12 August 2024: Yangzijiang Shipbuilding Holdings Ltd (YZJSGD SP), Goldwind Science & Technology Co Ltd. (2208 HK), Palantir Technologies Inc (PLTR US)

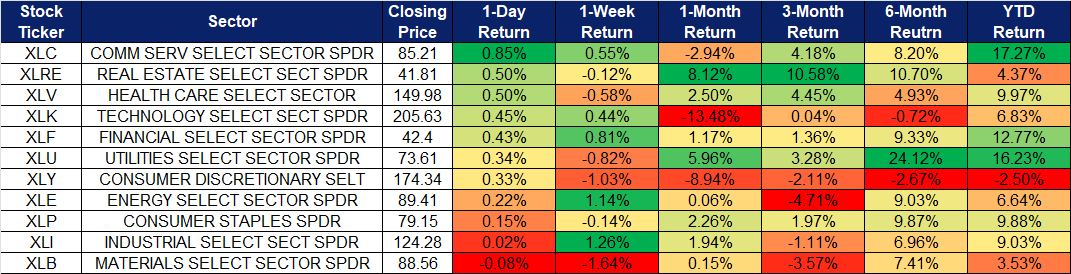

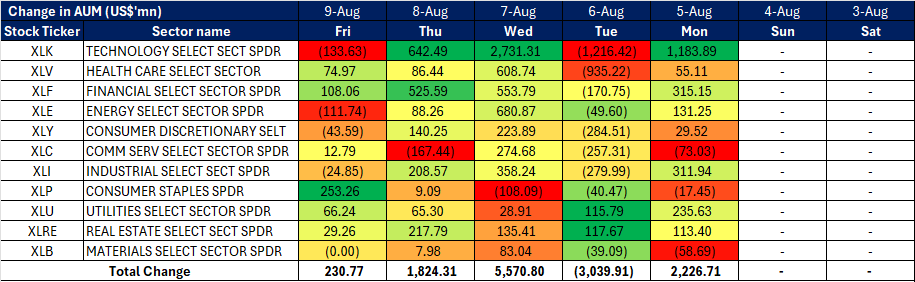

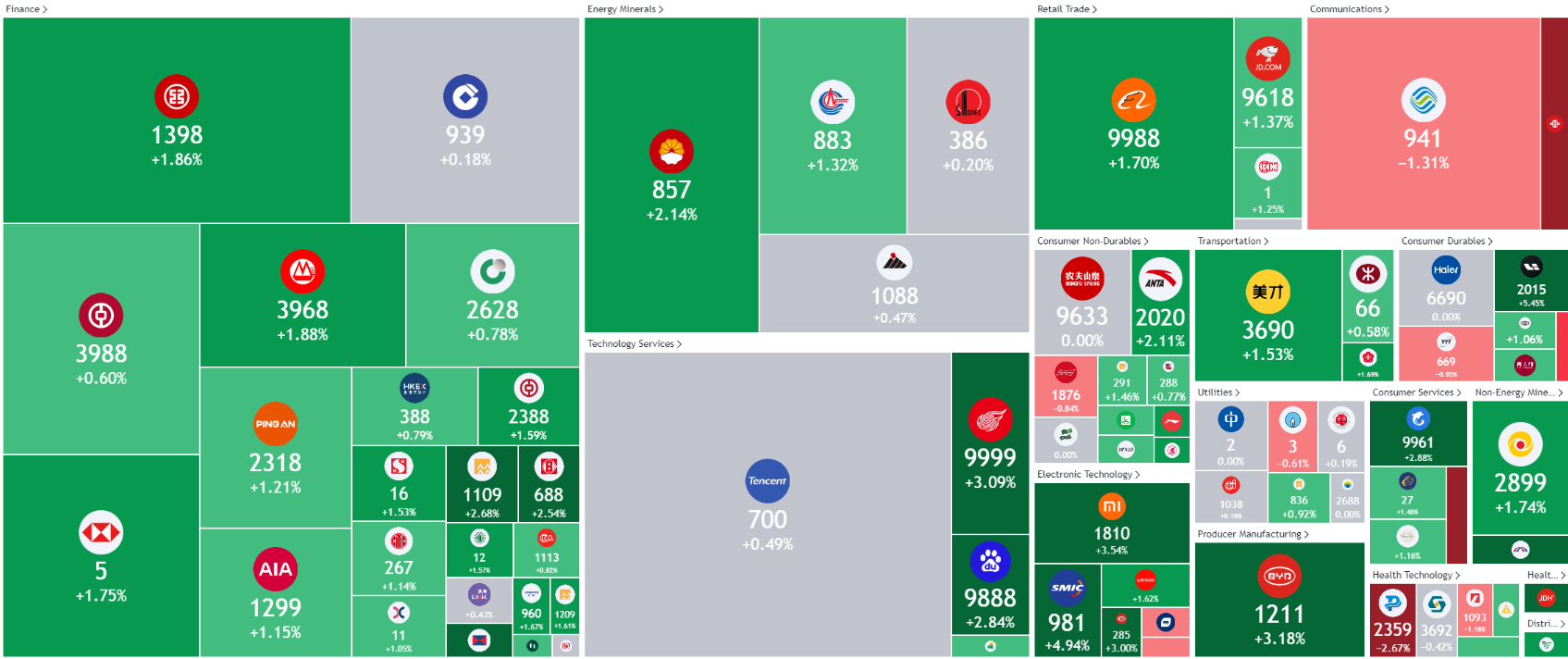

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

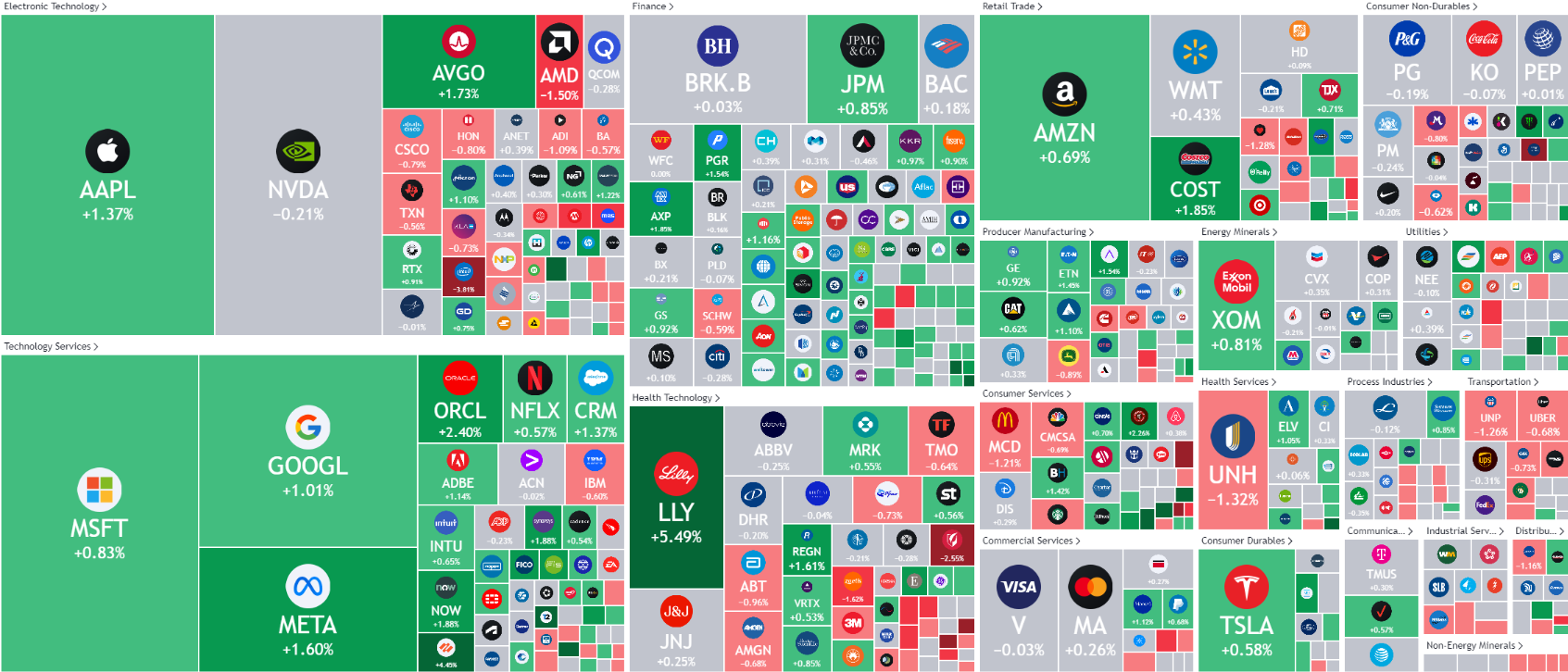

United States

Hong Kong

Yangzijiang Shipbuilding Holdings Ltd (YZJSGD SP): More growth in the Shipbuilding industrial

- BUY Entry – 2.30 Target– 2.52 Stop Loss – 2.19

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, containerships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

- Record order backlog. China’s largest private-sector shipbuilder, Yangzijiang Shipbuilding, has achieved a new record with its order backlog exceeding US$16bn, driven by soaring global demand for tonnage. To manage the increased volume, the company has acquired over 200 acres of land adjacent to its shipyard and plans to invest over US$400mn in an expansion plant, including a 300,000-tonne drydock. This expansion will add 800,000 deadweight tons of annual capacity, enhancing China’s self-reliance in high-value-added shipbuilding. Yangzijiang is also establishing an advanced, digitalized production plant with a 5G industrial data network, reflecting a shift towards more technologically advanced processes. This growth is part of a broader trend among Chinese shipyards. According to shipbroker BRS, Chinese orderbooks are nearly full through 2027, with orders extending to 2029, indicating a strong future for the industry.

- Expansion into VLAC carriers. Yangzijiang Shipbuilding has secured a US$440mn deal with Nissen Kaiun for four 88,000 cubic meter very large ammonia carriers (VLACs), marking Yangzijiang’s entry into this segment. These ships are ordered under seven-year time charters with energy trader BGN and will be delivered between May 2028 and February 2029. Nissen Kaiun, owning about 200 ships including 10 very large LPG carriers and nearly 40 newbuilds, is responding to the high demand for LPG/ammonia carriers driven by the anticipated surge in low-carbon ammonia trade, especially from Japan and South Korea due to their decarbonization initiatives.

- New manufacturing facility. Yangzijiang Shipbuilding has entered into a framework agreement with Jingjiang City in Jiangsu Province, to acquire 866,671 square meters of land in Xinqiao Park for a new clean energy ship manufacturing base. This land includes 1,320 meters of Yangtze River shoreline, allowing for efficient expansion. Strategically located next to its existing facility, the new site will enhance productivity and operational efficiency. The company plans to invest three billion yuan (S$554.3mn) over the next two years, pending the results of a feasibility study and government approvals. The project will be executed in phases to ensure regulatory compliance. The approval of this project will allow the company to manufacture clean energy ships, expanding its manufacturing capacity.

- FY23 results review. Revenue for FY23 increased by 16.5% YoY to RMB24.1bn, compared to RMB20.7bn in FY22. Net profit increased by 57.0% YoY to RMB4.10bn in FY23, compared to RMB2.61bn in FY22. NPM increased by 4.4ppts to 17.0% in FY23, compared 12.6% in FY22.

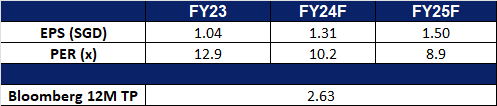

- Market Consensus.

(Source: Bloomberg)

SATS Ltd (SATS SP): Service improvement amidst air travel recovery

- RE-ITERATE BUY Entry – 2.90 Target– 3.20 Stop Loss – 2.75

- SATS Ltd. provides gateway services and food solutions. The Company specializes in airfreight, ramp and baggage handling; passenger services; aviation security services; aircraft cleaning; and cruise centre management. It also provides airline catering; institutional catering; aviation laundry; and food distribution and logistics. SATS has presence across Asia and the Middle East.

- Partnership to expand food solutions business. SATS is partnering with Mitsui & Co to expand its food and retail solutions businesses. They created a subsidiary, Food Solutions Sapphire Holdings, for joint investments. Mitsui will invest S$36.4mn for a 15% stake in this subsidiary, which includes four of SATS’ food solutions entities. The collaboration aims to enhance the food value chain by leveraging Mitsui’s global network and SATS’ expertise. They plan to grow the food solutions business in key Asian markets, focusing on product development, kitchen production, and logistics. The partnership is already showing results, especially in Japan, with plans to supply frozen meals to Muji Japan by early 2025. This collaboration is expected to drive long-term growth for SATS.

- Self-driving buses on trial. Changi Airport will trial a self-driving bus for transporting workers in its restricted area starting in the third quarter of 2024. The agreement on 17 July, involving Changi Airport Group (CAG), Singapore Airlines Engineering Company (SIAEC), and Sats Airport Services, aims to boost manpower productivity through automation. The two-year proof of concept will be in two phases: a nine-month controlled environment test followed by a live operational test. A safety driver will be on board throughout both phases. This trial is part of broader efforts, including previous trials of autonomous baggage vehicles, to improve operational efficiency and reduce congestion at Changi Airport. The project is co-funded by the Civil Aviation Authority of Singapore. Successful implementation could potentially benefit SATS, by reducing manpower for its airside operations.

- Air passenger traffic not slowing. According to the International Air Transport Association, in 2024, the airline industry has recovered from the COVID-19 crisis, with total traffic surpassing 2019 levels in February. Domestic travel returned to pre-COVID levels in spring 2023, while international routes have also recently recovered. Most regions are expected to exceed 2019 levels in 2024, with Asia Pacific leading growth at 17.2% YoY. Over the next 20 years, global passenger journeys are expected to increase by an average of 3.8% annually, resulting in over 4 billion additional journeys by 2043 compared to 2023. This yearly rise in global travel will contribute to SATS revenue growth in the coming years.

- Business restructuring. SATS recently announced the division of its airport ground handling services into separate units for Singapore and the Asia-Pacific region to stimulate company growth. The restructuring of its Gateway Services business resulted in the creation of two new units: the Singapore Hub and Gateway Services Asia-Pacific. The Singapore Hub will focus on enhancing aviation hub competitiveness in Singapore, while Gateway Services Asia-Pacific will aim to expand the group’s market share by managing operations in overseas airports.

- FY24 results review. Total revenue rose by 192.9% YoY to S$5.15bn in FY24, compared to S$1.76bn in FY23. Core PATMI rose by 331.3% to S$78.5mn in FY24, compared to S$18.2mn in FY23. Basic EPS was 3.8 Scents in FY24, compared to -2.2 Scents in FY23.

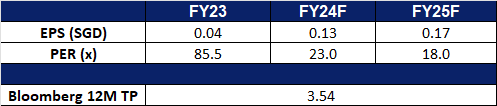

- Market Consensus.

(Source: Bloomberg)

Goldwind Science & Technology Co Ltd. (2208 HK): Spurring investments into renewable energy

- BUY Entry – 3.90 Target 4.30 Stop Loss – 3.70

- Goldwind Science & Technology Co Ltd, formerly Xinjiang Goldwind Science & Technology Co Ltd, is a China-based company that provides overall solutions for wind turbines, wind power services and wind farm development. The Company operates its businesses through four segments. The Wind Turbine Manufacturing and Sales segment is mainly engaged in the research and development, manufacturing and sales of wind turbines and their parts. The Wind Power Service segment mainly provides wind power-related consultants, wind farm construction and maintenance and transportation services. The Wind Farm Development segment is mainly engaged in the development and operation of wind farms. Other segment is mainly engaged in financial leasing and water treatment development and operation business. The Company conducts its businesses both in the domestic market and overseas markets.

- New Renewable Energy Consumption Benchmarks. China’s National Development and Reform Commission (NDRC) and National Energy Administration (NEA) have jointly released updated requirements for the percentage of energy that provinces must source from renewable generators in 2024 and 2025. These requirements are part of China’s renewable energy consumption guarantee mechanism, mandating a significant increase in the share of renewable energy in several provinces. The document also outlines tentative renewable energy consumption targets for 2025. Current data reveals that six provinces experienced increases exceeding 6 percentage points in their renewable energy consumption mandate between 2023 and 2024. China remains on track to achieve its renewable energy goals, aiming for renewable energy, including hydropower, to account for 40 percent of total national energy consumption by 2030. This benchmarks are likely to spur on more investment into renewable energy as well.

- Increasing use of renewable energy in China. China’s renewable energy utilization has reached or exceeded advanced international levels, demonstrating rapid progress in sustainable energy. The country has maintained strong momentum in renewable energy adoption, with a utilization rate of 97.6%, surpassing 95% for six consecutive years since 2018. Last year, newly installed renewable energy capacity rose to 290 million kW, 2.4 times that of 2022, accounting for 79% of the total new power generation capacity nationwide, making it the primary source of new power generation. This surge in capacity has spurred significant investments in solar, wind, and hydropower projects across the country. These efforts are part of China’s broader strategy to peak carbon emissions before 2030 and achieve carbon neutrality before 2060. Goldwind is likely to benefit from the increased investment and spending in renewable energy.

- Expanding presence. Goldwind Science & Technology recently acquired its first overseas wind turbine manufacturing plant in Brazil. In May, the company finalized an agreement with General Electric to acquire the Camacari assembly plant in Bahia state. The plant is set to begin mass production of wind turbines by the end of 2024, creating over 1,000 jobs in the region. Goldwind highlighted that this investment will enhance local supply chains and capitalize on the region’s abundant wind resources.

- 1Q24 earnings. The company’s operating revenue rose to RMB6.98bn in 1Q24, +25.42% YoY, compared to RMB5.56bn in 1Q23. The company’s net profit fell by 73.06% YoY to RMB332mn, compared to RMB1.23bn in 1Q23. Basic earnings per share fell to RMB0.0726 in 1Q24, compared to RMB0.286 in 1Q23.

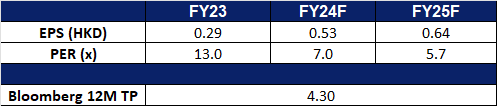

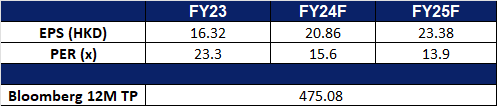

- Market consensus.

(Source: Bloomberg)

Tencent Holdings Ltd. (700 HK): To benefit from policy support

- RE-ITERATE BUY Entry – 350 Target – 390 Stop Loss – 330

- Tencent Holdings Ltd is an investment holding company primarily engaged in the provision of value-added services (VAS), online advertising services, as well as FinTech and business services. The Company primarily operates through four segments. The VAS segment is mainly engaged in the provision of online games, video account live broadcast services, paid video membership services and other social network services. The Online Advertising segment is mainly engaged in media advertising, social and other advertising businesses. The FinTech and Business Services segment mainly provides commercial payment, FinTech and cloud services. The Others segment is principally engaged in the investment, production and distribution of films and television program for third parties, copyrights licensing, merchandise sales and various other activities.

- Policy Support for AI development. Since the beginning of the year, the Chinese government has implemented various policies to boost and regulate the development of the artificial intelligence (AI) sector. Recently, they announced new guidelines specifying seven key areas for developing the AI standard system in the country, including standards for key technologies, intelligent products and services, and industry applications. According to these guidelines, China aims to formulate over 50 national and industrial standards for AI by 2026 and develop a comprehensive standard system to ensure the sector’s high-quality development. Tencent is poised to benefit significantly from these AI-focused policies.

- Further approval of games. China has recently approved 15 more foreign-developed titles for the local market, bringing the total for this year to 75. Domestic tech giants Tencent Holdings and NetEase have secured licenses for several major games. Tencent has received approval to release Tom Clancy’s Rainbow Six, one of the most popular tactical shooter games, and the role-playing game Paper Mario: The Origami King for the Nintendo Switch platform in China. Since the government resumed the approval of new video game licenses in 2023, China’s gaming market has been recovering. Last year, the market grew by nearly 14%, reaching almost 303 billion yuan, with the number of gamers hitting a record 668 million. These additional game approvals and the ongoing recovery of China’s gaming market are likely to boost the companies’ sales.

- Investment into AI. Tencent recently announced its participation in a financing round exceeding $300mn for Chinese generative AI startup Moonshot, raising the latter’s valuation to $3.3bn. This move reflects Tencent’s strategy to support promising ventures in the competitive AI sector, similar to its competitor Alibaba. The investment in Moonshot is part of a broader trend of substantial capital inflow into Chinese AI firms, with major technology companies and venture capitalists investing heavily to establish a strong presence in the AI market. This push for AI dominance aims to fill a market gap similar to that of ChatGPT in the United States.

- 1Q24 results review. Revenue increased 6.3% YoY to RMB159.5bn in 1Q24, compared with RMB150.0bn in 1Q23. Net profit rose 62.1% to RMB41.9bn in 1Q24, compared to RMB25.8bn in 1Q23. Basic earnings per share was RMB4.479 in 1Q24, compared to RMB2.725 in 1Q23.

- Market consensus.

(Source: Bloomberg)

Palantir Technologies Inc (PLTR US): A hidden AI-themed stock is catching up

- BUY Entry – 28 Target – 34 Stop Loss – 25

- Palantir Technologies Inc. develops software to analyze information. The Company offers solutions support many kinds of data including structured, unstructured, relational, temporal, and geospatial. Palantir Technologies serves customers worldwide.

- Growth and risk-off attributions. The company is one of the AI application concept stocks, and its platform has gained more use from business customers in the past two years. At the same time, the US Department of Defense is the company’s largest public business customer, and the company’s platform provides artificial intelligence training for the US Navy and Army. Therefore, under the economic pro-cycle, the increase of software expenditure is beneficial to the business growth of the company’s commercial sector; When the economic downturn cycle or high geopolitical risks, the U.S. defense spending, especially artificial intelligence, continues to grow, providing protection for the company’s public sector revenue growth.

- The first quarterly results meet the rule of 40. The Rule of 40 is a metric used to measure the overall performance of a SaaS company, which is considered good performance if the combined revenue growth rate and EBITDA Margin are at or above 40%. Palantir Technologies exceeded this indicator for the first time in the latest quarter. As a result, the company’s fundamentals are sound.

- 2Q24 earnings review. Revenue grew by 27.2% YoY to US$678.13M, beating estimates by US$25.71M. Non-GAAP EPS was US$0.09, beating estimates by US$0.01. The company expected 3Q24 revenue to be between $697M to $701M vs consensus of $680.2M and adjusted income from operations of between $233M to $237M. It also raise FY24 revenue guidance to be between $2.742B to $2.750B vs consensus of $2.7B.

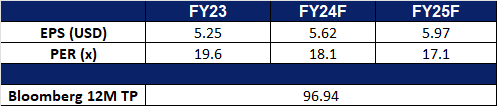

- Market consensus.

(Source: Bloomberg)

Corning Inc (GLW US): Double bonanza

Corning Inc (GLW US): Double bonanza

- BUY Entry – 38.0 Target – 42.5 Stop Loss – 36.0

- Corning is a leader in materials science, specializing in glass, ceramics and fiber optics. The company offers products for a wide range of applications, from flat panel displays in televisions to gasoline particle filters in automobiles to broadband access fiber optics, with leading shares in many end markets.

- AI-related infrastructure is in high demand. Artificial intelligence drives the demand for data centers and related infrastructure for data processing and transmission. The company said in its latest quarterly results release that its new optical link products will benefit from the increase in corporate spending under the wave, creating an additional $3 billion in annual revenue for the next three years.

- Consumer electronics upward cycle coming. It has been nearly four years since the last peak of consumer electronics upgrades, especially for smartphones, tablets and PCS. Four to five years is a cycle, so it is expected that the end of the year to next year is the peak of upgrading, and the embedded artificial intelligence function will accelerate the upgrading demand. Corning develops Gorilla Glass for high-end, mid-range and low-end smartphones. Major brands such as Apple, Samsung and Xiaomi use the company’s various gorilla glasses. It is expected that the new generation cycle will drive the rapid growth of performance.

- 2Q24 earnings review. Revenue rose 3.4% YoY to US$3.6B, beating estimates by US$20M. Non-GAAP EPS was $0.47, in line with expectations. Management expected 3Q24 core sales to grow to about US$3.7B versus US$3.79B consensus, with core EPS growing faster than sales in a range of US$0.50 to US$0.54 versus US$0.55 consensus.

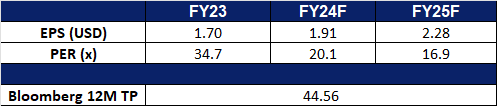

- Market consensus.

(Source: Bloomberg)

(Source: Bloomberg)

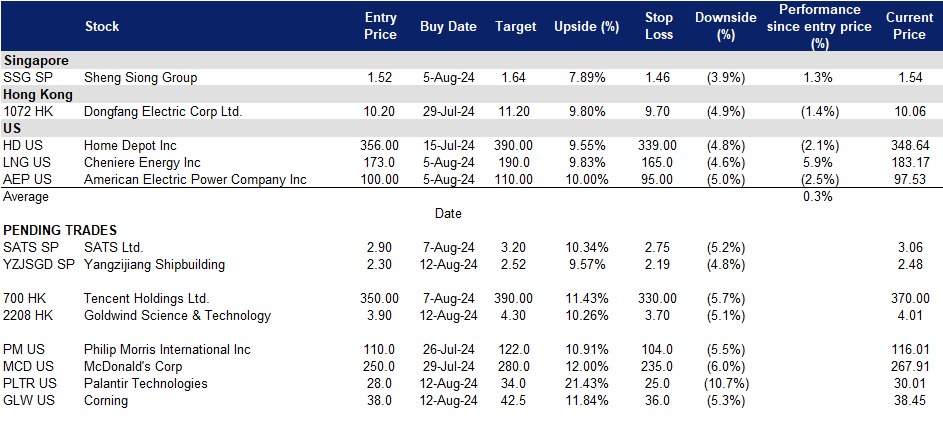

Trading Dashboard Update: Cut loss on COSCO Shipping Holdings (1919 HK) at HK$10.40.