11 February 2025: Futures Product Ideas

KGI Weekly Futures Update

SGX TSI Iron Ore CFR China (62% Fe Fines) Index Futures

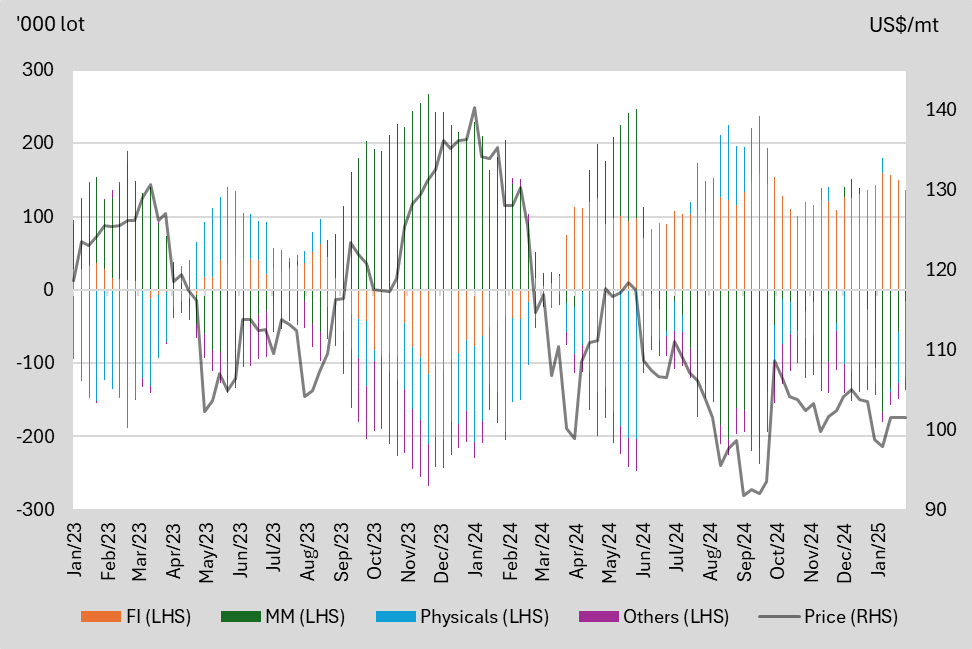

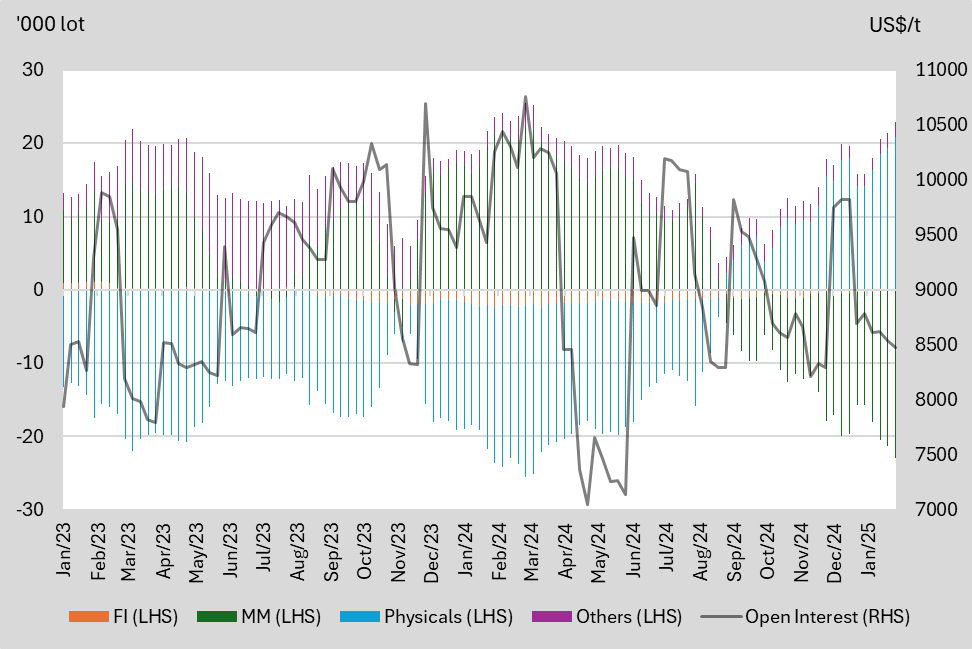

Net Long/Short and Price Comparison

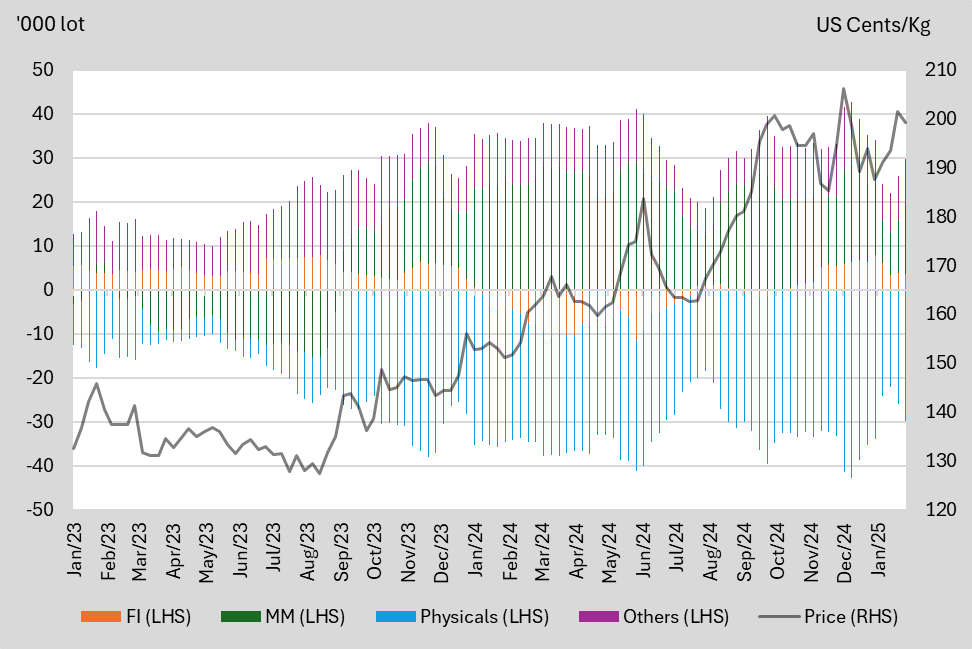

We highlight the key price levels that each participants switches their positions between net long and net short based on 2024 data.

2024 | Financial Institution (FI) | Manage Money (MM) | Physicals | Others |

Net Long | Below US$118/mt | Above US$118/mt | Below US$100/mt | NA |

Net Short | Above US$118/mt | Below US$115/mt | Above US$100/mt | NA |

Net-position WoW Change | Remarks | |

FI | -12.6 | Decrease for the last three consecutive weeks |

MM | +41.8 | Increase for the last three consecutive weeks |

Physicals | -33.8 | Decrease for the last three consecutive weeks |

Others | 4.68 | Rebounded after 2 weeks of consecutive decrease |

Figure 1: Net-positions by participant segment and price comparison

Source: SGX, KGI Research

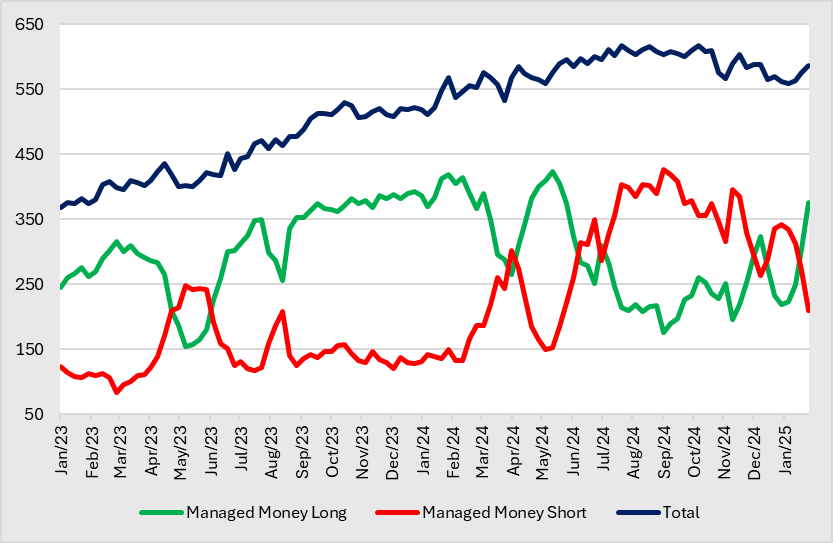

Long/Short Traders Snapshot

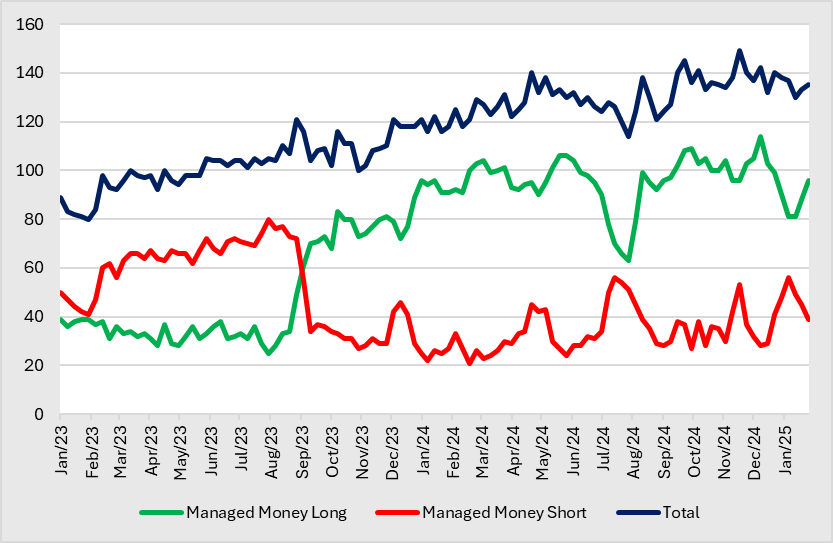

- Managed Money. The number of MM with long positions rebounded for four consecutive weeks to 376, since a low of 219 at the start of the year. Accordingly, the number of MM with short positions decreases further to 210, representing a decline for 4 weeks consecutively. Seasonally, More MMs are prone to long in 1HQ4 and 2HQ2, and there are more MMs with short positions in 1HQ2 and 1HQ3.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 423 | 427 | 393 | 248 |

Low | 176 | 131 | 154 | 83 |

Figure 2: Number of position holders iron ore futures

Source: SGX, KGI Research

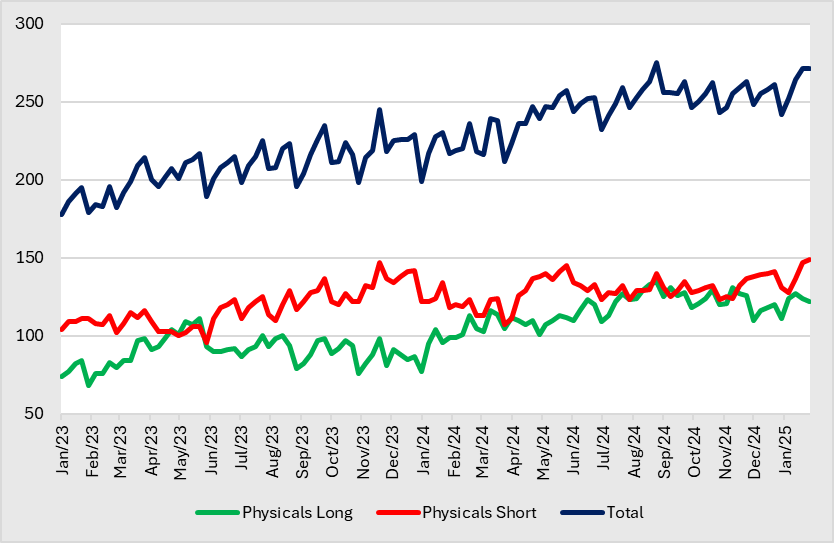

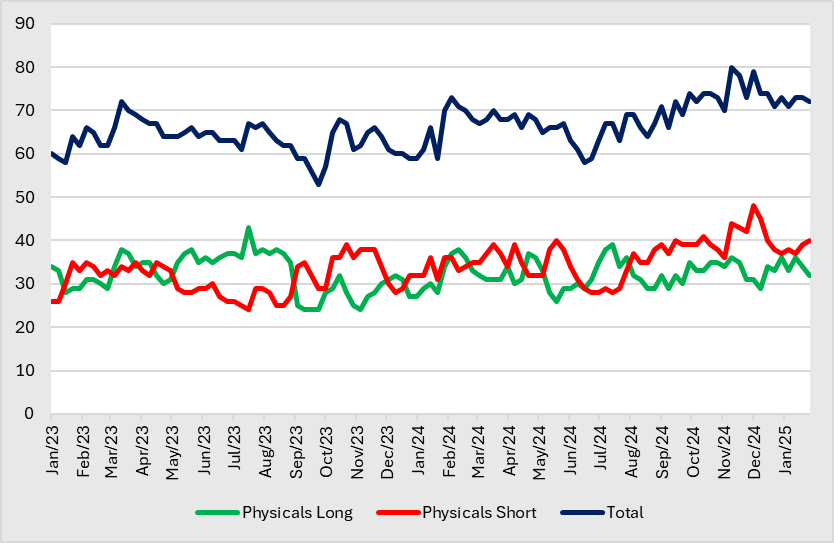

- Physicals. The number of physicals with long positions decreased slightly for 2 week to 122. Contrarily, the number of physical with short positions also increased for 3 consecutive weeks to 149, and represents a high in over two years. Seasonally, More physicals are prone to long in 1Q, and there are more physicals with short positions in Q4.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 135 | 145 | 111 | 147 |

Low | 77 | 107 | 68 | 96 |

Figure 3: Number of position holders iron ore futures

Source: SGX, KGI Research

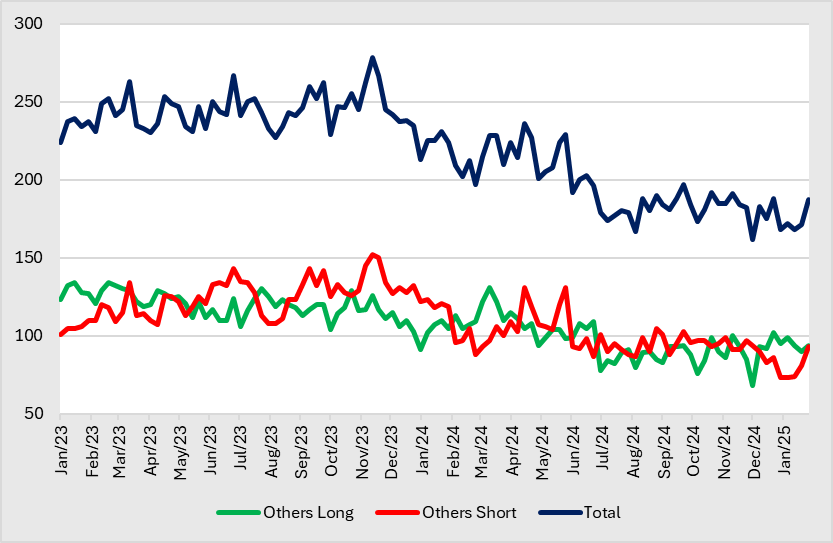

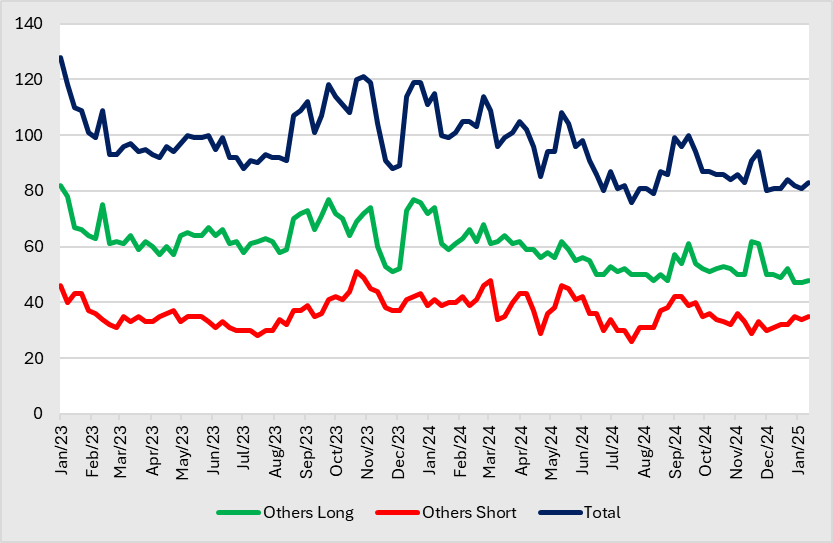

- Others. The number of others with long positions rebounded slightly to 94 after declining for 2 consecutive weeks, while the number of others with short positions increased for 3 consecutive weeks to 93.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 131 | 131 | 134 | 152 |

Low | 68 | 83 | 103 | 101 |

Figure 4: Number of position holders iron ore futures

Source: SGX, KGI Research

SGX Baltic Panamax Time Charter Average Futures

We highlight the key price levels that each participants switches their positions between net long and net short based on 2024 data.

2024 | Financial Institution (FI) | Manage Money (MM) | Physicals | Others |

Net Long | NA | Above US$9,000/t | Below US$8,500/t | NA |

Net Short | NA | Below US$9,000/t | Above US$9,500/t | NA |

Net-position WoW Change | Remarks | |

FI | +0.07 | Rebound for one week |

MM | -1.58 | Decrease for the last five consecutive weeks |

Physicals | +1.49 | Increase for the last four consecutive weeks |

Others | +0.03 | Increase for the last three consecutive weeks |

Figure 5: Net-positions by participant segment and price comparison

Source: SGX, KGI Research

Long/Short Traders Snapshot

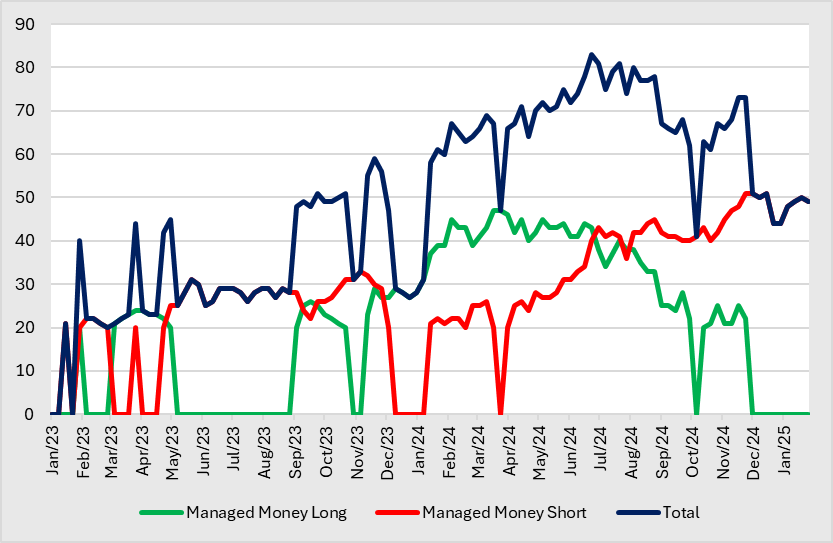

- Managed Money. The number of MM with long positions remained stable at 22 at the end of November. On the other hand, the number of MM with short positions remained stable in 2025 at around its current level at 49. Seasonally, More MM are prone to long in 1H, and there are more MM with short positions in 2H.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 47 | 51 | 29 | 33 |

Low | 20 | 20 | 20 | 20 |

Figure 6: Number of position holders freight futures

Source: SGX, KGI Research

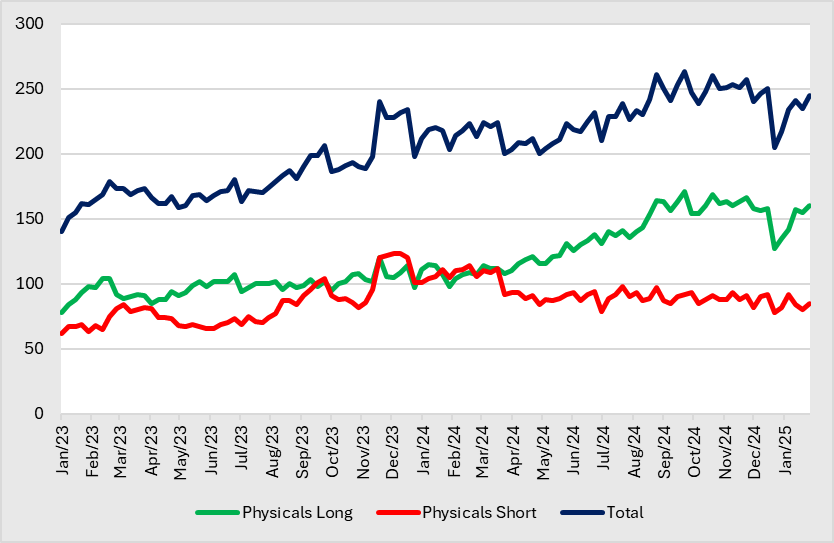

- Physicals. The number of physicals with long positions rebound back in 2025 to its current level at 160, representing a high since end November 2024. Accordingly, the number of physical with short positions rebounded to 85 after 2 consecutive weeks of decline. The number of physicals is on a general upward trend since 2Q, while physicals with short positions generally saw a downtrend since 2Q.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 171 | 114 | 120 | 123 |

Low | 98 | 78 | 78 | 62 |

Figure 7: Number of position holders freight futures

Source: SGX, KGI Research

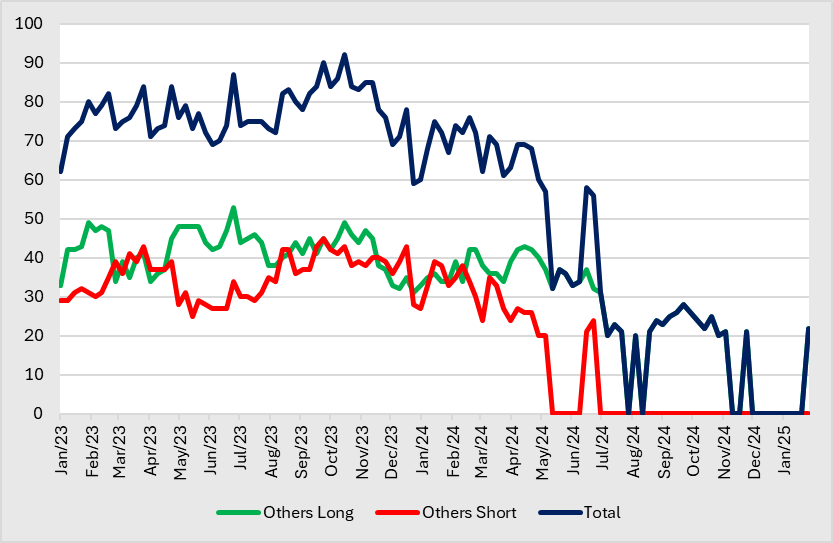

- Others. The number of others with long positions remain stable at 22 in 2025, while the number of others with short positions continues to remain stable around 24 each at the end of June 2024.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 43 | 39 | 53 | 45 |

Low | 20 | 20 | 31 | 25 |

Figure 8: Number of position holders freight futures

Source: SGX, KGI Research

SGX SICOM Rubber Futures – TSR20

Net Long/Short and Price Comparison

We highlight the key price levels that each participants switches their positions between net long and net short based on 2024 data.

2024 | Financial Institution (FI) | Manage Money (MM) | Physicals | Others |

Net Long | Below US$1.90/kg | NA | NA | NA |

Net Short | Above US$1.60/kg | NA | NA | NA |

Net-position WoW Change | Remarks | |

FI | -0.15 | Saw a overall YTD decrease |

MM | 3.39 | Largest increase since 6 December 2024 |

Physicals | -3.96 | Largest decrease since 6 December 2024 |

Others | 0.73 | Increase for the last three consecutive weeks |

Figure 9: Net-positions by participant segment and price comparison

Source: SGX, KGI Research

Long/Short Traders Snapshot

- Managed Money. The number of MM with long positions rebounded for 2 consecutive weeks to 96, representing a high since the start of the year. Accordingly, the number of MM with short positions fell for 3 consecutive weeks to 39, a low since the start of 2025.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 114 | 56 | 89 | 80 |

Low | 63 | 21 | 25 | 27 |

Figure 10: Number of position holders rubber futures

Source: SGX, KGI Research

- Physicals. The number of physicals with long positions declined for 2 consecutive weeks to 32, representing a low since mid-December 2024. Accordingly, the number of physicals with short positions increased for 2 consecutive weeks to 40, representing a high since mid-December 2024. Seasonally, more physicals are prone to long in early Q3, and there are more physicals with short positions in Q4.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 39 | 48 | 43 | 39 |

Low | 26 | 28 | 24 | 24 |

Figure 11: Number of position holders rubber futures

Source: SGX, KGI Research

- Others. The number of others with both long and short positions continues in a general downtrend. The number of long holders remained stable at around its current level of 48, but still hovering near a low since 2023. On the other hand, the number of short holders remained stable for 3 weeks at around its current level of 35.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 77 | 48 | 82 | 51 |

Low | 48 | 26 | 51 | 28 |

Figure 12: Number of position holders rubber futures

Source: SGX, KGI Research

Participant Category | Description |

Financial Institutions | An entity, such as a broker trading desk, bank trading desk or swap dealer, that uses the futures markets to manage or hedge the risk. |

Managed Money | An entity that is engaged in organized futures trading on behalf of funds or other special investment purpose vehicles such as Pension Funds, Asset Managers, Hedge Funds, Proprietary Trading Groups, Family Offices, etc. |

Physicals | An entity that predominantly engages in the physical markets and uses the futures markets to manage or hedge risks associated with the conduct of those activities. Such activities could include the production, processing, trading, packing or handling of a physical commodity, or the provision of transportation, warehousing or distribution services. |

Others | Every other trader that is not placed into one of the other three categories. E.g., Broker Agency, Bank Agency, Inter-Dealer Brokers, etc. |