Technical Analysis – 17 July 2024

United States | Singapore | Hong Kong | Earnings

Barrick Gold Corp. (GOLD US)

- Shares closed at a 52-week high with a surge in volume.

- MACD is positive, RSI is at an overbought level.

- Long – Entry 19.0, Target 21.0, Stop 18.0

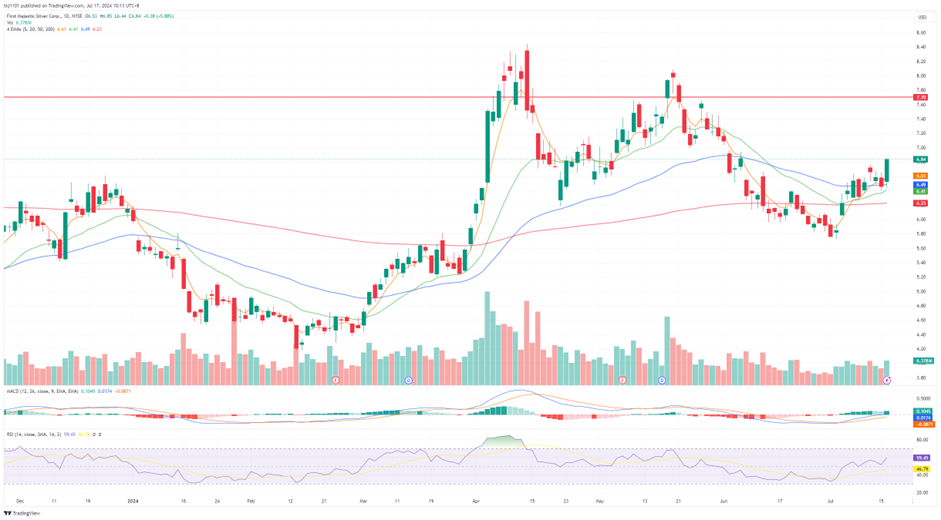

First Majestic Silver Corp. (AG US)

- Shares closed higher above the 50dEMA with more volume. 5dEMA recently crossed the 50dEMA and 20dEMA is about to cross the 50dEMA.

- MACD is positive, RSI is constructive.

- Long – Entry 6.70, Target 7.70, Stop 6.20

Seatrium Ltd. (STM SP)

- Shares closed higher above the 20dEMA. 5dEMA is about to cross the 20dEMA.

- MACD is positive, RSI is about to turn constructive.

- Long – Entry 1.48, Target 1.60, Stop 1.42

Aztech Global Ltd. (AZTECH SP)

- Shares closed at higher above the 5dEMA.

- MACD is positive, RSI is constructive.

- Long – Entry 1.02, Target 1.08, Stop 0.99

Zhaojin Mining Industry Co Ltd (1818 HK)

- Shares closed at a 52-week high above the 5mEMA.

- Both RSI and MACD are constructive.

- Long – Entry 15.6, Target 16.6, Stop 15.1

Shandong Gold Mining Co Ltd (1787 HK)

- Shares closed above the 5dEMA with rising volume. The 20dEMA crossed the 50dEMA.

- Both RSI and MACD are constructive.

- Long – Entry 17.4, Target 18.8, Stop 16.7

Goldman Sachs Group Inc. (GS)

- 2Q24 Revenue: $12.73B, +16.9% YoY, beat estimates by $360M

- 2Q24 GAAP EPS: $8.62, beat estimates by $0.20

- 2Q24 Dividend: Goldman Sachs (NYSE:GS) declares $3.00/share quarterly dividend, a 9.1% increase from the prior dividend of $2.75; Forward yield 2.5%; Payable Sept. 27; for shareholders of record Aug. 30; ex-div Aug. 30.

- FY24 Guidance: No guidance provided.

- Comment: Goldman Sachs reported robust earnings, driven by better-than-expected fixed income results and lower-than-anticipated loan loss provisions. The firm experienced a significant increase in fixed income revenue, boosted by heightened activity in interest rate, currency, and mortgage trading markets. Additionally, Goldman Sachs reduced its exposure to consumer loans, with its provision for credit losses in the quarter dropping 54% YoY to $282mn. The company’s cost-income ratio has improved significantly, following the company’s effort to reduce headcount and pivot strategically away from consumer lending. Despite these positive outcomes, the company’s investment banking business underperformed compared to rivals such as JP Morgan and Citigroup, which saw over 50% growth in investment banking fees. Goldman Sachs’ investment banking fees rose 21% to $1.73bn, slightly below market expectations. The company emphasized that it still held the no. 1 market share for mergers, attributing the comparison to a strong relative performance a year ago. They also noted they are in the early stages of a capital markets and M&A recovery, and are beginning to enjoy a return of M&A activities. While certain transaction volumes remain below their historical averages, Goldman Sachs believes it is well-positioned to benefit from a continued resurgence in activity. 3Q24 recommended trading range: $450 to $570. Positive Outlook.

摩根大通 (JPM)

- 24财年第二季营收:502亿美元,同比增幅22.0%,超预期45.4亿美元

- 24财年第二季Non-GAAP每股盈利:4.4美元,逊预期0.11美元

- 24财年第二季指引:确认全年净利息收入指引为910亿美元,调整后费用指引为920亿美元。预计信用卡服务净冲销率为3.4%。

- 短评:在并购交易复苏和资本市场强劲的推动下,摩根大通第二季度营收达到502亿美元,第二季度利润创历史新高,其中投行业务营收同比增长46%,至25亿美元。该行整体利润创历史新高,部分原因是与Visa相关的一次性会计收益。尽管业绩强劲,但该公司首席执行官对通胀、高利率和地缘政治不稳定等经济风险表示谨慎。摩根大通上半年的商业和投资银行业务收入达到创纪录的355亿美元,交易收入也在增长。净利息收入(NII)增长4%至229亿美元,受益于利率上升,利润增长25%至181.5亿美元。不过,该行拨备了31亿美元,以应对可能出现的贷款恶化造成的信贷损失。尽管美国消费者财务状况依然强劲,但核心成本和拨备的增加可能会影响该公司的盈利能力,同时利率下调可能导致NII下降。继任计划仍然是人们关注的焦点,预计将在五年内卸任的首席执行官已经确定了几位潜在的继任者。摩根大通计划今年第二次增加普通股股息,累计增幅约为19%。24年第三季度建议交易区间:195至225美元。中性前景。

BlackRock Inc. (BLK)

- 2Q24 Revenue: $4.81B, +7.8% YoY, beat estimates by $30M

- 2Q24 Non-GAAP EPS: $10.36, beat estimates by $0.40

- FY24 Guidance: Re-iterate FY24 guidance; Expect head count to be broadly flat in 2024; Expect a low to mid-single-digit percentage increase in 2024 core G&A expense.

- Comment: The company reported strong results, with assets under management reaching a record $10.65tn in the second quarter, driven by rising client asset values and increased investment in its exchange-traded funds. The company launched the Bitcoin ETF earlier this year, of which as become the largest Bitcoin spot ETF in the world, holding $18.3bn worth of Bitcoin. The company continues to anticipates growth opportunities for clients and shareholders in 2024 and beyond, particularly in the energy transition and artificial intelligence (AI) data centers. Management is optimistic about debt inflows, expecting investors to shift from high-yielding cash to riskier fixed income products as the Federal Reserve starts cutting interest rates. However, the company’s long-term net fund flows of $51bn missed market expectations, and overall net flows of $82bn for the second quarter also fell short of estimates. With declining fees from traditional asset management, the firm has been diversifying its offerings. BlackRock made two acquisitions this year to expand in tech and private markets and plans to close two more acquisitions in the second half of the year, enhancing its presence in infrastructure investments and private markets, both key growth areas. 3Q24 recommended trading range: $760 to $880. Positive Outlook.

富国银行 (WFC)

- 24财年第二季调整后营收:206.9亿美元,同比增幅0.8%,超预期4.6亿美元

- 24财年第二季GAAP每股盈利:1.33美元,超预期0.05美元

- 24财年指引:预计净利息收入将较23财年的524亿美元下降8%至9%,而此前的指导意见为下降7%至9%。利息支出从此前的526亿美元上调至54亿美元,这是因为随着股市表现超出预期,与营收相关的薪酬支出增加,以及运营损失和其他客户补救相关费用,以及美国联邦存款保险公司特别评估减少了24财年上半年的3.36亿美元。

- 短评:尽管第二季营收超出预期,但富国银行第二季获利下滑,且利息收入低于分析师预期,因激烈竞争导致存款成本上升。净利息收入(NII)同比下降9%,至119.2亿美元,低于预期。该行将NII年度降幅预期从8%修正至9%。该公司首席执行官指出,美国经济强劲,但警告称存在高通胀和高利率的风险。存款成本从上年同期的1.13%升至1.84%。尽管面临这些挑战,但在投资银行费用上涨38%的帮助下,利润还是超出了预期。净利润小幅下降至49.1亿美元。信贷损失拨备为12.4亿美元。非利息收入增至87.7亿美元。尽管在投资咨询、交易和投资银行费用方面表现强劲,但消费者银行业务和商业银行业务收入有所下降。贷款和平均存款略有下降。股本回报率上升至11.5%。富国银行计划在2009年下半年回购股票。由于过去的监管问题,该银行继续面临资产上限的限制,并正在努力改善其控制环境。展望未来,我们预计其收费收入的潜在增长可能无法抵消净利息收入的下降和净冲销的增加。富国银行也预计第三季度股息将增加14%。24年第三季度建议交易区间:52至60美元。负面前景。