17 October 2024: Wealth Product Ideas

ETF Strategies for Volatile Markets

- Looming US election and escalating geopolitical tensions are amplifying market volatility

- Extreme fluctuations in tech sector stocks (e.g., Nvidia) underscore the critical need for risk diversification

- Slower global growth coupled with inflationary pressures creates a complex investment landscape

- In these uncertain times, investors need strategies that balance growth and stability

Key Points:

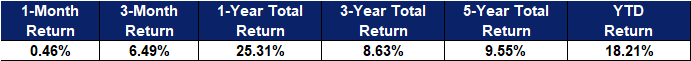

iShares MSCI USA Minimum Volatility Factor ETF (USMV)

- Defensive portfolio of large and mid-cap US equities to dampen volatility

- Historically 20% less volatile than similar funds, with superior risk-adjusted returns and a robust risk/return profile

- Preserves exposure to high-growth tech stocks while mitigating overall portfolio risk

- Consistently outperformed the S&P 500 during market downturns

Fund Name (Ticker) | iShares MSCI USA Min Vol Factor ETF (USMV US) |

Description | The iShares MSCI USA Min Vol Factor ETF seeks to track the investment results of an index composed of U.S. equities that, in the aggregate, have lower volatility characteristics relative to the broader U.S. equity market. |

Asset Class | Equity |

30-Day Average Volume (as of 14 Oct) | 1,504,435.0 |

Net Assets of Fund (as of 15 Oct) | $24,620,971,987 |

12-Month Yield (as of 30 Sep) | 1.64% |

P/E Ratio (as of 14 Oct) | 24.08 |

P/B Ratio (as of 14 Oct) | 4.10 |

Expense Ratio (Annual) | 0.15% |

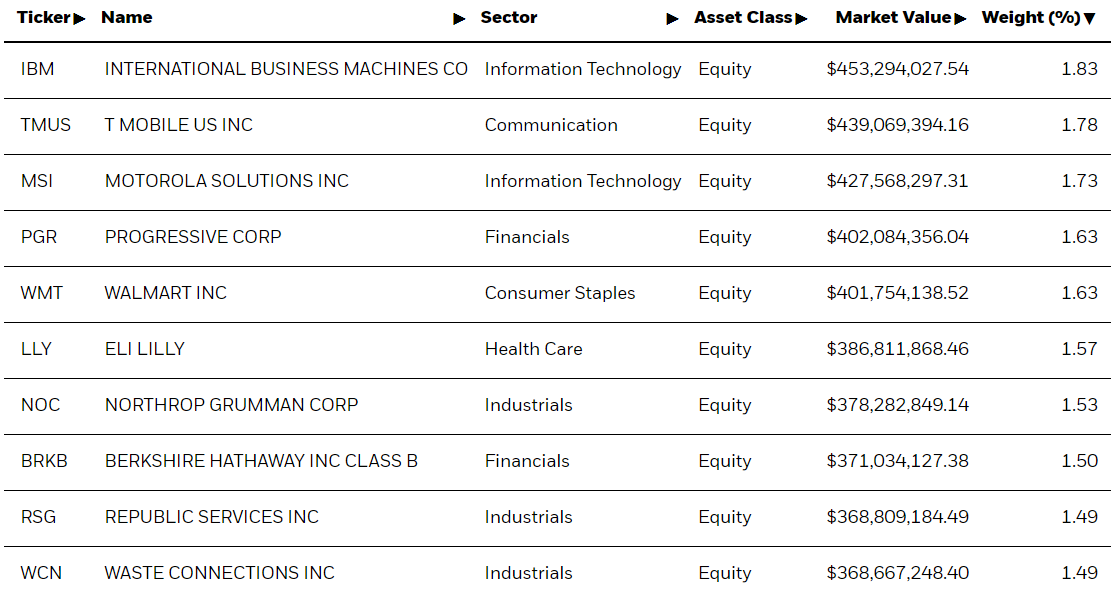

Top 10 Holdings

(as of 14 October 2024)

(Source: Bloomberg)

JPMorgan Equity Premium Income ETF (JEPI)

- Employs a sophisticated covered call option approach to generate income and curb volatility

- Delivers high yield with 40% less volatility than broad market indices

- Injects steady income and stability into the portfolio

- Since its 2020 launch, it has delivered steady income even in challenging markets

Fund Name (Ticker) | JPMorgan Equity Premium Income ETF (JEPI US) |

Description | JPMorgan Equity Premium Income ETF is an exchange-traded fund incorporated in the USA. The fund seeks to provide current income while maintaining prospects for capital appreciation by delivering the majority of the returns of the S&P500 while exposing investors to lower risk through lower volatility and still offering incremental income. |

Asset Class | Equity |

30-Day Average Volume (as of 15 Oct) | 2,719,850 |

Net Assets of Fund (as of 15 Oct) | $36,447,639,870 |

12-Month Yield (as of 15 Oct) | 7.09% |

P/E Ratio (as of 15 Oct) | 28.8 |

P/B Ratio (as of 15 Oct) | 6.0 |

Expense Ratio (Annual) | 0.35% |

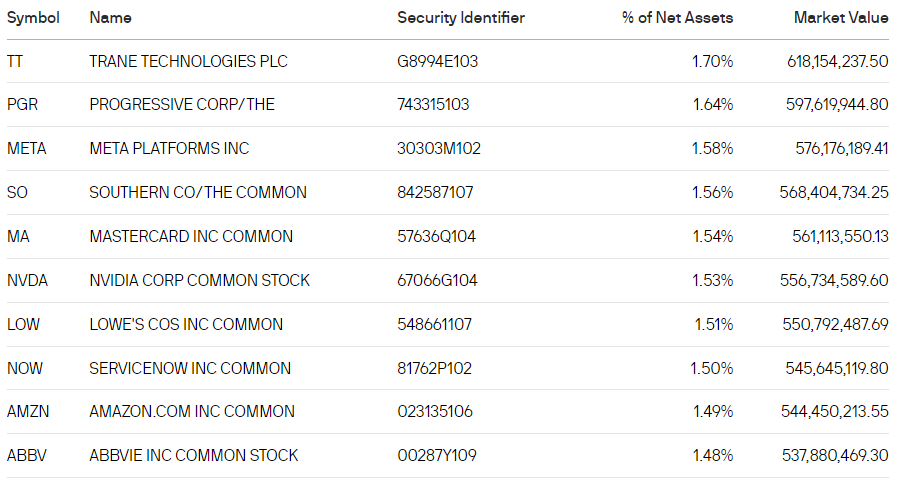

Top 10 Holdings

(as of 15 October 2024)

(Source: Bloomberg)