17 April 2025: Investment Product Ideas

SPDR Utilities Select Sector ETF (XLU US)

- Investing in the U.S. Utilities Sector. This index-tracking fund primarily holds stocks from the U.S. utilities sector, including water utilities, independent power producers, renewable energy providers, and natural gas utility companies.

- Low Volatility. Utilities tend to maintain stable operations and earnings during economic downturns or periods of inflation, exhibiting lower volatility compared to other equity sectors. This ETF is well suited for investors seeking to reduce overall portfolio volatility while gaining exposure to the U S utilities sector.

- Lower Expense Ratio. This ETF has an expense ratio of 0.08%, placing it among the lower end within its category. Its cost efficiency helps investors reduce overall investment expenses.

Fund Name (Ticker) | SPDR Utilities Select Sector ETF (XLU US) |

Description | The Utilities Select Sector SPDR® Fund seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Utilities Select Sector Index (the “Index”). The Index seeks to provide an effective representation of the utilities sector of the S&P 500 Index. |

Asset Class | Equity |

30-Day Average Volume (as of 15 Apr) | 13,517,132 |

Net Assets of Fund (as of 14 Apr) | $17,323,660,000 |

12-Month Yield (as of 15 Apr) | 2.93 |

P/E Ratio (as of 14 Apr) | 17.84x |

P/B Ratio (as of 14 Apr) | 2.25x |

Expense Ratio (Annual) | 0.08% |

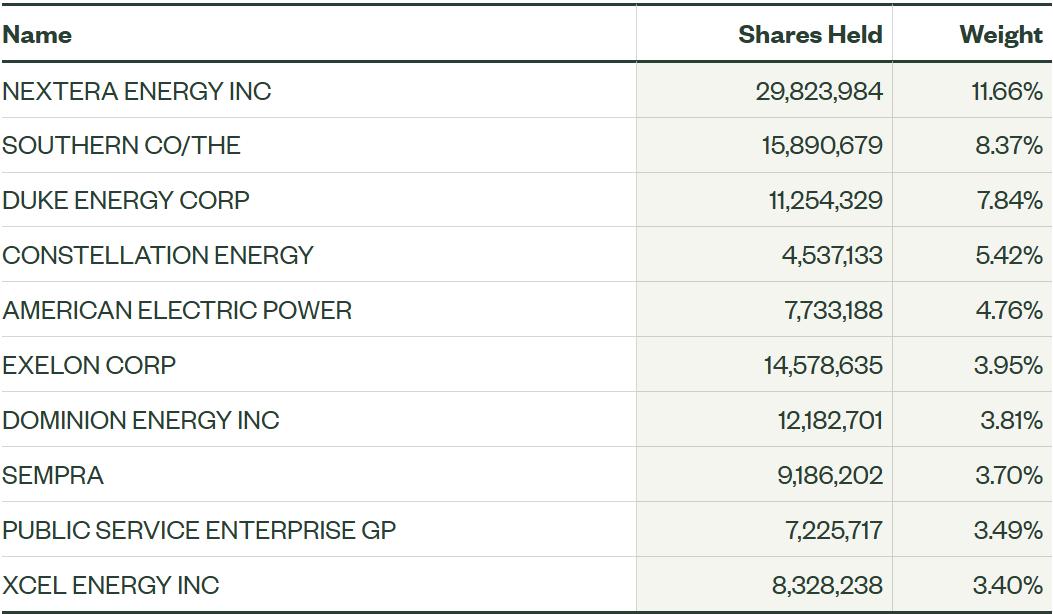

Top Holdings

(as of 14 April 2025)

(Source: Bloomberg)

iShares U.S. Telecommunications ETF (IYZ US)

- Focused on the U.S. Telecommunications Sector. This index-tracking fund primarily holds shares of U.S. companies that provide telephone and internet products, services, and technologies. It is well suited for investors optimistic about the widespread adoption of 5G, the future development of 6G, and emerging technology applications such as the Internet of Things (IoT), Virtual Reality (VR) and Augmented Reality (AR).

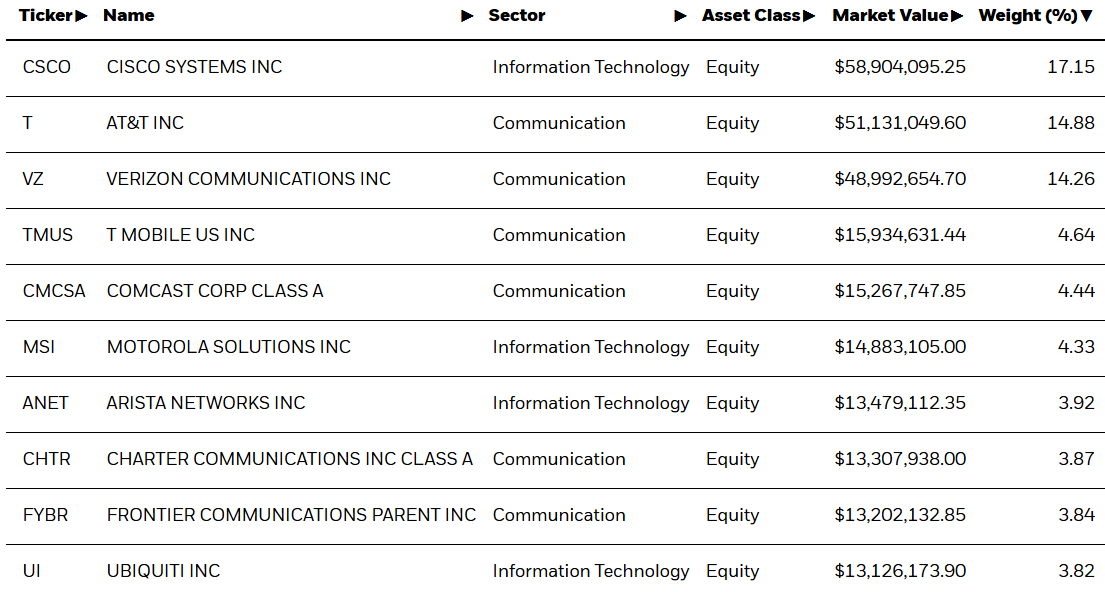

- Concentrated Holdings. The portfolio is highly concentrated, with the top 10 holdings accounting for over 70% of total assets. It focuses on a select group of major telecommunications companies, including Cisco, AT&T Inc., Verizon Communications Inc., Comcast Corp., and T Mobile US Inc.

- Moderate Expense Ratio. This ETF has an expense ratio of 0.4% which is considered moderate relative to other ETFs in the same category.

Fund Name (Ticker) | iShares U.S. Telecommunications ETF (IYZ US) |

Description | The iShares U.S. Telecommunications ETF seeks to track the investment results of an index composed of U.S. equities in the telecommunications sector. |

Asset Class | Equity |

30-Day Average Volume (as of 14 Apr) | 1,166,097 |

Net Assets of Fund (as of 15 Apr) | $345,109,532 |

12-Month Yield (as of 15 Apr) | 2.08% |

P/E Ratio (as of 14 Apr) | 14.09x |

P/B Ratio (as of 14 Apr) | 2.09x |

Expense Ratio (Annual) | 0.40% |

Top Holdings

(as of 14 April 2025)

(Source: Bloomberg)