to follow suit and expect continued strong performance and attractive returns for investors.

- Joint AI development project. Winking Studios entered a supplementary agreement with Acer for the second phase of their joint AI project to develop GenMotion.AI, a 3D animation generation tool. Acer will contribute US$200,000, with Winking providing resources. Both companies will share intellectual property 50/50 for any new inventions. GenMotion.AI converts text input into detailed 3D animations, enhancing efficiency and creativity for animators. GenMotion.AI leverages Winking’s proprietary, traceable training data, aiming to lead the way in AI adoption for digital art. The tool is expected to revolutionize workflows by improving visual quality, production speed, and ultimately, revenue per worker. This collaboration strengthens Winking’s position to handle more projects with tighter deadlines or larger projects, without the need for more manpower, unlocking significant growth potential.

- 1H24 results review. Total revenue for 1H24 increased by 7.1% YoY to US$15.23mn driven by strong growth in the Art Outsourcing Segment and Game Development segment, which saw a 6.6% and 8.1% rise respectively.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.35. Please read the full report here.

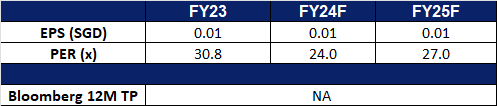

- Market Consensus.

(Source: Bloomberg)

People’s Insurance Company Group of China Ltd. (1339 HK): New stimulus measures

- BUY Entry – 3.85 Target – 4.35 Stop Loss – 3.60

- People’s Insurance Company Group of China Ltd is a holding company that mainly provides insurance products. The Company and its subsidiaries are mainly engaged in property insurance, health insurance, life insurance, reinsurance, Hong Kong insurance, pension insurance and operating insurance business. The property insurance business mainly includes providing property insurance products for companies and individuals, including motor vehicle insurance, agricultural insurance, property insurance and liability insurance. The health insurance business mainly includes health and medical insurance products. The life insurance business mainly includes life insurance products, including dividends, whole life, annuities and universal life insurance products. The Hong Kong insurance business includes property insurance business in Hong Kong, China. The pension insurance business includes business such as enterprise annuities and occupational annuities.

- New stimulus measures. China recently unveiled a series of measures designed to bolster the domestic stock market. Among these initiatives, the Chinese government plans to roll out the second phase of a pilot program in the first half of 2025, enabling insurance funds to make long-term equity investments. This phase will have a minimum scale of 100bn yuan ($13.7bn). The program permits insurance companies to establish securities investment funds dedicated to long-term stock market investments, with 50 bn yuan set to be approved before the Spring Festival to inject additional capital into the market. The program’s scope is expected to expand gradually over time. During the initial phase, which involved 50bn yuan, the funds achieved solid returns. These measures are poised to deliver sustained benefits to insurance companies in the long term.

- Expanding presence through partnerships. China People’s Property and Casualty Insurance Company (PICC P&C), a subsidiary of the People’s Insurance Company (Group) of China, has recently formed a strategic partnership with AXA Hong Kong & Macau and AXA Tianping P&C Insurance. This collaboration is centered on driving the growth of Hong Kong’s auto insurance market, with a particular focus on new energy vehicles (NEVs). By leveraging shared market insights, distribution channels, and technical expertise, the partnership aims to enhance insurance services for electric and other NEVs in the region. Key initiatives include expanding service offerings, developing innovative insurance products, and strengthening the companies’ market presence. Together, the three entities seek to combine their strengths to deliver superior solutions and support the evolving needs of Hong Kong’s auto insurance sector.

- 3Q24 results review. Revenue increased 28.5% YoY to RMB177.3bn in 3Q24, compared with RMB138.0bn in 3Q23. Net profit rose significantly to RMB13.6bn in 3Q24, compared to RMB622mn in 3Q23. Basic earnings per share significantly increased to RMB0.31 in 3Q24, compared to RMB0.01in 3Q23.

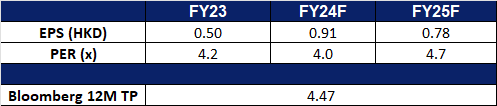

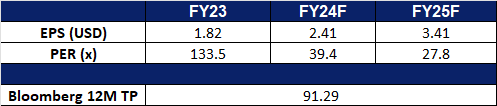

- Market consensus.

(Source: Bloomberg)

Tencent Holdings Ltd. (700 HK): Continued growth to come

- RE-ITERATE BUY Entry – 375 Target – 425 Stop Loss – 350

- Tencent Holdings Ltd is an investment holding company primarily engaged in the provision of value-added services (VAS), online advertising services, as well as FinTech and business services. The Company primarily operates through four segments. The VAS segment is mainly engaged in the provision of online games, video account live broadcast services, paid video membership services and other social network services. The Online Advertising segment is mainly engaged in media advertising, social and other advertising businesses. The FinTech and Business Services segment mainly provides commercial payment, FinTech and cloud services. The Others segment is principally engaged in the investment, production and distribution of films and television program for third parties, copyrights licensing, merchandise sales and various other activities.

- Potential new venture. Tencent Holdings Ltd. and the Guillemot family, owners of Ubisoft, are reportedly exploring a new venture that could redefine the global gaming industry. According to Bloomberg, discussions are underway about leveraging some of Ubisoft’s key assets to establish a joint venture, potentially allowing Tencent to acquire a stake while ensuring the Guillemot family retains control of Ubisoft. This initiative could significantly bolster Tencent’s presence in the international gaming market, particularly beyond China. By securing a stake in the venture, Tencent would gain greater influence over Ubisoft’s renowned portfolio of games and franchises, many of which have a substantial global fanbase.

- Upgrades to products. Tencent has introduced a major upgrade to its Tencent Meeting platform, incorporating several enhanced features. On the intelligence front, the company has unveiled the Tencent Meeting AI Assistant Pro, powered by its advanced Tencent Hyper-Generative Model. For organizational collaboration, the platform now offers improved capabilities, including the ability to add contacts, make calls, and select participants seamlessly. Additionally, all users can now create organizations within Tencent Meetings. The update also enables users to display certified identities externally, fostering greater trust in online communication. This upgrade is designed to boost online collaboration efficiency, delivering a smarter, more efficient, and user-friendly meeting experience.

- Continued focused on new growth opportunities in AI. In its latest earnings release, Tencent outlined plans to pursue new growth avenues by advancing the adoption of its proprietary Hunyuan large language model across various industries and enhancing its AI infrastructure for enterprise clients. The company emphasized that it is already realizing tangible benefits from integrating AI across its products and operations, including in areas like marketing services and cloud computing, and remains committed to investing in AI-driven technologies, tools, and solutions to support users and partners. Tencent is also exploring new overseas opportunities in cloud computing, aiming to leverage global demand for AI technology to counteract increasing competition in China, where both established players and startups are engaged in intense price competition. These initiatives could pave the way for additional growth in the coming years.

- 3Q24 results review. Revenue increased 8% YoY to RMB167.2bn in 3Q24, compared with RMB154.6bn in 3Q23. Net profit rose 47% to RMB54.0bn in 3Q24, compared to RMB36.8bn in 3Q23. Basic earnings per share was RMB5.762 in 3Q24, compared to RMB3.828 in 3Q23, representing a 51% YoY increase.

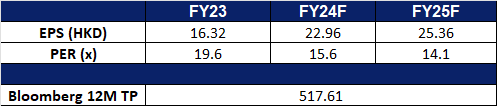

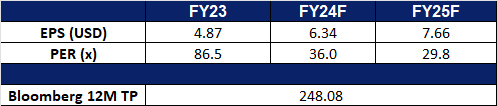

- Market consensus.

(Source: Bloomberg)

Ciena Corporation (CIEN US): Dominating the optical networking space

- BUY Entry – 93 Target – 105 Stop Loss – 87

- Ciena Corporation develops and markets communications network platforms, software, and offers professional services. The Company’s broadband access, data and optical networking platforms, software tools, and global network services support worldwide telecom and cable/MSO services providers, and enterprise, and government networks.

- Cloud and AI driven traffic. The company’s fourth-quarter earnings exceeded Wall Street expectations, with robust revenue and strong order flow highlighting the growing demand for cloud and AI-driven bandwidth across networks. As AI remains a central focus in the coming year, Ciena Corp. is well-positioned to capitalize on this trend, driving accelerated revenue growth and market share expansion. As a leading provider of networking systems and software services, Ciena stands to benefit significantly from the anticipated surge in AI-related traffic. Its expertise in optical networking, enabling high-speed data transmission over long distances, will be a key differentiator in modern telecommunications, where speed and reliability are critical. Additionally, Ciena’s advanced 1.6 Tb/s and 800G coherent Coherent-Lite pluggable solutions are designed to help cloud and data center providers manage the exponential growth in cloud, machine learning, and AI traffic. With major projects like the Stargate AI data center and other large-scale data center initiatives underway, Ciena is poised to see increased demand for its optical networking equipment and inventory management solutions, streamlining operations for its customers. Supported by substantial investments from cloud customers and telecom operators, Ciena’s growth prospects remain strong, solidifying its position as a key player in the AI and cloud infrastructure landscape.

- Secured new term loan. Ciena Corporation refinanced its existing senior secured term loan with a US$1.16bn loan maturing in October 2030. Proceeds from the new loan, along with cash, were used to fully repay the previous loan. The loan features quarterly amortization payments, a SOFR-based interest rate, and early repayment options. This refinancing aims to optimize Ciena’s capital structure and enhance financial flexibility while maintaining consistent terms with the prior agreement.

- Connectivity milestone achieved. Southern Cross Cable Limited has achieved a significant milestone by implementing the world’s first 1 Tb/s single-carrier wavelength across its 13,500 km transpacific network, utilizing Ciena’s cutting-edge WaveLogic 6 Extreme (WL6e) coherent optics. This groundbreaking achievement underscores the exceptional performance and scalability of Ciena’s technology in meeting the surging demands of today’s digital world. By leveraging WL6e, Southern Cross enhances its network capacity and efficiency, enabling it to deliver high-bandwidth services critical for AI, cloud computing, and video applications. This deployment demonstrates the power of Ciena’s technology to support the growing bandwidth needs of global connectivity.

- 4Q24 results. Ciena Corporation’s revenue declined slightly by 0.9% YoY to US$1.12bn in 4Q24 from US$1.13bn in 4Q23, above estimates by US$20mn. It delivered non-GAAP EPS of US$0.54, below estimates by US$0.0.11. The company repurchased approximately 2.1mn shares of common stock for the aggregate price of US$132mn during the quarter. The company maintains a long-term revenue growth target of 6-8% CAGR, driven by webscale and cloud provider market growth.

- Market consensus

(Source: Bloomberg)

Broadcom Inc (AVGO US): Orderbooks secured

- RE-ITERATE BUY Entry – 224 Target – 250 Stop Loss – 211

- Broadcom Inc. designs, develops, and supplies semiconductor and infrastructure software solutions. The Company offers storage adapters, controllers, networking processors, motion control encoders, and optical sensors, as well as infrastructure and security software to modernize, optimize, and secure the complex hybrid environments. Broadcom serves customers worldwide.

- Gaining AI market share. Broadcom is solidifying its role as a key AI hardware partner for hyperscale’s diversifying away from Nvidia. Its CEO revealed plans from three hyperscale customers to deploy one million XPU clusters each by 2027, with two more in advanced development. SK Hynix, a dominant HBM supplier, is scaling DRAM production by 70% in 2025 to meet surging demand from Broadcom and Nvidia, focusing on advanced HBM3E technology. Broadcom’s AI-driven semiconductor revenue reached US$30.1bn in 2024, reflecting a 220% YoY growth in AI revenue and highlighting its expanding influence in AI chip innovation.

- Continued innovation. Broadcom launched the Brocade G710, a 24-port 64G Fibre Channel SAN switch designed for small to mid-sized businesses. It offers low latency (460 ns), energy efficiency (65W), and scalability from 8 to 24 ports. Key features include cyber-resilient architecture, autonomous self-healing capabilities, and six nines (99.9999%) reliability. The G710 ensures robust data security with network isolation and root-of-trust validation. Backed by a lifetime warranty, it provides 24/7 support, firmware updates, and security patches, delivering a cost-effective solution for high-performance, secure, and reliable data canters.

- Data center growth prospects. According to JLL, global data center demand is expected to soar in 2025, with 10GW of capacity projected to break ground and 7GW expected to be completed. Market growth, driven by AI and advancements in semiconductors, is forecasted at a 15%–20% CAGR through 2027. AI workloads are driving higher power densities, with chips reaching up to 250kW per rack, though traditional workloads will remain significant, comprising over 50% of demand by 2030. The Biden administration has prioritized data center development, enabling the leasing of Department of Defense and Energy sites for gigawatt-scale AI projects. Developers are required to integrate sufficient clean energy resources to meet these facilities’ power demands. Additionally, a hyperscaler is planning 20 edge data centers across the US to reduce latency and improve redundancy. Globally, Spain will see two gigawatt-scale campuses developed through public-private partnerships, while Aligned Data Centers has raised US$12bn to fund its expansion. Macquarie Asset Management will invest US$5bn in Applied Digital, supporting its AI and HPC-focused facilities. Broadcom is well-positioned to benefit from this growth, offering solutions that optimize server speed, uptime, and storage connectivity, reducing the cost and complexity of hyperscale deployments. These developments will likely bolster its infrastructure software revenue as data center expansion accelerates globally.

- 4Q24 results. Broadcom’s revenue increased by 51% YoY to US$14.054bn in 4Q24, compared to US$9.295bn in 4Q23, driven by the successful integration of VMware and AI revenue growth. It delivered GAAP net income of US$4.324bn and non-GAAP net income of US$6.965bn for the fourth quarter. GAAP diluted EPS was US$0.90 and non-GAAP diluted EPS was US$1.42. The company also announced an increase in its quarterly common stock dividend by 11% YoY to US$0.59 per share. Looking ahead, Broadcom expects 1Q25 revenue of approximately US$14.6bn, an increase of 22% from the prior year period and an adjusted EBITDA guidance of approximately 66% of projected revenue.

- Market consensus

(Source: Bloomberg)

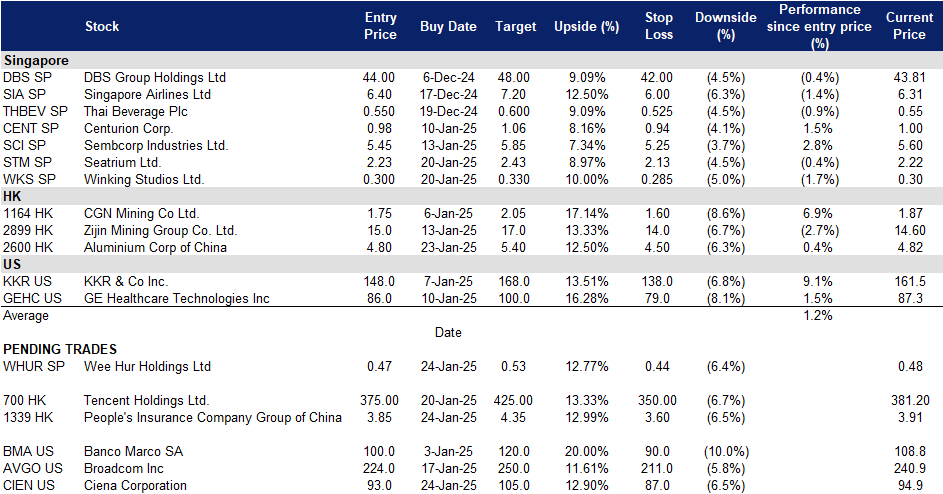

Trading Dashboard Update: Take profit on 3M Co (MMM US) at US$146, Intuitive Surgical Inc (ISRG US) at US$600 and ISOTeam Ltd (ISO SP) at S$0.061. Add Aluminium Corp of China (2600 HK) at HK$4.8.