Technical Analysis – 22 May 2025

United States | Singapore | Hong Kong | Earnings

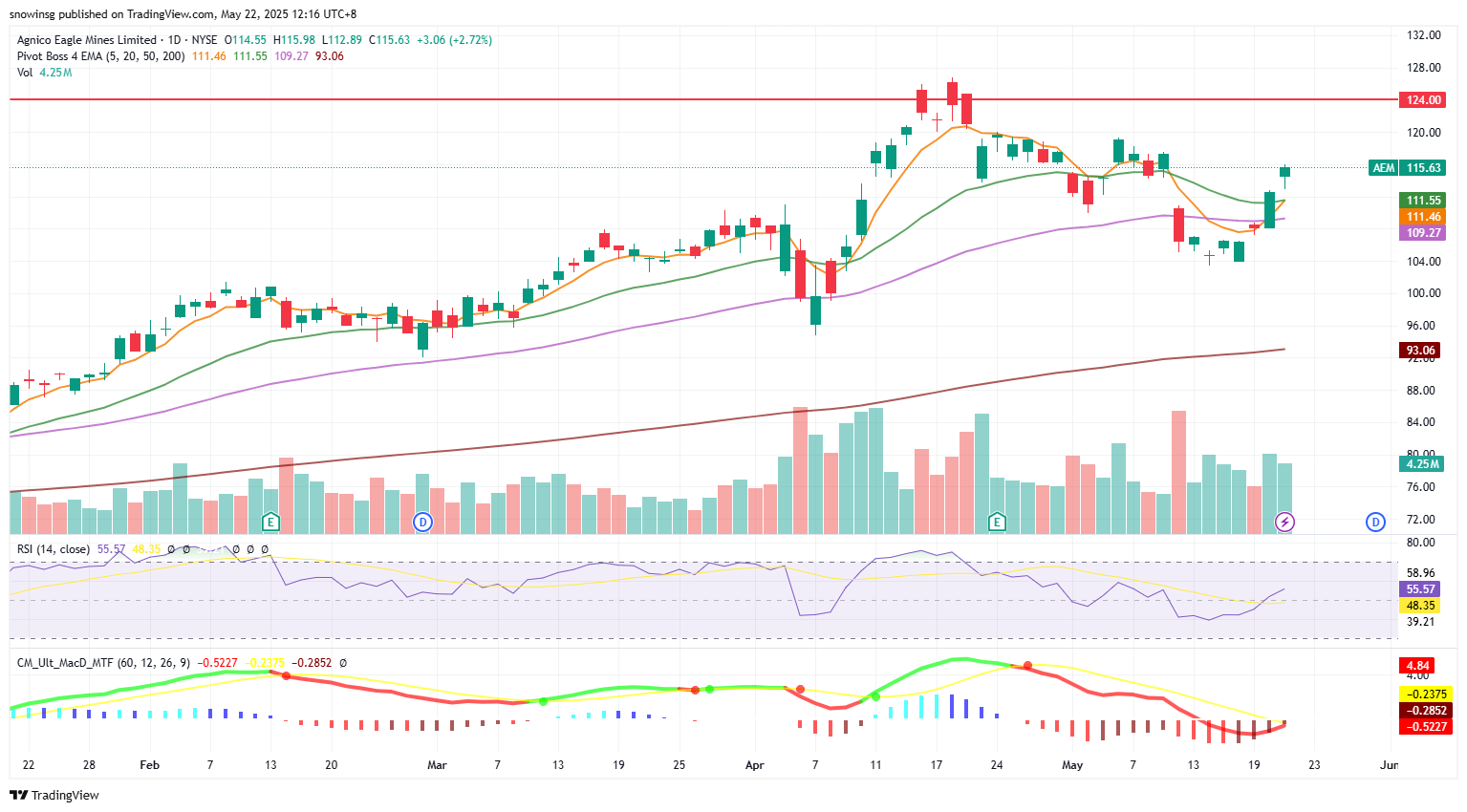

Agnico Eagle Mines Ltd. (AEM US)

- Shares closed above the 20dEMA. The 5dEMA is about to cross the 20dEMA.

- RSI is constructive while MACD is about to turn positive.

- Long – Entry 114.8, Target 124.0, Stop 110.2

Newmont Corp. (NEM US)

- Shares closed above the 20dEMA with rising volume. The 5dEMA crossed the 20dEMA.

- RSI is constructive while MACD is about to turn positive.

- Long – Entry 52.5, Target 57.0, Stop 50.3

SIA Engineering Ltd. (SIE SP)

- Shares closed at a 52-week high with a surge in volume. 20dEMA just crossed the 200dEMA.

- MACD is positive, RSI is at an overbought level.

- Buy – Entry 2.50, Target 2.70, Stop 2.40

Singapore Airlines Ltd. (SIA SP)

- Shares closed at a high since July 2024 with constructive volume.

- MACD is positive, RSI is at an overbought level.

- Buy – Entry 6.95 Target 7.25, Stop 6.80

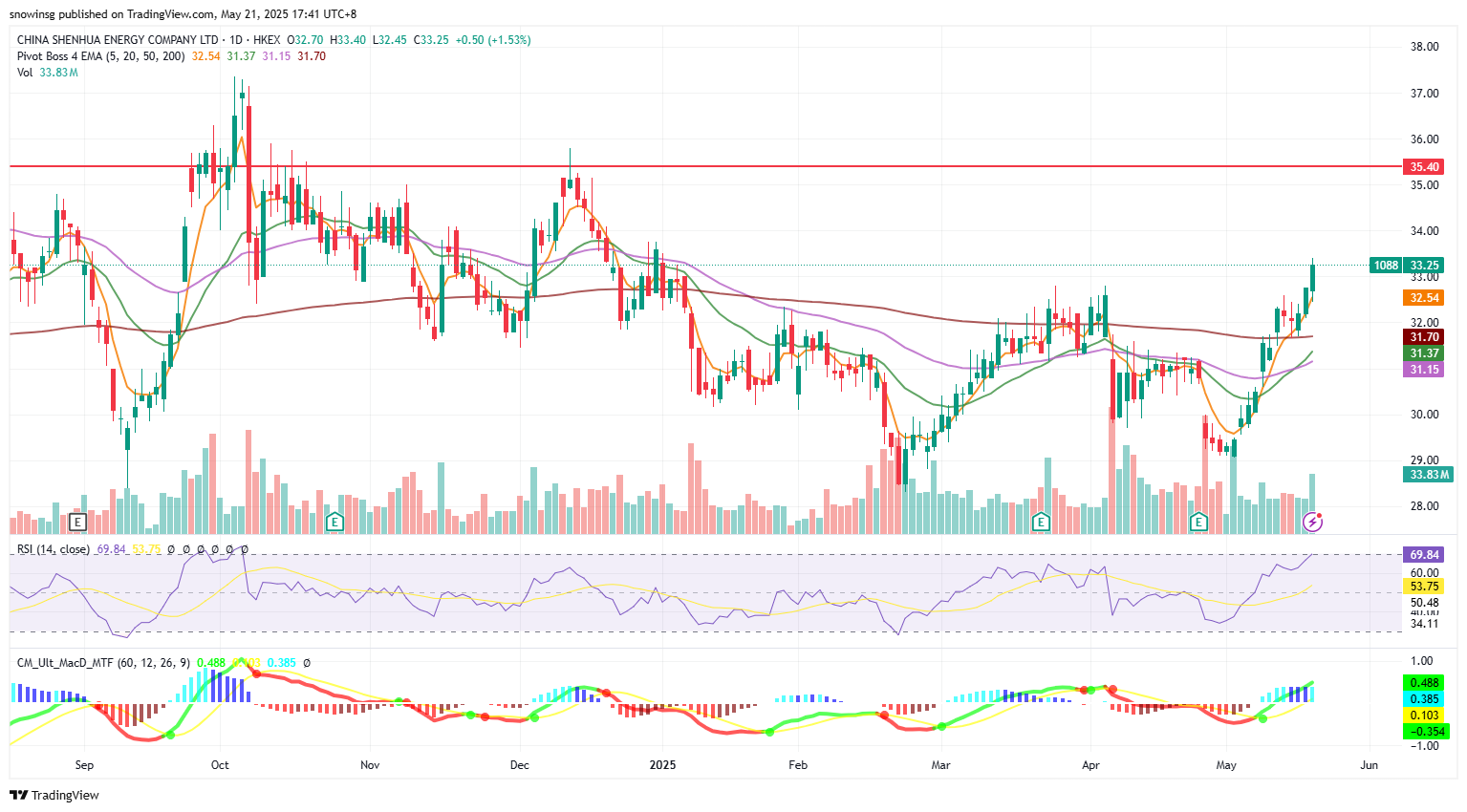

China Shenhua Energy Co Ltd (1088 HK)

- Shares closed at a four-month high above the 5dEMA with a surge in volume.

- Both RSI and MACD are constructive.

- Long – Entry 33.0 Target 35.6, Stop 31.7

China Coal Energy Co Ltd (1898 HK)

- Shares closed at a three-month high above the 5dEMA with rising volume.

- Both RSI and MACD are constructive.

- Long – Entry 8.74, Target 9.34, Stop 8.44

Baidu Inc. (BIDU)

- 1Q25 Revenue: $4.47B, +2.3% YoY, beat estimates by $170M

- 1Q25 Non-GAAP EPADS: $2.55

- FY25 Guidance: No guidance provided.

- Comment: Baidu reported better-than-expected Q1 revenue of RMB32.45bn, US$4.47bn, a 3% YoY rise, driven by 40% growth in AI cloud services to RMB9.4bn despite a 6% decline in core advertising to RMB17.31bn. The company emphasized resilience against US semiconductor export controls, citing its self-developed Kunlun P800 chips, a 30,000-unit cluster, and domestic AI ecosystem. While facing competition from startups like DeepSeek, Baidu has made its Ernie Bot chatbot free and launched upgraded AI models such as Ernie 4.5 Turbo and Ernie X1. Internationally, its Apollo Go robotaxi service secured a Dubai deployment and plans European and Turkish tests by year-end. Baidu is positioned to capitalize on China’s AI development, leveraging its homegrown chip infrastructure and cost-efficient models to compete against both domestic rivals and global benchmarks. The expansion of Apollo Go into Middle Eastern and European markets signals growing monetization potential beyond core search, while its open-access Ernie ecosystem could accelerate adoption across enterprise and consumer segments. However, margin pressures may persist as the company balances R&D investments in foundational models with the need to monetize its AI leadership in an increasingly crowded field. 2Q25 recommended trading range: $82 to $95. Neutral Outlook.

百度公司 (BIDU)

- 25财年第一季营收:44.7亿美元,同比增长2.3%,超出预期1.7亿美元

- 25财年第一季Non-GAAP每股收益:2.55美元

- 25财年指引:未提供指引。

- 短评: 百度报告的第一季度营收超出预期,达到人民币324.5亿元(44.7亿美元),同比增长3%,得益于其人工智能云服务增长40%至人民币94亿元,尽管核心广告收入下降6%至人民币173.1亿元。公司强调其在美国半导体出口管制下的韧性,提到其自主研发的昆仑P800芯片、3万台集群和国内人工智能生态系统。尽管面临来自像DeepSeek等初创公司的竞争,百度已将其ERNIE Bot聊天机器人免费化,并推出升级版人工智能模型,如ERNIE 4.5 Turbo和ERNIE X1。在国际上,其Apollo Go自动驾驶出租车服务在迪拜落地,并计划在年底前进行欧洲和土耳其的测试。百度有望利用中国的人工智能发展,凭借其自主芯片基础设施和高效的商业模式,与国内对手和全球标准竞争。Apollo Go向中东和欧洲市场的扩展表明其核心搜索之外的收入潜力,而其开放获取的ERNIE生态系统可能加速在企业和消费者领域的采用。然而,随着公司在基础模型上的研发投资与在日益拥挤的领域中实现人工智能领导地位的需求之间的平衡,利润压力可能会持续。25财年第二季度建议交易区间:82美元至95美元。中性前景。

Target Corp. (TGT)

- 1Q25 Revenue: $23.8B, -3.0% YoY, miss estimates by $550M

- 1Q25 Non-GAAP EPS: $1.30, miss estimates by $0.35

- FY25 Guidance: Expect annual adjusted earnings between $7.00 and $9.00 per share, compared to its prior forecast of $8.80 to $9.80.

- Comment: Target slashed its annual sales forecast, now expecting a low-single-digit decline after Q1 same-store sales fell 3.8%, worse than the estimated 1.08% drop, as inflation-weary shoppers cut back on discretionary spending. The retailer also faced backlash for scaling back DEI initiatives, which hurt brand loyalty, while Trump-era tariffs on Chinese imports, making up about 30% of Target’s private-label goods, squeezed margins. Adjusted EPS of US$1.30 missed estimates of US$1.61 and revenue of US$23.8bn also missed analysts’ estimates. Unlike Walmart, which relies on groceries, Target’s focus on non-essentials, such as apparel and home goods, which leaves it more exposed to economic pressures. Efforts to diversify sourcing by reducing China reliance from 60% in 2017 to under 25% by 2025 and supplier negotiations aim to mitigate tariff impacts, but pricing hikes remain a last resort for the retailer. Looking ahead, Target needs to balance cost pressures from tariffs with efforts to regain consumer trust and refine its merchandise mix. Should inflation ease and sourcing shifts progress, Target’s margins could improve, but risks remain if consumer sentiment fails to rebound or tariff costs escalate further. 2Q25 recommended trading range: $80 to $98. Negative Outlook.

塔吉特公司 (TGT)

- 25财年第一季营收:238亿美元,同比下降3.0%,低于预期5,500万美元

- 25财年第一季Non-GAAP每股收益:1.30美元,低于预期0.35美元

- 25财年指引:预计年度调整后每股收益在7.00美元至9.00美元之间,低于之前的预期8.80美元至9.80美元。

- 短评: 塔吉特下调了年度销售预期,现在预计将出现低个位数的下降,因为第一季度同店销售下降3.8%,低于预期的1.08%降幅,受通货膨胀影响,消费者削减了非必需品支出。该零售商还因缩减多样性、公平性和包容性(DEI)举措而面临反对,这损害了品牌忠诚度。同时,特朗普时代对中国进口商品的关税(占塔吉特自有品牌商品的约30%)挤压了利润。调整后的每股收益为1.30美元,低于预期的1.61美元,营收238亿美元也未达到分析师的预期。与依赖杂货的沃尔玛不同,塔吉特专注于非必需品,如服装和家居用品,使其更容易受到经济压力的影响。通过减少对中国的依赖(从2017年的60%降至2025年的25%以下)和与供应商的谈判,塔吉特努力多样化采购,以减轻关税影响,但价格上涨仍然是该零售商的最后手段。展望未来,塔吉特需要在关税带来的成本压力与努力恢复消费者信任和优化商品组合之间取得平衡。如果通货膨胀缓解和采购转变顺利,塔吉特的利润可能会改善,但如果消费者信心未能反弹或关税成本进一步上升,风险仍然存在。25财年第二季度建议交易区间:80美元至98美元。负面前景。

TJX Companies Inc. (TJX)

- 1Q26 Revenue: $13.11B, +5.0% YoY, beat estimates by $80M

- 1Q26 GAAP EPS: $0.92, beat estimates by $0.01

- 2Q26 Guidance: Expect comparable sales growth of 2% to 3%, compared with analysts’ estimate of a 2.98% rise. It expects earnings per share between $0.97 and $1, shy of the $1.03 estimate

- FY26 Guidance: Maintain $4.34-$4.43 EPS guidance and 2%-3% comp sales growth outlook amid tariff challenges.

- Comment: TJX delivered first quarter revenue of US$13.11bn and EPS of US$0.92 both above estimates, driven by resilient consumer demand as budget-conscious shoppers flocked to its off-price banners amid economic uncertainty. The company reaffirmed its fiscal 2026 guidance of a 2% to 3% comp sales growth and EPS of between US$4.34 to US$4.43. While tariffs pose a headwind, the company expects to mitigate impacts through flexible sourcing, pricing adjustments, and its value gap advantage. Q2 EPS guidance of US$0.97 to US$1.00 fell slightly below consensus of US$1.03, reflecting near-term tariff pressures on committed inventory, but its diversified supply chain, mostly reliant on U.S. middlemen, position it to navigate trade policy shifts better than peers. We believe that TJX is well-positioned to capitalize on sustained consumer trade-down trends, with its agile sourcing model and value-focused proposition providing insulation against macroeconomic volatility. While tariffs may temporarily compress margins, the company’s pricing power and inventory flexibility should enable it to maintain its growth trajectory in a challenging retail landscape. 2Q26 recommended trading range: $125 to $136. Neutral Outlook.

TJX公司 (TJX)

- 26财年第一季营收:131.1亿美元,同比增长5.0%,超出预期8,000万美元

- 26财年第一季GAAP每股收益:0.92美元,超出预期0.01美元

- 26财年第二季指引:预计可比销售增长在2%至3%之间,高于分析师预期的2.98%增长。预计每股收益在0.97美元至1.00美元之间,低于1.03美元的预期。

- 26财年指引:维持每股收益在4.34美元至4.43美元之间的预期,并预计在关税挑战下可比销售增长2%至3%。

- 短评: TJX第一季度营收为131.1亿美元,每股收益为0.92美元,均超出预期,得益于消费者需求的韧性,在经济不确定性中,预算有限的消费者纷纷涌向其折扣品牌。公司重申其2026财年的指引,预计可比销售增长在2%至3%之间,每股收益在4.34美元至4.43美元之间。尽管关税带来压力,公司预计将通过灵活的采购、价格调整和价值差距优势来减轻影响。第二季度每股收益指引在0.97美元至1.00美元之间,略低于1.03美元的共识,反映出对承诺库存的近期关税压力,但其多元化的供应链,主要依赖美国中介,使其能够比同行更好地应对贸易政策的变化。我们认为TJX有良好的条件来利用持续的消费者降级趋势,其灵活的采购模式和以价值为导向的主张为其抵御宏观经济波动提供了保护。尽管关税可能暂时压缩利润,但公司的定价能力和库存灵活性应能使其在面临挑战的零售环境中保持增长轨迹。26财年第二季度建议交易区间:125美元至136美元。中性前景。

Xpeng Inc. (XPEV)

- 1Q25 Revenue: $2.18B, +141.5% YoY, in-line with estimates

- 1Q25 Non-GAAP EPS: –$0.03, beat estimates by $0.18

- 2Q25 Guidance: Expect revenue of RMB 17.5B to RMB 18.7B, the midpoint of which is above analysts’ average estimate of RMB16.85B. It expects to deliver between 102,000 and 108,000 vehicles.

- Comment: XPeng delivered favourable first quarter results with revenue of US$2.18bn in-line with estimates and EPS of -US$0.03 surpassing estimates. The company reported a Q1 gross margin expansion to 15.6% compared to 12.9% in the same period last year and a narrowed loss, driven by strong demand for its MONA M03 sedan, competing with BYD and Tesla, and its premium X9 minivan. It forecast Q2 revenue of RMB17.5bn to RMB18.7bn, surpassing estimates of RMB16.85bn, as deliveries are expected to jump 237.7%-257.5% YoY to 102K-108K vehicles. The CEO highlighted record deliveries, making XPeng the top-selling emerging EV brand in China. Xpeng also plans to achieve mass production of vehicles with Level 3 autonomous features in China by late 2025, a significant improvement from Level 2 systems widely used. Looking ahead, XPeng is well-positioned to capitalize on China’s EV adoption wave, with its competitive pricing, margin improvements, and advanced autonomous driving roadmap. The upcoming Level 3 autonomy rollout could further differentiate its offerings, while expansion into premium segments, such as X9, and cost efficiencies may accelerate its path to profitability. However, intensifying competition and macroeconomic pressures remain key challenges to monitor. 2Q25 recommended trading range: $19 to $24. Neutral Outlook.

小鹏汽车 (XPEV)

- 25财年第一季营收:21.8亿美元,同比增长141.5%,符合预期

- 25财年第一季Non-GAAP每股亏损:0.03美元,超出预期0.18美元

- 25财年第二季指引:预计营收在人民币175亿元至187亿元之间,中值高于分析师平均预期的人民币168.5亿元,预计交付量在10.2万至10.8万辆之间。

- 短评: 小鹏汽车第一季度业绩表现优异,营收为21.8亿美元,符合预期,每股亏损为0.03美元,超出预期。公司报告第一季度毛利率扩大至15.6%,而去年同期为12.9%,亏损收窄,得益于其MONA M03轿车的强劲需求,与比亚迪和特斯拉竞争,以及其高端X9面包车。预计第二季度营收在人民币175亿元至187亿元之间,超过人民币168.5亿元的预期,交付量预计同比增长237.7%-257.5%,达到10.2万至10.8万辆。首席执行官强调创纪录的交付量,使小鹏成为中国销量最高的新兴电动车品牌。小鹏还计划在2025年底前在中国实现具备三级自动驾驶功能的车辆的量产,这相比于广泛使用的二级系统有显著提升。展望未来,小鹏将能够利用中国电动车的普及浪潮,凭借其具竞争力的定价、利润改善和先进的自动驾驶路线图。即将推出的三级自动驾驶功能有望进一步区分其产品,而向高端市场的扩展和成本效率可能加速其盈利之路。然而,竞争加剧和宏观经济压力仍然是需要关注的主要挑战。25财年第二季度建议交易区间:19美元至24美元。中性前景。

Snowflake Inc. (SNOW)

- 1Q26 Revenue: $1.04B, +25.5% YoY, beat estimates by $30M

- 1Q26 Non-GAAP EPS: $0.26, beat estimates by $0.05

- 2Q26 Guidance: Expect product revenue in the range of $1.035B to $1.040B, compared with estimates of $1.021B.

- FY26 Guidance: Raised product revenue expectations to $4.325B, compared to its prior target of $4.28B.

- Comment: Snowflake raised its fiscal 2026 product revenue forecast to US$4.325bn, from the previous US$4.28bn, after Q1 product revenue surged 26% YoY to US$996.8mn, beating estimates, as enterprises ramp up AI and cloud investments. The firm also projected strong Q2 product revenue of between US$1.035bn to US$1.040bn, compared to US$1.021bn estimate, and posted EPS of US$0.26 above the US$0.31 expected. Snowflake’s AI integrations, including partnerships with OpenAI and Anthropic, are attracting customers seeking to build advanced AI models on its platform, fuelling growth despite broader tech spending scrutiny. Snowflake is poised to maintain its leadership in cloud-based data analytics as AI adoption accelerates, with its partnerships and platform flexibility driving enterprise demand. However, competition from hyperscalers and cost optimization trends could pressure growth rates, requiring continued innovation in AI-native solutions to sustain momentum. 2Q26 recommended trading range: $180 to $200. Neutral Outlook.

雪花公司 (SNOW)

- 26财年第一季营收:10.4亿美元,同比增长25.5%,超出预期3,000万美元

- 26财年第一季Non-GAAP每股收益:0.26美元,超出预期0.05美元

- 26财年第二季指引:预计产品收入在10.35亿美元至10.40亿美元之间,高于预期的10.21亿美元。

- 26财年指引:将产品收入预期上调至43.25亿美元,高于之前的42.8亿美元目标。

- 短评: 雪花公司在2026财年第一季度将产品收入预期上调至43.25亿美元,较之前的42.8亿美元有所增加,主要是由于第一季度产品收入同比增长26%至9.968亿美元,超出预期,企业加大了对人工智能和云计算的投资。该公司还预测第二季度的产品收入将在10.35亿美元至10.40亿美元之间,高于10.21亿美元的预期,每股收益为0.26美元,高于预期的0.31美元。雪花的人工智能整合,包括与OpenAI和Anthropic的合作,吸引了希望在其平台上构建高级AI模型的客户,尽管整体技术支出受到审查,仍推动了增长。随着AI采用的加速,雪花有望在基于云的数据分析领域保持领先地位,其合作伙伴关系和平台灵活性推动了企业需求。然而,来自超大规模云服务商的竞争和成本优化趋势可能对增长率施加压力,需持续在AI原生解决方案上进行创新以维持势头。26财年第二季度建议交易区间:180美元至200美元。中性前景。