19 July 2024: Bumitama Agri Ltd (BAL SP), Shandong Gold (1787 HK), Zillow Group Inc (Z US)

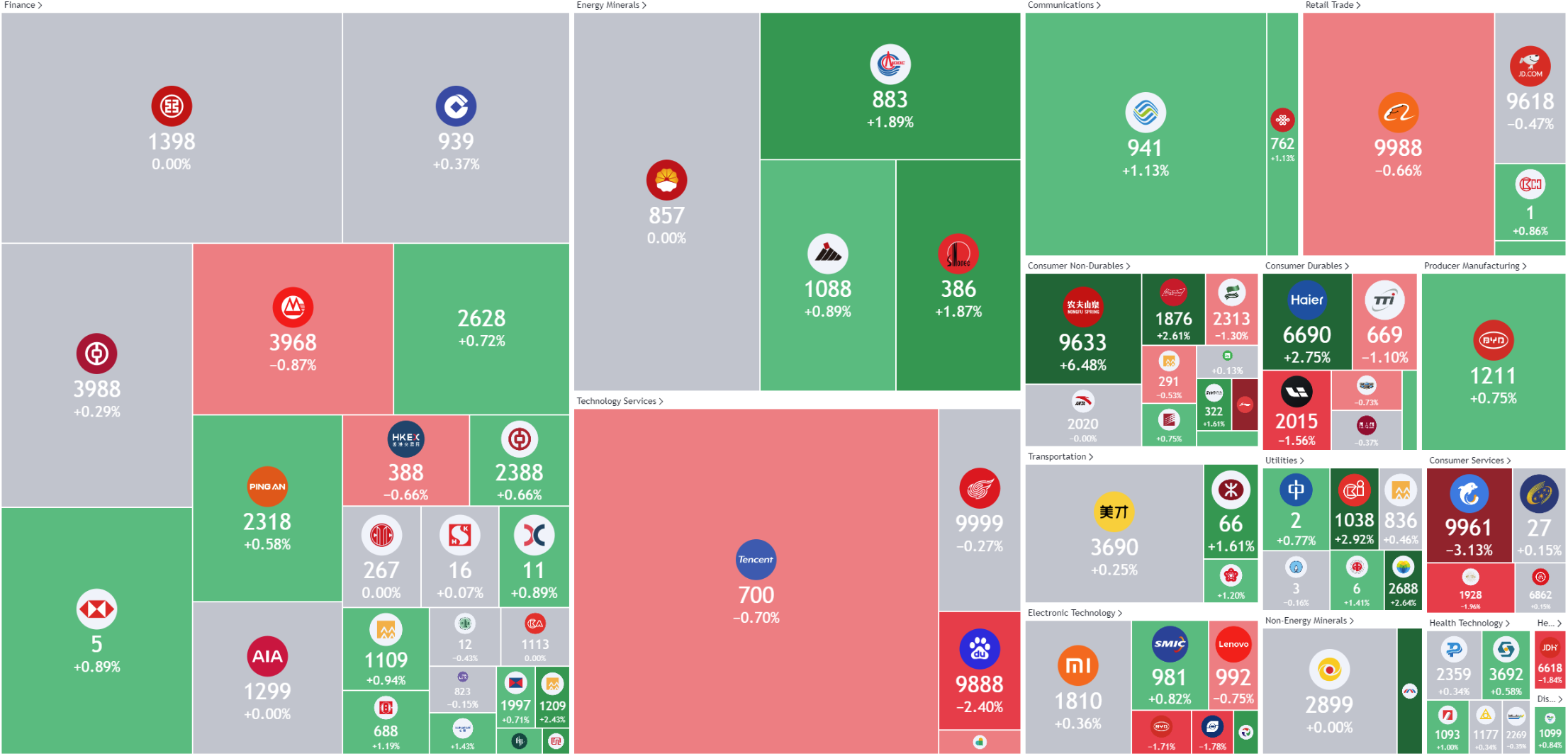

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Bumitama Agri Ltd (BAL SP): Potential upside of palm oil prices

- BUY Entry – 0.730 Target– 0.780 Stop Loss – 0.705

- Bumitama Agri Ltd. produces CPO and PK, with its oil palm plantations located in Indonesia. The Company’s primary business activities are cultivating and harvesting our oil palm trees, processing FFB from its oil palm plantations, its plasma plantations and third parties into CPO and PK and selling CPO and PK in Indonesia.

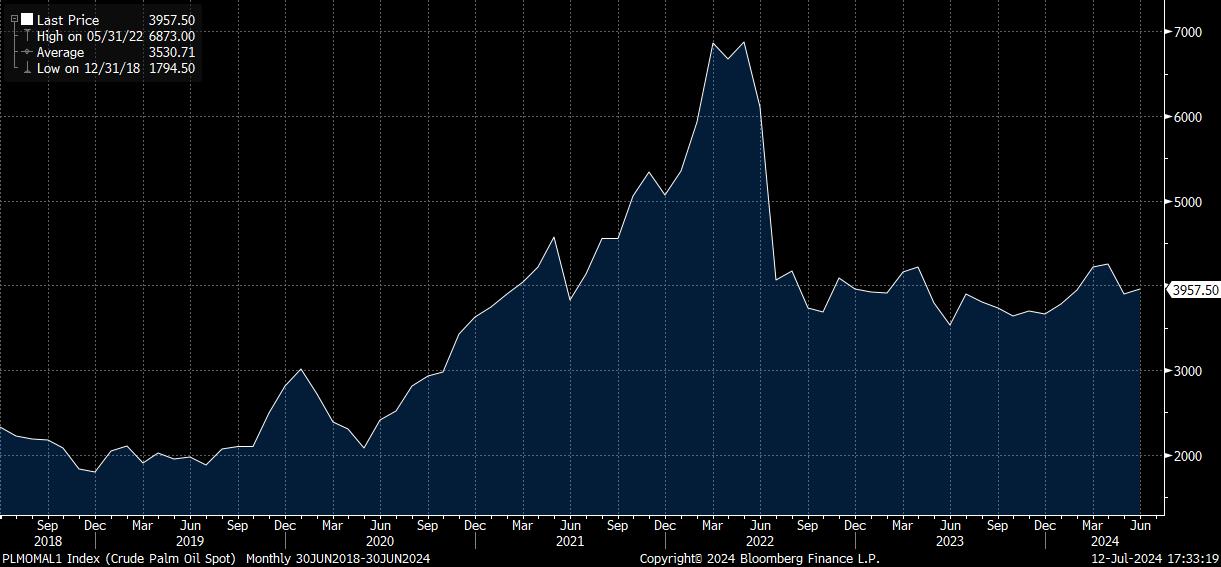

- Palm oil prices to remain elevated. Crude palm oil prices are anticipated to stay strong due to tighter production and high demand from India and China, according to the Malaysian Palm Oil Council (MPOC). Malaysia’s benchmark prices are expected to range between 3,800 ringgit to 4,200 ringgit per metric ton in 2H24. MPOC chief executive noted that Malaysia’s palm oil production growth will likely slow due to a high base effect from 2023’s peak output since 2018. Combined production from Indonesia and Malaysia shows a supply deficit of 200,000t. Despite Malaysia’s production increase of 440,000t from January to April 2024, Indonesia’s production decreased by 640,000t. Stable demand from India and China, along with slowing production, will maintain robust palm oil prices. Global supplies could further tighten if Indonesia raises its biodiesel blending rate to 40% next year. Malaysia’s palm oil production is forecast to rise by 2.4% to 19mt in 2024, with exports expected to increase by 3.1% to 15.6mt. The country’s palm oil inventory is projected to be around two million tons by December. This deficit in palm oil production alongside strong demand will continue to support the robust palm oil prices, benefiting company’s palm oil business.

Crude Palm Oil Price

(Source: Bloomberg)

- Strong demand for palm oil. India’s import of vegetable oils, including both edible and non-edible oils, increased by 18% in June to 15.5 lakh tonnes, driven by higher imports of crude palm oil and crude sunflower oil, according to trade data. In June 2024, vegetable oil imports reached 1,550,659 tonnes, up from 1,314,476 tonnes a year earlier. The robust import figures indicate sustained strong demand for palm oil in India, who is also the largest importer of palm oil globally. Bumitama Agri is likely to continue benefiting from this high demand for palm oil.

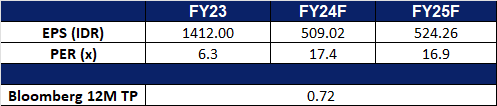

- FY23 results review. Revenue fell by 2.4% YoY to IDR15.4tn in FY23, compared to IDR15.8tn in FY22. Net profit fell by 13.8% to IDR2.93tn in FY23, compared to IDR3.40tn in FY22. Basic and Diluted EPS per shares is 1,412IDR in FY23, compared to 1,618IDR in FY22.

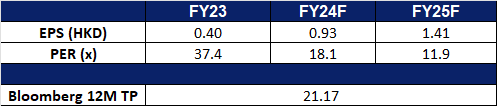

- Market Consensus.

(Source: Bloomberg)

SATS Ltd (SATS SP): Service improvement amidst air travel recovery

- RE-ITERATE BUY Entry – 3.08 Target– 3.40 Stop Loss – 2.94

- SATS Ltd. provides gateway services and food solutions. The Company specializes in airfreight, ramp and baggage handling; passenger services; aviation security services; aircraft cleaning; and cruise centre management. It also provides airline catering; institutional catering; aviation laundry; and food distribution and logistics. SATS has presence across Asia and the Middle East.

- Air passenger traffic not slowing. According to the International Air Transport Association, in 2024, the airline industry has recovered from the COVID-19 crisis, with total traffic surpassing 2019 levels in February. Domestic travel returned to pre-COVID levels in spring 2023, while international routes have also recently recovered. Most regions are expected to exceed 2019 levels in 2024, with Asia Pacific leading growth at 17.2% YoY. Over the next 20 years, global passenger journeys are expected to increase by an average of 3.8% annually, resulting in over 4 billion additional journeys by 2043 compared to 2023. This yearly rise in global travel will contribute to SATS revenue growth in the coming years.

- Business restructuring. SATS recently announced the division of its airport ground handling services into separate units for Singapore and the Asia-Pacific region to stimulate company growth. The restructuring of its Gateway Services business resulted in the creation of two new units: the Singapore Hub and Gateway Services Asia-Pacific. The Singapore Hub will focus on enhancing aviation hub competitiveness in Singapore, while Gateway Services Asia-Pacific will aim to expand the group’s market share by managing operations in overseas airports.

- Lounge improvements. SATS unveiled its upgraded Premier Lounge at Changi Airport Terminal 3 recently, featuring Singaporean dishes like laksa, chicken rice, and prawn noodles, along with interior designs by local artists and students. The lounge includes a new Executive space with private pods, dining service, and travel-friendly amenities. SATS plans to extend similar refurbishments to its other lounges in Terminals 1 and 2 over the next few years. The lounge also offers pasta made by robot chefs, products from SATS Gourmet Solutions, and collaborations with six renowned local food and beverage brands. SATS CEO highlighted the aim to enrich travellers’ experiences with a blend of food, culture, and hospitality. Refurbishments to the lounges in different terminals will offer more comfort and incentive for travellers at Singapore Changi Airport to visit the lounges.

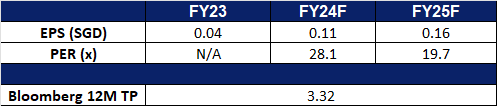

- FY24 results review. Total revenue rose by 192.9% YoY to S$5.15bn in FY24, compared to S$1.76bn in FY23. Core PATMI rose by 331.3% to S$78.5mn in FY24, compared to S$18.2mn in FY23. Basic EPS was 3.8 Scents in FY24, compared to -2.2 Scents in FY23.

- Market Consensus.

(Source: Bloomberg)

Shandong Gold (1787 HK): Record Gold Prices

- BUY Entry – 17.70 Target 19.30 Stop Loss – 16.90

- Shandong Gold Mining Co., Ltd. is a China-based company principally engaged in the mining, processing and sales of gold. The Company operates two segments. The Gold Mining segment is engaged in the mining of gold ore. The Gold Refining segment is engaged in the production and sales of gold. The Company is also engaged in the distribution of other metals extracted during the gold ore smelting process, such as silver, copper, iron, lead and zinc. The Company conducts its businesses in domestic and overseas markets.

- Better rate cut outlook driving Gold prices. Gold rose towards $2,470 per ounce on Thursday, nearing record highs amid growing optimism that the Federal Reserve will reduce rates as early as September. More Fed officials have expressed growing confidence that the pace of price increases is aligning more closely with policymakers’ goals. Powell also noted recently that June’s lower-than-expected inflation boosted confidence in achieving the price growth target, and emphasized the central bank’s readiness to cut rates before inflation reaches 2%. According to the CME’s Fed Watch Tool, markets now indicate a 98% chance of a rate cut at the Fed’s September meeting, with traders favoring three 25-basis-point rate cuts this year instead of two.

Gold Price

(Source: Bloomberg)

- New mining license. Shandong Gold Mining has successfully acquired the mining license for the Yanshan Mine Area from Shandong Gold Group Penglai Mining Co., Ltd., expanding its asset portfolio. The acquisition includes a total of five mineral rights, which promises to enhance the company’s mining capabilities and asset base. This strategic move is part of Shandong Gold Mining’s ongoing efforts to solidify its position in the mining industry.

- Continued global geopolitical tension and economic uncertainties. The ongoing Israel-Hamas conflict is likely to further escalate regional tensions. Red Sea attacks by the Houthis have continued to disrupt maritime networks, increasing uncertainty in the global economy. The recent assassination attempt on former President Donald Trump has also heightened political instability. These rising geopolitical tensions and economic uncertainties have led to a heightened demand for safe-haven assets such as gold.

- 1Q24 earnings. The company revenue rose to RMB19.0bn, +44.7% YoY, compared to RMB13.1bn in 1Q23. The company’s profit rose to RMB699.9mn, +59.5% YoY, compared to RMB438.9mn in 1Q23. Basic earnings per share were RMB0.13 in 1Q24, compared to RMB0.07 in 1Q23.

- Market consensus.

(Source: Bloomberg)

Sunny Optical Technology Group (2382 HK): Increasing supply chain presence

- BUY Entry – 48.6 Target 53.6 Stop Loss – 46.1

- Sunny Optical Technology Group Co Ltd is an investment holding company principally engaged in the design, research and development, manufacture and sale of optical and optical related products and scientific instruments. The Company operates its business through three segments: Optical Components segment, Optoelectronic Products segment and Optical Instruments segment. The Company’s main products include mobile phone lenses, automotive lenses, high-pixel lens lights, camera modules and others. The Company’s products are sold in China and overseas markets.

- Entering Apple’s Supply chain. According to market news, Sunny Optical will be a Compact Camera Module (CCM) supplier for some iPhone 16 models and MacBooks by 2025, with mass production in Vietnam. As a first-tier CCM supplier, Sunny Opticals entry into Apple’s supply chain would significantly boost its revenue and support profit growth through vertical integration. Despite losing iPhone lens orders in 2023 due to production issues, Sunny Optical is set to regain these orders starting in the second half of 2024, aiming to restore its 2023 supply allocation by 2025, enhancing its business momentum.

- Expectations for AI integration in 2H. According to the International Data Corporation (IDC), global smartphone shipments increased by 6.5% year over year to 285.4 million units in 2Q24, marking the fourth consecutive quarter of growth. However, demand remained weak in many markets. Looking ahead, Chinese OEMs are increasing shipments in the low-end market, while there is excitement surrounding the growth of Gen AI smartphones, which are expected to capture 19% of the market this year. The 2H24 smartphone market is expected to be competitive and potentially driven by new-gen AI smartphone launches. With the release of new-gen AI smartphones, an increase in smartphone purchases is expected, leading to a surge in demand for Apple’s iPhone and a subsequent rise in revenue for Sunny Optical.

- PC shipments jump. Global shipments of personal computers (PCs) increased by 3% in 2Q24, reaching 64.9mn units, driven by demand for AI-capable devices, according to IDC. This marks the second consecutive quarter of growth after two years of decline. Apple saw the highest growth among PC makers with a 20.8% increase in shipments, followed by Acer Group with a 13.7% rise. The PC market is expected to rebound from a post-pandemic lull, with AI and a commercial refresh cycle contributing to this positive trend. Excluding China, global shipments grew over 5% YoY. This demand for PCs is expected to continue through 2H24 and FY25, with the release of more AI-capable devices, which will be beneficial for the sales of Sunny Opticals components needed in the new devices.

- FY23 earnings. Revenue fell by 4.6% YoY to RMB31.68bn in FY23, compared to RMB33.20bn in FY22. Net profit fell to RMB1.15bn in FY23, compared to RMB2.47bn in FY22. Basic EPS fell to RMB1.01 in FY23, compared to RMB2.20 in FY22.

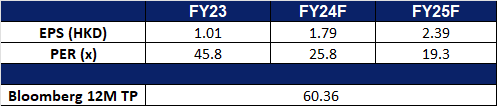

- Market consensus.

(Source: Bloomberg)

Zillow Group Inc (Z US): Double bonanza

- BUY Entry – 52 Target – 58 Stop Loss – 49

- Zillow Group, Inc. is a tech real-estate marketplace company. The Company provides information about homes, real estate listings, and mortgages through websites and mobile applications. Zillow Group serves homeowners, buyers, sellers, renters, and real estate professionals in the United States.

- Small-mid caps in focus. In the first half of the year, investors were mainly interested in large-cap and AI-related stocks, which boosted the performance of the S&P and Nasdaq. However, as the highly anticipated rate cut cycle is set to begin this quarter, funds and investors are now shifting their attention to sectors that have been underperforming, like small and mid-cap stocks and Dow component-related stocks. This change in investment focus will be advantageous for Zillow.

- All-time high home sales prices. In May, existing home sales fell 0.7% to an annual rate of 4.11mn, down 2.8% from the previous year, while the median home price in the US rose 5.8% YoY to a record US$419,300. Single-family home prices reached an all-time high of US$419,300 in May 2024. Inventory increased by 6.7% to 1.28mn units, a 3.7-month supply. Homes typically stayed on the market for 24 days, first-time buyers made up 31% of sales, and all-cash sales accounted for 28%. Mortgage rates averaged 6.87% as of 20 June. The housing market has been under pressure for the past two years due to the high-interest-rate environment. The Federal Reserve is anticipated to cut interest rates in the third quarter, leading to a decline in mortgage rates. This is expected to result in increased funds flowing into the real estate industry, potentially leading to a recovery in the real estate market and higher real estate sales.

- Housing showing early signs of recovery. US single-family homebuilding fell to an eight-month low in June due to higher mortgage rates, likely impacting economic growth in the second quarter. Permits for future single-family home construction also dropped to a one-year low, despite a shortage of previously owned houses keeping prices high. Single-family housing starts declined 2.2% to a rate of 980,000 units, with decreases in the Northeast and West but increases in the South and Midwest. The average rate for a 30-year fixed mortgage was 6.89% last week, down from a six-month high. Homebuilder confidence dipped in July, though sales expectations for the next six months improved. Residential investment likely detracted from GDP in Q2, with permits for single-family homes falling 2.3% to 934,000 units, while multi-family starts surged 22% to 360,000 units. Overall housing starts rose 3% to 1.353mn units, and completions reached the highest level since January 2007. It is expected that mortgage rates will decrease in line with the anticipated rate-cut cycle in the current quarter, which is likely to stimulate further activity in the housing market.

- 1Q24 earnings review. Revenue rose by 12.8% YoY to US$529mn, beating estimates by US$21.25mn. Net loss was US$23mn. Zillow reduced its Q2 sales estimate to between US$525mn and US$540mn short of analysts’ estimates of US$559mn.

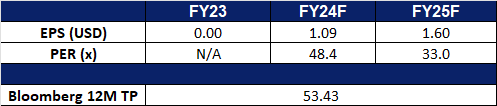

- Market consensus.

(Source: Bloomberg)

Home Depot Inc (HD US): Rate cuts incoming

- RE-ITERATE BUY Entry – 356 Target – 390 Stop Loss – 339

- The Home Depot, Inc. is a home improvement retailer. The Company offers wide range of building materials, home improvement, lawn, and garden products, as well as provides DYI ideas, installation, repair, and other services. Home Depot serves customers worldwide.

- The US housing market is expected to recover. The market expects the Federal Reserve to start a rate-cutting cycle in the third quarter. The housing market has been under pressure for the past two years due to the high-interest-rate environment. In the ongoing US bull market, its positive wealth effect has benefited the US public. Therefore, when mortgage rates decline, it is expected that some funds will flow into the real estate industry. Correspondingly, the home improvement industry will also benefit from the future recovery of the real estate market.

- Sector rotation. Looking back at the first half of the US stock market, funds were concentrated on artificial intelligence themes, leading to high valuations for popular stocks and lacklustre performance for other value stocks. In a rate-cut cycle, traditional sector stocks are likely to see valuation repair and have significant upside potential.

- 1Q25 earnings review. Revenue fell by 2.4% YoY to US$36.4bn, missing estimates by US$25mn. GAAP EPS was US$3.63, beating estimates by US$0.04. FY24 sales are expected to increase 1% (including Week 53), while comparable sales for Week 52 are expected to decline 1%. The company plans to open 12 new stores.

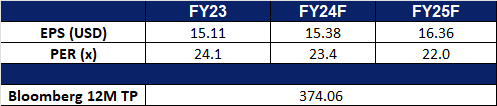

- Market consensus.

(Source: Bloomberg)

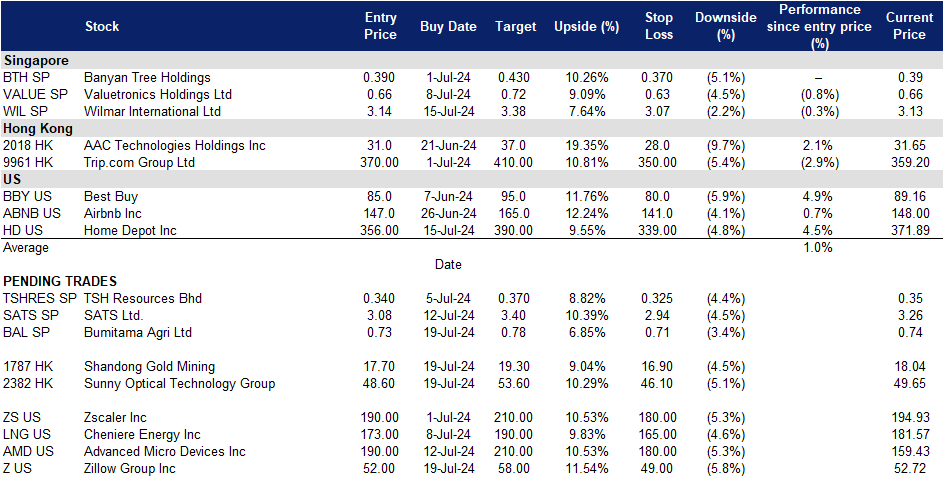

Trading Dashboard Update: Take profit on Singapore Airlines Ltd (SIA SP) at S$7.1 and Air Products and Chemicals Inc (APD US) at US$270.47. Cut loss on Baidu Inc (9888 HK) at HK$90, Tencent Holdings Ltd (700 HK) at HK$375, Samudera Shipping Line Ltd (SAMU SP) at S$0.965 and Frencken Group Ltd (FRKN SP) at S$1.58.