30 August 2024: Winking Studios Ltd (WKS SP), Sunny Optical Technology Group Co Ltd (2382 HK), Blackstone Inc (BX US)

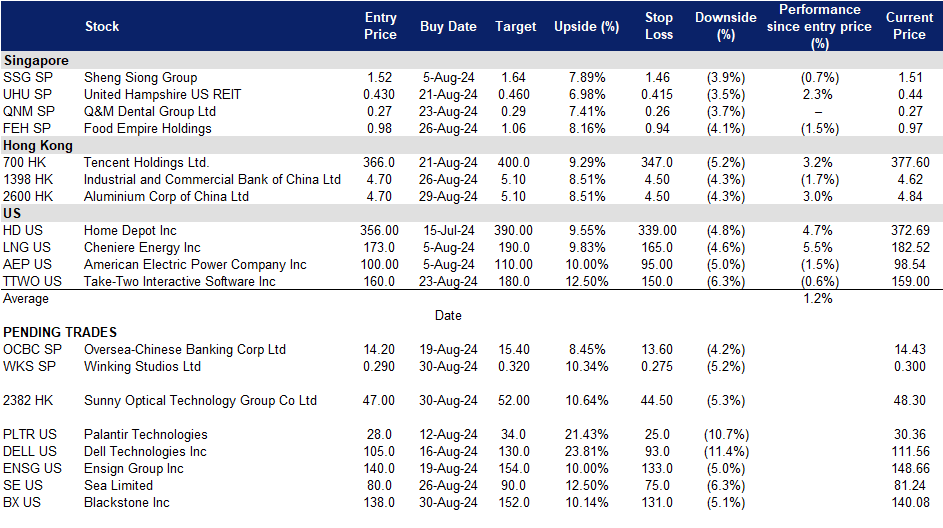

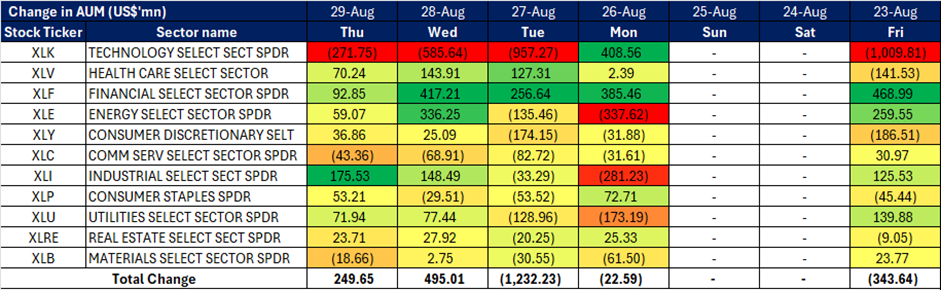

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

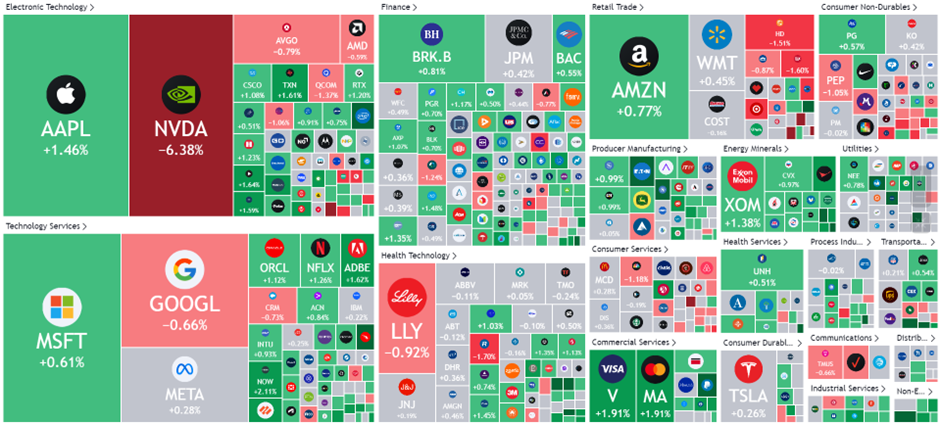

United States

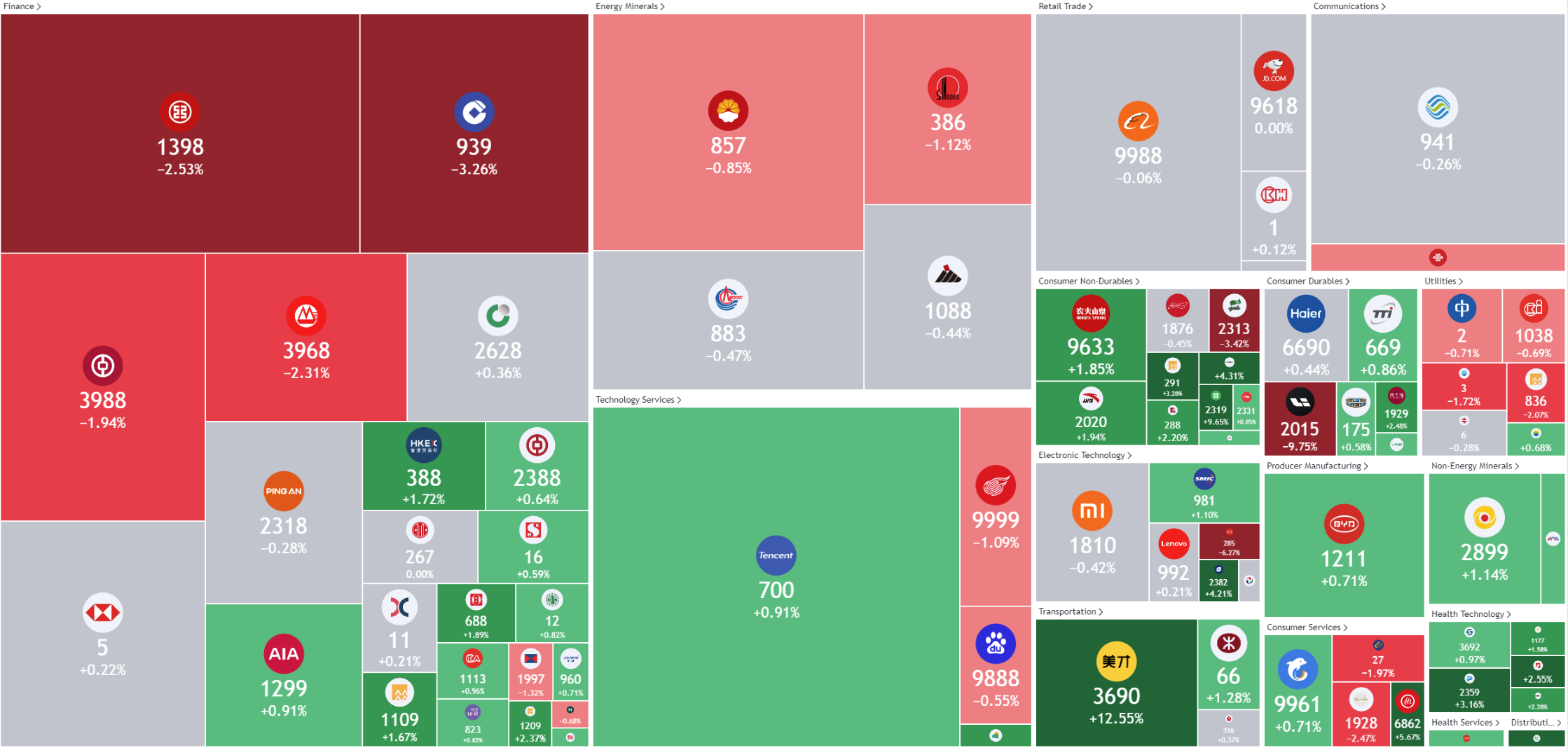

Hong Kong

Winking Studios Ltd (WKS SP): Growth through acquisition

- BUY Entry – 0.290 Target– 0.320 Stop Loss – 0.275

- Winking Studios Limited operates as a game art outsourcing studio. The Company provides complete end-to-end art outsourcing and game development services across various platforms for the video games industry. Winking Studios serves customers worldwide.

- The resounding success of Black Myth: Wukong is poised to catalyse a shift in the Chinese gaming industry to invest in AAA game development. As the game’s global acclaim coupled with its impressive sales figures (as of 23 August, over 10 million copies sold and a peak online player count of 3 million), demonstrates the potential for high-quality, home-grown AAA titles, more studios are likely to invest in ambitious projects, seeking to capitalize on the growing demand for immersive, high-budget games. This trend will drive demand for art outsourcing services, positioning Winking Studios as a key partner for studios seeking visually stunning and technically sophisticated games. As more studios pursue ambitious AAA projects, the demand for skilled artists and designers will rise, creating more opportunities for Winking Studios to collaborate with gaming companies and secure new projects, ultimately boosting growth and profitability.

- Continued M&A strategy to drive inorganic growth. Since its IPO, Winking Studios has strategically expanded its presence in Asia through the acquisition of two art outsourcing studios in Taiwan and Malaysia. This aligns with the company’s broader strategy of utilizing mergers and acquisitions to strengthen its position as a market leader in the art outsourcing industry. Its successful placement of new shares further supports its ongoing efforts to grow its market position through strategic acquisitions.

- Organic growth in the Japanese market. 1H24 revenue grew 7.1% YoY to US15.2mn from US$14.2mn in 1H23, driven by a surge in orders from both its Art Outsourcing and Game Development segments. Notably, the company’s business development efforts in Japan have yielded significant results, with revenue from this region increasing nearly threefold to US$1.5mn in the Art Outsourcing segment. This growth has contributed to a more balanced geographical revenue mix, strengthening the company’s resilience against potential economic fluctuations.

- Strategic dual-listing on the London Stock Exchange (LSE). Winking Studios is currently pursuing a dual-listing on LSE, which would provide several advantages. Fungible share transfers between the Singapore Exchange (SGX) and LSE would offer greater flexibility for shareholders in both markets. This could potentially increase trading volume and enhance market liquidity.

- 1H24 results review. Total revenue for 1H24 increased by 7.1% YoY to US$15.23mn driven by strong growth in the Art Outsourcing Segment and Game Development segment, which saw a 6.6% and 8.1% rise respectively.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.35. Please read the full report here.

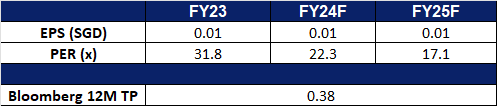

- Market Consensus.

(Source: Bloomberg)

Food Empire Holdings Ltd (FEH SP): More capacity, more growth

- RE-ITERATE BUY Entry – 0.98 Target– 1.06 Stop Loss – 0.94

- Food Empire Holdings Limited operates as a food and beverage manufacturing and distribution company. The Company offers beverages and snacks including classic and flavoured coffee mixes and cappuccinos, chocolate drinks, fruit-flavoured and bubble teas, cereal blends, and crispy potato snacks. Food Empire Holdings serves customers worldwide.

- Continued strong growth in South-East Asia and South Asia. Food Empire Holdings saw a sustained increase in sales across its core markets in 1H24, showcasing a resilient consumer demand for the company’s products, which saw volume growth YoY, especially in the Southeast Asia and South Asia regions. The group continues to reap the benefits of its brand-building efforts in Vietnam, increasing its market share across the Vietnamese market. Demand for the group’s products in South Asia also remains strong amidst a coffee consumption boom in the region.

- Ramped up capacity in Malaysia. The group recently completed the expansion of its non-dairy creamer production facilities in Malaysia. Commercial production started on 1st April, boosting production of non-dairy creamer going forward. The plant will reach full production capacity over the next 24 to 36 months and will drive more growth for the group’s Southeast Asia region and translate into higher revenue for the group in the region.

- 1H24 results review. Total revenue for 1H24 increased by 13.6% YoY to US$225.2mn from US$198.2mn in 1H23, led by strong growth in its South-East Asia and South Asia market, which saw a growth of 34.8% and 36.0% respectively.

- We have fundamental coverage with a BUY recommendation and a TP of S$1.35. Please read the full report here.

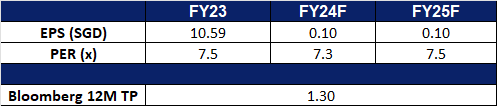

- Market Consensus.

(Source: Bloomberg)

Sunny Optical Technology Group Co Ltd (2382 HK): Upcoming Apple event

- BUY Entry – 47.0 Target 52.0 Stop Loss – 44.5

- Sunny Optical Technology Group Co Ltd is an investment holding company principally engaged in the design, research and development, manufacture and sale of optical and optical related products and scientific instruments. The Company operates its business through three segments: Optical Components segment, Optoelectronic Products segment and Optical Instruments segment. The Company’s main products include mobile phone lenses, automotive lenses, high-pixel lens lights, camera modules and others. The Company’s products are sold in China and overseas markets.

- Upcoming Apple event. Apple has announced its next major event, titled “It’s Glowtime,” scheduled for September 9, 2024. The company is widely expected to unveil the iPhone 16 lineup during this event. One of the most notable changes in the iPhone 16 and 16 Plus models is the anticipated switch to a vertically aligned camera system on the back. Additionally, all four iPhone 16 models are expected to feature an Action Button and possibly a new button dedicated to capturing photos and videos. The new lineup is also rumored to include several AI-powered enhancements, such as an upgraded Siri, AI-driven writing tools, and integration with ChatGPT. These improvements could drive strong demand for the iPhone 16 models, potentially benefiting suppliers like Sunny Optical.

- Higher sales expectations. Apple has reportedly asked suppliers to prepare parts for the production of around 88mn-90mn new iPhones, marking an increase of at least 10% from last year’s initial order of approximately 80mn units. This anticipated surge in demand for the new iPhone models is expected to drive higher demand for Sunny Optical’s handset lenses, boosting their sales. Sunny Optical’s recent earnings report highlighted that a higher average selling price could further enhance revenue and net profit due to an improved product mix. The company has also raised its growth guidance for FY24 to 5-10% and expects its gross margin to improve to 20-25% in the second half of the fiscal year.

- More smartphone shipments expected. International Data Corp. (IDC) recently raised its forecast for full-year global smartphone shipments, citing strong growth in the first half of the year as consumer electronics demand rebounds and AI features draw buyers. IDC now expects shipments to increase by 5.8% to 1.23bn units in 2024, up from its previous projection of 4% growth to 1.21bn units. The market anticipates that new AI features will boost demand, particularly in key markets like the U.S. and China, which is recovering from a prolonged slump.

- 1H24 earnings. Revenue rose by 32.1% YoY to RMB18.9bn in 1H24, compared to RMB14.3bn in 1H23. Net profit rose by 142.0% YoY to RMB1.11bn in 1H24, compared to RMB0.459bn in 1H23. Basic EPS increased to RMB0.9904 in 1H24, compared to RMB0.3999 in 1H23.

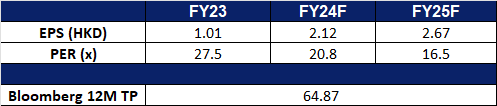

- Market consensus.

(Source: Bloomberg)

Industrial and Commercial Bank of China Ltd (1398 HK): More potential value in banks

- RE-ITERATE BUY Entry – 4.70 Target 5.10 Stop Loss – 4.50

- Industrial and Commercial Bank of China Ltd is a China-based company principally engaged in the provision of banking and related financial services. The Bank mainly operates three segments, including Corporate Banking segment, Personal Banking segment and Treasury segment. The Corporate Banking segment provides loan, trade financing, deposit, corporate finance, custody and other related financial products and services to enterprises, government agencies and financial institutions. The Personal Banking segment provides loan, deposit, bank card, personal finance and other related financial products and services to individual customers. Treasury segment includes money markets business, securities investment business, self and valet foreign exchange trading and derivative financial instruments business. The Company conducts its businesses within domestic and overseas markets.

- In search of high dividend yielding assets. Chinese banks have quickly become favourites in the market as investors are drawn to their substantial dividend payouts and strong state backing, positioning them as likely winners in a country where bond yields have plunged to near-record lows. The surge in demand for bank shares is largely driven by a broader scramble for high-dividend assets amid a year of economic uncertainty and a murky investment outlook. Optimists believe further gains are on the horizon, fueled by increasing interest from risk-averse funds and the continued support of the state for the market.

- Spurring economic growth. Chinese banks have kept their benchmark lending rates unchanged for August, as profit margins remain under pressure and policymakers prioritize the stability of financial institutions. The one-year loan prime rate (LPR) stays at 3.35%, while the five-year rate, which influences long-term credit such as mortgages, remains at 3.85%. This decision follows a 10-basis point reduction in the LPRs last month by commercial lenders, after the central bank lowered a key short-term policy rate for the first time in nearly a year in response to disappointing economic growth in the second quarter. Recent data from the National Bureau of Statistics of China (NBS) indicates that the economy may be experiencing modest growth in the third quarter. Although the July LPR reduction could further pressure banks’ profitability, the potential for increased loan volumes driven by improved business confidence could benefit banks in the long run.

- Partnership with Dubai Chambers. Dubai Chambers recently signed a Memorandum of Understanding (MoU) with the Dubai (DIFC) Branch of the Industrial and Commercial Bank of China Limited to strengthen cooperation and enhance support for companies and businesspeople in Dubai and China. The agreement outlines a framework for broad collaboration, where Dubai Chambers will assist the bank’s customers in establishing their businesses in Dubai. Additionally, both parties will work together to advance the interests of the business communities in Dubai and China, fostering collaboration between companies to boost bilateral trade and investment in both markets.

- 1Q24 earnings. Revenue fell by 3.80% YoY to RMB210.2bn in 1Q24, compared to RMB218.5bn in 1Q23. Net profit fell by 2.78% YoY to RMB87.6bn in 1Q24, compared to RMB90.2bn in 1Q23. Basic EPS fell 4.0% YoY to RMB0.24 in 1Q24, compared to RMB0.25 in 1Q23.

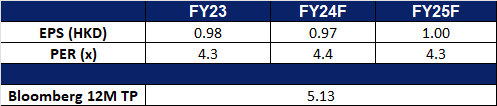

- Market consensus.

(Source: Bloomberg)

Blackstone Inc (BX US): Poised for rate cut benefits

- BUY Entry – 138 Target – 152 Stop Loss – 131

- Blackstone Inc. operates as an investment company. The Company focuses on real estate, hedge funds, private equity, leveraged lending, senior debts, and rescue financing. Blackstone serves customers worldwide.

- Rate cut benefits. After the recent Jackson Hole Conference, investors are increasingly focusing on economic data as the Federal Reserve prepares to begin cutting interest rates, starting with a likely 25 basis-point reduction in September. Blackstone, world’s largest commercial property owner, is positioned to capitalize on increased property valuations. Despite challenges in real estate due to elevated rates, the firm remains optimistic about a new cycle of rising property values. Blackstone has been actively investing and expects a significant increase in fee-related earnings as key funds begin generating full fees. Lower interest rates can lead to increased property valuations, which could positively impact Blackstone’s portfolio and ultimately result in increased returns for its investors.

- Enhanced investment opportunities. A lower interest rate environment can stimulate M&A activity and real estate investment, providing Blackstone with more opportunities to acquire and develop properties. Blackstone’s Reit, jointly owned with Soilbuild’s executive chairman, Lim Chap Huat, recently sold a S$1.6bn portfolio of industrial real estate assets in Singapore to Lendlease and Warburg Pincus. Additionally, Blackstone is in talks with banks to secure a five-year loan of around A$5.5 billion to support its bid for Australian data center operator AirTrunk. These activities demonstrate Blackstone’s continued global real estate investment. While global M&A activity in 2Q24 saw a 21% drop in the number of deals, there was a slight increase in deal volume to US$769.1bn. However, growing optimism is emerging as valuation gaps between buyers and sellers begin to narrow, signalling a potential return to a more normalized M&A market.

- 2Q24 earnings review. Revenue fell slightly by 0.7% YoY to US$2.80bn, beating estimates by US$240mn. Distributable EPS was US$0.96 missing estimates by US$0.02. It declared a quarterly dividend of US$0.82 per share.

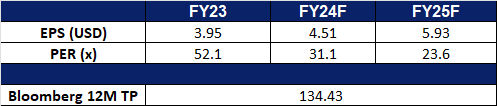

- Market consensus.

(Source: Bloomberg)

Sea Limited (SE US): Growth on track

Sea Limited (SE US): Growth on track

- RE-ITERATE BUY Entry – 80 Target – 90 Stop Loss – 75

- Sea Limited offers information technology services. The Company provides online personal computer and mobile digital content, e-commerce, and payment platforms. Sea serves customers worldwide.

- Southeast Asia’s leading e-commerce platform. Shopee anticipates a significant 25% increase in Gross Merchandise Value (GMV) this year, surpassing its initial mid-teens projection. This growth is fuelled by a strategic adjustment: increased commission fees for merchants in key markets. Despite this change, Shopee’s strong market position remains unchallenged due to its expansive user base and robust logistics infrastructure. This combination positions Shopee as a valuable partner for merchants seeking to tap into the region’s growing online marketplace.

- Gaming business continue to expand. The company’s flagship title “Free Fire” attracting over 100 million daily active users in the second quarter. This achievement solidified “Free Fire’s” position as the world’s most downloaded mobile game during the period. To bolster its gaming portfolio, the company has partnered with Tencent and Electronic Arts to launch “Need for Speed: Mobile” in Taiwan, Hong Kong, and Macau later this year. This strategic move positions the company for sustained growth in the competitive gaming market.

- 2Q24 earnings review. Revenue grew by 22.9% YoY to US$3.81bn, beating estimates by US$90mn. GAAP EPS was US$0.14 missing estimates by US$0.05.

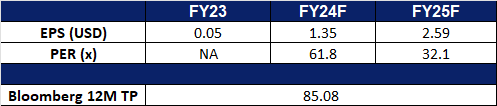

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Aluminium Corp of China Ltd (2600 HK) at HK$4.7.