KGI Daily Trading Ideas – 11 January 2021

Trading Dashboard

Market Movers – What’s Hot

Global/Macro

Higher US interest rate yields and the stronger dollar is putting pressure on gold prices, which dropped to US$1850 last Friday. The rotation into bitcoin by institutional investors is likely another contributing factor, as bitcoin prices traded above US$40,000 to hit a new record high last week. Once the current short-term sell-off in gold is over, we expect the upward momentum to resume as Democrats’ control of both the Senate and House should pave the way for higher fiscal spending.

- US 10-year Treasury yield rose to 1.122% last Friday, the highest since 18th March 2020, signalling rising expectations of additional fiscal stimulus and higher inflation in the US. Global banking stocks are the biggest beneficiaries of higher interest rates.

US

- Diginex (EQOS US) +29% as Bitcoin hits new highs, fuelling greater interest into cryptocurrency-related investments.

- Nio (NIO US) +8.55% at record high prior to Nio Day on 9 Jan, in which the company unveiled a fourth luxury production model.

- EARNINGS: Delta Airlines (DAL US), Blackrock (BLK US) and Charles Schwab (SCHW US) report earnings on 14 Jan. Major banks JP Morgan (JPM US), Citigroup (C US) and Wells Fargo (WFC US) report earnings at the end of the week on 15 Jan.

- IPO WATCH: Affirm (AFRM US), Playtika (PLTK US), Petco (WOOF US) and Driven Brands (DRVN US) prepare to go public in the upcoming week.

Hong Kong

- Geely Automobile Holdings Limited (175 HK) +19.3%, closing at a record high of HK$33.25. The company announced it will partner with Baidu (BIDU US) to jointly develop electric vehicles.

- Evergrande Property Services Group Ltd (6666 HK) +26.14%, closing at a new high of HK$11.1 since IPO. The Chinese government issued a notice to support the development of the residential property management sector, aiming to improve property management services.

- China Hongqiao Group (1378 HK) -10.71%, closing at HK$6.92. The company proposed to issue US$300mn convertible bonds with a preliminary conversion price of HK$8.91.

Singapore

- Covid-plays were surprisingly the largest market movers in Singapore, with glovemakers Top Glove (TOPG SP), UG Healthcare (UGHC SP) and Riverstone (RSTON) surging 9-11%, while local healthcare equipment maker, Vicplas International (VPS SP), gained 16%.

- Banks continued to rally strongly, with shares of DBS (DBS SP), UOB (UOB SP) and OCBC (OCBC SP) gaining 4-5% last Friday, on the back of rising interest rates and a possibly better-than-expected economic recovery in 2021.

US Trading Ideas

Salesforce (CRM US): Trading near technical support, concerns on blue wave overdone

- BUY Salesforce (CRM US): Entry – 221.90 Target – 239.90 Stop Loss – 214.20.

- Salesforce is the market leader in customer relationship management software with close to 20% share of the CRM market, according to IDC.

- While Democrats’ recent victories have created pressure on the tech sector, we think antitrust concerns regarding the Slack (WORK US) acquisition are unlikely to materialise

- Salesforce trades at its 200 EMA and has shown positive momentum in recent days.

Nvidia (NVDA US): Pole position for electrification and autonomous driving

- Reiterate BUY Nvidia (NVDA US) Entry – 534 (BUY STOP) Target – 570 Stop Loss – 515

- Nvidia’s partnership with Nio on their latest vehicle model is a series of continued wins for Nvidia’s AI chip, at the expense of Intel’s Mobileye.

- This could provide sufficient tailwind for Nvidia to climb out of its recent trading range between US$ 505 – 540.

HK Trading Ideas

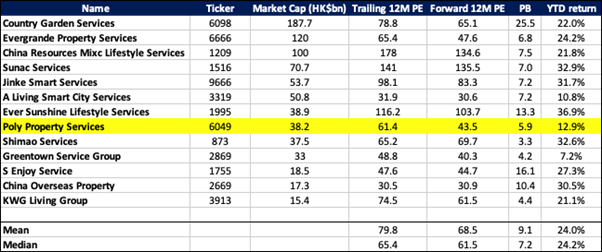

Poly Property Services Co Ltd (6049 HK): Tailwinds from policy support

- BUY Poly Property Services Co Ltd Entry – 65 Target – 79 Stop Loss – 57

- Poly Property Services Co., Ltd. (PPS) provides property management services. In China, the Company offers property services, property projects pre-consultation services post-delivery evaluation and analysis services, professional equipment and facilities maintenance services, housekeeping services, and other services.

- On 5th January, Ministry of Housing and Urban-Rural Development and other nine departments issued the Notice For Strengthening and Improving Residential Property Management Work. The Notice signals that China plans to accelerate the development of the residential property management sector, aiming to achieve diversified and high quality property management services.

- In terms of valuation and price performance, PPS relatively lags.

YTO Express (International) Holdings Ltd (6123 HK): Double bonanzas

- BUY YTO Express Entry – 5.3 Target – 7 Stop Loss – 4.4

- YTO Express (International) Holdings Limited engages in the provision of freight forwarding services from major airlines and other carriers.

- The company announced a profit guidance that net profit in FY20 is expected to jump by more than 600% YoY. The phenomenal growth is due mainly to the upsurge demand for healthcare and medical products from Europe and US driving the air and ocean freight business.

- Freightos Baltic Index (FBX) China/East Asia to North America West Coast remained at a year highs, and FBX China/East Asia to North Europe arrived at a new high. This will benefit international logistics and transportation operators.

SG Trading Ideas

Keppel Corp (KEP SP): The long-awaited strategic review of its O&M business finally set to conclude

- BUY KEP Entry – 5.63 Target – 6.72 Stop Loss – 5.04

- Last October, KEP announced a strategic review that involved the divestment of S$17.5bn worth of assets as part of its asset-light business model. The focus will likely be on its offshore & marine (O&M) segment, which management indicates could include both organic and inorganic options.

- As per management’s discussions back then, KEP is expected to announce the outcome of the strategic review of the O&M segment in the first week of February 2021 (100 days from 29 October 2020).

- We believe this could be a strong catalyst for the re-rating of KEP’s share price, similar to the outperformance of Sembcorp Industries (+98% share price appreciation from six months ago) after it divested Sembcorp Marine.

- KEP announces its 2020 full-year results on 28 January 2021.

First Resources (FR SP): Palm oil play waiting for its day

- Re-iterate FIRST RESOURCES Entry – 1.51 Target – 1.73 Stop Loss – 1.40

- Upcoming 4Q20 earnings may be a catalyst for its share price given how well palm oil prices have performed. The company normally reports its full-year results in the last week of February.

- FR was among the top 20 SGX-listed companies with the highest buyback consideration in CY2020, which we believe reflects managements’ view of the chronic undervaluation of its shares since March 2020.

- Even with the recent surge in its share price, FR still trades at the low end of its pre-covid levels of S$1.50. Hence, we think its current share price offers an attractive risk-reward