02 August 2024: SATS Ltd (SATS SP), Prada S.P.A. (1913 HK), Toll Brothers Inc (TOL US)

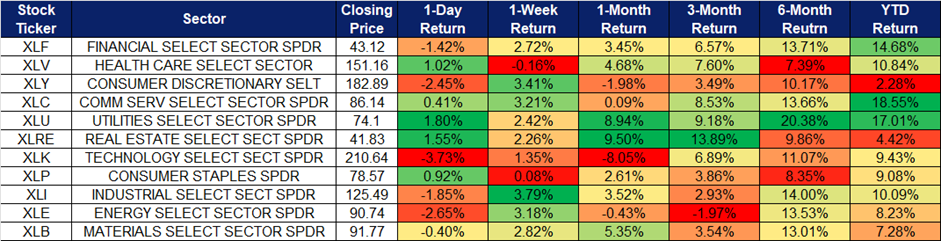

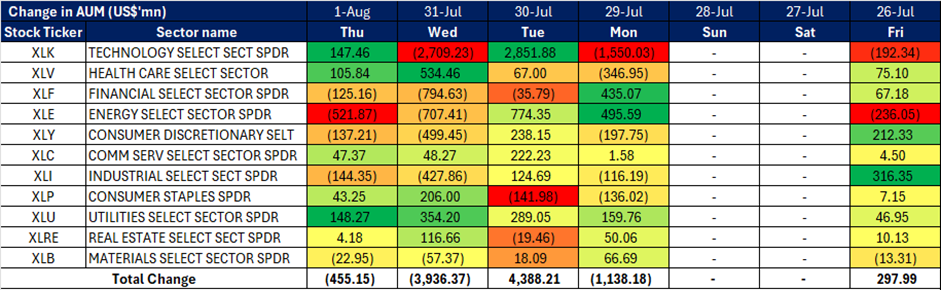

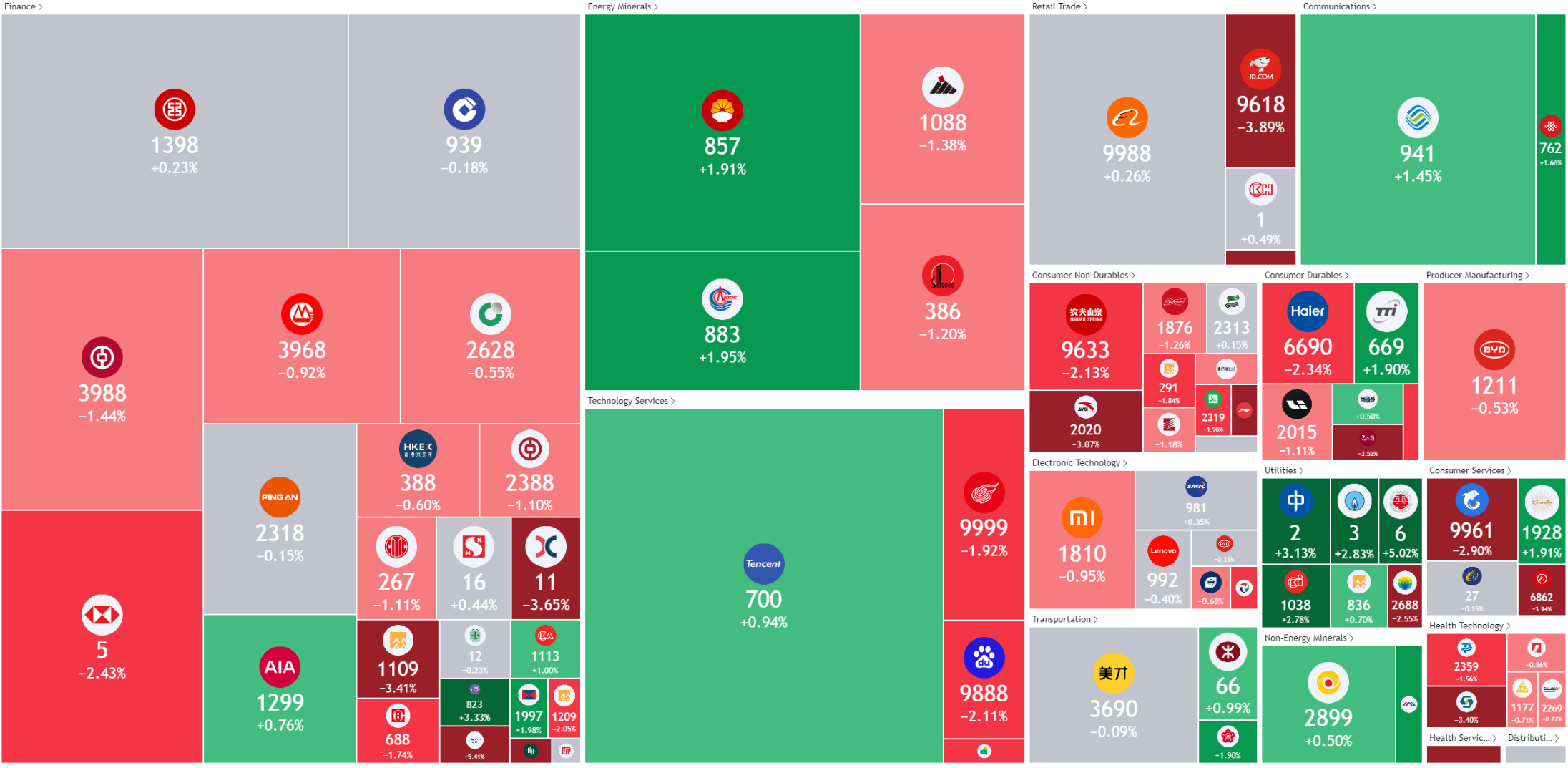

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

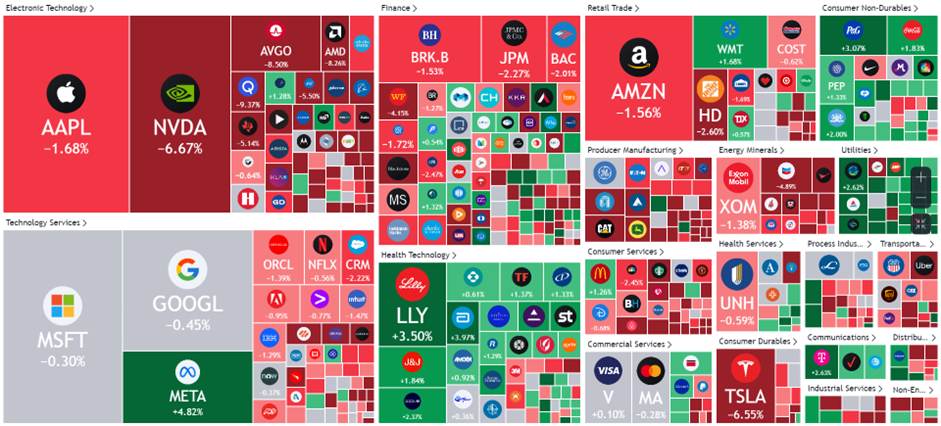

United States

Hong Kong

SATS Ltd (SATS SP): Service improvement amidst air travel recovery

- BUY Entry – 3.14 Target– 3.40 Stop Loss – 3.01

- SATS Ltd. provides gateway services and food solutions. The Company specializes in airfreight, ramp and baggage handling; passenger services; aviation security services; aircraft cleaning; and cruise centre management. It also provides airline catering; institutional catering; aviation laundry; and food distribution and logistics. SATS has presence across Asia and the Middle East.

- Partnership to expand food solutions business. SATS is partnering with Mitsui & Co to expand its food and retail solutions businesses. They created a subsidiary, Food Solutions Sapphire Holdings, for joint investments. Mitsui will invest S$36.4mn for a 15% stake in this subsidiary, which includes four of SATS’ food solutions entities. The collaboration aims to enhance the food value chain by leveraging Mitsui’s global network and SATS’ expertise. They plan to grow the food solutions business in key Asian markets, focusing on product development, kitchen production, and logistics. The partnership is already showing results, especially in Japan, with plans to supply frozen meals to Muji Japan by early 2025. This collaboration is expected to drive long-term growth for SATS.

- Self-driving buses on trial. Changi Airport will trial a self-driving bus for transporting workers in its restricted area starting in the third quarter of 2024. The agreement on 17 July, involving Changi Airport Group (CAG), Singapore Airlines Engineering Company (SIAEC), and Sats Airport Services, aims to boost manpower productivity through automation. The two-year proof of concept will be in two phases: a nine-month controlled environment test followed by a live operational test. A safety driver will be on board throughout both phases. This trial is part of broader efforts, including previous trials of autonomous baggage vehicles, to improve operational efficiency and reduce congestion at Changi Airport. The project is co-funded by the Civil Aviation Authority of Singapore. Successful implementation could potentially benefit SATS, by reducing manpower for its airside operations.

- Air passenger traffic not slowing. According to the International Air Transport Association, in 2024, the airline industry has recovered from the COVID-19 crisis, with total traffic surpassing 2019 levels in February. Domestic travel returned to pre-COVID levels in spring 2023, while international routes have also recently recovered. Most regions are expected to exceed 2019 levels in 2024, with Asia Pacific leading growth at 17.2% YoY. Over the next 20 years, global passenger journeys are expected to increase by an average of 3.8% annually, resulting in over 4 billion additional journeys by 2043 compared to 2023. This yearly rise in global travel will contribute to SATS revenue growth in the coming years.

- Business restructuring. SATS recently announced the division of its airport ground handling services into separate units for Singapore and the Asia-Pacific region to stimulate company growth. The restructuring of its Gateway Services business resulted in the creation of two new units: the Singapore Hub and Gateway Services Asia-Pacific. The Singapore Hub will focus on enhancing aviation hub competitiveness in Singapore, while Gateway Services Asia-Pacific will aim to expand the group’s market share by managing operations in overseas airports.

- FY24 results review. Total revenue rose by 192.9% YoY to S$5.15bn in FY24, compared to S$1.76bn in FY23. Core PATMI rose by 331.3% to S$78.5mn in FY24, compared to S$18.2mn in FY23. Basic EPS was 3.8 Scents in FY24, compared to -2.2 Scents in FY23.

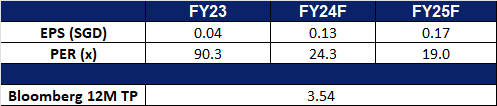

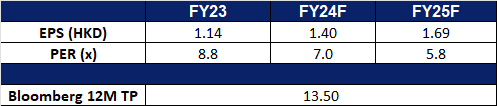

- Market Consensus.

(Source: Bloomberg)

Singapore Technologies Engineering Ltd (STE SP): Deepening collaborations and partnerships

- RE-ITERATE BUY Entry – 4.38 Target– 4.70 Stop Loss – 4.22

- ST Engineering Ltd is a global technology, defence, and engineering group. The Company uses technology and innovation to solve problems and improve lives through its diverse portfolio of businesses across the aerospace, smart city, defence, and public security segments. ST Engineering serves clients worldwide.

- Collaboration to boost Cybersecurity. SPTel, a joint venture between ST Engineering and SP Group, has launched its Quantum-Safe Services, enhancing its National Quantum-Safe Network Plus (NQSN+) by integrating advanced quantum encryption products from ST Engineering, Nokia, and Fortinet. This initiative aims to provide comprehensive network protection against quantum threats. Appointed by Singapore’s Infocomm Media Development Authority, SPTel and SpeQtral are developing Southeast Asia’s first quantum-safe infrastructure, supporting the nation’s Digital Connectivity Blueprint. The services, designed for compatibility with existing IT infrastructures, secure data across physical, data link, and network layers using Nokia’s DWDM, ST Engineering’s encryptors, and Fortinet’s next-generation firewall. This initiative addresses the emerging “harvest now, decrypt later” threat and aims to fortify cyber defences in critical industries such as healthcare and finance. As cyber threats continue to rise globally, the demand for such services will increase, which would be beneficial for the adoption of ST Engineering’s encryptors.

- Strong order book. ST Engineering’s order book remains robust, valued at $27.7bn as of its first quarter 2024 business updates. The company anticipates delivering $6.5bn worth of orders for the remainder of the year. In the first quarter of 2024, ST Engineering secured additional contracts totaling $3.0bn. This includes $839 mn in the commercial aerospace sector, $1,645mn in the defense and public security market, and $542mn in the urban solutions and satcom industry. These new contract wins, along with a consistently strong order book, highlight the sustained high demand for ST Engineering’s services.

- Deepening LEAP engine support for Safra Aircraft Engines. ST Engineering recently announced that its Commercial Aerospace business has deepened its support for Safran Aircraft Engines1 by entering into a two-year agreement, with an option for extension, to provide module repair offload support for the CFM LEAP-1A and LEAP-1B engines. Under the agreement, Safran Aircraft Engines will offload module repair work on the high pressure turbine (HPT) rotor assembly and stage 2 HPT nozzle assembly of the LEAP-1A and LEAP-1B engines to ST Engineering. This collaboration addresses the growing MRO demand for LEAP engines as operators ramp up their flying operations. ST Engineering’s offload support augments Safran Aircraft Engines’ MRO capacity and optimises the turnaround time of engine shop visits for customers. This agreement strengthens the partnership with Safran Aircraft Engines and support for LEAP engines operators, and well positions the company to address the rising demand for quick-turn and performance restoration shop visits for LEAP engines.

- 1Q24 results review. Revenue rose by 18% YoY to S$2,703mn in 1Q24, compared to S$2,289mn in 1Q23, driven by double-digit YoY growth in its commercial aerospace and defence and public security segments. In the first quarter, its commercial aerospace revenue and defence and public security revenue grew 32% YoY to S$1.2bn and 14% YoY to S$1.1bn respectively.

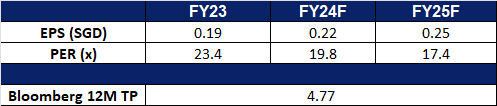

- Market Consensus.

(Source: Bloomberg)

Prada S.P.A. (1913 HK): Defying a luxury slowdown

- BUY Entry – 58.0 Target – 64.0 Stop Loss – 55.0

- Prada SpA is an Italy-based company engaged in fashion industry. The Company is a parent of the Prada Group. The Company, along with its subsidiaries, is engaged in the design, production and distribution of leather goods, handbags, clothing, eyewear, fragrances, footwear and accessories. Prada SpA manufactures jackets, trousers, skirts, dresses, sweaters, blouses, as well as perfumes and watches, among others. The Company trades its products through several brands, such as Prada, Miu Miu, The Church and The Car Shoe. Prada SpA operates in approximately 70 countries through directly operated stores, franchise operated stores, a network of selected multi-brand stores and department stores. Prada Spa operates through a numerous subsidiaries, including Artisans Shoes Srl, Angelo Marchesi Srl, Prada Far East BV, Tannerie Megisserie Hervy SAS and Prada SA, among others.

- Strong Miu Miu sales and a weak Japanese Yen. Sales at Miu Miu, Prada’s brand targeting younger consumers, surged 93% YoY, bucking the trend of a slowdown in the luxury goods market. Prada’s retail sales in Japan also grew by 55%, while sales in the wider Asia-Pacific region, including China but excluding Japan, increased by 12% during the same period. Japan, one of the world’s strongest luxury markets, has seen an influx of tourists attracted by a weaker yen, seeking bargains on luxury goods. The impressive results from Miu Miu and Prada’s robust sales in Japan underscore the company’s strong brand presence in the luxury market.

- Huge new store in Hong Kong. Prada is leasing an 8,000 sq ft store in K11 Musea, a luxury shopping mall by New World Development located on the harborfront. Construction for the two-floor store will begin soon, with an expected opening in early 2025. The rent is likely to be partly based on store sales. The affluent residents of Hong Kong are expected to provide stability for global brands amidst a sales slump in mainland China. As a popular destination for mainland tourists, this shopping hub will likely benefit Prada. This new store will be Prada’s first major new store in Hong Kong in years, after the company closed its flagship store in Causeway Bay back in 2020, ending one of the city’s most expensive retail leases with a monthly rent of HK$9mn.

- Topping Lyst Index. Miu Miu, an Italian high fashion women’s clothing and accessory brand and a fully-owned subsidiary of Prada, alongside Prada continued to top the Lyst Index in 2Q2024, coming in 2nd and 3rd place respectively. The Lyst Index is a quarterly ranking of fashion’s hottest brands and products. The formula behind The Lyst Index takes into account Lyst shoppers’ behaviours, including searches on and off the platform, product views, and sales. To track brand and product heat, the formula also incorporates social media mentions, activity, and engagement statistics worldwide, over three months. Miu Miu and Prada also top the Lyst Index in 1Q2024, coming in 1st and 2nd place respectively. Having consistently maintained high rankings over the past few quarters, this showcased the strength in Prada’s brand presence within the luxury market.

- 1H24 earnings. Revenue rose by 14.2% YoY at constant exchange rates to €2.55bn in 1H24, compared to €2.23bn in 1H23. Net income rose by 25.7% to €383.5mn in 1H24, compared to €305.2mn in 1H23. EPS rose to €0.150 in 1H24, compared to €0.119 in 1H23.

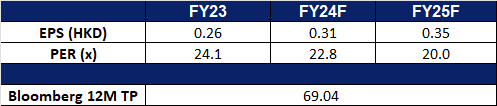

- Market consensus.

(Source: Bloomberg)

Dongfang Electric Corp Ltd. (1072 HK): Increased usage of renewable energy

- RE-ITERATE BUY Entry – 10.20 Target 11.20 Stop Loss – 9.70

- Dongfang Electric Corp Ltd is a China-based company mainly engaged in the manufacturing and sales of power generation equipment. The Company operates five major reporting segments: Clean and High-Efficiency Energy Equipment segment, Renewable Energy Equipment segment, Engineering and Trade segment, Modern Manufacturing Service Industry segment, and Emerging Growth Industry segment. The Company’s main products include water turbine generator sets, steam turbine generators, wind turbine generator sets, power station steam turbines and power station boilers as well as gas turbines. The Company distributes its products within the domestic market and to overseas market.

- Increasing use of renewable energy in China. China’s renewable energy utilization has reached or exceeded advanced international levels, demonstrating rapid progress in sustainable energy. The country has maintained strong momentum in renewable energy adoption, with a utilization rate of 97.6%, surpassing 95% for six consecutive years since 2018. Last year, newly installed renewable energy capacity rose to 290 million kW, 2.4 times that of 2022, accounting for 79% of the total new power generation capacity nationwide, making it the primary source of new power generation. This surge in capacity has spurred significant investments in solar, wind, and hydropower projects across the country. These efforts are part of China’s broader strategy to peak carbon emissions before 2030 and achieve carbon neutrality before 2060.

- Increased capacity. Dongfang Electric recently installed an 18 MW offshore wind turbine at a coastal test base in Shantou, Guangdong province. With a rotor diameter of 260 meters and a swept area of 53,000 square meters, this turbine can generate 72 GWh of electricity annually, sufficient to power approximately 36,000 households. Notably, this 18 MW offshore wind turbine is the largest of its kind currently installed in the world.

- Deal in Middle East. China’s Honghua Group, a subsidiary of Dongfang Electric, recently secured a contract with a major drilling company in the Middle East to deliver several 3000HP artificial island cluster well drilling rigs, valued at 1.5bn yuan. This contract highlights the global recognition of Honghua Group’s high-end smart drilling rigs and solidifies its leading position in the international market for advanced drilling technology. The drilling rigs, officially termed artificial island cluster well fast-moving smart drilling rigs, incorporate Honghua Group’s cutting-edge technology, integrating artificial intelligence with island cluster well drilling. This agreement signifies a milestone in the global expansion of China’s intelligent equipment and represents a significant achievement in high-quality Belt and Road cooperation, setting the stage for further international collaboration in the oil and gas industry.

- 1Q24 earnings. The company’s operating revenue rose to RMB15.1bn in 1Q24, +2.28% YoY, compared to RMB14.7bn in 1Q23. The company’s net profit fell by 11.1% YoY to RMB905.8bn, compared to RMB1.02bn in 1Q23. Basic earnings per share fell to RMB0.290 in 1Q24, compared to RMB0.327 in 1Q23.

- Market consensus.

(Source: Bloomberg)

Toll Brothers Inc (TOL US): Affluence appeal

- RE-ITERATE BUY Entry – 140 Target – 160 Stop Loss – 130

- Toll Brothers, Inc. builds luxury homes, serving both move-up and empty-nester buyers in several regions of the United States. The Company builds customized single and attached homes, primarily on land that it develops and improves. Toll Brothers also operates its own architectural, engineering, mortgage, title, security, landscape, insurance brokerage, and manufacturing operations.

- Favourable macro tailwinds. Interest rate cuts are expected in the second half of the year which would directly translate to reduced mortgage costs, making homeownership more affordable for prospective buyers. Consequently, this will stimulate housing demand and support property prices, benefiting the overall real estate sector.

- Wealth-focused strategy. Toll Brothers’ strategic focus on luxury homes, communities and prestigious locations has shielded it from the adverse effects of higher interest rates by capitalising on the preferences of high-net-worth individuals. The luxury real estate market in North America remains robust due to wealthy individuals diversifying their portfolios, and viewing luxury properties as stable, long-term investments. Despite high mortgage rates, a record number of luxury homes were bought in cash in early 2024, with demand exceeding supply, especially in desirable locations like major cities and coastal areas. Affluent buyers prioritize homes with extensive amenities, larger spaces, and features supporting their lifestyles, including work-from-home setups, gyms, and eco-friendly practices. The market is expected to evolve with changing consumer demands and technological advancements, maintaining strong long-term returns despite high purchase costs, as real estate provides security and a haven for families. A declining interest rate environment is expected to further bolster demand for luxury housing as a wealth preservation and appreciation asset, aligning with the company’s target market. The favourable long-term outlook for the luxury housing market will position Toll Brothers for continued sales growth and reinforce its market position in the luxury housing market.

- Demand and development not slowing down. Toll Brothers has purchased multiple large plots of land and properties in expensive regions for development, showing no signs of a slowdown in the luxury home market. The property developer most recently purchased a 22-acre site in Downingtown with plans to construct 89 townhouses and parcels at 1130 and 1136 Horseshoe Pike for US$6.23mn. Additionally, it also previously purchased Stone Meadows Farm for US$40.5mn and a 21-acre site for US$2.64mn with plans to construct a 55-plus community.

- 2Q24 earnings review. Revenue rose by 13.1% YoY to US$2.84bn, beat estimates by US$180mn. Non-GAAP earnings per shares was US$3.38 missing expectations by US$0.77. For Q3, the company expects deliveries of 2,750 to 2,850 units and average delivered price per home US$950,000 to US$960,000. For FY24, the company expects full-year deliveries of 10,400 to 10,800 units and average delivered price per home of US$960,000 to US$970,000.

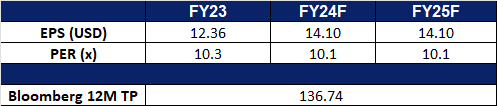

- Market consensus.

(Source: Bloomberg)

McDonald’s Corp (MCD US): Quick and cheap meal fix

McDonald’s Corp (MCD US): Quick and cheap meal fix

- RE-ITERATE BUY Entry – 250 Target – 280 Stop Loss – 235

- McDonald’s Corporation franchises and operates fast food chain. The Company offers various food products and soft drinks, and non alcoholic beverages. McDonald’s serves customers worldwide.

- Signs of recession benefitting defensive stocks. Recent US economic data points to a potential slowdown. While inflation is cooling, the labour market is softening, consumer spending and confidence are waning, and manufacturing is contracting. These factors have spurred concerns about a soft economic landing, leading to sharp corrections in growth sectors and a shift of investor funds towards more defensive assets.

- Favourable macro outlook. High inflation has increased McDonald’s operating costs. At the same time, fast food chain peers have begun price wars to increase market share. McDonald’s has already launched a US$5 set meal. Operating profits are expected to improve as inflation costs fall. In addition, the high interest rate environment has caused McDonald’s property valuations to fall. As the interest rate cut cycle begins, the company’s property valuation increases are expected to drive a rebound in the stock price. McDonald’s current dividend rate is 2.52%, and its attractiveness has increased during the interest rate cut cycle.

- 2Q24 earnings review. Revenue was flat YoY at US$6.5bn, missing estimates by US$130mn. Non-GAAP earnings per shares was US$2.97 missing expectations by US$0.10. For FY24, the company expects to open approximately 2,100 restaurants in the full-year, contributing nearly 2% to systemwide sales growth and expects approximately 5% net restaurant growth till 2027.

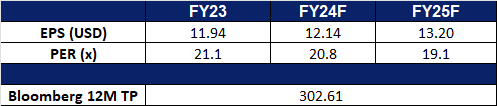

- Market consensus.

(Source: Bloomberg)

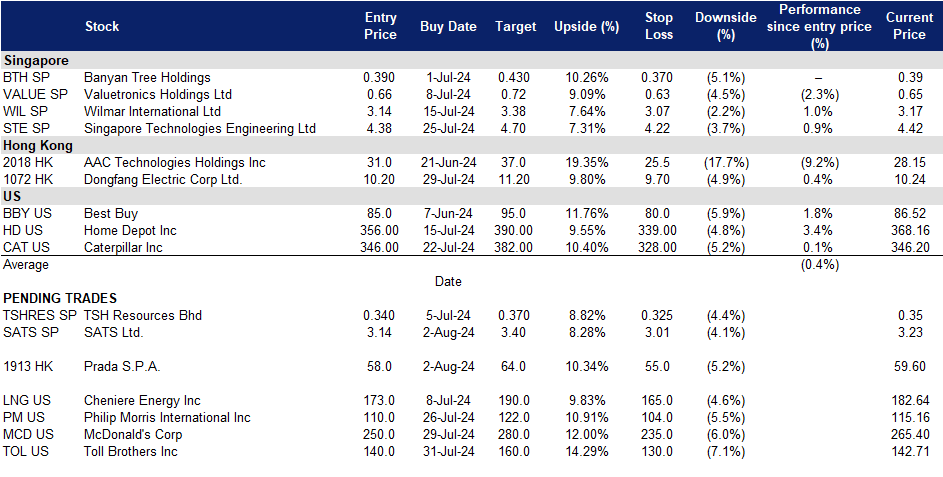

Trading Dashboard Update: Cut loss on Bumitama Agri Ltd (BAL SP) at S$0.71.