18 October 2024: Oversea-Chinese Banking Corp Ltd (OCBC SP), CGN Mining Co Ltd (1164 HK), PayPal Holdings Inc (PYPL US)

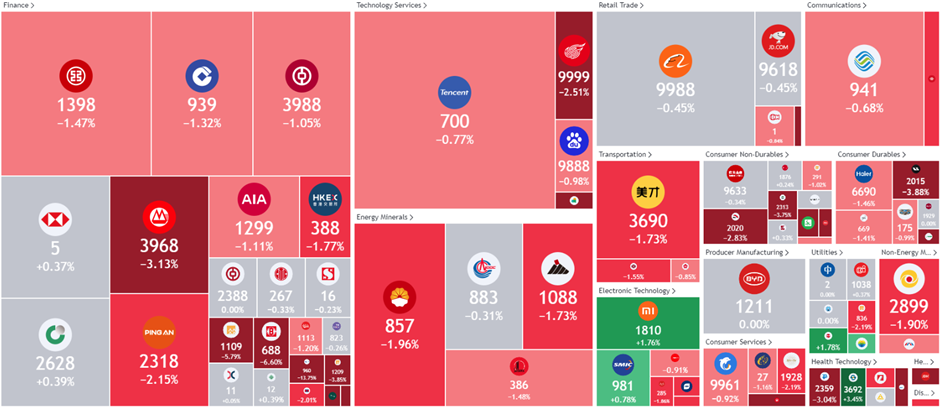

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Oversea-Chinese Banking Corp Ltd (OCBC SP): Increased banking activity

- BUY Entry – 15.2 Target– 16.6 Stop Loss – 14.5

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other financial and related services.

- Positive sentiment from the US banks. Despite declining interest rates impacting net interest income, US banks delivered strong third-quarter results, fuelled by increased deal-making and corporate debt issuance. There is growing optimism that the upcoming interest rate cuts will continue to boost deal activity as borrowing costs decline. Furthermore, with the strong stock market and expectations of a soft economic landing in the US are also boosting dealmakers’ confidence. This positive sentiment in the US banking sector has also extended to the banking market in Singapore.

- Collaboration with Disney. OCBC and Disney have announced a five-year strategic partnership across Singapore, Malaysia, and Indonesia, aimed at significantly increasing OCBC’s new customer base in Southeast Asia by 2029. The collaboration includes the launch of the OCBC MyOwn Account for children aged 7-15, allowing them to manage their own accounts under parental supervision via the OCBC app. The partnership will also feature Disney-themed bank cards, financial literacy materials with Disney characters, and related merchandise by mid-2025. OCBC highlighted that the partnership will help attract new customers by offering unique, non-price-based products and services.

- Increase in SME transactions. The OCBC SME Index saw gains for the second consecutive quarter, reaching 50.8 in 3Q24, up from 50.2 in 2Q24. This improvement reflects a slight increase in collections and payments by SMEs, supported by cooling inflation and stronger external demand. In a survey of 1,100 SMEs, 40% reported better business performance, up from 35% in the previous quarter. Looking ahead, 48% of SME owners expect further improvement over the next six months, while 40% foresee stable conditions. Singapore’s GDP growth for 3Q24 is estimated at over 3.5%, surpassing earlier forecasts. Despite, potential risks from geopolitical tensions and economic uncertainties, OCBC anticipates continued expansion in the fourth quarter and relative stability in the year ahead.

- 1H24 results review. Total income for 1H24 increased by 7% YoY to S$7.26bn, net interest income and non-interest income rose 3% and 15% YoY respectively. Net profit increase by 9% YoY to S$3.93bn in 1H24, compared to S$3.59bn in 1H23, mainly due to record total income and lower allowances. The Board declared an interim dividend of S$0.44, up 10% or S$0.04 from a year ago, representing a payout ratio of 50% of the Group’s 1H24 net profit.

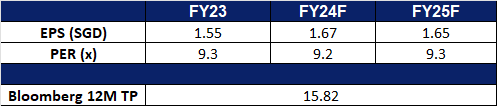

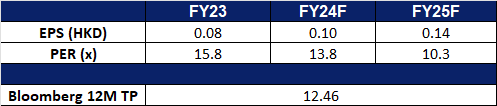

- Market Consensus.

(Source: Bloomberg)

Genting Singapore Ltd (GENS SP): Seasonal tailwinds

- RE-ITERATE BUY Entry – 0.860 Target– 0.940 Stop Loss – 0.820

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

- Expectations towards year-end travel season. With upcoming school holidays, as well as employees looking to clear their leaves before the year ends, we expect the year-end travel season to provide a boost to travel demand. Consumers who avoid the cold weather are also likely to travel to warmer countries, and vice versa. Travel demand has also remained strong ahead of the upcoming travel seasonality. Recently, Trip.com reported strong flight bookings globally as people flock to Singapore to watch the F1 Singapore GP in September, and also saw China’s travel booking during Golden Week reaching an all-time high. Many airlines such as Korean Air, Peach Aviation, AirAsia have also increased their flight routes moderately ahead of winter demand. The expectation of higher travel demand is likely to affect Genting Singapore positively.

- November is a good month seasonally. November has been a seasonally good month for Genting Singapore’s share price, with an average increase in share price by 8.78% in November over the past 10 years. Strong travel bookings and the announcement of more flight routes also add to positive sentiments as investors start to expect higher travel demand towards the end of the year. We expect these positive sentiments to positively benefit Genting Sing share price in November.

Genting Singapore Share Price Seasonality Performance

(Source: Bloomberg)

- More Catalysts ahead. Resorts World Sentosa plans to host more lifestyle events, such as Harry Potter: Visions of Magic, in late 2024 and is on track with new projects like Minion Land and Singapore Oceanarium, set to open in early 2025. Additionally, Resorts World Sentosa (RWS) has received the government’s provisional permission for a new Waterfront development which is expected to start construction in late 2024, and a new luxury hotel will launch in early 2025. Furthermore, back in May, RWS also signed an MoU with Sentosa Development Corporation and other partners to enhance RWS’s appeal as part of broader. government efforts to boost tourism, which saw receipts exceed S$27.2bn in 2023. This MoU is likely to continue benefitting Genting Singapore.

- 1H24 results review. Revenue increased by 25.5% YoY to S$1.36bn in 1H24, compared to S$1.08b in 1H23. Net profit rose by 29.0% to S$356.9mn in 1H24, compared to S$276.7mn in 1H23. Basic EPS rose to 2.96 Scents in 1H24, compared to 2.29 Scents in 1H23.

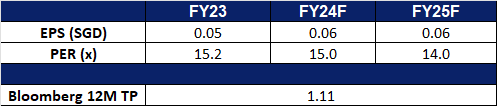

- Market Consensus.

(Source: Bloomberg)

CGN Mining Co Ltd (1164 HK): Growing nuclear power demand

- BUY Entry – 1.61 Target 1.90 Stop Loss – 1.45

- CGN Mining Co Ltd is a company mainly engaged in the trading of natural uranium. The Company operates its business through three segments. The Natural Uranium Trading segment is engaged in the trading of natural uranium. The Property Investment segment is engaged in leasing business. The Other Investments segment is engaged in investment activities.

- Big Tech venture into nuclear power. Earlier last month, Microsoft reignited interest in nuclear energy stocks by signing a power purchase agreement with Constellation Energy (CEG), the largest clean energy supplier in the U.S. According to the agreement, Constellation will restart the Three Mile Island Nuclear Station in Pennsylvania to support Microsoft’s growing artificial intelligence (AI) needs. Google, a subsidiary of Alphabet, has also partnered with private firm Kairos Power to construct a series of SMRs with a total capacity of 500 megawatts. Recently, Amazon also announced plans to collaborate with Energy Northwest, Dominion Energy, and private firm X-energy to build several SMRs. These nuclear resources will support Amazon’s future AI services. These partnerships are bound to drive more interest towards the uranium market.

- China Stimulus to boost demand for uranium. China’s recent announcement of stimulus packages has boosted bullish momentum in uranium markets, driven by increasing energy demand from the world’s third-largest power producer. Furthermore, China’s push to expand its nuclear energy capacity has improved the investment outlook, fueling stronger interest in uranium. With 22 of the 58 global nuclear reactors currently under construction in China, the country is at the forefront of a global nuclear renaissance.

- Potential restricted uranium supply. Russian President Putin said Moscow should consider limiting uranium, titanium, and nickel exports. Russia has approximately 44% of the world’s uranium enrichment capacity and provides 5.5% of the global supply. It owns about 8% of the global reserves. In May, the US passed the Prohibiting Russia Uranium Imports Act. Countries with nuclear energy, especially the Western ones have been sourcing reliable supplies. Russia’s potential uranium export restriction will lead to tight supplies, and prices will rebound accordingly. Current uranium prices have risen toward $83 per pound in October, the highest in over 2 months.

Uranium futures prices

(Source: Bloomberg)

- 1H24 operation update. In 1H24, the total equity source of the Group was 39,000tU and equity production was 624tU. The group was interested in 49% of the equity interest of Semizbay-U, which mainly owns and operates the Semizbay Mine and the Irkol Mine in Kazakhstan. The planned uranium extracted was 471tU with actual extraction of 477tU and the completion rate of planned production was 101% in the first half of the year; among which, actual uranium extracted from the Semizbay Mine and the Irkol Mine was 182tU and 295tU, respectively. The average production costs of the Semizbay Mine and the Irkol Mine were US$31.93/lbU3O8 and US$23.83/lbU3O8, respectively. The group was interested in 49% of the equity interest of Ortalyk, which mainly owns and operates the Central Mynkuduk Deposit and the Zhalpak Deposit in Kazakhstan. The planned uranium production was 905tU with actual production of 858tU and the completion rate of planned production was 95% in the first half of the year; among which, actual uranium extracted from the Central Mynkuduk Deposit and Zhalpak Deposit was 792tU and 66tU, respectively.

- 1H24 earnings. Revenue grew by 38.8% to HK$4.07bn. Gross loss was HK$56.4mn compared to HK$186.7mn profit in 1H23. Net profit attributable to the shareholders of the company declined by 37.0% to HK$113.1mn.

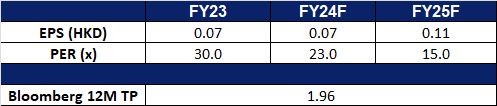

- Market consensus.

(Source: Bloomberg)

Lenovo Group Ltd (992 HK): PC shipment recovery on track

- RE-ITERATE BUY Entry – 10.7 Target 12.1 Stop Loss – 10.0

- Lenovo Group Limited is an investment holding company principally engaged in personal computers and related businesses. The Company’s main products include Think-branded commercial personal computers and Idea-branded consumer personal computers, as well as servers, workstations and a family of mobile Internet devices, including tablets and smart phones. The Company operates its business through four geographical segments, including China, Asia Pacific (AP), Europe, the Middle East and Africa (EMEA) and Americas (AG). The Company also provides cloud service and other related services. The Company distributes its products in domestic market and to overseas markets.

- Global PC recovery to continue through 1H25. Worldwide PC shipments reached 62.9 million units in the third quarter of 2024, reflecting a 1.3% decline compared to the same period in 2023, according to preliminary data from Gartner, Inc. This marks the first decline after three consecutive quarters of year-over-year growth in the PC market. Despite this dip, the market remains on a recovery trajectory. Global demand for PCs is expected to accelerate toward the end of 2024, with stronger growth anticipated in 2025 as the PC refresh cycle peaks. Lenovo maintained its position as the global market leader, holding a 26.3% share in Q3 2024 and posting a 2.5% year-over-year increase in shipments. The company’s strong financial performance in the first quarter of 2025, supported by rising global AI investments, reinforces optimism for a steady recovery in the computing industry. This resurgence is fueled by growing demand for servers, which are essential for AI development, helping to revitalize the hardware sector following the post-pandemic slowdown. As the industry approaches the four-year anniversary of the COVID-19 pandemic, the PC commercial refresh cycle is expected to gain momentum. With inventory levels stabilizing, average selling prices are projected to rise, driven by more advanced configurations and a reduction in discounting.

- Ramping up global AI spending. Major technology companies, including Microsoft, Alphabet, Meta, and Amazon, are projected to invest over $1tn in AI over the coming years, according to sources. In their recent earnings reports, these companies informed investors that they anticipate increased spending on AI infrastructure, particularly data centres, to secure their long-term positions in the AI sector and meet the growing computational demands. By investing in AI infrastructure now, these tech giants aim to ensure they have the necessary computing technology as AI continues to evolve. Lenovo’s AI PCs is likely to benefit from these AI investments.

- Expanding AI product portfolio. Lenovo continues to expand its AI product portfolio following the launch of its AI-enabled PCs earlier this year. The company recently introduced the Lenovo ThinkSmart Core Gen 2, one of the first AI-optimized devices specifically designed to power video conferencing room systems. Additionally, Lenovo announced that its Indian manufacturing facility has begun producing AI-powered servers. This news was further bolstered by the company’s plans to establish a new research and development lab in Bengaluru, its fourth globally. Looking ahead, Lenovo aims to integrate AI capabilities into all of its PCs by 2027. These advancements position the company to capitalize on the growing adoption of AI across industries as more businesses embrace AI-driven solutions in their operations.

- 1Q25 earnings. The company’s revenue rose by 19.7% YoY to US$15.4bn in 1Q25, compared to US$12.9bn in 1Q24. The company’s net profit rose by 38.3% YoY to US$253mn in 1Q25, compared to US$183mn in 1Q24. Basic earnings per share rose to US1.99 cents in 1Q25, compared to US1.48 cents in 1Q24.

- Market consensus.

(Source: Bloomberg)

PayPal Holdings Inc (PYPL US): Spending to rise

- BUY Entry – 78 Target – 86 Stop Loss – 74

- PayPal Holdings, Inc. operates as a holding company. The Company, through its subsidiaries, provides technology platform that enables digital and mobile payments on behalf of consumers and merchants. The Company offers online payment solutions. PayPal Holdings serves customers worldwide.

- Declining interest rates. Despite consumer sentiment declining to 68.9 in October from 70.1 in September, below forecasts of 70.8, inflationary pressures continue to affect consumers with persistently high prices. However, with 50bps rate cuts in September and another 50bps expected by year-end, the economic environment is starting to shift. The effects of these rate cuts have already begun to materialize, as seen in increased mergers and acquisitions among corporations, signalling more activity in the business sector. Inflationary pressures on consumption are expected to gradually ease, though consumers may still feel the pinch in the short term. During this period, more people may turn to PayPal’s “Buy Now, Pay Later” (BNPL) options, such as its “Pay in 4” checkout method, which allows users to make purchases in bi-weekly installments. This could incentivize higher spending as consumers look for ways to manage their cash flow while still making necessary purchases. For higher-value items, consumers may opt for monthly installment payments, where PayPal stands to benefit not only from increased transaction volumes and fees but also from the Annual Percentage Rate charged to consumers using the “Pay Monthly” option. With lowering interest rates and the upcoming holiday season, consumer spending is expected to rise, even among those who may not have the immediate funds to purchase items outright. The BNPL function will enable these consumers to buy now and pay later, boosting overall consumer spending and driving higher revenue for PayPal.

- Launch a platform in China. PayPal has launched its Complete Payments platform in China, aimed at streamlining payments and receivables for businesses of all sizes, supporting cross-border transactions. The platform offers Chinese businesses various payment options, quick fund settlements, and risk management and fraud detection tools. It connects merchants to PayPal’s global network, enabling transactions in over 100 currencies and 200 regions, reaching over 400 million active users. The platform is integrated with WooCommerce and aims to help small- to medium-sized businesses grow by offering customized checkout experiences and advanced solutions. This geographical expansion to China will help PayPal to expand its global footprint.

- Expansion of its cryptocurrency offerings. PayPal now allows US merchants to buy, hold, and sell cryptocurrency through their business accounts, expanding on its crypto services for consumers, which started in 2020. This follows the launch of its stablecoin, PayPal USD, in 2023. PayPal’s merchants had expressed interest in the same cryptocurrency features available to consumers. Businesses would be able to transfer digital currency to third-party wallets and conduct blockchain transactions, though the service would not initially be available in New York. By integrating cryptocurrencies into its US platform, PayPal gains a competitive edge in the market, offering a broader range of payment solutions compared to other platforms.

- 2Q24 earnings review. Revenue increased 8.2% YoY to US$7.9bn, exceeding expectations by US$80mn. Non-GAAP earnings per share were US$1.19, beating expectations by US$0.20. The company guided for 3Q24 revenue growth of mid-single digit and GAAP EPS of US$0.96 to US$0.98. For FY24, PayPal expects GAAP EPS of US$3.88 to US$3.98 and non-GAAP EPS growth of low to mid-teens.

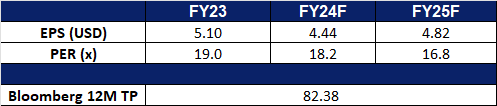

- Market consensus.

(Source: Bloomberg)

Deckers Outdoor Corp (DECK US): Upcoming shopping spree

Deckers Outdoor Corp (DECK US): Upcoming shopping spree

- RE-ITERATE BUY Entry – 156 Target – 176 Stop Loss – 146

- Deckers Outdoor Corporation designs and markets footwear and accessories. The Company offers footwear for men, women and children. Deckers sells its products including, accessories such as handbags, headwear, and outerwear. Deckers Outdoor serves customers in the United States.

- HOKA’s Growth Momentum. With the rise of professional outdoor sports in China, HOKA’s road running, trail running, and hiking shoes have gained significant traction in the market. The brand’s rapid expansion in China is driven by double-digit growth in the country’s trail running shoe segment. Deckers is capitalizing on this demand by increasing its store count and planning to open a flagship store in China. Over the past four years, HOKA has maintained an impressive annual revenue growth rate exceeding 50%, reaching US$1.41bn in FY24, with projections to hit US$2bn in FY25.

- UGG’s Resurgence. UGG snow boots have experienced a revival in the past two years, driven by the Y2K fashion trend, which draws inspiration from the late 1990s and early 2000s. This trend has contributed to a rapid rise in UGG’s sales, as the boots have become a popular choice once again among fashion-conscious consumers.

- Optimism for 4Q24. Deckers is well-positioned to benefit from the year-end shopping season in both China and Western markets. Key events such as China’s Double 11 Shopping Festival and Black Friday in Europe and the US provide strong opportunities for retail brands to boost their sales and meet annual targets. Historically, consumer discretionary stocks, especially those in the retail sector, perform well in November and December, and Deckers is likely to see a positive impact from better-than-expected holiday sales performance and strong Christmas season guidance in Western markets.

- 1Q25 earnings review. Revenue increased 22.1% YoY, exceeding expectations by US$18.82mn. GAAP earnings per share were US$4.52, beating expectations by US$1.01. The company guided for FY25 net sales to grow approximately 10% to US$4.7bn, with an earnings per share range of US$29.75 to US$30.65, higher than the previous range of US$29.5 to US$30.0.

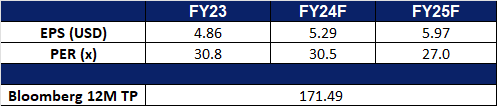

- Market consensus.

(Source: Bloomberg)

(Source: Bloomberg)

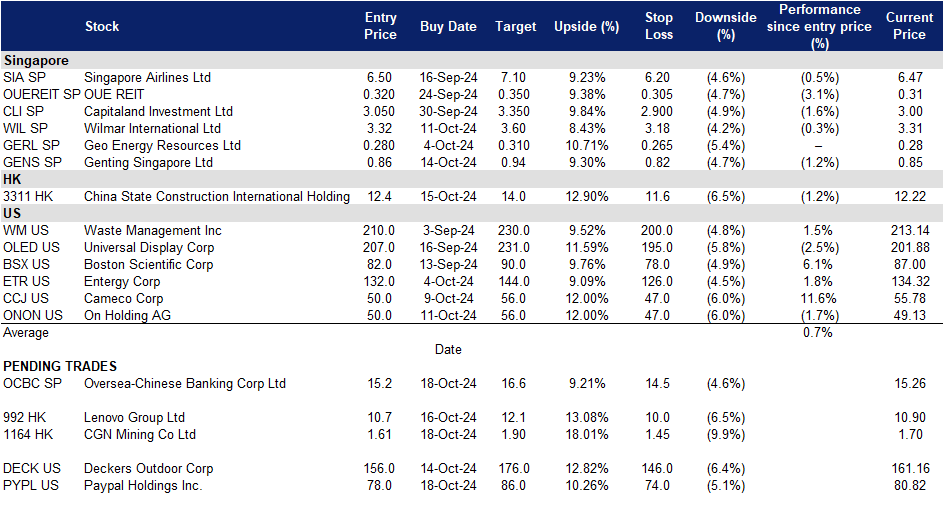

Trading Dashboard Update: Take profit on Sheng Siong Group (SSG SP) at S$1.59 and Winking Studios Ltd (WKS SP) at S$0.300. Close position on First Resources (FR SP) at S$1.46.