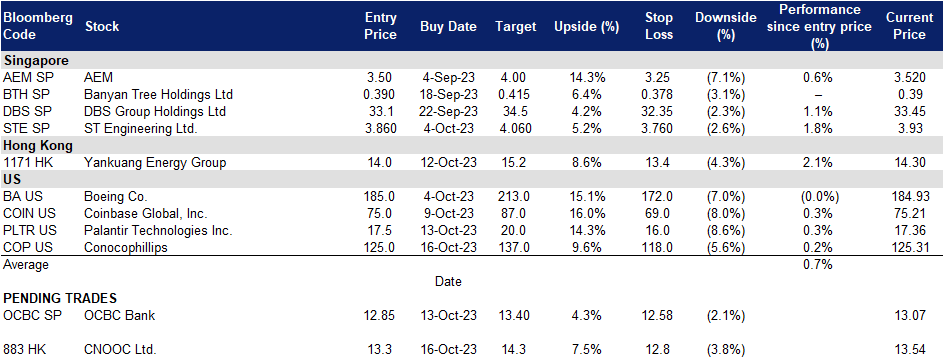

18 October 2023: DBS Group Holdings Ltd (DBS SP), CNOOC Ltd. (883 HK), Conocophillips (COP US)

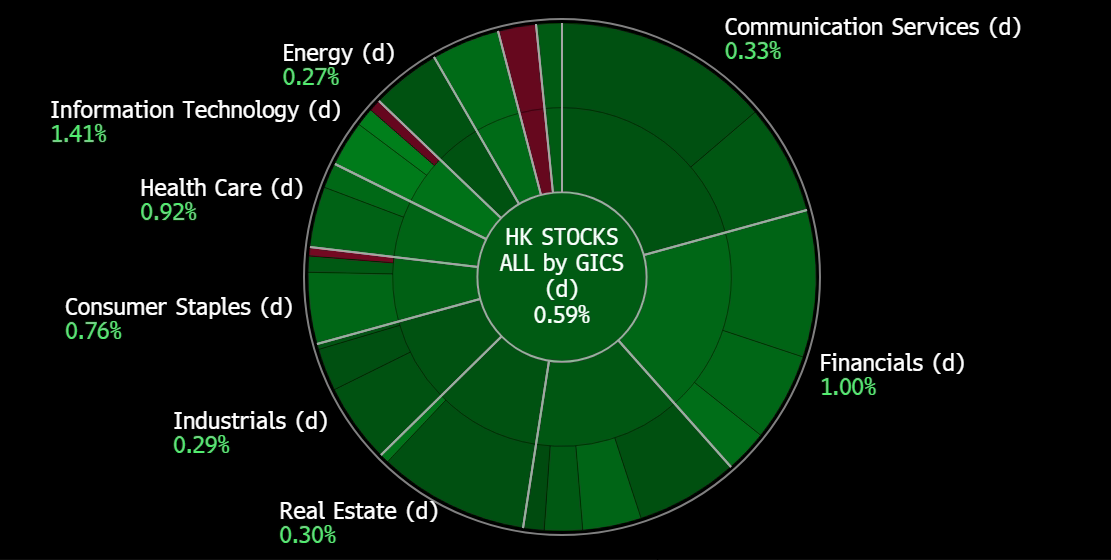

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

DBS Group Holdings Ltd (DBS SP): SGD strengthens again

- RE-ITERATE BUY Entry 33.10 – Target – 34.50 Stop Loss –32.35

- DBS Group Holdings Limited and its subsidiaries provide a variety of financial services. The Company offers services including mortgage financing, lease and hire purchase financing, nominee and trustee, funds management, corporate advisory and brokerage . DBS Group also acts as the primary dealer in Singapore government securities.

- New feature coming soon. OCBC, DBS, and UOB are introducing a new security feature to lock up customers savings in response to scams in Singapore. DBS recently announced the upcoming roll-out of a new banking account, “digiVault” that will adopt a “digitally in, only physically out” approach. DBS will launch its digiVault feature on their Digital app by the end of November, and will be made available after customers verify their identity physically. Customers will be able to make fund transfers digitally into this new account, but not out of the account.This feature aims to empower customers to secure their funds, reducing the risk of falling victim to scams while maintaining the convenience of digital banking.

- Jumping into the metaverse. DBS Bank is developing a metaverse game called DBS BetterWorld to raise awareness of sustainability issues, particularly global food waste. The game will be available later this year on The Sandbox platform and will allow players to interact with characters, take part in activities, and earn in-game rewards. DBS is partnering with sustainable companies to create the game and is using the metaverse to engage with its younger customers and promote its brand values.

- Largest foreign bank in Taiwan. DBS Bank recently acquired Citigroup’s consumer banking business in Taiwan, becoming the largest foreign bank by assets in the market. The deal effectively doubled DBS’ consumer banking customers in Taiwan and its credit card accounts climbed nearly fivefold. DBS paid a lower premium for the purchase than originally expected, and said the deal would accelerate its consumer business growth in Taiwan by at least 10 years. The acquisition is part of DBS’ strategy to build meaningful scale in its core Asian markets.

Share price and USD/SGD correlation

(Source: Bloomberg)

(Source: Bloomberg)

- 2Q23 results review. Profit rose 48% YoY to S$2.69bn from S$1.82bn in 2Q22, beating forecast. This jump in profit was due to higher interest rates and strong inflow of wealth into Singapore.

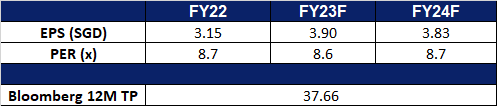

- Market consensus.

(Source: Bloomberg)

Oversea-Chinese Banking Corp Ltd (OCBC SP): Keeping wealth under lock and key

Oversea-Chinese Banking Corp Ltd (OCBC SP): Keeping wealth under lock and key

- RE-ITERATE BUY Entry 12.85 – Target – 13.40 Stop Loss – 12.58

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other financial and related services.

- New feature coming soon. OCBC, DBS, and UOB are introducing a new security feature to lock up customers savings in response to scams in Singapore. OCBC will launch this “money lock” feature on their Digital app by the end of November. It allows customers to ringfence a portion of their account balances to prevent digital transfers. To unlock the funds, a cross-channel authorisation process is required, typically through OCBC ATMs. This feature aims to empower customers to secure their funds, reducing the risk of falling victim to scams while maintaining the convenience of digital banking.

- Benefit from high rates being maintained. With interest rates expected to stay higher for longer, local banks such as OCBC will benefit from it as they will be able to earn higher interest margins. These interest margins are driven even higher by the continuous increase in capital through the inflow of foreign investments. This expectation of a high interest rate environment to stay is also supported by the recent increase in the Singapore government bond yield. Hence, we believe that OCBC will stand to benefit from the high-interest rates over the longer duration.

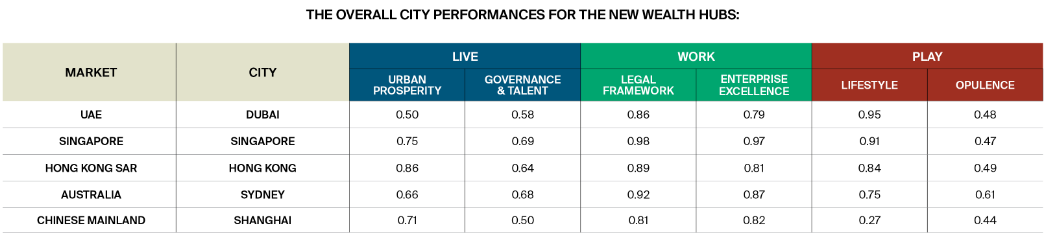

- Growing wealth. As Singapore continues to attract a growing number of wealthy individuals, the country’s banks are expected to receive a boost in assets and deposits. According to Knight Frank, Asia’s rapid ascent as a major contributor to global wealth generation is driven by a thriving middle class and innovative entrepreneurs. Singapore, at the epicenter of this wealth surge, has witnessed a flourishing real estate market and a remarkable 47% increase in inbound foreign direct investment (FDI) compared to 2019 levels. This robust growth narrative sees Asia outpacing the rest of the world, projected to be responsible for nearly 70% of global expansion this year, as stated by the International Monetary Fund. HSBC’s forecast that Asia’s wealth, excluding Japan, could surpass that of the United States by 2025 further underscores this region’s impressive trajectory, supported by per capita income growth.

Knight Frank overall city performances for new wealth hubs:

(Source: Knight Frank – Rise of The Super Wealth Hub Series)

- Continued expansion in China. OCBC Private Bank plans to expand its workforce in China despite the country’s economic slowdown. The bank’s CEO, Jason Moo, remains optimistic about the wealth potential in China, and the bank is actively hiring relationship managers in its core hubs of Singapore, Hong Kong, and Dubai. The goal is to grow the relationship-manager headcount to 500 by the end of 2025. OCBC is also targeting a 20% increase in assets under management, aiming for around $145 billion. While the economic slowdown in China is acknowledged, OCBC sees it as a cyclical phase rather than a structural issue. The bank believes there is still significant potential to attract clients with ample wealth from rivals. Additionally, mega-cities like Beijing and Shanghai are expected to experience substantial growth in the number of millionaires in the coming years, making China an attractive market for private banking. By expanding its presence and hiring more relationship managers in China, OCBC’s wealth segment can tap into China’s vast wealth potential, gain a competitive edge, and position itself for long-term growth in the Chinese wealth management market.

- Enabled QR payments in China. OCBC recently announced that it teamed up with Ant Group, the operator of Alipay, to allow its Singapore customers to make QR code payments in China using the OCBC Digital app. This partnership aims to simplify payments for tourists in China, where QR code payments through Alipay or WeChat Pay are widely accepted, while foreign credit cards often incur unfavorable exchange rates. OCBC’s integration of Ant’s Alipay+ cross-border payment solutions will facilitate payments directly from OCBC customers’ Singapore bank accounts to various China merchants in the Alipay+ ecosystem. This move aligns with OCBC’s broader strategy to enhance its presence in the Chinese market and offers competitive exchange rates for users, particularly with the Asian Games in Hangzhou on the horizon. Ant Group’s Alipay+ is extending support to multiple foreign payment services in China, filling a crucial gap in cross-border payments, giving it a competitive edge over the other local banks.

- Dividend yield. OCBC’s FY23F/24F dividend yield is 6.13%/6.29%.

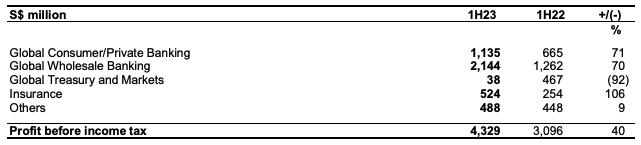

- 1H23 results review. PATMI jumped by 38.5% YoY to S$3.59bn. Net interest income surged by 47.6% YoY to S$4.73bn.

PBT by segment

(Source: Company)

(Source: Company)

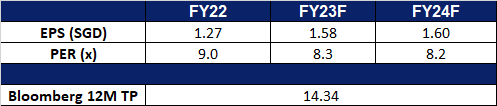

- Market consensus.

OCBC share price and USD/SGD comparison

(Source: Bloomberg)

(Source: Bloomberg)

CNOOC Ltd. (883 HK): Oil market embracing tailwinds

- RE-ITERATE BUY Entry – 13.30 Target – 14.30 Stop Loss – 12.80

- CNOOC Ltd is a China-based investment holding company principally engaged in the exploration, production and sales of crude oil and natural gas. The Company operates three segments. Exploration and Production segment is engaged in conventional oil and gas business, shale oil and gas business, oil sands business and other unconventional oil and gas businesses. Trading segment is engaged in entrepot trade of crude oil in overseas areas. Corporate segment is engaged in headquarter management, assets management, research & development, and other businesses. The Company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, and Brazil, among others.

- Continuous expectation of high oil demand. In its 2023 World Oil Outlook, OPEC has recently revised its medium-term and long-term projections for global oil demand, anticipating an increase to 116 million barrels per day (bpd) by 2045. This marks a significant upswing from the 99.6 million bpd recorded in 2022 and exceeds their previous estimate by approximately 6 million bpd. OPEC further underscores the potential for this growth to surpass their current expectations. The driving forces behind this surge are expected to be the expanding economies of India, China, other Asian nations, Africa, and the Middle East.

- Building up more oil supply. CNOOC recently brought onstream two oilfield developments offshore China. The company plans to commission 13 production wells and eight water injectors, and to deliver peak production of about 7,600 bbl/d of crude next year from one of these products, the Bozhong 28-2 South Oilfield Second Adjustment Project. In the company’s second project, the Lufeng 12-3 Oilfield Development Project, the company expects the project to reach a peak output of about 29,500bbl/day in 2024. This helps CNOOC to future maintain a secure source of oil amidst supply challenges globally.

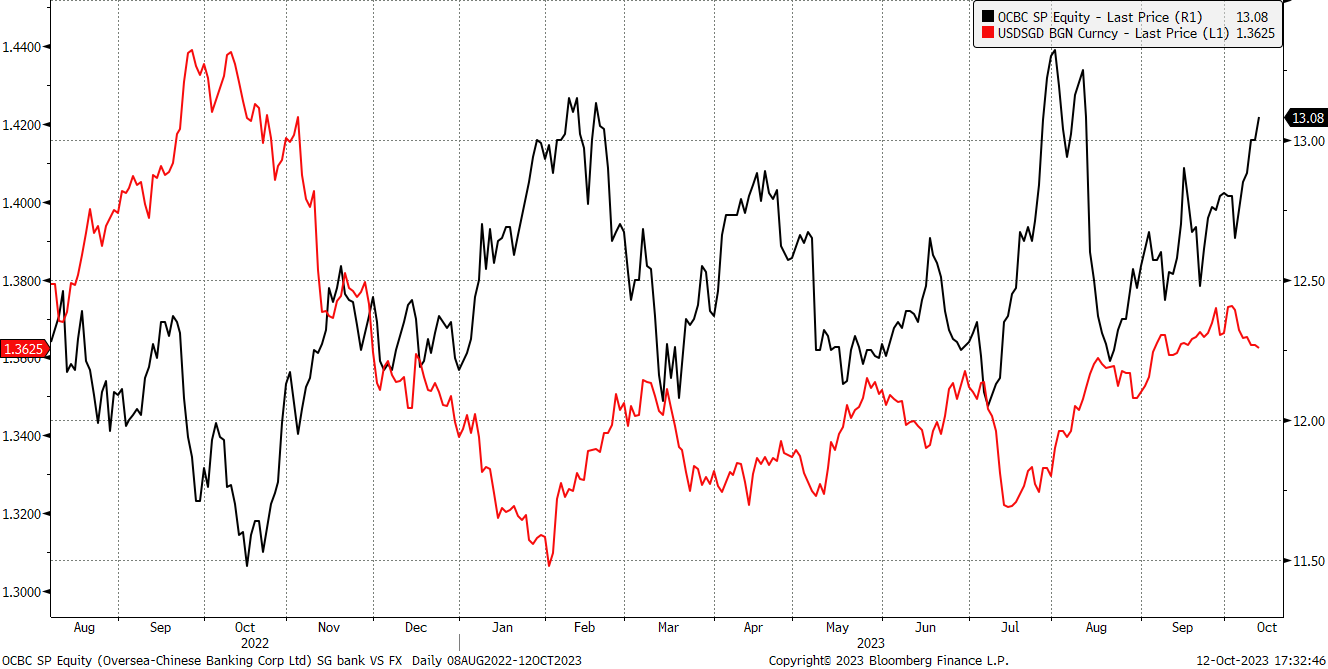

- Rising oil prices due amid the Israel-Hamas war. Escalating tensions between Israel and Hamas have triggered a surge in worldwide oil prices, raising concerns that the instability may extend throughout the Middle East, potentially endangering the global oil supply.

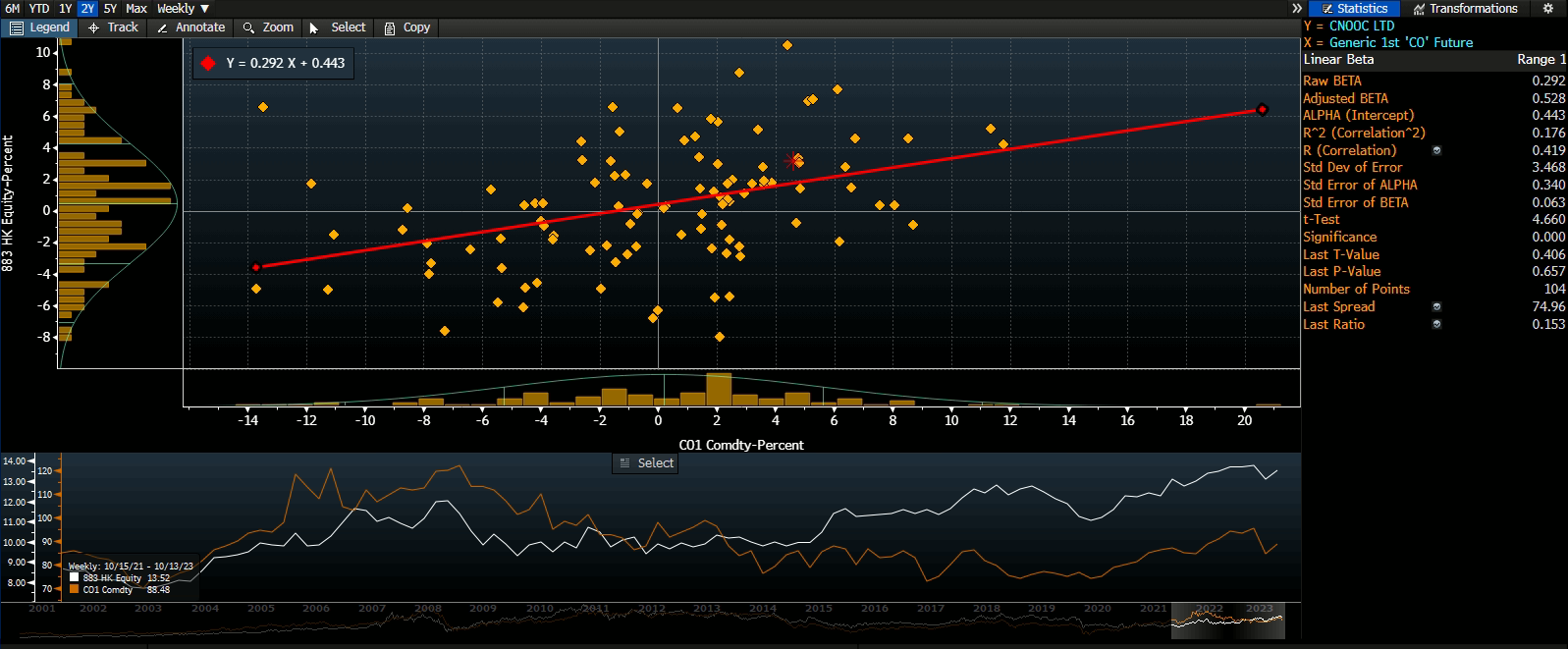

Brent Crude Oil Prices

(Source: Bloomberg)

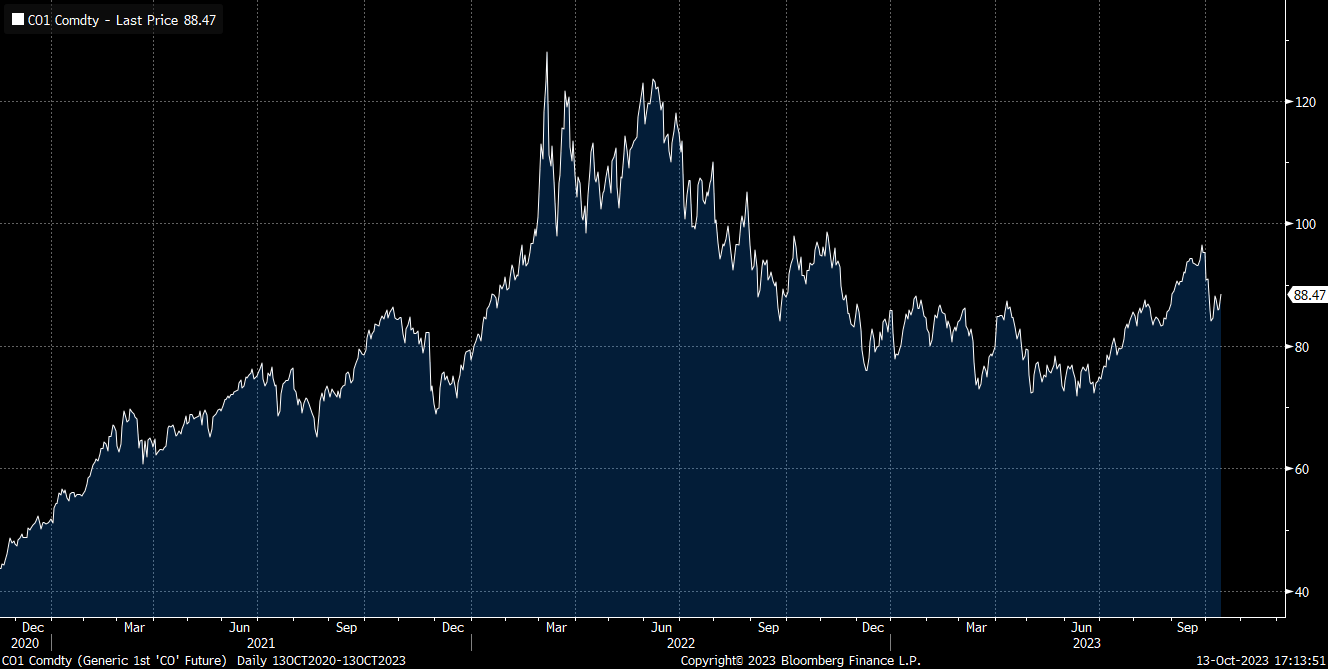

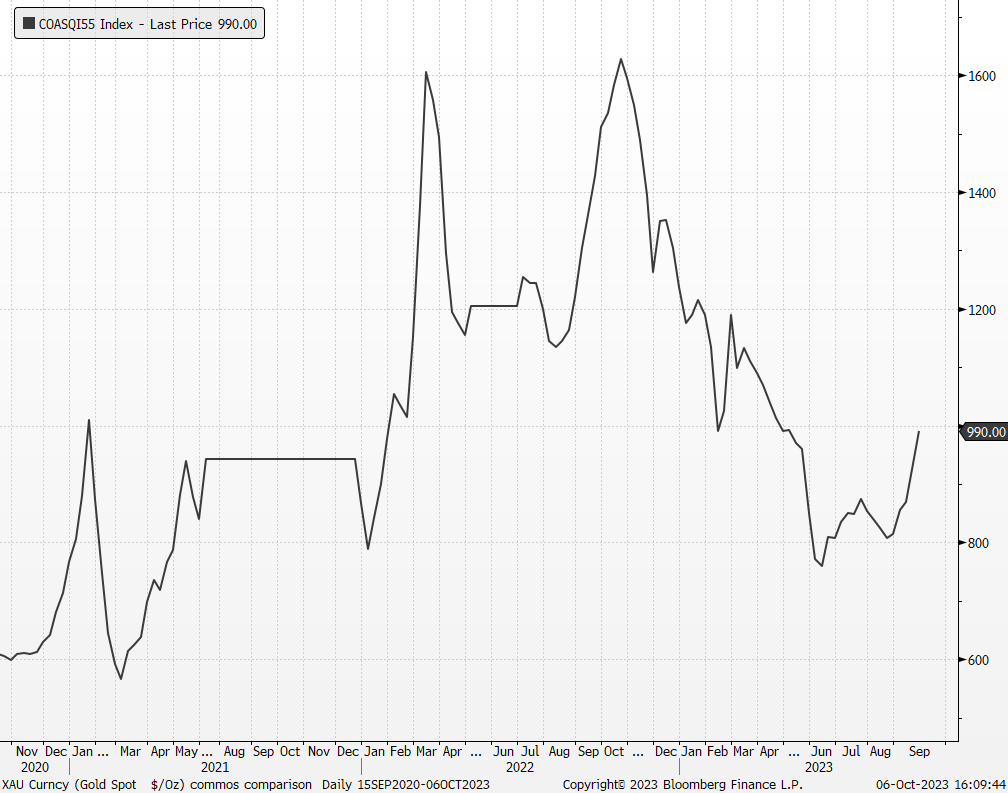

- 1H23 earnings. Revenue fell by 5.1% YoY to RMB192.1bn, from RMB202.4bn in 1H22. Net profit fell 11.3% YoY to RMB63.76bn, compared with RMB71.89bn in 1H22. Diluted and Basic EPS is at RMB1.34, down 14.6% YoY, compared to RMB 1.57 in 1H22.

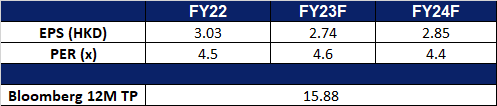

- Market Consensus.

Share price and Brent crude oil price correlation

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

Yankuang Energy Group Co. Ltd. (1171 HK): Winter is coming

- RE-ITERATE BUY Entry – 14.0 Target – 15.2 Stop Loss – 13.4

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets.

- China’s high demand for coal continues to drive coal output. As the continued drought in China severely reduced hydroelectric power in the southern provinces, the country has increased its reliance on coal-fired power generation. The upcoming winter season is likely to drive the demand for electricity up, and as a result, driving up the demand for coal as well. China’s coal output in August also increased by 2% YoY to 380mn tonnes in August compared to 2022. The growth in production was 1.9pp higher than that in July, signalling a modest rebound after safety measures had restricted mining operations the previous month.

- Coal prices rebounding. Coal prices on the global market have risen to their highest level in 5 months, driven by a surge in activity at Chinese coal-fired power plants, as Chinese power plants burn more coal to make up for the shortage of hydroelectricity caused by the drought. The Russio-Ukrainian war entering the 2nd year of cold snap has also contributed to bringing coal prices up to high since May 2023. Coal mining companies such as Yankuang Energy Group is likely to benefit from this surge in coal prices.

China Qinhuangdao thermal port coal 5,500 GAR spot price

(Source: Bloomberg)

- Yancoal’s improving operational efficiency. Yancoal Australia, a subsidiary of Yankuang Energy Group, recently announced that they have entered into a partnership with TPG Telecom to deploy a private mobile network at its Hunter Valley mines. This is set to bolster Yancoal’s ability to track and communicate with vehicles, equipment, and personnel across the site, increasing the efficiency of the mines, and hence increasing production levels.

- 1H23 results. Revenue fell to RMB84.4bn, down 15.8% YoY, compared to RMB100.3bn in 1H22. Net profit attributable to shareholders fell to RMB10.2bn in 1H23, down 43.4% YoY, compared to RMB18.0bn in 1H22. Basic EPS was RMB2.09 in 1H23, compared to RMB3.70 in 1H22.

- Market Consensus.

\

\

(Source: Bloomberg)

Conocophillips (COP US): Oil price support

- RE-ITERATE BUY Entry – 125 Target – 137 Stop Loss – 118

- ConocoPhillips explores for, produces, transports, and markets crude oil, natural gas, natural gas liquids, liquefied natural gas, and bitumen on a worldwide basis.

- War time again. Oil prices surged nearly 6% in response to Israel’s commencement of ground operations in the Gaza Strip, marking the highest weekly gain for Brent since February. The conflict’s potential to expand and its impact on oil supplies in the Middle East has stirred investor concerns. While Israel is not a significant oil producer, the situation could affect neighbouring countries in the oil-rich region. Iran’s Oil Minister predicted oil prices could reach $100 per barrel due to the crisis. Furthermore, Saudi Arabia paused plans to normalise relations with Israel and the US imposed sanctions on tankers carrying Russian oil, potentially affecting global supply. These led to higher expectations of stricter US enforcement of sanctions on Russia and Iran, leading to reduced oil supplies. OPEC maintained its forecast for global oil demand growth and US oil drillers increased rigs. Oil prices are anticipated to remain relatively supported by the escalation of global tensions, production uncertainty and supply disruption concerns.

Brent price

(Source: Bloomberg)

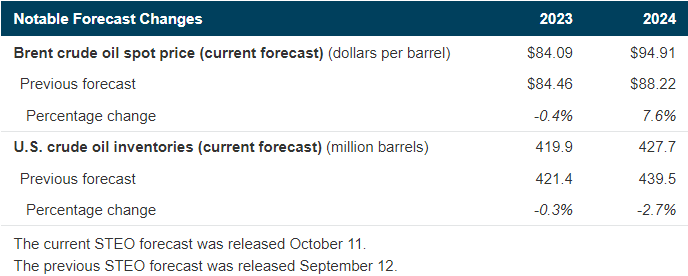

- Oil supply and demand dynamics. The US Energy Information Administration (EIA) anticipates rising oil and gasoline prices in 2024 due to OPEC+ production cuts, with revised projections of Brent crude reaching $94.91 per barrel and WTI crude at $90.91 per barrel, as increased oil demand is expected to outpace production, creating upward price pressure; furthermore, the EIA foresees an uptick in biofuels and jet fuel demand, driven by growing consumption of renewable diesel and biofuels, alongside a 6% increase in jet fuel demand in 2024, matching pre-pandemic levels due to higher travel demand and more efficient aircraft, yet these predictions may be subject to change due to geopolitical uncertainties and economic fluctuations. ConocoPhillips stands to benefit from the rise in oil prices as the demand for oil outpaces the supply.

Brent and WTI price forecasts by US EIA

(Source: EIA – Short-term energy outlook)

- Hitting first gas early. ConocoPhillips has successfully initiated gas production at the Tommeliten A field, which is located on the UK-Norway border in the North Sea. This £1 billion project, approved by the NPD, has managed to achieve its first gas production ahead of its original schedule, set for 1H24. Tommeliten A, linked to the Ekofisk complex, has a substantial resource potential of 120-180 million barrels of oil equivalent, with 70% being gas and 30% oil. The project has created approximately 5,000 jobs, mainly benefiting Norwegian businesses, with a total investment of NOK 13 billion (£976.6 million). At its peak, the project is expected to produce 35,000 to 48,000 barrels of oil equivalent per day. Notably, it is designed to have low greenhouse gas emissions, with just 7.5kg per barrel on a scope 1&2 gross operated basis. The project involves collaboration between multiple companies, with ConocoPhillips Skandinavia AS, PGNiG Upstream Norway AS, and TotalEnergies EP Norge AS as major stakeholders.

- 2Q23 results. Revenue fell 41% year-over-year to US$12.88bn, missing estimates of US$14.74bn. Non-GAAP EPS of $1.84 missed expectations by $0.12. Third-quarter 2023 production is expected to be 1.78 to 1.82 million barrels of oil equivalent per day (MMBOED). Full-year production is now expected to be 1.80 to 1.81 MMBOED, as compared to prior guidance of 1.78 to 1.80 MMBOED.

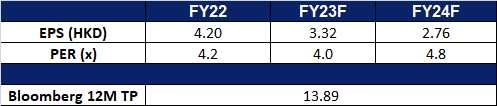

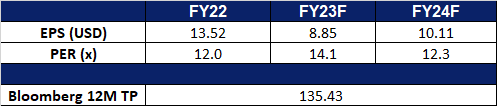

- Market consensus.

(Source: Bloomberg)

Palantir Technologies Inc (PLTR US): Tension escalation

- RE-ITERATE BUY Entry – 17.5 Target – 20 Stop Loss – 16

- Palantir Technologies Inc develops software to analyse information. The Company offers solutions support many kinds of data including structured, unstructured, relational, temporal, and geospatial. Palantir Technologies serves customers worldwide.

- War time again. The Israel-Palestine war began after Hamas assaulted Israel unexpectedly on 7 October, and Israel conducted military retaliation thereafter. As Israel’s ally, the US government announced that it supported Israel. Arms and ammunition were sent to Israel immediately. The defense sector benefited from the war sentiment again since the Russian invasion early 2022.

- The US Department of Defence is the main client. Recently, the company was awarded a contract by the US Army to provide artificial intelligence and machine learning capabilities in support of combatant commands, armed services, intelligence community, and special forces. The contract size is up to US$250mn.

- Ontrack to win a £480mn contract. Previously, Bloomberg reported that the company was on track to win a 5-year contract to overhaul the UK’s National Health Service. The contract size was estimated to be £480mn.

- 2Q23 results. Revenue rose 12.8% year-over-year to US$533.32mn, in line with estimate. Non-GAAP EPS of $0.05 in line with expectations. The number of U.S. commercial customers count increased 35% YoY, from 119 customers in 2Q22 to 161 customers in 2Q23.

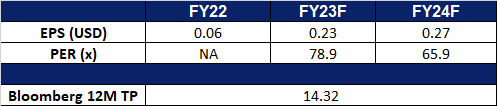

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Fuyao Glass Industry (3606 HK) at HK$37. Add ConocoPhillips (COP US) at US$125. Stop loss on Singapore Airlines Ltd (SIA SP) at S$6.3, Sinopharm Group Co. Ltd. (1099 HK) at HK$20.9, Ganfeng Lithium Group Co Ltd (1772 HK) at HK$31.5 and Samsonite International S.A. (1910 HK) at HK$24.9.