19 August 2024: Oversea-Chinese Banking Corp Ltd (OCBC SP), AAC Technologies Holdings Inc (2018 HK), Ensign Group Inc (ENSG US)

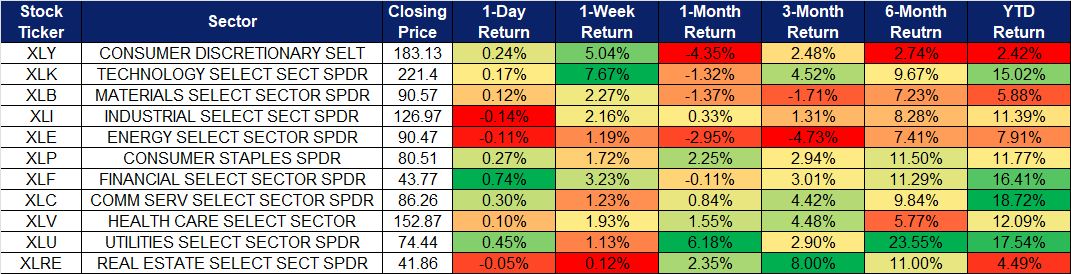

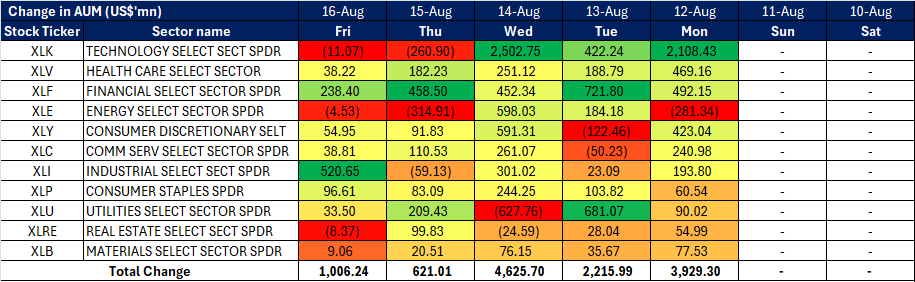

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

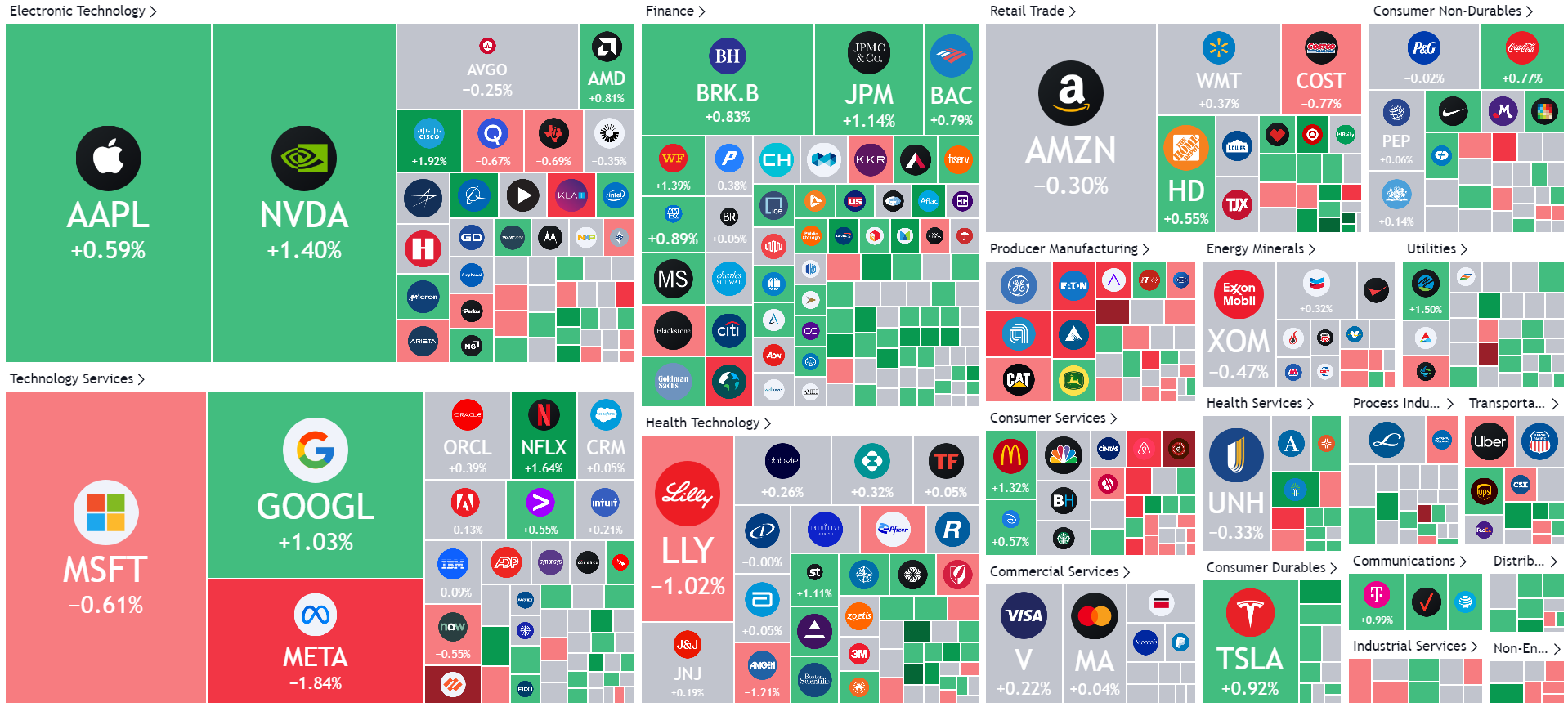

United States

Hong Kong

Oversea-Chinese Banking Corp Ltd (OCBC SP): Rate cuts to stimulate loan growth

- BUY Entry – 14.2 Target– 15.4 Stop Loss – 13.6

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other fin

- Optimism surrounding US Federal Interest rate cuts in 2H24. Following recent inflationary data, the market anticipates a potential 25 basis points rate cut in September 2024. While this could reduce borrowing costs and enhance financial flexibility for customers, it could also put pressure on the bank’s net interest margins. Lower rates generally narrow the spread between the interest earned on loans and the interest paid on deposits, potentially reducing profitability from interest income. However, the overall lower borrowing costs could stimulate loan demand and economic activity, which may help offset the impact on margins and support OCBC’s broader growth strategy.

- Diversifying loan portfolio. After launching a program aimed at accelerating the growth of women-led SMEs in April, OCBC saw a significant increase in loans to female-owned businesses, with a growth of over 30% in the two months following the launch. This outpaced the loan growth for male-owned businesses, which increased by over 20% during the same period. The program, now called Women Unlimited, includes expanded access to SME sustainable finance and offers up to S$100,000 in financing for women-founded startups within their first two years. It also provides educational workshops, networking opportunities, and plans to expand regionally to Malaysia and Hong Kong. This initiative strengthens OCBC’s market position by fostering growth among women-led SMEs, diversifying its loan portfolio, and enhancing customer loyalty through targeted support and expanded services.

OCBC share price and USD/SGD comparison

(Source: Bloomberg)

- Promising second quarter results. OCBC reported a 14% YoY increase in second-quarter net profit, reaching S$1.94bn, exceeding expectations. The profit growth was driven by increased income and reduced allowances. OCBC remains confident in the ASEAN economy and is on track to meet its 2024 targets, including maintaining a net interest margin (NIM) between 2.2% and 2.25%. The bank declared a 10% higher interim dividend of S$0.44 per share and saw a 17% rise in wealth management fees. Despite a slight decline in NIM to 2.2%, return on equity improved to 14.2%.

- 1H24 results review. Total income for 1H24 increased by 7% YoY to S$7.26bn, net interest income and non-interest income rose 3% and 15% YoY respectively. Net profit increase by 9% YoY to S$3.93bn in 1H24, compared to S$3.59bn in 1H23, mainly due to record total income and lower allowances. The Board declared an interim dividend of S$0.44, up 10% or S$0.04 from a year ago, representing a payout ratio of 50% of the Group’s 1H24 net profit.

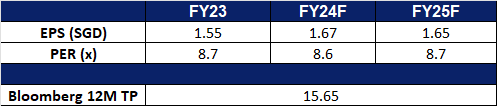

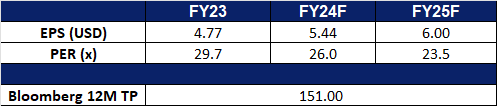

- Market Consensus.

(Source: Bloomberg)

United Hampshire US REIT (UHU SP): Tailwinds from the potential soft-landing of the US economy

- RE-ITERATE BUY Entry – 0.430 Target– 0.460 Stop Loss – 0.415

- United Hampshire US REIT operates as a real estate investment trust. The Company owns and operates shopping, storage, grocery, and necessity-based retail properties.

- Optimism surrounding US Federal Interest rate cuts in 2H24. Following recent inflationary data in June, the market anticipates a potential 25 basis points rate cut in September 2024. These expected rate reductions are poised to benefit United Hampshire US REIT by lowering borrowing costs, enhancing financial flexibility, and potentially attracting higher investor interest. This favourable interest rate environment aligns with the REIT’s growth strategy, positioning it for increased profitability and value creation in the upcoming quarters.

- Organic growth to drive upside in profitability. United Hampshire US REIT expects organic growth to drive profitability, leveraging built-in rental escalation in the majority of long-term tenant contracts and shorter-term leases in prime self-storage properties. These factors contribute to potential revenue growth and enhanced operational performance.

- Better positioning for active management. If the Federal Reserve implements rate cuts, United Hampshire US REIT stands to benefit in the coming year, enabling proactive portfolio management through strategic acquisitions and divestments. This flexibility underscores the REIT’s capability to adapt to changing market conditions and optimize its asset base.

- 1H24 results review. Revenue for 1H24 increased by 2.4% YoY to US$36.8mn, compared to US$36.0mn in 1H23. Net profit declined by 25.4% YoY to US$9.67mn in 1H24, compared to US$12.96mn in 1H23, mainly due to high interest rates. It also divested a Freestanding Lowe’s and Freestanding Sam’s Club Property within Hudson Valley Plaza for a divestment consideration of US$36.5mn.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.60. Please read the full report here.

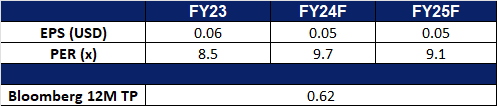

- Market Consensus.

(Source: Bloomberg)

AAC Technologies Holdings Inc (2018 HK): High expectations towards iPhone 16 sales

- BUY Entry – 28.5 Target 32.5 Stop Loss – 26.5

- AAC Technologies Holdings Inc. designs, develops and manufactures a broad range of miniaturized components that include speakers, receivers and microphones in the acoustic segment. The Company produces these components for mobile devices such as smartphones, tablets, wearables, ultrabooks, notebooks and electronic book-readers.

- AI features to boost sales. According to analysts, the anticipated demand for Apple’s new AI features, known as Apple Intelligence, is expected to result in a substantial increase in iPhone sales. This could potentially trigger what is known as an “iPhone supercycle.” These features will only be available on the iPhone 15 Pro or newer models, which may prompt many current iPhone users to upgrade. Apple Intelligence, currently in beta, will be available on the iPhone 15 Pro, iPhone 15 Pro Max, and devices with M1 chips or later. It will be integrated into iOS 18, iPadOS 18, and macOS Sequoia. This development may lead to a surge in sales of the iPhone 16 and might also give rise to a new AI App Store, which would significantly impact Apple’s market and boost iPhone sales. An increase in iPhone sales would also result in the need for more components from AAC Technology, benefiting its top lines.

- Ramping up iPhone 16 production. Apple supplier Foxconn recently announced that the company has hired 50,000 additional workers at its Zhengzhou factory in China to meet increased production demands for the upcoming iPhone 16. The recruitment drive comes as Apple aims to boost iPhone production by 10% this year, targeting 90mn units. The Zhengzhou facility, often referred to as “iPhone City,” is responsible for assembling approximately 80% of iPhones globally. Apple’s decision to boost production comes amid expectations of high demand for the iPhone 16 lineup, particularly due to new Apple Intelligence features. These AI capabilities will only be available on the iPhone 15 Pro models and the entire iPhone 16 series, potentially driving more upgrades this year. This increased production is expected to positively benefit AAC Technologies, whose key customers include Apple.

- Siri updates incoming. Apple plans to enhance Siri with generative AI, enabling it to control various apps more effectively. This upgrade aims to improve Siri’s understanding of user intentions and app functionalities, addressing previous challenges. A potential deal with OpenAI may integrate ChatGPT’s technology into iOS 18, making Siri more intuitive and context aware. The update is expected to boost iPhone sales, especially as Apple faces competition in China and slower growth in the US. Siri will support more natural language, follow-up questions, and text input, while also performing tasks based on on-screen content and drawing on personal context for more complex actions. On 10 June, Apple released an improved version of Siri and introduced AI features to a few applications. The enhancements announced by Apple will necessitate new components for the handset from AAC Technology, which in turn will benefit its acoustic business revenue.

- FY23 earnings. Revenue fell by 1.0% YoY to RMB20,419mn in FY23, compared to RMB20,625mn in FY22. Net profit fell 9.9% YoY to RMB740mn in FY23, compared to RMB821mn in FY22. Basic EPS fell 8.3% YoY to RMB0.63 in FY23, compared to RMB0.69 in FY22.

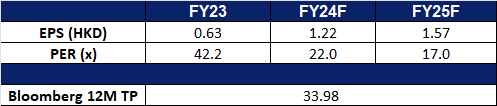

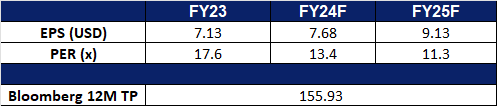

- Market consensus.

(Source: Bloomberg)

Lenovo Group Ltd. (992 HK): PC shipment recovery on track

- RE-ITERATE BUY Entry – 9.90 Target 10.90 Stop Loss – 9.40

- Lenovo Group Limited is an investment holding company principally engaged in personal computers and related businesses. The Company’s main products include Think-branded commercial personal computers and Idea-branded consumer personal computers, as well as servers, workstations and a family of mobile Internet devices, including tablets and smart phones. The Company operates its business through four geographical segments, including China, Asia Pacific (AP), Europe, the Middle East and Africa (EMEA) and Americas (AG). The Company also provides cloud service and other related services. The Company distributes its products in domestic market and to overseas markets.

- Global PC recovery to continue in the second half of the year. An IDC report indicates that the traditional PC market experienced its second quarter of growth following eight consecutive quarters of decline. In Q2, worldwide shipments reached 64.9 million units, reflecting a 3.0% YoY growth. Additionally, Lenovo’s robust 1Q25 results bolster optimism for a gradual recovery in the computing industry, driven by global AI spending. The results highlight how increasing demand for servers, crucial for AI development, is revitalizing the computing hardware market after its post-Covid downturn. As we reach the four-year mark since the COVID-19 pandemic began in 2020, it’s also expected that the PC commercial refresh cycle will start. Additionally, with inventory levels returning to normal, average selling prices are anticipated to increase due to more advanced configurations and reduced discounting.

- Ramping up global AI spending. Major technology companies, including Microsoft, Alphabet, Meta, and Amazon, are projected to invest over $1tn in AI over the coming years, according to sources. In their recent earnings reports, these companies informed investors that they anticipate increased spending on AI infrastructure, particularly data centres, to secure their long-term positions in the AI sector and meet the growing computational demands. By investing in AI infrastructure now, these tech giants aim to ensure they have the necessary computing technology as AI continues to evolve. Lenovo’s AI PCs is likely to benefit from these AI investments.

- Expanding product portfolio in India. Lenovo has been expanding its product portfolio in India, recently launching the Yoga Slim 7x, its first AI-powered Copilot+ PC in the country. Additionally, Lenovo also introduced its latest gaming tablet, the Lenovo Legion Tab, in India. With more Lenovo’s offerings alongside the company’s Microsoft’s AI expertise, the increased number of product offerings is expected to attract more customers.

- 1Q25 earnings. The company’s revenue rose by 19.7% YoY to US$15.4bn in 1Q25, compared to US$12.9bn in 1Q24. The company’s net profit rose by 38.3% YoY to US$253mn in 1Q25, compared to US$183mn in 1Q24. Basic earnings per share rose to US1.99 cents in 1Q25, compared to US1.48 cents in 1Q24.

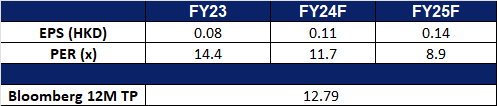

- Market consensus.

(Source: Bloomberg)

Ensign Group Inc (ENSG US): Capitalising on an aging population

- BUY Entry – 140 Target – 154 Stop Loss – 133

- The Ensign Group, Inc. operates facilities offering nursing and rehabilitative care services in multiple states. The Company provides a broad spectrum of nursing and assisted living, physical, occupational and speech therapies, and other rehabilitative and healthcare services for both long-term residents and short-stay rehabilitation patients.

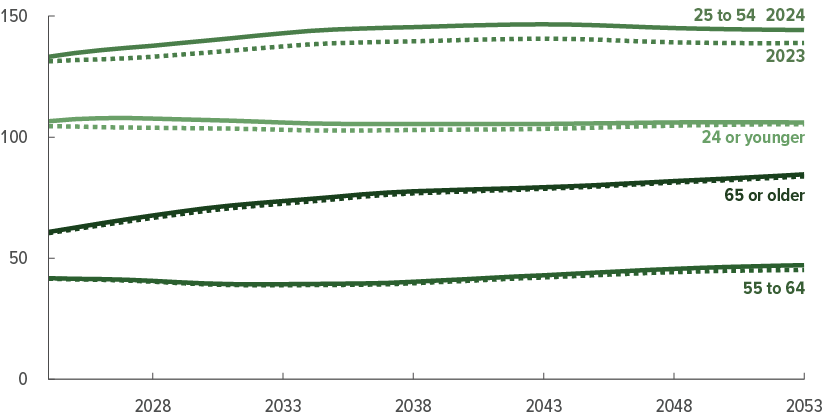

- Exhibits both defensive and growth attributes. Its business has steadily expanded over the past few years, demonstrating resilience across economic cycles. This defensive posture is complemented by robust growth prospects driven by the rapidly aging US population. According to the Population Reference Bureau, the number of Americans aged 65 and older will surge from 58 million in 2022 to 82 million by 2050. Concurrently, the shortfall in elderly care services will skyrocket from 6 million to 13 million over the same period. This burgeoning demand for nursing care positions the company favourably for significant future growth.

US demographic outlook – 2024 to 2054

Source: CBO

- 2Q24 earnings review. Revenue grew by 12.5% YoY to US$1.04B. Non-GAAP EPS was US$1.32.

- Market consensus.

(Source: Bloomberg)

Dell Technologies Inc (DELL US): Tailwinds from PC upgrade cycle & AI wave

Dell Technologies Inc (DELL US): Tailwinds from PC upgrade cycle & AI wave

- RE-ITERATE BUY STOP Entry – 105 Target – 130 Stop Loss – 93

- Dell Technologies Inc. provides computer products. The Company offers laptops, desktops, tablets, workstations, servers, monitors, printers, gateways, software, storage, and networking products. Dell Technologies serves customers worldwide.

- Global PC recovery to continue in the second half of the year. An IDC report indicates that the traditional PC market experienced its second quarter of growth following eight consecutive quarters of decline. In Q2, worldwide shipments reached 64.9 million units, reflecting a 3.0% YoY growth. When excluding China, worldwide shipments grew by more than 5% YoY. AI PCs are predicted to drive demand from the commercial market in the short term. As we reach the four-year mark since the COVID-19 pandemic began in 2020, it’s expected that the PC commercial refresh cycle will start. Additionally, with inventory levels returning to normal, average selling prices are anticipated to increase due to more advanced configurations and reduced discounting. Therefore, the report expects that the PC recovery will persist.

- Partnership to run the new platform. Dell Technologies and Nutanix have expanded their long-term partnership to offer a competitive alternative to VMware, particularly targeting customers unhappy with changes under Broadcom’s ownership. This collaboration integrates Nutanix’s software with Dell’s PowerEdge servers and PowerFlex storage, aiming to capture market share from discontented VMware users. The new Dell XC Plus appliance, a turnkey hyperconverged infrastructure (HCI) solution, is central to this strategy, offering simplified management and scalability for hybrid cloud environments. The partnership, which is set to expand further, could intensify competition in the HCI market and allow Dell to gain a competitive advantage in the computing space.

- Lowering costs. Dell Technologies is cutting jobs as part of a reorganization focused on streamlining its sales teams and prioritizing investments in AI products and services. The company is creating a new AI-focused group and adjusting its approach to data center sales. Despite growing investor interest in Dell’s AI capabilities, there is concern over the long-term payoff of such investments. The company, which had already cut 13,000 jobs earlier in 2023, aims to become leaner through the cutting of jobs. Dell remains optimistic about future growth, particularly with AI-optimized PCs, despite challenges in its traditional PC market.

- 1Q24 earnings review. Revenue grew by 6.2% YoY to US$22.2B, beating estimates by US$550M. Non-GAAP EPS was US$1.27, beating estimates by US$0.02.

- Market consensus.

(Source: Bloomberg)

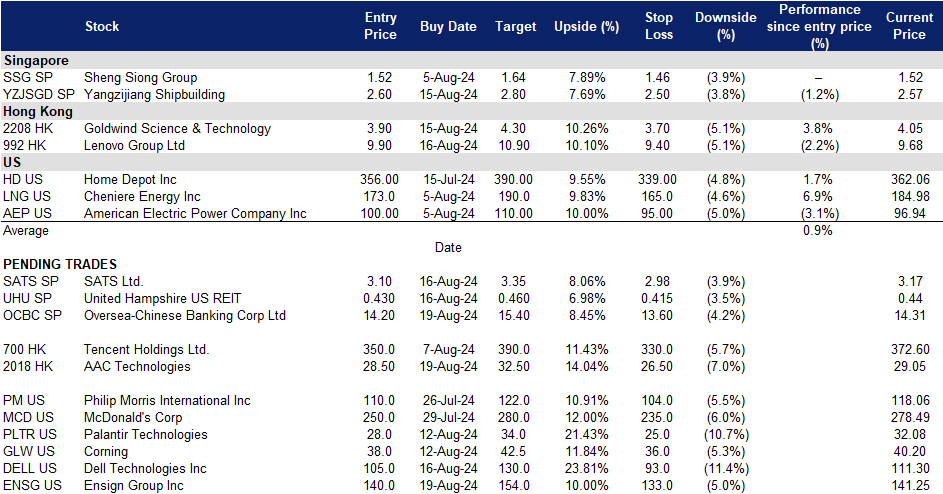

Trading Dashboard Update: Add Lenovo Group Ltd (992 HK) at HK$9.9.