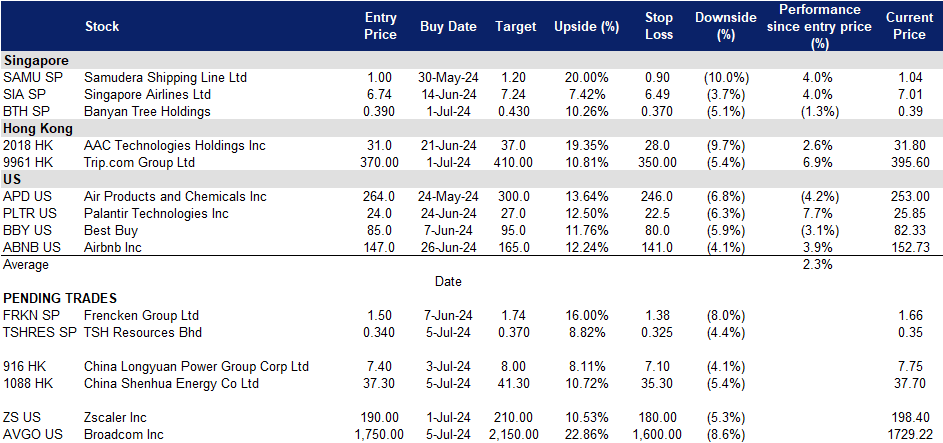

5 July 2024: TSH Resources Bhd (TSHRES SP), China Shenhua Energy Co Ltd (1088 HK), Broadcom Inc (AVGO US)

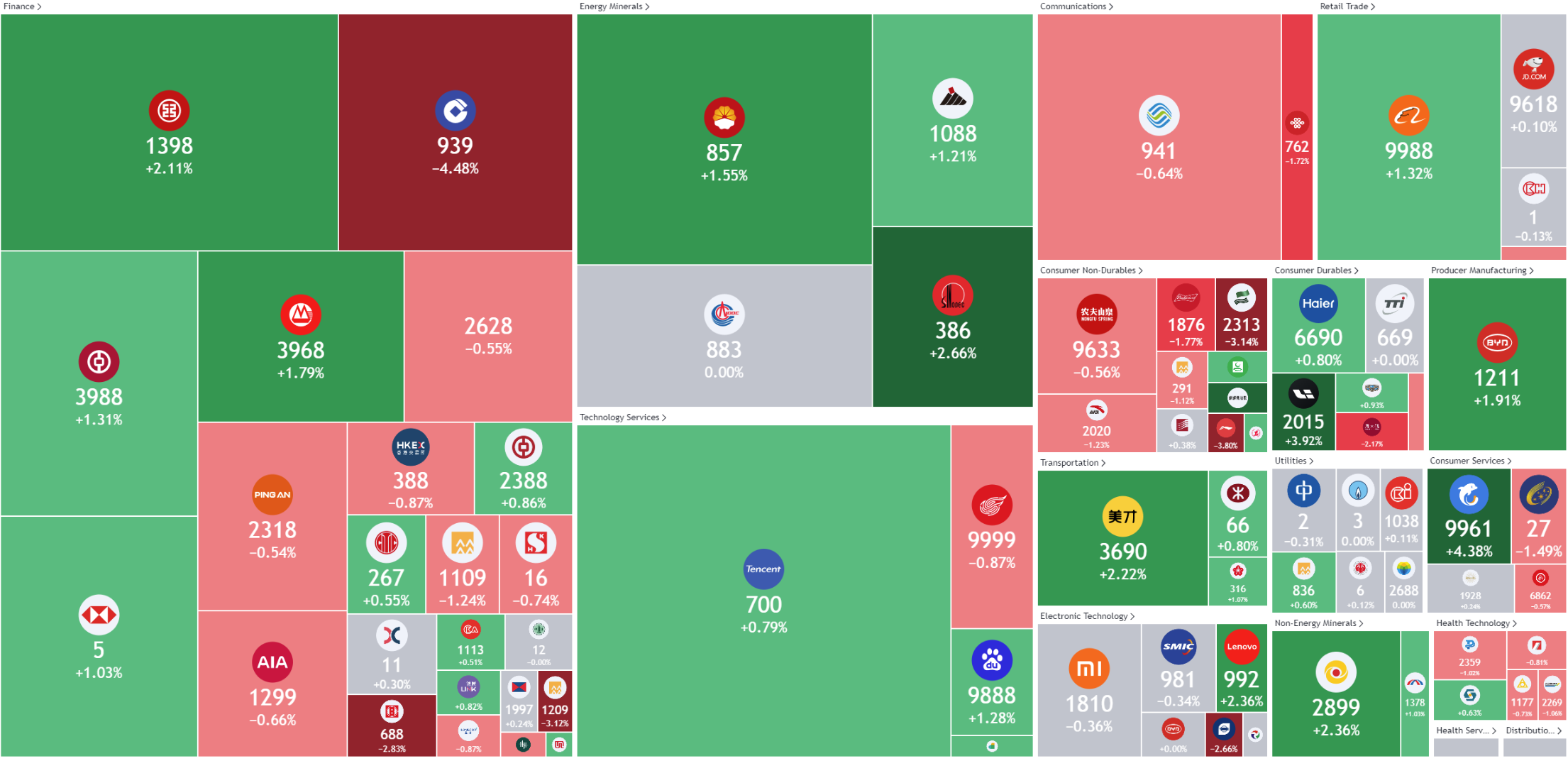

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

Hong Kong

TSH Resources Bhd (TSHRES SP): Palm oil demand to rise

- BUY Entry – 0.340 Target– 0.370 Stop Loss – 0.325

- TSH Resources Berhad operates as a holding company. The Company, through its subsidiaries, engages in cultivating, processing, and refining oil palm. TSH Resources serves customers in Malaysia, Singapore, and Spain.

- Palm oil usage in Mala. Malaysia is aiming to boost its palm oil exports by promoting its use in China’s popular mala hotpot, especially during Chinese Premier Li Qiang’s visit to Malaysia. As the world’s second-largest palm oil producer, Malaysia seeks to diversify its market amidst potential EU sanctions over deforestation concerns. China, the second-largest importer of Malaysian palm oil, could significantly increase its demand with nearly 400,000 hotpot restaurants. Malaysia has partnered with Chinese enterprises to integrate palm oil into the hotpot industry, emphasizing its suitability for high-heat cooking. This initiative aligns with Malaysia’s ongoing efforts to promote sustainable palm oil through its Malaysian Sustainable Palm Oil (MSPO) certification, aiming to counter the deforestation narrative and enhance market acceptance in China. The increase in palm oil exports will be beneficial to TSH Resources, boosting its top lines.

Malaysian Crude Palm Oil Spot Price Chart

(Source: Bloomberg)

- Palm oil price. Malaysian palm oil futures rose for the second session in a row despite lower export estimates for June 1-20. The benchmark contract for September delivery increased by MYR37, or 0.94%, closing at MYR3,957 per metric ton. Trading ranged between MYR3,901 and MYR3,966 per metric ton. Estimated exports dropped between 8.1% to 12.9% MoM, according to Intertek Testing Services and AmSpec Agri Malaysia. However, Societe Generale de Surveillance estimated higher exports of 737,717 metric tons for June 1-20, up from 647,353 metric tons in the previous period. In related markets, soyoil prices on the Dalian Commodity Exchange and the Chicago Board of Trade (CBoT) also saw gains. Palm oil prices are influenced by movements in related oils due to their competition in the global market. The continued rise in palm oil prices will also lead to an increase in TSH Resources sales for the year.

- 1Q24 results review. 1Q24 Revenue for the year fell by 3.2% YoY to MYR242.4mn from the previous MYR250.3mn in 1Q23. Net profit fell by 33.6% to MYR25.2mn from MYR37.9mn. Basic EPS fell to 1.45 sen in 1Q24, compared to 2.13 sen in 1Q23.

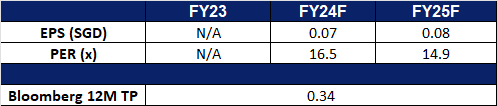

- Market Consensus.

(Source: Bloomberg)

Banyan Tree Holdings Ltd (BTH SP): Summer seasonality

- RE-ITERATE BUY Entry – 0.390 Target– 0.430 Stop Loss – 0.370

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Upcoming summer holidays. Tourism levels are expected to rise during the upcoming summer season. Many airlines have already increased the number of international flights to meet the heightened travel demand. Sporting events like UEFA Euro 2024 and the Paris 2024 Olympic Games have sparked significant interest in summer travel to Europe. Year-over-year growth in flight and hotel bookings has been substantial in these popular destinations. The Paris government anticipates 15 million visitors between late July and early September due to the Paris 2024 Olympic Games. According to digital booking site Hopper, airfares for flights from the U.S. to Paris during the weekend of the opening ceremony average about $877 per ticket, reflecting the increased interest in summer travel.

- Increasing market presence. Banyan Tree recently announced the upcoming opening of Banyan Tree Higashiyama Kyoto in the third quarter of 2024. The new property will feature 52 guestrooms, a signature Banyan Tree Spa, and two distinctive dining experiences. This addition enhances Banyan Tree Holdings’ portfolio, which includes over 80 hotels and resorts, more than 60 spas and galleries, and 14 branded residences in more than 20 countries. Additionally, the company was appointed to manage a new luxury island retreat in Bimini, Bahamas. These expansions underscore Banyan Tree’s capabilities as a global hospitality brand.

- 1Q24 results review. Revenue increased 38.8% to 1.90bn Baht in 1Q24, compared to 1.37bn Baht in 1Q23. FY24 net profit to 289.9mn Baht in 1Q24, compared to 65.3mn Baht in 1Q23. EPS rose to 1.65Baht in 1Q24, compared to 0.38Baht in 1Q23.

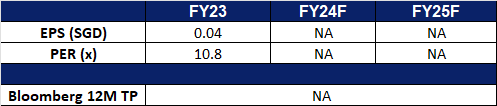

- Market Consensus.

(Source: Bloomberg)

China Shenhua Energy Co Ltd (1088 HK): Extreme summer heat

- BUY Entry – 37.3 Target 41.3 Stop Loss – 35.3

- China Shenhua Energy Co Ltd is a China-based comprehensive energy company. The Company operates its businesses through six segments. The Coal Business segment is engaged in coal mining and sales of surface and underground coal mines. The Power Generation Business segment is engaged in coal power generation, wind power generation, hydropower generation, gas power generation and power sales business. The Railway Business segment provides railway transportation services. The Port Business segment provides port cargo handling, handling and storage services. The Shipping Business segment provides shipping and transportation services. The Coal Chemical Business segment is engaged in the manufacturing and sales of olefin products. The Company conducts its businesses both in the domestic market and overseas markets.

- Extreme summer heat to persist. China’s weather agency recently reported that they expect extreme heat to persist across the country this summer as climate change pushes global temperatures higher, with a large part of northern China already being baked by heatwaves since the start of the summer season. The weather agency expects average temperatures to rise and the occurrence of high-temperature weather will tend to be more frequent, edging 1 to 2 degrees Celsius higher than normal in Zhejiang, Jiangxi, Hunan, Fujian, Guangdong, and Gansu provinces, as well as the regions of Guangxi and Ningxia. The country saw an average of 2.6 high-temperature days in June, the fourth-highest figure since records began in 1961, and saw heat records at 20 local weather stations breaking historical records.

- Increasing electricity demand. In 2024, China is projected to generate 9.96tn kilowatt hours (kWh) of power, as per the National Energy Administration, reflecting a growth rate of 5.3%. The International Energy Agency predicts a 5.1% rise in electricity demand, while the China Electricity Council anticipates a 6% increase, surpassing GDP forecasts. Additionally, extreme heat over the current summer season is expected to further boost electricity demand as consumers turn to air conditioning to escape the rising temperatures. This expectation of higher electric demand is likely to translate into a higher demand for coal for power generation.

- Coal stockpiling. China, the world’s biggest investor in and generator of wind and solar power has been stocking up on coal in anticipation of peak demand during the summer. Bloomberg recently reported that China has accumulated inventories of 162mn tons of coal over the first 5 months of the year, with the increase coming from both domestic products and imports. Strong levels of coal inventories also highlight a continued strong demand for thermal coal, which will benefit China Shenhua Energy.

- 1Q24 results review. Revenue 0.7% YoY to RMB87.65bn in 1Q24, compared with RMB87.04bn in 1Q23. Net income fell by 14.1% to RMB17.76bn in 1Q24, compared to RMB20.68bn in 1Q23. Earnings per share was RMB0.89 in 1Q24, compared to RMB1.04 in 1Q23.

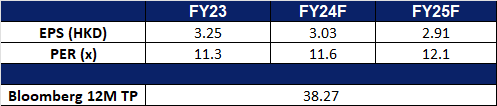

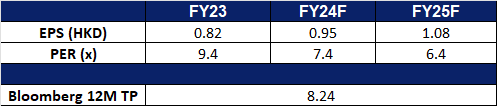

- Market consensus.

(Source: Bloomberg)

China Longyuan Power Group Corp Ltd. (916 HK): Going green

- RE-ITERATE BUY Entry – 7.40 Target 8.00 Stop Loss – 7.10

- China Longyuan Power Group Corp Ltd is a China-based company mainly engaged in power sales business. The company operates three segments. Wind Power segment constructs, manages and operates wind power plants and produces electricity and sells it to grid companies. Coal Power segment constructs, manages and operates coal-fired power plants and produces electricity and sells it to power grid companies. All Others segment is mainly engaged in manufacturing and selling power generation equipment, providing consulting services, providing maintenance and training services to wind power enterprises and other renewable energy power generation and sales.

- Launch of wind-fishery integrated floating platform. The world’s first wind-fishery integrated floating platform, was put into operation in Fujian province last week, with China Longyuan Power Group Corp being the operator. The new wind-fishery integrated floating platform, pioneering a new marine economic development model that combines underwater fish farming and above-water power generation in the field of floating offshore wind power, will take better advantages of the marine resources. The electricity generated by the offshore wind turbine will also ensures the safe and stable operation of the aquaculture equipment, solving the common problems of “insufficient power supply and unstable power supply” in traditional marine ranching.

- Transition to green energy. China’s power storage capacity is poised for significant growth, driven by rapid advancements in renewable energy, innovative technologies, and ambitious government policies promoting sustainable development. For the first 5 months of 2024, China has consumed over 180bn kWh of green electricity, representing a three fold increase YoY, according to the China Electricity Council. China has become a leader in renewable energy adoption, particularly focusing on enhancing its energy storage capabilities. In the first quarter of 2024, the nation’s energy storage capacity expanded substantially, with installed new-type energy storage reaching 35.3 gigawatts by the end of March, a 2.1-fold increase YoY. The surging demand for energy storage solutions, essential for integrating intermittent renewable sources like wind and solar into the power grid, has spurred extensive investments in storage projects nationwide. This momentum is expected to continue, positioning China to dominate the global energy storage market in the coming years.

- Offloading of Jiangyin Sulong. China Longyuan Power Group recently announced plans to dispose of 27% of its holdings in Jiangyin Sulong Heat and Power Generating for 1.32bn yuan. While the transaction will decrease the Chinese power company’s installed capacity by 1,240.76 megawatts, the deal will also raise the company’s net profit by 297mn yuan.

- 1Q24 results review. Revenue increased 0.10% YoY to RMB9.88bn in 1Q24, compared with RMB9.87bn in 1Q23. Net income rose by 1.3% to RMB2.76bn in 1Q24, compared to RMB2.72bn in 1Q23. Earnings per share was RMB0.329 in 1Q24, compared to RMB0.325 in 1Q23.

- Market consensus.

(Source: Bloomberg)

Broadcom Inc (AVGO US): Next to join the trillion-dollar club / Incoming stock split

- BUY STOP Entry – 1,750 Target –2,150 Stop Loss – 1,600

- Broadcom Inc. designs, develops, and supplies semiconductor and infrastructure software solutions. The Company offers storage adapters, controllers, networking processors, motion control encoders, and optical sensors, as well as infrastructure and security software to modernize, optimize, and secure the most complex hybrid environments. Broadcom serves customers worldwide.

- VMware innovation. Broadcom recently introduced VMware Cloud Foundation 5.2, which offers streamlined innovation with modern infrastructure and enhanced developer productivity. The new updates support faster infrastructure modernisation, improved developer productivity, and better cyber resiliency and security with a low total cost of ownership. The latest advancements include VCF Import functionality, capabilities for supporting VM and containerised workloads on a single platform, and integrated data services capabilities. VMware vSphere Foundation is the next evolution of the VMware vSphere solution, designed to support modern IT requirements by boosting operational efficiency, elevating security, and supercharging workload performance. Both VMware Cloud Foundation 5.2 and VMware vSphere Foundation 5.2 are expected to be available in Broadcom’s fiscal third quarter, which would boost its second-half sales.

- Expecting AI spending boom. Market analysts recently predicted increased capital expenditure, on AI capabilities for mega-cap tech firms this year. They project Alphabet, Meta and Amazon to boost spending by 43% to US$91bn on servers and equipment. With plans to enhance their AI prowess and possibly introduce new products, the estimated expenditures across these firms are expected to rise 35% YoY to US$145bn. This upswing in spending is expected to benefit chipmakers over the next few years. Additionally, according to Bain & Company’s survey of 200 US companies with at least US$5mn in revenue, corporations from other industries are also looking to adopt AI in the coming years, with language generation and software coding being the most common AI applications to prioritise. These companies have reported spending an average of US$5mn a year on generative AI. Therefore, Broadcom’s strong position in the AI semiconductor market presents an attractive opportunity for investors amidst soaring demand for AI semiconductors.

- Good results, better guidance. Broadcom recently released its second-quarter earnings and revenue results beating estimates. It raised its annual revenue forecast for AI-related chips by 10% to US$11bn for FY24. The company benefiting from increased investment in AI applications like OpenAI’s ChatGPT, recorded US$3.1bn in AI product revenue in Q2. The company also announced a 10-for-1 stock split to make shares more accessible to retail investors, effective 15 July. Broadcom’s semiconductor solutions segment revenue grew by 6% YoY to US$7.20bn, and its infrastructure software revenue more than doubled, partly due to acquiring VMware. Broadcom’s full-year revenue forecast increased by US$1bn to US$51bn, alongside higher profit projections. Looking ahead, with continued global AI integration in corporations, the demand for its products and services will also increase, benefitting Broadcom’s sales.

- 2Q24 earnings review. Revenue grew by 43.1% YoY to US$12.49bn, beating estimates by US$480mn. Non-GAAP EPS was US$10.96, beating estimates by US$0.12. FY24 revenue guidance of approximately US$51.0bn and adjusted EBITDA of 61% of projected revenue.

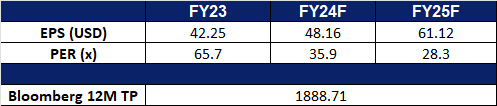

- Market consensus.

(Source: Bloomberg)

Zscaler Inc (ZS US): Demand for cybersecurity

- RE-ITERATE BUY Entry – 190 Target –210 Stop Loss – 180

- Zscaler, Inc. operates as a security software company. The Company offers cloud-based platform that provides web and mobile security, threat protection, cloud application visibility, and networking solutions. Zscaler serves clients worldwide.

- Partnership with Nvidia. Zscaler has announced a collaboration with NVIDIA to enhance enterprise security and user experience using AI-powered copilot technologies. This partnership will enable Zscaler to leverage NVIDIA AI technologies to process over 400 billion transactions daily from its Zero Trust Exchange platform. The collaboration introduces new AI capabilities, including NVIDIA NeMo Guardrails and the NVIDIA Morpheus framework, to defend against cyber threats and simplify IT and network operations. The Zscaler ZDX Copilot, in collaboration with NVIDIA NeMo Guardrails, offers insights into network, device, and application performance, simplifying IT support and operations on a larger scale. Additionally, Zscaler will utilize Nvidia’s Morpheus framework and Nvidia NIM inference microservices to deploy predictive and generative AI solutions, including the Zscaler ZDX Copilot with NVIDIA Morpheus and the Zscaler ZDX Copilot with Nvidia NIM, which can help to accelerate threat detection and the deployment of generative AI models.

- Relationship between AI and cybersecurity. In the first half of 2024, there was a notable increase in funding for cybersecurity startups, particularly those that utilize generative AI. This bounce-back comes after a decrease in early-stage funding deals in 2023. Venture capital investment in cybersecurity is once again on the rise, with a specific focus on AI-driven solutions for threat management and access control. Both attackers and defenders are increasingly using AI in cybersecurity, indicating a shift in the industry. As AI continues to advance, its impact on cybersecurity becomes significant for both attackers and defenders. AI allows cyber threats to conduct more successful large-scale phishing campaigns and use deepfakes for deception. In cyber defence, AI-driven security systems offer a proactive approach to threat detection by analysing patterns and predicting potential vulnerabilities. The rapid advancement of AI introduces new complexities to cybersecurity, requiring more investments in AI cyber defence to counteract modern cyber risks.

- 3Q24 earnings review. Revenue grew by 32.1% YoY to US$553.2mn, beating estimates by US$17.11mn. Non-GAAP EPS was US$0.88, beating estimates by US$0.23. 4Q24 revenue is expected to be between US$565mn to US$567mn vs consensus of US$564.98mn. Non-GAAP EPS is expected to be US$0.69 to US$0.70 vs consensus of US$0.67. FY24 revenue to be approximately US$2.140bn to US$2.142bn vs consensus of US$2.21B and Non-GAAP EPS to be between US$2.99 to US$3.01 vs consensus of US$2.76.

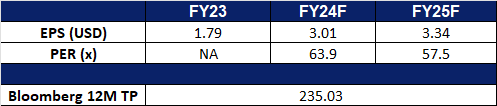

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Singapore Telecommunications Ltd (ST SP) at S$2.88. Cut loss on Samsonite International S A (1910 HK) at HK$22.9.