London Metal Exchange

LMEprecious

GOLD AND SILVER FUTURES FROM THE LONDON METAL EXCHANGE

LMEprecious is the initiative created by the London Metal Exchange (LME), the World Gold Council and a group of leading industry players to introduce exchange-traded, loco London precious metals products. LME Gold and LME Silver futures provide new opportunities for trading, price discovery and risk management creating an enhanced market structure for the precious metals community.

Key Benefits of Loco London Gold and Silver futures contracts

- A highly-flexible date structure – Gold and silver can be traded on a daily basis, from T+1 (TOM), T+2 (SPOT), through to T+25. LMEprecious also offers standardised monthly futures contracts, out to five years.

- Tradeable carries between all futures dates - Including the crucial TOM/NEXT carry trade for inventory management, and monthly roll trades for funds and other investors.

- Displayed electronic liquidity from day one – The LME’s market-making partners deliver deep and tight executable prices across the gold and silver forward curves.

- Loco London delivery – Gold and silver bullion physically held in London allows for the efficient settlement between LMEprecious and OTC market deliveries.

- Optimised capital management – LMEprecious contracts are cleared by LME Clear, the LME’s custom-built metals CCP, with scope for material capital savings.

- Flexible booking model – LMEprecious contracts can be traded electronically via LMEselect, and through the 24-hour telephone market.

Source: London Metal Exchange

LMEprecious date structure

The LME’s rolling prompt date mechanism enables a hybrid structure, bringing together the worlds of OTC trading and futures.

LMEprecious prompt dates

•TOM, SPOT and daily futures out to T+25

•Monthly futures out to 24 calendar months, and then quarterly out to 60 calendar months forward

•Offers single open interest space with margining and risk netting efficiencies, a shared liquidity pool and continuous pricing curve

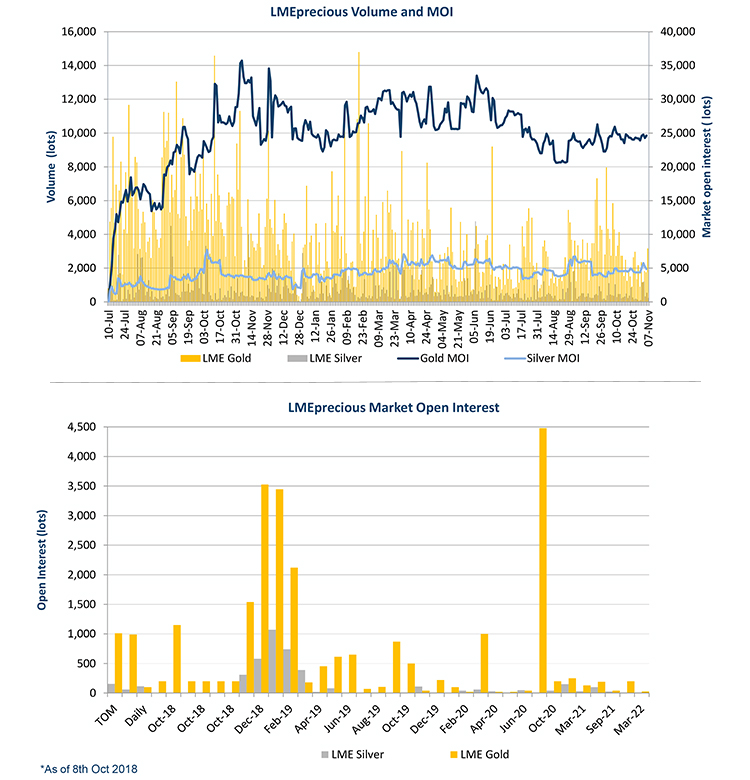

LMEprecious volume and open interest

Source: LMEprecious update November 2018

To find out more about LMEprecious, contact us via:

This advertisement has not been reviewed by the Monetary Authority of Singapore.