6 December 2024: DBS Group Holdings Ltd (DBS SP), Yidu Tech Inc (2158 HK), Tapestry Inc (TPR US)

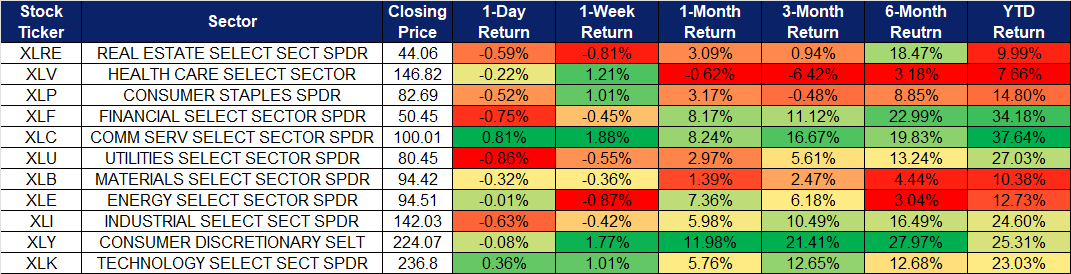

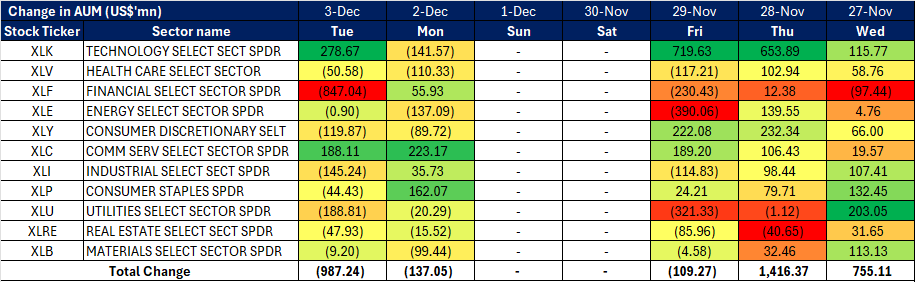

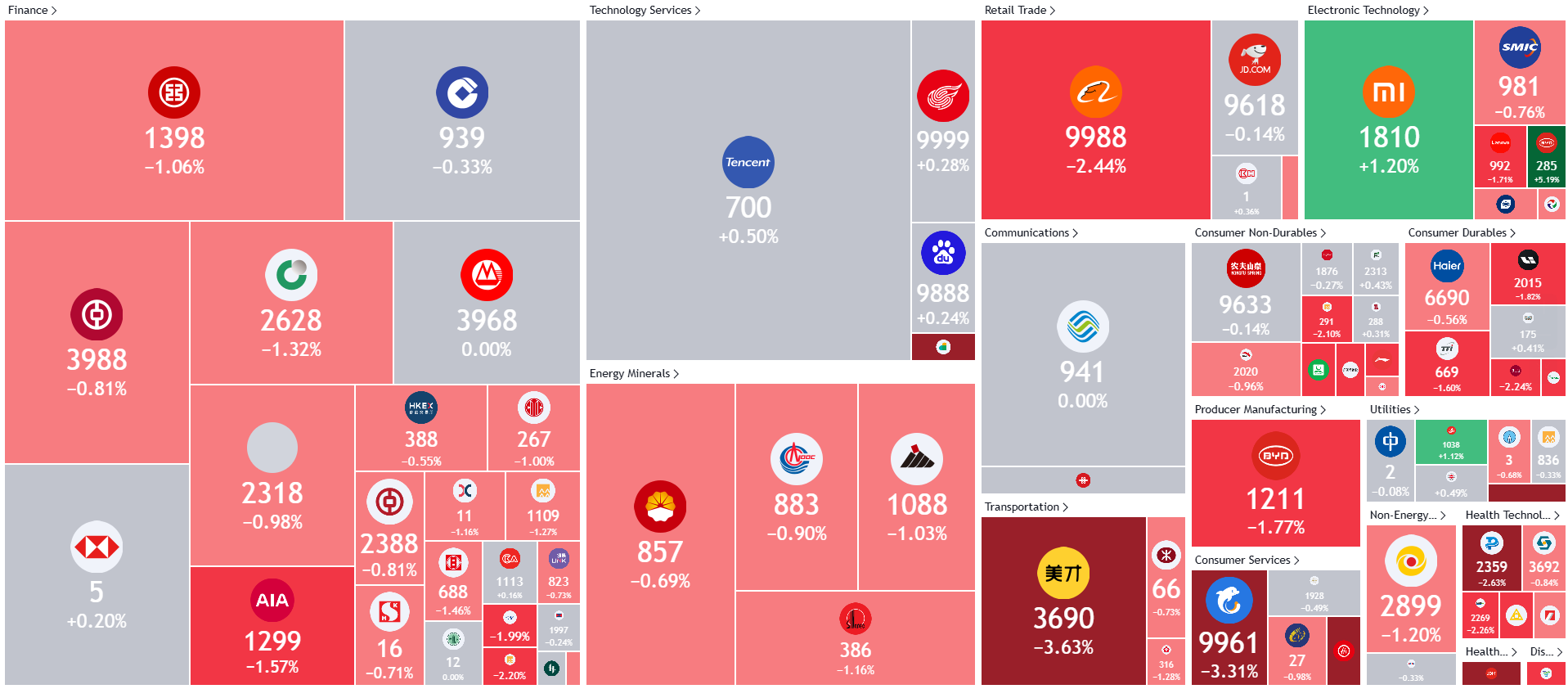

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

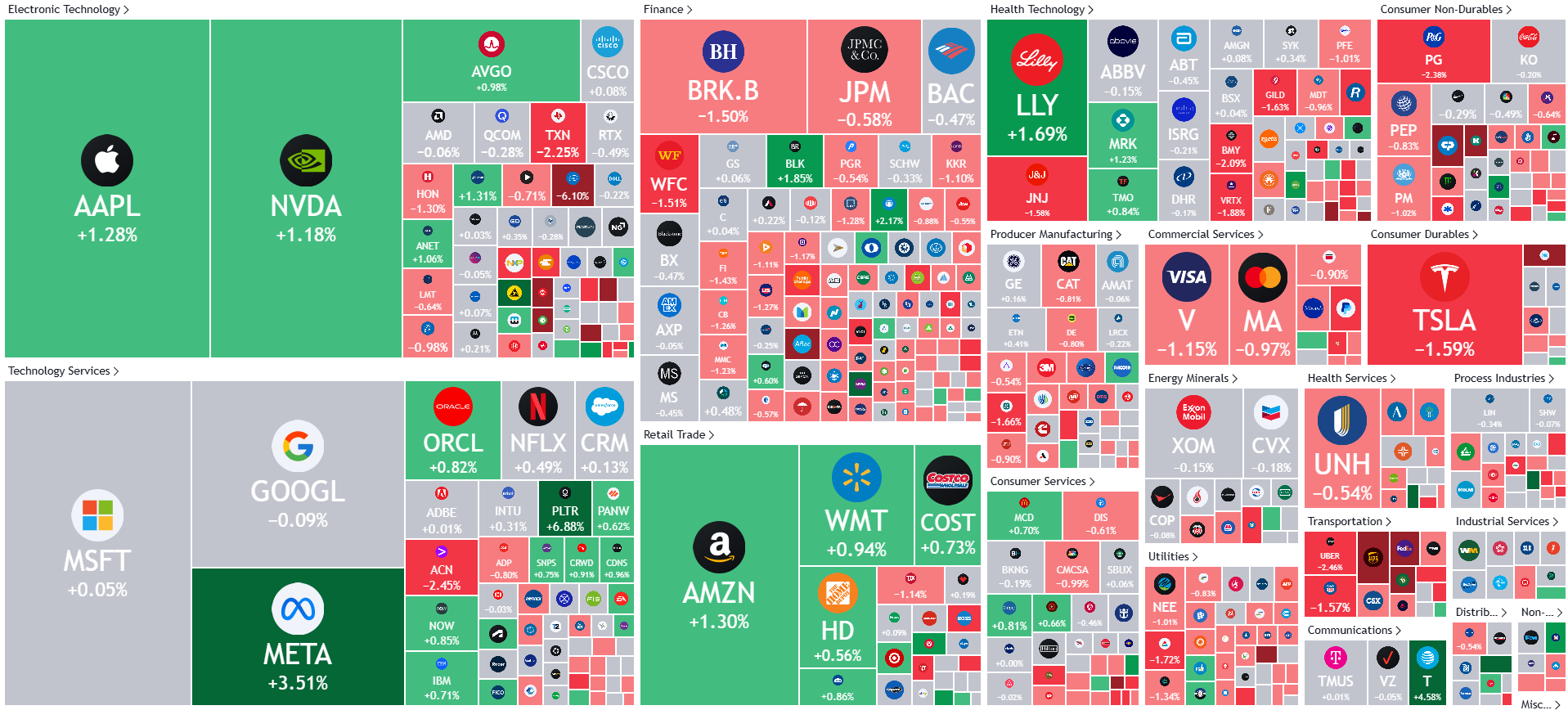

United States

Hong Kong

DBS Group Holdings Ltd (DBS SP): Visionary move

- BUY Entry – 44 Target– 48 Stop Loss – 42

- DBS Group Holdings Limited and its subsidiaries provide a variety of financial services. The Company offers services including mortgage financing, lease and hire purchase financing, nominee and trustee, funds management, corporate advisory and brokerage. DBS Group also acts as the primary dealer in Singapore government securities.

- Reaping benefits from wealthy Russians. DBS Group Holdings has expanded its wealth management team to serve affluent Russian clients, navigating global sanctions-related complexities while ensuring strict compliance. Recent hires include two Russian-speaking private bankers, bringing the total to at least nine in Singapore. Over the past two years, DBS has recruited talent from Credit Suisse and Julius Baer, attracting over US$1 billion in client assets after Credit Suisse exited its Singapore-based Russian wealth operations. While Russian assets represent a small fraction of DBS’s US$401 billion under management, this segment has shown significant growth. To ensure compliance, Russian clients must hold at least US$20 million in assets and undergo rigorous screening to verify wealth sources and confirm they are not under sanctions. As global competitors like UBS, HSBC, and OCBC exit Russian transactions due to regulatory challenges, DBS benefits from reduced competition, gaining access to a larger client pool. With plans to double wealth management fees by 2027, this team expansion better positions DBS’s wealth management division to achieve its goal, boosting its assets under management and solidifying its presence in Asia’s expanding wealth market.

- IMDA partnership. DBS and the Infocomm Media Development Authority (IMDA) have launched the Spark GenAI program to encourage Singapore’s SMEs to adopt generative AI (gen AI) solutions. With only 4.2% of SMEs currently using AI, the program aims to engage 50,000 businesses over two years, guiding on integrating gen AI into operations such as customer engagement and marketing. Spark GenAI will offer online resources, quarterly workshops, tailored solution recommendations, and access to grants from IMDA and EnterpriseSG. It will also enhance digital resilience through cyber insurance and a cyber wellness course. As Southeast Asia’s digital economy is projected to reach S$352 billion by 2024, DBS emphasizes the importance of innovation for SMEs to remain competitive. Through these advanced technology solutions, DBS will help to drive SME growth and cement its relationship with this key client segment.

- 3Q24 results review. Total income for 3Q24 rose 11% to S$5.75bn and net profit rose 15% YoY to surpass S$3bn for the first time. DBS announced a new S$3bn share buyback programme and declared Q3 dividend at S$0.54 per share.

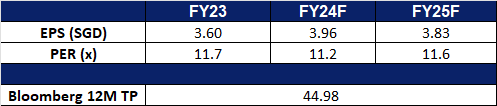

- Market Consensus.

(Source: Bloomberg)

CSE Global Ltd (CSE SP): Benefitting from global trends

- RE-ITERATE BUY Entry – 0.460 Target– 0.490 Stop Loss – 0.445

- CSE Global Limited provides systems integration and information technology solutions, computer network systems, and industrial automation. The Company also designs, manufactures, and installs management information systems. CSE Global develops, manufactures, and sells electronic and micro processor monitoring equipment.

- Reaping benefits from the AI trend. The rapid growth of artificial intelligence, particularly generative AI, is driving a significant surge in energy demand from data centers due to the resource-intensive computing processes required. Companies like Google, Apple, and Tesla are enhancing AI capabilities, further increasing electricity consumption in energy-hungry data centers. By 2027, global AI-related electricity usage is projected to rise by 64%, reaching 134 terawatt-hours annually, with broader data center consumption potentially doubling by 2030 to account for 9% of U.S. electricity demand. The IEA estimates global electricity use for AI, data centers, and crypto will grow nearly 75% from 460 TWh in 2022 to 800 TWh by 2026. Generative AI is forecasted to become a $1.3 trillion market by 2032, expanding at a CAGR of 42%, driven by training infrastructure and inference devices. As AI adoption accelerates across industries, energy demand from data centers will continue to rise, presenting growth opportunities for CSE Global, which offers data center and electrification solutions within its business segments.

- To benefit from a transition to renewables. The global focus on renewable energy has intensified, with many nations accelerating its adoption as a cleaner alternative to fossil fuels. The IEA reports that global renewable electricity capacity grew by an estimated 507 GW in 2023—a nearly 50% increase from 2022—driven by policy support across more than 130 countries. Projections indicate renewable capacity additions will surpass 700 GW by 2028, with solar PV and wind contributing 96% of this growth due to declining costs and robust policy backing. The United States saw a record-breaking year for renewables in 2023, installing 31 GW of solar capacity (a 55% year-over-year increase) despite supply chain delays. Solar now provides 5% of U.S. electricity, while wind energy, representing 11% of electricity generation, reached 147 GW in capacity by Q3 of 2023. Globally, China has made remarkable progress, with wind and solar collectively surpassing coal in installed capacity as of mid-2024. This transition underscores a broader global shift toward cleaner energy sources. The rising adoption of renewables is expected to drive demand for electrification projects, presenting growth opportunities for CSE Global in its key markets.

- Continued strength in Order Intake & Order Book. CSE Global’s order book fell marginally by 0.7% to S$633.6mn in 3Q24, compared to S$638.0mn in 3Q23. On the other hand, order intake declined by 18.1% to S$565.4mn in 9M24, compared to S$690.0mn in 9M23, largely due to a stronger base in 3Q23 and 4Q23. CSE Global also announced in early November that the company has secured 2 major contracts totalling S$38.4mn in the U.S., which are slated for execution from 2024 to 2026. The company also secured another major electrification contract worth S$90.7mn in the U.S., slated for execution between 2025 and 2026. This is bound to provide a boost to the company’s order book and order intake in 4Q24. The company’s order book remains robust, and CSE Global continues to be well-positioned to achieve a healthy financial performance in 2024. The company’s robust order book also re-emphasizes the company’s credibility, and enhanced market position, allowing for the company to have stronger bargaining power.

- 9M24 business updates. CSE Global reported a total revenue of S$642.8mn for 9M24, increasing by 20.2% YoY, compared to S$534.7mn in 9M23, mainly attributed to growth across all business segments and geographical regions. In the company’s 1H24 financial results, net profit increased by 36.4% YoY to S$15.0mn, compared to S$11.0mn in 1H23. The group’s EPS was 2.31 Singapore cents in 1H24, compared to 1.79 Singapore cents in 1H23.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.53. Please read the full report here.

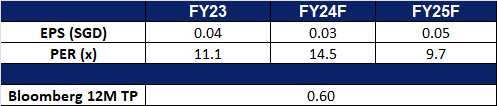

- Market Consensus.

(Source: Bloomberg)

Yidu Tech Inc (2158 HK): AI in healthcare

- BUY STOP Entry – 5.40 Target 6.40 Stop Loss – 4.90

- Yidu Tech Inc is a China-based investment holding company that mainly provides medical big data solutions. The Company operates through three segments. The Big Data Platform and Solutions segment is mainly composed of big data platform offerings and other solutions to customers. The Life Science Solutions segment is responsible for providing analysis-driven clinical development, real-world evidence (RWE)-based research, and digital commercialization solutions to pharmaceutical, biotech and medical device companies and other companies. The Health Management Platform and Solutions segment mainly operates research-driven personal health management platforms and provides insurance technology and disease management solutions to insurance companies and agencies. The Company’s main data intelligence infrastructure is YiduCore.

- Rotation to AI application. The AI investment theme is entering another segment, application, following the infrastructure (chips, data centre, and power). The software as a service (SaaS) segment has started seeing some improvement in business development, operations, and profitability owing to the adoption of AI technology, especially in using large language models in data analytics. In 2025, SaaS will be one of the key themes with a promising outlook.

- AI + Healthcare. As of September 2024, the company provided solutions to 105 top-tier hospitals in China and 40 regulators and policy makers, covering over 2,800 hospitals. The company launched the “Big Data + Large Language Model” dual middleware solution for scientific and clinical research. Approximately 50% of the R&D expenditures are allocated to the AI large model, focusing on the training of 70B parameter models.

- 1H24 earnings. Yidu Tech’s revenue decreased by 7.6% YoY from RMB356.5 million for 1H23 to RMB329.4 million in 1H24, this was primarily attributable to the decline in revenue from Life Science Solutions segment and Health Management Platform and Solutions segment. Overall, the company’s loss for the period decreased by 29.2% YoY from RMB79.6 million for 1H23 to RMB56.4 million for 1H24, due to the decline in cost of sales and other expenses. Basic loss per share rose to a loss of RMB0.04 in 1H24, compared to its loss of RMB0.07 in 1H23.

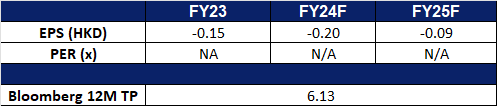

- Market consensus.

(Source: Bloomberg)

Trip.com Group Ltd. (9961 HK): Travel seasonality is back

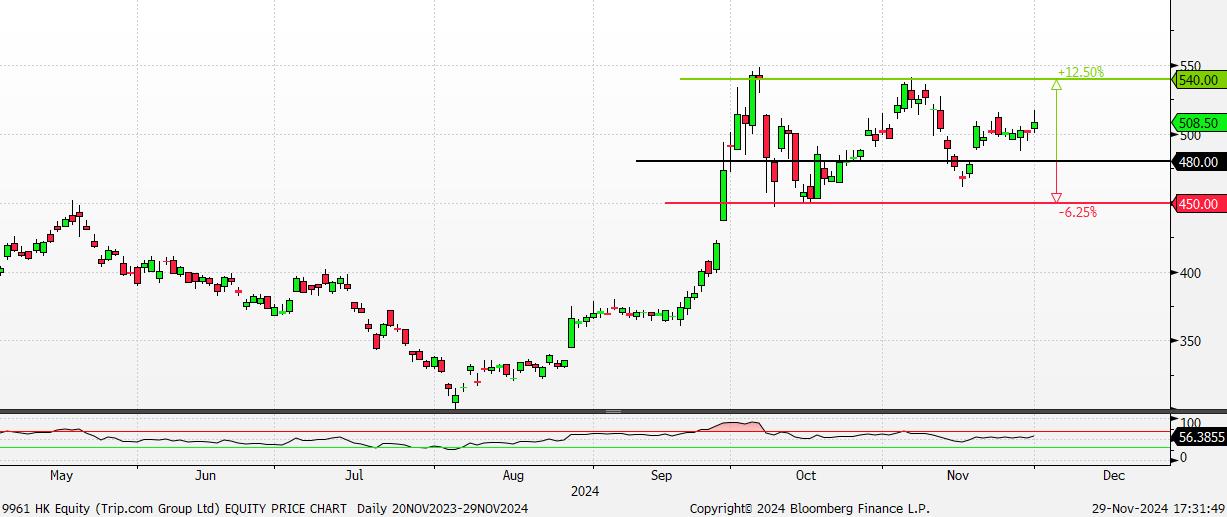

- RE-ITERATE BUY Entry – 480 Target 540 Stop Loss – 450

- Trip.com Group Ltd is a China-based company mainly engaged in the operation of one-stop travel platform. The Company’s platform integrates a comprehensive suite of travel products and services and differentiated travel content. Its platform aggregates its product and service offerings, reviews and other content shared by its users based on their real travel experiences, and original content from its ecosystem partners to enable leisure and business travelers to have access to travel experiences and make informed and cost-effective bookings. Users come to its platform for any type of trip, from in-destination activities, weekend getaways, and short-haul trips, to cross-border vacations and business trips.

- Winter travel seasonality. The approaching winter and festive seasons are anticipated to drive a surge in travel demand, as the period from early November to January is traditionally one of the busiest for travel. Many consumers are expected to take advantage of their remaining annual leave or seek seasonal getaways to escape extreme weather in their home countries. Festive celebrations during this time further amplify interest in holiday travel. Trip.com is well-positioned to capitalize on this peak travel season and the heightened demand it brings.

- Further expansion of visas. China will expand its visa-free arrangements to include Japan, Bulgaria, Romania, Croatia, Montenegro, and other countries, effective from November 30, 2024, to December 31, 2025, according to a foreign ministry spokesperson. Additionally, the visa-free stay period for citizens of all 38 countries in its program will be extended from 15 to 30 days, as reported by state broadcaster CCTV. These measures build on earlier visa-free agreements with South Korea and select European nations, aimed at stimulating tourism and trade amid economic headwinds. Furthermore, China has also eased visa rules for Shenzhen residents travelling to Hong Kong, allowing unlimited visits within a year instead of the previous one-trip-per-week limit. The expanded policy is expected to boost travel volumes to and from China, benefiting travel platforms such as Trip.com Group.

- More partnerships. Trip.com has launched a major brand campaign at Kuala Lumpur International Airport (KLIA) through a partnership with Meru Utama Sdn Bhd (VGI Airports). This initiative aligns with Trip.com’s strategy to strengthen its presence in the Southeast Asian market, leveraging KLIA’s role as a key regional hub. The campaign features prominent branding across high-traffic areas such as walkways, aerobridges, and other strategic locations, ensuring visibility to the millions of passengers passing through the airport. This collaboration enhances Trip.com’s brand visibility while reinforcing its commitment to supporting the recovery of global travel.

- 3Q24 earnings. Trip.com Group recorded better-than-expected third-quarter results amid robust local and international travel demand, with both domestic and international travel exhibiting robust growth. With increasing consumer confidence and heightened travel sentiment, the company is optimistic about the continued growth of the travel industry. The company’s revenue rose to RMB15.9bn in 3Q24, +15.6% YoY, compared to RMB13.7bn in 3Q23. The company reported a net profit of RMB6.77bn in 3Q24, compared to a net profit of RMB4.62bn in 3Q23. Basic EPS rose to RMB10.37 in 3Q24, compared to RMB7.05 in 3Q23.

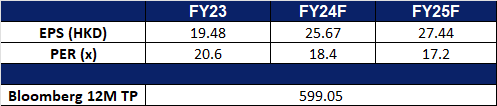

- Market consensus.

(Source: Bloomberg)

Tapestry Inc (TPR US): Deals and steals

- BUY Entry – 60 Target – 68 Stop Loss – 56

- Tapestry, Inc. designs and markets clothes and accessories. The Company offers handbags, leather goods, footwear, fragrance, jewelry, outer wear, ready-to-wear, scarves, sunwear, travel accessories, and watches. Tapestry serves customers worldwide.

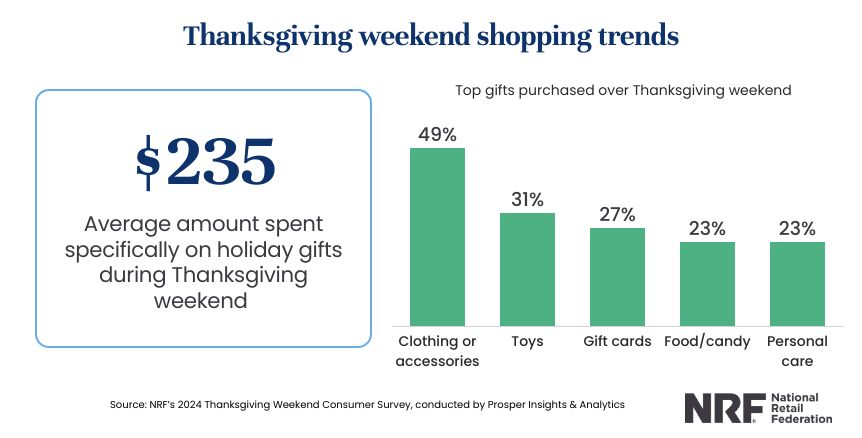

- Shopping for discounts. According to the National Retail Federation (NRF) the Thanksgiving holiday shopping weekend saw robust consumer activity, with 197 million people shopping from Thanksgiving to Cyber Monday, slightly fewer than the 2023 record of 200 million but surpassing the NRF’s expectations of 183 million. Shoppers spent more overall, with online spending up nearly 15% on Black Friday and total sales rising 3.4%, driven by discounts and deals. In-store traffic grew modestly by 0.7%. The NRF reported that consumers spent an average of US$235, up US$8 from last year, primarily on clothing and accessories. Retailers noted that shoppers were selective due to inflation, focusing on value and early sales promotions. Black Friday remained the peak shopping day for both in-store and online activity. The NRF expects holiday sales to grow up to 3.5% this year, slower than recent years but consistent with pre-pandemic trends. Retail executives described consumers as becoming more resourceful, with early holiday deals and budget-conscious behaviour shaping spending patterns. Tapestry Inc is well-positioned to benefit from the increased consumer demand for discounts during the holiday season. As shoppers prioritize value, the company’s promotions and competitive pricing will likely drive strong sales, capitalizing on consumers’ desire for good deals.

Thanksgiving weekend shopping trends (five-day holiday weekend from Thanksgiving through Cyber Monday)

(Source: National Retail Federation)

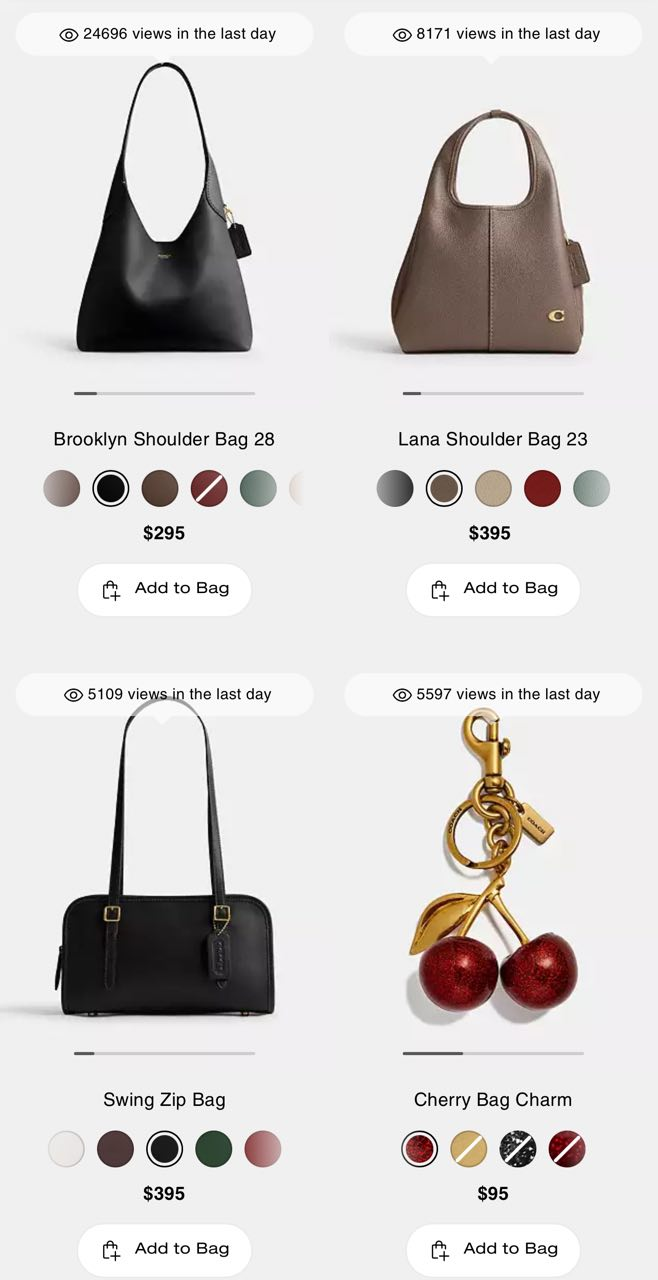

- Banking on Coach’s popularity. Coach has experienced a resurgence in popularity, fuelled by social media and the revival of Y2K nostalgia. As a more affordable luxury brand, Coach’s quality and stylish designs have resonated with Gen-Z and millennial consumers. This growth is evident in Tapestry Inc.’s first-quarter results, with Coach driving handbag revenue and AUR gains. The brand’s success was driven by strong demand for its Coach Tabby bags, which boosted full-price sales in 4Q24. Other designs, like the Brooklyn bag, have also gained traction on social media, selling out quickly. Celebrity endorsements, such as Bella Hadid carrying Coach bags, have further enhanced its appeal to Gen-Z. With its targeted social media marketing and vintage-inspired designs, Coach is poised to maintain strong revenue and profitability growth during this holiday season, which would benefit Tapestry’s top lines.

Bestsellers on Coach US website (prices listed in US$)

(Source: Coach)

- 1Q25 results. Revenue was US$1.51 billion, flat YoY, exceeding market expectations by US$40 million. Non-GAAP EPS was US$1.02, beating expectations by US$0.07. The company raised FY25 revenue expectations to over US$6.75 billion an increase of approximately 1% to 2% YoY, from the previous forecast of about 1% YoY growth, slightly above analysts’ consensus of US$6.706 billion. On an adjusted basis, Tapestry now expects earnings of US$4.50 to US$4.55 a share, compared to its prior guidance of US$4.45 to US$4.50 a share, above analysts’ estimates of $4.49. For Q1, it declared a quarterly dividend of US$0.35 per share, in line with the previous. Tapestry also announced plans for a US$2 billion accelerated share repurchase program.

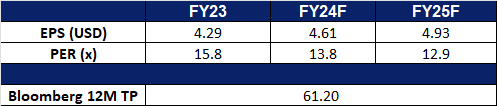

- Market consensus.

(Source: Bloomberg)

3M Co (MMM US): Manufacturing to revive

- RE-ITERATE BUY Entry – 132 Target – 146 Stop Loss – 125

- 3M Company conducts operations in electronics, telecommunications, industrial, consumer and office, health care, safety, and other markets. The Company businesses share technologies, manufacturing operations, marketing channels, and other resources. 3M serves customers worldwide.

- Manufacturing is expected to recover under Trump. Looking back at 2017, when Trump first took office, the U.S. ISM pharmaceutical industry PMI remained in the 55-60 range throughout the year, which was a period of expansion. At that time, Trump lowered the corporate tax rate from 35% to 21% and relaxed regulations on industries such as energy, finance and environment. That was also the first year of the trade war. The domestic manufacturing industry in the United States has recovered significantly under positive policy adjustments. The market expects that Trump will continue his governing philosophy in 2025 and implement it faster and more efficiently than in 2017. Therefore, the U.S. manufacturing industry is expected to return to expansion from the current contraction.

- Legal action expected to be resolved. 3M has faced multiple legal actions in recent years, the most important of which is environmental pollution liability issues related to per- and polyfluoroalkyl substances (PFAS, commonly known as “sustainable chemicals”). In addition, the company was sued collectively by members of the U.S. military over defective earplug products, claiming that the products failed to effectively protect hearing. The lawsuits have resulted in 3M paying huge settlements and putting pressure on its finances. At the same time, the company is taking steps to improve internal processes and address future legal and compliance challenges to restore investor confidence and stabilize business development.

- 3Q24 results. Revenue reached US$6.1 billion, down 26.6% from the same period last year, exceeding market expectations by US$40 million. Non-GAAP EPS were US$1.98, beating expectations by US$0.08. GAAP EPS from continuing operations was US$2.48, a YoY increase of 154%. Management raised full-year adjusted earnings per share to a range of US$7.20 to US$7.30, compared with the previous range of US$7.00 to US$7.30.

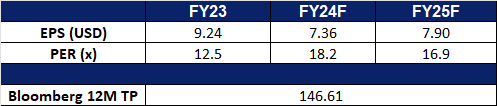

- Market consensus.

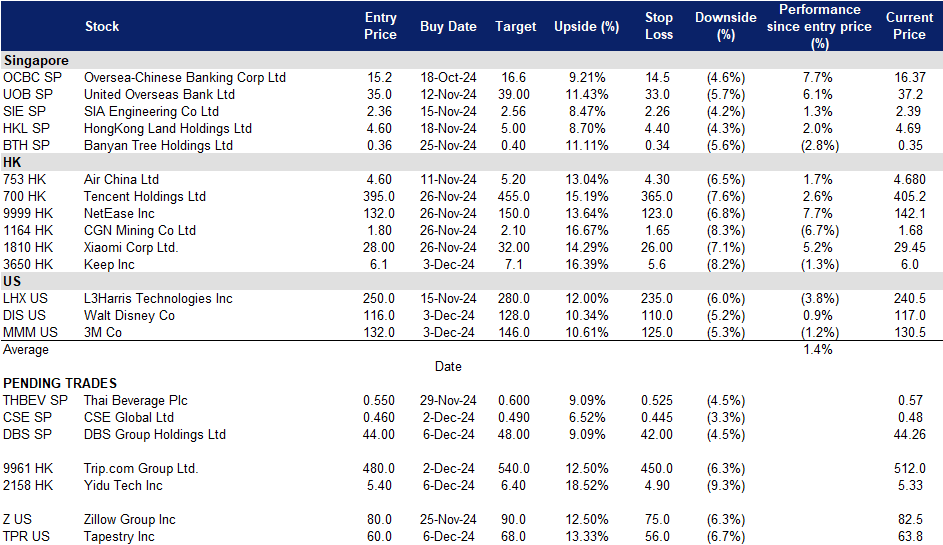

Trading Dashboard Update: Take profit on AppLovin Corporation (APP US) at US$360. Add Walt Disney Co (DIS US) at US$116 and 3M Co (MMM US) at US$132. Cut loss on Old Dominion Freight Line Inc (ODFL US) at US$209.