7 November 2024: Wealth Product Ideas

Key Topics from Trump Trades

Under a rules-based methodology, the ETFs mentioned below seek to include companies that are highly supportive of Republicans. With Trump being elected as the next U.S. President, these ETFs, focused on Trump-related stocks are likely to benefit from possible Trump trade themes as mentioned below:

Economic Reshoring – Trump has consistently pushed for bringing manufacturing jobs back to the U.S., aiming to reduce dependency on foreign markets. This could boost domestic employment and economic resilience, though it may strain trade relationships.

Trade Policy – Known for prioritizing “America First,” Trump may increase tariffs and negotiate stricter trade agreements, potentially reshaping international commerce but also risking retaliatory measures from other countries.

Immigration and Border Security – Trump has pledged to complete the U.S.-Mexico border wall, strengthening border security to curb illegal immigration and what he describes as the flow of drugs and crime across borders. Policies under a Trump administration would likely include stricter visa restrictions, aggressive deportation of undocumented immigrants, and limits on asylum, positioning immigration as a key national security issue.

Military and Security – Trump’s approach could see increased defense spending and a reassessment of U.S. involvement in foreign conflicts. While this may bolster national security, it could create tensions with allied countries that rely on U.S. support.

Energy Independence – Advocating for domestic energy production, Trump’s policies might drive a renewed focus on fossil fuels and reduced regulation on U.S. energy sectors. This could benefit local economies but raise concerns around environmental impact and climate commitments.

Social Policy and Education – Advocating for free speech on campuses and in public institutions, Trump is likely to target what he sees as “cancel culture” and censorship, especially in social media and mainstream media. Trump’s education policy includes promoting school choice, cutting federal control over education, and banning critical race theory from public education.

Cryptocurrencies – Trump used to be sceptical about cryptocurrencies, however, he repositioned himself as a pro-crypto presidential candidate in June this year. He declared that he wanted the U.S. to become the “crypto capital of the planet” and the Bitcoin “superpower of the world”. Trump’s crypto venture, World Liberty Financial, has launched its native token in October, and it plans to launch its own stablecoin, which is designed to peg 1 to 1 to the value of the USD.

Healthcare – Rather than supporting expanded government-funded healthcare, Trump advocates for market-driven healthcare reforms, which may include expanding health savings accounts, lowering prescription drug costs, and promoting private healthcare options.

|

Fund Name (Ticker) |

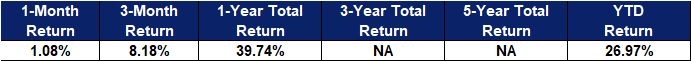

God Bless America ETF (YALL US) |

|

Description |

The God Bless America ETF seeks capital appreciation. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 5 Nov) |

10,363 |

|

Net Assets of Fund (as of 4 Nov) |

$81,510,000 |

|

12-Month Yield (as of 5 Nov) |

2.76% |

|

P/E Ratio (as of 5 Nov) |

30.17 |

|

P/B Ratio (as of 5 Nov) |

5.19 |

|

Expense Ratio (Annual) |

0.65% |

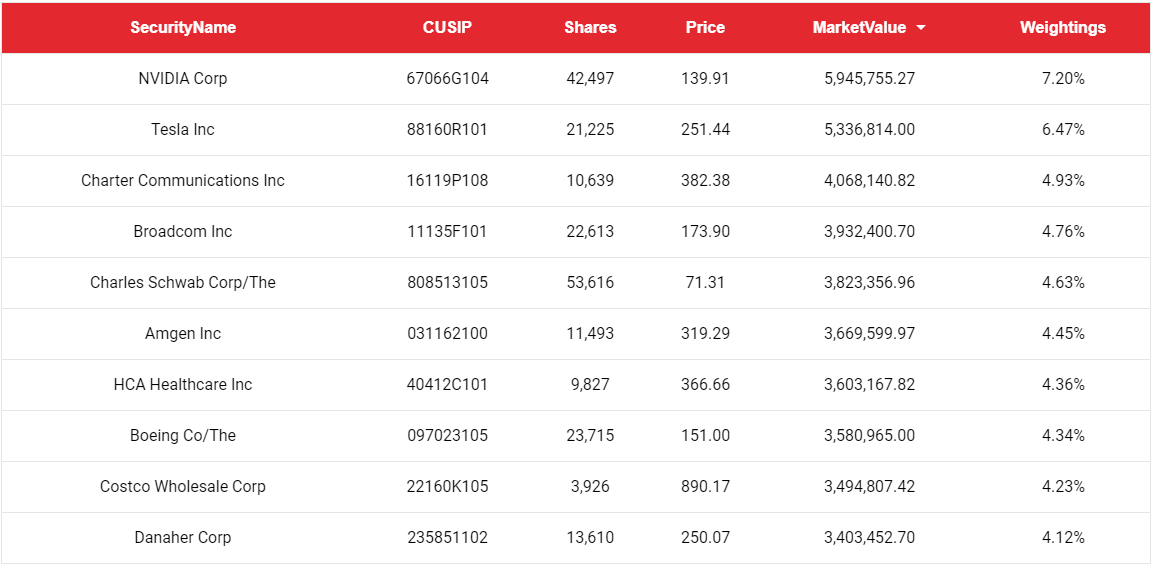

Top 10 Holdings

(as of 6 November 2024)

(Source: Bloomberg)

|

Fund Name (Ticker) |

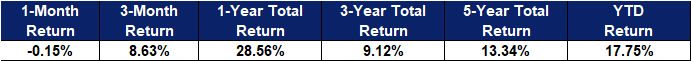

Point Bridge America First ETF (MAGA US) |

|

Description |

The innovative strategy behind the MAGA ETF that allows you to invest in companies that align with your Republican political beliefs. The MAGA Index is made up of 150 companies from the S&P 500 Index whose employees and political action committees (PACs) are highly supportive of Republican candidates. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 05 Nov) |

1669 |

|

Net Assets of Fund (as of 05 Nov) |

$24,596,300 |

|

12-Month Yield (as of 05 Nov) |

30.64 |

|

P/E Ratio (as of 05 Nov) |

20.913 |

|

P/B Ratio (as of 05 Nov) |

2.954 |

|

Expense Ratio (Annual) |

0.72% |

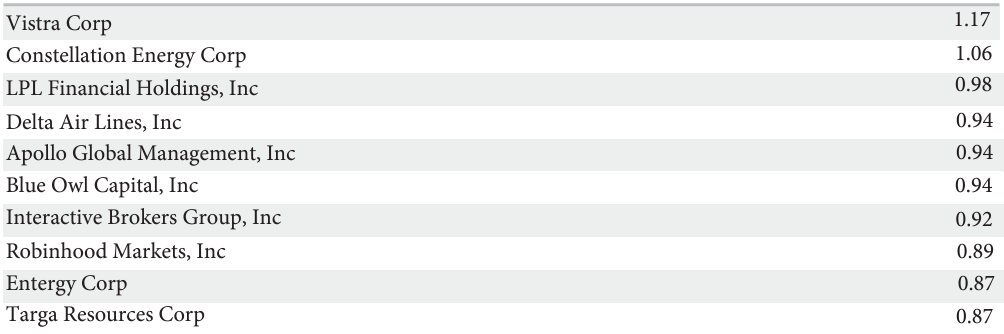

Top 10 Holdings

(as of 31 October 2024)

(Source: Bloomberg)