MARGIN POLICY AND PROCEDURES

Introduction

These margin policy and procedures address how KGI (Singapore) Pte. Ltd. (“Company”) monitors customer accounts, the rights it may exercise, and when these rights may be exercised in the event of margin call situations where the customer’s TNE (“Total Net Equity”) falls below the prescribed threshold level.

These margin policy and procedures describe the margin practices in relation to a typical customer of the Company. In the event of any conflict or discrepancy between these margin policy and procedures and any specific conditions that a customer may have agreed with the Company in writing, those specific conditions take precedence. In addition, the Company may at any time require customers to deposit additional margin in order to fulfill margin requirements.

It is the customer’s responsibility to continuously monitor and ensure that sufficient margin is available on his/her account at all times. The Company shall not be liable or responsible in any manner to customers for the performance of, delay in performance of, or any failure to perform, any of its rights hereunder.

The Company may impose a higher margin requirement and an initial margin limit (“IML”), as the Company sees fit, on a customer that is deemed as high risk based on geographical, financial, trading and professional information available to the Company.

For higher margin requirements, the Company’s prescribed margin requirements will be reflected on the customer’s daily statements where a margin factor will be applied on the customer’s Initial Margin and Maintenance Margin requirements.

Where IMLs are imposed, please note that any breaches of the IML may result in the forced liquidation of outstanding positions in the customer’s account, irrespective of the margin ratio of the customer’s account with the Company.

If in doubt, customers should contact the Company’s marketing representative to enquire if there is an applicable margin factor or IML on their trading account.

Fulfillment of margin call obligations can only be met via immediate funding greater or equal to the margin call amount and/or direct liquidation of positions at the point at which margin call was issued. When a trading account is on margin call, no new positions or day trades are allowed.

A margin call is only considered to be fulfilled when the Company has sighted the receipt of the required funds. For this reason, customers are encouraged to maintain adequate funding above their margin requirements to prevent margin calls during times of market volatilities and public holidays.

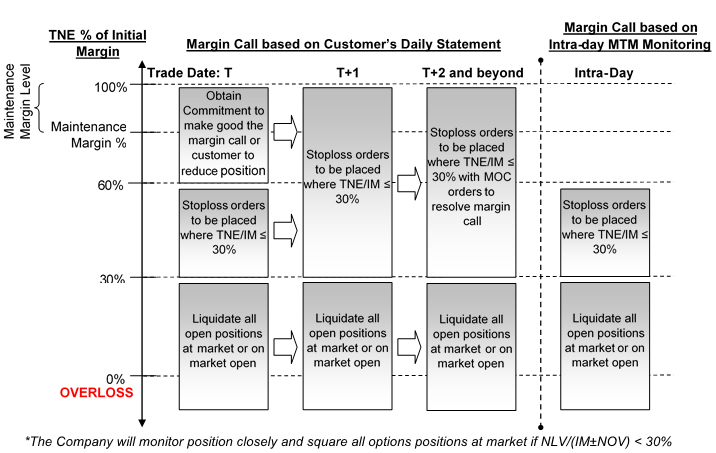

The Company’s margin call practices are illustrated in the “Margin Call Diagram” below, which aims to protect the interest of the Company, and operates without prejudice to any rights of the Company under the customer trading agreement between the Company and customers.

Generally, margin calls are issued when a customer’s TNE/IM ratio falls below the Maintenance Level. Customers have up till 2 business days (T+2) to top up their equity to the prescribed level. During this period and as illustrated in the Margin Call Diagram, the Company reserves the right, but not the obligation, to impose liquidation orders, including but not limited to Market-on-Open (“MOO”), Market-on-Close (“MOC”) and/or stop loss order on all or part of customer’s open positions at any time of the day if the TNE falls below 60% of the margin required based on marked to market valuation, regardless of whether the customer’s trading account was or was not on margin call based on the settlement of the previous close of business.

Upon placing stop loss orders, trading account would be inactivated and trades can only be done via call-in to the Company’s execution desk subject to the trading system limitations.

For the placement of stop loss orders and particularly for stop loss orders that are triggered intraday, reasonable attempts will be made to contact customers to inform them of the stop loss orders and level on a best effort basis subject to market conditions.

In the event that customers call-in to cancel, amend or check their order, no warranties or claims arising from the cancellation /amendment of orders via call-in shall be entertained.

Slippage on Liquidation

All liquidation orders are placed as a stop order subject to the trading system limitations. When triggered, stop orders become a market order available for execution at the next available market price. Stop orders guarantee execution but do not guarantee a particular price. At times, due to an increase in volatility or volume, orders may be subject to slippage. Slippage most commonly occurs during fundamental news events, periods of limited liquidity, or during market close and open periods. During periods such as these, the order type, quantity demanded, and specific order instructions can have an impact on the overall execution received.

Funding Arrangements

Please contact your account manager for our Standard Settlement Instructions (SSI) for funding arrangements.

In certain situations, the Company may exercise its discretion to take and/or not to take certain actions as prescribed hereunder based on a forthcoming funds basis. This will require the customers to furnish proof of payment, including but not limited to, copies of the banking instructions and MT103. The acceptance of such documents furnished by the customers as proof of payment is solely at the discretion of the Company.

Margin Call Diagram

(For illustration purposes only)

LEGEND:

TNE |

The sum of account ledger’s balance, forward and unrealized gains or losses (on open trade equity) and prescribed maximum value of acceptable marginable instruments. This is equivalent to “Equity Balance + Collateral” in your daily statement of account. |

IM |

Company’s prescribed Initial Margin requirement |

MM |

Company’s prescribed Maintenance Margin requirement |

T |

Trade date, position is put on/account becomes under margined |

T + 1 |

First Business Day after trade date |

T + 2 |

Second Business Day after trade date |

Intra-day |

Also known as "within the day", over the course of the trading session |

MTM |

Marked-to-Market: real-time value marked based on live prices during intra-day |

NOV |

Net Option Value: Sum of Short option Value (short option premium) and Long Option Value (long option premium) |

NLV |

Net Liquidating Value: Liquidation value of portfolio. This is the same as TNE for non-option trading customers and is equivalent to “TNE + NOV”. |

Stop Loss Order |

Order placed to liquidate all open positions of which the price is calculated at 30% of customer’s IM and ignores price correlation. This order will be executed at the market available price once the stop order price level is traded. The executed price may not be the stop order price. |