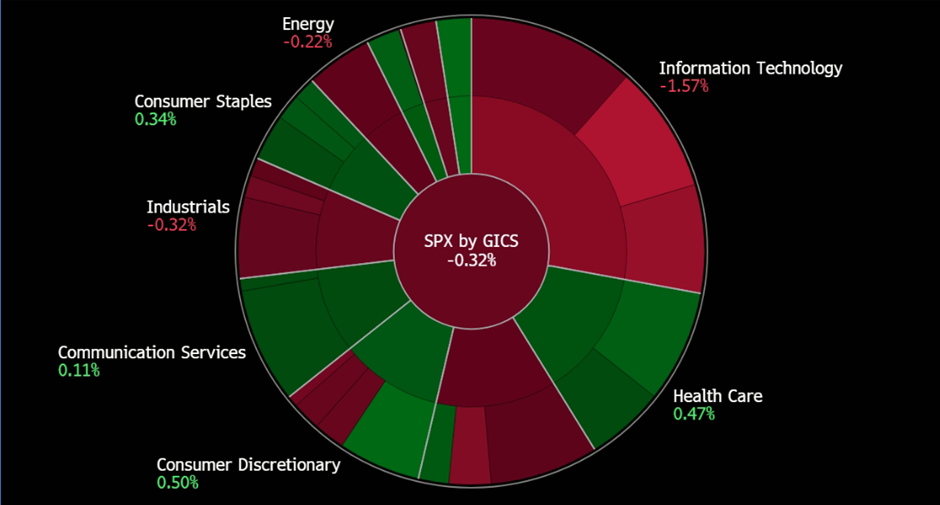

8 September 2023: Yangzijiang Shipbuilding (YZJSGD SP), China Oilfield Services (2883 HK), Advanced Micro Devices Inc (AMD US)

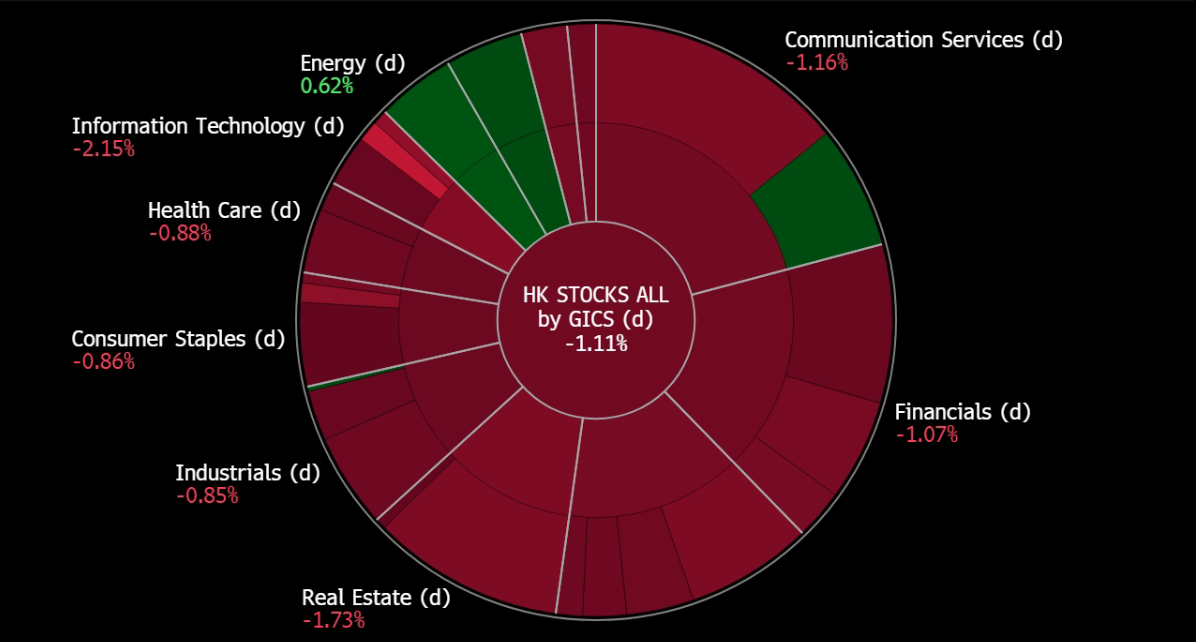

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

News Feed |

1. China’s oil imports surge in August as fuel exports, inventories rise |

2. China’s export slump eases as economy searches for stability |

Yangzijiang Shipbuilding (YZJSGD SP): Double bonanzas-record order book and weak RMB

- BUY Entry 1.67 – Target 1.80– Stop Loss – 1.61

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, container ships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

- Hedging against weakening RMB. Recent macro figures released from China showed a gloomy outlook as soft domestic, exports and property crisis continues to weaken confidence. USD/RMB broke 7.3 again. The authority has released multiple stimuli, but all are ineffective. The US Fed remains hawkish towards fighting against inflation, and hence, the US will keep rates high for the rest of 2023. There is downside room for RMB if China’s economy further slows down in 3Q23.

Share price and USD/RMB price trend comparison

- Shipbuilding outshines other sectors. According to the China Association of the National Shipbuilding Industry, new contracts secured by Chinese shipyards surged by 67.7% YoY in 1H23 with 123.77m dwt orders on hand as of June. Containerships and LNG carriers dominate the new orders. The newly-received orders and orders on hand in deadweight tonnage accounted for 49.6%, 72.6% and 53.2% of the global market share; the amount in gross tonnage accounted for 47.3%, 67.2% and 46.8% of the world volume, both ranking as number one in the global market.

- 1H23 orderbook exceeded the full-year target. As of June, the company has obtained orders for 72 vessels, amounting to a value of US$5.76 billion, surpassing its target of US$3 billion for 2023. This has resulted in the highest-ever outstanding orderbook value for Yangzijiang, standing at US$14.7 billion for 181 vessels. Among all ordered vessels, 91 are containerships, 29 are oil tankers, 53 are bulk carriers, and 8 are LNG/LPG/LEG.

- 1H23 results review. Revenue for 1H23 increased by 16% YoY to RMB11.3bn. Gross profit increased by 48% YoY to RMB2.1bn. GPM increased by 4ppts to 19%. PATMI increased by 26% YoY to RMB1.7bn.

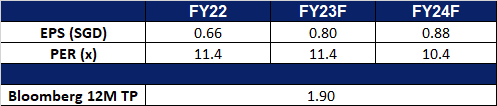

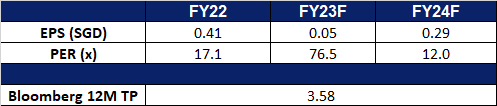

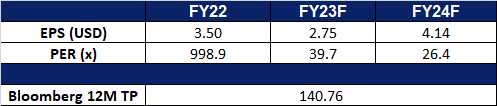

- Market Consensus.

(Source: Bloomberg)

AEM Holdings Ltd (AEM SP): Positive signs of recovery

- RE-ITERATE BUY Entry 3.50 – Target – 4.00 Stop Loss – 3.25

- AEM Holdings Limited is a Singapore-based company, which offers application specific-intelligent system test and handling solutions for semiconductor and electronics companies serving computing, fifth generation (5G) and artificial intelligence (AI) markets. Its segments include Equipment systems solutions (ESS), System Level Test & Inspection (SLT-i), Micro-Electro-Mechanical Systems (MEMS), Test and Measurement Solutions (TMS) and Others.

- An early sign of recovery. Early on, Intel released better-than-expected 2Q23 earnings. Revenue beat estimates by US$760mn though it dropped by 15.7% YoY to US$12.9bn. Non-GAAP EPS was US$0.13, beating estimates by US$0.16. Intel turned profitable after two prior consecutive loss-making quarters. The company guided 3Q23 adjusted EPS to be US$0.2, topping estimates of US$0.13. Its Client Computing segment delivered 17.5% QoQ growth and arrived at US$6.78bn due mainly to strong demand for Chromebooks and high-end notebooks. Data center & AI segment grew by 26.0% QoQ to US$4.00bn. The company’s foundry unit revenue surged 96.6% QoQ to US$232M. The turnaround in 2Q23 showed an early sign that the PC cycle was bottoming out. Last week, Dell also released its 2Q23 results, exceeding market expectations. Dell sees PC demand slowing rate is declining and is optimistic that the market will resume low single-digit growth in 2024.

- 1H23 earnings review. Revenue fell by 49% YoY to S$275.2mn. Gross profit fell by 50% YoY to S$83.1mn. GPM dropped by 2.3ppts to 30.2%. PATMI fell by 76% YoY to S$19.7mn. NPM dropped by 8.2 ppts to 7.2%. Full-year guidance for revenue was revised to the range between S$460mn and S$490mn. A US$20mn legal settlement will be recognised in 3Q23.

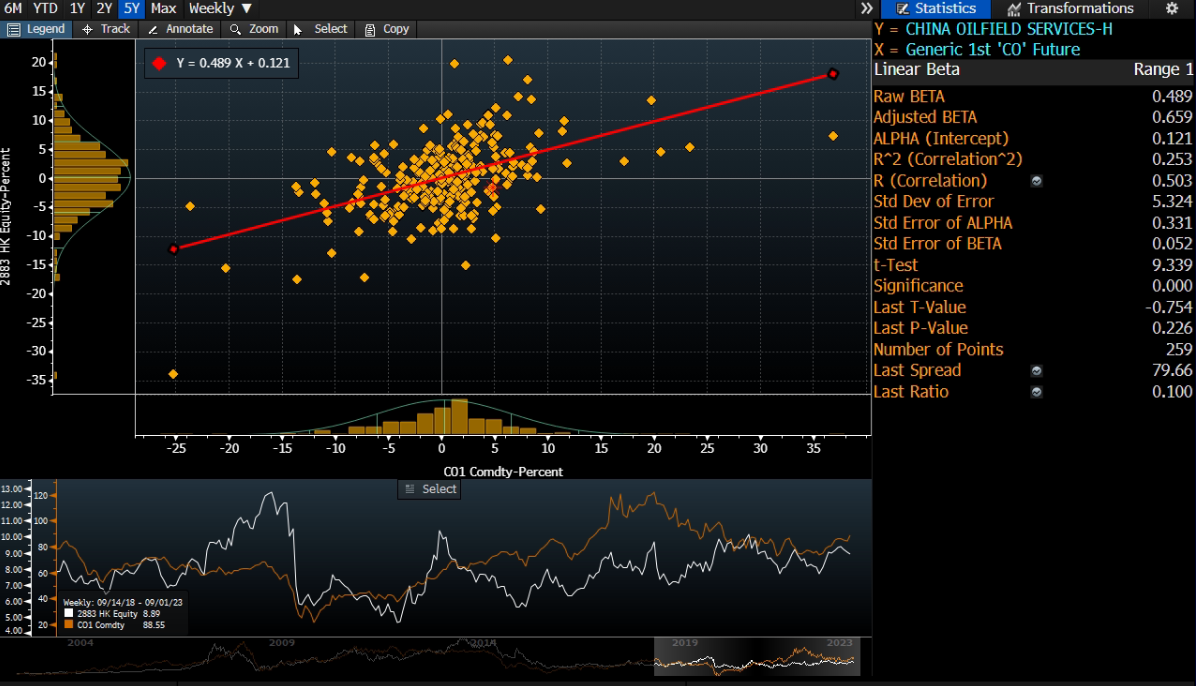

- Market consensus.

(Source: Bloomberg)

(Source: Bloomberg)

China Oilfield Services (2883 HK): Capturing Oil Demand

- BUY Entry – 9.50 Target – 10.20 Stop Loss – 9.10

- China Oilfield Services Limited is a comprehensive oilfield service provider. The Company mainly operates through four business segments. The Drilling Services segment is mainly engaged in the provision of oilfield drilling services. The Oil Field Technical Services segment is mainly engaged in the provision of oilfield technical services, including the logging, drilling fluids and directional drilling services. The Geophysical and Engineering Exploration Services segment is mainly engaged in the provision of seismic prospecting and engineering exploration services. The Marine Support Services segment is engaged in the transportation of supplies, including the delivery of crude oil, as well as refined oil and gas products. The Company mainly operates its businesses in domestic and overseas markets.

- New Drilling Rig Service Contracts. China Oilfield Services recently announced that its wholly owned subsidiary, COSL Drilling Europe, has entered into multiple drilling rig service agreements with two multinational oil firms in Norway, each with a set term and an option to extend for up to five years. The total value of the contracts with fixed terms is around 4.7 billion RMB.

- Demand for oil to outgrow supply. World oil demand is surging to record levels, with growth being driven by a number of factors, including a rebound in air travel, increased oil use in power generation, and strong demand from China’s petrochemical industry. Demand is expected to rise by 2.2 mb/d in 2023, reaching 102.2 mb/d. China is expected to account for more than 70% of this growth. Additionally, major oil-producing countries, including Saudi Arabia, also recently announced that they would be extending the voluntary oil cuts to year-end, putting more constraints on oil supply, and driving up oil prices in the near term. Saudi Arabia will be extending its voluntary oil cut of 1mn barrels per day to the end of 2023, and Moscos will be extending its voluntary oil cut of 300,000 barrels per day to end of 2023, with both countries to still review the cuts monthly. Consequently, the cost of oil is anticipated to increase within the market.

- 1H23 earnings. Revenue rose by 24.1% YoY to RMB18.9bn, compared to RMB15.2bn in 1H22. Net profit rose 31.0% YoY to RMB1.46bn, compared to RMB1.11bn in 1H22. Basic EPS rose by 21.1% YoY to RMB28.06, compared to RMB23.17 in 1H22.

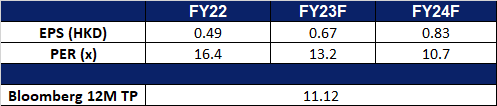

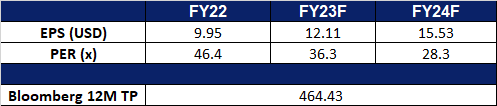

- Market Consensus.

Share price and Brent crude oil price correlation

(Source: Bloomberg)

(Source: Bloomberg)

Baidu, Inc. (9888 HK): Autobots, roll out!

- RE-ITERATE BUY Entry – 138 Target – 148 Stop Loss – 133

- Baidu Inc is a Chinese language Internet search provider. The Company offers a Chinese language search platform on its Baidu.com Website that enables users to find information online, including Webpages, news, images, documents and multimedia files, through links provided on its Website. The Company operates through two segments, Baidu Core segment and iQIYI segment. Baidu Core mainly provides search-based, feed-based, and other online marketing services, as well as products and services from the Company’s new artificial intelligence (AI) initiatives. Within Baidu Core, the Company’s product and services offerings are categorized as Mobile Ecosystem, Baidu AI Cloud and Intelligent Driving & Other Growth Initiatives. iQIYI is an online entertainment service provider that offers original, professionally produced and partner-generated content on its platform.

- Ernie Bot. Chinese authorities granted their approval for the tech giant Baidu to introduce its artificial intelligence Ernie Bot to the general public, commencing on 31st August 2023. Baidu achieved the distinction of being the first company to secure such approval, overcoming previous regulatory obstacles. Additionally, Baidu is gearing up to unveil a collection of new AI-native applications. This puts Baidu at the same competitive edge with other large language model competitors such as Google’s Bard, and OpenAI’s Chat-GPT.

- AI to drive more growth. With the successful approval of Baidu’s Ernie bot by the Chinese authorities,Baidu would be able to make use of AI to complement its online business. The use of AI allows Baidu to better match advertising to Baidu’s search queries, which in turn helped boost the company’s quarter’s online marketing sales growth.

- Driverless Taxis. Baidu’s self-driving taxi initiative has achieved a significant milestone by becoming the inaugural provider of autonomous transportation to and from airports in China. The introduction of Baidu’s Apollo Go service at Wuhan Tianhe International Airport signifies a groundbreaking achievement as it marks the first instance in China where an autonomous ride-hailing service seamlessly connects urban areas with an airport. Furthermore, this accomplishment also represents the pioneering integration of Chinese autonomous vehicles on both urban roads and highways.

- 1H23 earnings. Revenue rose by 15% YoY to RMB34.1bn, compared to RMB29.6bn in 1H22. Net profit rose 43% YoY to RMB5.2bn, compared to RMB3.6bn in 1H22. Basic EPS rose by 42% YoY to RMB14.17, compared to RMB9.97 in 1H22.

- Market Consensus.

(Source: Bloomberg)

Advanced Micro Devices Inc (AMD US): Generative new AI high

- BUY Entry – 108 Target – 116 Stop Loss – 104

- Advanced Micro Devices, Inc. (AMD) produces semiconductor products and devices. The Company offers products such as microprocessors, embedded microprocessors, chipsets, graphics, video and multimedia products and supplies it to third-party foundries, as well as provides assembling, testing, and packaging services. AMD serves customers worldwide.

- Improvement in interests. AMD CEO said that demand for AI semiconductors remains strong, with the company seeing continued acceleration of engagements for AI in the data center over the past 30 days. She also added that the market for AI semiconductors is skyrocketing and that AMD is one of the few companies that offers a complete AI technology portfolio across chips and software. The company expects the market for AI accelerators in data centers to reach $150 billion by 2027, and its upcoming MI300 AI accelerator is on track to launch during the fourth quarter. The company’s AI roadmap and customer interest in the MI300X processor indicates the potential for continued growth in the data center, with the product line expected to bolster margins. Although AMD is a laggard in the chip market, we believe funds will soon rotate into AMD shares. This is due to the company’s strong growth prospects in the AI market, as well as its competitive position in the server CPU market.

- US AI chip export restictions. The US government has expanded export restrictions on AI chips made by Nvidia and AMD beyond China to some countries in the Middle East. It is unclear what risks are posed by exports to the Middle East. However, the restrictions to China are likely to have a significant impact on China’s AI capabilities, as the country will need help accessing American chips necessary for carrying out advanced computing tasks. This could have a knock-on effect on China’s military capabilities. The US government’s decision to expand export restrictions on AI chips is a sign that it is willing to take more aggressive measures to counter China’s technological advances. However, it was noted that these restrictions imposed will have no material impact on AMD’s revenue.

- Latest GPUs. AMD has released two new mid-range GPUs, the RX 7700 XT and RX 7800 XT. Both cards are aimed at 1440p gaming and offer more VRAM than their Nvidia counterparts. The RX 7700 XT is priced at $449 and offers 12GB of VRAM, while the RX 7800 XT is priced at $499 and offers 16GB of VRAM. Both cards perform well at 1440p, beating Nvidia’s RTX 4060 Ti and RTX 4070 respectively. However, the RX 7800 XT does not offer a significant generational leap over the RX 6800 XT, which is still a good option for 1440p gaming. The RX 7700 XT and RX 7800 XT both use eight-pin power connectors, but the RX 7800 XT is more power-efficient than the RX 6800 XT.

- 2Q23 earnings review. Revenue fell 18.2% year-over-year to US$5.36bn, beating estimates by US$40mn. Non-GAAP EPS of $0.58 beat expectations by $0.01. It reported an increase in AI engagement by over 7 times, as the company saw more customers initiate or expand programs supporting future deployments of Instinct accelerators.

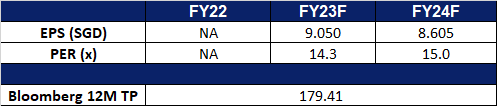

- Market consensus.

(Source: Bloomberg)

Netflix Inc (NFLX US): A hot show strikes again

Netflix Inc (NFLX US): A hot show strikes again

- RE-ITERATE BUY Entry – 438.0 Target – 475.0 Stop Loss – 419.5

- Netflix, Inc. operates as a subscription streaming service and production company. The Company offers a wide variety of TV shows, movies, anime, and documentaries on internet-connected devices. Netflix serves customers worldwide.

- Live-action. Netflix’s new Japanese pirate series “One Piece,” which is a live-action adaptation of a popular manga franchise, has garnered positive reviews and social media buzz. The show focuses on pirates in search of a legendary treasure and has been well-received by fan communities. It achieved a 95% audience approval rating on RottenTomatoes, although critics rated it slightly lower at 80%. Adapting anime into live-action has historically been challenging, with many previous attempts falling short of fan expectations. However, Netflix took seven years to adapt “One Piece,” working closely with the creator and experienced directors who are fans of Japanese comics to ensure a faithful adaptation. This effort seems to have paid off with a strong initial response from viewers. The successful adaptation of “One Piece” opens the door for Netflix to explore more adaptations of beloved series.

- Gaming expansion. Netflix has been gradually introducing gaming to its platform, aiming to provide a diverse range of games for its subscribers. While it has been offering mobile games since November 2021, it has taken a cautious approach to understand the gaming market better. This strategy, focused on mobile games initially, is seen as a clever move to avoid the pitfalls experienced by other media brands entering the gaming industry. Netflix intends to leverage its intellectual property to create unique gaming experiences, aiming to make gaming more accessible to a wider audience. The success of this approach will become clear in the future as Netflix continues to evolve its gaming offerings.

- Docu-series popularity. Netflix has taken a unique approach to sports programming by creating a deep catalogue of docu-series about various sports and athletes, rather than investing in live sports broadcasting rights, which can be costly and challenging. This strategy allows Netflix to tap into the sports-loving audience while avoiding the logistical challenges of live broadcasting. These sports docu-series are typically more cost-effective to produce and have a longer shelf life compared to live sports events. The success of series like “Formula 1: Drive to Survive” has demonstrated the appeal of this approach. Through this innovative and creative approach, Netflix has distinguished itself in the streaming industry, establishing a strong presence in the sports docu-series category.

- 2Q23 earnings review. Revenue rose 2.8% year-over-year to US$8.19bn, missing estimates by US$100mn. GAAP EPS of $3.29 beat expectations by $0.44. It reported an increase of 5.9mn subscribers after its crackdown on password sharing.

- Market consensus.

(Source: Bloomberg)

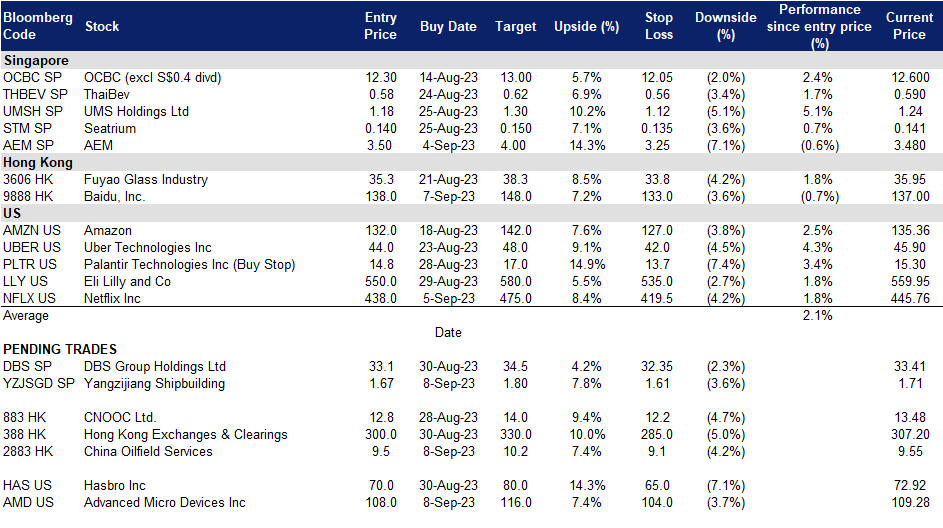

Trading Dashboard Update: Add Baidu Inc. (9888 HK) at HK$138.0 and Netflix Inc. (NFLX US) at US$438.0.