30 December 2024 : Bumitama Agri Ltd (BAL SP), Lenovo Group Ltd. (992 HK), Antero Resources Corp. (AR US)

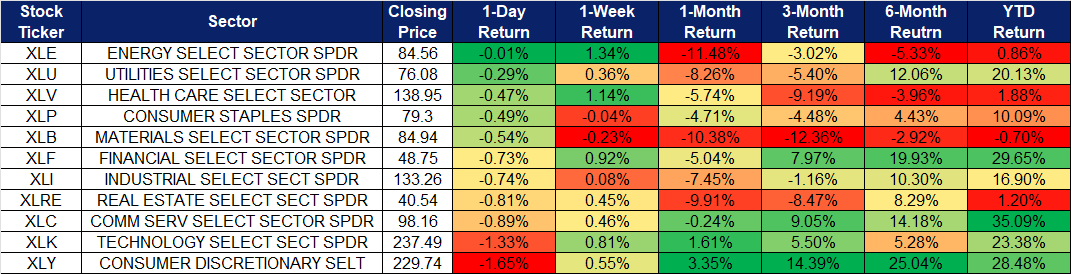

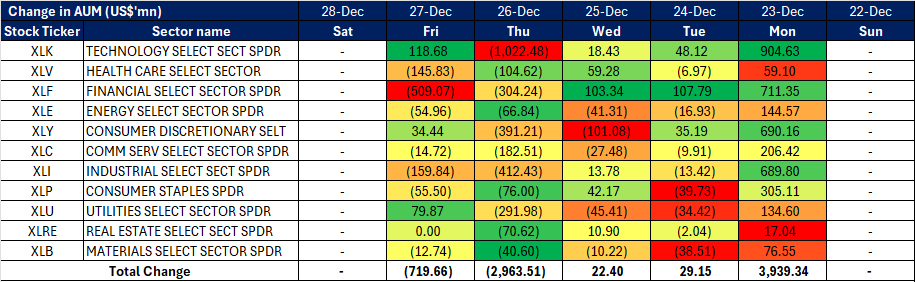

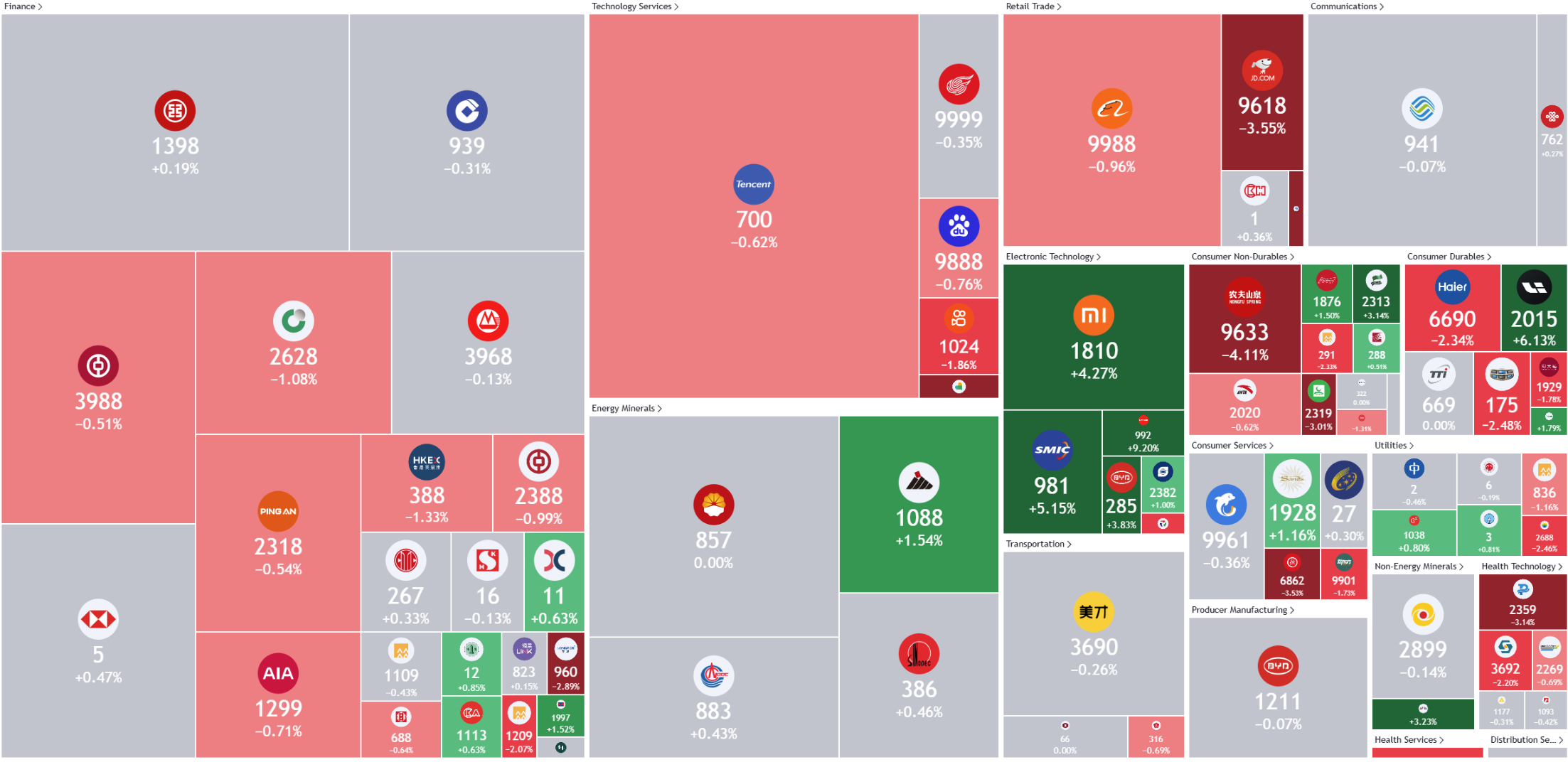

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

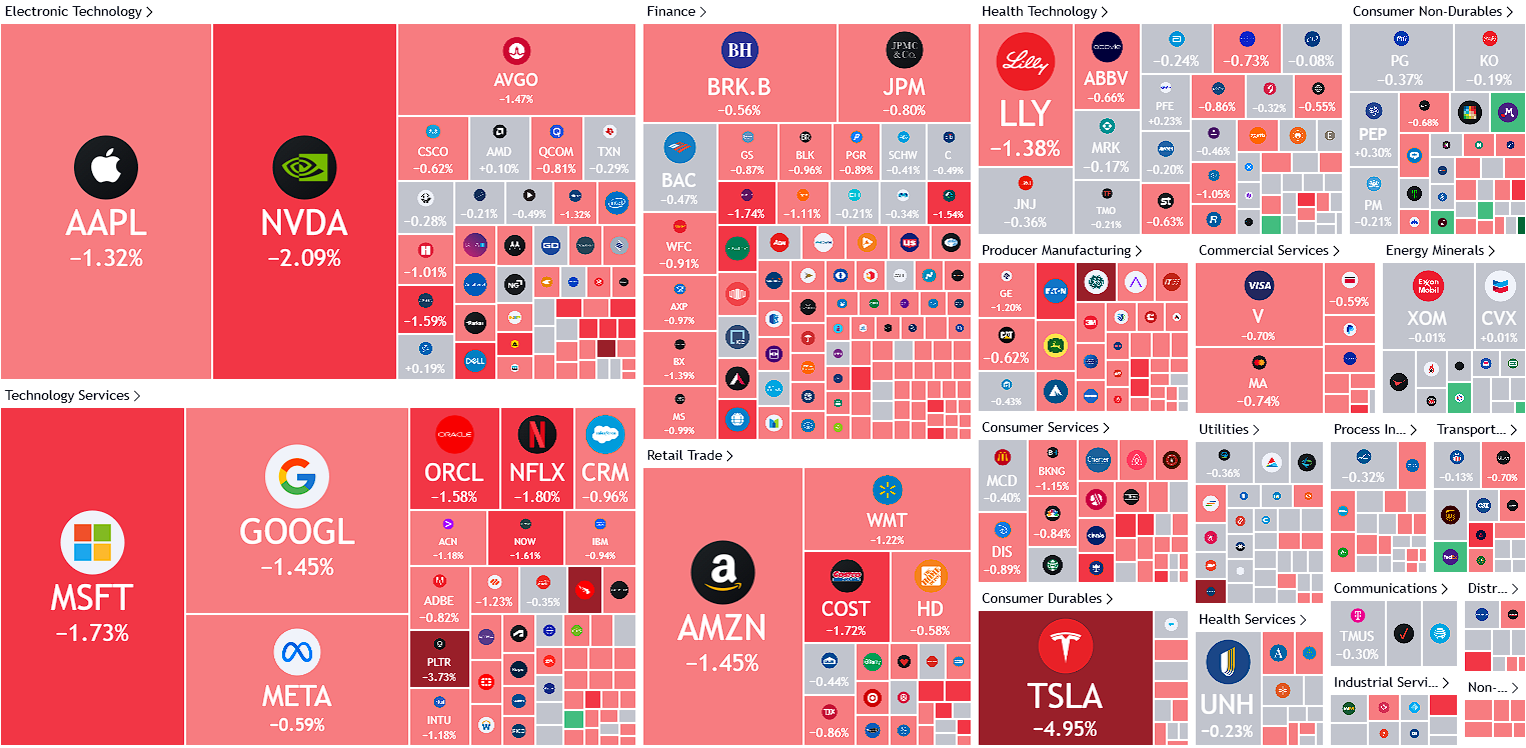

United States

Hong Kong

Bumitama Agri Ltd (BAL SP): Good signs for palm oil prices

- BUY Entry – 0.860 Target– 0.920 Stop Loss – 0.830

- Bumitama Agri Ltd. produces CPO and PK, with its oil palm plantations located in Indonesia. The Company’s primary business activities are cultivating and harvesting our oil palm trees, processing FFB from its oil palm plantations, its plasma plantations and third parties into CPO and PK, and selling CPO and PK in Indonesia.

- Rebound in Palm Oil Prices. Malaysian palm oil prices recently rebounded to above MYR 4,600 per tonne, supported by bargain buying. The contracts are on track for their first weekly advance in three, rising over 4% since its low on 20th December 2024, driven by optimism that the Lunar New Year festivities in key consumer China will boost demand for the commodity. On the production side, heavy rains in Malaysia led the industry regulator to project a fourth consecutive monthly decline in output for December, which could result in lower stockpiles for the third month in a row. Meanwhile, concerns about dry weather in parts of Argentina prompted speculators to unwind short positions in soybean and soymeal futures, lending additional support to palm oil prices. However, gains were capped by export data from cargo surveyors, which estimated that Malaysian palm oil shipments fell between 1.1% and 4% during December 1–25 compared to the same period in November.

Palm Oil Spot Price

(Source: Bloomberg)

- Palm oil prices to remain stable in 2025. According to the Council of Palm Oil Producing Countries (CPOPC), palm oil prices is expected to range between RM4,000-5,000/tonne in 2025 driven by stagnating production in key markets. As global demand for palm oil grows, stagnating production is likely to result in a supply shortage, driving prices higher. In addition, stagnating production – exacerbated by ageing plantations, unpredictable weather and limited expansion into new plantation areas – was expected to strain global supply, further pushing prices upward. Bumitama Agri is likely to benefit from a stable and better palm oil price going into 2025.

- Resilient business model. Bumitama Agri has demonstrated resilience over the past decade, navigating fluctuating palm oil prices driven by changing demand, adverse weather, and geopolitical tensions. The company has consistently delivered strong financial performance and shareholder returns, including a record 14% dividend yield in FY22 and 10% in FY23, supported by robust cash flow and a healthy balance sheet. Despite weather-related challenges and cost pressures in 1H24, Bumitama achieved significant QoQ growth in Q2, with gross profit, net profit, and EBITDA showing marked improvement. Core profit rose 43%, fueled by higher palm oil prices and easing cost pressures. Key growth drivers include Indonesia’s biodiesel mandate, set to increase blending requirements to 40% by 2025, boosting domestic consumption and reducing export volumes, thereby sustaining elevated global palm oil prices. Surging palm kernel prices further contribute to growth opportunities. Looking ahead, Bumitama is well-positioned for continued financial growth, supported by stable costs, strong demand, and favorable pricing for palm oil and palm kernel products.

- 1H24 results review. Revenue rose by 1.4% YoY to IDR7.6tn in 1H24, compared to IDR7.50tn in 1H23. Net profit fell by 29.5% to IDR1.00tn in 1H24, compared to IDR1.42tn in 1H23. Basic and Diluted EPS per share is DR494 in 1H24, compared to IDR686 in 1H23.

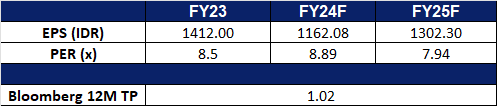

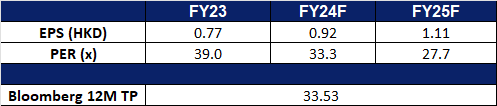

- Market Consensus.

(Source: Bloomberg)

Olam Group Ltd (OLG SP): Climate change driving agricultural product prices

- RE-ITERATE BUY Entry – 1.18 Target– 1.28 Stop Loss – 1.13

- Olam Group Ltd operates as a food and agri-business company. The Company supplies food ingredients, feed, fibre, and edible oil. Olam Group serves customers worldwide.

- Higher food ingredient prices. Coffee and cocoa prices recently climbed to a record high, with coffee rising to over US$3.24/lbs, while cocoa rose to over £9,600/ton. Coffee prices have soared this year due to major supply disruptions in key producers from Brazil to Vietnam, with the more budget-friendly robusta type that’s used in instant drinks recently hitting the highest since the 1970s. Concerns have also mounted that supplies from Brazil will slow after a long drought that hurt coffee trees, which may reduce next season’s output. On the other hand, adverse weather conditions and supply tightness in West Africa, which is home to around three-quarters of the world’s cocoa production, contributed to a rally in cocoa prices. As a major trader and processor of these commodities, the rally in prices of coffee and cocoa could lead to increased revenues for Olam.

- Expanding Presence. OLAM Agri, a subsidiary of the Olam Group, has reinforced its commitment to advancing agriculture in Nigeria by enhancing soybean production in Kwara State. The company recently donated soybean threshing machines to farmers in the Baruten Local Government Area, marking a significant step in its partnership with the Kwara State Government. This initiative aims to boost soybean yields by improving both the quantity and quality of production while also supporting the livelihoods of local farmers. Through this collaboration, OLAM Agri continues to play a pivotal role in fostering agricultural development and economic growth in the region.

- 1H24 results review. Total revenue rose to S$26.9bn in 1H24, +9.1% YoY, compared to S$24.7bn in 1H23. Net profit declined to S$67.2mn in 1H24, compared to S$116.7mn in 1H23. Diluted EPS remained flat at 0.84 S cents in 1H24, compared to 1H23.

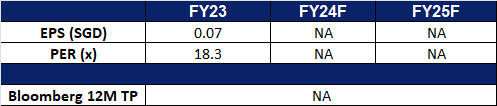

- Market Consensus.

(Source: Bloomberg)

Lenovo Group Ltd. (992 HK): Upcoming CES Expectations

- BUY Entry – 10.30 Target – 11.50 Stop Loss – 9.70

- Lenovo Group Ltd is an investment holding company primarily engaged in development, manufacture and marketing of technology products and services. The Company operates its business through three segments. The Intelligent Devices Group segment is engaged in the manufacture and sale of personal computer (PC), tablet, smartphone and other smart devices. The Infrastructure Solutions Group segment is engaged in the provision of artificial intelligence (AI) products, services and partnerships, the development of comprehensive full-stack infrastructure solutions portfolio as well as the provision of storage solutions. The Solutions and Services Group segment is engaged in the provision of information technology (IT) solutions and services across PC, infrastructure, and smart verticals, including attached services, managed services and As a Service (AaS) offering. The Company conducts its business in the domestic and overseas markets.

- Exciting CES expectations . Lenovo is poised to make a strong impression at the upcoming Consumer Electronics Show (CES) 2025, set to begin on January 7 in Las Vegas. The tech giant is expected to unveil a range of groundbreaking products that underscore its dedication to innovation and technological advancement. Among the highlights is a self-charging Bluetooth keyboard, designed to transform how users interact with their devices. Another key debut is an AI-powered travel set, tailored to enhance convenience and efficiency for users on the move. In a potential industry first, Lenovo is rumored to introduce a laptop with a rollable screen, offering unprecedented flexibility by allowing users to expand the display as needed—setting a new standard in portable computing. The lineup also includes four new tablets, addressing diverse user preferences, and the Lenovo Legion Go S, a handheld gaming device running on SteamOS. Designed for gamers, it promises a robust and portable gaming experience. With this diverse portfolio, Lenovo is showcasing its leadership in the tech industry, demonstrating its ability to innovate and meet evolving consumer demands.

- Partnership to with Volcano Engine. At the recent 2024 Lenovo Tianxi Ecosystem Partner Conference in Beijing, Lenovo officially announced its partnership with Volcano Engine. Leveraging the “super brain” of the Doubao large language model, Lenovo’s AI desktop assistant, Ruyi, will evolve from a traditional system tool into a comprehensive intelligent conversational assistant. This transformation aims to significantly enhance user interaction with PC systems, offering a more advanced and intuitive experience. These upgrades are expected to drive increased consumer interest and boost demand for Lenovo’s AI-powered PCs.

- Unveiling its AI OS. At Lenovo’s annual ecosystem partner conference in Beijing, the company unveiled a significant upgrade to its Tianxi Personal Intelligent System (Tianxi AS). Executives highlighted that Tianxi AS operates seamlessly on traditional operating systems, integrating deeply with them while supporting cross-platform functionality across multiple devices. Built on a “one body, multiple terminals” strategy, Tianxi AS enables hybrid deployment between terminals and personal clouds, providing users with a personalized assistant tailored to their needs. The system offers scenario-based integration capabilities and connects with multiple intelligent agents within an open ecosystem, further enhancing its versatility and user experience.

- 1H25 earnings. Revenue increased by 21.9% to US$33.3bn in 1H25, compared with US$27.3bn in 1H24. Net profit rose by 34.8% to US$636.8mn in 1H25, compared to US$472.5 in 1H24. Basic EPS rose to 4.91 US cents in 1H25, compared with 3.57 US cents in 1H24.

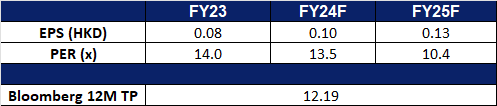

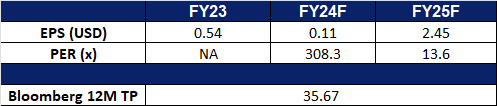

- Market consensus.

(Source: Bloomberg)

Xiaomi Corp. (1810 HK): Aggressive Expansion

- RE-ITERATE BUY Entry – 32.2 Target – 35.6 Stop Loss – 30.5

- Xiaomi Corp. is a China-based investment holding company principally engaged in the research, development and sales of smartphones, Internet of things (IoTs) and lifestyle products, the provision of Internet services, and investment business. The Company mainly conducts its businesses through four segments. The Smartphone segment is engaged in the sales of smartphones. The IoT and Lifestyle product segment is engaged in the sales of other in-house products, including smart televisions (TVs), laptops, artificial intelligence (AI) speakers and smart routers; ecosystem products, including IoT and other smart hardware products, as well as certain lifestyle products. The Internet service segment is engaged in the provision of advertising services and Internet value-added services. The Others segment is engaged in the provision of repair services for its hardware products. The Company distributes its products in domestic market and to overseas markets.

- Partnership to improve EV charging. Xiaomi Auto has forged strategic partnerships with Li Auto, Nio, and XPeng to bolster its electric vehicle (EV) charging infrastructure. Through these collaborations, users will gain access to over 6,000 Li Auto charging stations via the Xiaomi Charging Map, with select stations offering direct charging through the Xiaomi Auto app. Additionally, the integration will extend to more than 14,000 Nio charging points and over 9,000 XPeng charging points. This initiative is poised to enhance convenience for EV owners, potentially driving increased adoption of Xiaomi’s EVs and those from its partner companies.

- Continued Expansion. Xiaomi has announced plans to open at least two additional stores in Singapore by the end of 2025, increasing its total store count in the country to 10. This expansion aligns with Xiaomi’s strategy to strengthen its presence and enhance direct engagement in Southeast Asia. In Singapore, Xiaomi currently operates seven stores through distributor partners and has observed growing consumer interest in its products. Beyond Singapore, Xiaomi is focused on improving the customer experience globally, with a particular emphasis on Southeast Asia. The company recently expanded its footprint in the region by opening new stores in Thailand and Malaysia.

- Launch of YU7 in mid-2025. Xiaomi has announced plans to launch its first sport utility vehicle (SUV), the YU7, in June or July next year, marking a significant step into China’s highly competitive automotive market. The YU7 will feature a design similar to the SU7 sedan, Xiaomi’s debut electric vehicle, and will be powered by batteries produced by a subsidiary of Chinese manufacturer CATL. According to sources, the YU7 will measure approximately 5 meters in length, 2 meters in width, and 1.6 meters in height, making it both more spacious and lower-profile compared to Tesla’s current Model Y SUV. This design aims to position the YU7 as a compelling choice in the EV market.

- 3Q24 earnings. Revenue increased by 30.5% to RMB92.5bn in 3Q24, compared with RMB70.9bn in 3Q23. Net profit rose by 9.7% to RMB5.34bn in 3Q24, compared to RMB4.87mn in 3Q23. Basic EPS rose to RMB0.22 in 3Q24, compared with RMB0.20 in 3Q23.

- Market consensus.

(Source: Bloomberg)

Antero Resources Corp. (AR US): Benefitting from the current winter seasonality

- BUY Entry – 32.5 Target – 36.5 Stop Loss – 30.5

- Antero Resources Corporation explores, develops, and produces oil and natural gas. The Company focuses on the acquisition, development, and production of unconventional oil and liquids-rich natural gas properties. Antero Resources serves customers in the United States.

- Rallying Natural Gas prices. US natural gas futures rallied over 60% over the past 2 months. The commodity trimmed gains recently to $3.36/MMBtu following an EIA report showing a smaller-than-expected storage draw of 93 billion cubic feet for the week ending December 20, falling short of the forecasted 99 bcf decline and leaving inventories at 3,529 bcf. Futures found support, however, from colder overnight trends in the European weather model for early January, which had previously anticipated milder conditions compared to the US model. In parallel, natural gas production in the Lower 48 states averaged 103.1 bcf/day in December, while LNG exports are poised to reach a record high of 14.8 bcf/day, driven by robust global demand.

Natural Gas spot price

(Source: Bloomberg)

- Seasonality driving demand for natural gas. The winter season has driven up electricity demand as consumers rely on heating to combat the cold weather. This surge in electricity usage has directly increased the demand for natural gas, as reflected in the smaller-than-expected inventory decline, signaling sustained consumption. Forecasts of a January cold front in the U.S. have further elevated expectations for natural gas demand. Meteorologists predict below-average temperatures will sweep into the central and eastern U.S. from January 1-5, intensifying over the following five days. These conditions are expected to provide upward momentum for natural gas prices.

- Better outlook of natural gas export permits. President-elect Donald Trump has pledged to accelerate the approval of LNG export permits, reversing a Biden-era pause and paving the way for more lucrative exports compared to domestic gas sales. A new wave of North American liquefied natural gas supply is anticipated to enter the market by 2025. While global LNG prices are forecasted to weaken, U.S. natural gas prices are expected to rise, according to S&P Global Commodity Insights’ 2025 energy outlook, released on December 11. The market also anticipates the Trump administration will approve all pending LNG export projects, potentially enabling final investment decisions in the latter half of 2025.

- 3Q24 results. The company’s revenue declined slightly by 6.24% to US$1.06bn in 3Q24, compared to US$1.13bn in 3Q23. The company saw a net loss of US$20.4mn in 3Q24, compared to US$17.8mn net profit in 3Q23. The company reported a basic net loss per share of US$0.16 in 3Q24, compared to a net profit per share of US$0.50 in 3Q23.

- Market consensus.

(Source: Bloomberg)

IonQ Inc (IONQ US): Pure quantum computing play

- RE-ITERATE BUY Entry – 42 Target – 50 Stop Loss – 38

- IonQ, Inc. operates as a computing hardware and software company. The Company develops a general-purpose trapped ion quantum computer and software to generate, optimize, and execute quantum circuits. IonQ serves customers worldwide.

- Pure play quantum computing investment. Quantum computing has gained significant attention recently, especially following Google’s unveiling of its latest Willow Quantum Chip, which has sparked heightened investor interest in the field. While Google’s advancements have captured widespread attention, IonQ emerges as a compelling pure-play investment opportunity, uniquely positioned to benefit from the rapid growth of quantum computing as classical computing struggles to address increasingly complex problems. Unlike Google’s Willow chip, which features superconducting qubits that support large-scale integration but are challenging to manufacture, and other competitors like IBM who are facing challenges such as inconsistencies and short operational lifespan, IonQ offers notable advantages, including superior qubit consistency and a fully connected architecture, leveraging stable atomic properties for greater precision and extended performance times. With ongoing progress in hardware, networking, and software, IonQ is well-prepared to tackle the next generation of computational challenges.

- New Enterprise-Grade Quantum OS and Hybrid Services Suite. IonQ recently unveiled its newly branded quantum operating system, IonQ Quantum OS, alongside the IonQ Hybrid Services suite, a collection of innovative capabilities. The IonQ Hybrid Services suite is designed to streamline the development and deployment of hybrid workloads by seamlessly integrating IonQ quantum computers with high-performance classical computing resources via the cloud. These advancements significantly enhance the speed, performance, and usability of quantum workloads, marking a major step forward in the practical application of quantum computing. Together, these technologies are poised to transform quantum computing performance and utility, particularly for enterprise customers.

- 3Q24 results. The company’s revenue grew by 102.1% to US$12.4mn in 3Q24, compared to US$6.14mn in 3Q23. Net loss increased slightly by 17.1% to US$52.5mn in 3Q24, compared to US$44.8mn net loss in 3Q23. Basic and diluted net loss per share increased to US$0.24 in 3Q24, compared to US$0.22 in 3Q23.

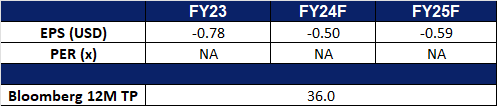

- Market consensus.

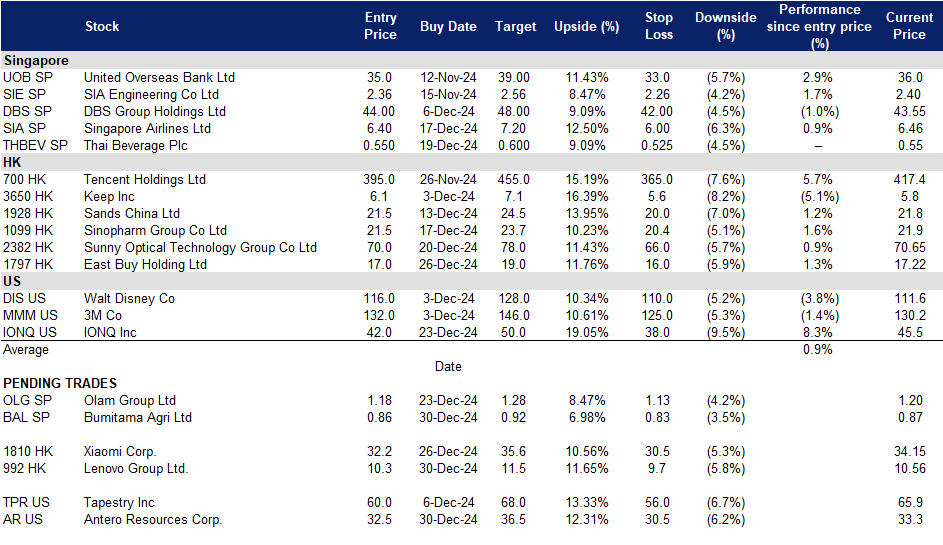

Trading Dashboard Update: Add East Buy Holding Ltd. (1797 HK) at HK$17.0. Cut loss on CSE Global Ltd (CSE SP) at S$0.445, Yidu Tech Inc. (2158 HK) at HK$4.90, and Goldwind Science & Technology Group Co Ltd. (2208 HK) at HK$6.50.