24 October 2024: Wealth Product Ideas

Global Defense Spending Continues to Rise

These ETFs focus on companies involved in the production, research, and development of defense equipment, aircraft, and related technologies. The theme is driven by global geopolitical tensions and increased defense spending worldwide.

Drivers:

- Global defense spending expected to grow at 4.2% CAGR

- Projected to exceed $3 trillion by 2030

- Increasing application of AI, robotics, VR, and big data in defense

- U.S. Department of Defense R&D spending proportion has increased

- Global top 100 arms production and military service companies’ revenue growth restarted

- European countries have raised military budgets post Russia-Ukraine war

- NATO relations and Middle East geopolitical issues reflected in company revenues

Potential Risks:

- Peace negotiations or de-escalation of conflicts could reduce defense spending.

- Budget constraints in some countries might limit defense expenditure growth

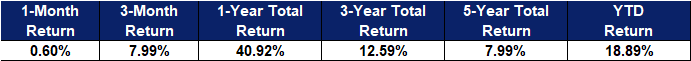

Fund Name (Ticker) | Invesco Aerospace & Defense ETF (PPA US) |

Description | The Invesco Aerospace & Defense ETF (Fund) is based on the SPADE™ Defense Index (Index). The Fund will normally invest at least 90% of its total assets in common stocks that comprise the Index. The Index is designed to identify a group of companies involved in the development, manufacturing, operations and support of US defense, homeland security and aerospace operations. The Fund and the Index are rebalanced and reconstituted quarterly. |

Asset Class | Equity |

30-Day Average Volume (as of 22 Oct) | 175,315 |

Net Assets of Fund (as of 15 Oct) | $4,496,900,000 |

12-Month Yield (as of 22 Oct) | 0.56% |

P/E Ratio (as of 30 Sep) | 32.40 |

P/B Ratio (as of 30 Sep) | 4.76 |

Expense Ratio (Annual) | 0.58% |

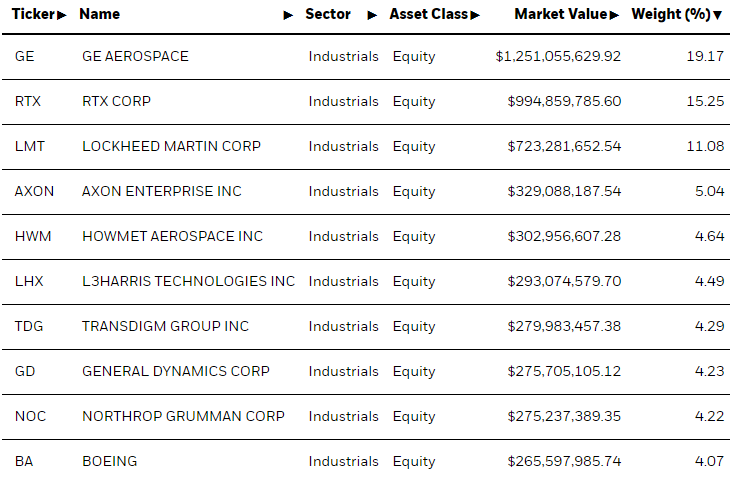

Top 10 Holdings

(as of 21 October 2024)

(Source: Bloomberg)

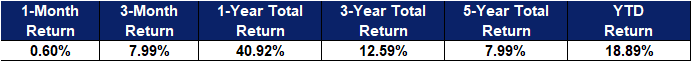

Fund Name (Ticker) | iShares U.S. Aerospace & Defense ETF (ITA US) |

Description | The iShares U.S. Aerospace & Defense ETF seeks to track the investment results of an index composed of U.S. equities in the aerospace and defense sector. |

Asset Class | Equity |

30-Day Average Volume (as of 21 Oct) | 339,397 |

Net Assets of Fund (as of 22 Oct) | $6,314,114,675 |

12-Month Yield (as of 30 Sep) | 0.82% |

P/E Ratio (as of 21 Oct) | 33.78 |

P/B Ratio (as of 21 Oct) | 5.00 |

Expense Ratio (Annual) | 0.40% |

Top 10 Holdings

(as of 21 October 2024)

(Source: Bloomberg)