10 April 2025: Investment Product Ideas

iShares Copper & Metals Mining ETF (ICOP US)

- Exposure to global copper demand. The index undergoes an annual quantitative screening to identify new constituents from companies with significant revenue in the copper and metals mining industry. This ETF is well-suited for investors with strong confidence in the growing demand for copper and metals mining.

- Strong demand outlook. Copper is a key material in various industrial and construction activities. The transition to green energy, infrastructure development, and advancements in new technologies are all expected to drive higher copper demand.

- Low expense ratio. The ETF has an expense ratio of 0.47%, which is relatively low among similar ETFs. Its cost efficiency helps investors reduce investment expenses.

Fund Name (Ticker) | iShares Copper and Metals Mining ETF (ICOP US) |

Description | The iShares Copper and Metals Mining ETF seeks to track the investment results of an index composed of U.S. and non-U.S. equities of companies primarily engaged in copper and metal ore mining. |

Asset Class | Equity |

30-Day Average Volume (as of 7 Apr) | 17,509 |

Net Assets of Fund (as of 8 Apr) | $38,405,337 |

12-Month Yield (as of 8 Apr) | 2.23% |

P/E Ratio (as of 7 Apr) | 16.82x |

P/B Ratio (as of 7 Apr) | 1.57x |

Expense Ratio (Annual) | 0.47% |

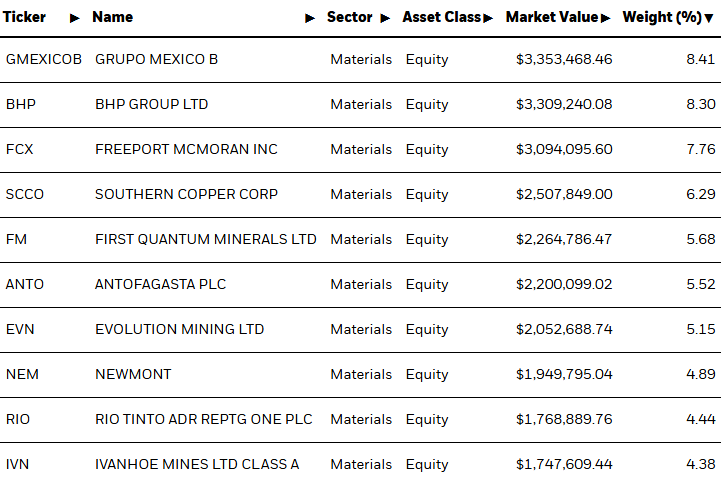

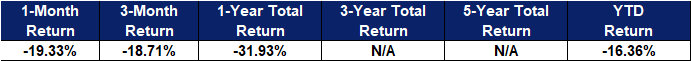

Top Holdings

(as of 07 April 2025)

(Source: Bloomberg)

Sprott Copper Miners ETF (COPP US)

- Focus on Pure Copper Business. The index constituents focus on large, mid, and small cap copper mining companies, which provide key minerals needed to meet the growing global demand for electricity This ETF is suitable for investors who want to focus on copper mining growth.

- Growing Demand. Copper is critical to all aspects of power supply As the development of power grids, technologies, manufacturing, and energy transition continues, copper demand may rise accordingly.

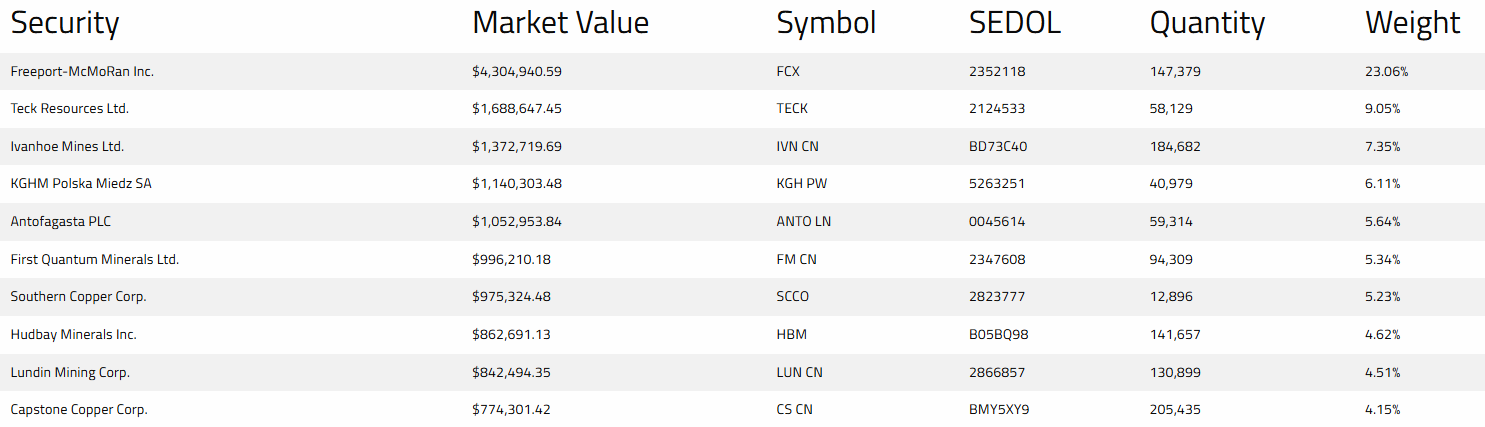

- Concentrated Holdings. This ETF has concentrated holdings, focusing on upstream companies in the supply chain. Freeport McMoRan is the largest holding, accounting for over 23%, and the top 10 holdings make up about 75.87% of the portfolio.

Fund Name (Ticker) | Sprott Copper Miners ETF (COPP US) |

Description | The Sprott Copper Miners ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Nasdaq Sprott Copper Miners™ Index (NSCOPP™). The Index is designed to track the performance of a selection of global securities in the copper industry, including copper producers, developers and explorers. |

Asset Class | Equity |

30-Day Average Volume (as of 08 Apr) | 22,520 |

Net Assets of Fund (as of 08 Apr) | $18,666,462.81 |

12-Month Yield (as of 08 Apr) | 3.40% |

P/E Ratio (as of 08 Apr) | 33.502x |

P/B Ratio (as of 08 Apr) | 1.403 |

Expense Ratio (Annual) | 0.65% |

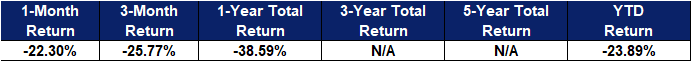

Top Holdings

(as of 8 April 2025)

(Source: Bloomberg)