29 November 2024: Thai Beverage PCL (THBEV SP), Keep Inc. (3650 HK), Walt Disney Co (DIS US)

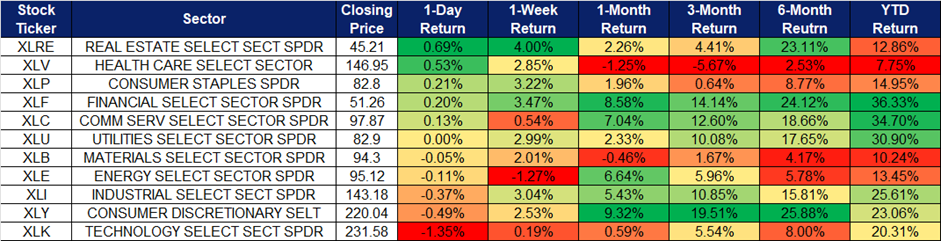

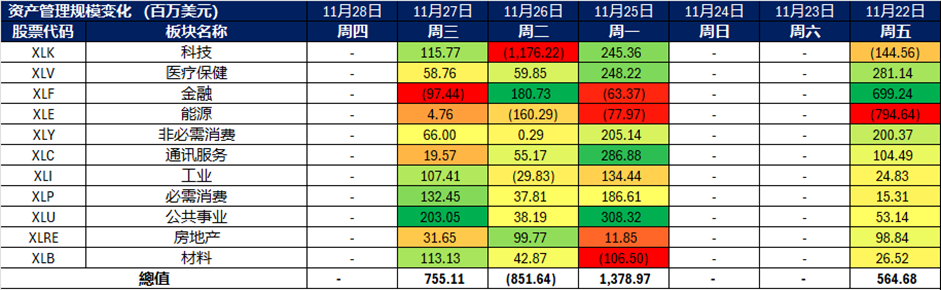

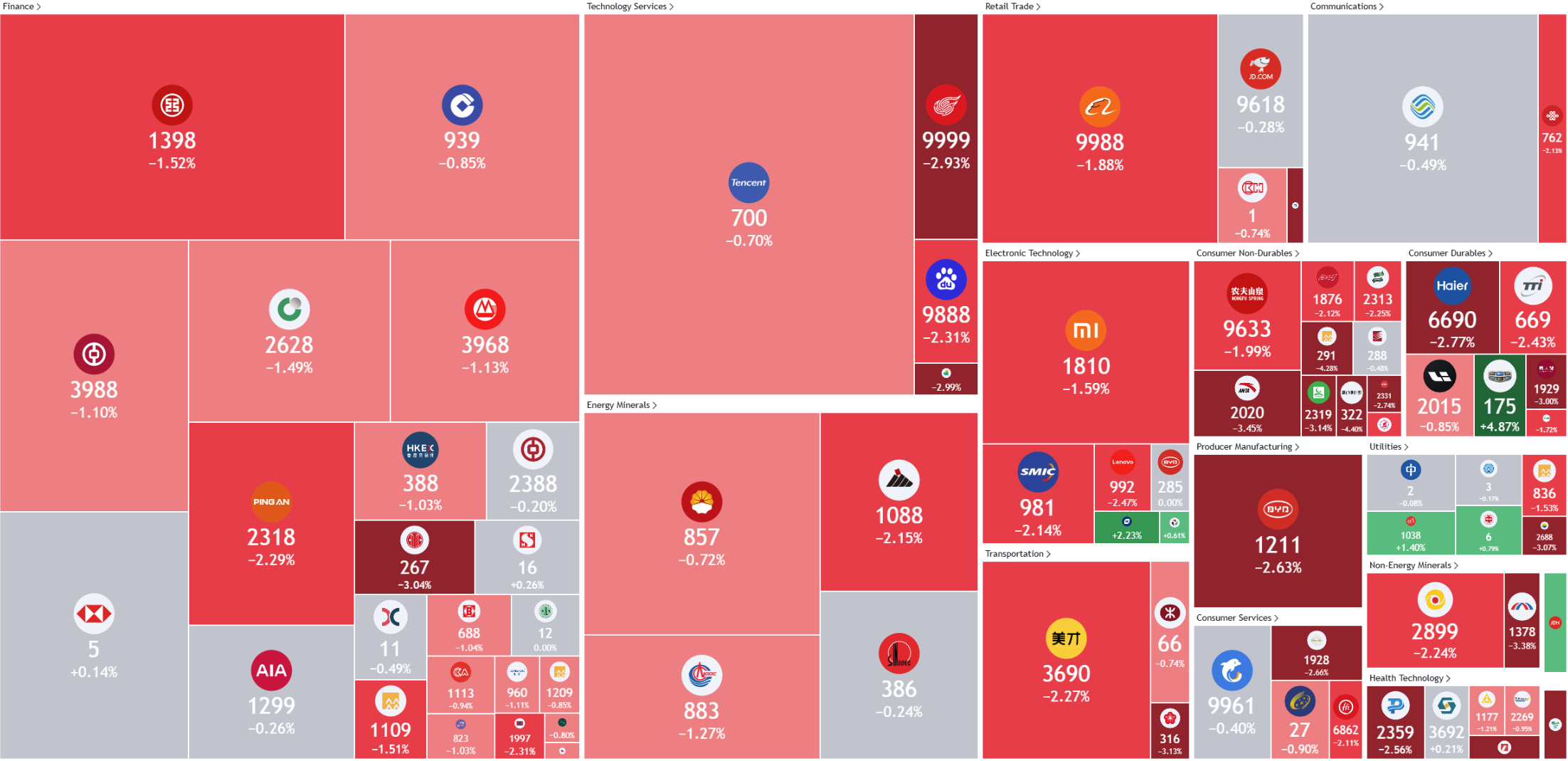

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

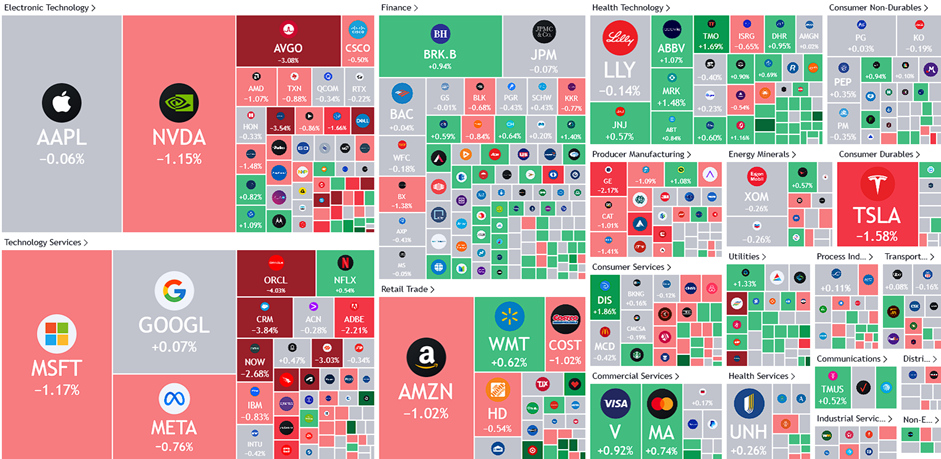

United States

Hong Kong

Thai Beverage PCL (THBEV SP): Consumption recovery

- BUY Entry – 0.550 Target– 0.600 Stop Loss – 0.525

- Thai Beverage Public Company Limited produces a wide range of branded beer and spirits in Thailand.

- Expectations of more tourists to drive consumption levels. Thailand is actively revitalizing its tourism industry as the sector recovers from the downturn caused by the COVID-19 pandemic. To stimulate domestic tourism and promote longer trips, the Thai government has introduced three additional public holidays in 2025, aiming to boost economic activity nationwide. The rebound in tourism is evident, with Thailand welcoming 28.15 million international visitors in 2023 and exceeding 29 million arrivals by mid-2024. The government projects over 36.7 million arrivals by the end of 2024, surpassing pre-pandemic levels. This surge in tourist numbers is expected to drive higher consumption across the country. As ThaiBev generates approximately two-thirds of its revenue from the domestic market, the anticipated increase in consumption presents a significant growth opportunity for the company.

- Digital wallet to the stimulate economy. Thailand launched a US$14 billion stimulus program, with an initial phase distributing 10,000 baht to 14.5 million welfare recipients and disabled citizens to boost spending and economic activity. The government plans further phases, including a THB40 billion handout to 4 million senior citizens before Lunar New Year 2025. Originally designed as a digital wallet initiative, the program faced technical and budgetary adjustments but still aims to promote financial inclusion and encourage digital payment adoption. The scheme supports small businesses by enabling cashless transactions, reduces cash dependency, and enhances economic resilience post-pandemic. Retail sectors and the non-alcoholic beverage market have already seen positive impacts. This program is expected to stimulate domestic consumption, attract foreign investment, and position Thailand as a leader in digital finance, fostering long-term economic growth. Thailand’s consumer confidence also rebounded in October to 56.0, compared to a low of 55.3 in September.

- Potential IPO. Thai Beverage recently announced the revival of plans for an IPO of its beer unit, BeerCo, aiming to capitalize on recovering global stock markets. The IPO could happen as early as 3Q25 if a decision is finalized by December. The company is also exploring equity partnerships, with interest from two potential partners. ThaiBev had shelved similar plans two years ago due to weak market conditions but sees renewed opportunity amid falling interest rates and market rallies. Its CEO noted the IPO could pave the way for future listings of other divisions. The spirits business, including popular brands like Mekhong and Ruang Khao, is also under consideration for a separate Singapore IPO. ThaiBev reported steady revenue of 217.06 billion baht in 9M24, with beer EBITDA rising 10.2% to 11.9 billion baht. The potential IPOs would help ThaiBev to unlock valuation in its different business segments and better position its company for further growth.

- Long-term investment strategy. Thai Beverage has announced a THB18 billion investment plan for fiscal 2025 as part of its “Passion 2030” strategy, targeting domestic and international expansion. The strategy focuses on adapting to evolving consumer behaviour and leveraging digital solutions, with the service sector and digital platforms identified as key growth areas. Such as its spirits division with plans to expand internationally over the next five years. Regional investments like THB2.5 billion in Cambodia, and THB8 billion will go toward Malaysia’s AgriValley project to develop an integrated dairy farm with halal product capabilities. Furthermore, it plans to prioritise its core markets, non-alcoholic beverage operations in Thailand, Malaysia, Vietnam, and Myanmar, with strategic opportunities in Singapore, Cambodia, Laos, and Indonesia. The investments aim to strengthen ThaiBev’s presence across its product lines, from food to alcoholic and non-alcoholic beverages, while positioning the company for long-term growth in diverse markets.

- FY24 results review. ThaiBev’s revenue rose to 340.3 billion baht, a 2.2% YoY increase, due to growth in sales from its spirit and food business. It reported earnings of 27.2 billion baht, decreasing 0.8% YoY, EPS of 1.15 baht. The group declared a final dividend of 0.47 baht per share, with a full-year dividend of 0.62 baht per share.

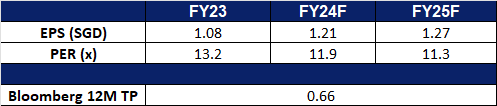

- Market Consensus.

(Source: Bloomberg)

Banyan Tree Holdings Ltd (BTH SP): Year-end travel demand

- RE-ITERATEBUY Entry – 0.36 Target– 0.40 Stop Loss – 0.34

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Extension of visa-free policy. With a significant portion of Banyan Tree Holdings’ hotels, resorts, and spas located in China, the country’s recent expansion of its visa-free policy presents promising opportunities. Effective 30 November 2024 just in time for the year-end holiday season, through 31 December 2025, the policy now includes travelers from 38 countries, allowing visa-free stays of up to 30 days for business, tourism, family visits, exchanges, and transit. Combined with the 72/144-hour transit visa-free options, has significantly boosted inbound tourism and cultural exchanges. In 3Q24, foreign arrivals to China reached 8.186 million, up 48.8% YoY, with visa-free trips accounting for 4.885 million, a 78.6% increase. In the first three quarters of 2024, 58.8% of the 22.821 million inbound trips were facilitated by the visa-free policy. The announcement has sparked increased interest, as evidenced by sharp rises in travel searches and bookings on platforms like Trip.com. Additionally, China’s visa-free agreements with six countries, including Singapore and Thailand, have enhanced economic and trade cooperation. Travel agencies have been actively enriching tourism offerings and strengthening partnerships to meet growing demand. This expanded visa-free policy is expected to attract more international tourists to explore China, creating potential growth opportunities for Banyan Tree Holdings by driving increased revenue through its properties in the region.

- Expected growth in holiday travel. Holiday air travel in the US is poised to reach record highs this winter, with the Transportation Security Administration (TSA) projecting over 18 million passengers between 26 November and 2 December, marking a 6% increase from last year. Thanksgiving remains the busiest travel period, fueled by a significant rise in international bookings, particularly to European destinations. International reservations are up 23%, partly due to a 5% decline in flight costs. United Airlines expects its busiest holiday season ever, with 25 million passengers anticipated. Popular European destinations such as London, Paris, and Munich have seen bookings surge by 30% compared to pre-pandemic levels. Similarly, American Airlines forecasts flying 8.3 million passengers during Thanksgiving, with its peak day on 1 December. Regional carriers like GoJet Airlines are also experiencing growth, with a 40% YoY increase in scheduled flights driven by higher demand and fleet expansion. Despite the positive outlook, weather challenges loom, with a “bomb cyclone” predicted to bring heavy rain and snow across the US West Coast, Midwest, and Northeast during the early Thanksgiving travel period. Airlines in the US are proactively preparing with de-icing equipment and trained teams to mitigate potential disruptions. The surge in holiday travel is expected to provide a boost to the global tourism industry, underscoring the resilience of the travel sector amid operational challenges.

- 1H24 results review. Banyan Tree Holding’s revenue rose to S$179.7mn in 1H24, 25% YoY, compared to S$143.7mn in 1H23. The increase in revenue was primarily due to the robust growth from all business segments. Revenue per available room (RevPAR) for owned hotels increased 17% (on a same-store basis) vs 1H23. Residences segment sets a new record with S$198mn new sales. The group opened 10 new properties in 2024; expecting at least 12 more in the next 12 months.

- Market Consensus.

(Source: Bloomberg)

Keep Inc. (3650 HK): Medals as a social currency

- BUY Entry – 6.10 Target 7.10 Stop Loss – 5.60

- Keep Inc is a company principally engaged in the provision of comprehensive fitness solutions. The Company operates its business through three segments. The Self-branded Fitness Products segment is engaged in m the sale of self-branded fitness products, including smart fitness devices, such as Keep Bike, Keep Wristband, smart scale, and treadmill, and complementary fitness products including fitness gear, apparel and food. The Membership and Online Paid Contentt segment provides membership subscription and online paid content. The Advertising and Others segment is engaged in offline centers, advertising and others (excluding offline centers).

- Increasing popularity of Keep’s medals. Keep, a leading sports-tech platform, has seen remarkable success with its innovative online events and collectible “Keep Medals.” Known for their diverse themes, striking designs, and emotional resonance, these medals have become viral sensations. Keep’s approach involves strategic collaborations with popular intellectual properties (IPs) to create themed events. Participants can earn a coveted medal by selecting an event, registering, and completing its challenges. The initiative began in 2021 with the launch of a Cinnamoroll-themed medal and has since expanded to partnerships with Hello Kitty, Kuromi, Line Friends, Crayon Shin-chan, and gaming franchises like Genshin Impact and Honkai Star Rail. Over time, these medals have transformed into a form of social currency, enabling young people to express their individuality, share emotions, and connect with others who share similar interests. Fans of these IPs have also inspired new ideas and gameplay for Keep’s events. Recent themed collaborations have drawn widespread participation. For example, Keep’s Detective Conan online event series attracted over 600,000 participants, while a single Genshin Impact event saw more than 1 million registrations, underscoring the growing appeal of these highly sought-after medals.

- A rising Guzi Culture. China has seen a surge in interest among young consumers for “guzi”—merchandise featuring popular ACG (anime, comics, games) characters. The growing enthusiasm for anime culture is evident in the success of related films and promotional events. Fans span a wide demographic, from children purchasing affordable character cards to university students spending thousands of yuan on rare collectibles. The “guzi” market is currently valued at an estimated $31bn. To capitalize on this trend, brands are increasingly collaborating with ACG IP owners to offer limited-edition guzi merchandise, aiming to capture the attention of this youthful audience. Keep’s strategy of partnering with popular IPs positions the company well to benefit from the rising demand as more young consumers embrace this cultural phenomenon.

- A new way to connect. In response to increasingly isolated digital lifestyles, Gen Z is actively seeking ways to foster a sense of community in the physical world. This shift has led to a growing interest in hobby-specific clubs, niche sporting communities, and targeted social apps. According to a survey by Chinese social platform Soul, many in China are experiencing a “friendship recession,” with young people reporting an average of just 2.5 close friends. This has driven them to explore new ways to build and sustain meaningful relationships. Keep Inc. addresses this need by offering opportunities for physical connection through fitness activities, enabling users to relieve stress, stay active, and engage in sports-based socializing.

- 1H24 earnings. The company’s revenue rose to RMB1,037.3mn in 1H24, +5.4% YoY, compared to RMB984.7mn in 1H23. The company reported an adjusted net loss of RMB160.69mn in 1H24, compared to an adjusted net loss of RMB223.143mn in 1H23. Basic (diluted) earnings per share were -RMB0.35 (-RMB0.35) in 1H24, compared to RMB8.64 (-RMB0.52) in 1H23.

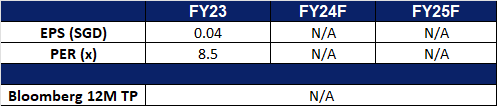

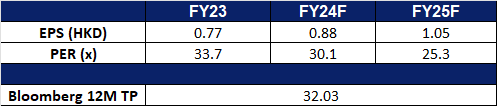

- Market consensus.

(Source: Bloomberg)

Xiaomi Corp. (1810 HK): Higher EV delivery goals signify strong demand

- RE-ITERATE BUY Entry – 28.0 Target 32.0 Stop Loss – 26.0

- XIAOMI CORPORATION is a China-based investment holding company principally engaged in the research, development and sales of smartphones, Internet of things (IoTs) and lifestyle products, the provision of Internet services, and investment business. The Company mainly conducts its businesses through four segments. The Smartphone segment is engaged in the sales of smartphones. The IoT and Lifestyle product segment is engaged in the sales of other in-house products, including smart televisions (TVs), laptops, artificial intelligence (AI) speakers and smart routers; ecosystem products, including IoT and other smart hardware products, as well as certain lifestyle products. The Internet service segment is engaged in the provision of advertising services and Internet value-added services. The Others segment is engaged in the provision of repair services for its hardware products. The Company distributes its products in domestic market and to overseas markets.

- Expecting more EV deliveries in 4Q24. Xiaomi recently announced in its 3Q24 results that it raised its electric vehicle (EV) delivery target for the year to 130,000 units, marking the third upward revision as the company reported a 30.5% increase in third-quarter revenue. This surpasses its previous forecast of 120,000 units for its debut EV, the SU7 sedan, and significantly exceeds the initial goal of 76,000 units set at the SU7’s launch earlier this year, driven by surging demand. The company also celebrated a key milestone, achieving 100,000 deliveries of the SU7 in just 230 days. With its factory capable of producing 20,000 vehicles per month and room for further expansion, the revised target underscores strong and sustained demand for the SU7 sedan in China.

- Possible launch of 2nd EV model in 1Q25. Chinese media report that Xiaomi’s second EV model, an SUV currently code-named MX11, is set to launch in the first quarter of 2025. Additionally, the production version of the Xiaomi SU7 Ultra is slated for an official release in March 2025. Xiaomi is expected to adopt a similar pricing strategy for the new SUV as it did with the SU7 sedan.

- Global rollout of HyperOS 2. Xiaomi has unveiled the global rollout schedule for HyperOS 2, its latest operating system update. The new UI introduces three core features: HyperCore, HyperConnect, and HyperAI. Additional enhancements include dual-camera streaming between Xiaomi tablets and phones, improved performance, AI-generated dynamic wallpapers, and a redesigned home screen with richer widgets and smoother animations. The first wave of devices to receive the update in November includes the Xiaomi 14 and 14 Ultra, Xiaomi 13T Pro, Redmi Note 13 series, Poco C75, and more. A second batch, comprising a range of older devices, will follow in December. Xiaomi, alongside a few other Chinese smartphone manufacturers, remains at the forefront of AI innovation, consistently advancing hardware and AI applications ahead of U.S. competitors like Apple. Currently ranked second in the AI smartphone market with a 26.9% share, Xiaomi’s strong position continues to attract and retain a loyal customer base.

- 3Q24 earnings. The company’s revenue rose to RMB92.5bn in 3Q24, +30.5% YoY, compared to RMB70.9bn in 3Q23. The company’s net profit rose by 9.7% YoY to RMB5.34bn in 3Q24, compared to RMB4.87bn in 3Q23. Basic earnings per share rose to RMB0.22 in 3Q24, compared to RMB0.20 in 3Q23.

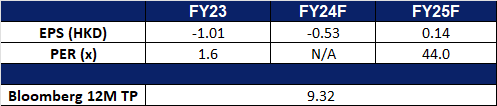

- Market consensus.

(Source: Bloomberg)

Walt Disney Co (DIS US): Holiday magic

- BUY Entry – 116 Target – 128 Stop Loss – 110

- The Walt Disney Company operates as an entertainment and media enterprise company. The Company’s business segments includes, media networks, parks and resorts, studio entertainment, consumer products, and interactive media. Walt Disney serves customers worldwide.

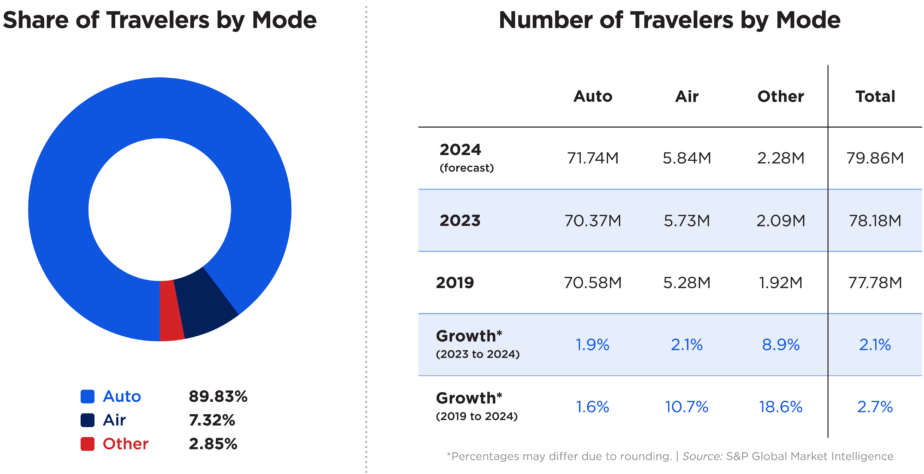

- Season to the thankful. Disney’s theme park division achieved record revenue and profit in fiscal 2024, with revenue rising 5% to US$34.15 bn and operating income up 4% to US$9.27bn. The experiences segment, which includes parks, cruises, and consumer products, outperformed other divisions in growth and is projected to see a 6%-8% profit increase in fiscal 2025. As part of its US$60 billion investment in parks, Disney plans new attractions, such as Coco-themed lands and Avengers Campus expansions, though these will debut in a few years. In the meantime, Disney is leveraging seasonal offerings like Halloween and winter holidays to drive revenue through higher ticket prices and in-park experiences. Limited-time events, such as holiday overlays on rides, themed merchandise, and parades, attract repeat visitors and boost attendance during peak travel months like October and December. Disney also anticipates strong performance from Thanksgiving holiday travel, with AAA projecting record car travel and lower gas prices, which may contribute to increased domestic park footfall. Additionally, Disney’s Moana 2 is poised for a significant box office debut, joining Wicked and Gladiator II to drive an expected US$200+ million in Thanksgiving ticket sales. With these initiatives, Disney is set to capitalize on the holiday season’s demand, driving its sales upwards.

AAA 2024 Thanksgiving Travel Forecast – between 26 Nov to 2 Dec

Source: Automotive, Travel, and Traffic Safety Information

- Disney cruise line fleet expansion. Disney Cruise Line is undergoing significant expansion, set to double its fleet by 2031. The Disney Treasure, launching in December 2024, will join the fleet as the sixth ship, with two more vessels — Disney Destiny and Disney Adventure — arriving in 2025. Additionally, Disney plans to introduce four more ships and enter the Asian market through a partnership with the Oriental Land Company, offering cruises from Singapore starting in 2025. Disney’s experiences division, which includes cruises, parks, and resorts, posted record revenue of US$34.15bn in fiscal 2024, up 5%.. The division outperformed other segments in revenue growth and is projected to see continued profit growth in fiscal 2025. Disney’s premium cruises are distinguished by guest-centric ship designs, storytelling, and integration of beloved Disney characters. Starting prices for its cruises are higher than competitors like Carnival and Royal Caribbean but offer comparable costs with upgrades. The Treasure’s seven-night cruises begin at US$4,277 for two guests. In Asia, bookings for Disney Adventure cruises will open in December 2024, with itineraries departing from Singapore through at least 2026 under a partnership with the Singapore Tourism Board. This strategic move aims to tap into key Southeast Asian markets, including China, India, and Indonesia. Despite a smaller fleet than competitors, Disney anticipates robust demand in the family cruising market, positioning its cruise segment for strong revenue growth in the coming year.

- Disney Plus new offerings. Disney Plus is expanding its portfolio of original Korean content to compete with Netflix, leveraging the global popularity of K-dramas. At the 2024 Disney APAC Content Showcase, the platform announced 10 new Korean series, including the second season of the hit show Moving, based on a webtoon by Kangfull. The first season became Disney Plus’ most-viewed original series globally in 2023. Another Kangfull adaptation, Light Shop, will premiere in December, alongside Disney’s first Korean historical drama, The Murky Stream. Since 2021, Disney Plus has launched over 130 original titles in the Asia Pacific, with Korean content dominating the platform’s top-performing international originals. In 2023, nine of the 15 best-performing international titles were Korean, including A Shop for Killers and BTS reality show Are You Sure?!, which resonated both regionally and globally. Disney sees Asia Pacific as a critical growth region, emphasizing its rich storytelling and global appeal. This strategic focus on exclusive K-dramas is poised to drive further subscriber growth for Disney Plus in FY25.

- 4Q24 results. Revenue increased 6% YoY to US$22.57 billion, exceeding expectations by US$80 million. Non-GAAP EPS was US$1.14 beating estimates by US$0.03. For FY25, Disney expects high single-digit adjusted EPS growth compared to FY24 vs estimated growth of 4.14% YoY. In 1Q25, it anticipates its sports segment operating income to grow 13% YoY and experiences to grow between 6% to 8% YoY. For FY26 and FY27, Disney anticipates double-digit adjusted EPS growth.

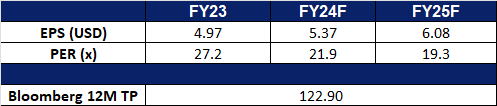

- Market consensus.

(Source: Bloomberg)

Zillow Group Inc (Z US): AI in the real estate

- RE-ITERATE BUY Entry – 80 Target – 90 Stop Loss – 75

- Zillow Group, Inc. is a tech real-estate marketplace company. The Company provides information about homes, real estate listings, and mortgages through websites and mobile applications. Zillow Group serves homeowners, buyers, sellers, renters, and real estate professionals in the United States.

- AI+ real estate. Zillow’s real estate information platform began using the company’s own machine learning model Zetimate to value real estate as early as 2022. There are currently approximately 200 million monthly active users using this model. In 2023, the company’s program will embed artificial intelligence natural language search capabilities, so users do not need to perform precise searches to find real estate listings that meet their requirements.

- Rebound in existing home sales. In October, existing home sales rose by 3.4% from the previous month to a seasonally adjusted annual rate of 3.96 million units, slightly surpassing market expectations of 3.95 million units. This recovery from a 14-year low was supported by sustained economic growth and robust employment levels, which continue to drive housing demand.

- Potential tax benefits. Trump’s proposed reduction of the corporate tax rate from 21% to 15%, applicable only to domestic companies, is expected to benefit the company significantly as its operations are based entirely in the United States.

- 3Q24 results. Revenue increased 17.1% YoY to US$581million, exceeding expectations by US$25.82 million. Net loss was US$20 million. In the third quarter, the group’s program views reached 2.4 billion times, and the average number of monthly active users reached 233 million.

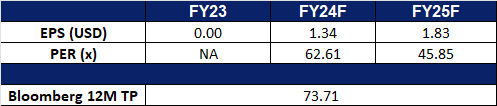

- Market consensus.

(Source: Bloomberg)

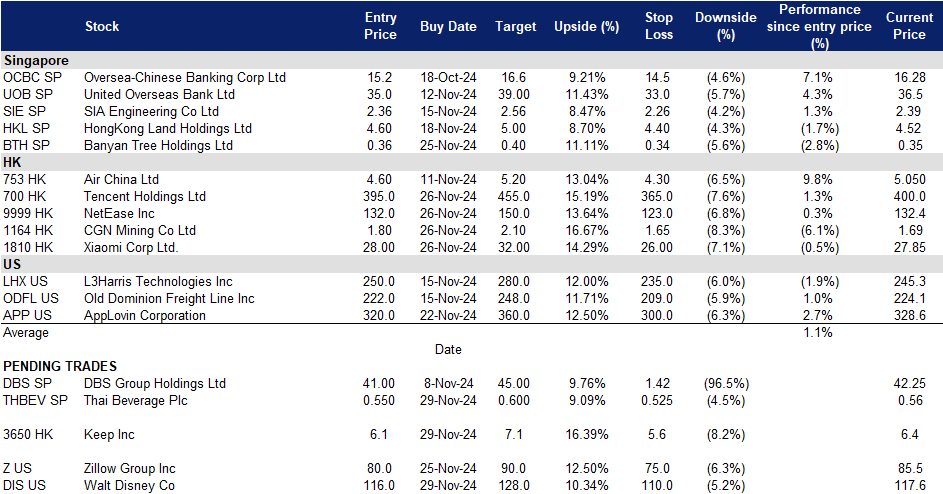

Trading Dashboard Update: Take profit on Pop Mart International Group Ltd. (9992 HK) at HK$90. Cut loss on Propnex Ltd (PROP SP) at S$0.87.