17 July 2024: Wilmar International Ltd (WIL SP), Tencent Holdings Ltd. (700 HK), Home Depot Inc (HD US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Wilmar International Ltd (WIL SP): Potential upside of palm oil prices

- RE-ITERATE BUY Entry – 3.14 Target– 3.38 Stop Loss – 3.07

- Wilmar International Limited operates as a food processing company. The Company offers oil palm cultivation, edible oil refining, crushing, and gains processing services, as well as provides sugar, flour, and rice. Wilmar International serves customers worldwide.

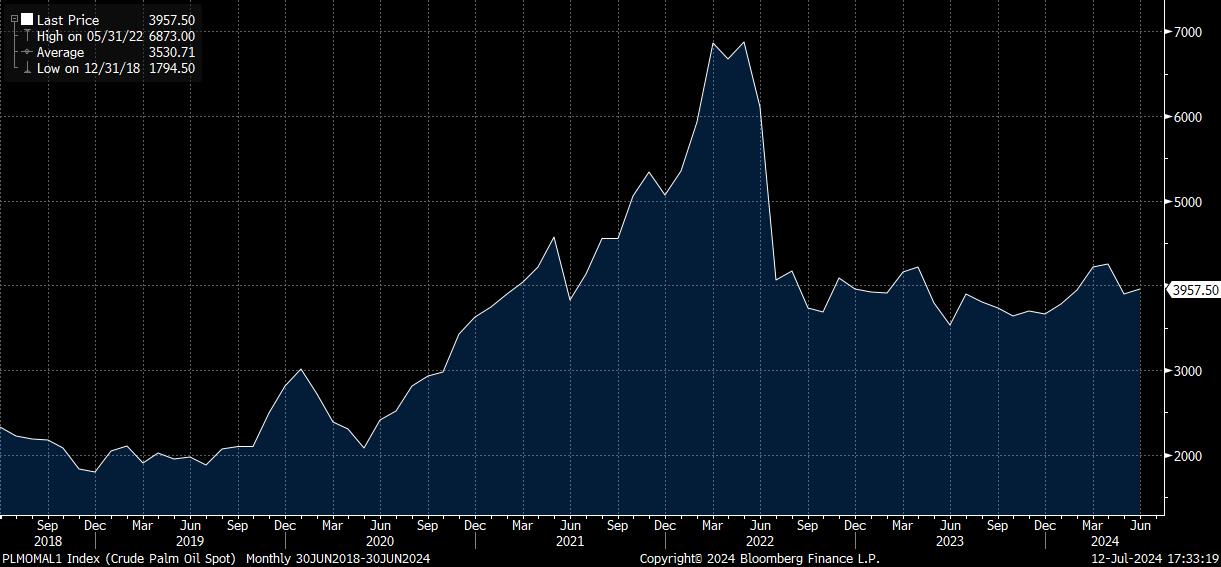

- Palm oil prices to remain elevated. Crude palm oil prices are anticipated to stay strong due to tighter production and high demand from India and China, according to the Malaysian Palm Oil Council (MPOC). Malaysia’s benchmark prices are expected to range between 3,800 ringgit to 4,200 ringgit per metric ton in 2H24. MPOC chief executive noted that Malaysia’s palm oil production growth will likely slow due to a high base effect from 2023’s peak output since 2018. Combined production from Indonesia and Malaysia shows a supply deficit of 200,000t. Despite Malaysia’s production increase of 440,000t from January to April 2024, Indonesia’s production decreased by 640,000t. Stable demand from India and China, along with slowing production, will maintain robust palm oil prices. Global supplies could further tighten if Indonesia raises its biodiesel blending rate to 40% next year. Malaysia’s palm oil production is forecast to rise by 2.4% to 19mt in 2024, with exports expected to increase by 3.1% to 15.6mt. The country’s palm oil inventory is projected to be around two million tons by December. This deficit in palm oil production alongside strong demand will continue to support the robust palm oil prices, benefiting Wilmar’s palm oil business.

Crude Palm Oil Price

(Source: Bloomberg)

- Increased stakes. Wilmar International increased its stake in Pakistan-listed Unity Foods to 42.17%, as announced on 28 June. This was achieved through its subsidiary Wilmar Pakistan Holdings and Unity Wilmar Agro, with the latter being 52% owned by Wilmar Pakistan Holdings. They acquired a total of 158.5mn shares for approximately US$15.4mn, raising their respective stakes to 34.84% and 14.08%. Unity Foods primarily produces edible oils, industrial fats, flour, and feed ingredients for Pakistan’s poultry and livestock sectors. Through its increased stakes in Unity Foods, Wilmar will be able to benefit from the price increase potential on the agricultural produce.

- 1Q24 results review. Revenue fell by 7.3% YoY to US$15.7bn in 1Q24, compared to US$16.9bn in 1Q23. Net profit fell by 22.6% to US$302.9mn in 1Q23, compared to US$391.4mn in 1Q23.

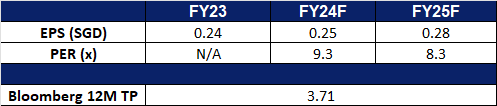

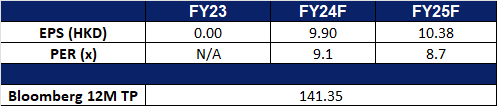

- Market Consensus.

(Source: Bloomberg)

SATS Ltd (SATS SP): Service improvement amidst air travel recovery

- RE-ITERATE BUY Entry – 3.08 Target– 3.40 Stop Loss – 2.94

- SATS Ltd. provides gateway services and food solutions. The Company specializes in airfreight, ramp and baggage handling; passenger services; aviation security services; aircraft cleaning; and cruise centre management. It also provides airline catering; institutional catering; aviation laundry; and food distribution and logistics. SATS has presence across Asia and the Middle East.

- Air passenger traffic not slowing. According to the International Air Transport Association, in 2024, the airline industry has recovered from the COVID-19 crisis, with total traffic surpassing 2019 levels in February. Domestic travel returned to pre-COVID levels in spring 2023, while international routes have also recently recovered. Most regions are expected to exceed 2019 levels in 2024, with Asia Pacific leading growth at 17.2% YoY. Over the next 20 years, global passenger journeys are expected to increase by an average of 3.8% annually, resulting in over 4 billion additional journeys by 2043 compared to 2023. This yearly rise in global travel will contribute to SATS revenue growth in the coming years.

- Business restructuring. SATS recently announced the division of its airport ground handling services into separate units for Singapore and the Asia-Pacific region to stimulate company growth. The restructuring of its Gateway Services business resulted in the creation of two new units: the Singapore Hub and Gateway Services Asia-Pacific. The Singapore Hub will focus on enhancing aviation hub competitiveness in Singapore, while Gateway Services Asia-Pacific will aim to expand the group’s market share by managing operations in overseas airports.

- Lounge improvements. SATS unveiled its upgraded Premier Lounge at Changi Airport Terminal 3 recently, featuring Singaporean dishes like laksa, chicken rice, and prawn noodles, along with interior designs by local artists and students. The lounge includes a new Executive space with private pods, dining service, and travel-friendly amenities. SATS plans to extend similar refurbishments to its other lounges in Terminals 1 and 2 over the next few years. The lounge also offers pasta made by robot chefs, products from SATS Gourmet Solutions, and collaborations with six renowned local food and beverage brands. SATS CEO highlighted the aim to enrich travellers’ experiences with a blend of food, culture, and hospitality. Refurbishments to the lounges in different terminals will offer more comfort and incentive for travellers at Singapore Changi Airport to visit the lounges.

- FY24 results review. Total revenue rose by 192.9% YoY to S$5.15bn in FY24, compared to S$1.76bn in FY23. Core PATMI rose by 331.3% to S$78.5mn in FY24, compared to S$18.2mn in FY23. Basic EPS was 3.8 Scents in FY24, compared to -2.2 Scents in FY23.

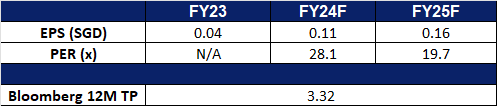

- Market Consensus.

(Source: Bloomberg)

Tencent Holdings Ltd. (700 HK): Catching up in AI filed amidst robust gaming recovery

- RE-ITERATE BUY Entry – 395 Target 435 Stop Loss – 375

- Tencent Holdings Ltd is an investment holding company primarily engaged in the provision of value-added services (VAS), online advertising services, as well as FinTech and business services. The Company primarily operates through four segments. The VAS segment is mainly engaged in the provision of online games, video account live broadcast services, paid video membership services and other social network services. The Online Advertising segment is mainly engaged in media advertising, social and other advertising businesses. The FinTech and Business Services segment mainly provides commercial payment, FinTech and cloud services. The Others segment is principally engaged in the investment, production and distribution of films and television program for third parties, copyrights licensing, merchandise sales and various other activities.

- Boosting AI training efficiency. The company recently focused on accelerating network communications to access idle GPU capacity. It upgraded its high-performance computing (HPC) network, enhancing its artificial intelligence (AI) capabilities as Chinese tech giants seek to improve large language model (LLM) training with existing systems amid a domestic push for technological self-reliance. The 2.0 version of Tencent’s Intelligent High-Performance Network, known as Xingmai in Chinese, will improve network communication efficiency by 60% and LLM training efficiency by 20%. This performance boost comes as China seeks to advance its AI ambitions despite restricted access to advanced Nvidia chips due to strict US export rules.

- AI Partnership with Nokia. Tencent Cloud recently partnered with Nokia to help businesses in the Asia Pacific (APAC) region leverage the potential of artificial intelligence (AI). This collaboration aims to create a seamless integration between cloud services and network infrastructure, enabling APAC businesses—especially enterprises, network infrastructure service providers, and data centers—to upgrade and optimize their IT environments for AI readiness.

- Topping the charts. Tencent’s game, Dungeon & Fighter (DnF) Mobile, has maintained its position as China’s top-grossing game despite facing competition from Mihoyo’s new release. This success demonstrates its strong popularity in a highly competitive market. The game is estimated to have generated over $140mn in player spending during its first week in China, marking one of the most lucrative debuts in the world’s largest gaming market. Since its release on May 21, DnF Mobile has grossed $63mn on Apple’s App Store in China, topping both download and grossing charts with 2.6mn iPhone downloads. The market expects the game to generate over $2bn in revenue in 2024.

- 1Q24 earnings. The company revenue rose to RMB159.5bn, +6.0% YoY compared to 1Q23. The company’s profit for the period was RMB42.7bn, +62% YoY. Net margin also increased to 26.7% in 1Q24 compared to 17.6% in 1Q23. Basic earnings per share were RMB4.479, while diluted earnings per share were RMB4.386.

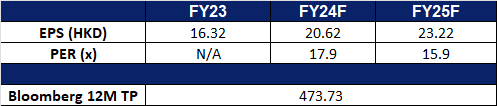

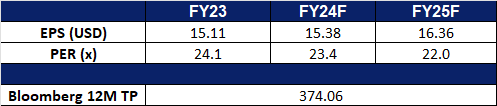

- Market consensus.

(Source: Bloomberg)

Baidu, Inc. (9888 HK): Robotaxi era coming

- RE-ITERATE BUY Entry – 95 Target 105 Stop Loss – 90

- Baidu Inc is a Chinese language Internet search provider. The Company offers a Chinese language search platform on its Baidu.com Website that enables users to find information online, including Webpages, news, images, documents and multimedia files, through links provided on its Website. The Company operates through two segments, Baidu Core segment and iQIYI segment. Baidu Core mainly provides search-based, feed-based, and other online marketing services, as well as products and services from the Company’s new artificial intelligence (AI) initiatives. Within Baidu Core, the Company’s product and services offerings are categorized as Mobile Ecosystem, Baidu AI Cloud and Intelligent Driving & Other Growth Initiatives. iQIYI is an online entertainment service provider that offers original, professionally produced and partner-generated content on its platform.

- Robotaxi era. Baidu’s autonomous ride-hailing platform, Apollo Go Robotaxi, has been gaining public attention as it expands its business in Wuhan, Central China’s Hubei Province. Both Beijing and Shanghai have recently announced their support for introducing robotaxis into ride-hailing and car rental fleets as advanced driver assistance systems become more prevalent in China. Additionally, with robotaxis being significantly cheaper than traditional taxis, they are likely to attract more consumers. Apollo Go Robotaxi also remains on track to achieve profitability with its advanced autonomous ride-hailing model.

- Improvement to Ernie AI Model. Baidu recently launched its latest iteration of its large language model, Ernie 4.0 Turbo, for its enterprise clients. The company also announced that they will cut the pricing of their earlier Ernie models by as much as 83%. These moves by the company are likely to further attract more clients to adopt the use of Baidu’s large language model, Ernie bot. Baidu also already noted that Ernie’s average daily usage went up 150% sequentially in 2Q24.

- Partnership with Tesla. Earlier this year, Baidu reached an agreement with Tesla to integrate its mapping and navigation technologies in China. This deal clears the final regulatory hurdle for Tesla’s Full Self-Driving (FSD) system to be offered in the Chinese market. Baidu also indicated that it sees potential in incorporating Tesla’s robotaxi technology into its product offerings for domestic consumers.

- 1Q24 earnings. Revenue rose by 1.2% YoY to RMB31.5bn in 1Q24, compared to RMB31.1bn in 1Q23. Net profit rose by 22.4% YoY to RMB7.01bn in 1Q24, compared to RMB5.73bn in 1Q23. Diluted EPADS rose 23.6% YoY to RMB0.1991in 1Q24, compared to RMB 0.161 in 1Q23.

- Market consensus.

(Source: Bloomberg)

Home Depot Inc (HD US): Rate cuts incoming

- RE-ITERATE BUY Entry – 356 Target – 390 Stop Loss – 339

- The Home Depot, Inc. is a home improvement retailer. The Company offers wide range of building materials, home improvement, lawn, and garden products, as well as provides DYI ideas, installation, repair, and other services. Home Depot serves customers worldwide.

- The US housing market is expected to recover. The market expects the Federal Reserve to start a rate-cutting cycle in the third quarter. The housing market has been under pressure for the past two years due to the high-interest-rate environment. In the ongoing US bull market, its positive wealth effect has benefited the US public. Therefore, when mortgage rates decline, it is expected that some funds will flow into the real estate industry. Correspondingly, the home improvement industry will also benefit from the future recovery of the real estate market.

- Sector rotation. Looking back at the first half of the US stock market, funds were concentrated on artificial intelligence themes, leading to high valuations for popular stocks and lacklustre performance for other value stocks. In a rate-cut cycle, traditional sector stocks are likely to see valuation repair and have significant upside potential.

- 1Q25 earnings review. Revenue fell by 2.4% YoY to US$36.4bn, missing estimates by US$25mn. GAAP EPS was US$3.63, beating estimates by US$0.04. FY24 sales are expected to increase 1% (including Week 53), while comparable sales for Week 52 are expected to decline 1%. The company plans to open 12 new stores.

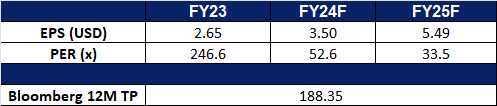

- Market consensus.

(Source: Bloomberg)

Advanced Micro Devices Inc (AMD US): Bolstering AI chip capabilities

- RE-ITERATE BUY STOP Entry – 190 Target – 210 Stop Loss – 180

- Advanced Micro Devices, Inc. (AMD) produces semiconductor products and devices. The Company offers products such as microprocessors, embedded microprocessors, chipsets, graphics, video and multimedia products and supplies it to third-party foundries, as well as provides assembling, testing, and packaging services. AMD serves customers worldwide.

- Acquisition to assist in AI race. AMD announced it will acquire Finnish AI startup Silo AI for approximately US$665mn in cash to enhance its AI chip capabilities and compete with Nvidia. The acquisition will bolster AMD’s ability to develop and deploy AI models using its chips and improve its software development capabilities. Although the deal will not immediately impact AMD’s financial performance, it is expected to unlock significant future business opportunities. Silo AI, known for its end-to-end AI solutions with clients like Philips, Rolls-Royce, and Unilever, will continue under the leadership of its CEO, Peter Sarlin, within AMD’s Artificial Intelligence Group. The acquisition is set to close in the second half of 2024 and follows AMD’s other investments in AI, including the acquisitions of Mipsology and Nod.ai, which will help to further advance the development of AMD’s next generation of AI and semiconductors.

- New launch. AMD’s upcoming Ryzen 9000 chips, set to release in July, have shown promising early benchmarks. The Ryzen 7 7900X and Ryzen 5 9600X both demonstrated higher performance than top previous-generation AMD and Intel chips in single-core tests. The results are rumoured to have come from pre-release testing and should be viewed cautiously as final hardware configurations may change. The Ryzen 7 9700X, with 8 cores and 16 threads, achieved 3370 in single-core and 16329 in multi-core tests, while the Ryzen 5 9600X, with 6 cores and 12 threads, scored 3284 and 14594 respectively. These chips outperform their predecessors despite lower clock speeds, likely due to AMD’s new Zen 5 architecture. This new release is highly anticipated as it will bring about new developments in the PC world.

- 1Q24 earnings review. Revenue rose by 2.2% YoY to US$5.47bn, exceeding estimates by US$20mn. Non-GAAP EPS was US$0.63, beating estimates by US$0.01. 2Q24 sales revenue is expected to be approximately US$5.7bn, plus or minus US$300mn vs. US$5.69bn consensus. Non-GAAP gross margin is expected to be approximately 53%.

- Market consensus.

(Source: Bloomberg)

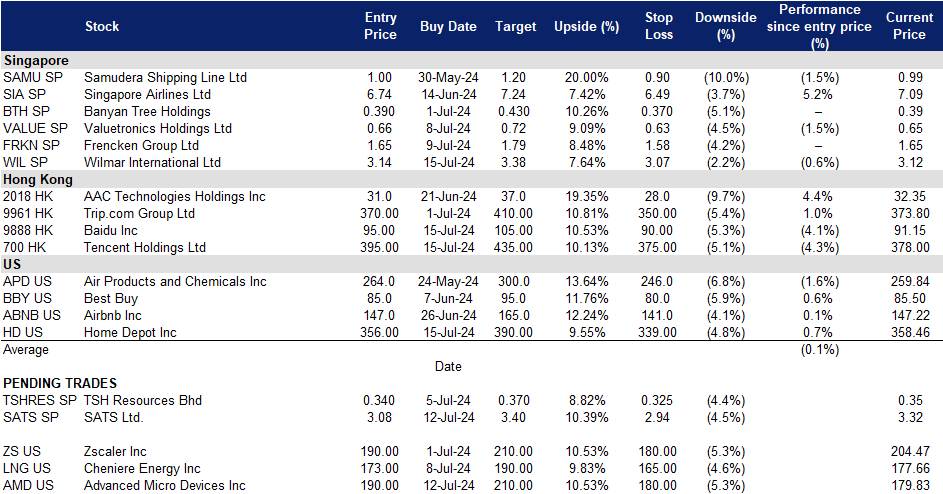

Trading Dashboard Update: Add Wilmar International Ltd (WIL SP) at S$3.14, Baidu Inc (9888 HK) at HK$95, Tencent Holdings Ltd (700 HK) at HK$395 and Home Depot Inc (HD US) at US$356. Cut loss on Uni-President China Holdings Ltd (220 HK) at HK$6.75 and Broadcom Inc (AVGO US) at US$1,600.