24 June 2025: Futures Product Updates

KGI Weekly Futures Update

SGX TSI Iron Ore CFR China (62% Fe Fines) Index Futures

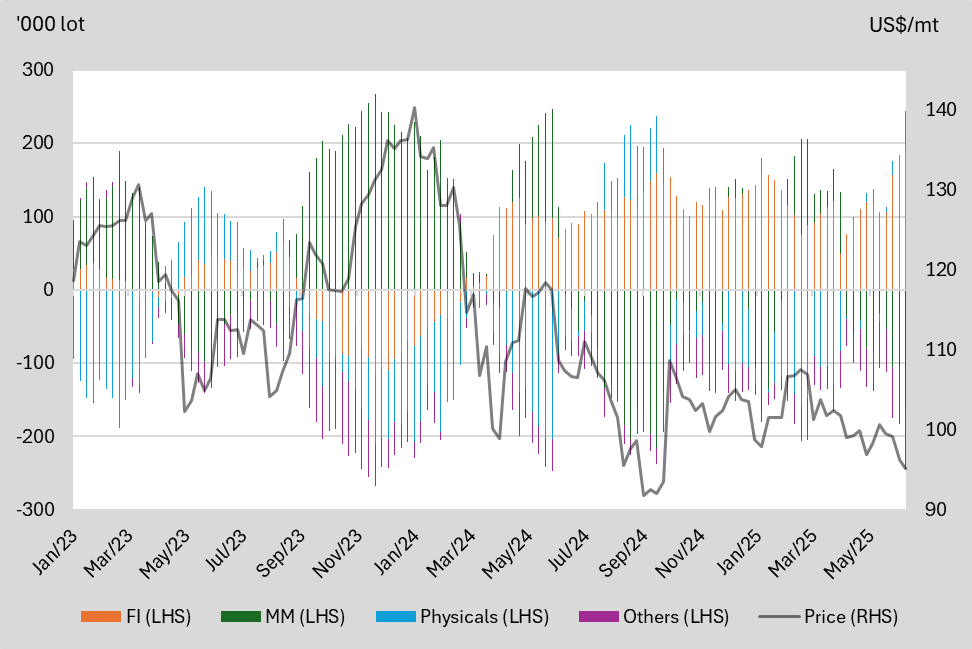

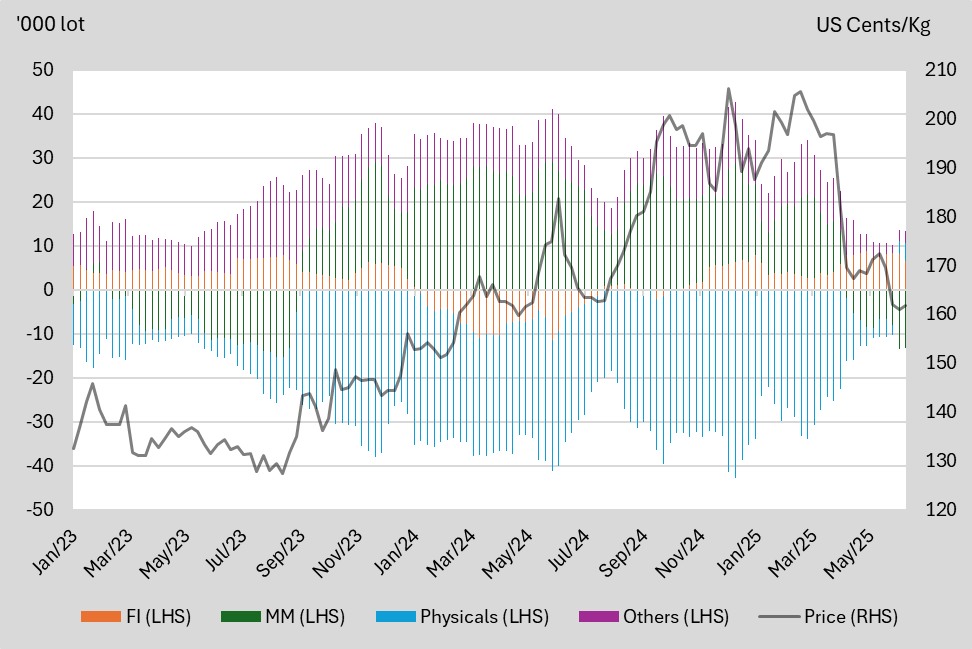

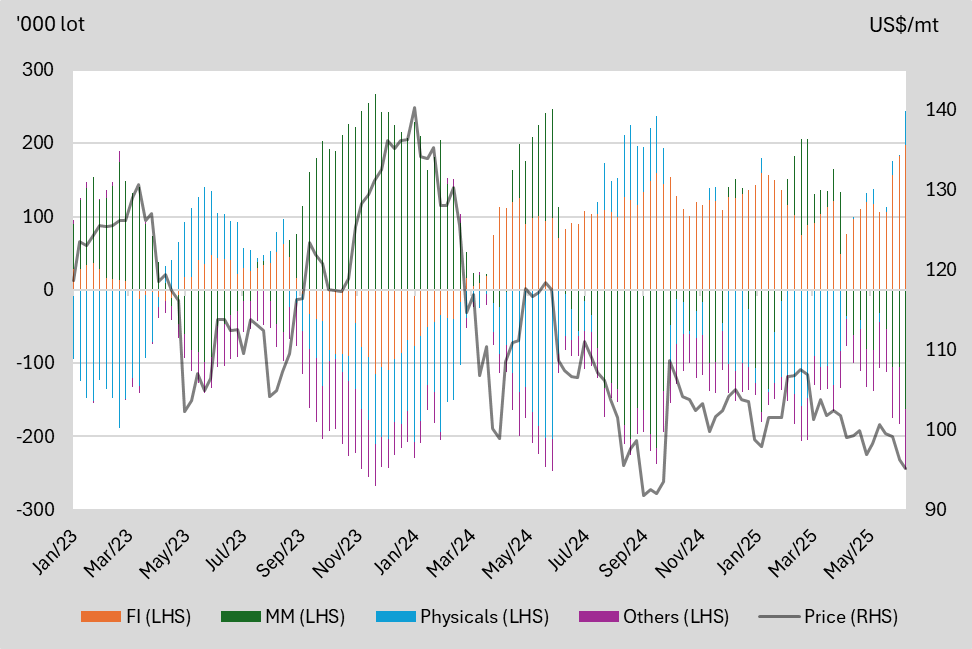

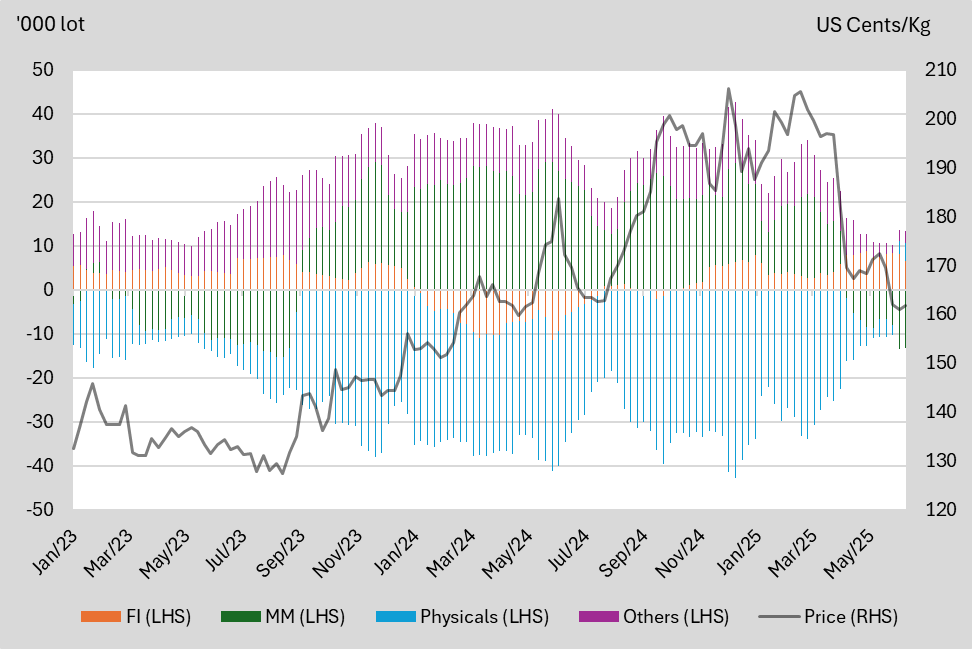

Net Long/Short and Price Comparison

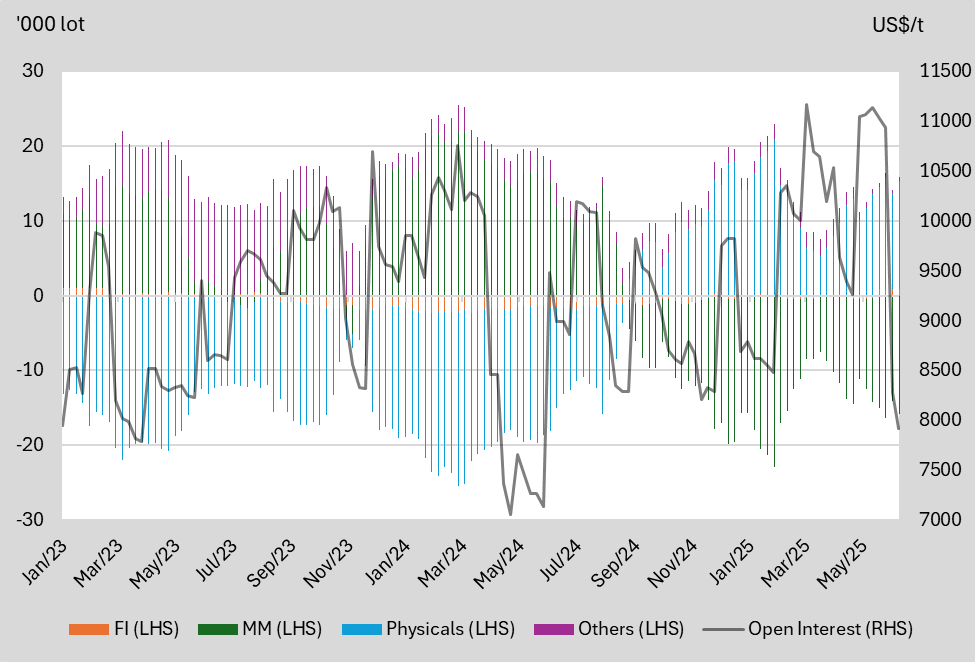

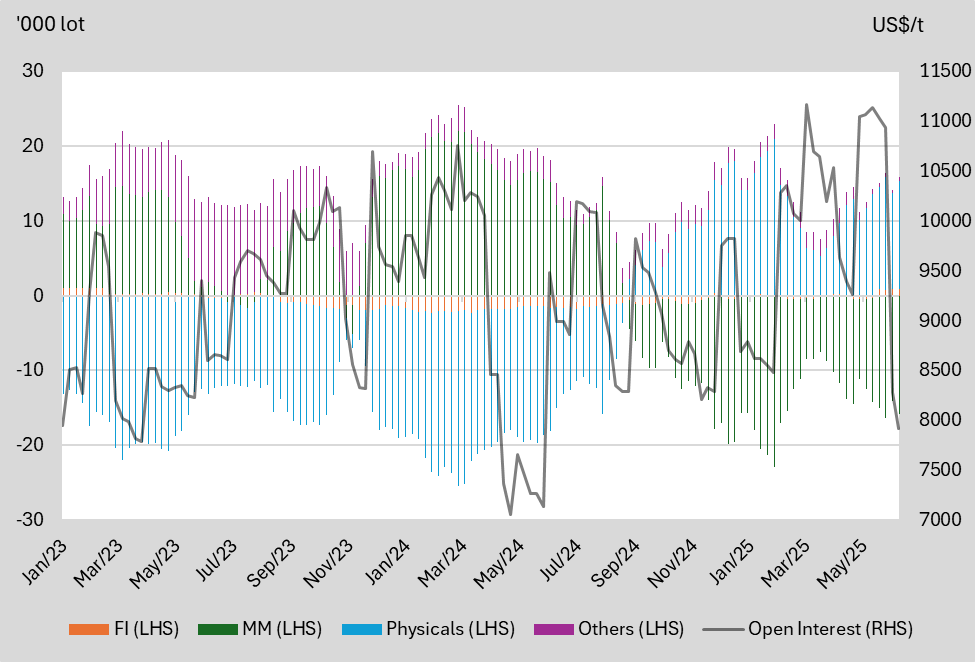

We highlight the key price levels that each participant switches their positions between net long and net short based on 2024 data.

2024 | Financial Institution (FI) | Manage Money (MM) | Physicals | Others |

Net Long | Below US$118/mt | Above US$118/mt | Below US$100/mt | NA |

Net Short | Above US$118/mt | Below US$115/mt | Above US$100/mt | NA |

Net-position WoW Change | Remarks | |

FI | +16.02 | Increase for four consecutive weeks. |

MM | -57.34 | Reverse from previous weeks’ incline and represents the largest decline since April. |

Physicals | +45.22 | Rebound from the previous week’s decline. |

Others | -3.90 | Decrease for three consecutive weeks. |

Figure 1: Net-positions by participant segment and price comparison

Source: SGX, KGI Research

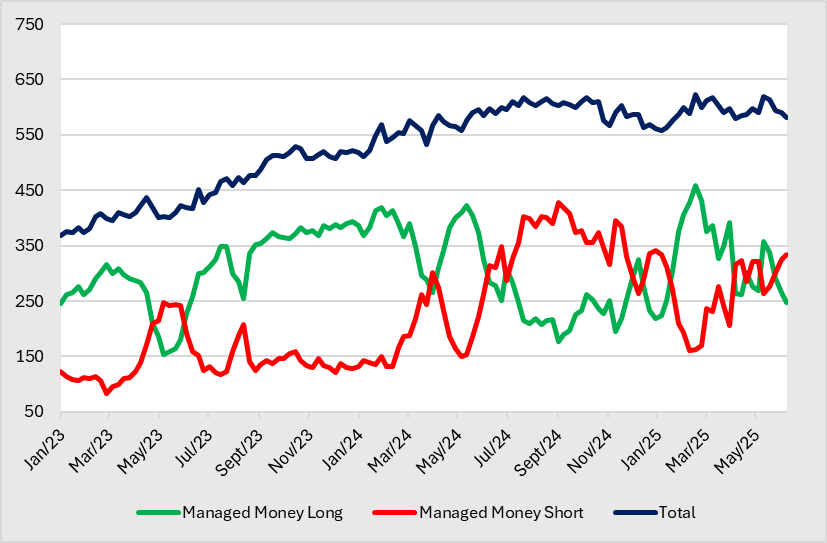

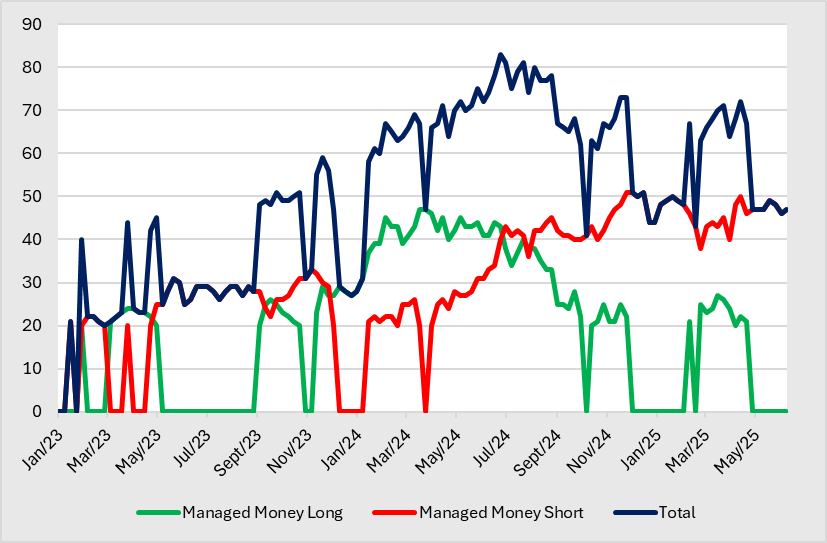

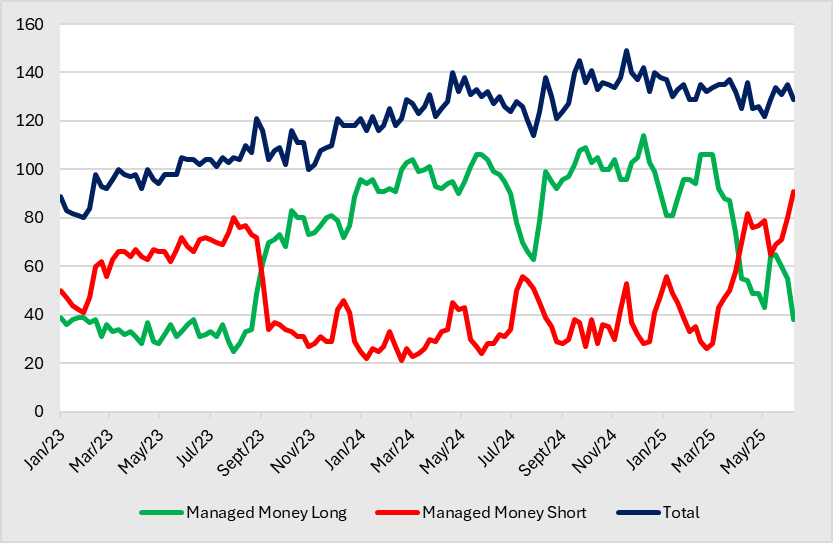

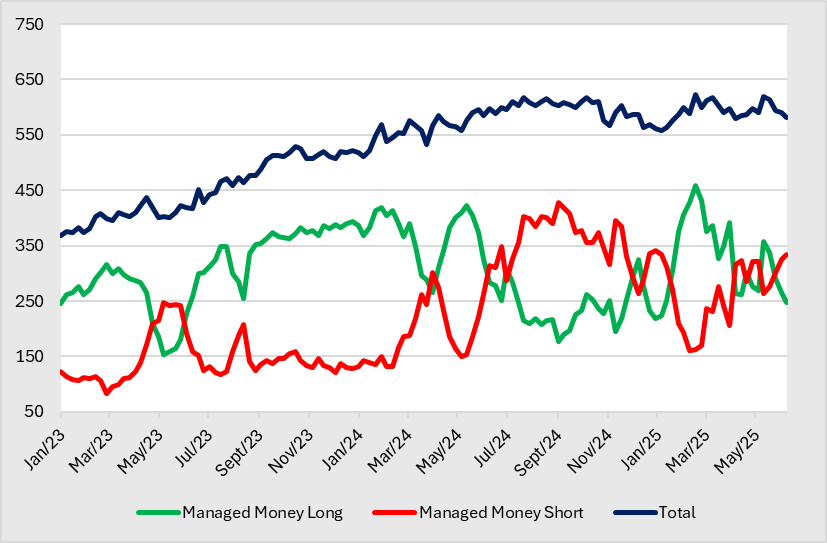

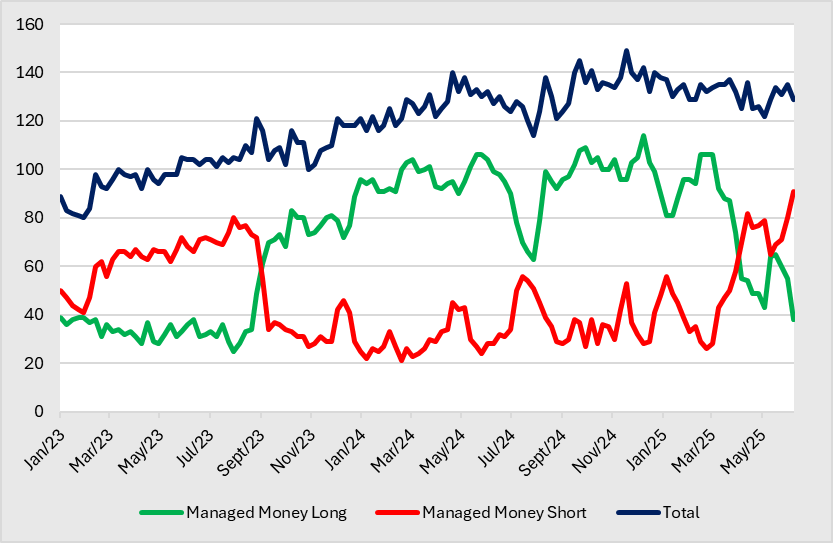

Long/Short Traders Snapshot

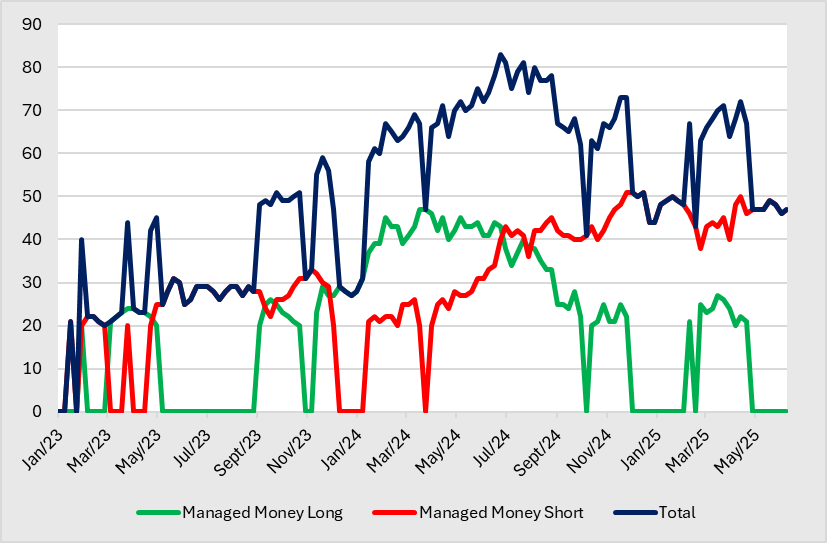

- Managed Money. The number of MM with long positions declined for four consecutive weeks to 248, representing a low since January 2025. Accordingly, the number of MM with short positions rose for four consecutive weeks to 333, representing a high since January 2025. Seasonally, more MMs are prone to long in 1HQ4 and 2HQ2, and there are more MMs with short positions in 1HQ2 and 1HQ3.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 423 | 427 | 393 | 248 |

Low | 176 | 131 | 154 | 83 |

Figure 2: Number of position holders iron ore futures

Source: SGX, KGI Research

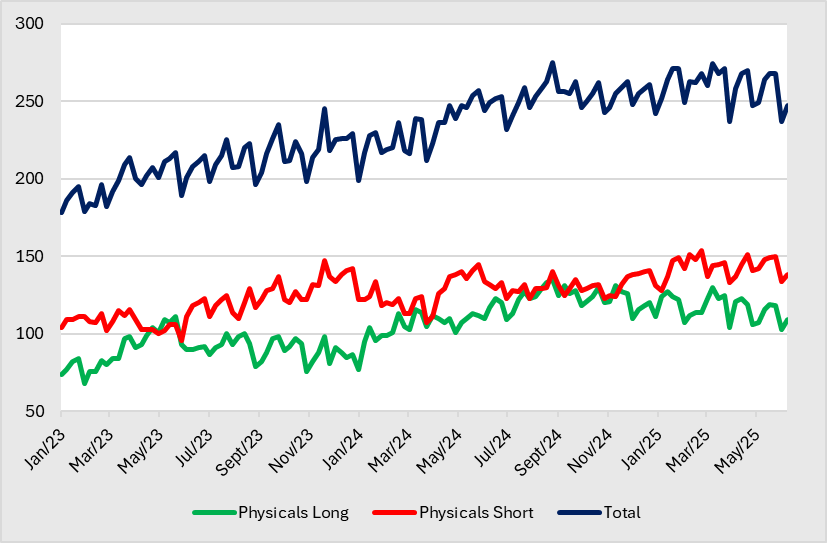

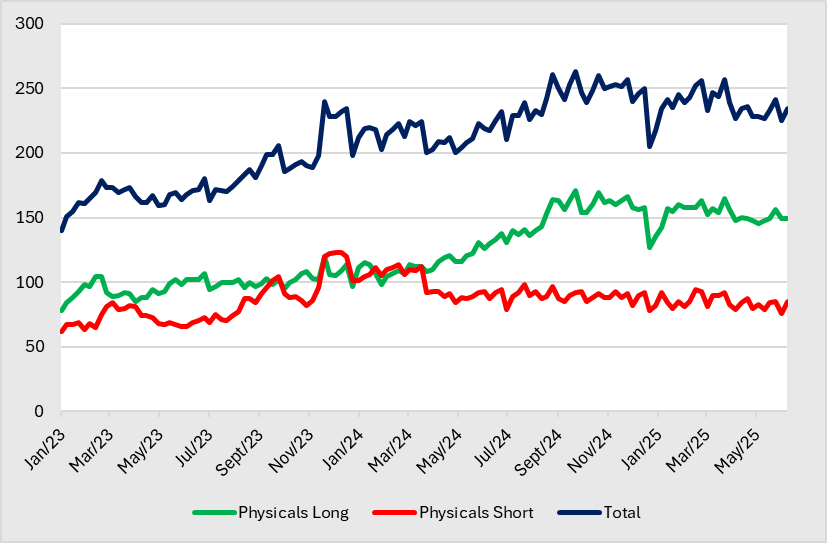

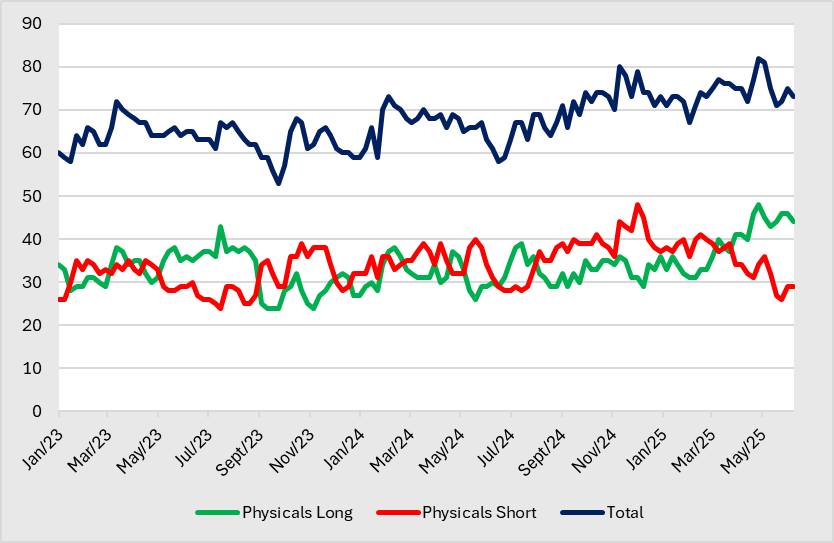

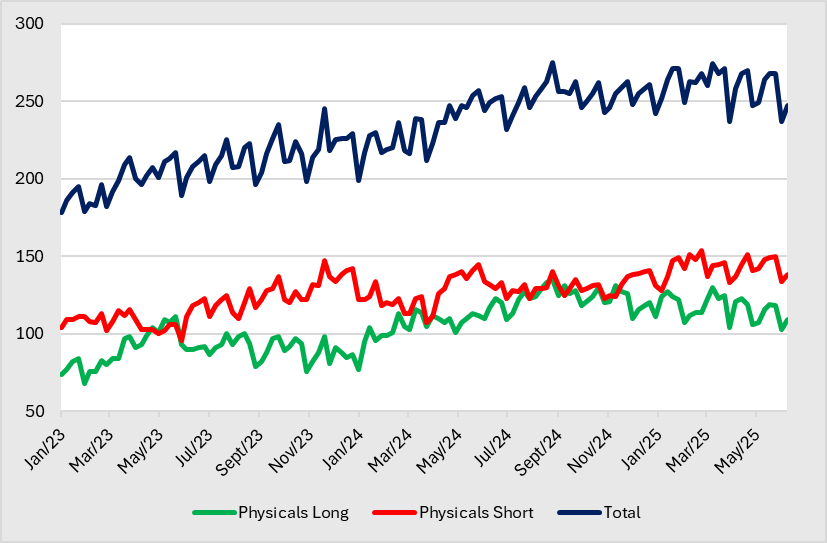

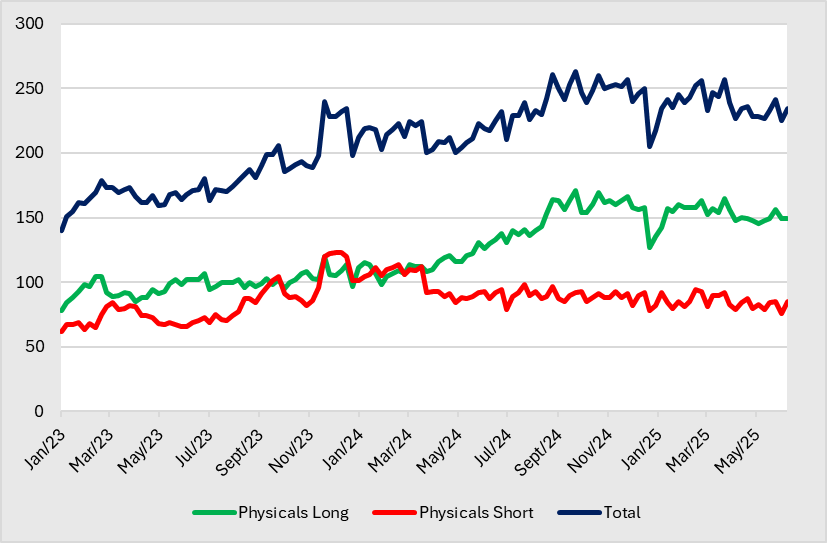

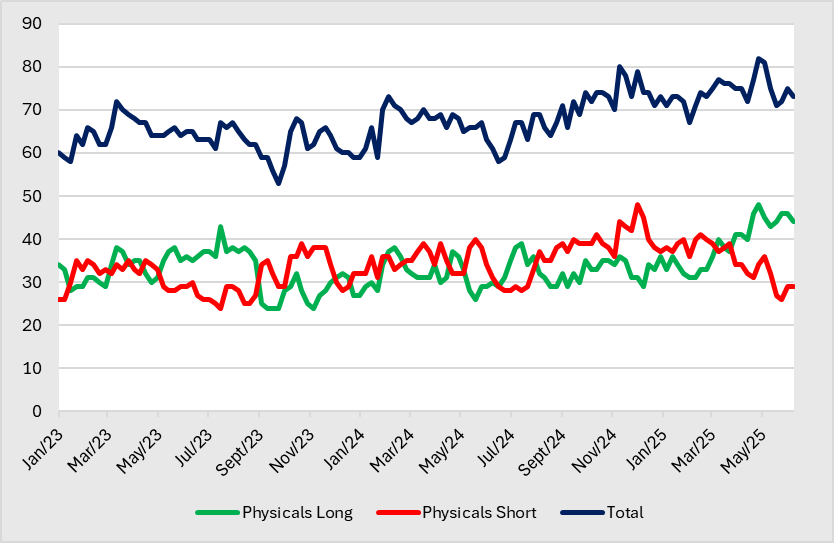

- Physicals. The number of physicals with long positions rebounded to 109 after two consecutive weeks of decline. Accordingly, the number of physicals with short positions increased to 138 after retreating a week ago. Seasonally, more physicals are prone to being long in 1Q, and there are more physicals with short positions in Q4.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 135 | 145 | 111 | 147 |

Low | 77 | 107 | 68 | 96 |

Figure 3: Number of position holders iron ore futures

Source: SGX, KGI Research

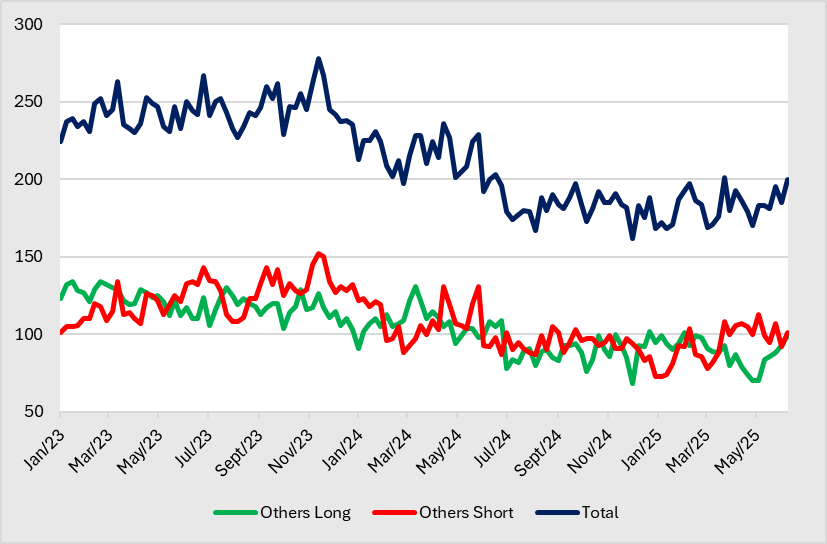

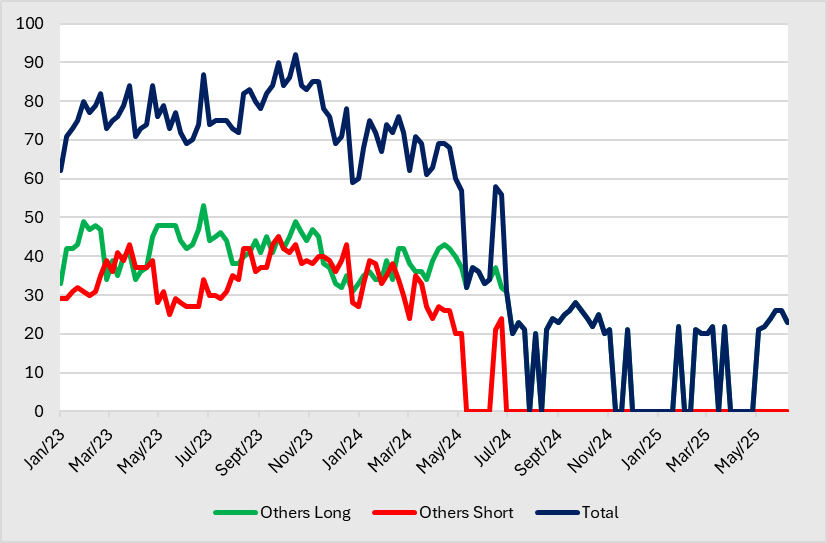

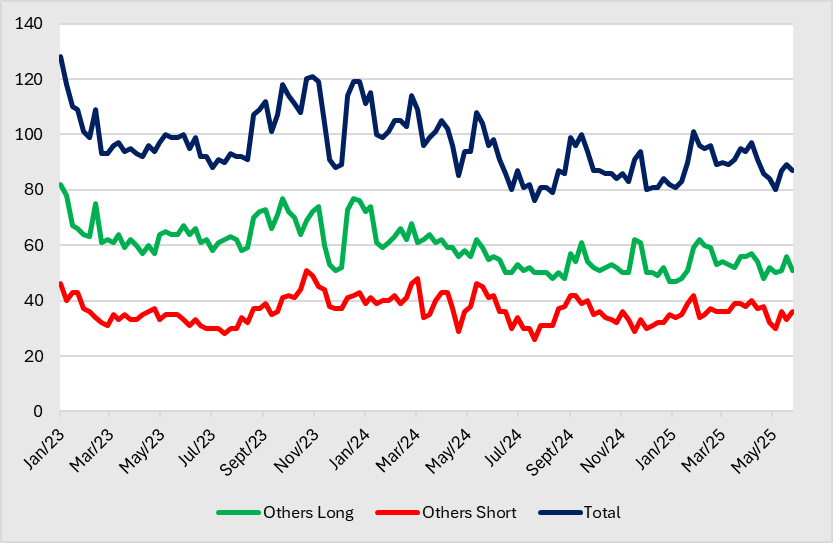

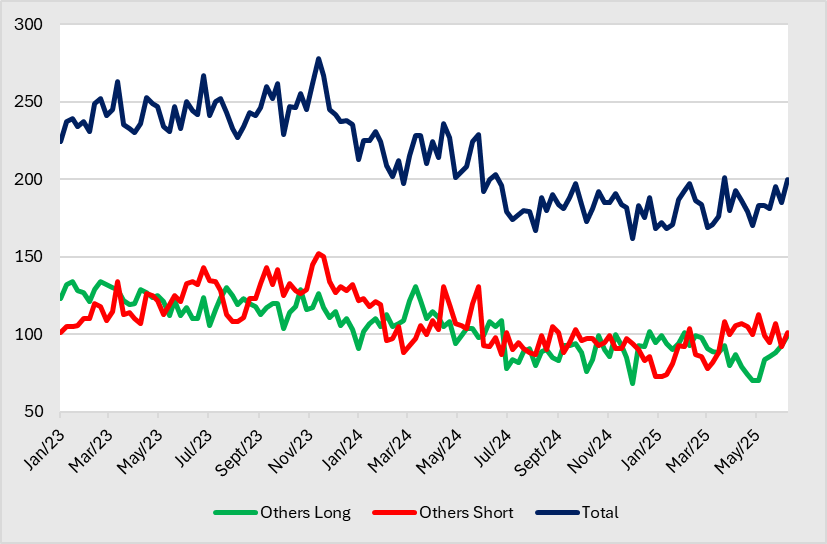

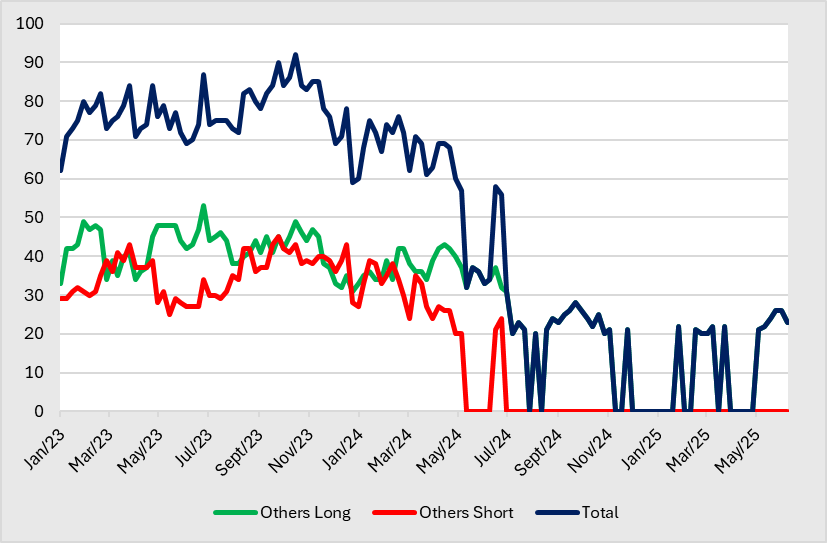

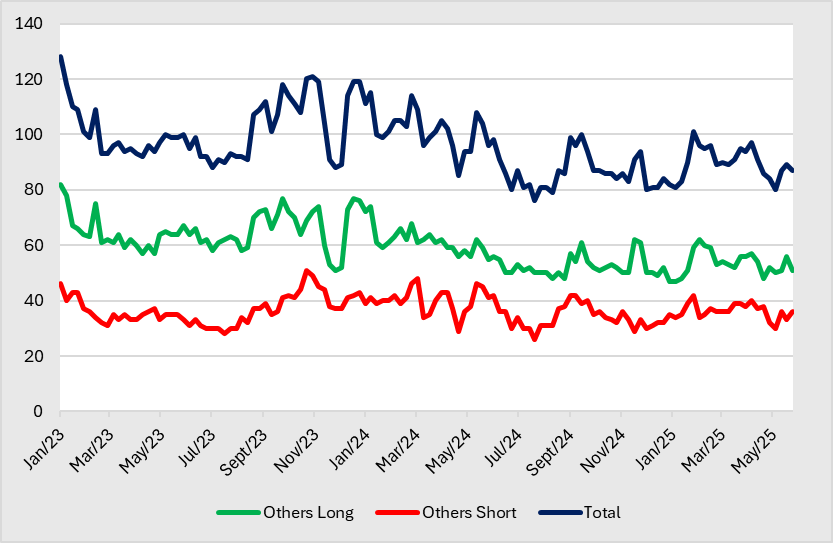

- Others. The number of others with long positions rose for five consecutive weeks to 99, representing a high since February 2025. The number of others with short positions increased to 102 after last week’s retreat.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 131 | 131 | 134 | 152 |

Low | 68 | 83 | 103 | 101 |

Figure 4: Number of position holders iron ore futures

Source: SGX, KGI Research

SGX Baltic Panamax Time Charter Average Futures

We highlight the key price levels that each participants switches their positions between net long and net short based on 2024 data.

2024 | Financial Institution (FI) | Manage Money (MM) | Physicals | Others |

Net Long | NA | Above US$9,000/t | Below US$8,500/t | NA |

Net Short | NA | Below US$9,000/t | Above US$9,500/t | NA |

Net-position WoW Change | Remarks | |

FI | +0.05 | Increase for two consecutive weeks. |

MM | -1.75 | Continue a general downtrend, reversing from last week’s increase. |

Physicals | +1.53 | Continue a general uptrend, rebounding from last week’s decline. |

Others | +0.17 | Rebound from last week’s decline. |

Figure 5: Net-positions by participant segment and price comparison

Source: SGX, KGI Research

Long/Short Traders Snapshot

- Managed Money. The number of MM with long positions had remained stable at 21 since April 2025. On the other hand, the number of MM with short positions increased marginally to 47 after two consecutive weeks of decline. Seasonally, more MM are prone to long in 1H, and there are more MM with short positions in 2H.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 47 | 51 | 29 | 33 |

Low | 20 | 20 | 20 | 20 |

Figure 6: Number of position holders freight futures

Source: SGX, KGI Research

- Physicals. The number of physicals with long positions remained stable at 149 after declining last week. Accordingly, the number of physicals with short positions rebounded back to 85 after declining last week. The number of physicals has been on a general upward trend since 2Q24, while physicals with short positions generally saw a downtrend since 2Q24.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 171 | 114 | 120 | 123 |

Low | 98 | 78 | 78 | 62 |

Figure 7: Number of position holders freight futures

Source: SGX, KGI Research

- Others. The number of others with long positions declined to 23.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 43 | 39 | 53 | 45 |

Low | 20 | 20 | 31 | 25 |

Figure 8: Number of position holders freight futures

Source: SGX, KGI Research

SGX SICOM Rubber Futures – TSR20

Net Long/Short and Price Comparison

We highlight the key price levels that each participants switches their positions between net long and net short based on 2024 data.

2024 | Financial Institution (FI) | Manage Money (MM) | Physicals | Others |

Net Long | Below US$1.90/kg | NA | NA | NA |

Net Short | Above US$1.60/kg | NA | NA | NA |

Net-position WoW Change | Remarks | |

FI | -1.73 | Decline for two consecutive weeks. |

MM | +0.24 | Rebound from three consecutive weeks of decline. |

Physicals | +1.20 | Rise for four consecutive weeks. |

Others | +0.29 | Rebound for two consecutive weeks after nine consecutive weeks of decline. |

Figure 9: Net-positions by participant segment and price comparison

Source: SGX, KGI Research

Long/Short Traders Snapshot

- Managed Money. The number of MM with long positions declined for three consecutive weeks to 38, continuing its general downtrend since February, and represents a low since August 2023. Accordingly, the number of MM with short positions rebounded for four consecutive weeks to 91 and represents a high in over 2 years.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 114 | 56 | 89 | 80 |

Low | 63 | 21 | 25 | 27 |

Figure 10: Number of position holders rubber futures

Source: SGX, KGI Research

- Physicals. The number of physicals with long positions declined to 44. Accordingly, the number of physicals with short positions remained stable at 29. Seasonally, more physicals are prone to long in early Q3, and there are more physicals with short positions in Q4.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 39 | 48 | 43 | 39 |

Low | 26 | 28 | 24 | 24 |

Figure 11: Number of position holders rubber futures

Source: SGX, KGI Research

- Others. The number of long holders decreased to 51 after increasing for two consecutive weeks. On the other hand, the number of short holders rebounded to 36 after retreating a week ago.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 77 | 48 | 82 | 51 |

Low | 48 | 26 | 51 | 28 |

Figure 12: Number of position holders rubber futures

Source: SGX, KGI Research

Participant Category | Description |

Financial Institutions | An entity, such as a broker trading desk, bank trading desk or swap dealer, that uses the futures markets to manage or hedge the risk. |

Managed Money | An entity that is engaged in organized futures trading on behalf of funds or other special investment purpose vehicles such as Pension Funds, Asset Managers, Hedge Funds, Proprietary Trading Groups, Family Offices, etc. |

Physicals | An entity that predominantly engages in the physical markets and uses the futures markets to manage or hedge risks associated with the conduct of those activities. Such activities could include the production, processing, trading, packing or handling of a physical commodity, or the provision of transportation, warehousing or distribution services. |

Others | Every other trader that is not placed into one of the other three categories. E.g., Broker Agency, Bank Agency, Inter-Dealer Brokers, etc. |

凯基证券期货周报 – 6 月 24 日

SGX TSI 铁矿石 CFR 中国(62% 铁粉)指数期货

净多头/空头和价格比较

我们根据2024年数据,突出了每个参与者在净多头和净空头之间切换仓位的关键价格水平。

2024 | 金融机构 (FI) | 管理资金 (MM) | 实物交割(Physicals) | 其他 (Others) |

净多头 | 低于 118 美元/吨 | 118 美元/吨以上 | 低于 100 美元/吨 | 无 |

净空头 | 118 美元/吨以上 | 低于 115 美元/吨 | 100 美元/吨以上 | 无 |

净仓位按周变化 | 备注 | |

金融机构 | +16.02 | 连续四周上升。 |

管理资金 | -57.34 | 从前几周的上升反转,代表自四月以来的最大下降。 |

实物交割 | +45.22 | 从上周的下降反弹。 |

其他 | -3.90 | 连续三周下跌。 |

图 1:按参与者细分的净持仓和价格比较

资料来源: 新交所、凯基研究

多头/空头交易简报

- 管理资金。持有多头头寸的管理资金数目连续四周下跌至248家,是2025年1月以来的新低。相应地,持有空头头寸的管理资金数目连续三周上升至333家,是2025年1月以来的新高。季节性来看,更多管理资金倾向于在第四季上半旬和第二季下半旬持有多头,而在第二季上半旬和第三季上半旬持有空头的管理资金较多。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 423 | 427 | 393 | 248 |

最低值 | 176 | 131 | 154 | 83 |

图 2:铁矿石期货持仓者数量

资料来源: 新交所、凯基研究

- 实物交割。持有多头头寸的实物交割交易者数量连续两周下跌后反弹至109家。相应地,持有空头头寸的实物交割交易者数量在前一周下跌后反弹至138家。季节性来看,更多实物交割交易者倾向于在第一季度持有多头,而在第四季度持有空头的实物交割较多。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 135 | 145 | 111 | 147 |

最低值 | 77 | 107 | 68 | 96 |

图 3:铁矿石期货持仓者数量

资料来源: 新交所、凯基研究

- 其他。其他类别多头持仓数量连续五周上升至99家,是自2025年2月以来的新高。而空头持仓数量在前一周下跌后反弹至102家。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 131 | 131 | 134 | 152 |

最低值 | 68 | 83 | 103 | 101 |

图 4:铁矿石期货持仓者数量

资料来源: 新交所、凯基研究

SGX 波罗的海巴拿马型船平均期租期货

我们根据2024年数据,突出了每个参与者在净多头和净空头之间切换仓位的关键价格水平。

2024 | 金融机构 (FI) | 管理资金 (MM) | 实物交割(Physicals) | 其他 (Others) |

净多头 | 无 | 9,000 美元/吨以上 | 低于 8,500 美元/吨 | 无 |

净空头 | 无 | 低于 9,000 美元/吨 | 9,500 美元/吨以上 | 无 |

净仓位按周变化 | 备注 | |

金融机构 | +0.05 | 连续两周增加。 |

管理资金 | -1.75 | 继续整体下行趋势,从上周的增加反转。 |

实物交割 | +1.53 | 继续整体上行趋势,从上周的下降反弹。 |

其他 | +0.17 | 从上周的下降反弹。 |

图 5:按参与者类别划分的净仓位及价格比较

资料来源: 新交所、凯基研究

多头/空头交易者快照

- 管理资金。过去四周持有多头头寸的做管理资金交易者数量自25年4月以来维持在21家。另一方面,持有空头头寸的管理资金交易者数在连续两周下跌后小幅上升至47家。季节性来看,更多管理资金倾向于在上半年持有多头,而在下半年持有空头的管理资金较多。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 47 | 51 | 29 | 33 |

最低值 | 20 | 20 | 20 | 20 |

图 6: 运费期货持仓者数量

资料来源: 新交所、凯基研究

- 实物交割。 持有多头头寸的实物交割交易者数量在前一周下跌后稳定在149家。相应地,持有空头头寸的实物交割交易者数量在前一周下跌后反弹至85家。自去年第二季度以来,实物交割交易者数量总体呈上升趋势,而持有空头头寸的实物交割交易者数量自去年第二季度以来总体呈下降趋势。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 171 | 114 | 120 | 123 |

最低值 | 98 | 78 | 78 | 62 |

图 7: 运费期货持仓者数量

资料来源: 新交所、凯基研究

- 其他。其他持有多头头寸的公司数量下跌至23家。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 43 | 39 | 53 | 45 |

最低值 | 20 | 20 | 31 | 25 |

图 8: 运费期货持仓者数量

资料来源: 新交所、凯基研究

SGX SICOM 橡胶期货 – TSR20

净多头/空头及价格比较

我们根据2024年数据,突出了每个参与者在净多头和净空头之间切换仓位的关键价格水平。

2024 | 金融机构 (FI) | 管理资金 (MM) | 实物交割(Physicals) | 其他 (Others) |

净多头 | 低于 1.90 美元/公斤 | 无 | 无 | 无 |

净空头 | 1.60 美元/公斤以上 | 无 | 无 | 无 |

净仓位按周变化 | 备注 | |

金融机构 | -1.73 | 连续两周下降。 |

管理资金 | +0.24 | 从连续三周的下降反弹。 |

实物交割 | +1.20 | 连续四周上升。 |

其他 | +0.29 | 在连续九周下降后,连续两周反弹。 |

图 9:按参与者类别划分的净仓位及价格比较

资料来源: 新交所、凯基研究

多头/空头交易者快照

- 管理资金。持有多头头寸的管理资金交易者数量连续三周下降至38家,延续自二月份以来的下行趋势。相应地,持有空头头寸的管理资金交易者数量连续三周反弹至80家。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 114 | 56 | 89 | 80 |

最低值 | 63 | 21 | 25 | 27 |

图 10:橡胶期货持仓者数量

资料来源:新交所、凯基研究

- 实物交割。持有多头头寸的实物交割交易者数量下跌至46家。相应地,持有空头头寸的实物交割交易者数量稳定在29家。从季节性来看,实物交割交易者在第三季度初更倾向于持有多头头寸,而在第四季度则更多持有空头头寸。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 39 | 48 | 43 | 39 |

最低值 | 26 | 28 | 24 | 24 |

图11:橡胶期货持仓者数量

资料来源:新交所、凯基研究

- 其他。 持有多头头寸的投资者数量连续两周上升后下跌至51家。另一方面,空头持仓数量在前一周下跌后反弹至36家。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 77 | 48 | 82 | 51 |

最低值 | 48 | 26 | 51 | 28 |

图 12:持仓橡胶期货数量

资料来源:新交所、凯基研究

参与者类别 | 描述 |

金融机构 | 使用期货市场管理或对冲风险的实体,如经纪商交易台、银行交易台或互换交易商。 |

管理资金 | 代表基金或其他特殊投资目的工具(如养老基金、资产管理公司、对冲基金、自营交易集团、家族办公室等)从事有组织的期货交易的实体。 |

实物交割 | 主要从事实物市场并使用期货市场管理或对冲与这些活动相关风险的实体。这些活动可能包括生产、加工、贸易、包装或处理实物商品,或提供运输、仓储或分销服务。 |

其他 | 未归类到上述三类中的其他交易者,例如经纪代理、银行代理、交易商间经纪商等。 |