26 June 2025: Investment Product Ideas

ETF ┃ 26 June 2025

iShares MSCI Intl Quality Factor ETF (IQLT)

- Focus on High-Quality Companies. The underlying index focuses on companies with three quality characteristics: high ROE, stable earnings growth, and low financial leverage. These indicators help identify financially sound and operationally stable companies, making them suitable as part of a resilient growth-oriented investment portfolio.

- International Diversification. Covers 22 developed countries (excluding the U.S.), including the UK, Switzerland, Japan, France, and the Netherlands, offering investors the opportunity for global diversification. The portfolio holds approximately 300 stocks, with over 70% in large-cap companies. The top 10 holdings account for around 22%, and the diversified allocation helps reduce risks associated with individual companies or regional concentration.

- Moderate Expense Ratio. This ETF has an expense ratio of 0.30%, which is considered moderate among similar ETFs.

|

Fund Name (Ticker) |

iShares MSCI Intl Quality Factor ETF (IQLT) |

|

Description |

The iShares MSCI Intl Quality Factor ETF seeks to track the investment results of an index that measures the performance of international developed large- and mid-capitalization stocks exhibiting relatively higher quality characteristics as identified through three fundamental variables: return on equity, earnings variability and debt-to-equity. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 23 June) |

1,162,904 |

|

Net Assets of Fund (as of 24 June) |

$11,787,972,678 |

|

12-Month Yield (as of 30 May) |

2.49% |

|

P/E Ratio (as of 23 June) |

19.80x |

|

P/B Ratio (as of 23 June) |

3.13x |

|

Expense Ratio (Annual) |

0.30% |

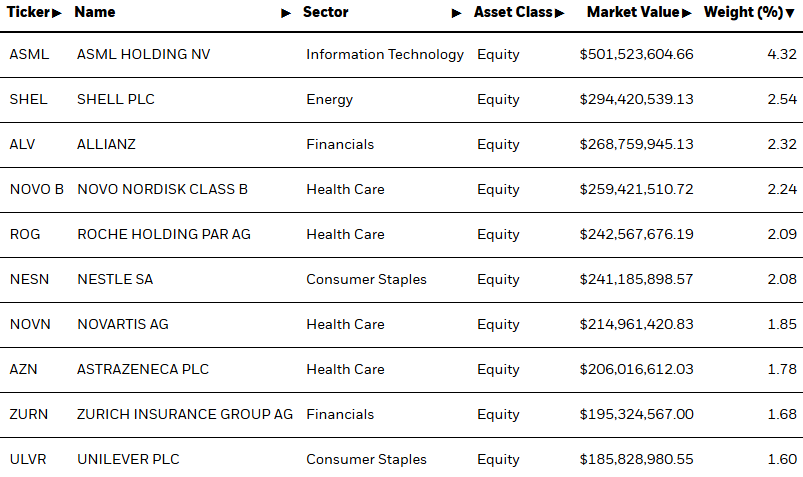

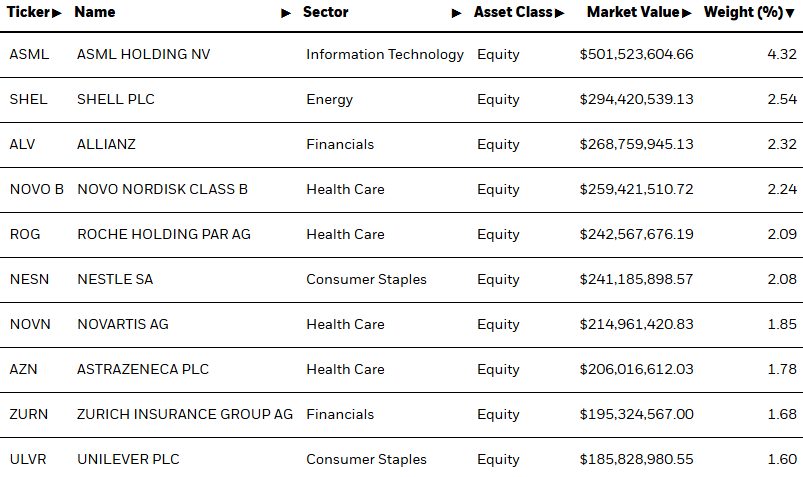

Top Holdings

(as of 23 June 2025)

(Source: Bloomberg)

VictoryShares Free Cash Flow ETF (VFLO)

- Focus on High Free Cash Flow Companies. The index uses expected free cash flow yield (Expected FCF Yield) as the stock selection criterion, choosing the 50 U.S. large-cap companies with the highest FCF yields from among eligible firms. Expected FCF is calculated as the average of actual FCF over the past 12 months and projected FCF for the next 12 months, providing a forward-looking perspective.

- Sector and Stock Weighting Limits. To avoid concentration risk, the index imposes limits on both sector and individual stock weightings, ensuring balanced exposure across industries. The index is reconstituted and rebalanced quarterly to reflect the latest financial data and market changes.

- A Focus Under High-Interest-Rate Conditions. In a high-interest-rate environment with rising capital costs, markets place greater emphasis on companies with stable cash flow and capital efficiency. This ETF centered on expected free cash flow, aligns with current investor priorities for financial health.

|

Fund Name (Ticker) |

VictoryShares Free Cash Flow ETF (VFLO) |

|

Description |

The VictoryShares Free Cash Flow ETF seeks to offer exposure to high-quality, large-cap U.S. stocks that trade at a discount and have favorable growth prospects. VFLO seeks to provide investment results that track the performance of the Victory U.S. Large Cap Free Cash Flow Index (the Index) before fees and expenses. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 24 June) |

993,119 |

|

Net Assets of Fund (as of 23 June) |

$4,205,047,985 |

|

12-Month Yield (as of 24 June) |

1.28% |

|

P/E Ratio (as of 31 May) |

13.40x |

|

P/B Ratio (as of 31 May) |

2.42x |

|

Expense Ratio (Annual) |

0.39% |

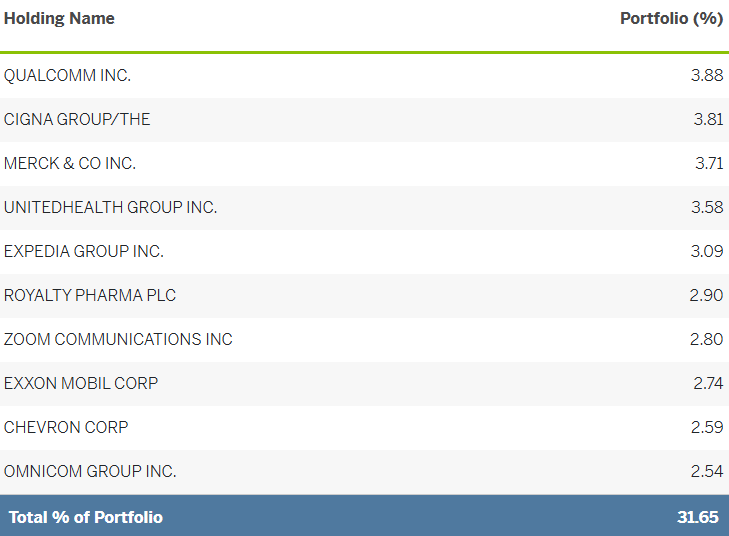

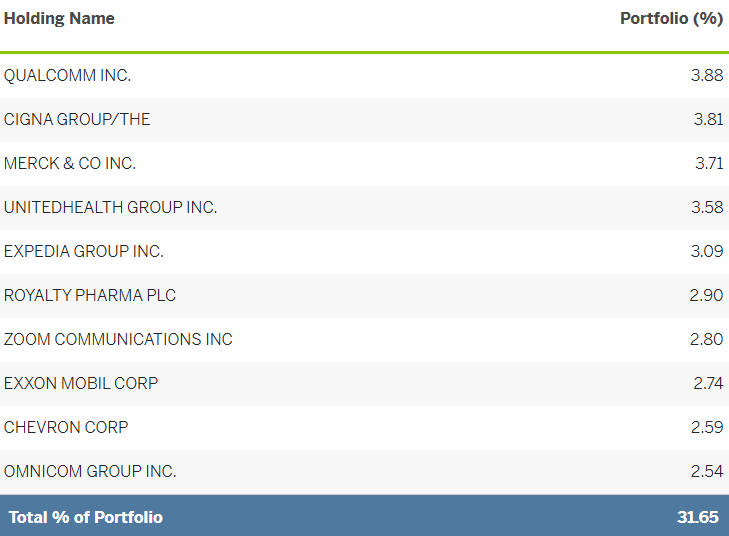

Top Holdings

(as of 24 June 2025)

(Source: Bloomberg)

ETF 推荐 ┃ 2025年6月26日

iSharesMSCI國際優質因子ETF (IQLT US)

- 專注於高品質企業。追蹤指數專注於具備以下三項品質特徵的公司,包括高股東權益報酬率、穩定的盈餘成長和低財務槓桿,這些指標有助於篩選出財務穩健、營運穩定的企業,適合作為投資組合中穩健成長型資產的一部分。

- 國際分散投資。涵蓋22個已開發國家(不含美國),包括英國、瑞士、日本、法國、荷蘭等,提供投資人全球化分散風險的機會,投資組合持有約300檔股票,超過70%為大型公司股票,前十大持股比重約22%,投資分散有助降低個別企業及區域集中的風險。

- 費用率適中。該ETF費用率為0.30%,在同類型ETF中屬於中等水平。

|

名称(代码) |

iSharesMSCI國際優質因子ETF (IQLT) |

|

描述 |

該ETF追蹤「MSCI World ex USA Sector Neutral Quality Index」,旨在追踨指數成份股並達到和指數相對應的投資表現。 |

|

资产类别 |

股票 |

|

30日平均成交量(截至6月23日) |

1,162,904 |

|

净资产规模(截至6月24日) |

$11,787,972,678 |

|

12个月收益率(截至6月30日) |

2.49% |

|

市盈率(截至6月23日) |

19.80x |

|

市净率(截至6月23日) |

3.13x |

|

费用比率(年) |

0.30% |

持股情况

(截止6月23日)

(Source: Bloomberg)

VictoryShares自由现金流ETF (VFLO)

- 聚焦高自由现金流企业。 该指数以预期自由现金流收益率(Expected FCF Yield)作为选股依据,从符合条件的公司中选出FCF收益率最高的50家美国大型企业,预期FCF是过去12个月与未来12个月预估FCF的平均值,具备前瞻性。

- 行业与个股权重限制。 为避免集中风险,指数设有行业与个股的权重上限,确保指数在各行业间保持适度分散,并于每季进行重构与再平衡,以反映最新财务数据与市场变化。

- 高利率环境下的关注焦点。 在利率偏高、资金成本上升的环境下,市场更重视企业的现金流稳定性与资本效率,该ETF以预期自由现金流为核心,符合当前投资者对企业财务健康的要求。

|

名称(代码) |

VictoryShares自由现金流ETF (VFLO) |

|

描述 |

VictoryShares自由现金流ETF旨在提供高质量、大型美国股票的投资机会,这些股票以折扣交易并具有良好的增长前景。VFLO旨在提供跟踪Victory美国大型自由现金流指数(该指数)表现的投资结果,费用和开支除外。 |

|

资产类别 |

Equity |

|

30日平均成交量(截至6月24日) |

993,119 |

|

净资产规模(截至6月23日) |

$4,205,047,985 |

|

12个月收益率(截至6月24日) |

1.28% |

|

市盈率(截至5月31日) |

13.40x |

|

市净率(截至5月31日) |

2.42x |

|

费用比率(年) |

0.39% |

持股情况

(截止6月24日)

(Source: Bloomberg)