3 April 2025: Investment Product Ideas

SPDR Portfolio S&P 500 Value ETF (SPYV US)

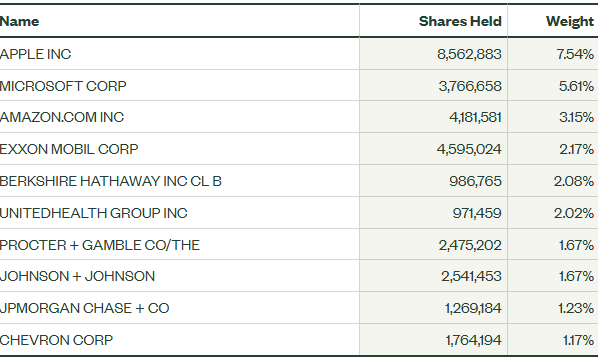

- Focus on U.S. large-cap value stocks. The ETF holds U.S. large-cap value stocks, including Apple Inc., Microsoft, Amazon.com, Exxon Mobil, and Berkshire Hathaway. The top 10 holdings account for approximately 28.53%, making it suitable for investors seeking broad exposure to value-driven growth opportunities.

- Diversified sector exposure. By tracking the S&P 500 Value Index, this ETF offers broad market coverage while reducing the risk of overconcentration in any single sector. It focuses on S&P 500 constituents that exhibit strong value characteristics.

- Low expense ratio. This ETF has an expense ratio of 0.04%, placing it among the lower-cost options in its category. It offers cost efficiency and helps investors reduce overall investment expenses.

|

Fund Name (Ticker) |

SPDR Portfolio S&P 500 Value ETF (SPYV US) |

|

Description |

The SPDR® Portfolio S&P 500® Value ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P® 500 Value Index (the “Index”). A low cost ETF that seeks to offer exposure to S&P 500 companies that could be undervalued relative to the broader market. The Index contains stocks that exhibit the strongest value characteristics based on: book value to price ratio; earnings to price ratio; and sales to price ratio. One of the low cost core SPDR Portfolio ETFs, a suite of portfolio building blocks designed to provide broad, diversified exposure to core asset classes. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 1 Apr) |

2,668,642 |

|

Net Assets of Fund (as of 31 Mar) |

$25,233,640,000 |

|

12-Month Yield (as of 31 Mar) |

2.14% |

|

P/E Ratio (as of 31 Mar) |

18.15x |

|

P/B Ratio (as of 31 Mar) |

3.15x |

|

Expense Ratio (Annual) |

0.04% |

Top Holdings

(as of 31 March 2025)

(Source: Bloomberg)

Vanguard Value ETF (VTV US)

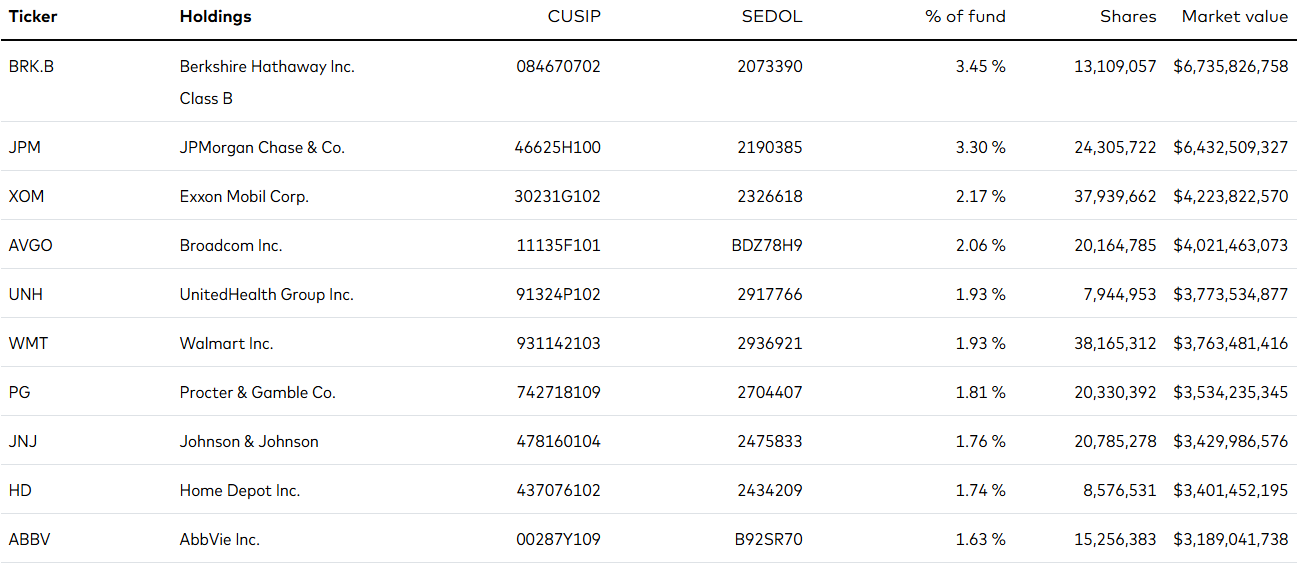

- Focus on U.S. large-cap value stocks. The ETF holds U.S. large-cap value stocks, including Berkshire Hathaway, JP Morgan, Exxon Mobil, Broadcom, United Health Group, and Walmart. The top 10 holdings account for approximately 21.78%, making it suitable for investors seeking broad exposure to value-driven growth opportunities.

- Diversified sector exposure. By tracking the S&P 500 Value Index, this ETF offers broad market coverage while reducing the risk of overconcentration in any single sector. It focuses on S&P 500 constituents that exhibit strong value characteristics.

- Low expense ratio. This ETF has an expense ratio of 0.04%, placing it among the lower-cost options in its category. It offers cost efficiency and helps investors reduce overall investment expenses.

|

Fund Name (Ticker) |

Vanguard Value ETF (VTV US) |

|

Description |

The Vanguard Value ETF seeks to track the performance of the CRSP US Large Cap Value Index, which measures the investment return of large-capitalization value stocks. The ETF provides a convenient way to match the performance of many of the nation’s largest value stocks, and follows a passively managed, full-replication approach. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 1 Apr) |

2,833,589 |

|

Net Assets of Fund (as of 01 Apr) |

$172.34bn |

|

12-Month Yield (as of 01 Apr) |

2.276% |

|

P/E Ratio (as of 01 Apr) |

21.97x |

|

P/B Ratio (as of 01 Apr) |

3.11x |

|

Expense Ratio (Annual) |

0.04% |

Top Holdings

(as of 28 February 2025)

(Source: Bloomberg)