SGX is launching the SGX Mysteel Shanghai Rebar (USD) Swap on 31 May 2021.

The rebar contract is a useful and unique risk management tool for physical and financial participants internationally to access China's domestic steel market, a key onshore sector that drives about 40% of the country's gross domestic product.

As the most liquid and robust spot market in steel, the Shanghai rebar market is widely seen as the barometer for China's steel industry and plays a central price discovery role in the global steel sector.

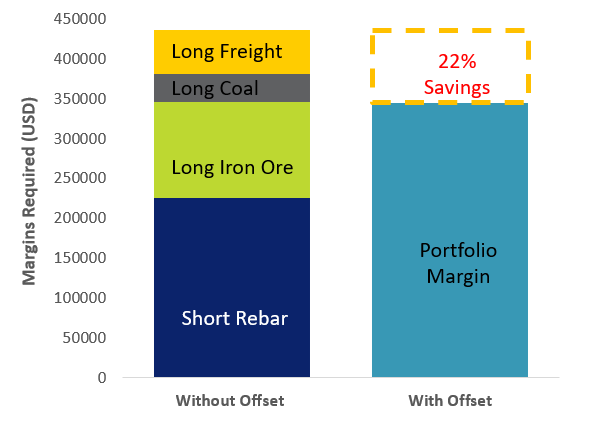

The launch of the rebar contract completes SGX's "Virtual Steel Mill" and increases trading optionalities around its iron ore products, while allowing for optimal capital efficiencies. As an illustration, a market participant trading a portfolio of SGX products to express views on steel mill margins could benefit from margin savings of around 22%, by taking a long position of 5,000 MT in iron ore, 2,500 MT in coking coal and 5 days in freight against a short position of 3,100 MT in rebar.

Source: Singapore Exchange

To find out more about SGX’s Mysteel Shanghai Rebar Swap, contact us via:

This advertisement has not been reviewed by the Monetary Authority of Singapore.