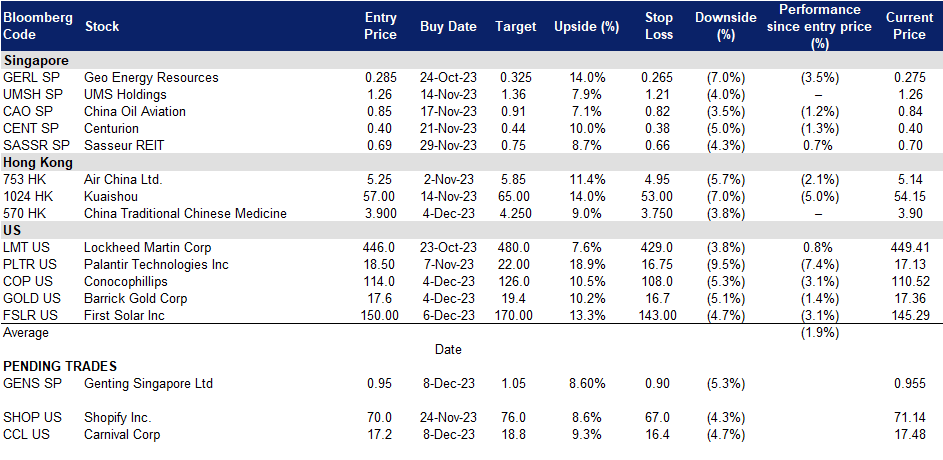

8 December 2023: Genting Singapore Ltd (GENS SP), China Traditional Chinese Medicine Holdings Co. Limited (570 HK), Carnival Corp (CCL US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

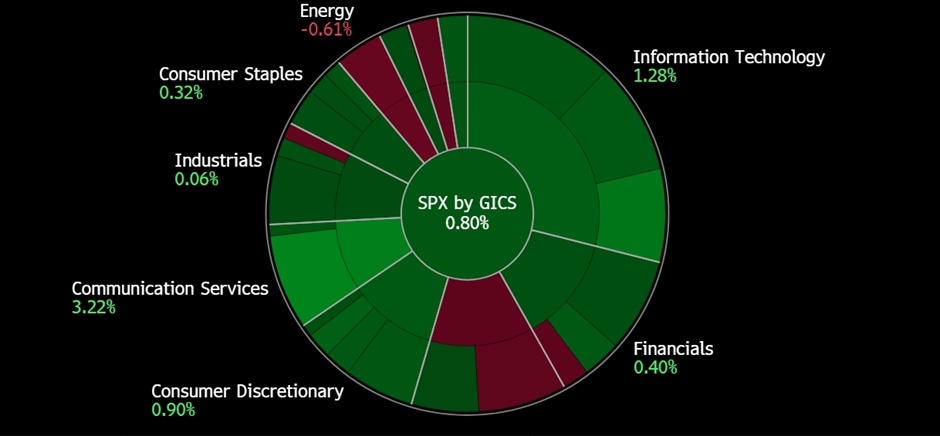

United States

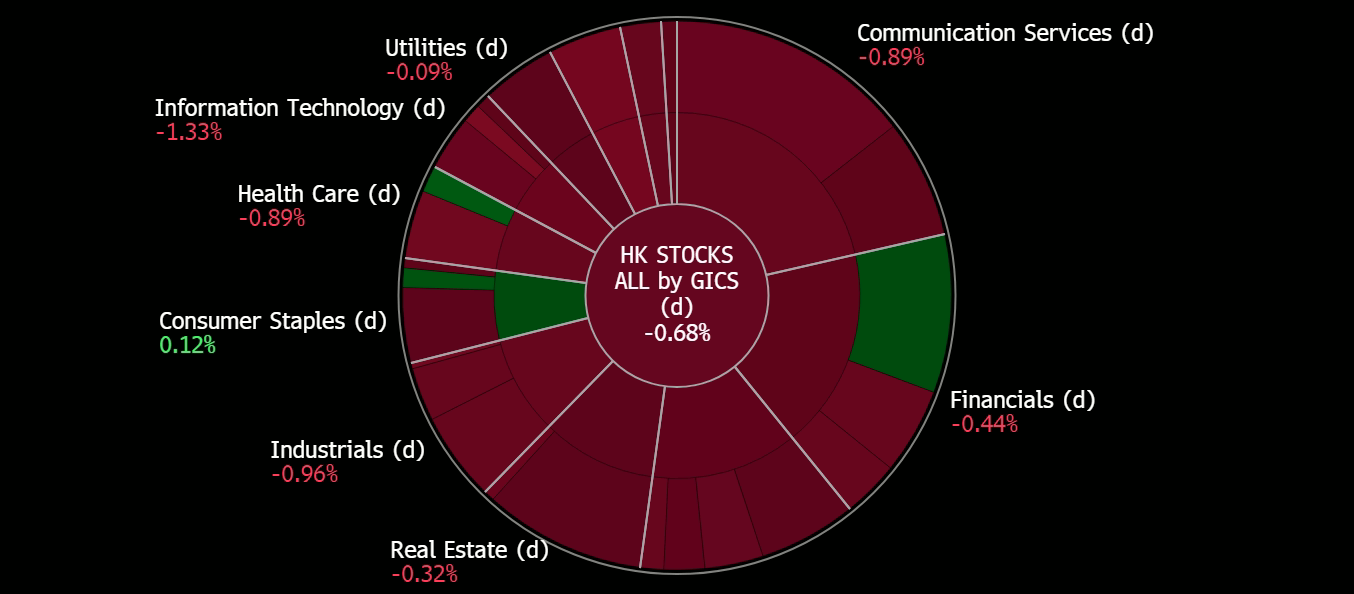

Hong Kong

Genting Singapore Ltd (GENS SP): China-Singapore mutual visa-free in 2024

- BUY Entry 0.95 – Target – 1.05 Stop Loss – 0.90

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

- 30-day mutual visa-free between Singapore and China. During the 19th Joint Council for Bilateral Cooperation, Singapore and China achieve a 30-day mutual visa-free arrangement. The implementation is expected to be in early 2024. Accordingly, Chinese visitor arrivals are estimated to further increase. Hence, Singapore Resorts World Sentosa shall see improvements in its revenue streams in 2024.

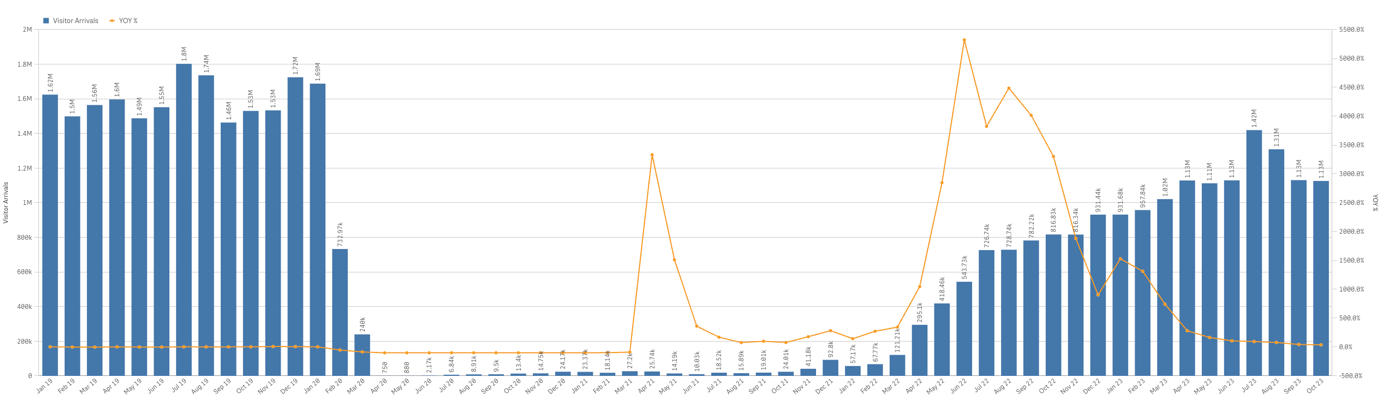

- Still has room for visitor arrivals to recover. Visitor arrivals to Singapore further improved in 2023. However, recent figures show that the number of visitors travelling to Singapore has flattened. Compared to the pre-CVOID level, tourism has not fully recovered. There is room for recovery as the average number of arrivals was above 1.5mn per month while the YTD number is around 1.1mn per month.

Singapore monthly visitor arrivals trend (2019-2023)

(Source: Singapore Tourism Analytics Network)

- Correlation between tourists and revenue. Genting Singapore reported a significant increase in net profit and revenue for 1H23. The company attributed this improved performance to an increase in foreign visitor arrivals to Singapore, despite challenges such as limited air capacity from certain regional countries and higher airfares affecting leisure travel. Resorts World Sentosa (RWS) saw a 37% growth in adjusted earnings in 2Q23, mainly due to a rebound in the non-gaming business, a strong VIP win rate, and a recovery in regional gaming activities. Gross gaming revenue also rose 3% on a hold-normalised basis, reaching $547.9mn. We anticipate continued growth in Genting’s revenue from the increase in visitor arrivals in 2H23 alongside its strong VIP gaming segment and keys added to its newly refurbished Ora Hotel.

- Project timeline. Genting Singapore previously mentioned that it aims to begin construction in FY24 after government approvals on the new Waterfront building, the Equarius Hotel extension and the Health and Wellness Centre.

- 1H23 earnings. The company revenue rose to S$1,080.4mn, +63% YoY compared to 1H22. The company’s net profit for the period was S$276.7mn, more than 3 times the net profit in 1H22 of S$84.4mn. Basic earnings per share were S$2.29 cents compared to the previous S$0.70 cents in 1H22. It also paid out an interim dividend of S$1.5cents on 22 September 2023.

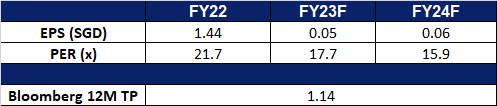

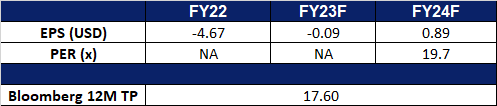

- Market Consensus.

(Source: Bloomberg)

Centurion Corp Ltd (CENT SP): Early signs of a re-rating catalyst

Centurion Corp Ltd (CENT SP): Early signs of a re-rating catalyst

- RE-ITERATE BUY Entry 0.40 – Target – 0.44 Stop Loss – 0.38

- Centurion Corporation Limited specialises in owning and operating worker and student accommodation assets. It ranks among Singapore’s largest owner-operators of high-quality worker accommodations in Singapore and Malaysia. Additionally, the company manages student accommodation properties across Singapore, Australia, the United Kingdom, and the United States.

- Sale and leaseback agreement. On 4 December, Centurion announced that it had entered into a sale and leaseback agreement with Malaysia’s public sector pension fund, Kumpulan Wang Persaraan (Diperbadankan) [KWAP], involving two of its Malaysia assets, Westlite Bukit Minyak and Westlite Tampoi. KWAP will acquire these assets for RM 227mn, and Centurion will lease them back for a 15-year term. This strategic move aligns with Centurion’s portfolio rationalisation and asset-light growth strategy, allowing the company to recycle and deploy capital for further expansion in response to the rising demand for Purpose-Built Workers Accommodation (PBWA) in Malaysia. As of September 2023, Centurion’s Malaysia PBWA portfolio bed capacity was 26,603 beds, with a 93% financial occupancy rate in 3Q23. The company will continue to enhance its portfolio through initiatives like Asset Enhancement Initiatives (AEIs) and management contracts for new PBWAs.

- Rate cut expectations. Global inflation is on track to decline, and major central banks increasingly signal peak rates. The October US inflation was unchanged, and the core CPI rose by 0.2% MoM and 4.0% YoY, further reinforcing the expectations of the end of rate hikes as the Fed weigh the inflation target as the key factor to decide its key rate path. The ECB signalled that it would maintain the current key rates for a couple of quarters. British inflation fell more than expected in October, mitigating the pressure of further rate hikes. Australia hiked another 25bps in November, and economists expected that this would be the last rate hike.

- Potential valuation pump-up and re-rating. Centurion remains its asset-heavy model, and hence, the peak rate and ensuing rate cut cycle is the largest tailwind for the company. Besides, the overall portfolio is healthy along with recovering cash flows as worker and student dormitories are in demand in the post-COVID period. Furthermore, the potential lower refinancing rate and interest burden will help improve profitability.

- 3Q23 business updates. Total revenue increased by 15% YoY to S$51.0mn. 9M23 revenue increased by 10% YoY to S$149.0mn. The respective 9M23 financial occupancy of PBWA and PBSA were 96% and 90%, up from 88% and 84% in 9M22. As of 3Q23, the total asset under management was S$1.9bn with 66,607 operations beds in 34 properties in 15 cities globally.

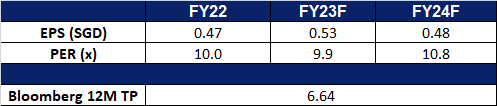

- Market consensus. We have a fundamental coverage with a BUY recommendation and a TP of S$0.56. Please read the full report here.

(Source: Bloomberg)

China Traditional Chinese Medicine Holdings Co. Limited (570 HK): Protection for winter flu

- RE-ITERATE BUY Entry – 3.90 Target – 4.25 Stop Loss – 3.75

- China Traditional Chinese Medicine Holdings Co. Limited is principally engaged in the manufacture and sales of traditional Chinese medicine (TCM). The Company operates through 12 subsidiaries, including Sinopharm Group Dezhong (Foshan) Pharmaceutical Co., Ltd., Sinopharm Group Feng Liao Xing (Foshan) Pharmaceutical Co., Ltd., Sinopharm Group Guangdong Medi-World Pharmaceutical Co., Ltd., Sinopharm Group Luya (Shandong) Pharmaceutical Co., Ltd., Sinopharm Group Feng Liao Xing (Foshan) Medicinal Material & Slices Co., Ltd., Foshan Winteam Pharmaceutical Sales Company Limited, Sinopharm Group Tongjitang (Guizhou) Pharmaceutical Co., Ltd., Sinopharm Group Jingfang (Anhui) Pharmaceutical Co., Ltd., Sinopharm Group Longlife (Guizhou) Pharmaceutical Co., Ltd., Qinghai Pulante Pharmaceutical Co., Ltd., Guizhou Zhongtai Biological Technology Company Limited and its subsidiaries and Jiangyin Tianjiang Pharmaceutical Co., Ltd. and its subsidiaries.

- China experiencing a respiratory illness outbreak. Seasonally, respiratory illness cases increase during winter season, especially in the norther part of China. However, a recent surge in flu and pneumonia cases in China raised concerns about whether COVID spread resumed. No new virus has been detected so far, and experts believe that the three-year lockdown policy protected most Chinese residents from COVID virus, and hence, a lack of antibodies contributes to people’s weakened immunity against COVID-like flu and pneumonia.

- Traditional Chinese medicines in demand. Thought traditional Chinese medicine is not the specialised drugs to treat flu or pneumonia, it is considered a supplementary treatment. Families are stocking up on traditional Chinese medicines and pills in case members have similar symptoms. The authorities have recently released the 2023 Winter Influenza Chinese Medicine Prevention and Treatment Plan for Beijing. Consequently, the demand for these medicines is likely to increase throughout the winter and early spring seasons.

- 1H23 results update. Revenue jumped by 57.4% YoY to RMB9.3bn. GPM was 51.1%, up 0.7ppts YoY. Net profit jumped by 40.0% YoY to RMB557.2mn. NPM was 6.2%, up 0.3 ppts.

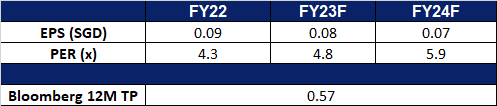

- Market consensus.

(Source: Bloomberg)

(Source: Bloomberg)

Air China Ltd. (753 HK): Flights to increase going forward

- RE-ITERATE BUY Entry – 5.25 Target – 5.85 Stop Loss – 4.95

- Air China Limited is a China-based company principally engaged in the provision of air passenger transportation, freight transportation, postal transportation and maintenance services in Mainland China, Hong Kong, Macau and foreign regions. The Company is also engaged in domestic and international business aviation businesses, plane business, aircraft maintenance, airlines business agents, ground and air express services related to main businesses, duty free on boards, retail business on boards and aviation accident insurance sales agents business.

- Returning to Profit. Air China returned to profitability during the initial nine months of the year, driven by a substantial increase in business and leisure travel after Beijing eased stringent COVID-19 restrictions. With the increase in deployment of transportation capacity by the company, and driven by the increase in both passenger load factor and price, the loss decreased significantly with growth in profit.

- More flights between China and the US. The US Department of Transportation announced that flights between China and the US will increase to 70 a week starting on 9 November, from the current 48 a week. The average flights between the two counties averaged 340 a week in the pre-COVID period. Recently, China and the US top officials started visiting each other, signalling some improvements in China-US relations.

- Rising seasonal travel demand. With the peak travel season coming up in November, travel demand is bound to pick up as consumers make their plans to travel for the end of the year, to escape the winter cold, or to experience the winter season. This winter holiday is also the first winter holiday since China’s reopening in Jan earlier this year, and hence is likely to see a rise in travel volume over the period. Chinese airlines have also seen a rise in scheduled flights for winter-spring, scheduling 96,651 domestic cargo and passenger flights each week for the upcoming winter-spring season, an increase of 33.95% from the same period in 2019-2020, according to the Civil Aviation Administration of China (CAAC). 516 new domestic routes will also be opened from Oct 29 to March 30 next year,, providing 7,202 flights each week, according to the CAAC. In terms of international flights, 150 domestic and foreign airlines plan to arrange 16,680 flights per week, reaching 68 foreign countries.

- 3Q23 earnings. Revenue rose to RMB45.86bn, up 152.89% YoY. Net profit was RMB 4.07bn, returning to profit for the first time for the year. Basic earnings per share was RMB0.28.

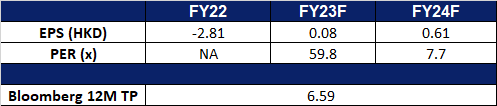

- Market Consensus.

(Source: Bloomberg)

Carnival Corp (CCL US): Sailing round the world

- BUY Entry – 17.2 Target – 18.8 Stop Loss – 16.4

- Carnival Corporation owns and operates cruise ships offering cruises to all major vacation destinations including North America, United Kingdom, Germany, Southern Europe, South America, and Asia Pacific. The Company, through a subsidiary also owns and operates hotels and lodges. Dually-listed company with CCL LN.

- Heightened travel demand for the holidays. With the holiday season approaching, the travel industry is gearing up for a festive season bonanza. Eager travellers, flush with disposable income and a thirst for adventure, are setting their sights on exciting vacations and memorable cruises. This presents a perfect storm of opportunity for investors to navigate the high seas of profit with Carnival Corporation, the undisputed champion of the global cruise industry. With a market share of roughly 48%, CCL is the market leader in the cruise industry and therefore stands to benefit the most from this uptick in demand. So far, bookings have exceeded pre-pandemic levels, showcasing the company’s resilience and continued appeal.

- Partnership with Neuron. On December 5th, CCL entered into a strategic partnership with Neuron, a leading connectivity management platform. The collaboration is geared towards elevating onboard connectivity across CCL’s extensive global fleet of cruise ships. By leveraging Neuron’s advanced connectivity management tools and business intelligence solution, CCL aims to deliver an enhanced internet experience, ensuring faster and more reliable connectivity for both guests and crew. This partnership underscores CCL’s dedication to providing the utmost in-sea connectivity and prioritizing guest satisfaction.

- 3Q23 results. Carnival Cruise Line reported robust financial performance for 3Q23, with a revenue of $6.85bn, marking a significant 59.2% YoY increase. The company achieved notable operating income and net income of $1.62bn and $1.07bn, respectively, a substantial improvement from the previous year’s quarter, which saw an operating loss of $279mn and a net loss of $770mn. Furthermore, CCL’s earnings per share (EPS) stood at $0.79, a positive turnaround from the loss per share of $0.65 the year before. Looking ahead, CCL’s revenue is expected to grow 37.1% YoY, reaching $5.26bn and it is also projected to show an 83.8% YoY improvement in EPS.

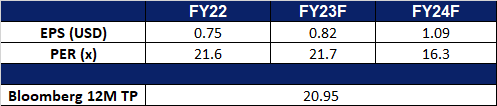

- Market consensus.

(Source: Bloomberg)

Barrick Gold Corp (GOLD US): A rate-cut bet

- RE-ITERATE BUY Entry – 17.6 Target – 19.4 Stop Loss – 16.7

- Barrick Gold Corporation is an international gold company with operating mines and development projects in the United States, Canada, South America, Australia, and Africa.

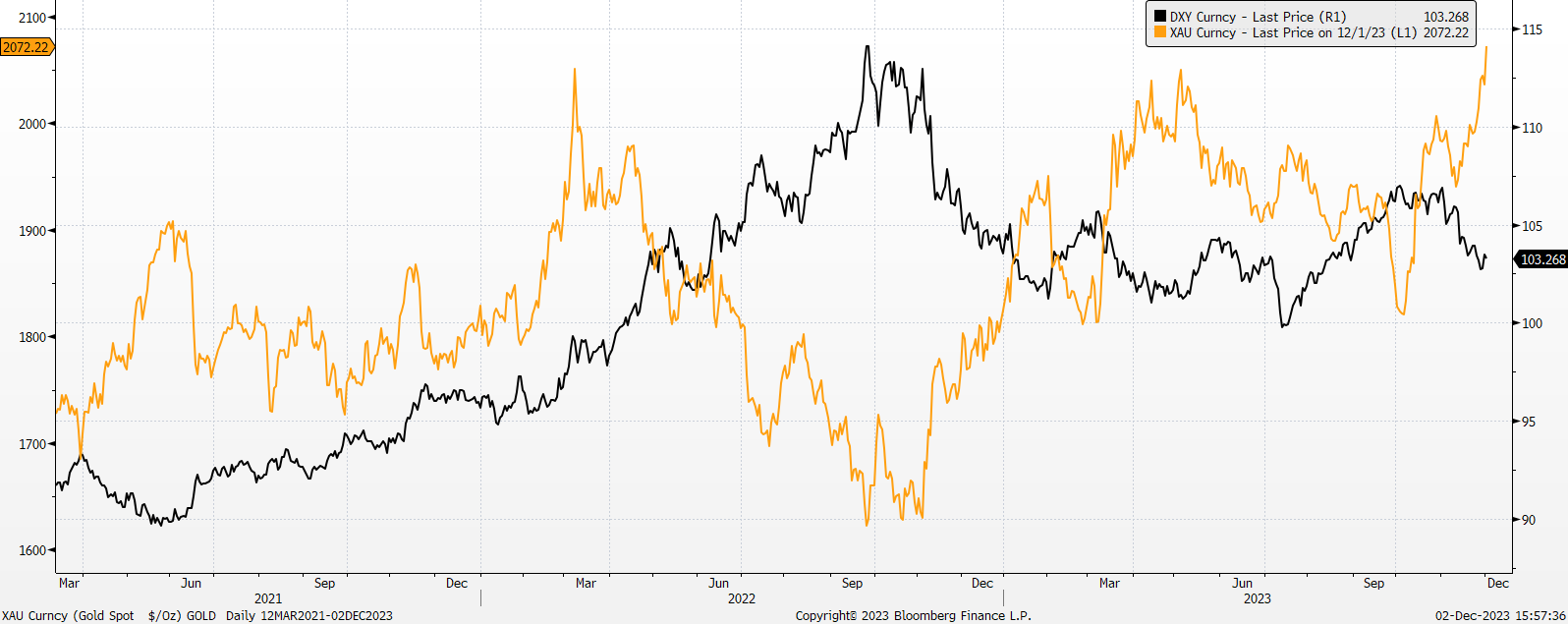

- Inflation easing. The anticipated conclusion of the current interest rate hike cycle is slated for the upcoming year. The Federal Reserve’s trajectory for US interest rate adjustments remains anchored in the pivotal long-term 2% inflation target, as underscored by recent addresses from various branch chairmen. Notably, recent inflation data suggests a notable easing of inflationary pressures in the United States. In October, the personal consumption expenditures (PCE) price index, rose 0.2%, in line with expectations, showing a 3.5% increase YoY. Personal income and spending both rose 0.2%, meeting estimates and suggesting consumers are keeping pace with inflation. Despite headline inflation remaining flat at 3% for the month, energy price decreases offset food price increases. Goods prices fell 0.3%, while services rose 0.2%, with notable gains in international travel, health care, and food services. Continuing unemployment claims surged to 1.93mn, the highest since 27 November 2021. This has prompted the market to accelerate its timeline for anticipating a Federal Reserve interest rate reduction, now anticipated in the second quarter of the coming year. Concurrently, both the 10-year and 30-year US bond interest rates, along with the US dollar index, have experienced recent declines. Conversely, the price of gold has rebounded, surging to levels reminiscent of May this year and surpassing the significant $2,000/oz threshold once more.

Gold Price vs Dollar Index

(Source: Bloomberg)

- Geopolitical unease remains elevated. Despite recent alleviation in tensions between China and the United States, the overall outlook remains cautious. As we approach 2024, anticipated geopolitical uncertainties loom, notably with the Taiwan election in January and the US election in November. The prevailing risk aversion continues to underpin elevated gold prices.

- 3Q23 results. Revenue rose 13% YoY, to US$2.86bn. Non-GAAP EPS beat estimates by US$0.04 at US$0.24. Expect stronger 4Q23 results, but FY23 gold production to be slightly below previous guidance range of US$4.2mn/oz to US$4.6mn/oz.

- Market consensus.

(Source: Bloomberg)

(Source: Bloomberg)

Trading Dashboard Update: Add First Solar (FSLR US) at US$150. Cut loss on Sembcorp Industries (SCI SP) at S$4.88 and Tianjin Pharmaceutical Da Re Tang (TIAN SP) at S$1.96.