21 November 2024: Wealth Product Ideas

Transport Stocks Rebound Post Election; Air Freight Rates Recover

- With the Republican party securing full control, Trump’s agenda of boosting U S domestic manufacturing is expected to drive demand for transport services focused on local procurement The proposed corporate tax cut to 15 for U S based firms could further support rail and ground freight companies, enhancing their operational and financial performance Valuations for these firms may see upside, particularly for larger players Over the past three months, transport stocks have surged following the election results, and potential policy benefits could sustain this momentum.

- Data from Drewry a transport consultancy, shows October east west air freight rates from Shanghai rose 4 2 YoY to 3 67 per kg, 0 7 higher than the previous year’s increase Strikes at East Coast and Gulf ports contributed to the uptick, alongside the upcoming peak season for consumer and freight demand, which could support a rate recovery Major air freight operators have added over 200 flights between Asia, the U S and Europe to meet rising demand, indicating growing momentum in air transport services.

U.S. Rail Transport Hits Record Highs, Profit Outlook Brightens

- The U S economy’s soft landing has bolstered rail operators’ growth this year Adjusted EPS for major rail companies has returned to positive territory, driven by rising freight volumes and the trend of reshoring U S manufacturing FTR Transportation Intelligence forecasts record intermodal rail volumes by 2025 With ongoing Fed rate cuts and Trump’s tax reduction policies boosting domestic demand, transport stocks stand to benefit.

- Rail operators have implemented long term productivity plans, reducing the operating ratio from over 70 to a stable 60 65 The widespread adoption of precision scheduling has improved efficiency, enhancing profitability Trump’s proposed corporate tax cuts are expected to further support financial performance.

Fund Name (Ticker) | iShares U.S. Transportation ETF (IYT US) |

Description | The iShares U.S. Transportation ETF seeks to track the investment results of an index composed of U.S. equities in the transportation sector. |

Asset Class | Equity |

30-Day Average Volume (as of 18 Nov) | 531,432 |

Net Assets of Fund (as of 19 Nov) | $726,955,831 |

12-Month Yield (as of 31 Oct) | 1.13% |

P/E Ratio (as of 18 Nov) | 22.62 |

P/B Ratio (as of 18 Nov) | 4.60 |

Expense Ratio (Annual) | 0.39% |

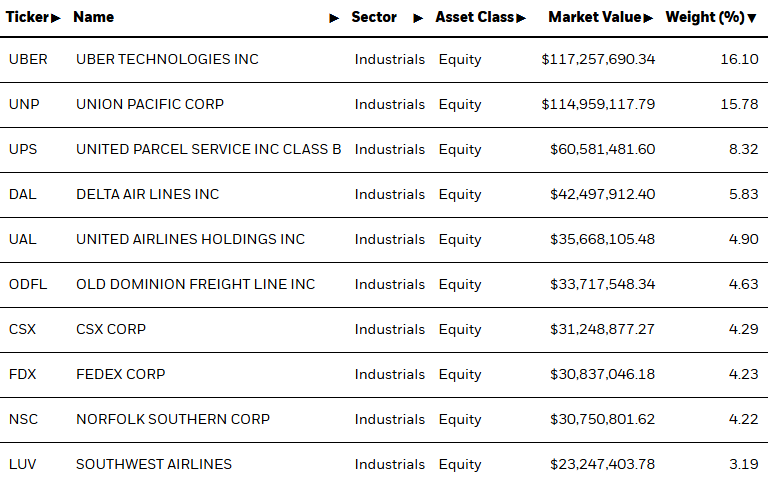

Top Holdings

(as of 18 November 2024)

(Source: Bloomberg)

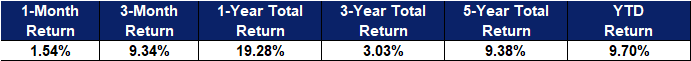

Fund Name (Ticker) | SPDR S&P Transportation ETF (XTN US) |

Description | The SPDR® S&P® Transportation ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P® Transportation Select Industry® Index (the “Index”). |

Asset Class | Equity |

30-Day Average Volume (as of 12 Nov) | 338,997 |

Net Assets of Fund (as of 18 Nov) | $263,740,000 |

12-Month Yield (as of 18 Nov) | 0.76% |

P/E Ratio (as of 18 Nov) | 19.95 |

P/B Ratio (as of 18 Nov) | 2.47 |

Expense Ratio (Annual) | 0.35% |

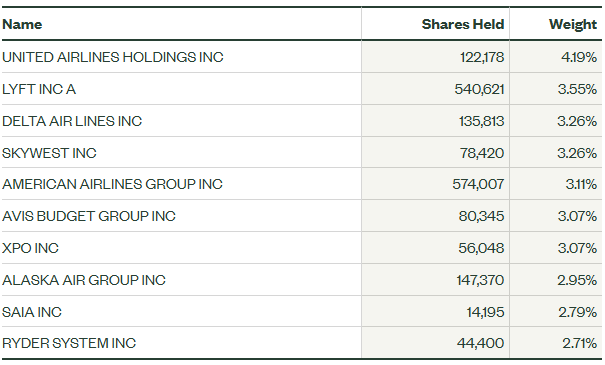

Top 10 Holdings

(as of 18 November 2024)

(Source: Bloomberg)