10 July 2024: Valuetronics Holdings Ltd (VALUE SP), Uni-President China Holdings Ltd. (220 HK), Cheniere Energy Inc (LNG US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

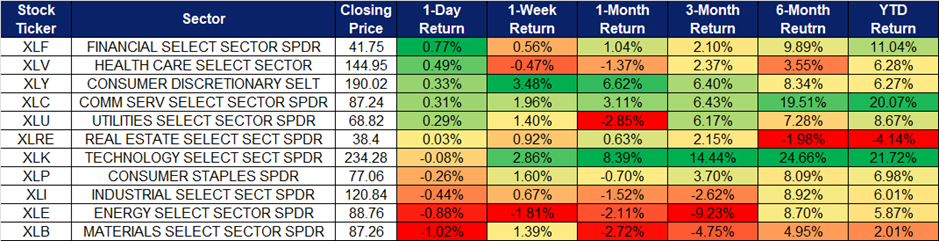

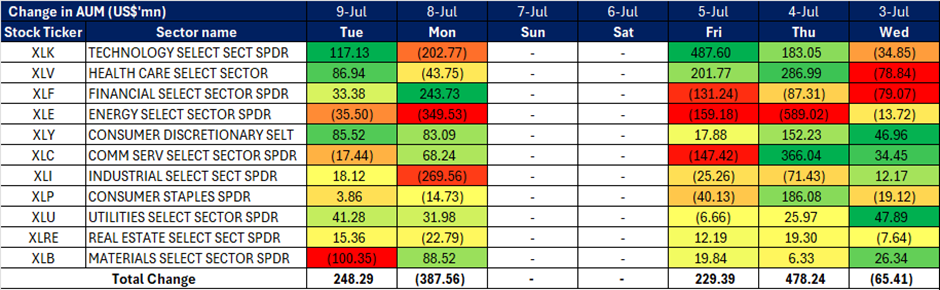

United States

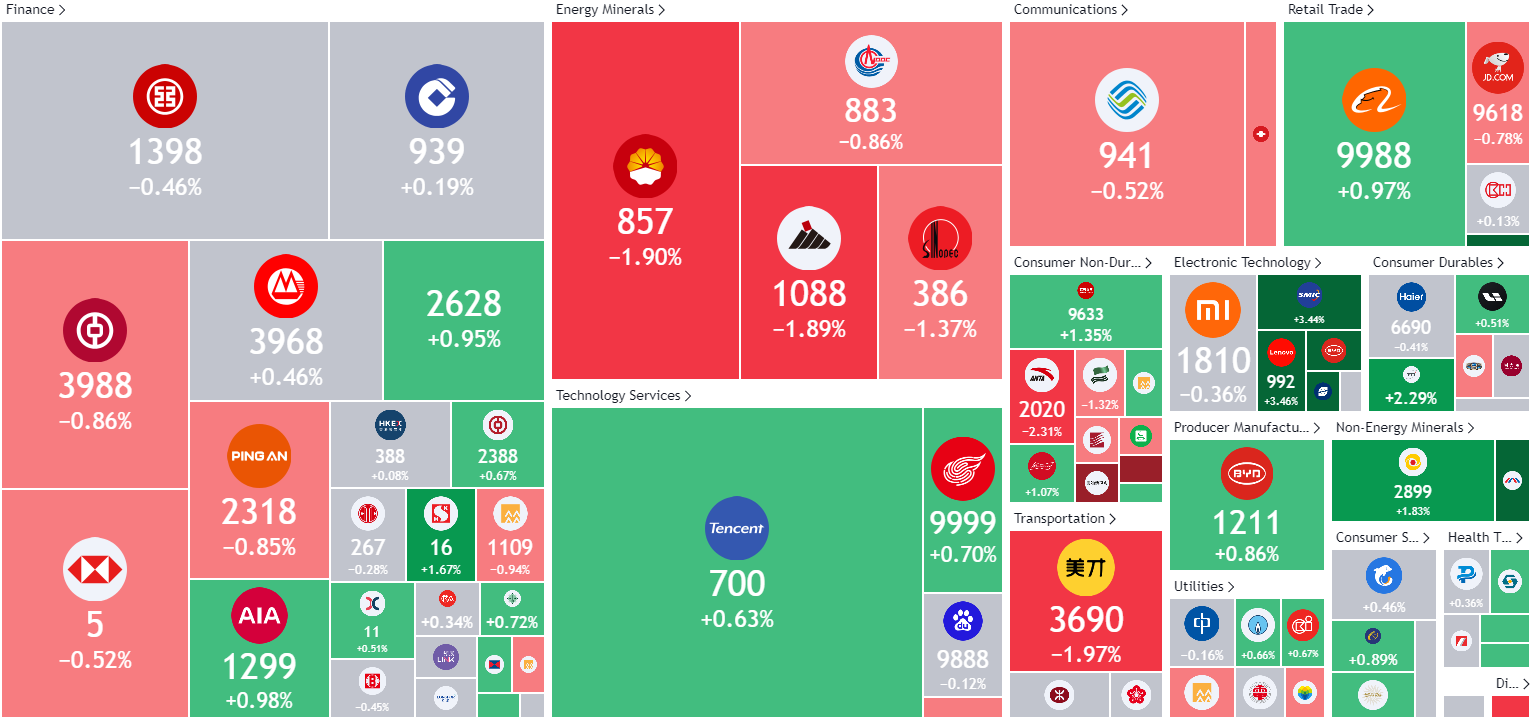

Hong Kong

Valuetronics Holdings Ltd (VALUE SP): Venture into AI

- RE-ITERATE BUY Entry – 0.66 Target– 0.72 Stop Loss – 0.63

- Valuetronics Holdings Ltd. offers original equipment manufacturing and original design manufacturing services. The Company serves customers in the telecommunications, industrial, commercial electronic products, and consumer electronic products industries.

- New Joint-Venture (JV) Partnership. Valuetronics recently announced a new joint venture partnership agreement with Sinnet Cloud HK Ltd. Through its wholly-owned subsidiary, Value Match Company Limited (VML), Valuetronics will invest HK$7.7mn (approximately US$986,000) in cash for a 55% stake in the JV, named Trio AI Limited, which will provide graphics processing units (GPU) and AI-related cloud services in Hong Kong. This JV offers Valuetronics potential access to manufacturing opportunities for AI-related hardware within the Group’s existing manufacturing capabilities, and also allows Valuetronics to benefit from favourable market demand supported by continuous advancements in AI and increasing needs for AI infrastructure services. This partnership marks Valuetronics’ first strategic initiative into the AI industry.

- FY24 results review. Total revenue fell by 17.1% YoY to HK$1.670bn in FY24, compared to HK$2.01bn in FY23. Net profit rose by 29.8% to HK$159.6mn in FY24, compared to HK$123.0mn in FY23. Basic EPS rose to 38.7 HK cents in FY24, compared to 29.1 HK cents in FY23.

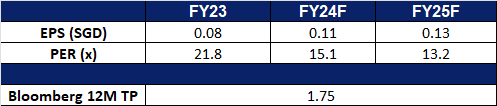

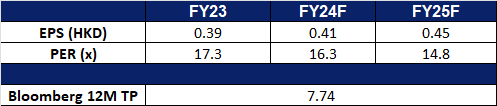

- Market Consensus.

(Source: Bloomberg)

Frencken Group Ltd. (FRKN SP): Semicon recovery on-track

- RE-ITERATE BUY Entry – 1.65 Target– 1.79 Stop Loss – 1.58

- Frencken Group Limited (“Frencken”) is a Global Integrated Technology Solutions Company that is listed on the Main Board of the Singapore Exchange. They provide comprehensive Original Design, Original Equipment, and Diversified Integrated Manufacturing solutions for world-class multinational companies in the analytical & life sciences, automotive, healthcare, industrial, and semiconductor industries.

- Nvidia delivering better than anticipated results again. Nvidia recently reported Q1 results which surpassed estimates, its revenue tripled YoY to US$26bn and it delivered profits that significantly exceeded expectations. The company projected higher-than-expected Q2 revenue of about US$28bn, surpassing analysts’ predictions of US$26.8bn. This positive outlook is driven by the strong demand for AI chips. Its CEO heralded this as the start of a new industrial revolution. Nvidia is currently bolstered by AI accelerators used by major tech firms like Amazon and Google. Despite high demand outpacing supply, Nvidia aims to diversify its market beyond hyperscalers to sectors like healthcare and automotive. This positive demand is expected to extend to Frencken’s semiconductor segment, which represents approximately 41% of its FY revenue.

- Good performance. Frencken Group’s revenue rose 12.2%YoY to S$193.6mn, with the mechatronics division seeing a 14.4% increase to S$170.1mn, primarily from the semiconductor, medical, and analytical life sciences segments. It reported a net profit of S$9mn for 1Q23, up 73% from S$5.2mn the previous year, driven by higher gross profit margins and revenue growth. The IMS division’s revenue remained stable at S$22.8mn, with a decline in the automotive segment offset by a significant increase in the consumer and industrial electronics segment. Gross profit margin improved to 13.7%. The company remains cautious due to global economic uncertainties and expects 1H24 revenue to be comparable to 2H23, with growth in semiconductor, medical, and analytical life sciences segments but softer automotive and industrial automation revenues. Frencken is anticipated to recover alongside the rest of the Semiconductor industry.

- 1Q24 results review. 1Q24 revenue rose by 12.2% to S$193.6mn, compared to S$172.5mn in 1Q23. Net profit increased 73% YoY to S$9mn from S$5.2mn in the previous year due to higher revenue growth and gross profit margins. Gross profit margin improved to 13.7% in 1Q24 from 12.3% in 1Q23, attributing it to better operating leverage. In 1H24, Frencken expects to deliver revenue comparable to 2H23 revenue. The semiconductor, medical, and analytical life sciences segments are expected to improve, while the industrial automation and automotive segments are expected to soften.

- Market Consensus

(Source: Bloomberg)

Uni-President China Holdings Ltd. (220 HK): Turning towards cheaper alternatives

- RE-ITERATE BUY Entry – 7.10 Target 7.80 Stop Loss – 6.75

- Uni-President China Holdings Ltd. is a Hong Kong-based investment holding company principally engaged in the manufacture and sales of beverages and instant noodles. It operates through three segments, including Beverages segment, Instant Noodles segment and Others segment. The Company’s beverage products include juice drinks, ready-to-drink tea, milk tea, coffee and bottled water, among others. Its instant noodles products include bowl noodles, packet noodles and snack noodles. The Company is also involved in the wholesales of forage and fertilizer, as well as the provision of catering services through its subsidiaries.

- To benefit from rising food prices. As food prices increase in China, many are opting for affordable choices like instant ramen. Yet, even instant ramen is becoming pricier as major manufacturers hike their retail prices, according to various media reports. Additionally, the costs of beverages, street food, fruits, and vegetables are rising due to increasing raw material expenses. This overall escalation in food prices is pushing consumers toward cheaper alternatives instead of dining at more expensive establishments such as restaurants. Reports also indicate that demand for premium food in China is waning due to economic uncertainty and escalating geopolitical tensions. As a result, Uni-President China is likely to benefit from both the rising food prices and the higher sales volume of instant products.

- China’s FMCG market growth. A recent report indicates that in 1Q24, China’s FMCG sector experienced a value growth of approximately 2.0%, an increase of half a percentage point compared to 1Q23, driven by a 3.5% rise in volume. This growth was primarily led by the packaged food and beverage segment, which saw stable YoY value growth of 2.7% and 4.3%, respectively. The majority of categories within packaged food experienced volume growth, attributed to the recovery of social mobility and activities.

- Expanding presence. Earlier this year, Uni-President’s board authorized a share purchase to acquire full ownership of South Korea’s Woongjin Foods, increasing its stake from 79.32%. This acquisition aligns with Uni-President’s strategy to establish a large distribution platform in Asia and underscores its commitment to expanding into Northeast Asia.

- FY23 earnings. Revenue rose by 1.2% YoY to RMB28.6bn in FY23, compared to RMB28.3bn in FY22. Net profit rose 36.4% YoY to RMB1.67bn in FY23, compared to RMB1.22bn in FY22. Basic EPS rose 36.4% YoY to 38.6 RMB cents in FY23, compared to 28.3 RMB cents in FY22.

- Market consensus.

(Source: Bloomberg)

AAC Technologies Holdings Inc (2018 HK): Riding the tailwinds of Apple’s new features

- RE-ITERATE BUY Entry – 31 Target 37 Stop Loss – 28

- AAC Technologies Holdings Inc. designs, develops and manufactures a broad range of miniaturized components that include speakers, receivers and microphones in the acoustic segment. The Company produces these components for mobile devices such as smartphones, tablets, wearables, ultrabooks, notebooks and electronic book-readers.

- Siri updates incoming. Apple plans to enhance Siri with generative AI, enabling it to control various apps more effectively. This upgrade aims to improve Siri’s understanding of user intentions and app functionalities, addressing previous challenges. A potential deal with OpenAI may integrate ChatGPT’s technology into iOS 18, making Siri more intuitive and context aware. The update is expected to boost iPhone sales, especially as Apple faces competition in China and slower growth in the US. Siri will support more natural language, follow-up questions, and text input, while also performing tasks based on on-screen content and drawing on personal context for more complex actions. On 10 June, Apple released an improved version of Siri and introduced AI features to a few applications. The enhancements announced by Apple will necessitate new components for the handset from AAC Technology, which in turn will benefit its acoustic business revenue.

- iPhone sales to improve. According to analysts, the anticipated demand for Apple’s new AI features, known as Apple Intelligence, is expected to result in a substantial increase in iPhone sales. This could potentially trigger what is known as an “iPhone supercycle.” These features will only be available on the iPhone 15 Pro or newer models, which may prompt many current iPhone users to upgrade. Apple Intelligence, currently in beta, will be available on the iPhone 15 Pro, iPhone 15 Pro Max, and devices with M1 chips or later. It will be integrated into iOS 18, iPadOS 18, and macOS Sequoia. This development may lead to a surge in sales of the iPhone 16 and might also give rise to a new AI App Store, which would significantly impact Apple’s market and boost iPhone sales. An increase in iPhone sales would also result in the need for more components from AAC Technology, benefiting its top lines.

- FY23 earnings. Revenue fell by 1.0% YoY to RMB20,419mn in FY23, compared to RMB20,625mn in FY22. Net profit fell 9.9% YoY to RMB740mn in FY23, compared to RMB821mn in FY22. Basic EPS fell 8.3% YoY to RMB0.63 in FY23, compared to RMB0.69 in FY22.

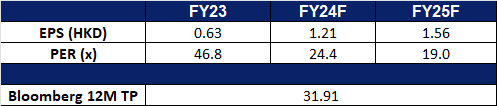

- Market consensus.

(Source: Bloomberg)

Cheniere Energy Inc (LNG US): Natural gas consumption to rise

- RE-ITERATE BUY Entry – 173 Target –190 Stop Loss – 165

- Cheniere Energy, Inc. is an energy infrastructure company engaged in LNG-related businesses. The Company provides liquefied natural gas (LNG) to integrated energy, utilities, and energy trading companies. Cheniere Energy serves customers worldwide.

- Trump themed stocks. After the first round of the 2024 U.S. presidential television debate, Trump gained momentum and his support rate continued to rise based on his lead over Biden. The market began to trade in Trump-themed sectors, and the oil and gas industry was the first to bear the brunt because Trump and Republican Party policies tend to support the oil and gas industry.

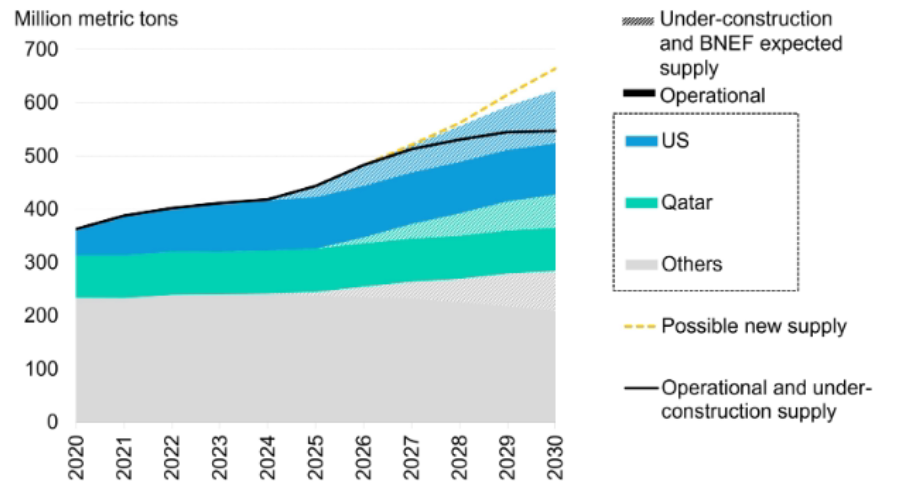

Global LNG Supply Outlook

(Source: Bloomberg)

- The extension of the artificial intelligence wave. The 2024 International Energy Agency (IEA) Electricity Report shows that global electricity demand for data centres, cryptocurrencies and artificial intelligence is expected to nearly double by 2026, reaching 620 to 1,050 terawatt hours (TWh), with a base case of just over 800 TWh. watt hours, up from 460 terawatt hours in 2022. In 2023, natural gas power generation in the United States will account for 43.1%, so the natural gas industry will also benefit from the artificial intelligence wave. Cheniere’s business belongs to the midstream of the supply chain, and its business is highly sensitive to changes in natural gas consumption and low to price changes.

- 1Q24 earnings review. Revenue fell by 43.1% YoY to US$4.3bn, beating estimates by US$280mn. GAAP EPS was US$2.13, missing estimates by US$0.06. 2Q24 revenue is expected to be in the range of US$2.68bn to US$2.74bn vs market consensus of US$2.74bn. Reaffirmed FY24 consolidated adjusted EBITDA guidance of US$5.5bn to US$6.0bn and FY24 distributable cash flow guidance of US$2.9bn to US$3.4bn.

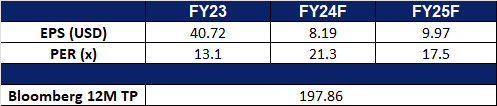

- Market consensus.

(Source: Bloomberg)

Broadcom Inc (AVGO US): Next to join the trillion-dollar club

- RE-ITERATE BUY STOP Entry – 1,750 Target –2,150 Stop Loss – 1,600

- Broadcom Inc. designs, develops, and supplies semiconductor and infrastructure software solutions. The Company offers storage adapters, controllers, networking processors, motion control encoders, and optical sensors, as well as infrastructure and security software to modernize, optimize, and secure the most complex hybrid environments. Broadcom serves customers worldwide.

- VMware innovation. Broadcom recently introduced VMware Cloud Foundation 5.2, which offers streamlined innovation with modern infrastructure and enhanced developer productivity. The new updates support faster infrastructure modernisation, improved developer productivity, and better cyber resiliency and security with a low total cost of ownership. The latest advancements include VCF Import functionality, capabilities for supporting VM and containerised workloads on a single platform, and integrated data services capabilities. VMware vSphere Foundation is the next evolution of the VMware vSphere solution, designed to support modern IT requirements by boosting operational efficiency, elevating security, and supercharging workload performance. Both VMware Cloud Foundation 5.2 and VMware vSphere Foundation 5.2 are expected to be available in Broadcom’s fiscal third quarter, which would boost its second-half sales.

- Expecting AI spending boom. Market analysts recently predicted increased capital expenditure, on AI capabilities for mega-cap tech firms this year. They project Alphabet, Meta and Amazon to boost spending by 43% to US$91bn on servers and equipment. With plans to enhance their AI prowess and possibly introduce new products, the estimated expenditures across these firms are expected to rise 35% YoY to US$145bn. This upswing in spending is expected to benefit chipmakers over the next few years. Additionally, according to Bain & Company’s survey of 200 US companies with at least US$5mn in revenue, corporations from other industries are also looking to adopt AI in the coming years, with language generation and software coding being the most common AI applications to prioritise. These companies have reported spending an average of US$5mn a year on generative AI. Therefore, Broadcom’s strong position in the AI semiconductor market presents an attractive opportunity for investors amidst soaring demand for AI semiconductors.

- Good results, better guidance. Broadcom recently released its second-quarter earnings and revenue results beating estimates. It raised its annual revenue forecast for AI-related chips by 10% to US$11bn for FY24. The company benefiting from increased investment in AI applications like OpenAI’s ChatGPT, recorded US$3.1bn in AI product revenue in Q2. The company also announced a 10-for-1 stock split to make shares more accessible to retail investors, effective 15 July. Broadcom’s semiconductor solutions segment revenue grew by 6% YoY to US$7.20bn, and its infrastructure software revenue more than doubled, partly due to acquiring VMware. Broadcom’s full-year revenue forecast increased by US$1bn to US$51bn, alongside higher profit projections. Looking ahead, with continued global AI integration in corporations, the demand for its products and services will also increase, benefitting Broadcom’s sales.

- 2Q24 earnings review. Revenue grew by 43.1% YoY to US$12.49bn, beating estimates by US$480mn. Non-GAAP EPS was US$10.96, beating estimates by US$0.12. FY24 revenue guidance of approximately US$51.0bn and adjusted EBITDA of 61% of projected revenue.

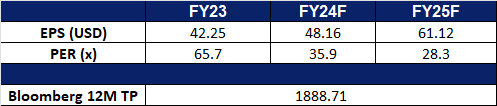

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Valuetronics Holdings Ltd (VALUE SP) at S$0.66, Frencken Group Ltd (FRKN SP) at S$1.65, China Longyuan Power Group Corp Ltd (916 HK) at HK$7.4 and Uni-President China Holdings Ltd (220 HK) at HK$7.1. Cut loss on China Longyuan Power Group Corp Ltd (916 HK) at HK$7.1.