29 May 2025: Investment Product Ideas

SPDR Gold MiniShares ETF (GLDM US)

- Strong Liquidity; Third Largest Gold Trust ETF After GLD and IAU. Among Gold-backed ETFs, GLDM ranks as the third largest by assets under management, offering relatively strong liquidity compared to peers.

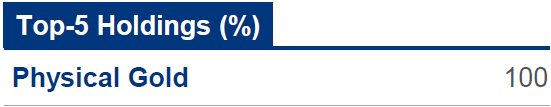

- Backed by Physical Gold. This ETF tracks the LBMA Gold Price PM. Unlike gold mining stock ETFs, which are exposed not only to fluctuations in gold prices but also to company-specific operational risks, this gold trust ETF tends to exhibit lower volatility. As such, it is often used as a hedge against inflation and market uncertainty, making it a suitable choice for investors seeking capital preservation in times of economic instability.

- Low Expense Ratio. With an expense ratio of just 0.10%, this ETF is among the most cost-effective in its category, helping investors reduce overall investment costs.

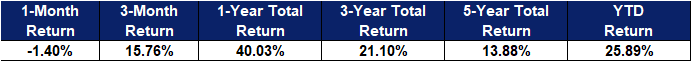

Fund Name (Ticker) | SPDR Gold MiniShares ETF (GLDM US) |

Description | This ETF tracks the LBMA Gold Price PM and seeks to replicate the performance of the index constituents in line with its benchmark. |

Asset Class | Commodity |

30-Day Average Volume (as of 27 May) | 4,353,296 |

Net Assets of Fund (as of 27 May) | US$6,529,322.05 |

12-Month Yield | N.A. |

P/E Ratio | N.A. |

P/B Ratio | N.A. |

Expense Ratio (Annual) | 0.10% |

Top Holdings

(as of 27 May 2025)

(Source: Bloomberg)

BlackRock World Gold Fund

- Invests in Gold and Precious Metals Industry. The fund also invests in equity securities of companies principally engaged in other precious metals, minerals, base metals, or mining related businesses However, it does not hold physical gold or other metals directly.

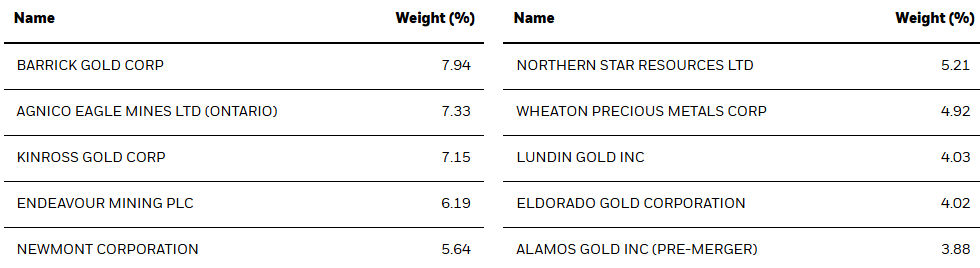

- Concentrated Holdings. The fund focuses on investing in large- and mid-cap companies with exposure across key regions such as Canada, the United States, and Australia. Holdings include major names like Barrick Gold, Agnico Eagle Mines, and Kinross Gold. The top 10 holdings account for over 50% of the portfolio.

- Expert Management Team and Research. With a track record of over 30 years, the fund is backed by BlackRock’s globally recognized investment team and extensive research capabilities. It employs a flexible investment strategy, adjusting portfolio allocations based on market conditions and macroeconomic trends.

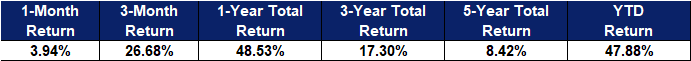

Fund Name (Ticker) | BlackRock World Gold Fund |

Description | The World Gold Fund seeks to maximise total return. The Fund invests globally at least 70% of its total assets in the equity securities of companies whose predominant economic activity is gold-mining. It may also invest in the equity securities of companies whose predominant economic activity is other precious metal or mineral and base metal or mineral mining. The Fund does not hold physical gold or metal. |

Asset Class | Equity |

30-Day Average Volume | N.A. |

Net Assets of Fund (as of 27 May) | US$5,634,729,993 |

12-Month Yield | N.A. |

P/E Ratio (as of 27 May) | 26.826x |

P/B Ratio (as of 27 May) | 2.255x |

Expense Ratio (Annual) | 1.75% |

Top Holdings

(as of 30 April 2025)

(Source: Bloomberg)