29 July 2024: Yangzijiang Shipbuilding Holdings Ltd (YZJSGD SP), Dongfang Electric Corp Ltd. (1072 HK), McDonald’s Corp (MCD US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

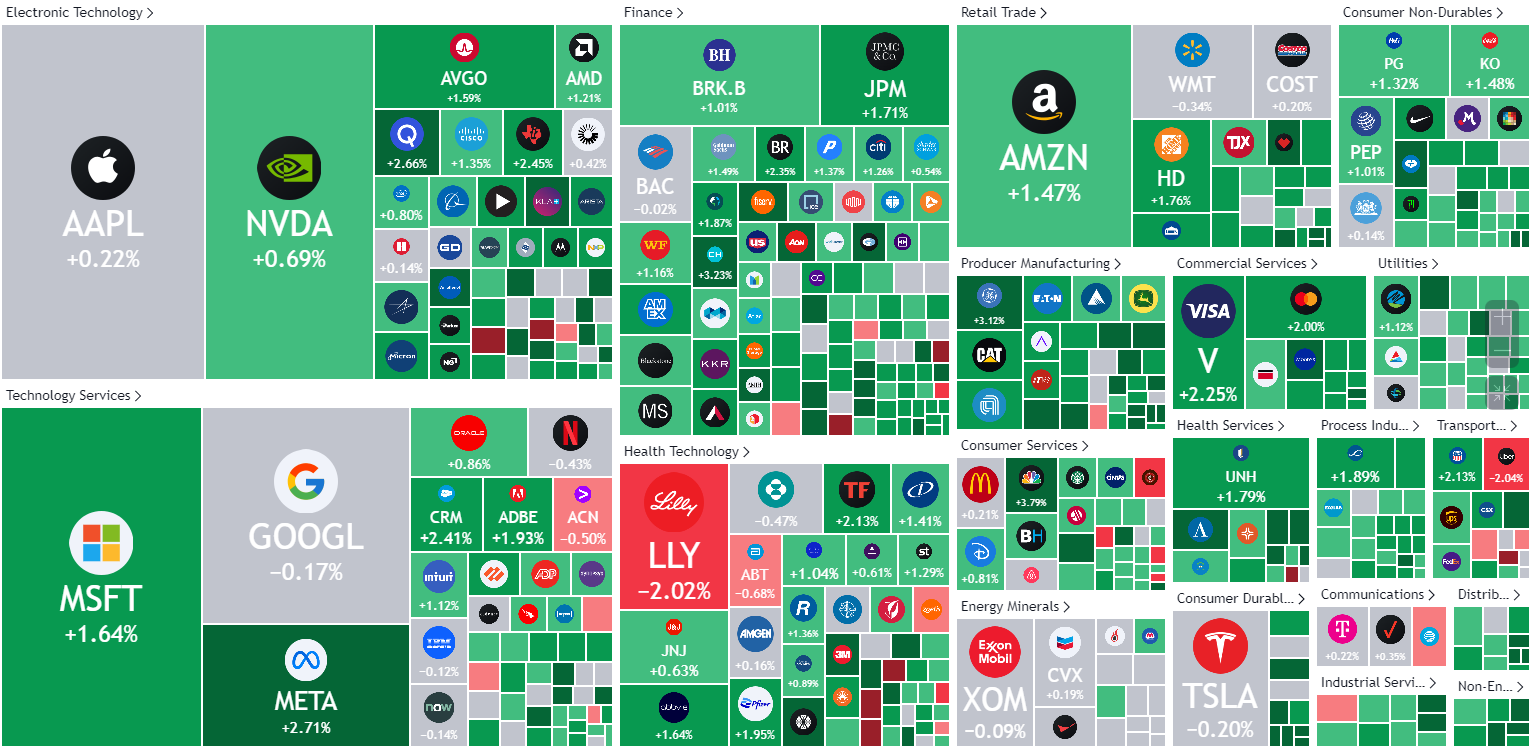

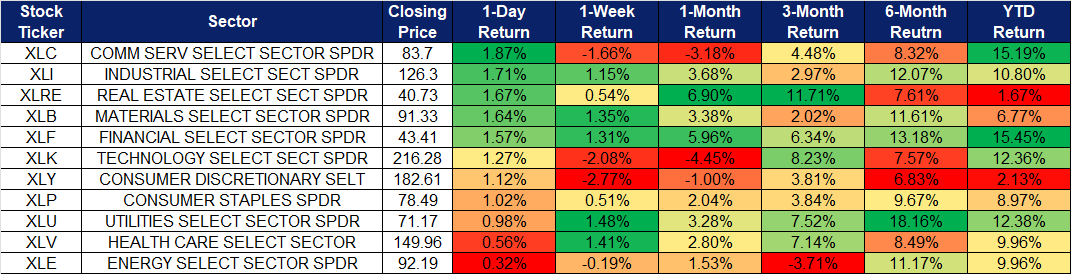

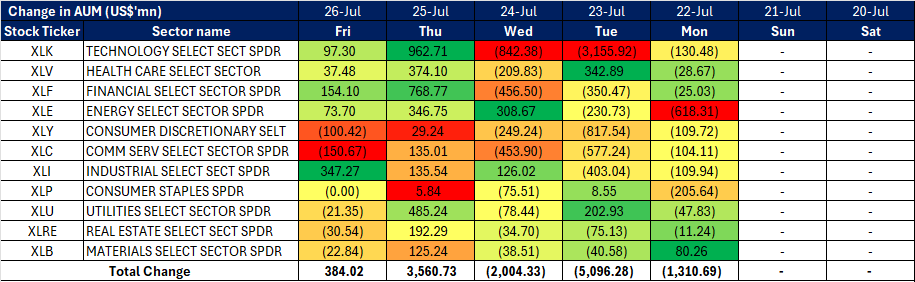

United States

Hong Kong

Yangzijiang Shipbuilding Holdings Ltd (YZJSGD SP): More growth in the Shipbuilding industrial

- BUY Entry – 2.46 Target– 2.70 Stop Loss – 2.35

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, containerships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

- Record order backlog. China’s largest private-sector shipbuilder, Yangzijiang Shipbuilding, has achieved a new record with its order backlog exceeding US$16bn, driven by soaring global demand for tonnage. To manage the increased volume, the company has acquired over 200 acres of land adjacent to its shipyard and plans to invest over US$400mn in an expansion plant, including a 300,000-tonne drydock. This expansion will add 800,000 deadweight tons of annual capacity, enhancing China’s self-reliance in high-value-added shipbuilding. Yangzijiang is also establishing an advanced, digitalized production plant with a 5G industrial data network, reflecting a shift towards more technologically advanced processes. This growth is part of a broader trend among Chinese shipyards. According to shipbroker BRS, Chinese orderbooks are nearly full through 2027, with orders extending to 2029, indicating a strong future for the industry.

- Expansion into VLAC carriers. Yangzijiang Shipbuilding has secured a US$440mn deal with Nissen Kaiun for four 88,000 cubic meter very large ammonia carriers (VLACs), marking Yangzijiang’s entry into this segment. These ships are ordered under seven-year time charters with energy trader BGN and will be delivered between May 2028 and February 2029. Nissen Kaiun, owning about 200 ships including 10 very large LPG carriers and nearly 40 newbuilds, is responding to the high demand for LPG/ammonia carriers driven by the anticipated surge in low-carbon ammonia trade, especially from Japan and South Korea due to their decarbonization initiatives.

- New manufacturing facility. Yangzijiang Shipbuilding has entered into a framework agreement with Jingjiang City in Jiangsu Province, to acquire 866,671 square meters of land in Xinqiao Park for a new clean energy ship manufacturing base. This land includes 1,320 meters of Yangtze River shoreline, allowing for efficient expansion. Strategically located next to its existing facility, the new site will enhance productivity and operational efficiency. The company plans to invest three billion yuan (S$554.3mn) over the next two years, pending the results of a feasibility study and government approvals. The project will be executed in phases to ensure regulatory compliance. The approval of this project will allow the company to manufacture clean energy ships, expanding its manufacturing capacity.

- FY23 results review. Revenue for FY23 increased by 16.5% YoY to RMB24.1bn, compared to RMB20.7bn in FY22. Net profit increased by 57.0% YoY to RMB4.10bn in FY23, compared to RMB2.61bn in FY22. NPM increased by 4.4ppts to 17.0% in FY23, compared 12.6% in FY22.

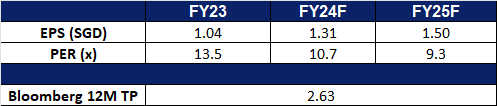

- Market Consensus.

(Source: Bloomberg)

Singapore Technologies Engineering Ltd (STE SP): Deepening collaborations and partnerships

- RE-ITERATE BUY Entry – 4.38 Target– 4.70 Stop Loss – 4.22

- ST Engineering Ltd is a global technology, defence, and engineering group. The Company uses technology and innovation to solve problems and improve lives through its diverse portfolio of businesses across the aerospace, smart city, defence, and public security segments. ST Engineering serves clients worldwide.

- Collaboration to boost Cybersecurity. SPTel, a joint venture between ST Engineering and SP Group, has launched its Quantum-Safe Services, enhancing its National Quantum-Safe Network Plus (NQSN+) by integrating advanced quantum encryption products from ST Engineering, Nokia, and Fortinet. This initiative aims to provide comprehensive network protection against quantum threats. Appointed by Singapore’s Infocomm Media Development Authority, SPTel and SpeQtral are developing Southeast Asia’s first quantum-safe infrastructure, supporting the nation’s Digital Connectivity Blueprint. The services, designed for compatibility with existing IT infrastructures, secure data across physical, data link, and network layers using Nokia’s DWDM, ST Engineering’s encryptors, and Fortinet’s next-generation firewall. This initiative addresses the emerging “harvest now, decrypt later” threat and aims to fortify cyber defences in critical industries such as healthcare and finance. As cyber threats continue to rise globally, the demand for such services will increase, which would be beneficial for the adoption of ST Engineering’s encryptors.

- Strong order book. ST Engineering’s order book remains robust, valued at $27.7bn as of its first quarter 2024 business updates. The company anticipates delivering $6.5bn worth of orders for the remainder of the year. In the first quarter of 2024, ST Engineering secured additional contracts totaling $3.0bn. This includes $839 mn in the commercial aerospace sector, $1,645mn in the defense and public security market, and $542mn in the urban solutions and satcom industry. These new contract wins, along with a consistently strong order book, highlight the sustained high demand for ST Engineering’s services.

- Deepening LEAP engine support for Safra Aircraft Engines. ST Engineering recently announced that its Commercial Aerospace business has deepened its support for Safran Aircraft Engines1 by entering into a two-year agreement, with an option for extension, to provide module repair offload support for the CFM LEAP-1A and LEAP-1B engines. Under the agreement, Safran Aircraft Engines will offload module repair work on the high pressure turbine (HPT) rotor assembly and stage 2 HPT nozzle assembly of the LEAP-1A and LEAP-1B engines to ST Engineering. This collaboration addresses the growing MRO demand for LEAP engines as operators ramp up their flying operations. ST Engineering’s offload support augments Safran Aircraft Engines’ MRO capacity and optimises the turnaround time of engine shop visits for customers. This agreement strengthens the partnership with Safran Aircraft Engines and support for LEAP engines operators, and well positions the company to address the rising demand for quick-turn and performance restoration shop visits for LEAP engines.

- 1Q24 results review. Revenue rose by 18% YoY to S$2,703mn in 1Q24, compared to S$2,289mn in 1Q23, driven by double-digit YoY growth in its commercial aerospace and defence and public security segments. In the first quarter, its commercial aerospace revenue and defence and public security revenue grew 32% YoY to S$1.2bn and 14% YoY to S$1.1bn respectively.

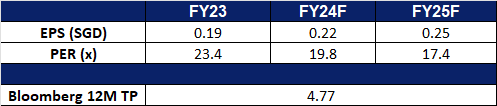

- Market Consensus.

(Source: Bloomberg)

Dongfang Electric Corp Ltd. (1072 HK): Increased usage of renewable energy

- BUY Entry – 10.20 Target 11.20 Stop Loss – 9.70

- Dongfang Electric Corp Ltd is a China-based company mainly engaged in the manufacturing and sales of power generation equipment. The Company operates five major reporting segments: Clean and High-Efficiency Energy Equipment segment, Renewable Energy Equipment segment, Engineering and Trade segment, Modern Manufacturing Service Industry segment, and Emerging Growth Industry segment. The Company’s main products include water turbine generator sets, steam turbine generators, wind turbine generator sets, power station steam turbines and power station boilers as well as gas turbines. The Company distributes its products within the domestic market and to overseas market.

- Increasing use of renewable energy in China. China’s renewable energy utilization has reached or exceeded advanced international levels, demonstrating rapid progress in sustainable energy. The country has maintained strong momentum in renewable energy adoption, with a utilization rate of 97.6%, surpassing 95% for six consecutive years since 2018. Last year, newly installed renewable energy capacity rose to 290 million kW, 2.4 times that of 2022, accounting for 79% of the total new power generation capacity nationwide, making it the primary source of new power generation. This surge in capacity has spurred significant investments in solar, wind, and hydropower projects across the country. These efforts are part of China’s broader strategy to peak carbon emissions before 2030 and achieve carbon neutrality before 2060.

- Increased capacity. Dongfang Electric recently installed an 18 MW offshore wind turbine at a coastal test base in Shantou, Guangdong province. With a rotor diameter of 260 meters and a swept area of 53,000 square meters, this turbine can generate 72 GWh of electricity annually, sufficient to power approximately 36,000 households. Notably, this 18 MW offshore wind turbine is the largest of its kind currently installed in the world.

- Deal in Middle East. China’s Honghua Group, a subsidiary of Dongfang Electric, recently secured a contract with a major drilling company in the Middle East to deliver several 3000HP artificial island cluster well drilling rigs, valued at 1.5bn yuan. This contract highlights the global recognition of Honghua Group’s high-end smart drilling rigs and solidifies its leading position in the international market for advanced drilling technology. The drilling rigs, officially termed artificial island cluster well fast-moving smart drilling rigs, incorporate Honghua Group’s cutting-edge technology, integrating artificial intelligence with island cluster well drilling. This agreement signifies a milestone in the global expansion of China’s intelligent equipment and represents a significant achievement in high-quality Belt and Road cooperation, setting the stage for further international collaboration in the oil and gas industry.

- 1Q24 earnings. The company’s operating revenue rose to RMB15.1bn in 1Q24, +2.28% YoY, compared to RMB14.7bn in 1Q23. The company’s net profit fell by 11.1% YoY to RMB905.8bn, compared to RMB1.02bn in 1Q23. Basic earnings per share fell to RMB0.290 in 1Q24, compared to RMB0.327 in 1Q23.

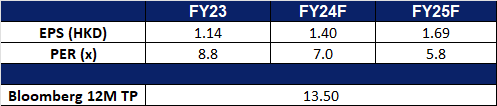

- Market consensus.

(Source: Bloomberg)

Goldwind Science & Technology Co Ltd. (2208 HK): Wind power is favourable again

- BUY Entry – 4.30 Target 4.70 Stop Loss – 4.10

- Goldwind Science & Technology Co Ltd, formerly Xinjiang Goldwind Science & Technology Co Ltd, is a China-based company that provides overall solutions for wind turbines, wind power services and wind farm development. The Company operates its businesses through four segments. The Wind Turbine Manufacturing and Sales segment is mainly engaged in the research and development, manufacturing and sales of wind turbines and their parts. The Wind Power Service segment mainly provides wind power-related consultants, wind farm construction and maintenance and transportation services. The Wind Farm Development segment is mainly engaged in the development and operation of wind farms. Other segment is mainly engaged in financial leasing and water treatment development and operation business. The Company conducts its businesses both in the domestic market and overseas markets.

- Increasing use of renewable energy in China. China’s renewable energy utilization has reached or exceeded advanced international levels, demonstrating rapid progress in sustainable energy. The country has maintained strong momentum in renewable energy adoption, with a utilization rate of 97.6%, surpassing 95% for six consecutive years since 2018. Last year, newly installed renewable energy capacity rose to 290 million kW, 2.4 times that of 2022, accounting for 79% of the total new power generation capacity nationwide, making it the primary source of new power generation. This surge in capacity has spurred significant investments in solar, wind, and hydropower projects across the country. These efforts are part of China’s broader strategy to peak carbon emissions before 2030 and achieve carbon neutrality before 2060. Goldwind is likely to benefit from the increased investment and spending in renewable energy.

- Expanding presence. Goldwind Science & Technology recently acquired its first overseas wind turbine manufacturing plant in Brazil. In May, the company finalized an agreement with General Electric to acquire the Camacari assembly plant in Bahia state. The plant is set to begin mass production of wind turbines by the end of 2024, creating over 1,000 jobs in the region. Goldwind highlighted that this investment will enhance local supply chains and capitalize on the region’s abundant wind resources.

- Project in the Philippines. In May, Goldwind signed an agreement with Singapore-based renewables developer The Blue Circle to supply turbines for a 100.8-MW wind project in the Philippines. Under the agreement, Goldwind will supply, commission, and service 17 units of its GW 165-6.0 MW wind turbines for The Blue Circle’s Kalayaan 2 project in Laguna Province. The contract also includes ten years of service for the turbines.

- 1Q24 earnings. The company’s operating revenue rose to RMB6.98bn in 1Q24, +25.42% YoY, compared to RMB5.56bn in 1Q23. The company’s net profit fell by 73.06% YoY to RMB332mn, compared to RMB1.23bn in 1Q23. Basic earnings per share fell to RMB0.0726 in 1Q24, compared to RMB0.286 in 1Q23.

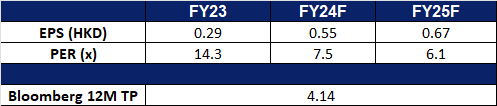

- Market consensus.

(Source: Bloomberg)

McDonald’s Corp (MCD US): Quick and cheap meal fix

- BUY Entry – 250 Target – 280 Stop Loss – 235

- McDonald’s Corporation franchises and operates fast food chain. The Company offers various food products and soft drinks, and non alcoholic beverages. McDonald’s serves customers worldwide.

- Signs of recession benefitting defensive stocks. Recent US economic data points to a potential slowdown. While inflation is cooling, the labour market is softening, consumer spending and confidence are waning, and manufacturing is contracting. These factors have spurred concerns about a soft economic landing, leading to sharp corrections in growth sectors and a shift of investor funds towards more defensive assets.

- Favourable macro outlook. High inflation has increased McDonald’s operating costs. At the same time, fast food chain peers have begun price wars to increase market share. McDonald’s has already launched a US$5 set meal. Operating profits are expected to improve as inflation costs fall. In addition, the high interest rate environment has caused McDonald’s property valuations to fall. As the interest rate cut cycle begins, the company’s property valuation increases are expected to drive a rebound in the stock price. McDonald’s current dividend rate is 2.52%, and its attractiveness has increased during the interest rate cut cycle.

- 1Q24 earnings review. Revenue rose by 4.6% YoY to US$6.17bn, in-line with estimates. Non-GAAP earnings per shares was US$2.70 missing expectations by US$0.03. For FY24, the company expects full-year global comparable sale growth of 4% to 6%.

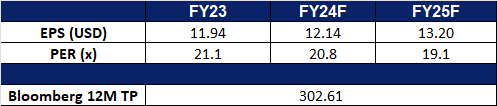

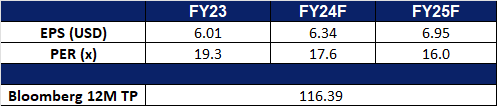

- Market consensus.

(Source: Bloomberg)

Philip Morris International Inc (PM US): Zynpocalypse

Philip Morris International Inc (PM US): Zynpocalypse

- RE-ITERATE BUY Entry – 110 Target – 122 Stop Loss – 104

- Philip Morris International Inc. (PMI) operates as a tobacco company working to deliver a smoke-free future and evolving its portfolio for the long term to include products outside of the tobacco and nicotine sector. The Company offers cigarettes, e-vapor, and oral smoke-less products. Philip Morris International serves customers worldwide.

- Signs of recession benefitting defensive stocks. Recent US economic data points to a potential slowdown. While inflation is cooling, the labour market is softening, consumer spending and confidence are waning, and manufacturing is contracting. These factors have spurred concerns about a soft economic landing, leading to sharp corrections in growth sectors and a shift of investor funds towards more defensive assets.

- Business transformation. The company has successfully pivoted in response to the global anti-smoking movement. By aggressively marketing smoke-free and heated tobacco products, it has not only survived but thrived. This quarter, canned oral product shipments surged 23.5%, primarily driven by nicotine pouches, while heated tobacco product sales climbed 10.2% globally, with particular strength in Japan (up 12.5%) and Europe (up 6.8%). However, a European Union ban on flavoured heated tobacco has forced a downward revision of IQOS’s full-year growth forecast to 13%. Despite this, the company remains optimistic, with the CEO highlighting strong business momentum and raising full-year earnings per share guidance to between US$6.67 and US$6.79. The company expects further revenue growth in the second half, driven by nicotine pouch expansion, IQOS launches in new markets, and rising cigarette prices.

- Investing heavily to address the Zyn shortage. Philip Morris’ US$600mn commitment to a new Colorado manufacturing facility underscores the surging demand for its nicotine pouches. Acquired from Swedish Match for US$16bn in 2022, Zyn has become a major growth driver, even popular among Wall Street professionals. Despite supply chain challenges, including a temporary halt to online sales, Zyn sales soared 50.3% YoY in Q2. To meet this unprecedented demand, Philip Morris is expanding production capacity and has raised its annual sales target to 580 million cans from the previous 560 million cans.

- 2Q24 earnings review. Revenue rose by 5.6% YoY to US$9.47bn, beating estimates by US$280mn. Non-GAAP earnings per shares was US$1.59 beating expectations by US$0.03. For FY24, the company expects full-year adjusted EPS of US$6.33 to US$6.45 vs. US$6.33 consensus and the prior forecast of US$6.26 to US$6.38.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Cut loss on Airbnb Inc. (ABNB US) at US$141.0 and Zscaler (ZS US) at US$180.0.